4.4 Conclusion

This study to a large extent, succeeded in establishing a

relationship between financial regulations, risk management and value creation

bearing in mind that these are not the only factors influencing the investment

decision-making process. It was revealed in this study that financial

regulations, risks management and value creation are the most influential

factors influencing investors in the investment decision-making process

although there are some other socio-psychological factors alongside. This study

also revealed that the behavioural school of finance is in support of the

observation that if the `music is playing you have to get up and dance'. Note

that the risks involved and the expected return need to be clearly established

first before any investment decision can be made. Therefore, it is the starting

point in the investment decision making process.

CHAPTER FIVE

CONCLUSIONS AND RECOMMENDATIONS

5.1 Introduction

In this chapter, the findings and analysis in the other

chapters together with the review of the existing literature brought out in

chapter two will be use for conclusions and in establishing whether or not

there exist a relationship between financial regulations, risk management and

value creation within financial institutions. This chapter should also be able

to tell whether the research questions were answered as well as confirming

whether the objectives of this study were achieved. In this section of the

study, some recommendations will also be made which can be helpful for future

research.

5.2 Overall Assessment of the Aims and Objectives

Attainment.

This study was aimed at understanding how financial

regulations, risk management and value creation together with other factors

influence the investment decision-making process of financial institutions.

This section of the study will examine the aims and objectives of the study as

well as proving whether or not these aims and objectives were attained. This

goes alongside making sure that the research questions asked at the beginning

of this study have been answered. If these questions have been answered, then

it justifies that the aims and objectives of this study have been attained.

In chapter two of this study, the meanings of financial

regulations, risk management and value creation were explained. Also the

reasons for financial regulations, risk management and value creation were

brought out. In addition to that, the methods of financial regulations, risk

management and value creation were brought to light. Still within the contents

of chapter two, the different types of risks affecting the performance of

financial institutions and how these

institutions manage these risks were explained. By

implication, it is obvious that the finding was able to provide answers to all

the research questions raised at the beginning of this study as well as meeting

the aims and objectives of this study.

5.3 Conclusion

The global crisis has proven that systemic threats posed by

irresponsible practices within the financial services industry can cause the

collapse of the international financial system. Owing to the behavioural

factors discussed above, any proposed reforms may prove insufficient to prevent

excess risk-taking. Owing to the above, this study suggests the creation of a

new global regulatory consensus with respect to redrawing the current model of

the national as well as international financial regulations. Under the

suggested model, the high risk/ high return activities will be monitored and

banking institutions involved in higher risks activities would be obliged to

buy excessive liquidity insurance as well as having limited access to cheap

funding basis. Arguably, the combined outcome of any suggested measures would

result to a safer banking industry and better customer services.

The consequences of the financial crisis on the global economy

and the fragility of the global financial system have proved beyond doubts that

doing much of the same is a gamble which western governments will not

like to participate. Therefore this is the right time to advance regulatory

reforms seeking to replace the `failed' model of the financial regulations with

a new one that will be able to liberate the creative forces of the market as

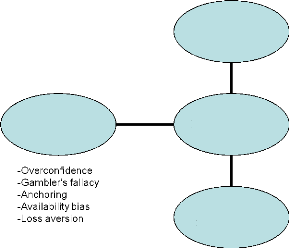

well as containing the social costs. The following diagram provides a summary

of this study.

Figure 10: Summary

Other Factors:

Financial Regulations

Investment

Decision-Making

Risk Management

Value Creation

All in all, financial regulations are cushions struggling to

limit investment decisions which do not comply with the law. Value creation is

the primary objective of any business entity and is geared towards adding an

additional value to the already existing bottom line. With all these in place,

the risk management team trying to comply with the government and its financial

regulations as well as creating value within its institution implies that there

exist a relationship between financial regulations, risk management and value

creation. The question being asked by this risk management team is whether it

is actually worth taking such risks.

The diagram above tells us that the investment decision-making

process within financial institutions is made possible with the combination of

financial regulations, risk management, value creation and other factors

(behavioural factors). Note that, any thing done within any business be it in a

financial sector or elsewhere is directed towards investment decision-making as

shown in the diagram above.

|