DECLARATION

I, UKWIBSHAKA Alexis, hereby declare to the best of my knowledge,

this dissertation entitled: The rationale and the impact of banques populaires

transformation from a cooperative to a commercial bank, here in presented, is

my original work and where another's work has been used, it is indicated in

quotations and the bibliography. It has never been presented any where for a

similar award at Umutara Polytechnic or in any other academic award.

UKWIBISHAKA Alexis

Signature .....................................

Date 09/02/2010

Supervisor: Dr Eugene NDABAGA

Signature .....................................

Date ......./02/2010

CERTIFICATE

This is to certify that this work titled « THE

RATIONALE AND THE IMPACT OF BANQUES POPULAIRES TRANSFROMATION FROM A

COOPERATIVE TO A COMMERCIAL BANK» was done by UKWIBISHAKA Alexis

REG n° BCUP/0027/E/06 a student in the option of Finance at Umutara

Polytechnic in partial fulfillment of the requirements for the award of the

bachelor's degree of commerce under my guidance and supervision.

Supervisor: Dr Eugene NDABAGA

Signature .....................................

Date ......./02/2010

DEDICATION

This work is dedicated to the Almighty God, My spouse Rosine

UMUTARUTWA, my daughter Milliam, the loving memory of my late parents:

NZAMUGURA Jacquéline and RUBADUKA Céléstin for their vital

support in my education. It is also dedicated to my brothers: HAKORIMANA

Aphrodis and NIYONSABA Pascal, the late beloved brother NSABIMANA

Théoneste, to my sisters: NYIRAMARIZA Angélique, MUKAYIRANGA

Dorothy and VUGUZIGA Grace for their crucial assistance during my long

education, finally this book is dedicated to all my uncles and aunts and all

relatives for their help to achieve this work.

ACKNOWLEDGMENTS

Enough has been done throughout my education, thanks be to GOD

THE ALMIGHTY for granting me life and courage throughout my work.

Many people contributed to the completion of this work; I would

like to express my sincere thanks to everyone who assisted and supported me to

reach the completion of this work.

I wish to express my sincere gratitude to my supervisor Dr.

Eugene NDABAGA for his vital professional guidance, patience and careful

supervision, which have made this work genuine.

I would like to recognize all the staff of Umutara Polytechnic,

especially my lecturers and classmates for their generous and brilliant

encouragement given to me to overcome some huddles during my studies.

May the founder members of this institution find my cordial

thanks for their work of launching this superb institution.

I am indebted to my supervisor Dr. Eugene NDABAGA, who has been

determinant to my academic research, without him, this work would not be

possible. Dear Sir, I appreciate and recognize your kind support for my work.

God Bless you.

I wish to express my sincere gratitude to the families:

NSENGIYUMVA Fulgence, SIBOMANA Laurent, RURANGWA Antoine, RUHAMANYA Francois,

MURENZI Eric, NARAYISENZE Aristote, MUGABE Anthony and HAKIZAKUMEZA Innocent

for their support.

Special thanks be delivered to my spouse UMUTARUTWA Rosine for

the great efforts and support that led to my life and academic accomplishment;

Thanks My dear wife.

I owe my thanks to my sisters and brothers, uncles and Aunts, my

friends, who scarified their time, comfort and support throughout my work and

success and all others whom we shared the struggle for success.

God bless you each and every body mentioned and unmentioned for

their support in the realization of this work.

TABLE OF CONTENT

DECLARATION

i

CERTIFICATE

ii

DEDICATION

iii

ACKNOWLEDGMENTS

iv

TABLE OF CONTENT

v

LIST OF ABBREVIATION AND ACRONYMS.

ix

LIST OF FIGURES

x

LIST OF TABLES

xi

CHAPTER ONE: GENERAL INTRODUCTION.

1

I.1. INTRODUCTION

1

I.1.1 THE BACKGROUND OF BANQUE

POPULAIRE

1

I.1.2 BANQUES POPULAIRES IN

RWANDA

2

I.1.3 KEY DATES IN BANQUES POPULAIRES

HISTORY

3

I.2 BACKGROUND OF MICROFINANCE IN

RWANDA.

3

I.3 STATEMENT OF THE PROBLEM

5

I.4 OBJECTIVES OF THE STUDY

7

I.5 RESEARCH QUESTIONS

7

I.6 PURPOSE OF THE STUDY

8

I.7 SIGNIFICANCE OF THE STUDY.

8

I.8 THE SCOPE OF THE STUDY

8

I.9 LIMITATIONS OF THE STUDY

8

I.10 ORGANISATION OF THE

STUDY

9

CHAPTER TWO: LITERATURE REVIEW.

10

II 1 BANKING TOWARDS THE

DEFINITION

10

II 1 1 DEFINITION

10

II 1 2 ORIGIN OF THE WORD

«BANK»

10

II 1 3 TRADITIONAL BANKING

ACTIVITIES

10

II 2 A COOPERATIVE TOWARDS THE

DEFINITION

11

II 2 1 DEFINITION

11

II 2 2 FEATURES OF COOPERATIVE

BANKS

11

II 3 A COMMERCIAL BANK TOWARDS THE

DEFINITION

13

II 3 1 DEFINITION

13

II 3 2 THE ROLE OF COMMERCIAL

BANKS

14

II 4 OVERVIEW OF A FINANCIAL SYSTEM IN

RWANDA

14

II 5 EXTENDING RURAL FINANCE IN

POST-CONFLICT ECONOMY IN RWANDA

16

II 6 ACCESSING FINANCIAL SECTOR DEVELOPMENT

IN RWANDA

17

II 7 1 UBPR TRANSFORMATION FROM A

COOPERATIVE TO A COMMERCIAL BANK UNDER RABOBANK : HISTORICAL

PERSPECTIVE

18

II.7 2 RFID INVESTS FRW 6.5B INTO

BPR

18

II.7.3 RABOBANK IN

PERSPECTIVE

19

II.7.4 RAIFFEISEN AND THE FIRST COOPERATIVE

BANK

19

II.7.5 THE EVOLUTION OF THE

COOPERATIVEBANKS IN THE NETHERLANDS

20

II.7.6 UTRECHT AND EINDHOVEN

21

II.7.7 THE MANAGEMENT STRUCTURE OF RABOBANK

NEDERLAND

21

II.7.8 INTERNATIONALISATION OF

RABOBANK

22

II.7.9 RABOBANK TODAY: MARKET LEADER IN THE

NETHERLANDS

22

II.8 FINANCIAL SECTOR CHALLENGES IN

RWANDA

23

II.9 THE ROLE OF THE FINANCIAL SECTOR IN

PRIVATE SECTOR DEVELOPMENT

23

II.10 POLICY GEARED TO INCREASE ACCESS TO

BANKING SERVICES:

24

II.11 DEVELOPMENT OF LONG TERM FINANCE AND

CAPITAL MARKETS

25

CHAPTER THREE: RESEARCH

METHODOLOGY

26

III.1 INTRODUCTION

26

III.2 METHODOLOGY

26

III.3 RESEARCH

DESIGN

27

III.4 SOURCES OF

DATA

27

III.4.1 PRIMARY

DATA

27

III.4.2 SECONDARY

DATA

27

IV. POPULATION

AND SAMPLE SIZE

28

IV.1 SAMPLE SIZE AND SAMPLING

TECHNIQUES

28

V. DATA COLLECTION

TECHNIQUES

29

V.1 DOCUMENTARY

SOURCES

29

V.2 OBSERVATIONS

29

V.3 QUESTIONNAIRE

29

V.4 INTERVIEWS

29

VI DATA PROCESSING

30

VI.1 EDITING

30

VI.2 CODING

30

VI.3 TABULATION

30

CHAPTER IV : DATA PRESENTATION, ANALYSIS

AND INTERPRETATION.

31

4 1 .INTRODUCTION.

