|

|

|

LOVELY PROFESSIONAL UNIVERSITY

|

|

|

DEPARTMENT OF COMMERCE

Report of Research on:

«CONTRIBUTION OF MICROFINANCE IN WOMEN

EMPOWERMENT»

A Case Study: Pro-Femmes/ Twese Hamwe through

DUTERIMBERE Micro-Finance Institution

Submitted to Lovely Professional University

In partial fulfillment of the

Requirements for the award of Degree of

Master of Commerce in Finance Specialization Prepared by:

Adeline MUKAYIRANGA

i

|

|

DECLARATION

I hereby declare that the study on «Contribution of

microfinance in women empowerment» a case study of Pro-Femmes/ Twese Hamwe

through Duterimbere Micro-Finances is my original work, that has not been to my

best knowledge submitted and presented to any university of higher learning for

a similar award, and that all sources I have used and quoted have been

acknowledged by complete references.

II

Signature

Date

Adeline Mukayiranga

I, Satendra Bhardwaj acknowledge that this research

project entitled «Contribution of microfinance in women empowerment:

A case study of Pro-Femmes/ Twese Hamwe through Duterimbere

Micro-Finances» is an original work of Mrs Adeline Mukayiranga and has

been done under my supervision.

III

Supervisor:SatendraBhardwaj

Date..............................................

Signature:

iv

DEDICATION

I dedicate this work to the Almighty God who enables us for

any commitment.

Special dedication to my parents, husband and children for

their unprecedented support through my life, and to all friends for their

devotion and courage that have led to the completion of my studies and this

research.

ACKNOWLEDGEMENTS

The final product of this research project is not the result

of the effort of one person but a combination of participation of different

parsons.

First and foremost I thank the Almighty God who has been

taking care of me and keeping me strong and done everything for my best.

My special thanks go to my husband, Kwizera Anicet and to my

children: Kwizera Sangwa Aldo and Kwizera Rwema Alida for their moral and

financial support along my education. Your love has made me what I am today.

My sincere gratitude goes to Mr Satendra Bhardwaj who

kindly accepted to supervise me and for his enrichment advices despite his

other duties.

I would like to thank so much Mr Manishaka Jean Bosco

Aboubacar. I will eternally remember your encouraging guidance and intellectual

capacity, which will surely always guide me in my further academic

endeavors.

I also wish to express and record my sincere appreciation to

the Lovely Professionally University (LPU) and Faculty of Management

administration in general, and especially to the teaching staff in the

department of Commerce, for the immense support accorded to me during my

courses. This was evidenced through material and moral support granted to

me.

I would like to thank all those who contributed in one or

another way to the accomplishment of this study.

I'm highly indebted to the Pro-Femmes/ Twese Hamwe for

contributing toward the successful completion of my research project. To the

Executive Secretary of Pro-Femmes/ Twese Hamwe, and to Mrs Suzanne Ruboneka and

to all staff of Pro-Femmes/ Twese Hamwe & Duterimbere MFI, I am

tremendously appreciative of the support you gave me.

It is not possible to thank all of you in person, as this may

not be sufficient or exhaustive in coverage, extent and depth.

However, special thanks go to my fellow friends who have been

together with me during my studies, and who managed to provide any kind of

support during this period.

