In order to understand quantitative fundamental factors, it

is necessary to understand where they can be found. Most of these factors can

be found in a company's financial statements. However, at the first look, these

can be extremely intimidating due to the extremely large amount of different

numbers and definitions on each. The three most important financial statements

of a company are the income statement, balance sheet, and statement of cash

flows. These can be found in either the investors packet along with the annual

report and can be obtained by calling investors relations, or by simply looking

up the company in a financial website such as Google Finance and looking at

these electronically. Following is a brief description of each statement and

some of its most important sections.

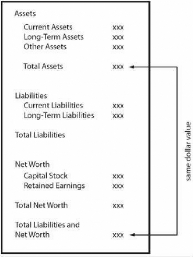

Balance Sheet

The balance sheet is a representation of assets, liabilities

and equity of a company at any given point in time. All balance sheets, at the

beginning say «As Of DATE.» This is important to understand because a

balance sheet is a snapshot of the company's financial situation at that given

point in time. It does not track changes over periods of time, but is rather a

clear picture of one point in time in the day of the company's life. The

premise of the balance sheet is that well, it balances. The businesses

financial structure balances in the following manner:

Assets = Liabilities + Stockholders Equity

Figure 1 - Balance Sheet

Source: Stock Market Investor's Pocket Calculator (113)

Assets

The resources that business owns or controls at the time

specified on the balance sheet. These can range anywhere from the stapler on

the secretary's desks, to the trucks that transport machinery, to the computers

that the IT department manages, and the building where it's based to the liquid

cash that's available in a company's bank account. They are further broken down

into categories called current assets, long term assets, and other assets.

Current assets

They are either cash, or can be easily converted to cash

within the nearest 12 months. This section of the balance sheet contains three

very important items crucial to company analysis. These include cash,

inventories, and accounts receivable.

Cash

Generally, investors are attracted to companies with a large

amount of cash on their balance sheets, believing that cash offers protection

from hard times and the ability for a company to quickly take advantage of

emerging business opportunities. And a growing cash account over several

business cycles indicates that cash accumulates so quickly that management

doesn't know where to put it. However, if a balance sheet's cash account seems

to hold an abnormally large amount of cash over several business cycles, a

question should pop up in every investor's mind as to why the money is not

being put to good use. Is the management too short sighted to do anything with

it? Has it run out of investment opportunities? These are questions that need

to be asked by every critical investor.

Inventories

Products that the company is keeping in warehouse and is ready

to sell. It is good to know if the company has too much money tied up in

inventory that it cannot move or is hard to move. If the company is not selling

what it has in stock at the warehouse, they cannot make the cash to pay bills

and make a profit. Receivables

Anything that is owed to the company. Finding out the speed

at which a company collects debts owed to it can tell a lot about how efficient

the company is financially. The collection period should not be growing longer

because that would mean that the company could be letting its customers stretch

their credit in order to increase its sales, but is not actually generating

cash. If when it's time to pay back, the customers don't have the cash to pay

because of a bad economy for example, the company could wind up in trouble.

Long term assets or non-current assets

They are capital assets minus accumulated depreciation. These

could be fixed assets such as buildings, machinery, and property. Unless the

company starts liquidating, these are not very important.

Other Assets

That includes any tangible or intangible assets such as

goodwill, prepaid assets such as insurance and

others.

Liabilities

Liabilities and Shareholders' Equity comprise the other side

of the balance sheet equation. They represent the total value of the financing

that the company has used to acquire those assets. If liabilities were used,

then the money to acquire assets came from loans and the company owes money to

banks or other lending agencies. These are also further subdivided into current

liabilities, and non-current liabilities.

Current Liabilities

Current liabilities are debts that the firm must pay off within

the nearest twelve months. These can include payments owed to suppliers and

other immediately payable expenses.

Non-Current Liabilities

Non-Current Liabilities are debts that need to be paid off in

over one year. These are usually debts to banks and bondholders.

Investors should look for a small amount of debt that is

preferably decreasing over the reporting cycles. The company should have more

assets than liabilities in order to be able to pay them all back and not go

bankrupt.

Shareholder's Equity

If the acquisition of assets financed by liabilities means

borrowing money from banks and other lending institutions, the acquisition of

assets financed by shareholder's equity means using the money gained from stock

sales to acquire them. It can be determined by the following formula,

Equity = Total Assets - Total Liabilities

Paid-In Capital

This is the amount that the shares were worth when they were

first sold. As discussed previously, the markets that the average investor

purchases from are secondary, and the prices of the stocks of those markets do

not affect a company's bottom line. Paid-In Capital discloses how much money

was made from the stock sales by the company.