31

4 2 .THE PROFILE OF

RESPONDENTS

32

4 3 .THE RATIONALE FOR BANQUES POPULAIRES

TRANSFORMATION FROM COOPERATIVE TO A COMMERCIAL BANK.

35

CHAPTER V: SUMMARY OF THE FINDINGS,

CONCLUSIONS AND RECOMMENDATIONS

46

5 1 Summary.

46

5 2 Conclusions.

48

5 3 Recommendations

50

BIBLIOGRAPHY

51

WEBOGRAPHY.

52

APPANDICES

53

1 QUESTIONNAIRES USED IN DATA COLLECTION.

53

2 COPY OF CLEARANCE LETTER.

63

LIST OF ABBREVIATION AND

ACRONYMS.

B.P.R s.a : Banque Populaire du Rwanda s.a

BCR : Banque Commerciale du Rwanda

CUNA : Credit Union National

Association

E.D.P.R.S : Economic Development and Poverty

Reduction Strategy

FSAP : Financial Sector Assessment

Program

FSAP : Financial Sector Development

Program

GDP : Gross Domestic Product

IMF : International monetary fund

MIF : Microfinance Institutions

MINICOM : Ministry of

Commerce,Industry,Investment promotion, Tourism and Co-operatives.

MINECOFIN : Ministry of Finance and Economic

Planning.

NBFI : Non-Bank Financial

Institutions

N.B.R : National Bank of Rwanda

NGO : Non-Governmental Organizations

Rwf : Rwandan franc

SACCO : Saving and Credit Cooperative

SME : Small and Medium Entreprises

SWIFT : Society for worldwide interbank

financial communication.

USAID : United Nations Agency for

International Development

WOCCU : World Council and Credit Unions.

LIST OF FIGURES

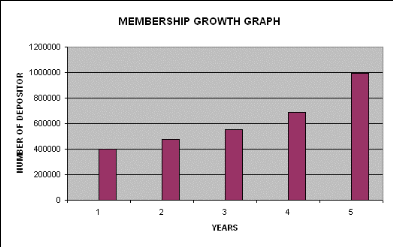

Graph 1 : Evolution of Depositors in Five

Years

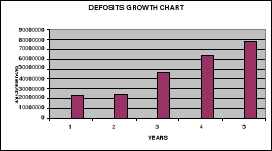

Graph 2 : Evolution of Deposits in Five Years

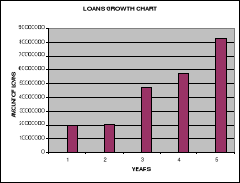

Graph 3 : Evolution of Loans in Five Years

LIST OF TABLES

Table 1 : Distribution of respondents according to their

relationship with the bank.

Table 2 : Distribution of respondents according to their

sex.

Table 3 : Distribution of respondents according to their

levels of education.

Table 4 : Distribution of respondents according to their

ages.

Table 5: Evolution of Depositors in Five

Years

Table 6: Evolution of Deposits in Five Years

Table 7: Evolution of Loan in Five Years

CHAPTER ONE: GENERAL INTRODUCTION.

I.1. INTRODUCTION

I.1.1 THE BACKGROUND OF BANQUE POPULAIRE

The first Banque populaires was created in German by Wilhem

Raiffeisen and Herman Schulze in 1864. By that time, the industrial development

of European countries created a large number of salaried populations in the

city from the mining of coals and metals.

The workers and subordinate employees who were poorly paid had

difficulties in surviving; the social security and life insurance did not exist

at that time. The families with modest revenues were required to get the

credits for solving extra ordinary expenses incurred. The banks did not grant

those kinds of credit but money lenders granted credits at the highest interest

rate.

It become important to change that situation through the creation

of credit co-operatives to have access to credit by low income earners, to put

together their financial capacities in order to have access to credit with low

interest rate. Thereafter the creation of «BANQUE POPULAIRES»

expanded quickly in German, Italy and other European nations. After Europe,

Banques populaires were extended to Canada where Alphonse Desjardins

established the first Banque populaire at Levis in Quebec. In 1970, there were

79,206 Banques populaires around the world and 1795 were in Africa.

A world association credit and savings cooperatives( CUNA

international) was established in 1958 and was replaced by a world council of

savings and credit cooperatives (WOCCU) in 1970 which comprised of seven

members and among those, there were credit and saving associations in Africa

(ACECA).

Banque populaire was introduced in Africa in 1946 and English

speaking countries were the first to receive them in Africa. Banques populaire

quickly expanded in Africa because Africans were carrying out the savings and

credit societies practically through traditional associations.

The first Banque populaire was created in 1948 at Kampala in

Uganda by a group of teachers through a Ugandan priest «Emmanuel

KABILIGE». Other countries followed such as Tanzania (1950),

Malawi 1952, Nigeria 1953, Ghana 1955, Lesotho 1961, Cameroon 1963, Kenya 1964,

Liberia1965, Zambia 1967 and Togo 1968. (www.banquepopulaire.fr)

I.1.2 BANQUES POPULAIRES IN RWANDA

In Rwanda, the idea of saving and credit by rural population was

started from independence.In 1963, «caisse d'épargne du

Rwanda» was created and its main objective was to offer means of saving

and credit by rural population and particularly to farmers. In 1968, it was

reported that the caisse d'épargne du Rwanda failed to achieve its

objectives. For that reason, the government of Rwanda asked France, Switzerland

and Canada technical and financial assistance to create a financial institution

capable of granting credit and keeping savings of rural population, in 1973,

the government of Rwanda and Switzerland signed an agreement to start the

project of saving and credit for rural development. In the same year, four

Rwandans went for training in the Swiss cooperatives of saving and credit

called «Caisse RAIFFEISENNS WISSES». After the training, they come

back and put in practice the knowledge they acquired from the training

(www.ubpr.com.).

The first Banque Populaire in Rwanda was opened officially at

Nkamba on 4th august 1975 in Kabarondo the former Kibungo province

now the Eastern Province. From that year, Banques populaires expanded at

significant rate and by December 31, 2006 there were 148 banques populaires in

the whole country. In Rwanda the saving and credit cooperatives are called

Banques populaires. They were supervised by the state through an institution

called «orientation bureau».

The orientation bureau exercised the following functions;

v To serve as the central bank for managing the deposits of all

Banques populaires;

v To execute the control of operations;

v To prepare accounting materials and Books for all Banques

populaires in the country;

v To train staff for those banks;

In 1968, the orientation bureau was replaced by Union des Banques

populaires du Rwanda (UBPR). Banques Populaires in Rwanda did not distribute

the benefits to their members. The annual benefits were affected in the reserve

fund, which constituted the guarantee for their creditors and for their members

and expand investments such as acquisitions of equipment and placement

buildings.

I.1.3 KEY DATES IN BANQUES POPULAIRES HISTORY

1975: Inception of the first Banque populaire

of NKAMBA in Kibungo, Eastern province. This was followed by the establishment

of many others around the country.

1986: The various autonomous Banques

Populaires du Rwanda formed an umbrella called Union des Banques Populaires du

Rwanda (UBPR) with a cooperative mission.

January 2008: Basing on its strong experience

of 33 years in the Rwandan financial sector, UBPR was transformed from a

cooperative Bank into a commercial bank «Banque Populaire du Rwanda

S.A». (www.bpr.rw)

I.2 BACKGROUND OF MICROFINANCE IN RWANDA.

Micro-finance is an important part of the financial sector in

Rwanda, led by the Union des Banques Populaires du Rwanda, a network of

micro-finance institutions that served as micro-lenders and micro-banks for

nearly two-thirds of all depositors in the country. This institution controlled

over 97% of the micro-finance sector in Rwanda. (Rwanda Microfinance Sector

Assessment 2005)

The microfinance sector in Rwanda has been dominated by the

network of Banques Populaires especially in terms of a number of recipients of

the financial services and volume of activities.