V

Adeline Mukayiranga

vi

TABLE OF CONTENTS

DECLARATION ii

DEDICATION iv

ACKNOWLEDGEMENTS v

LIST OF OBSERVATIONS xi

ABSTRACT xii

CHAPTER ONE: INTRODUCTION 1

1.1 Background of the study 1

1.2 Statement of the problem 2

1.3 OBJECTIVES OF STUDY 2

1.3.1 General objective 2

1.3.2 Specific objectives 2

1.4 HYPOTHESES OF THE STUDY 3

1.4.1 General hypothesis 3

1.4.2 Specific hypotheses 3

1.5 DEFINITION 3

1.6 ROLE OF MICROFINANCE IN WOMEN EMPOWERMENT 4

1.7 Microfinance & empowerment 5

1.8 Scope of study 6

1.9 INTRODUCTION TO THE ORGANIZATION (Pro-Femmes/ Twese Hamwe)

6

1.10 HISTORICAL BACKGROUND OF PRO- FEMMES /TWESE HAMWE 8

ORGANISATIONS UMBRELLA 8

1.11 PRO -FEMMES / TWESE HAMWE'S VISION 8

VII

1.12 PRO- FEMMES / TWESE HAMWE'S MISSION 9

1.13 PRO -FEMMES/TWESE HAMWE'S OBJECTIVES 9

1.14 CONCERN OF DUTERIMBERE MFI 10

1.14.1Duterimbere objectives 10

CHAPTER TWO: REVIEW OF LITERATURE 13

2.1. INTRODUCTION 13

2.2 DEFINITION OF MICROFINANCE CONCEPTS 15

2.3 MICROFINANCE INSTITUTION 21

2.4 CHALLENGES FACED BY MICRIFINANCE INSTITUTIONS 21

2.5 MICROFINANCE AND WOMEN'S EMPOWERMENT: QUESTIONNING 22

`VIRTUOUS SPIRALS' 22

2.6 Theoretical links between Microfinance and Poverty 27

2.6.1Reduction/Analytical Framework 27

2.6.2 Poverty Reduction and Microfinance 27

2.6.3 Analytical Framework 30

CHAPTER THREE: RESEARCH METHODOLOGY 33

3.1. RESEARCH METHODOLOGY 33

3.2 CASE STUDY 33

3.3. AREA OF THE STUDY 33

3.4. POPULATION OF THE STUDY 34

3.5. SAMPLE SIZE 34

3.6 SAMPLE TECHNIQUE 35

3.7 CLASSIFICATION AND SOURCES OF DATA 35

3.8 DATA COLLECTION TECHNIQUE 36

3.9 QUESTIONNAIRE FOR CLIENTS 36

3.10 INTERVIEWS FOR KEY STAFF 36

3.11 DATA PROCESSING, ANALYSIS, AND INTERPRETATION 37

VIII

3.12 EDITING 37

3.13 TABULATION 37

3.14 LIMITATIONS OF THE STUDY 37

CHAPTER FOUR: PRESENTATION OF KEY FINDINGS AND DATA ANALYSIS

39

4.1. INTRODUCTION 39

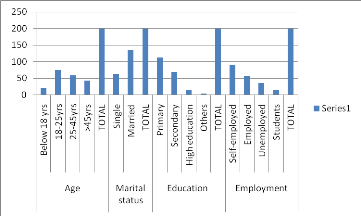

4.2. IDENTIFICATION OF PARTICIPANTS 39

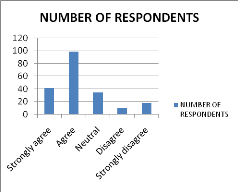

4.3. PRESENTATION OF RESULTS FROM QUESTIONNAIRES 42

4.4. DISCUSSION OF RESULTS 50

4.4.1. DISCUSSION OF RESULTS FROM QUESTIONNAIRES 50

4.4.2. DISCUSSION OF RESULTS FROM INTERVIEW 52

CHAPTER FIVE: CONCLUSION AND RECOMMANDATIONS 55

5.1. INTRODUCTION 55

5.2. CONCLUSION 55

ix

LIST OF TABLES

Table 1: Respondents numbers in the Districts

Table 2: Sample size in every district

Table3. Identification of respondents

Table 4: Women use savings and credit in economic activity for

their empowerment

Table 5: Women who benefit credit from Duterimbere IMF are

confined in range of

female low-income Activities

Table 6: Women economically-developed change gender role and

status within household

and community

Table 7: Microcredit given by Duterimbere IMF is limited

according to the beneficiary

Table 8: Microcredit provided by Duterimbere IMF is enough to

women empowering

Table 9: Women appreciate the short-term loan from Duterimbere

IMF for their

empowerment purpose

Table 10: Women may be economically self-sufficiency due to

microcredit without the men

support

Table 11: Socio-demographics variables such as education level,

age, marital and

professional status lead to success of microcredit in women

empowerment

Table 12: Business held by women are competitive with others

Table 13: Microcredit offered to women improves the family

standing

Table 14: Women empowerment involves the family and community

development

Table 15: Family economy may be based on the women empowerment

due to savings and

credit through microfinance

X

LIST OF GRAPHICS

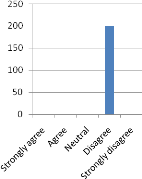

Graphic 1: Identification of respondents

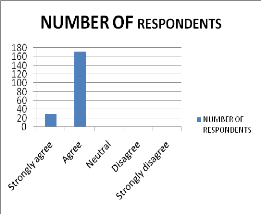

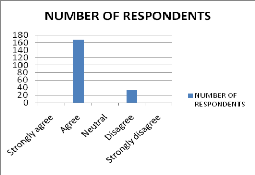

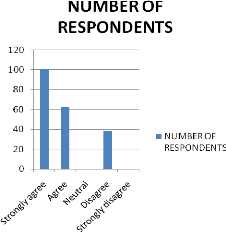

Graphic 2: Women use savings and credit in economic activity for

their empowerment

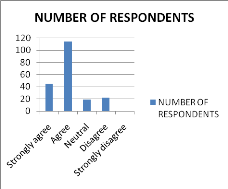

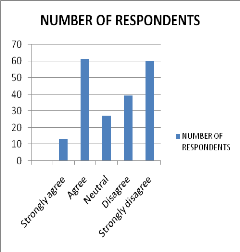

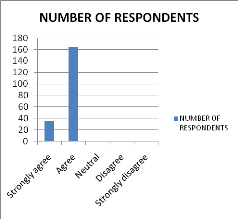

Graphic 3: Women who benefit credit from Duterimbere IMF are

confined in range of

female low-income Activities

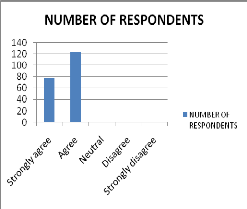

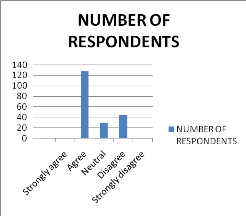

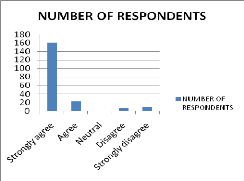

Graphic 4: Women economically-developed change gender role and

status within

household and community

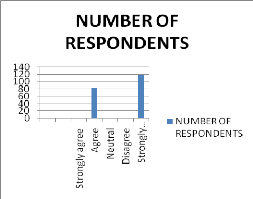

Graphic 5: Microcredit given by Duterimbere IMF is limited

according to the beneficiary

Graphic 6: Microcredit provided by Duterimbere IMF is enough to

women empowering

Graphic 7: Women appreciate the short-term loan from Duterimbere

IMF for their

empowerment purpose

Graphic 8: Women may be economically self-sufficiency due to

microcredit without the men support

Graphic 9: Socio-demographics variables such as education level,

age, marital and

Professional status lead to success of microcredit in women

empowerment Graphic 10: Business held by women are competitive with others

Graphic 11: Microcredit offered to women improves the family

standing

Graphic12: Women empowerment involves the family and community

development Graphic 13: Family economy may be based on the women empowerment

due to savings and credit through microfinance

LIST OF FIGURES

Figure 1: Framework of women's empowerment through microfinance

(Household

model)

Figure 2: Virtuous spirals

Figure 3: Linking Microfinance with Poverty Reduction

xi

LIST OF OBSERVATIONS

AKRSP: Agha Khan Rural Support Program

CEDAW: Convention on the Elimination of All

Forms of Discrimination Against

KFW: KreditanstaltfürWiederaufbau

LPU: Lovely Professionally University

MFI: Microfinance Institution

MIGEPROF: Ministry of Gender and Women

Promotion

NGO: Non government organization

OPP: Orangi Piolt Project

PTH: Pro-Femmes/ Twese Hamwe

RCA: Rwanda Cooperative Agency

RWAMREC: Rwanda Men's Resource Center

SBP: State Bank of Pakistan

UNFPA: United Nations Population Fund

UNIFEM: United Nations Development Fund for

Women

UNSCR1325: UN Security Council Resolution on

Women 1325

XII

ABSTRACT

In a male dominated society, women have always been

underestimated and discriminated in all spheres of life be it their family and

social life or their economic and political life. Moreover, the traditional

duties of managing households create hindrances in their social and economic

empowerment. Over the years various efforts have been made by many Government

and Non Government organizations to promote women empowerment in general and

especially in rural areas. One such effort is the microfinance intervention.

Many leading public and private sector banks are offering schemes exclusively

designed for women to set up their own ventures. Even the unorganized sector

has been heading into microfinance movement. The present paper is an attempt to

study the role of microfinance intervention in promoting women empowerment in

Rwanda through Pro-Femmes/ Twese Hamwe and other institutions. The objective is

to analyze the use of micro financial services by the women clients and access

their level of satisfaction with regards to these services.

After conducting this research the following results were

obtained:

Microfinance institutions have contributed to the improvement

of the economic and social conditions of the population and women in particular

by their policy of promotion of the saving and credit which helps this

population to carry out income generating activities via the individual

projects and groups of solidarity.

In general, this study found that microfinance institutions

contribute to rapid socio-economic growth by leveraging neglected sectors of

the economy through providing them financial assistance and helping them to

finance their own projects and increase their income.

13

1

CHAPTER ONE: INTRODUCTION

1.1 Background of the study

Rwanda is among the developing countries still characterized

by the fact that there is over dependence on agricultural activities in rural

areas, low savings, low income groups and the economy highly depending on

agricultural activities.

Globally, women disproportionately represent 70% of the

world's 1.3 billion population who live on less than one dollar per day.

In Rwanda, women comprise (54%) of 11 million of the entire

population. However, most of these Rwandan women are illiterate and this limits

their employment opportunities and financial ability to take care of their

families of which 37% of Rwandan household are managed by women. Moreover, 70%

of the Rwandans live below the poverty line yet a large proportion of these are

women.

Women have been the most underprivileged and discriminated

strata of the society not only in Rwanda but all over the world. Inspire of all

Government and Non-Governments' efforts, they have been highly inactive clients

of the financial sector. In the recent times, microfinance has been emerging as

a powerful instrument for empowering women particularly; the women that have

little financial ability. Apart from the informal sector of finance, the formal

and semi formal sectors like commercial banks, NGOs etc. are taking much

interest in providing microfinance services to women in order to promote them.

Women are also participating in the microfinance movement by availing the

microfinance services being provided by the various financial channels.

Women empowerment is one of the most important issues that

have been in the focus of various policies and programs initiated by the

Government and the non-government organizations. Microfinance is one such

effort that has been emerging as a powerful tool of women empowerment. It has

been observed through the available literature that most of the studies related

to microfinance have been carried out in the all province regions of the

country (Rwanda) particularly and worldwide in general. The present study aims

to fill in the gap in the available literature. It is a modest attempt to

analyze the role of microfinance in women empowerment and the satisfaction

level of the women towards microfinance services.

2

1.2 Statement of the problem

After the genocide of 1994, women in Rwanda took enormous

responsibilities that made it difficult for women to be able to support

themselves in absence of their spouses. This explain how women are vulnerable

to poverty especially those women heading the family.

In general, Rwanda women make up the majority of the low

income earners, unorganized informal sector of the economy and bigger number of

them are windows left behind by the 1994 genocide tragedy, others are

illiterate and have been marginalized by poverty and negative cultural

practices.

Accessing loan is the major constraint on women's ability to

earn income since most traditional financial systems require physical

collateral worth more than the amount of loan requested. The poor women find it

difficult to generate significant income from such loan because interest rates

are high. In addition, due to high rate of illiteracy, women have always been

facing unemployment problem compared to men. Providing the poor women with

financial services boost their income and productivity, thereby reducing

poverty.

