2.2.4 Money supply

In such context, monetary expansion exceeded markedly the

level initially anticipated, the financial year under review having been marked

by an over expansion of money supply estimated at 16.1% against real GDP growth

of 3.4%.

Owing to the very high domestic financing of budget deficit,

the growth of money supply exceeded the target of 9.2% anticipated in the

monetary program for the year.

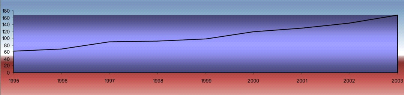

Figure 3: Development of

money supply (in billions of RWF)

Source: NBR, Research department

During the year, money supply recorded a saw tooth development

during the first half of the year, and a strong and continuous growth during

the second half. By end of May 2003, money supply stood at RWF 150.5 billion,

an increase of 4.5% compared to the situation at the end of December 2002. The

development observed during the first half of the year was in keeping with the

growth of 9.2% targeted for the whole year.

During the second half of the year, however, money supply

recorded a fast and sustained evolution.

This development was a result mainly of the Government

resorting to increased financing by the banking sector due to increased

expenditure necessitated by the political timetable and irregular external

financing ( NBR, Annual report,2003, p.47).

2.2.5 Exchange rate

Concerning the exchange rate policy for 2010, the priority of

the National Bank of Rwanda remains to maintain a stable and predictable

exchange rate of the RWF, and ensure that it remains fundamentally market

driven.

BNR will continue to intervene on the market by

selling and buying foreign exchange to banks to smoothen the RWF

exchange rate volatility depending on the market demand and the volume of

official foreign exchange reserves available.

Thus, in case there is an unexpected balance of payments

pressures, it will require policy flexibility to maintain macro-economic

stability and adjust to shocks.

More specifically, flexible exchange rate policy and

proactive monetary policy will be reinforced, in order to avoid possible

strong external shocks from higher imports or declining foreign exchange

inflows which could lead to excessive reserve losses.

However, as previously, the BNR's interventions on foreign

exchange market should be in line with its monetary policy objective of low

inflation. Indeed, the Central bank sales and purchases to or from commercial

banks will be maintained among important tools to be used in 2010 to regulate

the banking system liquidity.

Regarding the Forex market infrastructure development, the BNR

will continue the process of modernization of operations, by introducing a

communication platform such as Reuters and other market technologies to enhance

the market-determined Foreign exchange system (NBR, Monetary policy and

financial stability statement, February 2010, p.30).

2.2.6 Interest rate

With the consolidation of comfortable short term liquidity in

the banking system since the second half of 2009, money market interest rates

have been recording a declining trend. The average Repo rates fell from 7.3% in

January to 4.4% in December 2009. Regarding the commercial banks rates,

banks become aggressive in deposits collection and increased

deposit interest rates, between January and December

2009, from a monthly weighted average of 5.5% to 8.54%, after reaching a

high level of 9.94% in July. Lending rates have been also increasing since

January 2009 to reach 17.4% on average, before declining to 15.77% in December

2009.

This upward trend in lending rates in 2009 is linked to the

uncertainties in credit markets, on both demand and supply sides, as the

nonperforming portfolio has increased. As inflation rate in Rwanda has been

significantly declining in 2009, banks real lending and deposit rates remained

positives (NBR, Annual report 2009, p.48.)

|