2.12.2.2 CDS Netting

As far as any CDS contract is involved, the protection buyer

as well as the protection seller of credit protection takes on counterparty

risk in which it is spelt out that the protection buyer needs to take the risk

which the protection seller will default in future. There exists this `double

default' that only pops up when the triple A bank and the risky corporation

default at

the same time thereby resulting in the protection buyer losing

his protection against default by the supposed reference entity. At the same

time, if either the triple `A' bank defaults but the risky corporation does

not, then the protection buyer might need to replace the defaulted CDS but

doing so at a very high cost.

Contrary to the above, the protection seller sometimes take

the risk assuming the protection buyer will default on the contract thereby

depriving the protection seller of any expected revenue stream. The protection

seller and protection buyer both have different ways of handling the risks. The

protection seller limits his risks by buying protection from another party

hence hedging its exposure. If the original protection buyer drops out as a

result of this, the protection seller doubles his position by either unwinding

the hedge transaction or by selling a new CDS to a third party. Pending on

market conditions the price at the time may be lower than that of the original

CDS thereby implying a loss to the protection seller and vice-versa.

For instance let's consider an investor buying a CDS from a

triple `A' rated bank having a risky corporation as the reference entity. In

this case, the protection buyer of the protection is the investor who will make

regular payments to the triple `A' rated bank-the protection seller of the

protection. Note that should the risky corporation default on its debt, the

investor will eventually receive a one-time payment from the triple `A' bank

terminating the CDS contract.

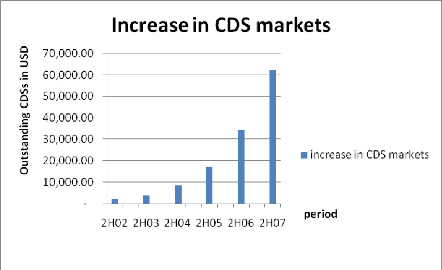

The first ever existed CDS was in the early 1990s although the

market only increased at the beginning of 2003 up to the end of 2007 and fell

by the end of 2008. The increase of these CDSs during this period is because

the CDSs help in completing markets to investors since they provide effective

means to hedge and trade credit risk. This is achieved by the CDSs allowing

credit risk to be hedged separately from interest rates. Also, CDSs allow

financial institutions to manage their exposures better thereby making it

possible for investors to

benefit from enhanced investment. In addition to this, CDSs

spreads provide a valuable market-based assessment of credit conditions. The

strong growth of this CDS market is because of financial institutions' desire

of better managing credit risk and of traders gaining exposure to the credit

markets. All in all, the main reason behind the growth of the CDS markets

during this period was because most banks used the CDS spreads as a measure of

their credit risk as well as their risks management tool (buying credit

protection through CDS). CDSs were used as trading tools as well as a means of

allocating risks efficiently.

The major reason for the fall of the CDS markets by the end of

2008 was as a result of the collapse of Lehman Brothers. As if this is not

enough, it is argued that the enhanced transparency in CDS would instead result

in lowering the risks of excessive market reactions. A case in point is the

collapse of Lehman Brothers which provided a vivid example on how insufficient

transparency may result to market reactions overshooting.

Table 3: The ISDA Market Survey for CDSs

Notional amounts (in billions of US dollars), semiannual data,

all surveyed contracts, 2002- 2009

|

Period

|

CDS Outstanding (billions of USD )

|

|

2H02

|

2,191.57

|

|

2H03

|

3,777.40

|

|

2H04

|

8,422.28

|

|

2H05

|

17,096.14

|

|

2H06

|

34,422.80

|

|

2H07

|

62,173.20

|

Figure 8: Increase in CDS Markets

Source: ISDA Market Survey

The graph above illustrates an increment in the CDS markets.

The increase was as a result of how investors used these CDSs for many reasons

such as hedging and trading risks as well as in managing their exposures.

Most of the time, credit events are referred to as defaults

and they include events such as failure to pay, restructuring and bankruptcy.

In situations where the reference entity defaults, the triple `A' bank pays the

investor the difference between the par value and the market price of the

specified debt obligation. This is mostly referred to as cash settlement.

The major difference existing between insurance and CDS is

that insurance contracts provide indemnity against losses suffered by policy

holders while the CDS contracts provide equal payout to all holders, using the

agreed, market-wide method of calculation. As if that is not enough, with

insurance contracts, all the risks involved needed to be disclosed whereas

with

CDSs they are no such requirement. The CDSs protection sellers

are not required to maintain any capital reserves to serve as guarantee payment

of claims unlike the insurance companies where it is a necessity.

Defaults are usually referred to as credit events since they

entail events such as failure to pay, restructuring and bankruptcy. Statistics

show that most CDSs range between $10 to $20 million with maturities varying

between 1 and 10years. Most of the time, the bond holders buy protection so as

to hedge their risks of default thereby making CDS to be similar to credit

insurance though different from some other governing regulations.

|