In 1972 Switzerland agreed to help Rwanda duplicate the Caisses

Raiffeisen model in

Rwanda with a double social objective for Banque Populaire:

1. To offer reliable and affordable deposit products,

2. To stimulate the creation of Small and Medium Enterprises

(SMEs) by democratizing credit. (Steven 2004)

The first Banques Populaires was inaugurated in Rwanda at NKAMBA

in 1975. Their

Federation, the Union of the Banques Populaires (UBPR) was

inaugurated in 1986.

In 1994 before the war and the genocide in Rwanda, UBPR had more

than 130 affiliated

Banques Populaires servicing 366.799 members throughout the

country. During the war 1990 - 1994

approximately 7 millions$ was stolen and the institution

closed.

UBPR reopened gradually after the war and in 1996 the system

comprised of 42.000 members

and only 20% of its old staff. Between 1996 and the 1998

operations of credit were stopped

because of the important level of nonperforming loans. The

distribution of credit started again

in 1998 and at the end of 2002 UBPR counted 315.356 members and

148 Banques Populaires.

The 27th General meeting of the UPBR of April 21, 2007 decided to

transform this very important coopec (Cooperative d'épargne de credit )

into commercial bank which would keep the cooperative principles of governance

while offering a range of varied financial services to its members. This was in

line with the recommendations of the Financial Sector Development Program

adopted by the Government. Beginning of the year 2008, these Banques Populaires

and their Central Caisse were transformed into a commercial bank, called Banque

Populaire du Rwanda SA (BPR SA) (WOCCU report 2002).

The Banques Populaires transferred all their assets to UBPR after

their evaluation. The capital of UBPR was increased by the value of these

assets. Thus the revalued capital increased by 35% which were bought by

Rabobank the strategic partner (Rabobank gives the technical assistance

necessary to transform BPR into a true commercial bank). The shareholders of BP

became shareholders of BPR SA. UBPR modified its network by transforming the 18

principal Banques Populaires into branches of BPR and other BP in sub branches.

BP has a structure of a cooperative banking license with commercial objectives

while maintaining its cooperative characteristics and by preserving the

shareholders role and its bond with the local communities.(www.bpr.rw)

The Government of Rwanda is aware that poverty reduction can

not be achieved without access to financial services to the poor. As a result,

microfinance is considered a powerful tool to reduce poverty and the current

Poverty Reduction Strategy (PRS) Paper emphasizes it.

A number of initiatives to boost the microfinance sector in

Rwanda have been put in place so far, including the development of a legal and

regulatory framework. The development of a sector policy is underway. SNV, in

its attempt to strengthen the private sector and make a dent into the poverty

level in Rwanda, deemed it necessary to carry out an analysis of the

microfinance sector in Rwanda, in order to develop an appropriate microfinance

strategy which would ensure effective provision of financial services.

Consequently, an assessment of the microfinance sector in

Rwanda was conducted by Enterprising Solutions. It focused on the range of

financial services available; who has access to them and who does not, the key

constraints and opportunities to providing microfinance, the key stakeholders,

and their respective roles in creating an enabling environment and access of

the poor to financial services (Microfinance Assessment paper 2005 ).

I.3 STATEMENT OF THE PROBLEM

In the last decade, Rwanda like most other sub-Saharan Africa

countries has religiously followed the economic liberalization program,

privatized the financial sector to reduce financial depression, encourage

market determined prices of financial services, encourage entry of

international players and entrance market competition.In 1999 the national Bank

of Rwanda act (i.e. the Rwanda central bank act) was revised to grant its

independence, to formulate and implement monetary policy and ensure financial

sector stability.

In addition, the central bank supervisory capacity was

strengthened to enhance regulatory frameworks, Reduce regulatory forbearance,

ensure market displine and comply with the basic principles of effective

supervision. However, despite of all the reforms, the Rwandan authorities

recognized that the financial sector's ability to play its role of mobilizing

saving, conducting effective intermediation and financing it's ambitious

economic reform agenda was still far from achievable.

The authorities invited the joint world bank/IMF Financial Sector

Assessment Program (FSAP) with a mission to carry out financial sector

assessment program and make a diagnostic of the sector and make recommendations

for further reforms. The conclusion of the 2005 FSAP report not surprisingly

describes the Rwandan financial sectors as "narrow and shallow» with an

oligopolistic banking sector and very low penetration of insurance services as

well as undiversified financial products. The Financial Sector Assessment

Program (FSAP) further recognized, High interest rate, poor savings rate,

scarcity of long term capital, unregulated pension and insurance sectors and

malfunction of payment system. (Financial Sector Development Program 2008)

In the context of addressing the weaknesses raised in the FASP

and in line with Rwanda's vision 2020, the long term vision for the development

of the country, the government launched the FSDP in 2006.

The overarching vision of the «FSDP» is to develop a

stable and sound financial sector that is efficiently deep and broad, capable

of mobilizing and allocating resources to address the development needs of the

economy and reduce poverty".

The government of Rwanda recognizes the importance of the

financial sector and has made the FSDP one of the key components of the growth

flagship in its Economic Development and Poverty Reduction Strategy (EDPRS

Paper 2006).

The scope of FSDP was to address weaknesses in four areas: access

to finance, capital market development, regulation of non-bank financial

institution ( NBFI ) and payment systems.

Access to banking and other financial services out side Kigali

and other major towns is still very limited. In 2005 the combined branch

net-work of the 7 commercial banks was only 38. In terms of business services

commercial banks accounted for about 75% of total deposits and loans yet only

about 10% in terms of customers. A net work of cooperative and credit union,

union des banques populaires du Rwanda UBPR with a national wide outreach of

148 savings and credit outlets, as well as other financial other MFI accounted

for 90% of customers but only 25% of total deposits and loans.

In addition, Microfinance Institutions (MFI) which should

normally play a significant role in bridging this gap was still weak lacked

adequate financial management systems, had weak internal controls and poor

governance structures.(FSAP paper 2008)

UBPR, the apex body of microfinance institution that controlled

over 97 % of the microfinance sector in Rwanda with about 90 % of all customers

served by Rwandan financial sector, had weaknesses such as inability to offer

full commercial services such as the use of checks, international transfers and

inability to grant long term loans.

The structure of UBPR also reduced its loan granting capacity

because each branch was considered separately , considering the above

weaknesses , these branches needed to be consolidated and transformed into a

bank that has an extended loan granting capacity and offering full range of

banking services in line with FSDP and 2020 vision , hence becoming a

commercial bank. Therefore the researcher wanted to find out the rationale and

the impact of «banques populaires transformation from a cooperative to a

commercial bank».

I.4 OBJECTIVES OF THE STUDY

The objectives of the study are the following:

ü To identify the rationale of «banques

populaires» transformation from a cooperative to a commercial bank.

ü To find out the impact of «banques

populaires» transformation from a cooperative to a commercial bank.

ü To find out if there is any improvement in its

services.

ü To find out if it has in any way improved its economic

activities.

I.5 RESEARCH QUESTIONS

The questions for which this study has to struggle to find

solutions to are the following:

Ø What was the rationale of «banques

populaires» transformation from a cooperative to a commercial bank?

Ø Is there any impact of «banques populaires»

transformation from a cooperative to a commercial bank?

Ø Has the transformation of «banques

populaires» from a cooperative to a commercial bank improved its

services?

Ø Has the transformation of «banques

populaires» from a cooperative to a commercial bank improved its economic

activities?

I.6 PURPOSE OF THE

STUDY

The purpose of the study is to find out the rationale and the

impact of «banques populaires» transformation from a cooperative to a

commercial. The researcher therefore, would like to find out if there is any

positive transformation for economic development and as a result of this,

formulate any recommendation that may help the bank in its financial

development.

I.7 SIGNIFICANCE OF THE STUDY.

A part from academic use as a requirement to complete a

bachelor's degree, this research will offer awareness of the structured changes

and operations of BPR SA and help its customers to be aware of its day-to-day

work. It may also help other researchers in related fields and finally the

stakeholders especially shareholders and the clients of the bank benefit from

this research on BPR transformation.

