5 Conclusion

The core/satellite strategy appeared in the financial world

after that the portfolio construction, provided by the modern portfolio theory

showed some issue and tended to underperform against a particular benchmark.

Most financial agents argue that investors can extract several benefits from

this portfolio construction.

My goal was to find the best way to take an advantage from the

core/satellite by using ETFs. Effectively, I think that this financial vehicle

has to take part in a core/satellite because of this features which can

overcome the few issues of this portfolio strategy like the lack of

transparency and liquidity in the satellite.

Secondly, when an investor has this kind of portfolio, he has

to accurately define his financial objectives to choose the right allocation

between the core and the satellite, and by consequent he could optimize the

return/risk pair.

Thirdly, an investor has to be aware of his tax situation. In

fact, an investor expect to get the higher after-tax return. A tax management

in his portfolio can increase the performance of this one.

This strategy has a major limit. It is not reachable to

everyone to implement this approach. The core/satellite construction can be

used only by high-net-worth investor. But even that, nowadays this strategy is

considered as one of the main driver of portfolio construction. This

dissertation allows me to discover the ETF and the core/satellite strategy.

In this first work, I have been pretty general in my

analysis to get a first approach of this environment. In a future work, I would

like to focus on the dynamic way to manage a core/satellite portfolio and

particularly the model about the DCS approach provided by the EDHEC risk

institute

23

6 Appendix

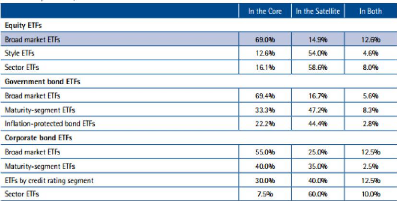

-- 1. Summary of the use of different instruments in the

core/satellite allocation

7 References

7.1 Academic references

-- Scott Welch, "The Hitchhiker's Guide to Core/Satellite

Investing", The journal of wealth management, Winter 2008.

-- Donald J. Mulvihill, "Core and Satellite Portfolio

Structure : Investments and Tax Considerations",The journal of wealth

management, Summer 2005.

-- Clifford H. Quisenberry, "Core/Satellite Strategies for the

High-Net-Worth Investor", CFA institute, December 2006.

-- Donald J. Mulvihill, "Core and Satellite : Implementation

Issues", The journal of wealth management, Spring 2006.

-- N. Amenc, F. Ducoulombier, F. Goltz, V. Le Sourd, A. Lodh,

and E. Shirbini, "The EDHEC European ETF Survey 2014", EDHEC-Risk

institute, March 2015.

-- N. Amenc, P. Malaise, L. Martellini, "Revisiting

Core-Satellite Investing - A dynamic Model of Relative Risk Management",

EDHEC-Risk institute, November 2012.

24

-- Clifford H. Quisenberry, "Optimal allocation of a Taxable Core

and Satellite Portfolio Structure", The journal of wealth management,

Summer 2003.

-- N. Amenc, F. Goltz, and A. Grigoriu, "Risk Control Through

Dynamic Core-Satellite Portfolios of ETFs : Applications to Absolute Return

Funds and Tactical Asset Allocation", The Journal of Alternative

Investments, Fall 2010.

|