|

RISK MANAGEMENT IN ETABLISSEMENT KAZOZA JUSTIN ET

COMPAGNIE-RWANDA

NOHELI SAM

09/A/KAB/MAPPM/039/PG

A Dissertation Submitted in Partial Fulfilment of the

Requirements for the Award

of a Masters of Arts Degree in Project Planning

and Management of Kabale

University.

October, 2011

DECLARATION

I hereby declare that «Risk Management in

Etablissement Kazoza Justin et Compagnie-Rwanda» is my own work

that has not been submitted to any university for any academic award.

NOHELI Sam

Signature.......................................................

October 2011

APPROVAL

This research entitled: «Risk Management in Etablissement

Kazoza Justin et Compagnie-Rwanda» has been under my supervision.

Supervisor: BARIGYE Godfrey

Signature:.....................................

Date:..............................................

DEDICATION

I dedicate this piece of work to my wife TUYIZERE Petronille,

our son JABO MAKOMA Rock and our lovely daughter JURU MAKOMA Raeka for their

endless love and patience for all time i devoted up to the completion of this

piece of work.

ACKNOWLEDGEMENTS

I would like to extend my sincere gratitude to my supervisor

Mr. Barigye Godfrey who has always been there for me throughout my piece of

work by teaching me research with patience and goodwill.

I thank the Almighty God for giving me the power, wisdom,

knowledge and the courage to successfully accomplish my mission as a

student.

I am so grateful to the management of Kabale University for

providing a master degree which is rare in this region. Without their support,

this study would not have been possible. My heartfelt thanks go to all the

lecturers and staff of the Department of project planning and management for

their efforts towards the completion of my studies. I am highly indebted to the

management of Etablissement Kazoza Justin et Compagnie and all respondents who

participated in this study, without you this study would not have been

possible.

I am also grateful to my colleagues at King Faisal Hospital,

Kigali for their constant support and love throughout my two years of study.

Special thanks go to members of Boundless Consultancy Group Ltd and their

families for the moral support and words of encouragement they always gave me

throughout my studies.

Lastly, my utmost appreciation goes to my late father

Rutaganira, my mother Madeleine Nyiragapasi and my brothers Ntamuhanga Ningi

Emmanuel and Sekaneza Jean Pierre for their persistent love and care that i

received from them days and nights.

May the Almighty Lord bless you all.

TABLE OF CONTENTS

Declaration

i

Approval

ii

Dedication

iii

Acknowledgements

iv

Table of contents

v

List of tables

viii

List of figures

ix

List of abbreviations

x

Abstract

xi

CHAPTER ONE: BACKGROUND TO THE STUDY

1

1.0 Introduction

1

1.1 Background to the study

1

1.2 Statement of the problem

3

1.3 The purpose of the study

3

1.4 Objectives of the study

3

1.4.1 General objective of the study

3

1.4.2 Specific objectives of the study

3

1.5 Scope of the study

4

1.6 Significance of the study

4

1.7 Definitions of terms

5

1.8 Conceptual frame work

6

CHAPTER TWO: LITERATURE REVIEW

8

2.0 Introduction

8

2.1 Overview of Risk Management

8

2.2 Risk management plan

10

2.2.1 Risk Identification

10

2.2.1.1 Objectives of Risk Identification

10

2.2.1.2 Risk Identification Process

11

2.2.2. Risk Quantification

12

2.2.2.1 Low Risk Events

13

2.2.2.2 Moderate Risk Events

13

2.2.2.3 High Risk Events

14

2.2.3 Risk Response

14

2.2.4 Risk Monitoring and Control

16

2.2.4.1 Purpose of risk monitoring and control

16

2.2.4.2 Inputs to risk monitoring and control

17

2.2.4.3 Dangers of uncontrolled risk

18

2.3 Benefits of Risk Management

18

2.4 Challenges to risk management

19

2.5 Risk awareness among employees

23

2.5.1 Creating risk awareness culture

23

2.6 Current trend of risk management

26

CHAPTER THREE: RESEARCH METHODOLOGY

29

3.0 Introduction

29

3.1. Study area

29

3.2. Research design

30

3.3. Study population

30

3.4. Sample and Sample size

30

3.5. Research tools

31

3.6. Data analysis

32

3.7 Ethical considerations

32

CHAPTER FOUR: PRESENTATION OF RESEARCH FINDINGS AND

ANALYSIS

33

3.0 Introduction

33

3.1 Section A: Quantitative Data

33

4.2 Section B: Qualitative Data

57

CHAPTER FIVE: CONCLUSION, SUMMARY AND

RECOMMENDATIONS

63

4.0 Introduction

63

4.1 Summary of the findings

63

5.1.1 Risk management plans

63

5.1.2 Challenges to risk management

64

5.1.3 Trends of risk management

65

5.2 Conclusion

67

REFERENCES

69

APPENDICES

73

LIST OF TABLES

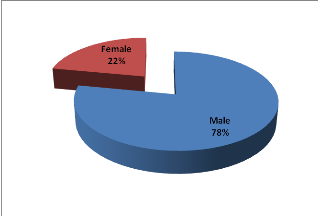

Table 4.1.1: Distribution of respondents by

Gender

33

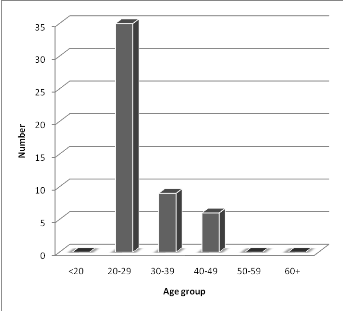

Table 4.1.2 Distribution of resondents by age

34

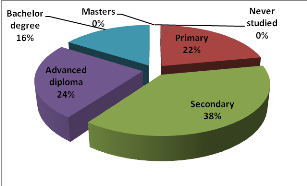

Table 4.1.3 Distribution of respondents by

Education

36

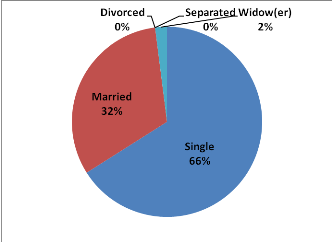

Table 4.1.4 Distribution of respondents by marital

status

37

Table 4.1.5 Distrbution of respondents by

occupation

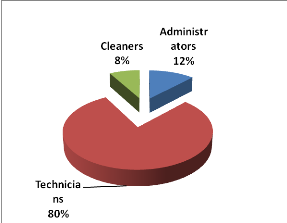

39

Table 4.1.6 Distribution of respondents by job

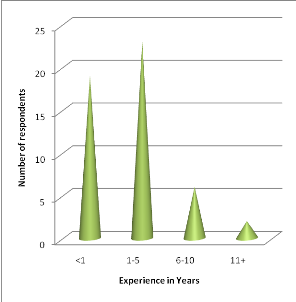

experience

40

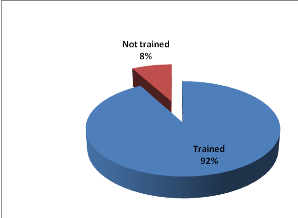

Table 4.1.7 Training(s) on Risk Management

42

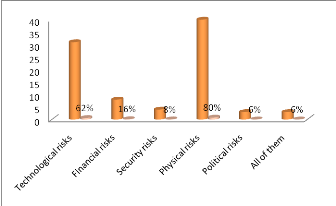

Table 4.1.8 Types of risks likely to be encountered

by respondents

43

Table 4.1.9 Training on risk management in relation

to which a respondent faces

44

Table 4.1.10 Response on whether respondents have

met risks that could put life in danger

46

Table 4.1.11 How risks were managed?

