Table of content

Abstract i

Acknowledgement ii

Table of Content iii

List of figures v

List of tables viii

Glossary ix

Chapter 1 Introduction to thesis page 1

1.1 Background 1

1.2 Research questions 3

1.3 Objectives 4

1.4 Methodology 4

1.5 Structure of thesis 7

1.6 Data sources 7

1.7 Key assumption 7

1.8 Choice of performance measures 8

1.9 Summary 9

Chapter 2 ASECNA's region Air Transport Industry

10

2.1 Economic characteristics 11

2.2 Transport infrastructure 13

2.2.1 Roads 13

2.2.2 Railways 13

2.2.3 Ports 14

2.3 Air Transport Industry 14

2.3.1 Airport Infrastructure 15

2.3.2 Airlines 16

2.3.3 Fleet 17

2.4 Regulatory 25

2.5 Air Travel Demand 26

2.6 Conclusion 32

Chapter 3 Air navigation Performance Review

34

3.1 Introduction 34

3.2 Airspace organization 34

3.2.1 Description of ASECNA's strategy 34

3.2.2 Fragmentation 36

3.3 Traffic 38

3.3.1 Airport activity 38

3.3.2 En-route traffic 40

3.4 Delays 44

3.5 Impact of future trends 44

3.5.1 Prospects 44

3.5.2 Impact on runway capacity 45

3.5.3 Impact on en-route capacity 46

3.6 Traffic complexity 47

3.7 Safety 48

3.7.1 Air Proximities 48

3.7.2 Users' claims 49

3.7.3 Birdstrikes 49

3.7.4 Safety Review System 50

3.8 Efficiency 50

3.8.1 Flight efficiency 50

3.8.2 Fuel efficiency 51

3.9 Cost effectiveness 54

3.9.1 Navigation charges 54

3.9.2 Air Navigation Costs 55

3.10 Cooperation 57

3.11 Training 59

3.12 Financing 59

3.13 CNS and Aviation weather management issues

60

3.13.1 Shortcomings of conventional systems 60

3.13.2 ASECNA's systems' performance 64

3.15 Conclusion 69

Chapter 4 CNS/ATM systems and concepts 70

4.1 Introduction 70

4.2 Suitable CNS/ATM systems for ASECNA 72

4.2.1 Geographic characteristics 72

4.2.2 Efficiency 72

4.2.3 Capacity for Safety 73

4.2.4 Surveillance 73

4.3 Study of selected systems 73

4.3.1 Communications 73

4.3.2 Navigation 83

4.3.3 Surveillance 92

4.3.4 Air Traffic Management 97

4.4 Transition phase 98

4.6 Affordability 99

4.7 Conclusion 100

Chapter 5 Analysis of ASECNA's modernization strategy

102

5.1 Description of the strategy 102

5.1.1 Communications 102

5.1.2 Navigation 103

5.1.3 Surveillance 103

5.1.4 Systems on board the aircraft 105

5.1.5 Aviation weather 105

5.1.6 Air Traffic Management 106

5.1.7 Cooperation 107

5.1.8 Training 110

5.1.9 Financing 110

5.1.10 Implementation schedule up to 2015 112

5.2 Analysis 113

5.3 Conclusion 115

Chapter 6 Recommendations and Conclusion 117