Retained Earnings

They are the amount of money that the company has gained from

selling its stock that the company has used to reinvest in itself instead of

paying it back to shareholders in the form of dividends. An investor should

look how well the company puts this money to use and how it generates return on

this money.

Income Statement

The income statement is where all the juicy numbers are

located that always show up in the news. Figures like revenues, expenses,

profits and earnings per share and expressed on this statement. The main reason

for analyzing the income statement is for an investor to figure out if the

company is making money. Unlike the balance sheet, the Income Statement begins

with «For The Period Ending... Date.» This is to specify that the

income statement is a record of a certain amount of time in the company's life.

If the balance sheet is a picture, then the income statement is a short film.

The main formula that governs the income statement is:

Profits = Revenue - Expenses

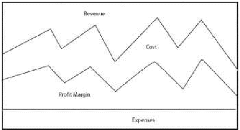

Figure 2 - Operating

Statement

Source: Stock Market Investor's Pocket Calculator (136)

Revenue

Revenue or its synonym, sales, is how much money a company

has made over a certain period of time covered by the income statement. This

number is the main driver for the profitability of a company. However, since

profit, or earnings equal revenues minus expenses, it is good for the expenses

to be going doing while the revenues are going up.

COGS - Cost Of Goods Sold

This can be the sum of several different accounts. These can

include merchandise purchased for sale or manufacture, the cost of shipping,

salaries and wages that are paid out to employees that are in positions

directly related to revenues, and changes in inventory levels from the

beginning to the end of the reporting period. It is important to understand the

difference between costs and expenses. Costs should follow revenues very

closely, as they are essentially the cost of generating those revenues. So when

revenues go up, the costs will most often go up as well.

Gross Profit

This is the number obtained when subtracting costs from

revenues. This number should also vary along with sales. A gross profit that

fluctuates wildly from one period to the next could mean a merger or

acquisition, a new product, a sale of an operating unit, or a change in an

inventory valuation method. Further research should follow such a

phenomenon.

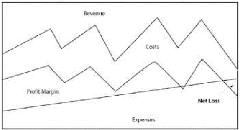

Expenses

Unlike costs, expenses do not vary alongside revenues. This

category includes all the money leaving the company that is not in direct

relation to revenue production. It is very important to note the difference

between costs and expenses. The relationship between costs, expenses, profit

margin and revenues is demonstrated Figure 3.

Figure 3 - Operating Statement with Controlled Expenses

Source: Stock Market Investor's Pocket Calculator (138)

As can be seen from the graph above, as revenue varies, the

costs vary alongside them, while expenses stay relatively unchanged. This

assumes that expenses are controlled. When revenues increase, so does profit

margin, making more money for the company that the expenses are not eating up.

However, consider the following graph with uncontrolled expenses.

Figure 4 - Operating Statement with Uncontrolled Expenses

Source: Stock Market Investor's Pocket Calculator (139)

This chart represents a company who is unable to successfully

manage its expenses, one of the usual reasons for this phenomenon being lack of

good internal controls.15 The level of expense rises over time

15 Michael C. Thomsett, Stock Market Investors Pocket

Calculator

eventually turning profit margin into loss. The profit margin

is shrinking when revenues are on the rise and when they are falling, which is

not a good thing for any company. A company with a relationship like this

between profit, revenues and expenses should be avoided at all costs by any

investor.

Expenses can also be further broken down into two categories

called selling expenses and administrative costs or overhead. Selling expenses

are related to the generation of sales but not directly, like costs. Overhead

can include rent for the office, wages of employees not directly related to

revenue generation, office supplies and electricity. These usually recur each

year.

Operating Profit.

This section discloses the profit made from operations which

will be the same or close to core earnings as defined by S&P (Discussed

Later). This number may often not be reliable, because even with GAAP it is

possible for companies to distort this number by creative accounting.

Other Income and Expenses

This is a series of additional adjustments from the non-core

section. For the income part, these can be profits from sale of capital assets,

currency exchange adjustments, or interest income. For the expense part this

could be losses from sale of capital assets, currency exchange losses and

interest expenses.

Pretax Profit

After subtracting expenses and adding income from the other

income and expenses section to operating profit, this is the number that is

determined. This is the value used to report net earnings.

Provision For Income Taxes

This is the amount set aside by companies to pay income taxes.

This value can change based on what country or state the company operates in,

its tax liability changes and other such variables.