47

Table 4.1.12 Need of protective equipment

49

Table 4.1.13 Use of protective equipment

50

Table 4. 1.14 Status of personal protective

equipment

51

Table 4.1.15 Existence of Risk Management plans

52

Table 4.1.16 Knowledge on whether the company has

internal rules and regulations

54

Table 4.1.17 Insurance among Respondents

55

Table 4.2.1 Results on Risk management plan

58

Table 4.2.2 Risk management

59

Table 4.2.3 Results on challenges in Risk

management

61

Table 4.2.4 Results on current trends of Risk

Management

62

LIST OF FIGURES

Chart 4.1.1 Distribution of Respondents by

Gender

34

Chart 4.1.2 Distribution of Respondents by age

35

Chart 4.1.3 Distribtion of respondents by

education

37

Chart 4.1.4 Distribution of respondents by marital

status

38

Chart 4.1.5 Distribution of respondents by

occupation

39

Chart 4.1.6 Job experience of Respondents

41

Chart 4.1.7 Training(S) on Risk Management

42

Chart 4.1.8 Types of risks likely to be encountered

by respondents

43

Chart 4.1.9 Training on risk management

45

Chart 4.1.10 Response on whether respondents have

met risks that could put life in danger

46

Chart 4.1.11 How risks were managed?

48

Chart 4.1.12 Need of protective equipment

49

Chart 4.1.13 Use of protective equipment

50

Figure 4.1.14 Status of personal protective

equipment

52

Chart 4.1.15 Existence of Risk Management plans

53

Chart 4.1.16 Knowledge on whether the company has

internal rules and regulations

55

Chart 4.1.17 Insurance among Respondents

56

LIST OF ABBREVIATIONS

BSI : British Standard Institutions

CRO : Chief Risk Officer

EKJ & Cie : Etablissement Kazoza Justin et Compagnie

ERM : Enterprise Risk Management

GE : General electric

IT : Information Technology

PPE : personal Protective Equipment

PSF : Private Sector Federation

RDB : Rwanda Development Board

RM : Risk Management

RMP : Risk Management Plan

UNEP : United Nations Environment Programme

US : United States

ABSTRACT

This study examined how Etablissement Kazoza Justin et

Compagnie (EKJ & Cie) handled potential risks which were threatening its

business. It was guided by four objectives. It adopted a case study design,

used both qualitative and quantitative research methods for data collection. It

covered 50 respondents and employed interviews, questionnaires and observation

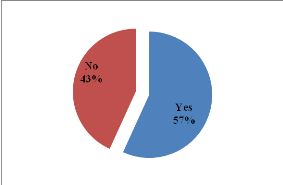

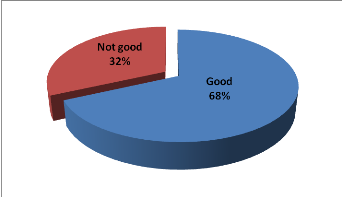

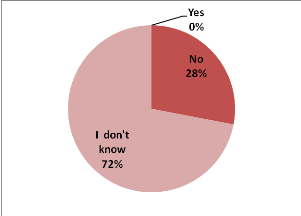

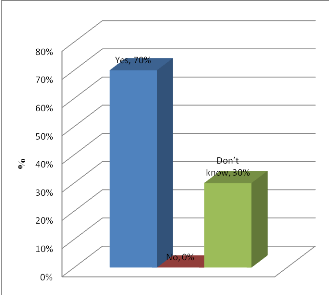

methods for data collection. The findings from interviews revealed that there

are no structured and written risk management plans but still employees have

some knowledge about risk as confirmed by interviewees. Ninety two percent of

respondents confirmed to have had trainings related to risk management, 84%

expressed their concern about physical and technological risks. Seventy four

percent had been once at risk which could put their life in danger. Also,

respondents demonstrated their need of protective equipment by 88% but this

number dropped to nearly 57% with no convincing reasons as the management

confirmed their existence. Respondents admitted by 72% that they don't know

whether there are risk management plans within the company but, nearly the same

percentage confirmed the existence of rules and regulations that govern the

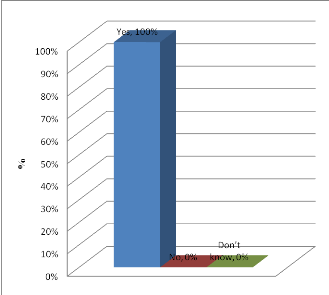

company. All respondents (100%) know that they have health insurance which

helps them to pay less when they are sick or their close relatives. As far as

the future of risk management is concerned, the management is planning to hire

a consultant to carry out the feasibility study. The study demonstrated needs

for the enterprise management to come up with strong operational risk

management plans.

CHAPTER ONE: BACKGROUND TO THE STUDY

1.0

Introduction

This chapter contains the background of the study,

statement of the problem, the purpose of the study, general and specific

objectives, research questions, significance of the study, definitions of terms

as well as the conceptual framework. It covers the overview of

risk management in general, highlights the motivation of the researcher to

carry out this study and states the importance of the study towards the readers

as well as to the research setting.

1.1 Background to the study

Risk is usually defined as an assessment of the possibility of

some adverse event occurring and the likely consequences of this event. Risk is

inherent in the functions and activities of any organisation and its service

providers.

Risks can come from uncertainty in all areas such as in

accidents, natural causes, business and project failures, attack from

adversaries etc (Hillson D.1997). Any business has exposure to a diverse range

of risks. This exposure includes professional risks, commercial risks,

political risks, risks to beneficiaries, community services and risks

associated with competition. The organisation's main risk mitigation strategies

to date have included administrative, contractual, technical, safety and

management controls as a part of business and program activities

(www.treasury.act.gov.au).

As the consequences of an adverse event may include an

inability to meet beneficiary and customer requirements, financial loss,

organisational or political embarrassment, operational disruption, legal

problems, and so forth, it is important that management policies, procedures

and practices are in place to minimise the organisation's exposure to risk.

Risk management involves adopting and applying a systematic process to

identify, analyse, assess, control and monitor risk so that it is reduced and

maintained within an acceptable level. Risk management is a business tool and a

part of «good management» and good planning processes. (Hillson

D.1997)

Risk management is a key part of improving a business and

services to be a leading business. The aim is to achieve best practice in

controlling all the risks to which business is exposed. To achieve this aim,

risk management standards should be created, maintained and continually

improved. This will involve risk identification and risk evaluation linked to

practical and cost-effective risk control measures. (

www.standards.com.au)

Risk management is a continuous process demanding awareness

and proactive action from all the organisation's employees and outsourced

service providers to reduce the possibility and impact of accidents and losses,

whether caused by the organisation or externally. Risk management is a core

responsibility for all managers. Suitable risk management activities should be

incorporated into the business planning, operations and the management.

(

www.insuranceriskadvice.act.gov.au).

Risk management is one way of business planning and

implementation process, but, the fact of having a Risk Management Plan (RMP) is

not enough, it must be operational and all company's employees must be aware of

it and get trainings on how it is implemented. These trainings are mandatory

because these ones must know how to prevent some risks and how they behave in

front of a materialized risk (issue) because they may be themselves either,

source of risk or be at risk if not well protected (www.treasury.act.gov.au).

Importantly, the research will assess the level of risk management in private

institutions.