The microfinance has been developed to fill these gaps, with

increasing assistance from the various financial institutions and other donors,

microfinance service is emerging as a powerful tool to reduce poverty and

improve access to financial services for the poor women of Rwanda.

It is against this background that the researcher intends to

carry out a study in order to analyze the outreach and impact of microfinance

on the poor women of Rwanda. The findings will be drawn from an in-depth

analysis of data obtained from microcredit issued to women beneficiaries.

1.3 OBJECTIVES OF STUDY

1.3.1 General objective

To determine the contribution of microfinance in women

empowerment in Rwanda.

1.3.2 Specific objectives

? To identify various determinants of women empowerment.

? To find out the impact of microcredit in women

development/promotion. ? To analyze the role of microfinance in family

empowerment by women.

3

1.4 HYPOTHESES OF THE STUDY

1.4.1 General hypothesis

The main hypothesis stipulates that the microfinance

contributes in women empowerment.

1.4.2 Specific hypotheses

? Savings, credits and family self-sufficiency are among various

determinants of

women empowerment.

? Microcredit impacts the women development/promotion.

? Women contribute in family empowerment through microfinance.

1.5 DEFINITION

1. WOMEN EMPOWERMENT

Empowerment of women means to let women survive and let them

live a life with dignity, humanity, respect, self esteem and self reliance

source. Different scholars have identified the indicators of women's

empowerment, likewise, Schuler and Hashemi (1994) outlined six elements of

women's empowerment in Bangladesh which includes a sense of self and vision of

a future, mobility and visibility, economic security, status and decision

making

power within the household, ability to interact effectively in

the public sphere and participation in non-family groups. While on other hand,

Friedman's (1992) analysis of women's empowerment identified different kinds of

power: economic, social, political and psychological. Economic power means

access to income, assets, food, markets and decision-making power in the

economic activities. Social power means access to certain bases of individual

production such as financial resources, information, knowledge, skills and

participation in social organizations. Political power means the access of

individual household members to the process by which decisions, particularly

those that affect their own future, are made. Psychological power means the

individual's sense of potency, which is demonstrated in self-confident behavior

and self esteem. While on other hand Rowlands (1995) describe it as «a

process whereby women become able to organize themselves to increase their own

self-reliance, to assert their independent right to make choices and to control

resources which will assist in challenging and eliminating their own

subordination». Her emphasis that ability to exercise choice incorporates

three interrelated dimensions: Resources, Agency and Achievements. According to

UNIFEM, «to generate choices, gaining the ability and exercise bargaining

power», «developing a sense of

4

self worth, to secure desired changes, belief in one's ability

and the right to control one's life» are important elements of women

empowerment. Women will be empowered when they will have full control over

their own life. For the analysis of the present research we will use both

Schuler and Hashemi (1994) and Friedman's (1992) definitions of the term women

empowerment

2. MICROFINANCE

Some see microfinance as a source of major social

transformation; others see it as the seed of a revolution in banking access. Is

true believers push for both? Microfinance is a type of banking service which

provides access to financial and non financial services to low income or

unemployed people.

According to Kreditanstalt fürWiederaufbau (KfW)

microfinance is a significant instrument for poverty reduction. Whether it can

also be seen as a tool for women's empowerment is of special interest to

KfW.

The connection between microfinance and women's empowerment

becomes obvious when one realizes that the vast majority of clients are women.

Given the interconnectedness of the social, political and economic dimensions

of empowerment, empowering changes in one dimension may trigger changes in

other dimensions. Thus, the improvement of women's economic empowerment has the

potential to lead to positive changes in social and political dimensions.

1.6 ROLE OF MICROFINANCE IN WOMEN

EMPOWERMENT

Microfinance is a type of banking service which provides

access to financial and non financial services to low income or unemployed

people. Microfinance is a powerful tool to self empower the poor people

especially women at world level and especially in developing countries.

Microfinance activities can give them a means to climb out of poverty. From

early 1970's women movement in number of countries has been increasing to

alleviate poverty through microfinance programs. The problem less access to

credit by women was given a particular concentration at First International

Women Conference in Mexico in 1975.

The evolution of microfinance is from Bangladesh since late

1970s and a very successful project. But in Pakistan, the movement of

microfinance sector started from Agha Khan Rural Support Program (AKRSP) and

Orangi Piolt Project (OPP). With the passage of time microfinance becomes NGO

activity and five microfinance banks have been started under State Bank of

Pakistan (SBP) ordinance. Microfinance services lead to women empowerment by

positively

5

influencing women's decision making power at household level

and their overall socioeconomic status. By the end of 2000, microfinance

services had reached over 79318million of the poorest of the world (Women and

Men). As such microfinance has the potential to make a significant contribution

to gender equality and promote sustainable livelihood and better working

condition for women. (ILO Geneva)

It has been well documented that an increase in women

resources or better approach for credit facilities results in increased well

being of the family especially children. (Maoux, 1997; Kabeer, 2001).

Basic infrastructure is insufficient in rural areas where 78%

of female population resides. Nyabihu and Musanze are highly deprived districts

in Northern Province poverty reduction strategy paper( government Statistics

report, 2010). Women community in this region is also deprived. Microfinance

plays a great role in the lives of millions of poor people particularly women.

Most areas of city, where microfinance loan is disbursed, dearth of women

decision making at domestic level exist in both rural and urban areas of city.

Microfinance as a whole is a new concept in the Rwanda country for improvement

of women empowerment.

1.7 Microfinance & empowerment

Regarding the contribution of microfinance to women's

empowerment, most people listed the facilitation of economic and financial

independency (41%) followed by the increase in child and family welfare (18%).

(Cheston, Susy & Kuhn, Lisa, 2002)

All persons were ready to suggest how this influence could be

expanded. Most mentioned financial-product innovation to fit women's specific

needs (41%), followed by awareness-raising programs (19%). 48% of the

interviewees suggested that training and capacity building (on financial, legal

and gender issues, technical, entrepreneurship, personal development and health

issues) are services that could increase this influence.

When asked what contributed to women's empowerment, all

interviewees found equal rights and opportunities most important, followed by

increased welfare. Financial independence, decision-making in the household and

education were deemed more important by Pro-Femmes/ Twese Hamwe attribution and

MFI partners than by the clients themselves. Expanded networks and elevated

status as business women were neither perceived as neither most nor least

important by all interviewees.

6

1.8 Scope of study

The research adopted a case study approach mainly because of

limited time and resource. There are many financial players in the economy

trying to empower women through microloan support. Due to limited time and

resource Pro-Femmes/ Twese Hamwe through Duterimbere FMI, was chosen to

represent all players in the empowerment of women.

The researcher want to build on the growing body of research

on the topic, combine academic theories, what is done in practice and field

experiences, and encourage further exploration and dialogue on the subject.

Throughout the paper, we provided references so that those interested in

exploring specific aspects of empowerment can find more in-depth information.

At the outset of my research, I wished to find out how microfinance empowers

the women in general and particularly in Rwanda.

1.9 INTRODUCTION TO THE ORGANIZATION (Pro-Femmes/ Twese

Hamwe) Pro-Femmes/ Twese Hamwe is an Umbrella Organization that

promotes gender, peace and development. It was created on 18th

October 1992, by 13 Rwandan Women Associations. Today Pro-Femmes/ Twese Hamwe

is composed of 58 member associations including Rwanda Men's Resource Center, a

men's Organization. (Inside Pro-Femmes newsletter Issue no 1)

Those associations are follows:

1. AEC: Drivers' Wives Associations

2. AFCF: Households Heading Women Associations

3. AFEPROF: ASSOCIATION DES FEMMES POUR LE PROGRES FAMILIAL.

4. AFER: Association of Female Entrepreneurs in Rwanda

5. AGR: Association of Girl Scouts in Rwanda

6. AHUMWAGUTARI

7. AMALIZA

8. AMIZERO

9. ARBEF: Rwandan Organisation for Family Welfare

10. ARCT- RUHUKA: Rwandan Association of Trauma

Counsellors

11. ARFEM: Rwandan Association of Media Women

12. ARTCF: Rwandan Association of Christian Female Workers

13. ASOFERWA: Rwandan Women Solidarity Association

14. ASSOCIATION MISERICORDE

15.