I.8 THE SCOPE OF THE STUDY

The study was carried out in Banque Populaires du Rwanda SA at

its head quarters by interviewing a group of sixty respondents involving twenty

employees, thirty five customers and five members of board of directors.

I.9 LIMITATIONS OF THE STUDY

The first limitation of the study was to

deal with busy people, some of whom do not have time to be interviewed or to

fill questionnaires. Getting the sufficient information from such people was

very difficult.

Time stipulated for this study was in such away that the

collection, compilation and submission of the research work was not enough

because of limited resources. However, the results are significant and pave

away for further research.

Another problem encountered was that of non-response.

Some of the respondents reserved their views. However, the researcher used

probing approach to deal with this problem.

Overall, although the researcher faced many problems, the

respondent's general involvement in the whole exercise was remarkably good.

This made the present study possible and fruitful since all respondents reacted

positively to the study.

I.10 ORGANISATION OF THE STUDY

This study is organised in five chapters; the first chapter is

the general introduction which includes introduction, background of the study,

statement of the problem, purpose of the study, research questions, the

significance of the study ,the scope of the study , limitations of the study,

organisation of the study and definition of terms. The second chapter is

literature review. The third chapter is titled research methodology. The fourth

chapter is titled data presentation and analysis of data and the last chapter

of recommendations and conclusions.

CHAPTER TWO: LITERATURE REVIEW.

II 1 BANKING TOWARDS THE DEFINITION

II

1 1 DEFINITION

A bank is a financial institution licensed by a government. Its

primary activities include borrowing and lending money. For example Banks are

important players in financial markets and offer financial services such as

investment funds. In some countries such as Germany, banks have historically

owned major stakes in industrial corporations while in other countries such as

the United States, Banks are prohibited from owning non-financial companies.

The level of government regulation of the banking industry varies widely, with

countries such as Iceland, the United Kingdom and the United States having

relatively heavier regulation of the banking sector, and countries such as

China having relatively heavier regulation (including strict regulations

regarding the level of reserves)(www.wikipedia/bank).

II

1 2 ORIGIN OF THE WORD «BANK»

The name bank derives from the Italian word banco

»desk/bench», used during the renaissance by Florentine bankers, who

used to make their transactions above a desk covered by a green tablecloth.

However, they are traces of banking activity even in ancient times. In fact,

the word traces its origins back to the Ancient Roman Empire where moneylenders

would set up their stalls in the middle of enclosed courtyards called macella

on a long bench a bancu, from which the words banco and bank are derived. As a

moneychanger, the merchant at the» banca» did not so much invest

money as merely convert the foreign currency into the only legal tender in Rome

(www.wikipedia/bank)..

II

1 3 TRADITIONAL BANKING ACTIVITIES

Banks act as payment agents by conducting checking or current

accounts for customers, paying cheques drawn by customers on the bank, and

collecting cheques deposited to customer's current accounts. Banks also enable

customer payments via other payment methods such as telegraphic transfer,

EFTPOS (Electronic Funds Transfer Through Point of Sale) and ATM (Automatic

teller Machine).

Banks borrow money by accepting funds deposited on current

accounts, by accepting term deposits, and by issuing debt securities such as

bank notes and bonds. Banks lend money by making advances to customers on

current accounts, by making installment loans, and by investing in marketable

debt securities and other forms of money lending.

Banks provide almost all payment services, and a bank account is

considered indispensable by most businesses, individuals and governments

(www.wikipedia/bank).

II 2 A COOPERATIVE TOWARDS THE

DEFINITION

II 2 1 DEFINITION

A co-operative bank is a financial entity which belongs to its

members, who are at the same time the owners and the customers of their bank.

Co-operative banks are often created by persons belonging to the same local or

professional community or sharing a common interest. Co-operative banks

generally provide their members with a wide range of banking and financial

services (loans, deposits, banking

accounts...)(www.wikipedia/cooperativebank).

Co-operative banks differ from stockholder banks by their

organization, their goals, their values and their governance. In most

countries, they are supervised and controlled by banking authorities and have

to respect prudential banking regulations, which put them at a level playing

field with stockholder banks. Depending on countries, this control and

supervision can be implemented directly by state entities or delegated to a

co-operative federation or central body (www.wikipedia/cooperativebank).

II

2 2 FEATURES OF COOPERATIVE BANKS

Even if their organizational rules can vary according to their

respective national legislations, co-operative banks share common features:

· Customer-owned entities: In a

co-operative bank, the needs of the customers meet the needs of the owners, as

co-operative bank members are both owners and customers. As a consequence, the

first aim of a co-operative bank is not to maximize profit but to provide the

best possible products and services to its members. Some co-operative banks

only operate with their members but most of them also admit non-member clients

to benefit from their banking and financial services.

· Democratic member control:

Co-operative banks are owned and controlled by their members, who

democratically elect the board of directors. Members usually have equal voting

rights, according to the co-operative principle of «one person, one

vote» (www.wikipedia/cooperativebank).

· Profit allocation: In a

co-operative bank, a significant part of the yearly profit, benefits or surplus

is usually allocated to constitute reserves. A part of this profit can also be

distributed to the co-operative members, with legal or statutory limitations in

most cases. Profit is usually allocated to members either through a patronage

dividend, which is related to the use of the co-operative's products and

services by each member, or through an interest or a dividend, which is related

to the number of shares subscribed by each

member(www.wikipedia/cooperativebank).

Co-operative banks are deeply rooted inside local areas and

communities. They are involved in local development and contribute to the

sustainable development of their communities, as their members and management

board usually belong to the communities in which they exercise their

activities. By increasing banking access in areas or markets where other banks

are less present - SMEs, farmers in rural areas, middle or low income

households in urban areas - co-operative banks reduce banking exclusion and

foster the economic ability of millions of people. They play an influential

role on the economic growth in the countries in which they work in and increase

the efficiency of the international financial system. Their specific form of

enterprise, relying on the above-mentioned principles of organization, has

proven successful both in developed and developing

countries(www.wikipedia/cooperativebank).

II 3 A COMMERCIAL BANK TOWARDS THE

DEFINITION

II 3 1 DEFINITION

A commercial bank is a type of financial intermediary and a type

of a bank. Commercial banking is also known as business banking. It is a bank

that provides checking accounts, savings accounts, and money market accounts

and that accepts time deposits. After the Great Depression, the U.S. Congress

required that banks engage only in banking activities, whereas investment banks

were limited to capital market activities. As the two no longer have to be

under separate ownership under U.S. law, some use the term "commercial bank" to

refer to a bank or a division of a bank primarily dealing with deposits and

loans from corporations or large businesses. In some other jurisdictions, the

strict separation of investment and commercial banking never applied.

Commercial banking may also be seen as distinct from retail banking, which

involves the provision of financial services direct to consumers. Many banks

offer both commercial and retail banking services

(www.wikipedia/commercialbank).

Commercial bank is the term used for a normal bank to distinguish

it from an investment bank. This is what people normally call a "bank". It

raises funds by collecting deposits from businesses and consumers via checkable

deposits, savings deposits, and time (or term) deposits. It grants loans to

businesses and consumers. It also buys corporate bonds and government bonds.

Its primary liabilities are deposits and primary assets are loans and bonds.

Commercial banking can also refer to a bank or a division of a

bank that mostly deals with deposits and loans from corporations or large

businesses, as opposed to normal individual members of the public (retail

banking)(www.wikipedia/commercialbank).

