Technical Analysis

While fundamental analysis is focused on looking back at the

financial trends, the focus of fundamental analysis is looking forward and

trying to predict what will happen with the stock price. It is focused on how

the day's price, volume and trading trends will affect the price in the future.

It is important to remember that technical and fundamental analyses are not

exclusive, but are usually used in conjunction with one another by successful

traders. Neither point of view is considered «right» since any

analysis is essential an estimate, but the more information the investor has,

and the more data he or she can gather, the more confident he or she can be in

his decisions. Just like looking at only history data and ignoring price trends

is a mistake, while only looking at price without checking profitability is

similarly misguided.

Furthermore, technical trends are very important for

identifying risk levels. Even a company who has great management, growing

revenues, and growing dividends may have high volatility levels in price. After

all, the shares in the market are priced and move based on supply and demand.

Oftentimes, companies with similar fundamentals may have wildly different

volatility levels which define market risk and any investor would be stupid to

ignore those facts.

In addition, numerous technical signals could predict changes

in fundamentals. For example, a change in the volatility of the stock price can

predict earnings surprises. If a share is bought and sold 50,000 times a day,

the investor can use the combined knowledge of the traders by looking at the

charts to predict his or her own moves.

Introduction to Technical Analysis

Technical analysis is based on one thing: the stock price and

the trends in price movement. Volume is also key to considering the movement of

a stock's price. The main idea of technical analysis is to attempt estimate the

next direction the stock's price will move and to invest either in a short or

short term position. Technical analysis can also be used to estimate hold and

sell decisions as well. To do this more successfully, techniques such as chart

watching, price and volume formulas and observations of trading ranges are

employed by the investor.

Technical analysis originates from the Dow Theory that stock

prices tend to act in concert. Some very specific concepts determine how trend

analysis takes place. The first time frame technicians look at is the tertiary

movement or the daily trend of the market, not reliable for estimating long

term trends. The next is the secondary movement measured on the 20-60 period

and this movement reflects current sentiment. Finally, the primary movement can

go on from several months to several years, which is what is used to determine

if it's a bull market or a bear market.25

Current Price

This is the price the stock is currently trading at.

52 Week High / Low Price

The highest and the lowest price within the last 52 weeks, or

one year.

25 Jack D. Schwager, Getting Started in Technical

Analysis

Daily Dollar Volume

This tells the investor how much money trades in the stock on

a given day, determining how liquid the stock is, or how easily it's bought and

sold. The thing to keep in mind is that most mutual funds won't touch stocks

with low dollar volumes because it may be difficult for them to sell the stock

in the future because they trade in very large lots. The bare minimum trading

volume should be no less than $50,000 a day. Small cap investors will look for

low daily volume, less than $ 3 million so that the mutual funds are not

touching it. When the volume spikes, the mutual funds will go for the stock if

it's a good value, and the price will increase.

Chart Patterns

The whole premise of technical analysis is the study of price

and its patterns. There are several specific price patterns and concepts that

form the basis of technical analysis. In addition, the purpose of computing the

market mood and directions is not just to make good timing decisions, but also

to judge risk and volatility. Viewing price trends demonstrates the risk /

reward relationship. If the price movement is volatile, there is a greater

chance of upward movement, but also a greater chance of lower movement.

Conservative investors would rather accept lower volatility as a trade off for

smaller returns.

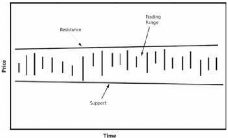

Trading Range, Resistance, Support

Volatility is defined by the trading range. Usually, the

prices of stocks establish a range of number of points in which they trade. If

the price breaks through this range, it's a significant event forecasting a new

rally or decline in the price level. Also, technicians will look at the stock's

price level approaching the upper or lower limits two or more consecutive

times, attempting to break through, and event called the breakout. If that

happens, it's usually a signal that the price will move in the opposite

direction.