Risks are everywhere in this world, it is almost impossible

for all of them to be prevented or controlled before they appear. Some risks

are harder to identify and prevent their occurrences (e.g. risks of a natural

disaster like Tsunami, draught, floods etc). But, some of them are manageable

and preventable but do occur and cause serious negative consequences in life

simply because of ignorance, negligence or lack of planning (

http://www.mindtools.com). Etablissement

Kazoza et Compagnie (EKJ&CIE) is a fourteen year old company working in

Rwanda involved in house and road building, electrical ware repair. With

time and of the ambitious plans by owners, its capacity was increased time to

time. However, EKJ&CIE like any other business company faces a high market

competition of similar and older companies registered in the Rwanda Development

Board (RDB). Among others, it faces risks like high competition, theft,

environmental pollution, physical injuries to the personnel, fire, IT fraud,

insecurity among others which may cause negative consequences such as financial

loss, injuries, deaths of employees etc (

www.morebusiness.com) despite good

financial investments. The success on the open market requires many factors

among which the risk management plays a big role.

1.2 Statement

of the problem

The EKJ & CIE like any other business company was under

threat of a number of business risks. These are linked with high competition,

tax penalties, theft, insufficient capital investments, unstable human

resource, physical injuries to personnel, fraud, global economy crisis etc.

The researcher investigated the company's operational risk

management plan, assessed challenges they face and examined the current trend

in risk management. The researcher also assessed the level of awareness of

company's staff about risk and how they deal with them.

1.3 The purpose of the

study

This study aimed at examining how EKJ&CIE deals

with potential risks that endanger its businesses. It found out the current

trend in risk management strategies in EKJ&CIE and assessed the employees'

awareness in matters related to risk management procedure. It aimed at finding

out the gap in risk management between the current and the one desired and made

appropriate recommendations to the management of EKJ&CIE which other

similar business institutions may benefit as well.

1.4 Objectives of the

study

1.4.1 General objective of

the study

To examine the risk management plans of EKJ&CIE. These are documents prepared by/for the

manager to foresee

risks, to estimate the impacts, and to create response plans to

mitigate them.

1.4.2 Specific objectives of the study

1. To explore the level of awareness of EKJ&CIE employees

in relation with risk management

2. To analyse the risk management plans used in EKJ&CIE

3. To investigate challenges faced by the risk management in

EKJ&CIE

4. To examine the current trend of risk management in

EKJ&CIE

The following questions were raised from this study:

1. What is the level of awareness of EKJ&CIE employees in

relation with risk management?

2. What are plans of risk management in EKJ&CIE?

3. Which challenges does EKJ&CIE face in relation with

risk management?

4. What is the current trend of EKJ&CIE in risk

management?

1.5 Scope of the

study

This study covered only the area of risk management whereby

the researcher analysed how the management assessed, treated and communicated

risks. The research demonstrated risk management plans used in EKJ&CIE,

identified challenges faced, assessed the level of awareness of the staff and,

examined the current trend of EKJ&CIE in risk management. It was a case

study due to financial and time constraints and was carried out in EKJ&CIE

and covered the period from 2006 to 2011.

1.6 Significance of the

study

Risks are worldwide and human beings need to control and

minimize them at some extent in order to cope with life. In the

business/project environment, it is ideal to equip with a well structured risk

management which requires sequential and orderly phases namely; Risk

identification, quantification, response, monitoring and control. However,

there have been a lot of researches done in other countries regarding risk

management as one of business promoting strategies. However, in Rwanda, there

was no research done concerning risk management in private businesses/projects

and therefore no information was available on risk management as business

promoting strategy. The study highlighted the role of risk management plans,

challenges of risk management plans, the current trends of risk management and

the employee awareness regarding risk management in EKJ&CIE.

It was hoped that the findings

from this study would be relevant to a variety of beneficiaries including the

researcher, Kabale University, future readers of the findings as well as the

EKJ&CIE management.

1.7 Definitions of

terms

Business: A business (also

known as enterprise or firm) is an

organization engaged in

the trade of

goods,

services, or

both to

consumers. Businesses are

predominant in

capitalist

economies, in which most of

them are

privately owned and

administered to earn

profit to

increase the

wealth of their owners.

Businesses may also be

not-for-profit

or

state-owned.

A business owned by multiple individuals may be referred to as a

company, although that term

also has a more precise meaning.

Insurance: A

promise

of compensation for specific

potential

future losses in

exchange for a

periodic

payment. Insurance

is designed to

protect the

financial

well-being of an

individual,

company or other

entity in the case

of unexpected

loss.

Issue: concern that requires solution on the

project.

Personal protective equipment (PPE): it is

any apparel, accessories, apparatus, or substance which guards an individual

from suffering injuries during mishaps. As such, equipments such as these are

vital in industries working with heavy machinery, production, medical, and the

like requiring the handling of dangerous substance and equipment. It can also

refer to those protective attire and accessories used in sporting activities.

The key reason for PPE is to reduce occupational hazards to ensure the safety

of employees.

Risk analysis: Risk analysis is the process

of defining and analyzing the dangers to individuals, businesses and government

agencies posed by potential natural and human-caused adverse events or a

process of assessing identified risks to estimate their impact and probability

of occurrence (likelihood).

Risk control: The process through which

decisions are reached and protective measures are implemented for reducing

risks to, or maintaining risks within, specified levels.

Risk identification: The process of

identifying risks using techniques such as brainstorming, checklists and

failure history.

Risk Management (RM): the way through which

an organisation identify and treat risk minimise loss. It is a

logical and systematic method of identifying, analyzing, treating and

monitoring the risks involved in any activity or process.

Risk Management Plan: is a document prepared

by a

business/manager to

foresee risks, to estimate the effectiveness, and to create response plans to

mitigate them.

Risk response:

Appropriate

steps taken or

procedures

implemented upon

discovery

of an unacceptably

high

degree

of

exposure

to one or more

risks.

Also called

risk

treatment.

Risk: A risk is something that may happen and

if it does, will have a positive or negative impact

1.8 Conceptual frame

work

This is a theoretical

structure

of

assumptions,

principles,

and

rules that

holds

together the

ideas

comprising a broad

concept.

It is structured from a set of broad ideas and theories that help a researcher

to properly identify the problem they are looking at, frame their questions and

find suitable literature. It is used to guide in data collection and

analysis.

-Policies

Risk management

Other variables Dependent variable

-Risk identification

-Risk quantification

-Risk

analysis

-Risk response

-Risk monitoring and control

Intermediate variables

- Prevention of financial loss

-Risk awareness

-Quality

management

-Business plans

-Communication

-Business growth

Private business institutions

Independent variable Consequential variables

EKJ&CIE Environment-Rwanda

Source: Field research, June 2011

Private business development is

one of development leading factors in any country. However, there are many

factors that influence this growth either inside the business institution

itself or from outside of it. One of those factors is the government policies

(other variables) in relation with trade, taxes etc. In Rwanda for instance,

the doing business policy allows new entrepreneurs to register in Rwanda

development board and start the business within 24 hours only.

The business establishment is not enough, it requires other

factors for its growth and sustainability like risk management (dependent

variable) among others. This is a continuous process whose purpose is to

clarify the importance and events for tackling the risks that the business may

face. Risk management is important because it gives the ability to figure out

methods for which events can be managed, especially those events that may have

an adverse impact on the financial or human capital of the organization.

This includes the information about the evaluation of various

risks and four options for managing each risk (intermediate variables) which

are risk identification, quantification, response and risk monitoring and

control. This is a proactive process and not reactive.

The implementation of the risk management process illustrated

above leads to the following positive outcomes (consequential variables);

prevention of financial losses whereby resources are well planned and

allocated, risk awareness by all employees of the institution by following

internal rules and regulations and obeying the law among others which leads to

quality management, establishing good business plans, adequate communication

within the business organisation which in combination lead to a business growth

of the institution (independent variable)

CHAPTER TWO: LITERATURE REVIEW

2.0 Introduction

This chapter gives an overview of the literature of other

researchers and writers about risk management. However key words are well

explained and theories are discussed. The historical back ground of risk

management is explained, dangers and benefits of implementing a risk management

plan, challenges of risk management and the current trend of risk

management.