7

ASSOCIATION NDABAGA

16. ASSOCIATION NZAMBAZAMARIYA Veneranda

17. AVEGA AGAHOZO: Genocide Widows' Association

18. BENIMPUHWE

19. BENISHYAKA

20. CARITAS UMUHOZA

21. CMS: Club Mamans Sportives

22. COCOF: Women Consultative Council

23. COR-UNUM

24. DUHOZANYE

25. DUKANGUKE

26. DUTERIMBERE

27. FAWE Rwanda : Forum for African Women Educationalists

28. FONDATION BARAKABAHO

29. FONDATION TUMURERE

30. FVA: Faith Victory Association

31. GIRANEZA

32. GIRIBAMBE

33. HAGURUKA

34. ICYUZUZO

35. JOC-F: Female Catholic Working Youth

36. LUMIERE DE LA VIE

37. MBWIRANDUMVA INITIATIVE

38. MISSION OF HOPE

39. MTCR : Mouvement des Travailleurs Chrétiens Rwanda

40. RESEAU DES FEMMES OEUVRANT POUR LE DEVELOPPEMENT RURAL

41. RWAMREC : Rwanda Men's Resource Centre

42. RWANDA WOMEN'S NETWORK

43. SERUKA

44. SEVOTA : Solidarité pour l'Epanouissement des Veuves

et des Orphelins visant le Travail et l'Autopromotion

45. SOLIDAIRES BENURUGWIRO

46. SOS RAMIRA

47. SWAA RWANDA: Society for Women against AIDS in Africa

48. UCFR: Christian Union of Rwandan Women

49. UMUSEKE

50. UMUSHUMBA MWIZA

51. URUMULI RW'URUKUNDO

52. URUNANA DEVELOPMENT COMMUNICATION

53. WIF: WOMEN INVESTMENT FUND

54. WOMEN FOR WOMEN INTERNATIONAL

55. ATEDEC : Action Technique pour un Développement

Communautaire

56. Association KANYARWANDA

57. RéseauCulturelSangwa

58. Association of Kigali Women in Sports

59. CCOAIB (Honorary member)

8

1.10 HISTORICAL BACKGROUND OF PRO- FEMMES /TWESE HAMWE

ORGANISATIONS UMBRELLA

In 1991, there were associations working for women promotion.

They had been initiated for various specific reasons.

In 1992, 13 Rwandan Associations decided to combine their

efforts and created the umbrella PRO-FEMMES/TWESE HAMWE. On 18th

October 1992 it was publicly started and obtained its legal status in 2002.

(Inside Pro-Femmes newsletter Issue no 1)

1.11 PRO -FEMMES / TWESE HAMWE'S VISION

PRO-FEMMES/TWESE HAMWE is longing for a Rwandese society rid

of all forms of gender related discrimination, and thus characterised by

equality and equity between men and women in the development process and in a

context of a stable and peaceful society.

It has made a recognizable impact at national, regional and

international levels. Through cooperation, coordination and consultative

meeting between member organizations, the government, parliament and

international organization.

9

Pro-Femmes/Twese Hamwe advocated and contributed towards

revision of discriminatory laws and initiation of new ones in favour of women

and children, ratification of different conventions on human and women rights

like CEDAW, UNSCR1325, Beijing Platform for action, mobilization of women to

participate in decision making decision positions by training women candidates

through Women can do it program among others.

Pro-Femmes/ Twese Hamwe endeavours to promote gender equality

through advocacy, economic empowerment, and equal participation of women and

men in the development process and fight gender based violence for a better

Rwandan society. (Pro-Femmes report 2011).

1.12 PRO- FEMMES / TWESE HAMWE'S MISSION Its

mission is to contribute to:

> the eradication of all forms of discrimination towards

women and promotion of their socioeconomic, political and legal status,

> the enhancement of the institutional capacity of the

umbrella and member associations , and the promotion of:

· A sustainable human development based on gender and

· A culture of peace based on social justice, respect of

human rights, tolerance and nonviolence.

1.13 PRO -FEMMES/TWESE HAMWE'S OBJECTIVES

· To combine efforts, work for change so as to eradicate

all forms of discrimination and violence towards women;

· To be a consultation and a reflection framework on

success strategies on mission of member associations committed to the promotion

of peace, women's social, economic, cultural and legal status;

· To facilitate exchanges between various member

organisations and to promote partnership with organisations or institutions

working for women promotion.

10

1.14 CONCERN OF DUTERIMBERE MFI

The Duterimbere MFI is microfinance institution which

receives the economies of usual customers served by the banking system and

those who don't have sufficient guaranties to offer in order to ensure the

refunding of the authorized credit. The activities of saving and credit for

Duterimbere MFI were created on June 5th, 1997.

Last year, Duterimbere made a net profit of Rwf116 million

and is targeting a total of Rwf200 million as proceeds this year, which signals

the recovery of MFIs after a period of poor business practices and now that

institution have a total of 53,500 customers, the women have 70% of clients.

1.14.1Duterimbere objectives

? To aim at the improvement of economic and social conditions

of its members, in particularly the women

? To provide the financial services (Saving and credit) to

the population with low and to the women in particularly

? To help the women to carry out the income activities via

individual projects and the groups of solidarity

? To promote the agriculture of saving and economic, social

education and cooperatives of its members.

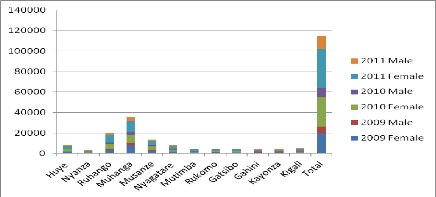

The customers situation of Duterimbere MFI period of 2009 to

2011 according of the different sites/branches

Sites

|

2009

|

2010

|

2011

|

|

Male

|

Female

|

Male

|

Female

|

Male

|

Huye

|

982

|

327

|

2,454

|

818

|

2,643

|

880

|

Nyanza

|

374

|

124

|

438

|

146

|

1583

|

527

|

Ruhango

|

3,286

|

1,095

|

4,620

|

1,539

|

7,101

|

2,367

|

Muhanga

|

7,674

|

2,558

|

8,032

|

2,677

|

10,963

|

3,652

|

Musanze

|

2,679

|

893

|

3,399

|

1,133

|

4,010

|

1,336

|

Nyagatare

|

954

|

317

|

2316

|

771

|

2,859

|

952

|

|

11

Mutimba

|

453

|

151

|

1,321

|

440

|

1,470

|

490

|

Rukomo

|

815

|

271

|

1,147

|

382

|

1,641

|

547

|

Gatsibo

|

630

|

209

|

1,312

|

437

|

1,541

|

513

|

Gahini

|

744

|

247

|

889

|

296

|

1089

|

363

|

Kayonza

|

662

|

220

|

891

|

296

|

1,268

|

422

|

Kigali

|

444

|

147

|

1389

|

462

|

2,288

|

762

|

Total

|

19,692

|

6,564

|

28,204

|

9,401

|

38,451

|

12,816

|

|

Source: Duterimbere MFI report

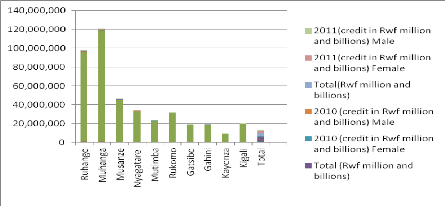

Situation of loans of Duterimbere MFI given its

customers from 2009 to 2011

Sites

|

Total (Rwf million and billions)