References 122

Appendix 1 Presentation of ASECNA 126

Appendix 2: Ground Based Navigation Systems Principles

130

1 How the VOR works 130

2 How DME works 132

3 How ILS works 133

4 Multilateration 134

Appendix 3 WGS-1984 136

Appendix 4 ASECNA'S Telecommunications Network

137

Appendix 5 Air Traffic Projected Growth by world region

138

Appendix 6 ICAO's Navigation SARPs 139

Appendix 7 ASECNA's Satellite Navigation Circuits

140

Appendix 8 ASECNA'S ATS/Direct Speech Network

141

Appendix 9 CNS/ATM: Drivers and Origins 142

List of Figures

Chapter 1

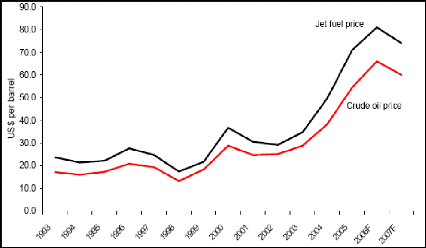

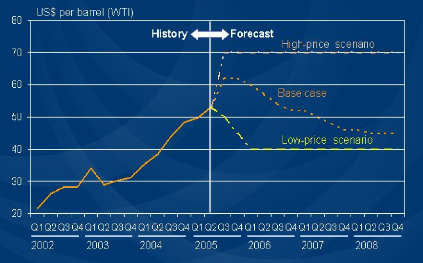

Figure 1.1 Short term evolution of crude oil 2

Figure 1.2 Analytical Framework of ASECNA's performance analysis

5

Chapter 2

Figure 2.1 ASECNA area in this report 10

Figure 2.2 Share of population and GDP by country 12

Figure 2.3 Stakeholders 15

Figure 2.1 Repartition of Aircraft types in Africa 18

Figure 2.2 Intra African market Fleet (Jets + Turbo Propellers)

19

Figure 2.3 African fleet annual utilization 20

Figure 2.4 African fleet Evolution from 2003 to 2023 21

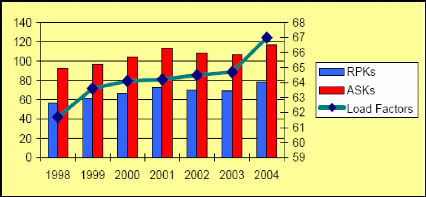

Figure 2.5 RPK, ASK (Billion) and Passengers load factors in

Africa 21

Figure 2.6 Trend in Aviation fuel cost 23

Figure 2.7 Yields and Unit costs in Key markets 23

Figure 2.8 African Airlines 1 Operating costs (Unit

cost $ per tonne per Km) 24

Figure 2.9 Regional share of global international air passenger

traffic 26

Figure 2.10 Evolution of passenger traffic (1994-2003) 27

Figure 2.11 Average Airport Passenger Traffic (2000-2004) 28

Figure 2.12 Evolution of Cargo traffic (1994-2003) 31

Chapter 3

Figure 3.1 ASECNA's Flight Information Regions 37

Figure 3.2 Number of flights from 1993 to 2003 38

Figure 3.3 Number of aircraft movements at 15 key airports 39

Figure 3.4 Areas of Routing 41

Figure 3.5 Average number of flights controlled per hour and per

controller 43

Figure 3.6 Projected growth over the next decade 45

Figure 3.7 Projected runway occupancy in ASECNA's main airports

46

Figure 3.8 Projected controllers' productivity in 2015 47

Figure 3.9 Evolution of Air Proximities 48

1 Flight Equipment comprises maintenance, insurance, and rental.

The others operating expenses are not mentioned here. But it's interesting to

note that administration unit costs for non efficient airlines are extremely

high, almost twenty times higher than an efficient airline' unit costs.

