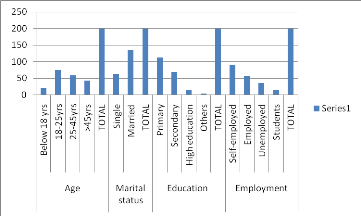

4.2. IDENTIFICATION OF PARTICIPANTS

Participants to our research were identified according to some

socio-demographics variables. These are the age, marital status, education

level, and employment status, which are synthesized in the below table. These

variables affect the use of savings and credit operations.

40

Table3. Identification of respondents

|

Category

|

Number of respondents

|

Percentage

|

|

Age

|

Below 18 yrs

|

22

|

11%

|

|

18-25yrs

|

75

|

37, 5%

|

|

25-45yrs

|

59

|

29, 5%

|

|

>45yrs

|

44

|

22%

|

|

TOTAL

|

200

|

100%

|

|

Marital status

|

Single

|

64

|

32%

|

|

Married

|

136

|

68%

|

|

TOTAL

|

200

|

100%

|

|

Education

|

Primary

|

112

|

56%

|

|

Secondary

|

69

|

34,5%

|

|

High education

|

14

|

7%

|

|

Others

|

5

|

2,5%

|

|

TOTAL

|

200

|

100%

|

|

Employment

|

Self-employed

|

91

|

45,5%

|

|

Employed

|

58

|

29%

|

|

Unemployed

|

36

|

18%

|

|

Students

|

15

|

7,5%

|

|

TOTAL

|

200

|

100%

|

Source: Primary data.

41

According to the variable age, most of respondents

are ranged between 18-25 years, representing 37, 5%. This meets the fact that

the above category represents the active population in general; while below 18

years of respondents have 11%, which means that this group have not yet begin

the income generating activities.

With regard to the marital status, the married group showed

68%, and became higher involved in savings and credit operations rather than

the single one. The explanation behind is that the single population is less

charged than the married group, in terms of people who are/are not dependents

on them. The person who has to satisfy the needs of many people has to increase

his incomes.

From the above table, results show that people with primary

level constitutes 56% of the respondents. Thus, 2.5% of respondents represents

category of others. The others group includes those who didn't finish their

primary school or never attended. We explain these findings as a result of the

microfinance's institutions deal with low income projects.

Reference made to employment status, the high number of

respondents (45.5%) is self-employed, whereas the students represent the small

group with 7,5%. These results match with the Rwandan government initiatives

which encourage people not to look at States employment, but to set up their

own business (entrepreneurship). In addition, students are few beneficiaries

because they launch their business simultaneously with their studies.

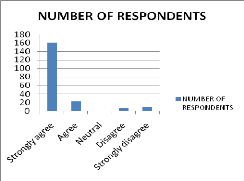

4.3. PRESENTATION OF RESULTS FROM QUESTIONNAIRES

Results from questionnaires are presented in different tables.

The questions have been formulated regarding the objectives and hypotheses of

the research. For each question, respondents had to choose their position

regarding the statement, and depending on the following

elements: strongly agree, agree, neutral, disagree and strongly

disagree.

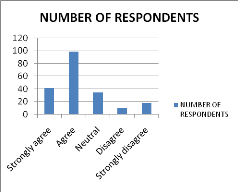

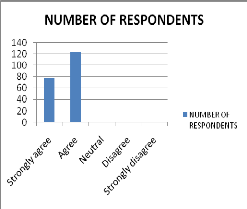

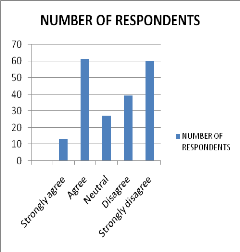

Table 4: Women use savings and credit in economic activity for

their empowerment

|

STATEMEN T

|

NUMBER OF RESPONDENT S

|

%

|

|

Strongly

|

41

|

20.50

|

|

agree

|

|

%

|

|

Agree

|

98

|

49%

|

|

Neutral

|

34

|

17%

|

|

Disagree

|

10

|

5%

|

|

Strongly

disagree

|

17

|

8.50%

|

|

Total

|

200

|

100%

|

42

Source: Primary data

From the tables above, most of respondents (49%) agreed with

the statement that women use saving and credit for economic activity, while a

small group of them (5%) were disagreed. It should also be noted that 20.5%

strongly agree with the statement. This means that 69.5% agree with the

statement at certain level. The neutral receives 17% of respondents. This may

result from low knowledge or lack of information on existence of schemes that

help women in promoting their economic activities.