|

2009 (credit in Rwf

million and billions)

|

Total (Rwf million and billions)

|

2010 (credit in Rwf

million and

billions)

|

Total(Rw

f million

and

billions)

|

2011(credit in Rwf million and billions)

|

|

|

Female

|

Male

|

|

Female

|

Male

|

|

Female

|

Male

|

Huye

|

76,236

|

53,365

|

22,871,072

|

69,536

|

48,675

|

20,861

|

131,046

|

91,732

|

39,313

|

Nyanza

|

48,733

|

34,113

|

14,619,992

|

30,278

|

21,194

|

9,083

|

61,041

|

42,729

|

18,312

|

Ruhango

|

318,858

|

223,200

|

95,657,547

|

423,508

|

296,456

|

127,052

|

477,462

|

334,223

|

143,238

|

Muhanga

|

394,274

|

275,992

|

118,282,30 9

|

442,260

|

309,582

|

132,678

|

496,947

|

347,863

|

149,084

|

Musanze

|

150,193

|

105,135

|

45,057,947

|

244,041

|

170,828

|

73,212

|

383,066

|

268,146

|

114,919

|

Nyagatar e

|

108,984

|

76,289

|

32,695,420

|

192,481

|

134,737

|

57,744

|

277,966

|

194,576

|

83,390

|

Mutimba

|

75,063

|

52,544

|

22,519,049

|

124,192

|

86,934

|

37,257

|

149,036

|

104,325

|

44,710

|

|

12

Rukomo

101,696

|

71,187

|

30,508,985

|

142,401

|

99,681

|

42,720

|

163,758

|

114,630

|

49,127

|

Gatsibo

|

|

41,579

|

17,819,715

|

165,325

|

|

|

|

150,698

|

64,584

|

|

59,399

|

|

|

|

115,728

|

49,597

|

215,283

|

|

|

Gahini

|

|

42,920

|

18,394,614

|

75,385

|

|

|

|

64,147

|

27,491

|

|

61,315

|

|

|

|

52,769

|

22,615

|

91,638

|

|

|

Kayonza

|

|

20,096

|

8,612,619

|

65,181

|

|

|

|

84,775

|

36,332

|

|

28,708

|

|

|

|

45,626

|

19,554

|

121,108

|

|

|

Kigali

|

|

44,594

|

19,111,899

|

140,174

|

|

|

|

157,900

|

67,671

|

|

63,706

|

|

|

|

98,121

|

42,052

|

225,571

|

|

|

Total

|

|

1,041,01

|

446,151

|

2,114,76

|

|

|

|

1,955,74

|

838,178

|

|

|

9

|

|

7

|

1,480,33

|

634,430

|

2,793,928

|

9

|

|

|

1,487,170

|

|

|

|

7

|

|

|

|

|

|

Source: Duterimbere MFI report

13

CHAPTER TWO: REVIEW OF LITERATURE

2.1. INTRODUCTION

The literature review on how microcredit impact women

empowerment will allow to assess and let women survive live a life with

dignity, humanity, respect, self esteem and self reliance. The emphasis will

assess the ability to exercise choice incorporates three interrelated

dimensions and the women will be empowered when they will have full control

over their own life.

According to KreditanstaltfürWiederaufbau (KfW)

microfinance is a significant instrument for poverty reduction, whether it can

also be seen as a tool for women's empowerment is of special interest to

KfW.

In order to answer the question many studies (reports,

journals, microfinance profile) have been carried out in developing countries

and the majority of these studies have been carried on Rwandan women because

this was the country where microfinance schemes first time started by women

umbrella called Pro-Femmes/ Twese Hamwe through its member called Duterimbere

microfinance institution since 1992.

The main objective of this initiative was to provide loans to

poor people without collateral, alleviating poverty and unleashing human

creativity and endeavor of the poor people.

Microfinance has proven its potential to generate results and

in general, studies suggested the poorest seldom benefit from

microfinance, while the middle and upper poor benefit the most. Women

in particular face significant barriers to achieving sustained increases in

income and improving their status, and require complementary support in other

areas, such as training, marketing, literacy, social mobilization, and other

financial services (e.g.,

Consumption loans, savings).

In fact, it is difficult to separate the impact of

microfinance from that of other interventions (Maclsaac, 1997).Further Maclsaac

(1997) said that «most women borrowers have only partial control over

loans, or have relinquished all control to male members of the family. This has

serious implications for the impact of gender equity. However, this is not to

say benefits are non-

14

existent. As part of a broader effort to raise awareness and

mobilize women, credit could play an important role as an «entry

point» to strengthen women's networks and mobility, increase their

knowledge and self-confidence, and increase their status in the

family.»

In the context of Rwandan women and men discusses that

«during the last two decades, micro-credit approach has been increasingly

incorporated in the development discourse. Specially the loan is given to the

women and the popular belief is that women are benefited and empowered and are

being acknowledged for having a productive and active role and thus it is the

gateway of gaining freedom for themselves.»

There are few studies in the context of Pakistan which

discussed the relationship between microcredit and microfinance and women

empowerment, one of them was a review based study done by Malik and Luqman

(2005).

Thus I see a broadening of the concept of microfinance the

current challenges is to find efficient and reliable ways of providing a richer

menu of microfinance products.

Microfinance and other services for poor people are important

instruments for poverty reduction and for entrepreneurship development

especially for women according to a report prepared by the United Nations

Secretary General Kofi Annan (Ref. world submit and social development and

microfinance 6-12 March 1995 Copenhagen).

They assert that «from the previous research studies, it

was concluded that micro finance or microcredit programs had the potential and

powerful impact on women's empowerment. Although these were not always

empowering all women, most women did experience some degree of empowerment

because it was a complex process of change experienced by all individuals

somewhat differently and varied from culture to culture.

Microfinance programs had both positive and negative impacts

on women's empowerment and eradication of poverty throughout the world.»

There are different perspectives on the issue of microfinance in connection

with women empowerment. In few cases, women were unable to use the microcredit

to empower themselves. In this regard, Goetz and Gupta (1996) said that

«most programs could not ensure that women retained control over the

money. The Women commonly hand over control of the loan or invest it in a

family enterprise.

15

2.2 DEFINITION OF MICROFINANCE CONCEPTS

It is necessary first to make explicit definitions and

assumptions which much of this paper work is based. These points are based on

mostly on field experience with microfinance program and in particular the work

of MFIs in developing countries rather than in the middle income and industries

countries.

1. What is microfinance?

The term refers to the provision of financial services to

low-income clients; including the self-employed. Financial services generally

include savings and credit. However, some microfinance organizations also

provide insurance and payment services. (UNIFEM, 2001)

In addition to financial intermediation, many MFIs also

provide social intermediation services such as group formation, development of

self confidence, and training in financial literacy and management capabilities

among members of a group. Thus the definition of microfinance often includes

both financial intermediation and social intermediation. Microfinance is not

simply banking, it is a development tool.

Microfinance activities usually involve:

+ Small loans, typically for working capital.

+ Informal appraisal of borrowers and investments.

+ Collateral substitutes, such as group guarantees or compulsory

savings.

+ Access to repeat and larger loans, based on repayment

performance.

+ Streamlined loan disbursement and monitoring.

+ Secure savings products.

MFIs can be nongovernmental organizations (NGOs), savings and

loan cooperatives, credit unions, government banks, commercial banks, or

nonbank financial institutions.

The people who require the micro finance are typically

self-employed, low-income entrepreneurs in both urban and rural areas. Clients

are often traders, street vendors, small farmers, service providers

(hairdressers, rickshaw drivers), and artisans and small producers, such as

blacksmiths and seamstresses. Usually their activities provide them stable

source of income (often from more

16

than one activity). Although they are poor, they are generally

not considered to be the "poorest of the poor."(Lidgerwood, 1999)

2. What is economic empowerment?

According to Cheston & Kuhn, (2002); «the economic

empowerment is bringing people on the outside of a decision process into

it» (Rowlands, 1997). It is the ability to obtain an income that enables

participation in economic decision making. Individual become empowered when

they obtain, the right to determine choices in life and to influence the

direction of change, through the ability to gain control over material and non

material resources (Rowlands, 1997).

