2.8.1 Financial Regulations Methods and

Implementations

Basel II financial regulation method is the most commonly used

type of financial regulations. Basel II is the second of the Basel Accords

which are a set of recommendations on banking and regulators issued by the

Basel Committee on Banking Supervision. The purpose of Basel II is to

create an international standard that banking regulators can use when creating

regulations on how much capital banks need to put aside to guard against the

different types of financial and operational risks. Supporters of Basel II

believe that such an international standard can help to protect the

international financial system from the types of problems that might arise if a

major bank or series of banks should collapse. Bear in mind that this Basel II

accord made sure the issues of risk measurement as well as risk management

within financial institutions were tackled.

One of the most difficult aspects of implementing an

international agreement such as Basel II

is the need to accommodate

different cultures, different structural models and the already

existing

regulations. Bear in mind that regulators can't leave capital decisions totally

to the

banks because if they do so they will not be doing their jobs

and the public's interest will not be served as well. The Basel II framework is

intended to promote a more forward-looking approach to capital supervision,

that is, one that encourages banks to identify the risks they may face today

and in the future and to develop their abilities in managing those risks. As

such, Basel II is intended to be more flexible and better able to evolve with

advances in markets and risk management practices.

Following Moody's statistics, it was evident that the CDO

market in the Europe, Middle East and Africa (EMEA) grew up to 78% in 2006.

This growth was driven by banks in a bid in adjusting to the Basel II

regulation. This Basel II regulation forced many banks in 2006 to reexamine

their risk exposure so as to limit the amount of capital they will be holding

against investments, Crompton, 2007. Crompton looked at securitization and CDOs

as means of banks moving some of the risks of their balance sheets into

investors hands. All of these centre on Basel II because it has focused its

attention on economic capital as well as driving the project market into

securitization. This is because securitization is assumed to offer easier

access to mortgage assets for investors thereby making things difficult for

direct holders of home mortgage loans to procure because of the uncertainty

existing in the credit quality of the loans and the problems associated with

servicing them.

2.8.1.1 The Growth of CDOs

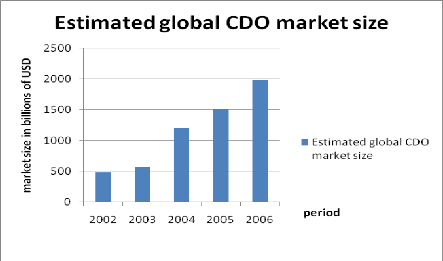

Table 1: Estimated Size of the Global CDO Market by the

end of 2006.

|

Period

|

Estimated amount in billions of USD

|

|

2002

|

480.0

|

|

2003

|

570.0

|

|

2004

|

1200.0

|

|

2005

|

1510.0

|

|

2006

|

1980.0

|

Figure 5: Estimated Global CDO Market Size

Source: Thomson Financial

From the graph above, it is clear that between 2002 and 2006,

the CDO market size experienced a steady growth increase. The issuance of the

CDOs market experienced a significant increase of about 78% in the year 2006.

During this period, most of the CDOs tranches obtained the highest level of

credit rating which is the triple A (AAA) rating considered to be the safest by

the credit rating agencies. The growth in the CDOs market is as a result of

innovation such as the creation and implementation of the Basel II regulation.

Thanks to this innovation, the CDO market became one of the most profitable

markets for investment banking. The CDO market is now moving towards the

direction of on demand credit risk whereby an investor can specify a product's

risk/return ratio and the bank merely originates and then distorts this

risk/return ratio of the portfolio and delivers a new product to its client.

The above mentioned points greatly contributed to the growth of the CDO markets

between the years 2002 and 2006 and thereby creating some value to its

investors, customers as well as the shareholders hence influencing the

investment decision-making process.

|