|

1

Dissertation

Efficient way to build a Core-Satellite Portfolio by using

Exchange-Traded Funds

Vincent Llovio, Master 1 in Economics

Advisor : Milo

Bianchi

Toulouse School of Economics

June 15, 2016

2

Table des matières

1 Introduction 4

2 The core-satellite approach, what is it ? 5

2.1 Born from the failure of traditional portfolio construction

5

2.2 The features of this approach 7

2.2.1 What about the core? 8

2.2.2 What about the satellite? 8

2.2.3 Consequences from the separation of Alpha and Beta 9

2.3 One last word! 12

3 ETF, a young financial instrument 12

3.1 An ETF, what is it? 12

3.2 ETF in this portfolio approach 14

3.2.1 ETFs in the core 14

3.2.2 ETFs in the satellite 15

3.3 One last word! 16

4 How much of the portfolio to allocate to the core vs

the satellite? 17

4.1 The static approach 18

4.2 Quick word on the dynamic approach 20

5 Conclusion 22

6 Appendix 23

7 References 23

7.1 Academic references 23

3

7.2 Online references 24

4

1 Introduction

Initially, the construction portfolio was based on the modern

portfolio theory (1952). This concept through strategic and tactical asset

allocation tries to optimize the risk and the return of the portfolio with an

active management by taking into account the financial goals and the risk

tolerance of the investor. During 64 years, the financial environment has

progressed and the financial agents (academic and professional) have gained

experience from the past. So inevitably during those years, new concepts, new

behaviors arose in the financial market. An alternative to the modern portfolio

theory no tends to appear, the core/satellite portfolio construction.

This approach is an old concept which has seen its popularity

suddenly raised because new investment vehicles appear to improve this later,

like Exchange-Traded Fund. This strategy is based on asset allocation which is

a pretty important point to take into account, to expect earn consequent

portfolio return. This approach divides the portfolio in two parts, the core

and the satellite. The core must provide a beta exposure and the satellite aims

to get an alpha return. By consequent, the core is passively managed whereas

the satellite is actively managed. This strategy has the same goal than the

modern portfolio theory.

This new investment vehicles, called ETFs, was created in

1993. It combines the advantages of both index funds and stocks. In other

words, it allows to get a market exposure with a certain liquidity. It permits

to achieve diversification against narrow segment of the market. That's one of

the reasons that this instrument improves the core/satellite approach.

Recently, this later and the core/satellite strategy have seen

their popularity raised. Therefore, the academic research about these two

elements is pretty large. The EDHEC risk institute has a large research chair

which works on both. Consequently, there are updated and consistent documents

about these subjects.

5

In my analysis, I'm going to consider only the taxable

investors, and not the institutional investors. Note that to get a positive

outcome from this strategy, it's crucial to implement it optimally. Therefore,

one question arises : How to take the best side of the core/satellite approach

by using ETFs?

I'm going to divide my analysis in three parts. Firstly, I'm

going to provide some background of this approach. What are the

benefits/disadvantages? Why should we see this strategy to emerge? Secondly,

I'm going to focus on the ETFs and their role in this approach. Finally, I'm

going to try to answer the following question : how much of the portfolio to

allocate to the core vs the satellite?.

2 The core-satellite approach, what is it ?

2.1 Born from the failure of traditional portfolio

construction

The modern portfolio theorem (MPT) and the capital asset

pricing model (CAPM) indicate that return and risk are positively correlated

and as well that a portfolio should be diversified in its sources of risk.

Based on the MPT, the common approach to build a traditional portfolio is to

take a long-term view by hiring active portfolio managers to implement

allocations to stock or bond markets, with a diversification objective. The

active managers are divided by size, style, and investment approach and

evaluate their performance against a specific benchmark. For instance, growth

managers are compared with a growth benchmark.

On one hand, traditional equity managers take position with a

long-only constraint : they can own stocks but have an inability to go short

and to use leverage. According to the analysis of Finn, Fuller, and Kling,

shorting a stock can grab an opportunity to add value to a portfolio

6

which can be two times more benefit than an opportunity on the

long side1 . Therefore, the return of a portfolio manager from the

identification of an overvalued stock can be limited by this constraint. In

other words, the long-only constraint put a stop to managers from fully

implementing some of their views2 . For instance, constrained

managers can use a negative insight only by underweighting a stock relative to

its benchmark weight. In fact, a Traditional portfolio manager can derive

little benefit from negative views. Note that, the long-only constraint becomes

more binding as target tracking error increases. This later is a measure of

active risk which comes from the attempt to beat the benchmark by the manager.