Batliwala (1994) also sees economic empowerment as a process

of challenging existing power relations and of gaining greater control over the

sources of power or is social force meant to inspire the poor to challenge the

status quo.

According the UNIFEM, economic empowerment is gaining the

ability to generate choices and exercise bargaining power, developing a sense

of self worth, a belief in one's ability to secure desired changes, and the

right to control one's life. Empowerment is about change, choice, and power. It

is a process of change by which individuals or groups with little or no power

and ability to make choices that affect their lives.

Microfinance programs can have tremendous impact on the

empowerment process if their products and services take these structures into

account. In the order for women to be empowered, she needs access to the

material, human, and social resources necessary to make strategic choices in

her life. Not only have women been historically disadvantaged in access to

material resources like credit, property, and money, but they have also been

excluded from social resources like education or knowledge of some

businesses.

Access to resources alone does not automatically translate

into empowerment or equality; however, women must also have the ability to use

the resources to meet their goals. In order for resources to empower women,

they must be too able to use them for a purpose that they choose. Naila Kabeer

uses the term agency to describe the processes of decision making, negotiation,

and manipulation required for women to use resources effectively. Women who

have been excluded from decision making for most of their lives often lack this

since of agency that allows them to

define goals and act affectively to achieve them. Since women's

economic empowerment is the key to socio economic development of the community,

bringing women into the mainstream of national development has been a major

concern of government of Rwanda.

Figure 1: Framework of women's empowerment through

microfinance (Household model)

Women economic

Change in intra-household

Empowerment

increased status of

Bargaining and gender

relation women within household

Income under women's Control increases

17

Women decision Increased independent increased household

Women's access to credit

About savings and income income

Credit use

Source: The role of microfinance in economic empowerment of

women in Rwanda, 2009

It has been well documented that an increase in women's

resources results in the well being of the family, especially children (Mayoux,

1997; Kabeer, 2001; Hulme and Mosley, 1997). A more feminist point of view

stresses that an increased access to financial services represent an

18

opportunity for greater economic empowerment. Such as

organizations explicitly perceive microfinance as a tool in the fight for the

women's rights and independence. Finally, keeping to up with the objective of

financial viability, an increasing number of microfinance institutions prefer

women members as they believe that they are better and more reliable

borrowers.

Hashemi

et.al (1996), investigated whether women's

access to credit has any impact on their lives, irrespective of who had the

managerial control. Their results suggest that women's access to credit

contributes significantly to magnitude of the economic contributions reported

by women, to the likelihood of an increase in asset holdings in their own

names, to an increase in their exercise of purchasing power, and in their

political and legal awareness as well as in combined economic empowerment

index. Also Kabeer (1999), stresses that women's economic empowerment is about

the process by which those who have been denied the ability to make strategic

life choices acquire such ability. According to her, it is important to

understand economic empowerment as a process and not an instrumentalist for of

advocacy.

3. Various Credit Lending Models

Microfinance institutions are one of the oldest financial

institutions in the world, but like all the other institutions in the world,

with time they have adapted various kinds of changes, and have started using

various credit lending models. The Microfinance service/or community has

divided itself into hierarchies. Some of the popular microfinance credit

lending models adopted across the world are:

Associations: In this type of model, a

target community forges together to form an association through which a variety

of microfinance activities are carried out. The microfinance activities may

also include savings. The associations may comprise of youth, women, or be

formed around cultural, religious, or political issues.

In some of the countries a legal body can also form an

association. These legal associations have certain advantages, like collection

of insurance, fees, tax breaks, and provide other protective measures.

Community banking: This financing model

considers the whole community as one unit and facilitates the establishment of

semi-formal and formal institutes through which microfinance are administered.

Usually NGOs and other similar organizations take it upon themselves to form

such institutions, and also educate the community members in diverse financial

activities.

Co-operatives: A co-operative is an

independent association of people who come together voluntarily to meet their

mutual economic, social and cultural aspirations and needs through a

19

egalitarian controlled enterprise. Sometimes the cooperatives

also include savings activities and member financing as well.

Credit Unions: A credit union is a

member-driven unique self-help financial institute comprising of members of a

specific group like labor unions or a social fraternity who assent to save

money and make loans to each other out of that fund at reasonable interest

rates. A credit union membership is free to all, and it follows a democratic

approach in electing the director as well as the committee representatives.

Grameen model or JLG model: The Grameen

model is the most popular model which is practiced by so many MFIs all around

the world. The grameen model entails that a bank unit be composed with a field

manager and a set of bank staff covering a specified area, like 15 to 20

villages. The banking service starts when the manager and the staff familiarize

themselves with the native people and explain to them the intent, functions

motives, and mode of operation. Finally, groups comprising of five future

borrowers are formed, out of which only two people get the loan initially, and

if within fifty weeks they return the principal amount along with interest, as

per the banking rules, the othermembers become eligible as well for taking

loans. This is done, so that there is a collective liability on the group,

which serves as guarantee against the loan as risk factor is so high.

Group: This model is based on overcoming

individual shortcomings by the aggregated accountability and security

engendered by the formation of a group of these individuals. This collective

approach also helps in educating and building awareness, collective negotiation

powers, peer pressure etc.

Individual: This is the simplest and the

oldest credit lending model where small loans are given straight to the

borrower. In most cases such loans are accompanied by socio-economic services

like education and skill development.

Intermediaries: As the name suggests this

model is a `go-between' organization operating between the lender and borrower.

They play a critical role of creating credit cognizance like starting savings

programs and thus raising the credibility of the borrowers to a sufficient

level. These intermediaries can be NGOs, individuals, commercial banks etc.

Non-Governmental Organizations: NGOs are

very active in the field of micro-credit, be it creating consciousness of the

importance of micro-credit, or developing tools and resources to monitor and

identify righteous practices. The NGOs have also created many opportunities to

help people learn all about micro-credit practices and principles through

organizing workshops, seminars, training programs etc..

20

Rotating Savings and Credit Associations: A

group of people join together and make periodic cyclical contributions to a

common fund that is given to a member in a lump sum. After receiving the amount

the member starts paying back by making regular contributions.

Small Business Enterprises (SME): They get

loans from micro-credit programs for creating employment, increasing income

etc. The micro credit is either provided directly to the SME or as a part of a

bigger SME development program.

Village Banking: This is a community based

banking. In this 15-50 low income individuals who seek self-employment come

together to collect funds and give loans. The initial capital is generally

arrived from outside, but the members follow a democratic approach in operation

and moral collateral for repayment. (

http://www.gdrc.org)

Literature prepared for the Microfinance Summit in Washington

in February 1997, many donor statements on credit and NGO funding proposals

presented an extremely attractive vision of increasing numbers of expanding,

financially self-sustainable micro-finance programs reaching large numbers of

women borrowers. Through their contribution to women's ability to earn an

income these programs are assumed to initiate a series of `virtuous spirals' of

economic empowerment, increased well-being for women and their families and

wider social and political empowerment. Female-targeted programs have

supplanted support for many other gender strategies in many donor agencies.

However parallel to, but to a large extent marginalized by,

the enthusiasm of donors and many MFIs and NGOs some researchers have

questioned the degree to which micro-finance services in themselves benefit

women. Some argue strongly that current models of microfinance where the

overriding concern is financial sustainability divert resources from other more

effective strategies for empowerment and/or poverty alleviation. There are now

beginning signs of a change in thinking. On the one hand donors are beginning

to be more skeptical of the achievements and potential of microfinance on its

own and also more interested in self-managed programs. On the other hand there

is rapid innovation at program level and an increasing focus on participation.