After Tax Profit

This is the final net profit or loss, and the value used to

calculate Earnings per Share (Discussed Later). The problem with this measure,

however is that since this bottom line is subject to many nonrecurring and

non-core adjustments and other factors, the investors cannot compare two

different companies on the same level using EPS.

The income statement can provide some valuable knowledge

inside a company. Increasing sales shows a sign of good fundamentals, rising

margins can indicate increasing efficiency and expense control. It's also good

to compare the company with its industry peers and competitors to see how other

companies fare against the one you are researching.

Statement Of Cash Flows

This statement shows how much cash moves in and out of the

company over the quarter or year. This is also calculated for a specific period

like the income statement, but there is a big difference. Accrual accounting

requires companies to record revenues and expenses when the transactions occur,

not when cash is exchanged, and this type of accounting is used on the income

statement. For example, when the company shows a net income of $20 Million on

the income statement, that does not mean that he cash account on the balance

sheet will increase by $20 Million. The cash flow statement is more

straightforward, and when it shows $20 million cash inflow, the cash account on

the balance sheet is exactly what changes. It shows the

company's true cash profit. It shows the investor how the

company is able to pay for its future growth and expansion.

As a matter of fact, every investor should look for a company

that can produce cash. Just because profit shows up on the income statement

does not mean that the company won't get in trouble later because it does not

have enough cash flow.

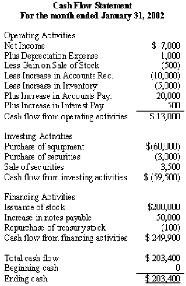

Figure 5 - Statement Of Cash Flows

Source: http://financial-education.com/

The cash flow statement is subdivided into three different

sections. The following paragraphs will discuss them in more detail.

Cash flow from Operating Activities

This section provides the investor with information on how

much cash moves in and out of the company from the sales of goods and services

and from the amount needed to make and sell those goods and

services. Net positive cash flow is

always preferred, but high growth companies, such as technology companies will

show negative cash flow in this section during their first several years. Also,

changes in this section offer a forecast of changes in net future income.

Cash Flow from Investing Activities

This section shows how much cash the company spent acquiring

capital and any other equipment necessary in order to keep the business

running. It also includes mergers and acquisitions, and monetary investments.

It's good to see a company reinvest in itself by at least the rate of

depreciation expenses yearly. If that doesn't happen, the next year it could

show artificially inflated cash flows which would be fake.

Cash Flow from Financing Activities

This section describes the moving of cash associated with

outside financing. These can be the sales of stock or bonds or bank borrowings.

Also, paying back debt to a bank or dividend payments and stock repurchases are

all reflected here.

Reliability credibility core earnings

Before further discussing how to analyze the financial

statements presented above, it is necessary to make a distinction between what

is reported on the financial statements and what the real numbers may be. When

financial statements are prepared, they must follow GAAP, or generally accepted

accounting principles which were standardized by the SEC in order to avoid

accounting scams by companies. In addition, the Sarbanes- Oxley Act passed

after the Enron scandal prevents the same accounting firm that does the

auditing of financial statements to do consulting for the company. Discussing

this further is outside the scope of this thesis, but it will suffice to say

that the numbers on the financial statements may not always tell the whole

story, and the investor, in his or her analysis must dig deep and find the true

numbers often by him or herself.

Standard and Poor's Corporation developed the concept of

«core earnings,» or earnings from a primary product or service and

excluding nonrecurring items16, and at the time it was estimated

that the corporations under the S&P 500 index had their earnings overstated

by 30% the first year the adjustment was calculated.17 Therefore, it

stands to reason that using the core net profit and core net worth as a

reliable means for calculating the formulas and ratios that will be described

below will provide a clearer picture of a company's financial situation. Things

that can be excluded from financial statements that are GAAP approved are stock

options granted to executives or employees which can be huge if cashed in.

Contingent liabilities such as lawsuits that have not been lost yet but will

most likely be also escape the financial statements. Core earnings adjustments

account for these and therefore make sure that the financial statements tell

the actual position of the company excluding any one time revenues and

including hidden expenses. This allows the investor to look at the financial

statements and compare trends of how the company is doing and how it may grow

in the

16 S&P Core Earnings FAQ

17 «2002 S&P Core Earnings,» Business Week Online,

October 2002; through June 2002, reported profits for the 500 corporations

totaled $26.74 per share versus a core net profit of only $18.48, a reduction

of 30%.

future. These data can be found in the S&P's stock reports

service, (APPENDIX) which most brokers will provide.