In other words, an increase of active risk is translated into more views that

are not fully implemented because of long-only constraint3 .

On the other hand, an active management can be successful if

the managers detect market inefficiencies and have the ability to implement

those insights, as we see before it can be pretty difficult. With this

portfolio construction, the managers have to do two things at once. Firstly,

they have to invest in the equity market to obtain the beta. Secondly, they try

to add value through stock selection. They cannot focus on a specific task, so

managers fully invest in the benchmark market at all time and keep low tracking

error relative to this benchmark. One more weakness, this strategy requires

large management cost for manager fees and rebalancing. To put in another way,

the traditional portfolio construction has alpha-type costs to only get beta or

less. Another point approves the previous sentence, managers tend to track the

benchmark to avoid the risk of being fired, by consequent they dilute their

alpha4 .

With regarding to the two previous point, there is some

obstacle to have a benefit portfolio by using this strategy. Moreover, the

asset allocation methods to achieve a return while keeping

1. Finn. MarkT.,Russell J. Fuller. and John L. Kling. "Equity

Mispricing : It's Mostly on the Short Side." Financial Analysts Journal.

November/December 1999.

2. Ronald N. Kahn "What Plan Sponsors Need from Their Active

Equity Managers." Association for Investment Management and Research, 2002.

3. Ronald N. Kahn "What Plan Sponsors Need from Their Active

Equity Managers." Association for Investment Management and Research, 2002.

4. Clifford H. Quisenberry, "Core/Satellite Strategies for

the High-Net-Worth Investor", CFA institute, 2006.

7

a certain risk control, have non negligible limitations. The

strategic asset allocation tends to give erroneous portfolio weight by not

taking into account the movements in asset correlation through time. The

tactical asset allocation relies on the correct and consistent prediction of

the future price variation; the academic research showed that just few managers

consistently have a right expectation. An academic research highlight this

failure and the underperforming in general, 80% of active manage funds

underperform the market. The part of fund which outperforms are often never the

same which outperforms in the next period5 .

Furthermore, the tax code penalizes this traditional approach

because its high turnovers increase the taxation of the market return.

Therefore, it's very difficult for active managers to beat their benchmark, net

of fees and after-tax basis, especially in strong bull markets.

That's why logically advisers were looking for a better way to

manage an asset portfolio. The core/satellite was «born» from the

issues in implementing a traditional portfolio. With this approach and its

separation of alpha and beta, they found a way to avoid those constraints and

allow a better concentration for each manager. By consequent, the

core/satellite approach has rapidly become a major portfolio strategy of these

advisers. The recent crisis helped this ascension.

2.2 The features of this approach

The core-satellite strategy allows to match the portfolio to

the client's risk aversion, like traditional approaches. The whole portfolio is

managed to be efficient in a taxable client's three-dimensional space : return,

risk and taxes. The basement of this approach is to drive the portfolio in

specific directions, or to control its performance as it is impacted by the

three previous factors. This method is designed to minimize costs, tax

liability and volatility while

5. William R. Thatcher,«When Indexing Works and When It

does not in U.S. Equities : the Purity Hypothesis", 2009

8

providing an opportunity to outperform the broad stock market

as a whole. The core-satellite approach must produce long term wealth creation.

This strategy is based on asset allocation which is the main driver of

long-term performance; that explain 94% of the movement in portfolio

returns6 .

2.2.1 What about the core?

The core of the portfolio consists mostly of passive

investments that track the performance of major market indices like the

S&P500 in the US or the CAC40 in Europe. By following such indices, it is a

cap-weighted portfolio. Its goal is to generate beta; it should not generate

performance alpha. Note that Beta is the performance delivered by the market

and Alpha is the performance delivered by a manager over and above what the

market delivers.