These trends are combined with a growing recognition of the need to address

macro-level constraints. The solutions proposed have been varied and are far

from presenting a coherent strategy for poverty elimination and empowerment.

Nevertheless there are now spaces for introducing policy changes which may

increase the contribution of microfinance to both these development aims.

21

2.3 MICROFINANCE INSTITUTION

A micro finance institution is an organization that offers

financial services to the poor. Most MFIs are non-governmental organizations

committed to assisting some sector of low income earning population. Almost all

of these MFIs offer micro credit and only take back small amounts of savings

from their borrowers, not from the general public.

Within the microfinance industry the term microfinance

institution has come to refer to a wide range of organizations dedicated to

providing these services NGOs, Credit Unions, Cooperatives, Private commercial

banks and non bank financial institutions some that have transformed from NGOs

into regulated institutions and parts of state owned banks. (Rwanda

microfinance forum report, 2000)

2.4 CHALLENGES FACED BY MICRIFINANCE INSTITUTIONS

Among challenges facing microfinance industry in developing

nations are:

? High cost of service delivery with poor infrastructure,

regulatory policy issues and the need to develop institutional leadership.

Because infrastructure and communication technology remain largely

underdeveloped in most developing nations, it is significantly more expensive

for microfinance institutions in these nations to operate compared to their

peers in developed countries.

? Another challenge is policy making and government

regulations, which vary by country. I many countries, the supervisory capacity

of central banks, which holds the ultimate responsibility of financial sector

needs an adjustment. The countries which are able to close the microfinance

demand gap most successfully will be those that improve their policy frameworks

and adapt their legal and regulatory systems in line with rapidly changing

environment.

? A low population density area where the number of women to

form a variable group is inadequate also poses as challenges. The situation is

worsened by the unequal distribution of the family resources, which makes it

difficult for women to raise the necessary savings and participate in a

group.

? Some women access credit, but only to pass it into others

who are not directly accountable, leaving them with the loan repayment burden.

The one year repayment period is one of the reasons for default in repayments.

Examples of such failure make other women reluctant to borrow. Another one is

because of the society's perception of a

22

women's place in the home, some women are reluctantly not

informed of the existence of sources of finance.

2.5 MICROFINANCE AND WOMEN'S EMPOWERMENT: QUESTIONNING

`VIRTUOUS SPIRALS'

Micro-finance programs have a significant potential

contribution to women's economic, social and political empowerment. Access to

savings and credit can initiate or strengthen a series of interlinked and

mutually reinforcing ' virtuous spirals ' of empowerment (See Figure 2).

· Women can use savings and credit for economic

activity, thus increasing incomes and assets and control over these incomes and

assets.

· This economic contribution may increase their role in

economic decision-making in the household leading to greater well-being for

women, children as well as men.

· Their increased economic role may lead to change in

gender roles and increased status within households and communities.

The women in agriculture sector

These virtuous spirals are potentially mutually reinforcing in

that both improved well-being and change in women's position may further

increase their ability to increase incomes and so on.

This process of empowerment may be further reinforced by group

formation focusing on savings and credit delivery:

· Women can access wider information and support networks

for economic activity.

· Groups can support women in disputes within the household

and community

· Groups can link to wider movements for change in women's

position.

23

Particularly in Rwanda microfinance programs like those of PTH

through of Duterimbere, Inkingi, Agaseke, Goshen, etc have been pioneers of an

empowerment approach to development for women in the informal sector and rural

areas.

However although it is clear that microfinance programs have

led to such changes for some women in microfinance programs, these changes are

not an automatic consequence of savings and credit alone or of group formation.

Evidence suggests that even in financially successful micro finance

programs:

· Most women remain confined to a narrow range of ' female

' low-income activities

· Many women have limited control over income and/or

what little income they earn may substitute for former male household

contributions as men retain more of their earnings for their own use

· Women often have greater workloads combining both

production and reproductive tasks

· Women's expenditure decisions may continue to

prioritize men and male children while daughters or daughters in law bear the

brunt of unpaid domestic work

· Where women actively press for change this may

increase tensions in the household and domestic violence

· Women remain marginalized in local and national level

political processes

Together association of women supported by Dutermbere

Microfinance through microcredit.

24

This is not just a question of lack of impact, but may also be a

process of disempowerment:

? Credit is also debt. Savings and loan interest or insurance

payments divert resources which might otherwise go for necessary consumption or

investment.

? Putting the responsibility for savings and credit on women

may absolve men of responsibility for the household.

? Where group meetings focus only on savings and credit this

uses up women's precious

work and leisure time, cutting program costs but not necessarily

benefiting women.

Impacts are therefore very complex. There may be trade-offs

for individual women which they negotiate to the best of their ability. There

may be both reinforcing and conflicting changes at household level. Impacts on

gender inequalities at the community level may also combine elements of

empowerment and disempowerment and affect different women in different ways.

Handcraft trading for AGASEKE Association, there are used the

loans microfinance in their activities.

Importantly women themselves are not passive victims, but

active participants using opportunities as best they can in the context of the

many constraints of gender inequality and poverty. Many apparent positive

impacts may be more due to the determination and ingenuity of women than to

program policy. Many negative impacts may be unavoidable because of the

magnitude of constraints.

25

26

Fig.1 VIRTUOUS SPIRALS :

QUESTIONING ASSUMPTIONS

SAVINGS

AND

CREDIT

?MEN MAY TAKE LOAN

WOMEN'S

DECISION ABOUT

SAVINGS AND

CREDIT USE

REPAYMENT

INCREASED WELLBEING

?DIVERSION OF LOAN

?WOMEN MAY GIVE TO MEN

?MEN MAY WITHDRAW THEIR

INCOME CONTRIBUTION

WOMEN'S

DECISIONS ABOUT

CONSUMPTION

?WOMEN'S DECISIONS MAY

REPLICATE

GENDER INEQUALITY

WOMEN'S

MICRO-

ENTERPRISE

?INCOMES MAY BE LOW

INCREASED

INCOME

SOCIAL AND POLITICAL

EMPOWERMENT

ABILITY TO

NEGOTIATE CHANGE

IN GENDER

RELATIONS

?MAY REINFORCE

EXISTING ROLES

?MAY HAVE

LITTLE

IMPACT

?MEN MAY CONTROL INCOME

INCOME UNDER

WOMEN'S

CONTROL

?WOMEN MAY USE

UNPAID FAMILY

LABOUR

IMPROVED

WELLBEING OF

WOMEN

INCREASED

STATUS AND

CHANGING ROLES

IMPROVED

WELLBEING OF

CHILDREN

|

|

WOMEN'S

NETWORKS AND

MOBILITY

|

?WOMEN MAY

NOT WORK FOR

WIDER CHANGE

|

|

|

|

|

|

ECONOMIC EMPOWERMENT

IMPROVED

WELLBEING OF

MEN

|

INCREASED

WAGE

EMPLOYMENT

FOR WOMEN

|

WIDER MOVEMENTS

FOR

SOCIAL

AND POLITICAL

CHANGE

|

Source: UNFEM PAPER, 1995

|

|

|

|

27

2.6 Theoretical links between Microfinance and Poverty

2.6.1Reduction/Analytical Framework

This section is a presentation of theoretical debates about

microfinance and poverty reduction and an illustrative analytical framework

that is relevant for understanding this study.

2.6.2 Poverty Reduction and Microfinance

The poor and poverty reduction has become the object of

unparalleled concentration now days both at national and international levels (

www.countercurrents.org).

As one of the MDGs, elimination of poverty has become a key issue for all those

interested in development of the developing countries (Nalunkuuma, 2006), with

microfinance as one of the predominant methodologies for making finance

accessible to the poor especially among the donor community. Many donor

agencies and governments in developingcountries are now funding a growing

number of microfinance organizations (Lont and Hospes 2004).

Microfinance is considered to be a solution for overcoming

poverty. Lack of savings and capital make it difficult for many poor people who

want jobs in the farm and non-farm sectors to become self employed and to

undertake productive employment-generating activities. Providing credit seems

to be away to generate self employment opportunities for the poor. But because

the poor lack physical collateral, they have almost no access to institutional

credit.