II

3 2 THE ROLE OF COMMERCIAL BANKS

Commercial banks engage in the following activities:

· Processing of payments by way of telegraphic transfer,

EFTPOS, internet banking, or other means issuing bank drafts and bank cheques

accepting money on term deposit

· Lending money by overdraft, installment loan, or other

means providing documentary and standby letter of credit, guarantees,

performance bonds, securities underwriting commitments and other forms of off

balance sheet exposures safekeeping of documents and other items in safe

deposit boxes sale, distribution or brokerage, with or without advice, of

insurance, unit trusts and similar financial products as a «financial

supermarket» traditionally, large commercial banks also underwrite bonds,

and make markets in currency, interest rates, and credit-related securities,

but today large commercial banks usually have an investment bank arm that is

involved in the mentioned activities(www.wikipedia/commercialbank).

II 4 OVERVIEW OF A FINANCIAL SYSTEM IN RWANDA

The National Bank of Rwanda (NBR) i.e. the Central Bank has the

sole responsibility for monetary policy and its principal objective is to

ensure price stability within the system. All financial institutions are

subject to supervision and regulation by the NBR under the Banking Law of 1999.

On 31st December 2007, the Rwandan financial sector was made

up of six commercial banks; a development bank; a housing bank; a micro-finance

bank; a discount house and two hundred thirteen (213) micro-finance

institutions, from which two hundred (200) were cooperatives while twelve (12)

were public limited companies and one (1) private limited company. Among other

financial institutions operating in Rwanda, there was the unit of the Giro

Account of the Post office, five (5) insurance companies and the Social

Security fund of Rwanda (SSFR)(Annual report on bank supervision period

1995 to 2007).

Micro-finance is an important part of the financial sector, led

by the Union des Banques Populaires du Rwanda, a network of micro-finance

institutions that served as micro-lenders and micro-banks for nearly two-thirds

of all depositors in the country. This institution controls over 97% of the

micro-finance sector in Rwanda.

Recently, most commercial banks have centered their operations on

trade finance as opposed to long-term debt financing. This has triggered off to

lack of productive investment activity, thus there is urgent need to focus

attention on the reform and strengthening of the financial sector. These

appeals for introduction of more banks, financial products and capital

market.

There are a number of opportunities for investment into mortgage

banks to enhance access to property, agricultural banks to offer credit to

farmers and introduction of new financial products including leasing and

venture capital to minimize hardships of opening business as well as its

continued successful operation NBR (Annual report on bank supervision

period 1995 to 2007).

II 5 EXTENDING RURAL FINANCE IN POST-CONFLICT ECONOMY IN

RWANDA

During the eight years since the end of the civil war and

genocide that ravaged Rwanda's society and economy in 1994, Rwandans and

international partners have worked diligently to rebuild the country. The

genocide not only led to more than 1 000,000 deaths and many more refugees and

internally displaced people, but also, in 1994, the GDP fell by 50%. Still

today, at least 60% of Rwandans live below poverty line according to the U.S.

Agency for International Development (USAID) and the International Monetary

Fund (IMF) report 1999, approximately 80% of the population lives in rural

areas. Immediately, before the war, the Union des Banques Populaires du

Rwanda (UBPR - the national federation of Rwandan credit unions) and over

130 affiliated banques populaires (individual credit unions) located

throughout the country, served 366,799 member clients. During the war, roughly

$7 million was stolen. The UBPR closed its doors, like other all financial

institutions including the Central Bank of Rwanda, during the war in 1994.The

UBPR reopened gradually with most banques populaires resuming

operations in 1996. By the end of 1996, there were 42,000 members and only 20%

of the pre-war staff. Between 1996 and 1998, credit operations were halted

since virtually all loans that had been granted before the war were

non-performing. Most pre-war borrowers were deceased or displaced and most

collateral as well as banque populaire records had been destroyed.

Banques populaires resumed lending in 1998. ( WOCCU report

2000).«Rwanda has

The World Council of Credit Unions (WOCCU) received funding

totaling of $3 million from USAID/Rwanda to carry out a four-year program of

rehabilitation and institutional strengthening of both UBPR (the federation)

and a limited number of pilot banques populaires. The WOCCU Rwanda

program fits within USAID/Rwanda's strategic objective of expanding economic

opportunities in rural areas, particularly under the rubric of improving access

to financial services. The program also responded to the desire of the Central

Bank of Rwanda for the banques populaires to provide credit for rural

development. The UBPR system, 148 banques populaires at year-end 2002,

has the widest geographical coverage of any financial institution in Rwanda.

The WOCCU Rwanda program (8/00-8/04),working in close

collaboration with the UBPR, set out in late 2000 to restructure the UBPR and

guide it from a loss-making position to a solvent position (WOCCU report

2000).

II 6 ACCESSING FINANCIAL SECTOR DEVELOPMENT IN RWANDA

Rwanda's financial sector is comprised of a central bank, eight

commercial banks, several foreign exchange bureau, a stock exchange market, as

well as microfinance institutions. Commercial banks account for over 75 percent

of total deposits. The financial sector development plan of the Government of

Rwanda aims at addressing four main weaknesses in the financial sector: access

to finance, capital market development, regulation and supervision of non-bank

financial institutions and the development of payments systems(FSAP Paper

2005).

Financial sector reforms in Rwanda started in 1994/95 with the

establishment of five new banks after the war. Overall, Government has been

cautious in its efforts to undertake financial sector reforms. Among all these

aspects of reforms mentioned above, the main areas of reform focused on

strengthening prudential supervision and regulation of the financial sector.

80 percent of «Banque Commerciale du Rwanda» were sold to foreign

investors in 2003/04. The National Bank of Rwanda also started comprehensive

annual inspections of banks in 2004. In an effort to support the mobilization

of long-term savings, the Rwandese Government has set up a Working group to

spearhead the establishment of the Rwanda stock exchange project in June 2004.

The stock exchange was eventually established in January 2007 (FSAP Paper

2005).

As regards the current state of the financial sector reform, it

was noted in the statement of the IMF Staff Representative at the Rwanda

Donors' meeting in Kigali, November 26-27, 2007 that the Government of Rwanda

had developed a comprehensive and detailed «Financial Sector

Development Plan» (FSDP), based on the 2005 Financial Sector

Assessment Program (FSAP), which the Government had submitted to the donors in

May 2007. The plan for the financial sector reforms focused on five main

areas:

(i) Building financial sector infrastructure (e.g., legal

framework);

(ii) Increasing access to finance (notably in the rural and SME

sectors);

(iii) Building capital markets;

(iv) Strengthening the pension and insurance sectors; and

(v) Developing the payments system. (FSAP 2005)

II

7 1 UBPR TRANSFORMATION FROM A COOPERATIVE TO A COMMERCIAL BANK UNDER

RABOBANK : HISTORICAL PERSPECTIVE

The National Bank of Rwanda (BNR) licensed Bank Populaire, a

highly successful local savings and credit union with 148 branches nationwide

into a fully-fledged commercial bank in January 2008. The decision was part of

a wide range of recommendations by a team of consultants hired to advise BNR on

the financial sector reforms.

Banque Populaire had the largest bank depositor base of over

500,000 clients. The Banque Populaire was just a union of cooperative savings

and had some limitations such as inability to offer a full range of financial

services and so on (East African Business 2008)

II.7 2 RFID INVESTS FRW 6.5B INTO BPR

In 2008 Rabobank acquired a minority share of 35 percent in BPR,

to share up and shape the long-term cooperation by means of management and

support. The customers of BPR become the shareholders, confirming once more its

grass roots in Rwanda. This eventually enabled both BPR and the economy of

Rwanda to take a major step towards of financial services. The network of

credit unions at BPR has a number of unique features. It is by far the

country's largest provider of financial services outside the urban areas. It

bears a cooperative signature based on Rabobank's principles and is now

considering the choice between becoming a fully-fledged retail bank, thereby

meeting widespread demand, or continuing to work as a purely member-based

cooperative. Facilitated by Rabo Development, a strategy has been devised to

retain the strengths of the cooperative structure while benefiting from its

transformation into a one-tier, one-stop shop for financial services (

www.bpr.com).