A Passive managers will purchase investments with the

intention of long-term appreciation and limited maintenance. By consequent, low

fees are expected for this kind of portfolio manager. So the core portfolio

should be relatively inexpensive. The most appropriate core is a broadly

diversified portfolio, built with ETFs, Index Funds, or tax-enhanced index. It

should take a long-term view with rebalancing maybe once per year. A tax

managed core allows to increase the after-tax return. Regarding to the low

turnover and the low gain realization provided by a passive management, the

core is as well tax efficient. Note that it can be improved if it is tax

managed by using a tax-loss harvesting strategy. That is to say the ideal core

strategy depends on the investor's overall tax situation. We're going to speak

about that in another section.

2.2.2 What about the satellite?

The satellite positions are added into a portfolio by taking

into account the goals of the investor and the investor's tolerance for risk

and illiquidity, time horizon, and non-transparency. This part of the portfolio

is in the form of actively managed investments, several portfolios

6. Roger G. Ibbotson, Paul D. Kaplan, "Does Asset Allocation

Policy Explain 40, 90, or 100 Percent of Performance?", 2000.

9

of active manager. This kind of manager are aggressive alpha

seekers with fewer investment constraint, they continuously monitor their

activity in order to exploit profitable conditions across multiple markets

(market inefficiencies). In other words, they allow to get access to active

risk strategies that have an attractive expected return. So to choose a

specific satellite strategies, an investor must be considered the return to

active risk offered by each strategy. Managers implement different strategies

according to the market capitalization and the style (e.g. mid-cap value) to

mostly produce long term gains. The satellite components can be a

«concentrated» long short equity portfolio, private equity or hedge

fund (market neutral one). Unlike the core, the satellite is not tax efficient

because of its possible high turnover and capital gains. Even of this tax

inefficiency and high fees, an investor is willing to pay for active strategy

to get alpha. Finally, managers must have to cover taxes and fees, so they must

produce enough excess return.

The satellite part is independent of the core part, that is to

say exhibits a low correlation with the benchmark. So the diversification level

of the portfolio increases. This fact enhances the total performance

consistency, especially in down markets.

2.2.3 Consequences from the separation of Alpha and Beta

To allow an improvement of the features of a portfolio, it is

vital to divide it into two elements which are managed in different way to

achieve the goals of each component. I speak about the separation of alpha and

beta. In other words, this is the separation of market returns and stock active

managers return in evaluating performance. Beta is delivered by the core and

Alpha by the satellite. This evolution can be considered as the main

industry-changing in investment management.

As I said before, this division allows to

avoid the long-only constraint, and by consequent to give more flexibility to

managers. With the core/satellite approach, active managers can have short

positions, use leverage, and they don't have to track a benchmark. The last

point

10

allows the manager to be more focus on their primary goal of

taking advantage from market inefficiencies to produce more alpha. Academic

research show that the constraints from the traditional portfolio construction

reduced the expected excess return, especially the long-only one7 .

Moreover, the opportunity of borrowing grabs a better risk management to the

portfolio. Active managers can use leverage to achieve an accurate level of

risk. For instance to increase risk, they can borrow to buy more of the optimal

portfolio. But the ability to use leverage has a side effect. For instance,

shorting stock can have unlimited losses. The large potential downside risk

mitigates the effectiveness of the risk management.

Another good point is that the distinction between passive and

active strategy allows to build cost effective portfolio. Than the traditional

construction portfolio, this approach needs to hire less managers (must have

only one for the passive core) and is easier to monitor (less rebalancing for

instance) so the associated costs are lower. Moreover, no extra money is spent

to only obtain beta. This saving allows investor to spend higher active

management fees in the search for «pure» alpha.

Finally, one last benefit of this approach is about the

taxation. This separation put on one side the tax-inefficient trading

activities and on the other side the tax-efficient benchmark tracking. So,

investors can enjoy a pre-tax Beta, and is subject to tax if his active

investment produces positive returns. The market exposure is not anymore

subject to tax like in a traditional approach, therefore this separation allows

to avoid the tax hurdle8 . This is the fact that an active manager

has to produce enough excess pre-tax to offset the tax consequences of active

management. The goal is the outperformance of the benchmark on an after-tax

basis.

7. Clarke. Roger, Harindra de Silva, and Steven Thorley,

"Portfolio Constraints and the Fundamental Law of Active Management",

Financial Analysis Journal, September/October 2002.

