2.12 Assets Influencing Investment Decision-Making

In spite of the in-depth idea of risk and return, risk

management, financial regulations and value creation towards investment

decision-making discussed above, some prominent economists still suggest that

they are some assets within the financial markets that help in influencing

investment decisions-making processes. Some of these include:

2.12.1 Collateralized Debt Obligations (CDOs)

CDOs are investment grade securities which are backed by

bonds, loans as well as other assets. Note that CDOs do not specialise in just

one debt type rather they are more of non-mortgage loans or bonds. With CDOs,

the different debt types are often referred to as `tranches' with each tranche

having different maturities and risks associated with it. Bear in mind that the

higher the risk the higher the CDO to be paid. These CDOs are very unique in

that they represent different types of credit risks and debts. No doubt, they

are being looked at as structured finance vehicles aimed at issuing multiple

classes of liabilities as well as rating debt tranches having different credit

risk/return profiles.

With CDOs, the securities are divided into different classes of

risk because the interest and

the principal payments are being made with

reference to the risk class with the most senior

classes being looked upon as the safest securities. Some

investors warned that CDOs are assumed to be spreading risks through

diversification rather than reducing risks of the underlying assets. As a

result of this, one of the reasons for the outbreak of the present financial

crisis was the failure of the credit rating agencies in adequately accounting

for large risks when they were rating these CDOs.

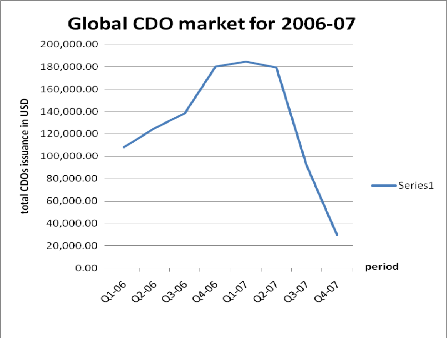

According to Moody's Investors Service, the growth of the CDO

markets never accelerated until in the early 2000s when these CDOs were

introduced. They got to their peak in the first half of 2007 although it was so

short-lived because statistics show that from the first half of 2007 to the

second half of the same year, the CDO issuance is assumed to have dropped by

50% . This drastical drop was considered to have resulted from liquidity

problems especially as investors disappeared leaving residential

mortgage-backed securities to deteriorate (Steven, 2008). Below is a table

summarising the global CDO market issuance data for the period of 2006-2007.

Table 2: Global CDO Market for 2006-2007

|

Period

|

Total Issuance in millions of USD

|

|

2006-Q1

|

108,012.7

|

|

2006-Q2

|

124,977.9

|

|

2006-Q3

|

138,628.7

|

|

20006-Q4

|

180,090.3

|

|

2007-Q1

|

184,757.4

|

|

2007-Q2

|

179,493.0

|

|

2007-Q3

|

91,529.2

|

|

2007-Q4

|

29,946.7

|

Figure 6: Global CDO Market for 2006-2007

Source: Thomson Financial

Looking at both the table and the graph, it can be observed

that the global CDO issuance was increasing steadily between Q1-06 and Q1-07.

It got to its peak during the first quarter of 2007 but this was so short lived

because by the fourth quarter of the same 2007, the global market has dropped

drastically. Because of what was experienced in the first quarter of 2007,

academicians as well as economists have regarded CDO as one of the most

important new financial innovations of the past decade no doubt it has

registered an increasing number of appeal from many asset managers and

investors. This is so because, the CDOs enabled the originators of the

underlying assets pass on credit risks to other investors and institutions,

thereby making it possible for investors to be forced to understand the

in-depth of how the risk for CDOs is being calculated. As if that is not

enough, when the CDOs is being issued,

the issuer (typically an investment bank), earns a commission

done at the time of the issue as well as a management fee during the life of

the CDO.

Note that for any CDO transaction to be effected some

participants need to be present. These include investors, underwriters

(structurers and arrangers of CDOs- assigning different interest rates to

different securities with more risky classes of securities bearing higher

interest rates so that investors can be attracted to those securities),(Chromow

and Little, 2005), asset managers, trustee and collateral administrators as

well as accountants and attorneys with each having different functions and

interests. Banks were allowed to participate only at the beginning of 1999

following the Gramm-Leach-Bliley Act (also known as the Financial Services

Modernization Act). This is because this Act helped in opening up markets

within the banking industry, securities companies as well as insurance

companies.

According to Steven, 2008, balancing risk perception,

monitoring the performance of underlying assets, getting investors to return to

the market and finding liquidity again are some of the things that need to be

restructured in the CDO for it to survive. The growth of the CDO was as a

result of investors' demand although the issuing of these CDOs were reduced in

2008 because investors had disappeared and liquidity problems began thereby

portraying CDOs as greater risks indicators.

CDOs offer returns that are sometimes 2-3 percentage points

higher than corporate bonds with the same credit rating. Because of this

discrepancy, CDOs have been criticized and looked up to as some sort of complex

instruments which are difficult to value. No doubt some economists refer to

CDOs as financial weapons of mass destruction thereby blaming them for making

the 2007-2009 credit crises more severe than it should have been and led to the

subsequent failure of some big financial institutions such as Lehman

Brothers.

There exists so many different types of CDOs of which some

include: CLOs (collateralized loan obligations)- these are mostly CDOs that are

backed up primarily by leveraged bank loans; SFCDOs (structure finance

CDOs)-CDOs backed by structured products; CBOs (collateralized bond

obligations)-CDOs backed by fixed income securities; CSOs (collateralized

synthetic obligations)-implying CDOs backed by credit derivatives, etc as well

as there are some CDOs backed by commercial real estate assets, corporate

bonds, insurance, etc. With all these different types of CDOs, bear in mind

that as of the year 2007, 47% of these CDOs were backed by structured products,

45% were backed by loans and just less than 10% were backed by fixed income

securities.

CDOs are known to vary in structure as well as the underlying

assets although the basic principle is the same. It is evident that the growth

of the CDOs plus the increasing appetite of the CDOs managers for more debt

securities are having an important impact in the real estate debt markets

(Chromow and Little, 2005). Apportioning different credit rating levels to the

different tranches of CDOs makes things easier to be understood since it will

be easier for institutional investors to make their investment decisions. This

is in the sense that with credit rating agencies rating an asset with AAA

signifies the asset is very safe. Therefore, with investors bearing this in

mind, they will be able to sell the most risky assets to those they know can

withstand high risks while the safest (AAA-rated) assets would be held by the

more risk-averse investors.

This credit rating is done so as to get the exact size of

classes and this is done with the help of credit rating agencies such as

Standard and Poor's and Moody's. These agencies rate the highest/safest class

with AAA although this class has the lowest interest, followed by the AA

assets. Note that the lowest priority classes are either not rated at all or

referred to as the junk class (Chromow and Little, 2005). Because of this

increased demand for AAA assets, the lower quality securities that were issued

against the initial package of mortgages needed to be

repackage with similar securities from other packages thereby

resulting in the creation of new AAA securities referred to as portions of the

CDOs since investors used to rely heavily on these securities while the credit

rating agencies do their valuations.

Contrary to the above, this process does not work well all the

time. Investors have learnt to believe that assets with a triple `A' are always

the safest. Unfortunately, this was not the case all the time. These credit

rating agencies did rate some toxic assets with AAA, which was therefore

misleading. Hence one of the causes of the global financial crises was as a

result of this mistake done by these credit rating agencies. This is because

investors hurried up to these assets thinking they were safe not knowing that

they were toxic assets whose financial values have significantly fallen.

|