3.3 Research Approach

Reading from Saunders et al, 2007, it is evident that the

general research approach adopted just for study purposes is based mainly on

the philosophical stance which is adopted for the research with the

deductive approach normally based on positivism and the

inductive approach on interpretivism. Contrary to the

deductive approach which focuses on the formulation of the hypotheses

and the use of statistical methods in the data analysis process, the

inductive approach helps in establishing links between the research

objectives as well as assisting in the production of reliable and valid

findings. Note that the deductive approach will be used in presenting

the findings and conclusions.

3.4 Choice of Method

According to Trow, 1957, the application of the philosophical

assumptions of positivism and interpretivism to this study is

an indication that this study took a pluralist methodological stance. This is

so because this study focuses on understanding, interpreting, describing and

explaining how financial regulations, risk management and value creation

influence investment decision-making combine with some socio-psychological

factors.

For the purpose of this study, we will be using the

secondary and tertiary methods of data collection. Reading

from Saunders et al, 2003, secondary data is a form of data that has

been collected for use for other purpose(s) but can still be used in answering

the designed research questions. In other words, these are can be referred to

as ready-made materials. These are often used in providing foundations for

present day studies by helping in the investigation and provision of some

already existing theories in classical and behavioural finance that relate to

the study. While secondary data is mostly gotten from textbooks,

newspapers, journals and magazines, tertiary data is gotten from the

internet and encyclopaedias.

CHAPTER FOUR

ANALYSIS AND DISCUSSION OF FINDINGS

4.1 Purpose of the Chapter

This chapter will focus on the presentation of the results

obtained from the findings. These results will be analysed by bringing out the

difference between the classical and behavioural schools of finance as well as

testing the hypotheses. Also, within the content of this section, we will be

explaining how the concept of behavioural finance best explains and contributes

to the outbreak of the present global crisis. Note that the analysis and

results are dependent upon the findings of this study. In this chapter, the

results of the findings will be described and presented.

4.2 Description of Findings-Classical Finance Vs

Behavioural Finance

Statistics has proven that risk plays a very important role in

investment no doubt it is considered to be a very important topic in

investment. This is because an understanding of risk and how it is measured is

cardinal to the development of investment strategies and the subsequent making

of investment decisions. As pointed out by Blume (1971), risk constitutes a

controversy amongst different financial theories which can all be classified

under the classical and behavioural schools of finance. Based on these

differences, this section of the study will be responsible for the on going

debate on the existing views of the risk concept.

Levy and Sarnat (1972) stress on the fact that some already

existing classical financial theories such as the CAPM, MPT and EMH are all

moving towards the direction of risk being a uni-dimensional concept since its

measurement is so purely objective. Based on this, they try in providing very

basic description of the classical finance school of thought's approach towards

risk as follows:

«Subsequently, various economists have tried to

evaluate investments with the aid of two (or more) indicators based on the

distribution of returns. Generally one index reflects the profitability of the

investment while the other is based on the dispersion of the distribution of

returns and reflects the investment?s risk. The most common profitability index

used is the expected return that is the mean of the probability distribution of

returns; the risk index is usually based on the variance of the distribution,

its range and so on». (p.303)

Following what Levy and Sarnat mentioned above, it is evident

that risk has to do with; the standard deviation where by the volatility of the

return can be measured with the beta coefficient responsible for comparing the

volatility of the different security and portfolio within the market with that

of the market as a whole. Risk is most often than not evaluated following the

different variations of returns of an investment with reference to its expected

return, hence confirming the fact that risk is a double sided coin. The main

reason behind risk centres on the fact that risky investments stand better

chances of higher expected returns unlike a risk-free investment. This is

because it is assumed that during decision-making, investors try to make

decisions with possible outcome being associated with specific expected

return.

As such, there are two categories of risks as far as the

classical financial theories are concern-systematic risk also known as

non-diversifiable risk, is the risk type that can not be eliminated hence it is

associated with the entire market. On the other hand, we have the

unsystematic risk which is entirely associated with particular

companies, thereby making this risk type unique and diversifiable (Bodie et al,

2008).

Within the content of the classical financial investment

decision theories, it is assumed that individual investors behave in a rational

manner and make optimal decisions when confronted with judgements regarding

risk and uncertainty.

In addition to the above, this research equally revealed the

fact the behavioural finance scholars just as the name `behavioural' try to

provide an absolute understanding of the behaviour of investors in general. As

a result, they look into the general idea on risk and investment from all

fields of life no doubt it is mostly referred to as an interdisciplinary field

which developed from all subjects in life be it sociology, psychology, finance

as well as behavioural economics hence greatly influencing some investment

decisions.

This boils down to the fact that behavioural finance, unlike

classical finance, takes a completely radical view when it comes to the subject

of decision-making. As if that is not enough, behavioural finance researchers

claim that investors do not need to always seek the highest return for a given

level of risk at any given point in time as assumed by MPT.

In the course of our study, it was realised that unlike the

classical financial school of thought, the behavioural financial school of

thought views the decision-making process to be a rationality bounded process.

This is fully supported by Bajeux-Besnainou and Ogunc, 2003 when they stated

that:

«Satisficing? is an optimization methodology that

involves emotions, adaptive learning and cognitive biases. Simon calls for

individuals to satisfice?, that is, to optimize until it is close

enough in the traditional sense of optimization. By contrast, the traditional

way of optimizing is a maximization of a utility function subject to budget

constraints, as in the classic economics framework». (p.119)

Contrary to the views of classical finance, with behavioural

finance, it is assumed that an important aspect in investment decision-making

process is subjective to aspects perceived by risk investors. No doubt they

look at risk to be multidimensional unlike it being unidimensional therefore

implying a blend of accounting and financial variables. Looking at risk at a

greater in-depth, it has revealed that individual attitudes towards risk are

far from being

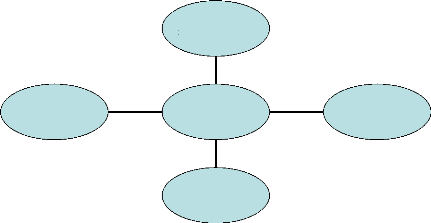

Other Factors:

Investment

Decision-Making

Financial Regulations

Risk Management

Value Creation

logical. This is so because in real day to day decision-making

situation, people are faced with the need to address risk in situations that

they have never come across and which they might never encounter thereafter,

thus the reliance on statistical techniques is sometimes largely irrelevant and

can hardly have any impact on their decisions. As a result, behavioural finance

stands a better chance of providing very convincing explanations for the causes

of the global financial crisis.

All in all, through out our study, we realised that everything

on the investment decision-making process centred on these two schools of

finance. Both schools stressed on the fact that some aspect of risk needs to be

taken in order to expect any form of return, therefore investors need to take

on to the risk in order to create an expected return.

|