8. Jeffrey. Robert H., and Robert D. Arnott, "Is Your Alpha

Big Enough to Cover Its Taxes?", The journal of portfolio management,

Spring 1993.

11

Moreover, this approach leads to less turnover events (e.g.

infrequent rebalancing), by consequent the incidence of tax decreases.

One more thing about the taxable environment, the core can be

tax managed. The tax-loss harvesting strategy has to be applied. That consists

to sell benchmark stocks that have decrease in value while keeping those that

have appreciated. The short- or long-term losses from the sales can be netted

against gains from satellite portfolios. Therefore, the investors can absorb

some capital gains tax liability. The use of this strategy allows to get a

higher after-tax return than a non-tax managed core. To implement this

strategy, an investor has to have a willingness to sell stocks which do not

perform well, and a willingness to hold appreciated stocks. Note that this

strategy can be run while keeping a low tracking error versus the benchmark.

Overall, the separation of alpha and beta allow the active

manager to create higher return per unit of tracking error.

This division has not only good side effects. Now, active

managers have only one goal. But in the traditional portfolio construction, the

benchmark constraint allowed to monitor their behavior; they needed to have a

broadly diversified portfolio to get beta. So this evolution gives some freedom

in the large amount of investment possibility to the managers, and takes some

control from the investors.

Furthermore, Investors can have some difficulty to get

information about his active holding. Because some component of the portfolio

like hedge funds, does not report frequently the portfolio holdings and their

results. The investors can lose some transparency with this approach.

Another point states that some investment of the satellite

portfolio are blocked for a long period of time. For instance, hedge fund can

require investors to stay in the fund during a

12

minimum period of time, like one year. So an investor can see

his portfolio liquidity decreases with a core/satellite approach.

We can see that the benefits from this separation largely

overcome the side effects. By taking into the previous points and the need of a

new alternative in portfolio construction, we can expect that this approach is

pretty used in the financial world.

2.3 One last word!

In 2014, 50% of ETF investors have run a core/satellite

strategy, which represents a 2% increase than 2013 9 . According to

the features of this approach, a higher use will not be surprising. But this

later needs a large amount of invested money. For instance, according to

Quisenberry (2006), the core portfolio can be effectively managed with a

minimum of $250 000 of investment. So a lot of investors cannot implement this

strategy under this constraint.

To implement this strategy, advisers have to take into account

the investor's goal to align the asset allocation with his need. Overall, with

this approach, investors expect to take an advantage in terms of return from

the smart asset allocation and the active manager selection. The cost-and

tax-effectiveness of Exchange-Traded Fund (ETF) can facilitate the

implementation of this portfolio construction.

3 ETF, a young financial instrument

3.1 An ETF, what is it ?

ETFs are «new» vehicles, they appears in 1993 in the

U.S. At the end of 2007, there were 1171 ETFs in the whole world, with

underlying assets close to $800 billion 10 .

9. The EDHEC European ETF Survey 2014.

10. According to Morgan Stanley.

13

An Exchange-Traded Fund (ETF) is marketable security that

tracks an index, a commodity, or a basket of asset like an index fund. Its goal

is to replicate the performance of its underlying index. Therefore, an ETF

which is tracking a particular index, will hold the same securities, and in the

same proportion of this one. An ETF pays out dividends received from the

underlying stocks on a quarterly basis.

Unlike index funds, an ETF trades like a common stock on a

stock exchange. Thanks to its presence in both primary and secondary market,

ETFs typically have higher daily liquidity than traditional mutual funds. The

supply and the demand in the secondary market determine the price of ETF

shares; this later can diverge from the value of the underlying securities net

asset value (NAV). This fact provides an arbitrage opportunity for investors,

one of the main feature of ETF. Note that the arbitrage activity keep very

close the ETF price and the underlying securities NAV.

Furthermore, ETFs have low fees, this is due to the fact that

an ETF is passively managed. Note that few actively managed ETFs exist. This

reduction in cost can be balanced by the fact that investors must pay a

brokerage commission to purchase and sell ETF shares. For those investors who

trade frequently, this can significantly increase the cost of investing in

ETFs.