Again 13.5% of the respondents do not agree with the

statement

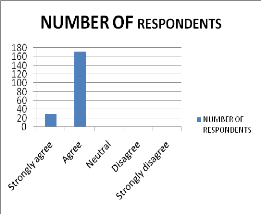

Table 5: Women who benefit credit from Duterimbere IMF are

confined in range of female low-income activities

|

STATEMEN T

|

NUMBER OF RESPONDENT S

|

%

|

|

Strongly

|

29

|

14.50

|

|

agree

|

|

%

|

|

Agree

|

171

|

85.5

|

|

Neutral

|

0

|

0%

|

|

Disagree

|

0

|

0%

|

|

Strongly disagree

|

0

|

0%

|

|

Total

|

200

|

100%

|

43

Source: Primary data

According to the table above, 14.5% of respondents strongly

agree while 85.8% only agreed that economic contribution may increase women

role in economic decision-making in the household and leading to greater

well-being for women, children as well as men. Again none of the respondents

disagree with the statement. This shows the high level of knowledge by the

respondents on the criteria as of benefiting credits.

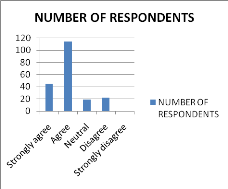

Table 6: Women economically-developed change gender role and

status within household and community

|

STATEMENT

|

NUMBER OF

RESPONDENTS

|

%

|

|

Strongly

|

45

|

22.5

|

|

agree

|

|

%

|

|

Agree

|

114

|

57%

|

|

Neutral

|

19

|

9.5%

|

|

Disagree

|

22

|

11%

|

|

Strongly disagree

|

0

|

0%

|

|

Total

|

200

|

100%

|

Source: Primary data A big number of respondents 57% confirms

that the women economically-developed change gender role and status within

household and community, 22.5%, 9.5% ,11% and 9.5% strongly agree, are neutral

and disagree respectively with the role of economic of women in household and

the communities while 0% of respondent strongly disagree with the statement.

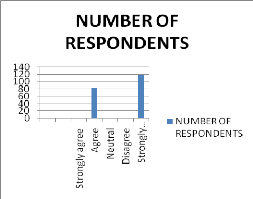

Table 7: Microcredit given by Duterimbere IMF is limited

according to the beneficiary

|

STATEMEN T

|

NUMBER OF RESPONDENT S

|

%

|

|

Strongly

|

77

|

38.50

|

|

agree

|

|

%

|

|

Agree

|

123

|

61.50

|

|

|

%

|

|

Neutral

|

0

|

0%

|

|

Disagree

|

0

|

0%

|

|

Strongly disagree

|

0

|

1.50%

|

|

Total

|

200

|

100%

|

44

Source: Primary data From the table above, 61.5% of respondents

agree that the microcredit given by Duterimbere IMF is limited according to the

beneficiary and 77 persons (38.5%) strongly agree with the same statement.

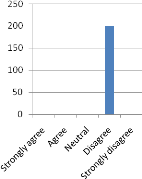

Table 8: Microcredit provided by Duterimbere IMF is enough to

women empowerin

STATEMENT

|

NUMBER OF

RESPONDENTS

|

%

|

|

Strongly agree

|

0

|

0%

|

|

Agree

|

82

|

41%

|

|

Neutral

|

0

|

0%

|

|

Disagree

|

0

|

0%

|

|

Strongly disagree

|

118

|

59%

|

|

Total

|

200

|

100%

|

Source: Primary data

According to the table above, 41% of respondents agree that:

Microcredit provided by Duterimbere MFI is enough to women empowering while 59%

of respondents strongly disagree with the statement. This means that the

majority confirmed microcredit provided by Duterimbere is not enough in case of

the women empowerment.

Table 9: Women appreciate the short-term loan from Duterimbere

MFI for their

empowerment purpose

45

|

STATEMENT

|

NUMBER OF

RESPONDENTS

|

%

|

|

Strongly agree

|

0

|

0%

|

|

Agree

|

0

|

0%

|

|

Neutral

|

0

|

0%

|

|

Disagree

|

200

|

100%

|

|

Strongly disagree

|

0

|

0%

|

|

Total

|

200

|

100%

|

Source: Primary data

According to the above table, all respondents (100%) have been

disagreed the short-term loan from Duterimbere IMF for their empowerment. It

means that time allocated to the repayment of credit is not enough according to

the capacity of the initiated business.