Figure 7 - Trading Range, Resistance, Support

Source: Stock Market Investor's Pocket Calculator (159)

The upper trading limit is called the resistance level and is

the highest price in the current trading range. The lower level is called the

support level which is the lowest price of the stock. Once these have been

crossed, the trading range could become more volatile, until a new range has

been set. It is also necessary to point out that trading range changes may

foreshadow things like earnings surprises or meeting or not meeting earnings

expectations, causing the stock price to go up or down.

Head and Shoulders

A classic charting pattern is named head and shoulders, named

because it involves three high prices with the middle price being higher than

the first and third.

Figure 8 - Head and Shoulders Charting Pattern

Source: Stock Market Investor's Pocket Calculator (163)

It is seen as an attempt of the price to break through the

resistance, and once the price retreats without breaking through, the pattern

forecasts a price retreat. The inverse head and shoulders pattern indicates the

opposite, and forecasts a pending price rally. 26

26 Michael C. Thomsett, Stock Market Investors Pocket

Calculator

Gaps

Gaps occur when the price closes at one level one business

day, and opens above or below the trading range of the previous day (highest

and lowest price). Gaps are important because they imply major changes in

trading range and interest among buyers or loss of interest among sellers.

Figure 9 - Gaps

Source: Stock Market Investor's Pocket Calculator (165)

Four kinds of gaps exist that are worth looking at:

· Common gap is part of daily trading and implies

nothing

· Breakaway gap pushes the price into a new territory and

does not fill during further trading

· Runaway Gaps are several gaps over a few days moving the

price in the same direction.

· Exhaustion gap is usually large signaling the end of the

runaway pattern. After this gap, the price usually moves in the opposite

direction. 27

Other Patterns

There are many other patterns that are used by technical

analysts, but these represent the major ones and are the most important for

forecasting. In addition, it is out of scope of this paper to go into full

detail on technical analysis. Trading the range of the stock reveals the degree

of volatility and market risk. The trading range is the best value of risk.

Further Measuring Volatility through Formulas

To the technician, the price volatility is of central issue. A

smaller trading range implies lower volatility. Therefore, even as price levels

change, the trading range may state the same. However, if the trading range

begins to widen or narrow, it is a sign of coming change. Even though it is

possible to calculate the price

27 Jack D. Schwager, Getting Started in Technical

Analysis

volatility by subtracting the 52 week low price from the 52

week high price and dividing it by the low price, this formula is not entirely

accurate. Any investor that has looked at a stock chart measure the performance

over the course of a year knows that spikes in price of a stock are imminent.

Most often, these spikes do not represent the trading range well because they

are abnormal, and therefore, they should be adjusted for. A spike can be

defined as a price that is outside of the trading range substantially and the

price trading immediately returns to normal trading levels, and the spike is

not repeated. The formula proposed for calculating volatility is adjusted

volatility.

|

(H - L) - S = V

H = 52 Week High Price

L = 52 Week Low Price

S = Price Spikes

V = Point Based Spread Volatility

|

Beta

Beta is a measure of systematic risk of a security, as

compared to the market as a whole. A good way to understand beta is how a

return of a security moves with the market. Beta is calculated using regression

analysis and is often used in the Capital Asset Pricing Model, which is out of

the range of this paper. However, it is useful for an investor to know the Beta

of a company in order to understand how risky a security can be. A beta of 1

indicates that the price of the security moves along with the market. If the

market moves up one point, the stock moves up one point. A beta that's greater

than 1 is an indication that the security is more volatile than the market. For

example a lot of stable companies such as utilities will have a beta of less

than one, meaning that the investor can expect less volatily, but he or she

gives up a higher return. However, on the other hand, technology stocks have a

beta greater than one indicating that in order to get the possibility of a

higher return that comes with purchasing a tech stock, the investor needs to

take on additional risk.

Combined Testing

There is a large debate about whether technical analysis is

more reliable or better than fundamental analysis. But the main point is, who

cares? Smart investors will use both to their benefit and succeed in the

market. Both offer useful information to make good decisions as an investor. In

fact, each side is valuable for interpreting trends in the other side. For

example, when there is a lot of difference between reported earnings and core

earnings, stock volatility tends to increase, and when the investor analyzes

the stock from a technical standpoint, his suspicions can be affirmed.