At the same time, informal lenders in many developing

countries often charge high interest rates, inhibiting poor households from

investing in productive income-increasing activities (Khandker, 1998).

According to Guerin and Palier (2005), the primary objective

of microfinance is the provision of financial aid on a small scale to those who

are on the fringes of society, too overwhelmed by the formal restrictions and

procedures of the organized sector, too vulnerable to help them and left out of

the mainstream. Microfinance provided to the vulnerable has to be synonymous

with empowerment of the beneficiary groups in order to sustain their income

flow and make them economically independent (ibid)

Microfinance institutions are therefore intended to provide

reliable and affordable financial services to the poor by providing cheap

credit with minimum requirements for example they demand for securities which

are affordable by the poor clients. These schemes also cut on the

28

bureaucratic tendencies which make it easier for the poor

people to access micro credit. It is argued these microfinance institutions

(MFIs) are in position to enhance the ability of the poor to move out of

poverty as well as to prevent those above the poverty line from sliding into

poverty (Qorini Iwan, 2005).

Montgomery and Weiss point out that the case for microfinance

as a mechanism for poverty reduction is simple. If access to credit is

improved, it is argued, the poor can finance productive activities that will

allow income growth, provided there are no other binding constraints

(Montgomery and Weiss, 2005).This is a route out of poverty for the

non-destitute chronic poor. For the transitory poor who are vulnerable to

fluctuations in income that bring them close to or below the poverty line,

microfinance provides the possibility of credit at times of need and in some

schemes the opportunity of regular savings by a household itself that can be

drawn on. The avoidance of sharp declines in family expenditures by drawing on

such credit or savings allows `consumption smoothing' (ibid).

However, there are inconclusive arguments on the impact and

the role of microfinance and micro credit programs in poverty reduction.

Proponents of microfinance consider that poor's access to credit boosts income

levels, increases employment at the household level and thereby alleviates

poverty.

Also that, credit enables poor people to overcome their

liquidity constraints and undertake some investments. Furthermore that credit

helps poor people to smooth out their consumption patterns during the lean

periods of the year(Okurut et al 2004).By so doing, credit maintains the

productive capacity of the poor households (ibid).

Zeller and Sharma (1998) cited by Okurut et al (2004) argued

that microfinance can help to establish or expand family enterprises,

potentially making the difference between grinding poverty and economically

secure life.

But Burger (1989) observed that microfinance tends to

stabilize rather than increase income, and tends to preserve rather than create

jobs. In the same view, Arbuckle et al (2001) cited by Nalunkuuma (2006)

indicates that studies carried found little to recommend that micro credit has

any significant impact on enterprise incomes. Evidence by Coleman (1999)

suggested that the village bank credit did not have any significant impact on

physical asset accumulation; production and expenditure on education. The women

ended up in a vicious cycle of debt as they used the money from the village

bank for consumption and were forced to borrow from money

29

lenders at high interest rates to repay the village bank loans

so as to qualify for more loans. However, impact for women who had access to

bigger cheaper loans from the village bank was significant. The main conclusion

of the study was that credit is not an effective tool for helping the poor to

enhance their economic condition and that the poor are poor because of other

factors (like lack of access to markets, price shocks, un equitable land

distribution) but not lack of credit. A study of 13 MFIs in seven developing

countries concluded that households' income tended to increase at a decreasing

rate, as the debtors income and asset position improved (Mosley and Hulme 1998)

cited by Okurutet al (2004).Similarly, Hulme and Mosley (1996) cited by Lont

and Hospes(2004) in a study made on Twelve lending institutions providing

micro-lending services in seven countries found that the impacts of microcredit

on the poor were on average small or negative relative to the control group.

Results by Diane and Zeller (2001) in the study done in Malawi also suggested

that microfinance did not have significant effect on household income. Fisher

and Sriram (2002) stress that access to microfinance services protects the poor

against the often severe consequences of fluctuating incomes, ill health, death

and other emergency expenditures. Despite the overwhelming claims that

microfinance credit works best for the poor people, Johnson and Rogaly (1997)

argue that poorest borrowers become worse off as a result of credit and that it

makes them vulnerable and expose them to high risks.

Using gender empowerment as an impact indicator, some studies

argue that microcredit has a negative impact on women empowerment (Goetz and

Gupta, 1994). Goetz and Gupta (1994) as cited by Kabeer (2000) using a five

point index of `managerial control» over loans as their indicator of

empowerment. At one end of their index are women who are described as having

`no control' over their loans: these are women who either had no knowledge of

how their loans were used or else had not provided any labor into the

activities funded by the loan. At the other end are those who were considered

to have exercised `full' control, having participated in all stages of the

activity funded by the loan including the marketing of the produce. The study

found that the majority of women, particularly married women exercised little

or no control over their loans by this criterion. Sebstad and Chen (1996) as

cited by Lont and Hospes (2004) in their summaries of the thirty-two research

and evaluation reports found that micro lending to women had positive impacts

on their empowerment in Asian countries. However, reports from African programs

found very little or no impacts of microcredit on the empowerment of women. In

the same studies, credit had a positive impact on households' income, but the

impacts on health, on

30

the nutrition level of family members, and on children's

attendance at schools were not conclusive.

Also the view that it is the less badly-off poor who benefit

principally from microfinance has become highly influential and for example was

repeated in the World Development Report on poverty (World Bank, 2000) cited by

Montgomery and Weiss ( 2005). Simanowitz and Alice (2002) put it clearly that,

the microfinance industry has concentrated not on reaching the poor but rather

on financial and situational performance. Meanwhile Mayoux (2001) argues that

microfinance institutions are undergoing a period of rapid innovations. They

are coming up with products and new methodologies for reaching the broader

category of poor people including the poorest of the poor. This will enable

microfinance to have a significant impact in achieving poverty reduction.

Also where group lending is used, the very poor are said to be

excluded by other members of the group, because they are seen as bad credit

risk, jeopardizing the position of the group as a whole. Similarly, it's argued

that when professional staff operates as loan officers, they may exclude the

very poor from borrowing, again on the grounds of the repayment risk

(Montgomery and Weiss, 2005). Simanowitz in regard to groups points out that

while the use of the groups has the potential to build social capital, develop

skills; the way they are used varies considerably between MFIs. Some use them

solely as means for creating peer group pressure while others use them more

deliberately as vehicles of the empowerment (Simanowitz, 2003). From the above

discussions, we realize that core issues remain how to make microfinance

accessible to the poor and ensure that the benefits are positive. For the

purpose of this study, the above theoretical debates form the bedrock to

explore into the role of microfinance in poverty reduction in Rwanda.

2.6.3 Analytical Framework

There are various factors and constraints which may explain

why people are poor: inadequate amount and/ or quality of assets; constrained

opportunities for welfare generation from assets; and qualitative factors such

as vulnerability, powerlessness and social exclusion (Gulli and Berger 1999).

The main contribution of financial services savings, credit and insurance is to

address their financial constraints and to facilitate management of money

(ibid)

FIGURE 3: LINKING MICROFINANCE WITH POVERTY

REDUCTION

31

MFI OUTREACH IMPACT DOMAINS POVERTY REDUCTION

? MFI

· Mission and objectives

· Methodology, terms and conditions ?

OUTREACH

· Scale

· Depth

· Breadth

· Geographical

· Quality

? IMPACT DOMAINS

· Income increases

· Protection against income shocks + reduced

vulnerabilities +diversified IGAs

· Health and nutrition improvement

· Children Education

· Empowerment and building social capital

? Poverty Reduction

Source: Adapted from Gulli and Berger (1999)

This analytical framework is build on the ground that if the

MFI mission and objectives are geared towards poverty reduction, then the

terms, conditions and methodology and product design have to be favorable for

the poor to access the microfinance products and services which will be