Its daily liquidity allows a consequent flexibility, that's

why it can be an attractive alternative to implement various investment

strategies like hedging strategies, or to build an investment portfolio. For

portfolio construction, one of the main advantage of this instrument is the

broad diversification that it can provide. Add to total and broad market ETFs,

a lot of type of ETFs exists, like sector ETF, market capitalization ETF

(large, mid, small cap), fixed income ETF, currency ETF, commodity ETF, bond

ETF, etc. The combination of several of them allows the investor not only to

diversify across all the major asset classes but also to diversify into

investments that have a low correlation to the major asset classes

(commodities, emerging

14

market...). Furthermore, the diversity of ETFs allows to

achieve specific segment of the market through low-cost indexes. Before, those

segments could be reached through active management.

Another advantage of this instrument is its tax efficiency.

It's come from the fact that most of ETFs have very low turnover, so investors

amass only few capital gains by holding them. Moreover the tradability of ETF

allows to sell it to another investor like a stock, this means no capital gains

transaction for the ETFs. Moreover, ETFs offer better transparency into their

holdings than mutual funds. ETFs disclose their full portfolios on public every

single day of the year.

Overall, ETFs combine the advantages of both index funds and

stocks. They are convenient, cost efficient, tax efficient and flexible; their

diversity allows an investor to easily fill the «holes» in his

portfolio to get a broad diversification. This vehicle provides investors the

market exposure they require, at the level they want, at the time need it.

3.2 ETF in this portfolio approach

With the introduction of ETFs, the use of a core/satellite

strategy becomes a very practical strategy for the investor to implement. In

general, investors use ETFs to control different aspect of their portfolios, to

satisfy their individual investment preferences. ETFs provide a simple way to

implement a professional style approach to portfolio management. In the case of

this strategy, this instrument can have different functions. Even if, the main

use of ETFs remains long-term buy and hold into market indices (core approach),

it can act in the core and as well in the satellite.

3.2.1 ETFs in the core

According to the previous section, we can say that a low-cost

diversified portfolio can easily be constructed with a few ETFs to cover the

major equity asset classes and the fixed-income

15

market. In fact, investors use several ETFs as core position

to generate low cost beta thanks to an optimal allocation between them. By

consequent, they get an instant and great diversification and reduce overall

portfolio risk. As well, they can only use one index ETF to get a diversified

market exposure without taking stock selection decisions. The use of only one

manager can reduce the cost. Thanks to the myriad of ETFs, investors can

diversify risk against most of financial asset.

Moreover, the using of some ETF as the core

position allows an easier rebalancing. For instance, if an investor wants to

increase his equity exposure, the purchase of additional shares of an ETF makes

it easy to do without having to buy additional shares for current holdings.

Therefore, ETFs can grab the same outcome than index funds in

the core part of a portfolio (diversified portfolio which provides beta

return). But they take an advantage over index funds thanks to their

characteristics like their cost efficiency (fee, tax), their transparency, or

their high liquidity. This later provides a higher handling ability than index

fund.

3.2.2 ETFs in the satellite

ETFs are less suit to the satellite part because most of them

are passively managed, so we can think that just produce beta and low turnover.

But they can have a useful role in the satellite. Investors can use them to

spread risk and enhance potential return.

ETFs in the satellite provide a better tactical overlay.

Effectively, some ETFs can capture the risk premium performance of certain

asset classes (e.g. value stocks). So ETFs that are not broadly diversified,

such as industry sector ETF or maturity-segment ETF,

can be used in a tactical way to enhance the performance of the whole

portfolio. In the satellite, ETFs provide opportunities for outperformance.

Moreover, ETFs have several advantages over active funds. ETFs have low

turnover per year. So using ETFs in the satellite is tax effective to produce

alpha. Then the active fund satellite suffers of lack of transparency, risk

control and liquidity;

16

by introducing them, ETFs could dilute this issues. It can be

a valuable added value in the portfolio regarding to the features of actively

managed funds.