2.1 Overview of Risk Management

The entire history of the human species is a chronology of

exposure to misfortune and adversity of efforts to deal with risks. Although it

is perhaps an exaggeration to claim that the earliest profession was risk

management, it can be argued that from the dawn of their existence, humans have

faced the problem of survival, not only as individuals but as species. The

initial human concern was a quest for security and avoidance of the risks that

threatened extinction. Our continued existence is testimony to the success of

our ancestors in managing risk (Emmett, 1997).

The real risk management record is from Babylon in the code of

Hammurabi, dating from around 2100 BC (Sadgrove, 2005). This concerned a form

of naval insurance whereby the owner of the vessel can borrow money to buy

cargo and does not have to pay the debt if the ship is lost at the sea. Until

recently insurance was still the main way that companies managed risk. Thus in

1960s and 1970s insurance companies sought to reduce their potential losses by

encouraging businesses to make their premises safer. This was the

«1st age» of risk management. Currently, insurance desire

other aspects for risk management.

Businesses considered only non entrepreneurial risk (such as

security). They also used risk reactively, to see how much insurance they

should buy. In 1980s, businesses started to introduce quality assurance, to

ensure that products conformed to their specifications. This was heralded by

the British Standard Institutions (BSI) launching the quality standard BS5750

in 1979. In this, the «2nd age» of risk management,

companies treated risk in a more proactive or preventive way (Emmet, 1997).

In 1993, James Lam became the world's first Chief Risk

Officer, at the US financial services firm GE capital.

The «3rd age» of risk management arrived

in 1995 with the publishing by Standards Australia of world's risk management

standard, AS/NZS4360: 1995, which has now been updated three times. This was

followed by the Canadian standard, CAN/CSA-Q850-97 (Fone & Young, 2000).

It is not known when exactly risk management was used in

Africa in general and in east Africa in particular but, really, as in the

middle-east and Europe. Africans also had their ways of handling risks and

issues even though data were not recorded like other parts of the world because

of illiteracy. For instance, in the field of prediction and early warning of

disasters, the Luo community in the Lake Victoria basin had a large number of

climate monitoring indicators that enabled them to tell such things as the

right time to start planting in anticipation of the rains or to preserve and

store food in anticipation of a dry season. These indicators included

observation of the behaviour of animals, birds, reptiles, amphibians, insects,

vegetation and trees, winds, temperatures and celestial bodies. In the area of

animal health, the Maasai, who inhabit both Kenya and Tanzania, had at least

half a dozen different medicinal plants for treating East Coast Fever alone in

cattle. In farming technologies, the Matengo people, believed to have lived in

the steep slopes of Matengo Highlands since the Iron Age, had developed a

sophisticated system that enabled them to grow crops on hillsides while at the

same time controlling soil erosion and improving soil moisture and fertility.

For example, the Banyala community in Budalang'i living on the shores of Lake

Victoria had a well-organized system for mitigating impeding disasters. There

were elders who dealt with rainfall prediction and early warning. Each

homestead had a dugout canoe ready for transport in case of heavy flooding.

Each community was also required to dig trenches to control the water around

the homestead and around farmlands. In addition, they were required to avoid

ploughing along the lake shores when heavy flooding was predicted and were

advised to catch fish during April-August rainy period when they were plentiful

and preserve them by drying and smoking for use in times of scarcity.

Those living on the highlands were expected to accommodate

neighbours displaced by floods in the lowlands, which were flood prone areas,

and so on.

In Swaziland, where drought and occasional floods are common

disasters, communities took precautions after predicting disasters. For

example, they used the height of the nests of the emahlokohloko bird (Ploceus

spp.) on trees to predict floods. When floods are likely to occur the nesting

of the emahlokohloko is very high up the trees next to a river and when floods

are unlikely the nests are low down. The Swazis also used the cry of certain

birds to predict rain and yields of certain wild fruit plants to predict

famine. Other indigenous methods used by the Swazis to predict natural hazards

include wind direction, the shape of the crescent moon and the behaviour of

certain animals (UNEP, 2008).

2.2 Risk management plan

Some experts have said that a strong risk management process

can decrease problems on a project/business by as much as 80 or 90 percent

(www.executivebrief.com)

There are four stages to risk management planning; Risk

Identification, Risks Quantification, Risk Response and Risk Monitoring and

Control (

www.projectperfect.com).

2.2.1 Risk Identification

It consists of identifying and naming all possible risks. The

best approach is a workshop with all staff to carry out the identification by

using a combination of brainstorming and reviewing of standard risk lists (

www.projectperfect.com). Other

researchers have identified other methods to identify risks by using a risk

calculator (www.referenceforbusiness.com). The risk calculator measures three

kinds of internal pressures: risk stemming from growth, corporate culture, and

information management. Using the risk calculator, managers can determine if

their company has a safe or dangerous amount of risk.

Although the risk calculator is not a precise tool, it does

indicate areas where risks and potential losses exist, such as the rate of

expansion and the level of internal competition.

2.2.1.1 Objectives of Risk Identification

The objectives of risk identification are to identify and

categorize risks that could affect the project and

document these risks. The outcome of risk identification is a list of risks.

What is done with the list of risks depends on the nature of the risks and the

project. On noncomplex, low-cost projects with little uncertainty (few risks),

the risks may be kept simply as a list of red flag items. The items can then be

assigned to individual team members to watch throughout the project development

process and used for risk allocation purposes. On complex, high-cost projects

that are by nature uncertain, the risks can feed the rigorous process of

assessment, analysis, mitigation and planning, allocation, and monitoring and

updating described in this document (Highways Agency 2001).

The risk identification process should stop short of assessing

or analyzing risks so that it does not inhibit the identification of "minor"

risks. The process should promote creative thinking and leverage team

experience and knowledge. In practice, however, risk identification and risk

assessment are often completed in a single step, a process that can be called

risk assessment. For example, if a risk is identified in the process of

interviewing an expert, it is logical to pursue information on the probability

that it will occur, its consequences/impacts, the time associated with the risk

(i.e., when it might occur), and possible ways of dealing with it. The latter

actions are part of risk assessment, but they often begin during risk

identification (Federal Highway administration, 2005).

2.2.1.2 Risk Identification Process

The risk identification process begins with the team compiling

the risk events. The identification process will vary, depending on the nature

of the project and the risk management skills of the team members, but most

identification processes begin with an examination of issues and concerns

created by the project development team. These issues and concerns can be

derived from an examination of the project/business description, work breakdown

structure, cost estimate, design and construction schedule, procurement plan,

or general risk checklists. The team should examine and identify events by

reducing them to a level of detail that permits an evaluator to understand the

significance of any risk and identify its causes, (i.e., risk drivers). This is

a practical way of addressing the large and diverse numbers of potential risks

that often occur on highway design and construction projects. Risks are those

events that team members determine would adversely affect the project (Highways

Agency, 2001).

After the risks are identified, they should be classified into

groups of like risks. Classification of risks helps reduce redundancy and

provides for easier management of the risks in later phases of the risk

analysis process. Classifying risks also provides for the creation of risk

checklists, risk registers, and databases for future projects (Federal Highway

Administration, 2005).