Table 10: Women may be economically self-sufficiency due to

microcredit without the men support

|

STATEMENT

|

NUMBER OF

RESPONDENTS

|

%

|

|

Strongly agree

|

0

|

0%

|

|

Agree

|

112

|

560%

|

|

Neutral

|

0

|

0%

|

|

Disagree

|

55

|

27.50%

|

|

Strongly disagree

|

33

|

16.50%

|

|

Total

|

200

|

100%

|

46

Source: Primary data

The above table shows that 112 respondents (56%) agreed that

most women may be economically self-sufficiency due to microcredit without the

men compared to 33 respondents (16.5%) who did not strongly agree with the

statement.

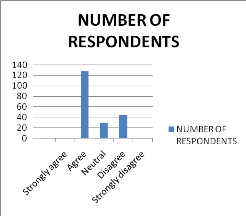

Table 11: Socio-demographics variables such as education

level, age, marital and professional status lead to success of microcredit in

women empowerment

|

STATEMEN T

|

NUMBER OF RESPONDEN TS

|

%

|

|

Strongly agree

|

13

|

6.50%

|

|

Agree

|

61

|

30.50

|

|

|

%

|

|

Neutral

|

27

|

13.50

|

|

|

%

|

|

Disagree

|

39

|

19.50

|

|

|

%

|

|

Strongly disagree

|

60

|

30%

|

|

Total

|

200

|

100%

|

47

Source: Primary Data From the above data, 6.5% strongly agree

and 30.5% agree that Socio-demographics variables such as education level, age,

marital and professional status lead to success of microcredit in women

empowerment and/or what little income they earn may substitute for former male

household contributions as men retain more of their earnings for their own use.

13.5% of respondents are neutral while 19.5% and 30% strongly disagree and

disagree with the statement respectively

Table 12: Business held by women is competitive with others

|

STATEMENT

|

NUMBER OF

RESPONDENTS

|

%

|

|

Strongly agree

|

0

|

0%

|

|

Agree

|

127

|

63.50%

|

|

Neutral

|

29

|

14.50%

|

|

Disagree

|

44

|

22%

|

|

Strongly disagree

|

0

|

0%

|

|

Total

|

200

|

100%

|

Source: Primary data

The table shows that 63.5% of respondents confirmed that Business

held by women is competitive with others and reproductive tasks, 44% disagreed

with the statement while 14.5% of respondents did not comment about the

subject.

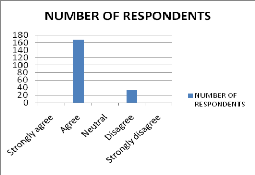

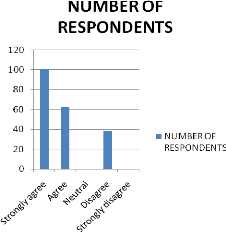

Table 13: Microcredit offered to women improves the family

standing

48

|

STATEMENT

|

NUMBER OF

RESPONDENTS

|

%

|

|

Strongly agree

|

100

|

50%

|

|

Agree

|

62

|

31%

|

|

Neutral

|

0

|

%

|

|

Disagree

|

38

|

19%

|

|

Strongly disagree

|

0

|

0%

|

|

Total

|

200

|

100%

|

Source: Primary data

From the above table, most of respondents (50%) were strongly

agreed, and 31% agreed that the microcredit offered to women improves the

family standing, whereas 38% of them disagreed with the statement.

Table 14: Women empowerment involves the family and community

development

|

STATEMENT

|

NUMBER OF

RESPONDENTS

|

%

|

|

Strongly agree

|

36

|

18%

|

|

Agree

|

164

|

82%

|

|

Neutral

|

0

|

0%

|

|

Disagree

|

0

|

0%

|

|

Strongly disagree

|

0

|

0%

|

|

Total

|

200

|

100%

|

Source: Primary data 18% 0f the women interviewed strongly agreed

to Women empowerment involves the family and community development have highest

the important in the family promotion and the number of the 82% of respondents

agreed with the statement.

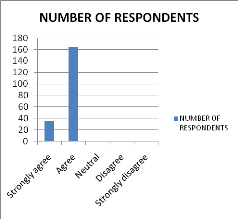

Table 15: Family economy may be based on the women empowerment

due to Savings and credit through microfinance

49

|

STATEMENT

|

NUMBER OF

RESPONDENTS

|

%

|

|

Strongly agree

|

161

|

80.50%

|

|

Agree

|

23

|

11.50%

|

|

Neutral

|

0

|

0%

|

|

Disagree

|

7

|

3.50%

|

|

Strongly disagree

|

9

|

4.50%

|

|

Total

|

200

|

100%

|

Source: Primary data

50

The study shows that 80.5% of the women respondents were

particularly proud of the financial contribution of the loan received to their

empowerment especially in their family and 11.5% of respondents agreed with the

same. However, 4.5% and 3.5% disagreed and strongly disagreed with the

statement respectively.

|