3.3 One last word!

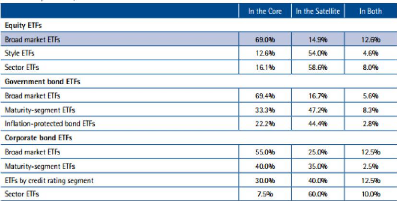

In this European ETF survey (2014), the EDHEC risk institute

provides some statistics about the preference of European investor for ETFs for

their asset allocation in both core and satellite (Appendix 1). The most use

ETF in the core is the broad market ETF. For instance, 69% of equity broad

market ETFs users use them in the core. Whereas style, sector and other narrow

ETFs lie mainly in the satellite. For instance, 59% of equity sector ETFs users

use them in the satellite. Note that these ETFs are clearly less popular than

broad-based ETFs. Some investors use ETFs both in core and satellite. The

equity broad market ETF is the one which is the most use in both part of the

portfolio (12,5%). This study approves what I said in the two previous section.

That is to say, the narrower ETFs are widely used as satellite vehicles for

tactical asset allocation and the core is built around broad market ETFs to get

a broadly diversification.

To sum up, ETFs are especially adapted to the core/satellite

approach. They offer a natural vehicles for implementing allocation strategies

both in the core and in the satellite. Their use can help to optimize the

risk/return of the portfolio. On one hand, they allow to get easily a broadly

diversified core. On the other hand, they can help investors to improve the

return of the portfolio thanks to the addition of specific ETFs in the

satellite. Their tradability is one of their main advantages, we're going to

see that this later allows the management of highly dynamic strategies by

facilitating the shifts from the core to satellite.

17

4 How much of the portfolio to allocate to the core vs

the satellite?

We have seen the structure of this kind of portfolio and its

benefits, and as well the fact to incorporate ETFs inside cannot be negligible.

These later have numerous added values for the core/satellite portfolio. We're

going to focus on the way to manage the portfolio. There exists two major

approaches. On one hand, the portfolio can be run statically. In this case, the

investors try to achieve an optimal allocation between the core and the

satellite, to minimize risk and maximize return. On the other hand, they can

also try to obtain the optimal allocation but by taking into account the market

performance. According to this performance, the investors is going to shift

some allocation from the core to the satellite and vice versa. This is a

dynamic management. Again, the goal to optimally allocate between the two

components is to optimize the risk and the after-tax return to may be obtain

similar risk and return than an actively managed equity portfolio, or even

better.

During the construction of a core/satellite portfolio, one of

main question which arises, is how much of the portfolio to allocate to the

core versus the satellite, or to passive versus active investment. There is no

right or wrong answer, this later depends on the objective of the investor,

both have a legitimate place in this portfolio. For instance, if an investor is

risk averse, then more proportion of the portfolio will be allocate to the core

and less to the satellite. Or it could be willing to take more risk to increase

his potential return, then the satellite part will increase in the portfolio.

Finally, the optimal allocation is driven by risk, return and correlation

between the core and the satellite.

18

4.1 The static approach

This approach corresponds to a symmetric management of

tracking error by fixing allocation to the core and satellite. Again, the most

important point is to fill the investor's objective. According to BlackRock's

iShares division, a typical core/satellite portfolio is built as follow, 70% in

the core and 30% in the satellite. But according to the model of Quisenberry

and its assumptions, the optimal mix was determined to be 62% in the core; this

allocation maximizes the after-tax information ratio (excess return per unit of

risk / alpha over tracking error). The two previous sentences highlight the

fact that there is not an universal optimal allocation. But according to each

factor (risk, return) that an investor wishes to optimize to get an efficient

allocation, we can drive the allocation in an efficient manner.

The use of satellite has to be temperate : high enough to

improve the initial portfolio performance (otherwise there could have more

cost-effective strategy to obtain this return) and low enough to keep enough

liquidity which helps to fill the investor's goals. Logically, if the investor

would like to reduce the risk exposure, he needs to allocate more to the core.

According the model of Quisenberry, if core portfolio is integrated in a

satellite-only portfolio, the after-tax returns will increase. Because the

marginal benefit of adding core is more than the marginal cost of alpha

dilution. More core allocation than the optimal allocation will decrease the

after-tax return. The interaction between the core and the satellite is subject

to several dynamics, let's consider them.

The higher the after-tax return of the core, the higher the

return asked to justify an allocation in the satellite. With a satellite view,

if active managers produce a large amounts of alpha, the opportunity cost to

shift more allocation to the core is significant. That is to say, if the alpha

is high, the allocation to the core portfolio should be lower. But this dynamic

can be dilute by a

19

lower correlation between the core and the satellite. This

later decreases the expected return required to justify an allocation to the

satellite.