It also stands to reason that a big difference between core

earnings and reported earnings may serve as a big red flag, because companies

with such a large difference could be using shady accounting practices. Well

managed companies tend to have a low core earnings adjustment in most years.

However, in some cases, when a unit has been sold off or an acquisition made,

sometimes the adjustment may be large. Also, companies with low core earnings

adjustments tend to report lower than average volatility in stock price.

Looking At Ratios

A ratio or a percentage tells the investor nothing. It's just

a number. They become much more powerful in comparison with those from previous

years or compared against industry and competitors to judge a company's

strength and growth. The real key to determining value of a company is whether

the key ratios that judge its performance have been growing and if it's

outperforming the industry on average. Furthermore, because of the sheer number

of comparisons that can be made between different factors influencing the

company, it is up to the investor to judge what ratios can be used and when.

Tracking all of these ratios can be impractical and time consuming, and for the

investor who has other things to do is just plain stupid. For example, in

retail intensive industries, it's worth looking at inventory indicators while

the number rarely matters in the financial sector or the software industry.

Think of the following section as a toolkit rather than an analysis sheet for

evaluating companies, and then when planning and researching investments, use

the tools that will provide the best picture.

Return On Equity

ROE answers the question of how well did the company but its

capital to work in order to make money. Since corporations are responsible to

their shareholders, who want to gain a better return on the money they invested

in that specific company rather than investors who invested in its competitor.

Return on equity measures how well the company put the money that investors

gave it to work. The basic formula for return on equity is as follows:

The result is expressed as a number of turns. This shows how

many times the working capital has generated its value in revenues. As part of

a bigger long term trend, it shows how effectively management controls its

funds.

Where It Can Be Found: While most financial websites will not

have it, brokerages a lot of times provide a research report for a stock

compiled by Reuters which will provide this number. If not, it can be

calculated.

20 Michael C. Thomsett, Stock Market Investors Pocket

Calculator

Accounts Receivable Tests

The accounts receivable account is a current asset account

representing the balance of the money owed to the company by its customers.

Since not all customers pay their debts, there is a reserve account for bad

debts. Since in accounting, every credit must be offset by a debit, credits to

the reserve account are offset by a debit to the expense account. In other

words, increasing reserve for bad debts results in a larger expense for bad

debts. When certain accounts receivable are identified as bad debts, they are

removed from the asset and from the reserve. The net asset includes the bad

debt reserve and the asset account.

The company bases how much it wants to place into the reserve by

recent history of bad debts. The reserve is only an estimate.

Bad Debts to Accounts Receivable

This formula tests the corporate policy regarding reserve

requirements and is expressed as a percentage. This should remain fairly level

even when receivable levels grow.

B / A = R

B = Bad Debts Reserve

A = Accounts Receivable

R = Bad Debts to Accounts Receivable Ratio

Where It Can Be Found: Most stock screeners and financial

websites will not include this number and the investor will have to calculate

it himself.

Accounts Receivable Turnover

This is a way to compare receivable levels to credit-based

sales. The relationship between the two accounts should be consistent, and if

accounts receivable is increasing at a greater rate than credit sales, working

capital could be in danger.

S / A = T

S = Credit Sales

A = Accounts Receivable

T = Accounts Receivable Turnover

Where It Can Be Found: While most financial websites will not

have it, brokerages a lot of times provide a research report for a stock

compiled by Reuters which will provide this number. If not, it can be

calculated.

Average Collection Period

This is a very important test of how the company is managing

the money that is owed to it. According to many studies, the longer that the

money is owed to a company, the more chance it has of not getting paid back. In

addition, during times when revenues are expanding, companies sometimes relax

collection efforts and internal controls. If historically, the period for

collection has been 30 days and all of a sudden spikes up to 45, there is a

problem in collection procedures, and even if the company is doing good does

not mean it should relax and stop collecting the money owed to it.

R / (S / 365) = D

R = Accounts Receivable

S = Annual Credit Sales

D = Average Collection Period

Where It Can Be Found: This must be calculated

Inventory Tests

Inventory is a current asset and is the value of the goods

the company holds for sale. When looking at retail organizations or other

organizations with significant inventory levels, inventory turnover is

important to determine how fast the company is selling its products and

effective management is at controlling inventory levels so that storage and

maintenance costs are not running up.

Average Inventory

In order to determine this, average inventory needs to be

calculated. The reason for this is because companies like retail stores or

manufacturing companies may maintain different levels at different times

throughout the year due to customer demand or sales cycles. To calculate

average inventory this is the formula.