Building on the strategic outline that BPR has now embraced, an

extensive technical assistance programme has been designed to build the

products, provide the desired channels (including ATMs and mobile banking) and

serve all customers, not just members. The fact the former members became

shareholders of BPR, it became a unique bank owned by over 500,000 shareholders

and offering full banking services while maintaining its cooperative features.

Rabo Development has become a strategic investor as a fully-fledged bank. It

organizes the expertise required to restructure the bank and provide management

services as well as board members and hope to become a leading bank in Rwanda

that will reach out to rural parts of the country (

www.bpr.com).

II.7.3 RABOBANK IN PERSPECTIVE

Rabobank Group is the largest financial services provider in the

Netherlands, with an extensive network of international offices. It is

comprised of a diverse range of business units that began in the late

nineteenth century as a collection of small agricultural cooperative banks.

Although much has changed, some things have remained the same since the bank's

inception - Rabobank's cooperative structure and its commitment to local

involvement have remained the cornerstone of Rabobank's values and practices

for more than a century(

www.rabobank.com).

The history of Rabobank has always been characterised by its

cooperative nature: people working together, banks joining forces and

specialised business divisions combining their knowledge. A

distinguishing feature of the cooperative structure - one that underpins every

move that Rabobank has ever made (and continues to make) - is a primary

commitment to serving the best interests of the customers (

www.rabobank.com).

II.7.4 RAIFFEISEN AND THE FIRST COOPERATIVE BANK

Friedrich Wilhelm Raiffeisen founded the first agricultural

cooperative bank in Germany in 1864. As a rural mayor Raiffeisen had witnessed

first the poverty suffered by some members of the farming community. In his

first efforts to assist that community, Raiffeisen set up a charitable

foundation that would provide financial relief to farmers and their families.

However, over time Raiffeisen came to the conclusion that self-help was more

likely to bring about lasting improvements in the farming community than

charity. So in 1864 he transformed his charity into the first agricultural

cooperative bank. This first cooperative - "Heddesdorfer Darlehnskassen-Verein"

- collected the savings of rural citizens and used them to create a fund for

providing loans to the local agricultural community (

www.rabobank.com).

II.7.5 THE EVOLUTION OF THE COOPERATIVEBANKS IN THE

NETHERLANDS

In the late 1890s, the German cooperative movement got many

followers in the Netherlands. One of the first Dutch sponsors of the new

cooperative banking idea was the priest called Gerlacus van den Elsen. Van den

Elsen established a number of local agricultural cooperative banks in the

southern part of the Netherlands. The priest saw his work with cooperatives as

a mission that was simultaneously exalted and down-to-earth. He viewed the role

of the cooperatives thus: "To ward off the shylocks, stand by the farmer in his

hour of need, as well as promote frugality, charity, industriousness and

temperance" (

www.rabobank.com).

Following in the tradition established by van den Elsen, most of

the earliest cooperative banks were founded on the initiative of clerics and

other local notables, such as mayors, entrepreneurs and educators. Other

proponents of the new cooperative banking idea were wealthy farmers who

established cooperatives for the benefit of their less successful colleagues.

Although the driving force behind the cooperatives was

idealistic, the working method that the banks devised was based on pragmatic

business principles, including:

- Unlimited liability of members;

- Unpaid management;

- Profits reserved for further growth;

- A field of operation limited to the local area;

- Association with a cooperative central bank (whilst still

retaining local independence).

It was largely these business elements - the practical pillars of

an idealistic philosophy - that were responsible for the successful development

of the agricultural cooperative banks. From their very first day of operation

both cooperative banks were financially successful. Local member banks operated

at the heart of the local community and consequently knew their customers

personally. In contrast to lenders from the city, they were adept at selecting

creditworthy farmers and keeping a close eye on their loans. As a result, the

agricultural cooperative banks were able to provide the agricultural community

loans with better interest rates and generate and retain a loyal customer base(

www.rabobank.com).

II.7.6 UTRECHT AND EINDHOVEN

Today the two most important locations of Rabobank in Netherland

are Utrecht and Eindhoven. The prominence of these locations dates back to the

existence of two central cooperative banks, both founded in 1898, that existed

alongside each other for three-quarters of a century. Six cooperative banks in

the northern part of the Netherlands joined forces to found the

Coöperatieve Centrale Raiffeisen-Bank in Utrecht. Twenty-two cooperative

banks in the south together founded the Coöperatieve Centrale

Boerenleenbank in Eindhoven. The two banks established their different domains

in part along geographic lines. However, they were also, at the end of the 19th

century, divided by political and religious differences. In spite of their very

similar structure and provenance, the Northern and Southern cooperative

organisations followed separate paths. The bank in Eindhoven was run as a

Catholic institution, whereas the bank in Utrecht, although formally

non-denominational, in reality was Protestant. Additionally, the management in

Eindhoven was more stringent and centralized than in Utrecht, where the

tendency was to emphasize local autonomy(

www.rabobank.com)..

II.7.7 THE MANAGEMENT STRUCTURE OF RABOBANK NEDERLAND

Reflecting the management structure of the Coöperatieve

Centrale Boerenleenbank (one of the two central banks that merged) at the time

of the merger in 1972, Rabobank Nederland has five governing bodies: the

general meeting at which the boards of all the local banks were represented,

the Central Delegates Assembly, the Executive Board, the Board of Directors,and

the Supervisory Board. In 2002 this fairly complex management system of

Rabobank Nederland was simplified somewhat. The influence of members - the

control of the local banks - was strengthened by giving the Central Delegates

Assembly greater authorities. The Board of Directors was abolished. The

executive management was made responsible for the integral managing and is now

called the Executive Board. So this board now not only has the task of managing

the banking business, but is also responsible for serving the interests of the

local member banks. The independent, supervisory role of the Supervisory Board

was strengthened. The chairman of this board now leads the Central Delegates

Assembly. The Central Delegates Assembly is particularly what makes the

management structure of Rabobank Nederland distinctive from other large Dutch

banks (

www.rabobank.com).

II.7.8 INTERNATIONALISATION OF RABOBANK

Although the name Rabobank International only dates back to 1996,

the Rabobank Group's international activities actually began much earlier.

During the course of the 1970s Rabobank's business customers began to demand

more and better services abroad. In response to those demands Rabobank sought

to ensure that it could serve its customers abroad, slowly building the network

that has now become Rabobank International:

- Opening branch offices in Europe, North America, Asia and South

America, primarily to serve larger business customers

- Entering into strategic alliances with allied European

partners. The most well-known examples of such alliances are ADCA in Germany

and PIBA in Australia. In 2002 the Rabobank Group acquired the ACC Bank in

Ireland and the Valley Independence Bank in the United States. These

acquisitions fit in with the Group's modern strategy of exporting expertise in

the field of consumer banking and the agricultural sector to promising markets

abroad. Each branch office of Rabobank International in the key trading

countries within Europe now has a Dutch Desk to serve Dutch SME customers. (

www.rabobank.com)

II.7.9 RABOBANK TODAY: MARKET LEADER IN THE NETHERLANDS

Today Rabobank is the market leader in the Netherlands in almost

all areas of financial services, with a considerable market share in the

agricultural sector. From a historical perspective, agricultural financing is

the Rabobank's forth. The market share in the agricultural sector still

fluctuates between 85 and 90 percent. Over time the non-agricultural small- and

medium-sized enterprise sector has become an important target group of the

cooperative banks. In the mid-1970s the Rabobank already had a thirty percent

share of this market and since then it has risen to around forty percent. In

1987 of all the loans issued to the business community, for the first time, the

number of loans to non-agricultural companies was greater than agricultural

companies. Lending to the primary agricultural sector currently accounts for

slightly less than eight percent of the group's total lending operations (

www.rabobank.com)..