In the same process, a lower expected volatility in the

satellite lowers the required return. In other words, if the tracking error in

the satellite increases, the core allocation should be higher.

On another hand, the allocation depends also on the total cost

of the portfolio. To get an optimal portfolio, the expensive active management

in the satellite require to increase the core allocation to offset this high

expenses.

The expected market return is also an important factor. When

allocate between the both sides, the investors or managers have to take into

account their insights about the market. If they are bullish (high expected

market return), they should increase the core part because there must be an

opportunity with the upside trend of the market and as well it's more difficult

for active manager to beat a bull market. Whereas with a bear insight, they

should increase their allocation in the satellite to enjoy the diversification

effect and so protect themselves against the market.

Finally, the anticipated changes in tax rates can influence

the final decision. If tax rates change, the dynamic in choosing the right

allocation has to take into account this tax change. The shift between the core

and the satellite can be different.

Moreover, as we have seen before, some investor can

efficiently use tax-managed core. In this case, the whole dynamic is changed

because the losses from the core help absorb the tax costs of the satellite's

gains (Tax loss harvesting). Overall, a higher expected satellite return is

required to shift a part of the portfolio from the core to the satellite.

Because if higher gains are generated in the satellite, more losses are needed

to offset this increase in tax costs. Let's take an example. I said before that

«if the alpha is high, the allocation to the core portfolio should be

lower». An increase in alpha means higher gains from the turnover in the

satellite.

20

By consequent, with a tax-managed strategy, there is as well

an increase in the need for the losses from the core. Therefore, a tax-managed

core balances the dynamic in favor of the core. But the investors don't have to

increase to much the core weight, because at a precise point the benefit of

losses is not justified regarding to the capital gains from the satellite. In

one sentence, with a tax-managed core higher tax cost leads to a higher

allocation to the core.

In the real world, the return is positively correlated with

the risk. Generally, an investor wishes to have an optical allocation to

minimize the tracking error and to maximize the after tax-return. Therefore, a

good way to obtain the optimal allocation is to maximize the after-tax

information ratio as Quisenberry, which can combine the both aspect.

To sum up, with this static approach, an investor has to

carefully take into account the interaction between the satellite and the core

in terms of after-tax return and overall risk to determine the right allocation

to achieve his objectives. According to the academic researches, the optimal

core allocation is often greater than 50% but depends on several parameters,

like alpha or as well the market environment.

4.2 Quick word on the dynamic approach

Recently, the EDHEC risk institute adapted the concept of

constant proportion portfolio insurance (CPPI) to propose a dynamic way to

manage a core/satellite portfolio. This later tends to tight the tracking error

by investing in passive strategy (low tracking error). Therefore, investors can

miss return improvement from active investment. This trend is stronger in

market downturns, during which active strategies must outperform passive

strategies.

The dynamic approach has the objective to avoid this

deficiency through an asymmetric management of the tracking error by using a

strategy to limit the underperformance of the core («bad» tracking

error) while take advantage from the upside potential of the satellite

(«good»

21

tracking error). By using this approach, the managers are

going to shift some allocation from the core to the satellite when this later

outperforms the benchmark portfolio. On another hand, the satellite part in the

portfolio decreases if the active portfolios underperform the benchmark. This

approach generate always greater risk-adjusted returns than those from a static

approach, with an excess return above the benchmark about twice as large in all

cases 11 . Therefore, investors have to take into account this

management when they are holding a core/satellite portfolio.

But the risk control benefits from this approach need

consequent transaction costs due to the frequent rebalancing. This fact is

likely to affect the performance of a dynamic core-satellite portfolio. So

there is a trade-off between risk management and cost of trading. A less

frequent rebalancing leads to a more cost-efficient management and to a likely

consequent change in relative performance of the satellite with respect to the

core portfolio (higher period of time). This infrequency can mitigate the

result of this management by failing to get the guaranteed performance.

Increasing the frequency of trading could decreases the likelihood to fail.

Therefore, the presence of transaction costs is likely to be an important

concern to portfolio managers.

Moreover, this approach relies on active forecasting of the

future market performance, that grabs additional risk to the portfolio even if

the manager is a pretty good forecaster.

Finally, the high liquidity and relatively low cost make the

ETFs a natural tool to implement such dynamic strategies. They provide enough

liquidity for the frequent rebalancing of this approach.