Numerous techniques are available to facilitate risk

identification after documents have been reviewed. Brainstorming, scenario

planning, and expert interviews are tools commonly used. The nominal group

method allows each team member to create a list individually. The Delphi method

is a process in which each team member individually and anonymously lists

potential risks and their inputs. The Crawford slip method allows the team to

individually list up to 10 risks. Afterward these risks are divided by the team

into various categories and logged by category. Influence or risk diagramming

is explained in the

"Probability

or Decision Trees and Influence Diagrams". Nominal group, Delphi, Crawford

slip, and influence diagramming also serve as good tools for risk assessment,

which is often blurred with risk identification (Operations, 2005)

The key to success with any risk identification tool or

technique is to assist the experts in identifying risks. People and the

agency's risk culture are the keys to continuous risk identification and risk

management. The documents and techniques should only support the people in the

risk assessment process and never inhibit or replace the engineering judgment

required for a comprehensive risk identification process (United States

Department of Labour, 2003)

The risk identification process identifies and categorizes

risks that could affect the project/business. It documents these risks and, at

a minimum, produces a list of risks that can be assigned to a team member and

tracked throughout the project/business development and delivery process. Risk

identification is continuous and new risks should continually be invited into

the process. The tools and techniques should support the risk identification

process, but it will be the people involved in the exercises who are most

critical to the success of the process (Highways Agency 2001).

2.2.2. Risk Quantification

Following the risk identification

and qualitative risk assessment phases, risks are characterized by their

frequency of occurrence and the severity of their consequences. Frequency and

severity are the two primary characteristics used to screen risks and separate

them into minor risks that do not require further management attention and

significant risks that require management attention and possibly quantitative

analysis. Various methods have been developed to help classify risks according

to their seriousness. One common method is to develop a two-dimensioned matrix

that classifies risks into three categories based on the combined effects of

their frequency and severity.

It

requires classifying risks into one of five states of likelihood (remote

through near certain) and into five states of consequence (minimal through

unacceptable). These assessments yield a five-by-five matrix that classifies a

risk as either "high" (red), "moderate" (yellow), or "low" (green).

Risks need to be quantified in two dimensions. The impact of

the risk needs to be assessed. The probability of risk to occur needs to be

assessed. For simplicity, rate each on a 1 to 4 scale.

The larger the number, the high is the impact or probability

of that event to occur. By using a matrix, a priority can be established

(www.projectperfect.com).

If probability is high, and impact is low, it is a Medium

risk. On the other hand if impact is high, and probability low, it is High

priority. A remote chance of a catastrophe warrants more attention than a high

chance of a hiccup (www.projectperfect.com).

2.2.2.1 Low Risk Events

Risks that are characterized as low can usually be disregarded

and eliminated from further assessment. As risk is periodically reassessed in

the future, these low risks are closed, retained, or elevated to a higher risk

category (www.projectperfect.com).

2.2.2.2 Moderate Risk Events

Moderate-risk events are either high-likelihood,

low-consequence events or low-likelihood, high-consequence events. An

individual high-likelihood, low-consequence event by itself would have little

impact on project cost or schedule outcomes. However, most projects contain

myriad such risks (material prices, schedule durations, installation rates,

etc.); the combined effect of numerous high-likelihood, low-consequence risks

can significantly alter project outcomes. Commonly, risk management procedures

accommodate this high-likelihood, low-consequence risks by determining their

combined effect and developing cost and/or schedule contingency allowances to

manage their influence (www.projectperfect.com).

Low-likelihood, high-consequence events, on the other hand,

usually warrants individualized attention and management. At a minimum,

low-likelihood, high-consequence events should be periodically monitored for

changes either in their probability of occurrence or in their potential impacts

(www.projectperfect.com).

2.2.2.3 High Risk Events

High-risk events are so classified either because they have a

high likelihood of occurrence coupled with at least a moderate impact or they

have a high impact with at least moderate likelihood. In either case, specific

directed management action is warranted to reduce the probability of occurrence

or the risk's negative impact (www.projectperfect.com).

An example Risk Matrix would be as follows:

|

Negligible

|

Marginal

|

Critical

|

Catastrophic

|

|

Certain

|

High

|

High

|

Extreme

|

Extreme

|

|

Likely

|

Moderate

|

High

|

High

|

Extreme

|

|

Possible

|

Low

|

Moderate

|

High

|

Extreme

|

|

Unlikely

|

Low

|

Low

|

Moderate

|

Extreme

|

|

Rare

|

Low

|

Low

|

Moderate

|

High

|

Source: Cox, L.A. Jr., 2008

2.2.3 Risk Response

Risk identification, assessment, and analysis exercises form

the basis for sound risk response options. A series of risk response actions

can help agencies and their industry partners avoid or mitigate the identified

risks. Wideman, in the Project Management Institute standard Project and

Program Risk Management: A Guide to Managing Risks and Opportunities, states

that a risk may be the following; unrecognized, unmanaged, or ignored (by

default), recognized, but no action taken (absorbed by a matter of policy),

avoided (by taking appropriate steps), reduced (by an alternative approach),

transferred (to others through contract or insurance), retained and absorbed

(by prudent allowances) or handled by a combination of the above.

The above categorization of risk response options helps

formalize risk management planning. The Caltrans Project Risk Management

Handbook suggests a subset of strategies from the categorization defined by

Wideman above. The Caltrans handbook states that the project development team

must identify which strategy is best for each risk and then design specific

actions to implement that strategy. The strategies and actions in the handbook

include the following:

1. Avoidance. The team changes the project plan to eliminate

the risk or to protect the project objectives from its impact. The team might

achieve this by changing scope, adding time, or adding resources (thus relaxing

the so-called triple constraint).

2. Transference. The team transfers the financial impact of

risk by contracting out some aspect of the work. Transference reduces the risk

only if the contractor is more capable of taking steps to reduce the risk and

does so.

3. Mitigation. The team seeks to reduce the probability or

consequences of a risk event to an acceptable threshold. It accomplishes this

via many different means that are specific to the project and the risk.

Mitigation steps, although costly and time consuming, may still be preferable

to going forward with the unmitigated risk.

4. Acceptance. The project manager and team decide to accept

certain risks. They do not change the project plan to deal with a risk or

identify any response strategy other than agreeing to address the risk if it

occurs.

Given a clear understanding of the risks, their magnitude, and

the options for response, an understanding of project risk will emerge. This

understanding will include where, when, and to what extent exposure will be

anticipated. The understanding will allow for thoughtful risk planning (Traffic

Management Act, 2005).

There are five types of strategies that are being used

according to the level of risk that exists: risk avoidance, risk reduction,

risk transfer, risk sharing and risk retention . Risk avoidance takes place

when there are either poor arrangements or hazards that cannot be controlled,

and hence, managers postpone the activity or offer an alternative one

(Swarbrooke et al, 2003; Parkhouse, 2005; Beech and Cladwick, 2004). In risk

reduction, all activities should be managed by capable and well-trained

leaders, who have the experience and the competence to cope with possible risks

(Swarbrooke et al, 2003; Beech and Cladwick, 2004; Outhart et al, 2003).

Managers often employ the risk transfer method, in which the risk is

transferred to insurance companies, to the clients or to third parties

(Centner, 2005; Swarbrooke et al, 2003; Beech and Chadwick, 2004; Boyle, 2000).

Finally, risk retention is a strategy during which mainly low risks are being

accepted either unconsciously or because of incapability to transfer them to

others.

A risk response plan should include the strategy and action

items to address the strategy. The actions should include what needs to be

done, who is doing it, and when it should be completed.

2.2.4

Risk Monitoring and Control

The final step is to continually monitor risks to identify any

change in the status, or if they turn into an issue. It is best to hold regular

risk reviews to identify actions outstanding, risk probability and impact,

remove risks that have passed, and identify new risks (

www.clinicalgovernance.scot.nhs.uk).

Monitoring and control is not complete unless communication

has occurred. Communication is the lynch-pin of

effective project management and risk management. Communication within and

among the team will be crisp, concise, complete, correct and timely as will the

communication to upper management and executives. Effectiveness of the risk

response actions will be monitored and reported regularly (Project Risk

Management, 2010).

