Annexe 1 : Résultats du test de Jarque-Bera et

du test de Ramsey

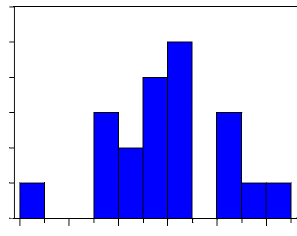

Series: Residuals Sample 1986 2005 Observations 20

|

Mean

|

-4.57E-16

|

|

Median

|

0.007241

|

|

Maximum

|

0.228698

|

|

Minimum

|

-0.280744

|

|

Std.Dev.

|

0.122103

|

|

Skewness

|

-0.203909

|

|

Kurtosis

|

2.925987

|

|

Jarque-Bera

|

0.143161

|

|

Probability

|

0.930921

|

4

2

6

5

3

0

-0.3 -0.2 -0.1 0.0 0.1 0.2

1

Ramsey RESET Test:

F-statistic 0.934300 Probability 0.349075

Log likelihood ratio 1.208477 Probability 0.271634

Test Equation:

Dependent Variable: LPIB Method: Least Squares

Date: 07/26/08 Time: 06:37 Sample: 1986 2005

Included observations: 20

Variable Coefficient Std. Error t-Statistic Prob.

C 5.512931 1.172549 4.701663 0.0003

LM2 16.42049 14.77313 1.111511 0.2838

LCREPRIV -6.296474 5.667971 -1.110887 0.2841

LCREPUB -7.325560 6.589129 -1.111765 0.2837

FITTED^2 -0.370071 0.382862 -0.966592 0.3491

R-squared 0.905180 Mean dependent var 9.219351

Adjusted R-squared 0.879894 S.D. dependent var 0.384728

S.E. of regression 0.133333 Akaike info criterion -0.979623

Sum squared resid 0.266664 Schwarz criterion -0.730690

Log likelihood 14.79623 F-statistic 35.79848

Durbin-Watson stat 1.911141 Prob(F-statistic) 0.000000

Annexe 2 : Résultats des tests de

Dickey-Fuller

Null Hypothesis: D(LPIB) has a unit root

Exogenous: Constant

Lag Length: 0 (Automatic based on SIC, MAXLAG=8)

t-Statistic

Elliott-Rothenberg-Stock DF-GLS test statistic

-4.571394

Test critical values: 1% level -2.699769

5% level -1.961409

10% level -1.606610

*MacKinnon (1996)

Warning: Test critical values calculated for 20 observations and

may not be accurate for a sample size of 18

DF-GLS Test Equation on GLS Detrended Residuals Dependent

Variable: D(GLSRESID)

Method: Least Squares

Date: 07/26/08 Time: 06:43

Sample(adjusted): 1988 2005

Included observations: 18 after adjusting endpoints

Variable Coefficient Std. Error t-Statistic Prob.

G LSRESI D(-1 ) -1.101951 0.241054 -4.571394 0.0003

R-squared 0.551414 Mean dependent var 0.001428

Adjusted R-squared 0.551414 S.D. dependent var 0.331295

S.E. of regression 0.221890 Akaike info criterion -0.119319

Sum squared resid 0.836997 Schwarz criterion -0.069854

Log likelihood 2.073869 Durbin-Watson stat 2.023519

Null Hypothesis: D(LM2) has a unit root

Exogenous: Constant

Lag Length: 0 (Automatic based on SIC, MAXLAG=8)

t-Statistic

Elliott-Rothenberg-Stock DF-GLS test statistic -3.360151

Test critical values: 1% level -2.699769

5%level -1.961409

10% level -1 .606610

*MacKinnon (1996)

Warning: Test critical values calculated for 20 observations and

may not be accurate for a sample size of 18

DF-GLS Test Equation on GLS Detrended Residuals Dependent

Variable: D(GLSRESI D)

Method: Least Squares

Date: 07/26/08 Time: 06:45

Sample(adjusted): 1988 2005

Included observations: 18 after adjusting endpoints

Variable Coefficient Std. Error t-Statistic Prob.

|

GLSRESID(-1)

|

-0.802876

|

0.238940 -3.360151

|

0.0037

|

|

R-squared

|

0.399048

|

Mean dependent var

|

-0.000716

|

|

Adjusted R-squared

|

0.399048

|

S.D. dependent var

|

0.084211

|

|

S.E. of regression

|

0.065281

|

Akaike info criterion

|

-2.566275

|

|

Sum squared resid

|

0.072448

|

Schwarz criterion

|

-2.516809

|

|

Log likelihood

|

24.09647

|

Durbin-Watson stat

|

1.901109

|

Null Hypothesis: D(LCREPRIV) has a unit root Exogenous: Constant,

Linear Trend

Lag Length: 0 (Automatic based on SIC, MAXLAG=8)

t-Statistic

Elliott-Rothenberg-Stock DF-GLS test statistic

-6.222079

Test critical values: 1% level -3.770000

5%level -3.190000

10% level -2.890000

*Elliott-Rothenberg-Stock (1996, Table 1)

Warning: Test critical values calculated for 50 observations and

may not be accurate for a sample size of 18

DF-GLS Test Equation on GLS Detrended Residuals Dependent

Variable: D(GLSRESI D)

Method: Least Squares

Date: 07/26/08 Time: 06:49

Sample(adjusted): 1988 2005

Included observations: 18 after adjusting endpoints

|

Variable

|

Coefficient

|

Std. Error t-Statistic

|

Prob.

|

|

GLSRESID(-1)

|

-1 .408002

|

0.226291 -6.222079

|

0.0000

|

|

R-squared

|

0.694832

|

Mean dependent var

|

-0.002091

|

|

Adjusted R-squared

|

0.694832

|

S.D. dependent var

|

0.189711

|

|

S.E. of regression

|

0.104800

|

Akaike info criterion

|

-1 .619571

|

|

Sum squared resid

|

0.186712

|

Schwarz criterion

|

-1.570105

|

|

Log likelihood

|

15.57614

|

Durbin-Watson stat

|

1.879050

|

Null Hypothesis: D(LCREPUB) has a unit root Exogenous:

Constant

Lag Length: 0 (Automatic based on SIC, MAXLAG=8)

t-Statistic

Elliott-Rothenberg-Stock DF-GLS test statistic

-3.428569

Test critical values: 1% level -2.699769

5%level -1.961409

10% level -1 .606610

*MacKinnon (1996)

Warning: Test critical values calculated for 20 observations and

may not be accurate for a sample size of 18

DF-GLS Test Equation on GLS Detrended Residuals Dependent

Variable: D(GLSRESI D)

Method: Least Squares

Date: 07/26/08 Time: 06:48

Sample(adjusted): 1988 2005

Included observations: 18 after adjusting endpoints

Variable Coefficient Std. Error t-Statistic Prob.

|

GLSRESID(-1)

|

-0.824322

|

0.240428 -3.428569

|

0.0032

|

|

R-squared

|

0.408705

|

Mean dependent var

|

-0.002325

|

|

Adjusted R-squared

|

0.408705

|

S.D. dependent var

|

0.188947

|

|

S.E. of regression

|

0.145292

|

Akaike info criterion

|

-0.966188

|

|

Sum squared resid

|

0.358867

|

Schwarz criterion

|

-0.916723

|

|

Log likelihood

|

9.695692

|

Durbin-Watson stat

|

1.981950

|

|