Run a dynamic approach by using ETFs could be a great option.

Investors could take advantage from both : ETFs and the access to

outperformance provided by a dynamic core/satellite approach.

11. N. Amenc, P. Malaise, L. Martellini, "Revisiting

Core-Satellite Investing - A dynamic Model of Relative Risk Management",

EDHEC-Risk institute, November 2012.

22

5 Conclusion

The core/satellite strategy appeared in the financial world

after that the portfolio construction, provided by the modern portfolio theory

showed some issue and tended to underperform against a particular benchmark.

Most financial agents argue that investors can extract several benefits from

this portfolio construction.

My goal was to find the best way to take an advantage from the

core/satellite by using ETFs. Effectively, I think that this financial vehicle

has to take part in a core/satellite because of this features which can

overcome the few issues of this portfolio strategy like the lack of

transparency and liquidity in the satellite.

Secondly, when an investor has this kind of portfolio, he has

to accurately define his financial objectives to choose the right allocation

between the core and the satellite, and by consequent he could optimize the

return/risk pair.

Thirdly, an investor has to be aware of his tax situation. In

fact, an investor expect to get the higher after-tax return. A tax management

in his portfolio can increase the performance of this one.

This strategy has a major limit. It is not reachable to

everyone to implement this approach. The core/satellite construction can be

used only by high-net-worth investor. But even that, nowadays this strategy is

considered as one of the main driver of portfolio construction. This

dissertation allows me to discover the ETF and the core/satellite strategy.

In this first work, I have been pretty general in my

analysis to get a first approach of this environment. In a future work, I would

like to focus on the dynamic way to manage a core/satellite portfolio and

particularly the model about the DCS approach provided by the EDHEC risk

institute

23

6 Appendix

-- 1. Summary of the use of different instruments in the

core/satellite allocation

7 References

7.1 Academic references

-- Scott Welch, "The Hitchhiker's Guide to Core/Satellite

Investing", The journal of wealth management, Winter 2008.

-- Donald J. Mulvihill, "Core and Satellite Portfolio

Structure : Investments and Tax Considerations",The journal of wealth

management, Summer 2005.

-- Clifford H. Quisenberry, "Core/Satellite Strategies for the

High-Net-Worth Investor", CFA institute, December 2006.

-- Donald J. Mulvihill, "Core and Satellite : Implementation

Issues", The journal of wealth management, Spring 2006.

-- N. Amenc, F. Ducoulombier, F. Goltz, V. Le Sourd, A. Lodh,

and E. Shirbini, "The EDHEC European ETF Survey 2014", EDHEC-Risk

institute, March 2015.

-- N. Amenc, P. Malaise, L. Martellini, "Revisiting

Core-Satellite Investing - A dynamic Model of Relative Risk Management",

EDHEC-Risk institute, November 2012.

24

-- Clifford H. Quisenberry, "Optimal allocation of a Taxable Core

and Satellite Portfolio Structure", The journal of wealth management,

Summer 2003.

-- N. Amenc, F. Goltz, and A. Grigoriu, "Risk Control Through

Dynamic Core-Satellite Portfolios of ETFs : Applications to Absolute Return

Funds and Tactical Asset Allocation", The Journal of Alternative

Investments, Fall 2010.

7.2 Online references

-- "ETFs - Implementing Core & Satellite for SMSF & HNW

Investors",

www.LPAConline.com.au

M. Nairne, "How millionaires use ETFs to build 'core and

satellite' portfolios", Financial Post January 2013.

-- S. Cohen, "Using ETFs to cut the cost of core-satellite",

Professional Adviser, August 2013.

-- "Why Are ETFs So Tax Efficient?",

textitwww.etf.com, January

2014.

-- "ETFs in Core-Satellite Portfolio Management", EDHEC Risk

and Asset Management Research Centre.

N. Amenc, "The Core-Satellite Approach: Adding Value to Asset

Management", EDHEC Risk and Asset Management Research Centre, November

2006.

-- J. Fink, "Using a Core and Satellite ETF Strategy to Generate

Alpha", Investing Daily, January 2011.

-- "ETFs and core satellite investing", Professional Wealth

Management, Summer 2008. --

www.investopedia.com

|