Risk monitoring and control is required in order to ensure the

execution of the risk plans and evaluate their effectiveness in reducing risk,

keep track of the identified risks, including the watch list, monitor triggers

conditions for contingencies, monitor residual risks and identify new risks

arising during project execution and updating the organizational process assets

(

www.faculty.kfupm.edu.sa).

2.2.4.1 Purpose of risk monitoring and

control

The purpose is to determine if risk responses have been

implemented as planned, actions are as effective as expected or if new

responses should be developed. Whether project assumptions are still valid,

risk exposure has changed from its prior state, with analysis of trends, if a

risk trigger has occurred, proper policies and procedures are followed or if

new risks have occurred that were not previously identified (

www.faculty.kfupm.edu.sa)

2.2.4.2 Inputs to risk

monitoring and control

Risk Management Plan: The Risk Management

Plan is details how to approach and manage project risk. The plan describes the

how and when for monitoring risks. Additionally the Risk Management Plan

provides guidance around budgeting and timing for risk-related activities,

thresholds, reporting formats, and tracking (www.anticlue.net).

Risk Register: The Risk Register contains the

comprehensive risk listing for the project. Within this listing the key inputs

into risk monitoring and control are the bought into, agreed to, realistic, and

formal risk responses, the symptoms and warning signs of risk, residual and

secondary risks, time and cost contingency reserves, and a watch list of

low-priority risks (www.anticlue.net).

The Approved Change Requests: They are the

necessary working methods and contracts. Changes can impact existing risk and

give rise to new risk. Approved change requests need to be reviewed from the

perspective of whether they will affect risk ratings and responses of existing

risks, and or if a new risk is a result (www.anticlue.net).

Work Performance Information: Work

performance information is the status of the scheduled activities being

performed to accomplish the project work. When comparing the scheduled

activities to the baseline, it is easy to determine whether contingency plans

need to be put into place to bring the project back in line with the baseline

budget and schedule. By reviewing work performance information, one can

identify if trigger events have occurred, if new risk are appearing on the

radar, or if identified risks are dropping from the radar

(www.anticlue.net).

Performance Reports: Performance reports

paint a picture of the project's performance with respect to cost, scope,

schedule, resources, quality, and risk. Comparing actual performance against

baseline plans may unveil risks which may cause problems in the future.

Performance reports use bar charts, S-curves, tables, and histograms, to

organize and summarize information such as earned value analysis and project

work progress.

All of these inputs help the manager to monitor risks and

assure a successful project/business (

www.anticlue.net)

2.2.4.3 Dangers of uncontrolled

risk

Uncontrolled risks for any business/project may be summarized

into financial loss due to product recall, customer defecation, fines, customer

disfavour, bad publicity, workforce dissatisfaction, theft of money etc. While

also, they can cause direct human sufferings like harm to staff and customers

when caught with fire which appear accidentally within the company's premises (

http://portal.surrey.ac.uk).

2.3 Benefits of Risk

Management

Management of risk is an integral part of good business

practice and quality management. Learning how to manage risk effectively

enables managers to improve outcomes by identifying and analysing the wider

range of issues and providing a systematic way to make informed decisions. A

structured risk management approach also enhances and encourages the

identification of greater opportunities for continuous improvement through

innovation (http://portal.surrey.ac.uk).

Risk management techniques provide the personnel, at all

levels, with a systematic approach to managing the risks that are integral

parts of their responsibilities. Also, a number of studies have been undertaken

to identify the benefits that can be expected by those implementing a

structured approach to risk management (Newland, 1997). These benefits include;

better informed and achievable business plans, schedules and budgets, increased

likelihood of business growth, proper allocation of risk through the contract,

identification of best risk owner, improved communication etc. It is of paramount

importance for each business company, development project to have a working

risk management plan that help top managers to early identify and treat risks

that may negatively or positively affect the business/ project. However, almost

all writings are from the developed world and there is little third world

experiences shared in risk management.

2.4 Challenges to risk

management

Risk management challenges are implicit in a corporation's

activities because risk events are typically uncertain. An effective risk

management process helps a company's top leadership establish rules to prevent

operating losses due to human error, employee carelessness, technological

malfunction or fraud. To illustrate, a company's management may put into place

internal controls and procedures as well as periodic internal audit reviews to

ensure that employees comply with rules when performing duties. A risk

management policy also may cover financial risks such as credit and market

risks. Challenges that may arise in risk management processes may be

significant if a corporation does not establish proper decision-making

mechanisms, and internal controls are not adequate or functional. A functional

procedure provides appropriate solutions to internal problems. An adequate

policy instructs employees on how to perform tasks and report problems. Risk

management challenges may include staff non-compliance with rules and

regulations, technological problems due to software or hardware updates and

inaccuracies that may exist in financial market data. Also, Challenges may

relate to operational, technological or compliance risks (

www.ehow.com). Other challenges like market

and credit risks are also common.

Very few organizations find enterprise risk management

implementation easy. It requires a rare combination of organizational

consensus, strong executive management and an appreciation for various program

sensitivities. Despite the effort required, however, ERM is worth it because it

forces most organizations to step back and identify their risks, which is one

of the first steps to protecting capital and driving shareholder value. As

boards and executive management evaluate ERM, however, they usually come away

with more questions than answers. While each company faces specific concerns,

the more challenging ERM issues are generally consistent across companies and

are largely unrelated to industry, geography, regulation or competitive

landscapes. By examining some of these common ERM challenges, as well as the

creative solutions that have been applied by other organizations, management

will be better equipped to develop and revamp their own enterprise risk

management programs.

However, J. Negus (2010) insisted on 10 ERM challenges

commonly found as the following: assessing ERM's value, privilege, defining

risk, risk assessment method, risk assessment method, time horizon, multiple

potential scenarios, ERM ownership, risk reporting as well as simulations and

stress tests.

1. Assessing ERM's Value

The issue: In an economy driven by positive return on

investment, organizations often struggle to demonstrate sufficient ERM value to

justify implementation costs. While traditional investment decisions are

evaluated using common risk and reward metrics such as return on equity (ROE),

return on assets (ROA) and risk adjusted return on capital (RAROC), ERM value

drivers are less prescriptive. Despite growing guidance, ERM remains largely

voluntary, resulting in a value proposition void of compliance language and

regulatory encouragement.

2. Privilege

The issue: An ERM program allows management to quantify the

company's risks. As risk information becomes increasingly event-driven and

dollar-based, company lawyers may raise issues regarding risk distribution to

external regulators, auditors and constituents. Organizations must balance risk

visibility and legal exposure.

3. Defining Risk

The issue: One of the biggest challenges is establishing a

consistent and commonly applied risk nomenclature. Any inconsistencies between

risk definitions or methodologies are likely to jeopardize the program's

success.

4. Risk Assessment Method

The issue: Enterprise risk assessments are performed using a

variety of approaches and tools, including surveys, interviews and historical

analysis. Each approach offers its own value and drawbacks that must be closely

reviewed to determine organization

suitability.

5. Risk Assessment Method

The issue: A key decision for many organizations is whether

risks are assessed using qualitative or quantitative metrics. The decision is

generally driven by the organization's industry, commitment to ERM, its view

regarding privilege and overall cost.

The qualitative method provides management with general

indicators rather than specific risk scores. Qualitative results are commonly

presented as red, yellow and green light, or high, medium and low risks.

Qualitative risk assessments are frequently favored because

they require less sophisticated risk aggregation methods, mathematical support

and user training, which means lower implementation costs. Conversely,

qualitative results are commonly criticized for their limited alignment with

key financial statement and budgetary indicators. Additionally, some critics

suggest qualitative results are generally more difficult to interpret, which

limits management's ability to assign accountability and remediate.