II.8 FINANCIAL SECTOR CHALLENGES IN RWANDA

The rwandan financial sector faces a number of challenges; some

of them are inherent to the limited access to banking and other financial

services outside Kigali and the provincial towns (www.bnr.rw):

ü Commercial banks have only 38 branches and all located in

major towns;

ü Insurance products are undiversified and its penetration

is still very low;

ü MFI's which should play a significant role in filling the

gap has been marred by a weak financial base, and inadequate management;

ü Poor saving culture;

ü Lack of long-term resources for funding investments due to

undeveloped debt and equity market;

ü Inadequate capital.

ü Undeveloped Payment system infrastructure

ü Weak legal and regulatory framework for the NBFI

ü Poor quality and culture of auditing and accounting in

most organisations.

ü Low level of human and institutional capacity..

II.9 THE ROLE OF THE FINANCIAL SECTOR IN PRIVATE SECTOR

DEVELOPMENT

Domestic capital formation is fundamental to any country's

economic development and effective financial institutions are a prerequisite.

Financial sector promotes private sector development through the following

pillars (www.bnr.rw):

ü Enhances savings mobilisation and efficient allocation of

resources into productive investments hence increasing productivity;

ü Facilitating trade, capital flows and remittances from

abroad;

ü Intermediating between savers and users of capital thus

reducing transaction costs;

ü Increase the access to financial services and reduce

informal sector business transactions;

II.10 POLICY GEARED TO INCREASE ACCESS TO BANKING

SERVICES:

Accessibility of financial services is one of the prerequisites

for a country to boost and ensure its sustainable development, the following

are policies geared to increase access to banking services (www.bnr.rw):

ï Strengthen Banking and MFI sector through adequate

capitalisation, improved regulation and Institutional capacity building through

Bankers association and Umbrella MFI;

ï Establish deposit guarantee schemes for banks and MFIs;

ï UBPR to operate like a de facto commercial bank while

maintaining those aspects regarding cooperative principles;

ï BHR to Issue mortgage backed bonds to raise long term

capital;

ï Banks including BHR to develop mortgage savings

accounts;

ï BHR to organise the property market sector, real estate

evaluation;

ï Banks to continue to develop leasing products;

ï BRD to attract new equity shareholders as long as it

maintains its mission;

ï Continue to raise debt capital from external sources on

long term to be able to on-lend locally;

ï BRD will diversify its loan portfolio to minimise risk

while investing in all targeted key economic sectors;

ï BRD to design bonds backed by good loans as a vehicle to

raise more capital;

II.11 DEVELOPMENT OF LONG TERM FINANCE AND CAPITAL MARKETS

Capital market refers to that financial market where long-term

funds are raised. long-term investments are needed for strengthening national

economy, and this requires to be funded by long-term funds, for ensuring the

sufficient supply of long-term funds the government through the central bank

taken the following decisions:

ï Develop Long-term government bonds to build a yield curve

by securitizing Government Debt to CSR (Caisse Sociale du Rwanda) and reissue

the existing stock of Treasury Bills on a long-term basis;

ï Create a sound and facilitating environment, legal,

regulatory and operational guidelines for an OTC (Over The Counter) market and

for issuance of corporate and municipal bonds;

ï Establish a Capital Markets advisory council;

ï Enact the company Act and Accountants bill;

ï Facilitate creation of private pension funds and mutual

trust funds by establishing a legal and regulatory framework and inbuilt tax

incentives;

ï Increase penetration of CSR to include the self

employed;

ï Consolidate regulation of contractual savings institution

( Insurance and Pension) into a department of BNR, specifically charged with

that responsibility.(

www.bnr.rw)

CHAPTER THREE: RESEARCH METHODOLOGY

III.1 INTRODUCTION

This chapter is about the overall approach to the

research process, from the rationale underpinning the study to the collection

and analysis of the data. The chapter explains how the researcher collected the

data, the nature of data, which was collected, where data was collected, and

how it was analyzed. It presents the methods and methodological techniques and

approaches that applied in data collection, sampling techniques as well as

problems encountered in the study.

III.2 METHODOLOGY

Bailey (1978: 26) defined the term methodology as the

philosophy of the research process. This includes assumptions and values that

serve as rationale for research and the standards the research will use for

data collection, interpreting and researching conclusions.

Cohon and Mario (1985) argue that

research is best understood as the process of arriving at the dependable

solution to problems through systematic collection, analysis, interpretation of

data.

It is a paramount tool for promoting knowledge, progress and

to enable humans relate more effectively to their environment and accomplish

their purposes and solve their problems with reference to the research

questions.

It is important to decide on the sources of data that would

give most appropriate responses to the questions and which methods and tools

most appropriate to collect the relevant data. Therefore, this research used

triangulation methodology, which combines qualitative and quantitative.

Quantitative is an approach that believes in quantifying

responses in different levels, it uses mathematical conclusions such as mean,

percentages, standard deviation etc... to show the degree of correlation of

responses from different respondents.

In this research data was analysed through the sample

tabulation of the targeted population and percentages was calculated to

describe the degree or level of correlation of the results collected from

different respondents.

Qualitative approach on the other hand, it may use some

mathematical conclusions and analysis, it stresses the human interaction

through explanations, descriptions, relationships or reactions and so many

other human interactions. In this research, qualitative approach was used to

analyse some expressions from respondents such as having been satisfied by BPR

becoming a commercial bank.

III.3 RESEARCH DESIGN

This study was carried out in BPR SA from its

headquarters, Interviews and questionnaires were used with the intention of

accessing the rationale and impact of Banques Populaires transformation from a

cooperative to a commercial bank and find out possible recommendations to other

financial institutions so that they could achieve efficiency in their

operations. It can also be defined as a pre-arranged program for collecting and

analyzing the information needed to satisfy the study objectives at the invest

cost (Williamson et al., 1987: 39)

III.4 SOURCES OF DATA

III.4.1 PRIMARY DATA

According to Audrey (1989: 57), primary data comes

straight from the people a researcher is researching from and is therefore the

most direct kind of information a researcher can collect. The primary data is

said to be the first hand observation and investigation. In this research, the

primary data is composed by information from interviewees.

III.4.2 SECONDARY DATA

Secondary data is usually extracted from the original

data and is often the examination of the study someone else has carried out on

a subject or an evaluation of commentary, or summary of primary material

(Audrey, 1989: 57). The secondary data of this research was extracted from

different bank and government reports, textbooks, statistics and other previous

research documents in the same field.

IV. POPULATION AND SAMPLE SIZE

Bailey says that «the population is

universal objects over which research is to be carried out». The ideal

practice in research would be to gather information from the entire population;

this will ensure maximum coverage of the population concerned in the research.

But due to limited time and funds the entire population of the research can not

be covered and the sample defined as a sub set of population was used.

Duttolph et al (1986) argue that if the sample is

selected properly, the information collected about the sample may be used to

make statements about the whole population.

The target population of this research was a group of sixty

stakeholders interviewed, and the group was composed of twenty five employees

and board of directors and thirty five customers interviewed in this research

in relation to Banques Populaires transformation from a cooperative to a

commercial bank, its rationale and impact. This Group of interviewees was

chosen because they are involved in Banques Populaires activities directly or

indirectly, they were supposed to have all the information regarding the life

of the bank.

IV.1 SAMPLE SIZE AND SAMPLING TECHNIQUES

In selecting the sample size, stratified sampling was

applied. Arkin and gult (1987) point out that in determining the sample, 10% of

the total population estimate is required.

|

Category of respondents

|

Employees and board of

directors

|

Customers

|

Total number of customers

|

|

Number of respondents

|

25

|

35

|

60

|

V. DATA COLLECTION TECHNIQUES

Data collection for this study was collected through

documentary sources, observation, questionnaires and structure and unstructured

interviews.

V.1 DOCUMENTARY SOURCES

According to Mbaaga (1990: 29), documents are materials,

which contain the information about a phenomenon that researchers wish to

study. In this study the documents targeted are government reports, laws and

international reports, previous researches about Banques Populaires,Commercial

banks and financial sector in Rwanda.