Furthermore, it is necessary to note that technical and

fundamental analysis are compliments to each other, rather than two directly

opposing theories of valuing securities. A long term investor will focus on

fundamentals to make sure he or she is buying a good company. That's great

because in the long run fundamentals are what really determine the market price

of the stock. However, in the short term they do not work, and technical

analysis must be relied on. Therefore a speculator will use those techniques to

make his or her decisions.

Finally, what this section will talk about is factors that

combine fundamental indicators along with technical indicators, and these are

the most watched factors for any security.

P/E Ratio

The major indicator that combines fundamental and technical

information is the P/E ratio. Annual P/E and Quarterly P/E

|

P / E = R

P = Current Stock Price

E = EPS (Annual or Quarterly)

R = P/E Ratio

|

Basically, the ratio determines the multiple of earnings that

the current prices consist of. So for exam ple a P/E of 10 means that the

current price is 10 times greater than that latest EPS. It fol lows that the

P/E that is calculated and shown on most financial websites is based on

unadjusted EPS. What the investor needs to do is to adjust it based on Core

EPS. Therefore instead of calculating P/E as Price / Earnings per Share,

calculate it as Price / Core Earnings Per Share, calculated earlier.

The importance of P/E ratio is important in determining

whether the stock is currently trading at bargain levels. This is critical to

the value investor. When the stock price is driven up, the P/E follows, and the

investor could tell if the stock is overpriced or not. A good way to narrow

down the investments is by using a stock screener and eliminating all stocks

trading above a certain P/E.

Another advantage of the P/E ratio can help the investor set

entry and exit points into position based on this ratio. If the P/E falls too

low, the investor may want to sell, and if it goes very high, he or she may

want to sell at the high point. In addition, comparing P/E to Core P/E can be a

great test of volatility.

It also helps to determine the average P/E Over the past several

(usually 5) years:

Average P/E over N Number Of years

|

(P/E1+ P/E2+ P/En) / N

P = Current Stock Price

E = EPS (Annual or Quarterly)

R = P/E Ratio

|

Comparing this with the current P/E can help to determine if the

stock is overpriced or under priced more than usual.

Problems with P/E

While the P/E is widely used, it is potentially unreliable

when the earnings figures used are quarterly, and that is what one would expect

to find on the financial websites. For example, in the retail industry the

report that comes out December 31 has the highest earnings, because of the

holiday season. If the P/E calculation takes place using those numbers, it

could be very unreliable. However, even when tracking annual P/E reliability

problems come up because the annual P/E could easily become outdated several

months after the annual report.

Overcoming P/E Problems

They key is to measure annual P/E and track its historical

trend, as well as measure quarterly P/E and track its trend as well. Also,

evaluate year-end P/E and price range next to current quarter data. If the

investor discovers that the current P/E is out of range with the year-end

historical P/E, it could be that information is

flawed and a lot has changed since the earnings that the

investor is using. Also, it is necessary to confirm P/E changes by comparing

other ratios such as price to revenue, book value per share, and cash. This is

valuable in improving the reliability of information and determining if the

current price is typical or not by looking at trends.

PEG Ratio

The PEG ratio is popularized by Peter Lynch, but is more of a

rule of thumb than a mathematical ratio. According to Lynch, a P/E of a company

that's fairly priced will equal its growth rate. This usually works better for

growth stocks than it does for value stocks. PEG ratio is calculated as

PE/Projected Earnings Growth Rate over the next 5 years.

Price to Sales or Revenue

Price to Sales is calculated as fol lows

|

P / S = R

P = Current Stock Price

S = Sales Per Share

R = Price To Revenue Ratio

|

The price to sales ratio can also get the investor more

information if for some reason he or she is unable to determine core earnings

of the company. Because this compares sales, which usually tend to be the core

sources of revenue for the company, they may provide a clearer picture. It is

also useful to compare it in situations where earnings are flat as a percentage

of revenue, but grow each year. In this case the P/E may not be very revealing,

but the Price to Sales ratio may provide a better view.

|