6. Time Horizon

The issue: The time horizon of ERM risk assessment is largely

based on the organization's intent to use ERM risk results and its willingness

to invest in risk management.

Many companies use ERM results for quarterly or year-end

planning, while more sophisticated companies integrate ERM results into annual

budgeting and longer-term strategic planning processes.

The shorter-term time horizon (less than 12 months) is

generally preferred as it requires less user training, provides increased risk

estimation accuracy and is generally less expensive than the longer-term

alternative. The longer-term solution is applied where management values risk

visibility beyond the annual financial reporting period and additional time to

remediate. Regardless of the approach, the risk assessment time horizon must be

consistent with intended ERM program objectives.

7. Multiple Potential Scenarios

The issue: Consider the following scenario: The ERM

team asks a respondent to assess the likelihood of counterparty default and its

subsequent loss impact during the current fiscal year. The respondent

determines that there is a 100% probability of at least one counterparty

default with a low financial impact over the defined time horizon (high

probability/low impact event). There is also a 5% probability of at least one

counterparty default with a significant financial impact (low probability/high

impact event) and several default scenarios with varying loss severity

estimates (moderate probability/moderate impact).

This situation highlights an issue associated with basic risk

assessment methods most risks have multiple event likelihoods and risk

severities.

8. ERM Ownership

The issue: The question regarding who should "own" ERM is

often unclear and commonly disputed at the board, audit committee and

management levels.

While there is no one single industry practice with respect to

organization structure, ERM administration should generally be held by risk

management followed by internal audit, finance/treasury, legal and various

supporting departments (e.g., compliance, strategic planning).

9. Risk Reporting

The issue: Organizations often struggle with two risk

reporting issues: 1) what information should be shared with various internal

and external constituents, and 2) how should risk be

communicated.

10. Simulations and Stress Tests

The issue: Stress tests allow management to assess the degree

that business operations may be negatively affected by prescribed events and

gauge the organization's ability to respond. While the concept is intuitive,

organizations often struggle to balance the need for meaningful simulation and

stress tests against a nearly infinite number of potential scenarios.

Similarly, organizations frequently struggle to identify and predict unknown or

unlikely risks (also known as black swans or game changers).

2.5 Risk awareness among

employees

All business institutions should have a vibrant risk culture.

A healthy risk culture gives employees a stake in risk management. Employees'

basic principles, values, and attitudes as well as their understanding of how

to deal with risk shape a company's risk culture. An appropriate risk culture

is necessary for corporate risk management procedures to work effectively

(www.rsmi.com). This requires that employees directly involved in internal

controls be fully aware of risks. For the company's internal control system to

fulfill its purpose, employees must operate within a well-established,

enterprise-wide risk culture. The tone at the top, the ethical atmosphere that

the organisation's leadership creates is fundamental. This is imperative for

all employees to become `risk aware' to evidence and ensure compliance (

www.safetrac.com). A risk aware culture

is required to support and pervade the work ethic.

2.5.1 Creating risk awareness culture

Risk management consultants play a key role in helping

companies prevent fraud by installing an effective and vibrant risk culture in

companies. A healthy risk culture gives employees a stake in risk management.

Employees' basic principles, values, and attitudes as well as their

understanding of how to deal with risk shape a company's risk culture.

An appropriate risk culture is necessary for corporate risk

management procedures to work effectively. The compliance requires that

employees directly involved in internal controls be fully aware of risks. For

the company's internal control system to fulfill its purpose, employees must

operate within a well-established, enterprise-wide risk culture. The tone at

the top the ethical atmosphere that the organisation's leadership creates is

fundamental. But exemplary leadership does not automatically lead to an

effective risk culture, nor does it guarantee a properly functioning internal

control system.

Shaping risk culture

Annual reports typically convey the impression that companies

have implemented effective risk management procedures. But risk culture is

often neglected as an integral part of corporate risk management. E. Schein

(1984) developed a model of corporate culture whereby, three elements determine

the risk culture of an enterprise: Basic assumptions, values, and artifacts and

creations.

Basic assumptions are the foundation of corporate culture.

They are the invisible matters of organisational and environmental relations

that are commonly taken for granted. Employees' perceptions, thoughts, and

feelings about risks shape a company's risk culture.

Values determine employees' moral and behavioural standards.

Principles, unwritten guidelines, and taboos that employees respect come from

these values. Often these values are only partially visible from employees'

outward conduct.

Artifacts and creations are the tangible components of a

company's risk management system. They include a risk manual, a risk manager,

risk committee, published risk principles and guidelines, an IT-based risk

reporting system, and a printed risk report included in the annual report as

well as employee risk workshops. Such items are clearly visible and allow risk

managers to understand the existing risk culture of an enterprise. The presence

or absence of artifacts and creations enable managers to evaluate and shape the

company's risk culture.

According to O. Bungartz,( 2010), a plan for shaping risk

culture in an enterprise should contain four steps; creating a team to lead the

process, evaluating the existing risk culture, determining what the desired

risk culture should look like and devising and implementing an action plan to

build the new risk culture.

Create a risk culture team

Management should appoint a person independent of the

enterprise (possibly an external risk management consultant) to lead the risk

culture team. Members can include not only top management and the

risk-controlling department, but also board members and internal/ external

auditors.

Evaluate the Existing Culture

Ultimately, employees should diagnose their company's risk

culture free of external forces imposing views on them. However, the members of

the risk culture team should be responsible for discovering the employees'

views on the existing risk culture and what it should become.

The team should speak with all company employees so the entire

staff is sensitised to the risk-culture topic. Standardised and anonymous

questionnaires usually elicit more honest responses to questions about the

«risk appetite» of the company. The independent coordinator and the

members of the risk-culture team should prepare an analysis workshop for

selected upper management and cultural leaders to help uncover the invisible

basic assumptions that are fundamental to the enterprise's values. In addition

to the analysis workshop, the risk culture team should individually interview

each member of top management to promote high interactivity and frankness.

These interviews prompt senior managers to think deeply about the range of

possibilities for shaping a new risk culture. The members of the risk culture

team then conduct a critical review of the existing culture based on the

results of the enterprise-wide survey, the analysis workshop, and the

individual interviews (Oliver Bungartz, 2010).

Determine Desired Risk Culture

The profile of the target culture will be based on the same

factors that were used to evaluate the existing culture. Reorientation of the

company culture is possible only if there is a compelling reason and a shared

understanding of the need for cultural change among managers and employees. The

foremost goal of cultural reorientation is to sensitise every employee to the

necessity of conscious handling of corporate risks (Oliver Bungartz, 2010).

Action Plan

The fourth step in the risk culture programme is the

formulation of an actionable plan to realise the new cultural vision. Senior

management is responsible for implementing and monitoring this plan. New

orientation patterns are accompanied by new signals and formats as well as an

update of artifacts and creations. Securing «buy in» from employees

is crucial to the success of the action plan. They must know their input was

instrumental in creating new policies and that their continued involvement is

essential. Transparency and communication are key to making this happen. All

employees must understand that they each have a continuing role to play.

Management should reward risk sensitive behaviour that helps build the target

culture and dissuades unethical behaviour. Once the action plan begins to

initiate cultural change in the enterprise, it is common to see unanticipated

consequences. Erroneous trends (such as irritated employees or adverse cultural

developments) can surface that require monitoring and correction. A new risk

culture is vulnerable to undesired changes. Management must therefore

continuously observe and evaluate newly implemented risk-culture measures. The

figure overleaf summarises the factors and effects of an appropriate risk

culture (Oliver Bungartz, 2010).