V.2 OBSERVATIONS

According to bailey, as cited by Rwigamba (2001: 46), an

observation is the primary technique for collecting data on the non-verbal

behavior. Although observation commonly involves sight or visual data

collection via other senses such as hearing, touching and smelling, observation

was used especially to categories of those respondents who do not want to

reveal their personal status with regard to what they own.

V.3 QUESTIONNAIRE

Mbaaga (1990: 25) defined a

questionnaire as a set of questions which are asked to get information from a

respondent. It is also currently used to mean a set of questions, which are

self-administrated. A questionnaire was designed and pre-tested before the

researcher submited it to the selected respondents.

V.4 INTERVIEWS

An interview can be defined as

face-to-face conversation between an interviewer and the respondent conducted

for the purpose of obtaining information (Mbaaga, 1990: 338). Two types of

interviews have been used: the formal (structured) interview and the informal

(unstructured) interview.

VI DATA PROCESSING

Normally, data collected from

respondents was in a row form, which was easy to interpret and analyze for

conclusions. Data processing was used to transform the respondent's views into

meaningful test.

Therefore, enough was done to process it before proper

analysis could be made. On this note, editing, coding and tabulating of data

was done in order to be able to handle it easily.

VI.1 EDITING

Mbaaga (1990: 155) defines editing as the process whereby

errors in completed interview, schedule and the mail questions are identified

whenever possible. For some unclear responses, the researcher went back to the

respondents so as to make them clarify their responses.

VI.2 CODING

According to Kakooza (1996: 29), coding refers to the

«assigning of symbol or a number to a response for identification

purpose». This was used to summarize data by classifying different

responses, which was made into categories for easy interpretation and

analysis.

VI.3 TABULATION

Frequency distribution tables were used after editing and

coding of data. Tables were constructed according to the main themes in the

questionnaire to summarize all the findings of the study.

CHAPTER IV : DATA PRESENTATION, ANALYSIS AND

INTERPRETATION.

4 1 .INTRODUCTION.

This chapter presents the findings from the research carried out

in BPR SA. The data collected in this research was collected through

questionnaires, documentary sources, structured and unstructured interviews.

The interviews attracted a group of respondents implicated from banques

populaires du Rwanda SA.

This chapter depicts the views, feelings and comments from

respondents regarding banques populaires transformation from a cooperative to a

commercial bank.

The researcher attempted to analyze the data in view of answering

the research questions set at the beginning of this study and in particular

establishing the rationale and impact of banques populaires transformation from

a cooperative to a commercial bank. Consequently, the analysis here was based

on the views gathered from the respondents.

This chapter is organized into four sections, the introduction,

the profile of respondents, the rationale of banques populaires transformation

from a cooperative to a commercial bank and the impact of banques populaires

transformation from a cooperative to a commercial bank

4 2 .THE PROFILE OF RESPONDENTS

The population targeted in this research was made up of bank

populaire' stakeholders which are (a) board of directors, (b) employees, (c)

shareholders and (d) customers; the sample used in this research was selected

using stratified and random sampling technique.

The profiles of respondents are summarized in the tables

below:

Table 1 : distribution of respondents according to their

relationship role in the bank.

|

Stakeholders with the bank/ relationship

|

Number of respondents

|

Percentage

|

|

Employees and board of directors

|

25

|

41.6%

|

|

Shareholders and customers

|

35

|

58.4%

|

|

TOTAL

|

60

|

100%

|

The stakeholders were grouped into two categories according to

the questions that the researcher intended to ask them; those are the category

of employees and board of directors and the category of shareholders and

customers.

From the table above, it is shown that 58.4% of the selected

groups were shareholders and customers because they constitute a big number of

bank stake holders; and the category of employees and members of board of

directors constitute 41.6% of the sample size.

Table 2 : distribution of respondents according to their

sex.

|

Sex

|

Frequency

|

Percentage of frequency

|

|

male

|

42

|

70%

|

|

female

|

18

|

30%

|

|

total

|

60

|

100%

|

From the table 2, it is noted that 70% were males while fameles

were 30%

Table 3 : distribution of respondents according to their

levels of education.

|

Level of education

|

Frequency

|

Percentage of frequency

|

|

university

|

22

|

37%

|

|

secondary

|

27

|

45%

|

|

primary

|

11

|

18%

|

|

other

|

0

|

0%

|

|

total

|

60

|

100%

|

From the table 3, it is clearly evident that the majority of the

respondents, equivalent to 45% are secondary school diploma holders, 37%

university degree holders and 18% primary school certificate holders.

Table 4 : distribution of respondents according to their

ages.

|

Age group

|

Frequency

|

Percentage of frequency

|

|

18-35

|

44

|

73%

|

|

35 - 55

|

13

|

22%

|

|

above 55

|

3

|

5%

|

|

total

|

60

|

100%

|

As shown from the table above the largest number of respondents

fall into the age group of 18-35 that makes up the percentage of 73%. This

shows that the majority of bank stakeholders are young people.

It is followed by 22% lying in the age group of 35 - 55 and the

last and smallest age group of above 55 five years that makes only 5% of total

respondents.

4 3 .THE RATIONALE FOR BANQUES POPULAIRES TRANSFORMATION FROM

COOPERATIVE TO A COMMERCIAL BANK.

According to the findings from the respondents during this study,

the main reasons for bank populaires transformation from a cooperative to a

commercial bank were:

- Acquiring license to offer a full range of financial services

in urban and rural areas;

- Strengthening the bank capacity to grant loans;

- To foster and strengthen high service quality and customer

care;

- To upgrade its core business from being a cooperative that

offers basic savings and credit services to becoming a fully fledged retail

bank;

A number of respondents stated that«mbere y'uko banki

ihinduka banki y'ubucuruzi ntitwabonaga amafaranga uko tubyifuza, batangaga

amafaranga make cyane kandi ibyo byatumaga abanyamuryango bakeneye amafaranga

menshi bigira mu mabanki y'ubucuruzi meaning that before the bank become

transformed from a cooperative to a commercial bank, it did not granted to us

loans as required, they granted a very little money and this caused the flight

of a good number of customers who needed a good amount of money».

Before the transformation of banques populaires from a

cooperative to a commercial bank each bank was financially and administratively

independent credit union; the fact that each bank was independent, the separate

independence for each credit union limited the capacity for granting loans in

favor of clients and this fact led to the desertion of customers who needed a

reasonable amount of loans.

In terms of loan granting capacity, the transformation of banques

populaires from a cooperative to a commercial bank led to the consolidation of

separate credit unions assets first and second to acquire the bank license

where there is no restriction on the percentage of loan to be granted in favor

of one person or one group of person compared to the total deposits.

According to the interviews the

majority of customers interviewed: «the waiting time for withdrawals or

deposits have relatively reduced compared to the time used before the

transformation of banques popularizes into a commercial bank».

(a) Front office staff has been reinforced,

(b) The time to wait at the counter has been

significantly reduced.

Crucial in this development are the investments in buildings.

Banking offices in all branches are being redesigned to become:

· Modern and professional

· spacious and bright

· customer friendly

Each branch has a VIP (Very Important Person) reception area

while the head office has a new corporate office for this new customer Segment

and the VIP cards are provided; so that VIP customers are served at any branch

and sub branch or outlet without delay and all this to offer quality

services.

According to BPR S.A articles of association, after the

transformation of banques populaires from a cooperative to a commercial bank;

the purpose was both for itself and on behalf of third parties, to carry out

all banking operations, particularly the following:

- Performance of all banking operations relating to discounting,

rediscounting and commission,

- Receipt of deposits,

- Issuance of short-term, medium and long-term loans,

- Effecting the transfer of funds and assets,

- Performance of all stock exchange and currency exchange

transactions,

- Investment and participation in any company that already exists

or is yet to be established, within the limits laid down under the relevant

legislation and regulations,