2.6 Current trend of risk management

Over the past years, it was seen how events have altered the

perception of risk management, both inside and outside an organization. There

are three broad trends that have resulted from the exposure this area has had

recently: vertical transparency, a strengthening of risk cultures and data

control.

Pressure on firms to prove the robustness of internal risk

controls and the perceived failure of the credit rating agencies are just two

of the factors that have driven an increase in the number of chief risk

officers in western world. This is particularly important as investors

are now demanding greater transparency to ensure that risk profiles are being

properly monitored. Vertical transparency within the institution is

therefore demanded since, as this external messaging is the responsibility of

the board, the CRO requires clear bilateral communication between them

(http://blogs.sungard.com).

It's also been crucial to strengthen the risk culture right

across an institution. Metrics produced by the risk management function

need to be used in the decision-making process all across the trading

floor. This is vital for two reasons. First, limits tend to be set

centrally, with an enterprise view in mind, whereas a trader has local limits

with little or no enterprise-wide visibility. The second reason is related to

the efficiency of the calculations. Exposing the methods and data used as well

as the outputs from the risk process allows traders to see that the correct

parameters were employed. This removes objections to risk related

decisions and further allows traders to understand the backdrop to the risk

limitation process.

(http://blogs.sungard.com)

Data control was long seen as the cornerstone of the risk

management process has now taken on an even greater level of importance.

Recent market events have created a skewed set of correlated, downward sloping

data that will take a while to work through the system. The effect of

this is that close attention has to be paid to the input data and historical

stress scenarios. Multiple data sets are likely to be needed in order to

capture risks appropriate for both current and future states.

(http://blogs.sungard.com)

The emphasis on risk management has moved from increasing

product complexity towards more fundamental concerns. This change of focus has

gone a long way to helping ensure that there is no repeat show.

It has been crucial to strengthen the risk culture right

across an institution. Data produced by the risk management function need

to be used in the decision-making process. Finally, data control, long seen as

the cornerstone of the risk management process, has now taken on an even

greater level of importance. Recent market events have created a skewed

set of correlated, downward sloping data that will take a while to work through

the system (http://blogs.sungard.com)

Risk management seems to be on the minds of everyone these

days, there is no surprise that risk management is changing, and the

risks

involved in risk management are rising. So, here are some of the emerging

trends in risk management.

Liquidity Risk Overview

Liquidity risk management has taken the forefront in

risk

management plans. Liquidity issues can especially be seen within the

technology and financial parts of most businesses. Within liquidity risk, there

are three main areas:

Funding Risks: Funding risk means that the

business does not have enough cash to run the business. This is a huge worry

for anyone within risk management. Funding liquidity risk can affect how well

your organization operates. It has become a major

risk

management priority within any risk management plan.

Market Risks: Market risk usually comes in

the form of items within a portfolio, items that can't ever be sold, or

products that can't be sold in the market for their stated worth.

Counter party Risks: Counter party risk can

almost be considered consumer-driven in many cases. For example, if your client

stops paying you for something that they've bought, they have not fulfilled

their obligations to you. With the recent crisis of late, companies have had to

really consider these emerging risk management trends and implement risk

policies. It has to become part of their overall business strategy in order to

thrive in the new and more challenging environments of today

(www.brighthub.com).

CHAPTER THREE: RESEARCH

METHODOLOGY

3.0

Introduction

This chapter presents methodology describing how the study was

conducted. It includes; research design, Study population, sample and sample

size, methods of data collection, methods of data analysis and anticipation of

the study.

Research methodology refers to a philosophy of research

process. It includes the assumptions and values that serve a rationale for

research and the standards or criteria the researcher uses for collecting and

interpreting data and reaching at conclusions (Martin and Amin, 2005:63). In

other words research methodology determines the factors such as how to write

hypothesis and what level of evidence is necessary to make decisions on whether

to accept or reject the hypothesis.

3.1. Study area

This study was carried out in a private business company

dealing with house and road construction and electrical ware repair. It is

located in Kigali City in Rwanda, precisely in Nyarugenge District. It employs

101 staff.

THE MAP OF THE CITY OF KIGALI

Etablissement Kazoza Justin et Compagnie

3.2. Research design

A research design represents a plan of how particular study

should be conducted. It is concerned with the type of data that will be

collected and the means used to obtain them (Nieswiadomy; 1993). (Oswala E.C,

2001:52) refer to research design as the overall plan to use and follow in

answering the research questions. Thus it involves deciding on what type of

research questions to use and the answers to them while considering the best

way to gather data required for the study. This is a case study research. This

refers to a method based on an in-depth investigation of a single individual,

group, or phenomenon (Robert K. Yin: 2009). The researcher also used

triangulation of both quantitative and qualitative research methods for

collecting and analyzing data to describe and interpret it into information.

3.3. Study population

A research study population is also known as a well-defined

collection of individuals or objects known to have similar characteristics.

(Oswala E.C, 2001:55) refer to population as the number of persons or objects

covered by the study or with which the study is concerned. In other words, it

is a set of people or items under consideration in a study. In this research,

all employees of the EKJ&CIE form the research population through which the

sample was drawn from. The total population number was 105 employees among

which four of them were top managers.

3.4. Sample and Sample size

A sample is a small group of cases drawn from and used to

represent the large group or whole population under investigation. Therefore

sample size is the number of people or objects in the selected sample (Manheim

JB and Rich, 1999:448).

Sampling is the process of selecting elements from the total

population in such a way that the sample elements selected represent the total

population. Thus in research the sample should be a representation of the total

population such that as much as possible, most characteristics of the

population should be represented in the sample selected (Martin, E. Amin

2005:67). The researcher used two different samples according to the required

data related to the objectives of the study. On one hand, the researcher

purposively chose two of the top managers for interview in order to collect

information related to the risk management plans used, challenges they face and

the current trend of risk management. Any manager who would be available

especially the risk operation manager was considered. On the other hand, the

researcher made another sample drawn from the rest of employees from which he

intended to get information related to the employees' awareness on risk

management. This information was obtained from a distributed questionnaire to

that sample which was obtained from this formula below:

n=N/1+N(e)2

whereby:

n= sample size; N= population; e= the level of precision.

The confidence interval or margin of error is 10% or .1 where

as the confidence level is 90%

N= 101 e= 10% or 0.1 n= 101/1+ 101(0.1)2= 50.2

cases/respondents

To get that sample, the researcher had a list of all employees

arranged in alphabetical order excluding 4 top managers. A systematic sampling

method was used whereby a starting number was randomly chosen then an interval

was determined by N/n=K. It is 101/50=2

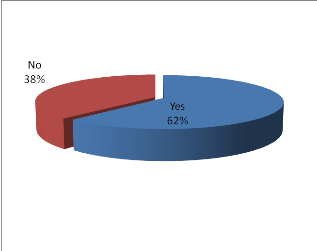

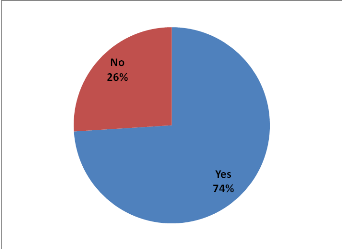

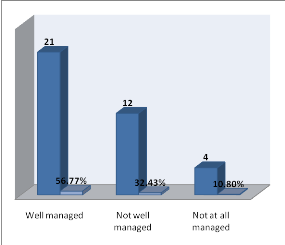

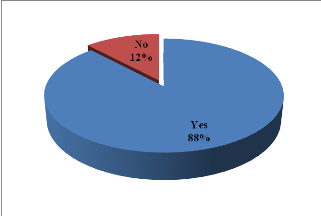

the starting number was randomly