Figure 3.10 Evolution of incidents during the last six years

49

Figure 3.11 Flight paths between Douala and Dakar 51

Figure 3.12 The different phases of a flight 52

Figure 3.13 Evolution of air navigation charges 54

Figure 3.14 Personnel, ANS and transport costs from 1996 to 2003

55

Figure 3.15 Evolution of the average cost per flight from 1996 to

2003 56

Figure 3.16 Evolution of en route revenues from 1996 to 2003

57

Figure 3.17 Regional fragmentation of ATM sectors 58

Figure 3.18 Financial results from 1994 to 2003 59

Figure 3.19 OPMET availability rate 68

Chapter 4

Figure 4.1 Communication links in ASECNA 74

Figure 4.2 CPDLC test message 75

Figure 4.3 Estimated capacity gained as a function of % of CPDLC

equipage 76

Figure 4.4 Aeronautical telecommunications network concept 82

Figure 4.5 Comparison between EGNOS and GPS 85

Figure 4.6 Lateral and Vertical Total System Error 87

Figure 4.7 Comparison between RNAV, RNP and conventional

navigation 89

Figure 4.8 Atlanta SID trials: Non RNAV tracks 90

Figure 4.9 Atlanta SID trials: RNAV tracks 90

Figure 4.10 Projected RNP-RNAV capable aircraft 91

Figure 4.11 ADS-B operational capabilities 94

Figure 4.12 ADS-B performances Vs Radar 96

Chapter 5

Figure 5.1 Classification of CNS/ATM expenditure 112

Figure 5.2 Possible Airspace redesign by 2030 115

Appendices

Statutory structure 128

External representations' organisation chart 129

VOR station 131

World Geodetic System 136

ASECNA's Telecommunication Network 137

ASECNA's Satellite connectivity 140

ASECNA's ATS/DS network 141

Evolution of CNS/ATM implementation 145

List of Tables

Table 2.1 Comparative GDP and Population 11

Table 2.2 Situation of aircraft operated in the world 19

Table 2.3 Daily passenger traffic between city pairs 29

Table 2.4 International traffic at major regional airports 30

Table 3.1 The main airstream in ASECNA 40

Table 3.2 Traffic by FIR 40

Table 3.3 Average traffic density from 2001 to 2003 42

Table 3.4 Average traffic density by 2015 46

Table 3.5 Average ANS cost per flight in Europe, ASECNA and the

USA 56

Table 3.6 Equipments availability 65

Table 3.7 Air circulation control: controlled routes 67

Table 4.1 Workload reduction as a function of aircraft equipage

77

Table 4.2 Delays reduction as function of aircraft equipage 77

Table 4.3 Results for lateral and vertical accuracy with EGNOS

87

Table 4.4 Results for availability during trials Vs ICAO's SARPs

87

Table 4.5 ICAO's SARPs for lateral and vertical accuracy 87

Glossary A

ACC Area Control Centre

ADS Automatic Dependent Surveillance

ADS-B Automatic Dependent Surveillance Broadcast mode

ADS-C Automatic Dependent Surveillance Contract mode

AFI Africa Indian ocean area

AFS Aeronautical Fixed Service

AFTN Aeronautical Fixed Telecommunication Network

AIS Aeronautical Information Service

AMS(R) S Aeronautical Mobile-Satellite (R) Service

AMHS Aeronautical Mobile Handling System

AMSS Aeronautical Mobile-Satellite Service

ANSP Air Navigation Service Provider

AOC Airline Operation Centre

APIRG AFI Planning and Implementation Regional Group

APV Approach with vertical guidance

AR Area of routing

ASECNA Agency for Security, Aerial Navigation in Africa and

Madagascar

ASM Airspace Management

ASK Available Seat Kilometre

ATC Air Traffic Control

ATFM Air Traffic Flow Management

ATM Air Traffic Management

ATN Aeronautical Telecommunication Network

ATS Air Traffic Services

ATS/DS Air Traffic Services Direct Speech

C

CDM Collaborative Decision Making

CDMA Code Division Multiple Access

CFIT Controlled Flight Into Terrain

CNS/ATM Communications, Navigation, Surveillance / Air Traffic

Management

CPDLC Controller pilot data link communications

D

DECCA A low frequency hyperbolic radio navigation system

DFIS Data Link Flight Information Services

DME Distance Measuring Equipment

E

EGNOS Eurpean Geostationary Navigation Overlay Service

EUR European Region

EUROCAT Thales ATM (Commercial organisation) air traffic

management

automation product

F

FAF Final Approach Fix

FANS Future Air Navigation Systems

FIR Flight Information Region

FDPS Flight Data Processing System

FL Flight Level

FMS Flight Management System

G

GLONASS Global Orbiting Navigation Satellite System (Russian

Federation)

GNSS Global Navigation Satellite System

GPS Global Positioning System (United States)

H

HF High Frequency

HFDL High Frequency Data Link

I

IATA International Air Transport Association

ICAO International Civil Aviation Organization

IFR Instrument Flight Rules

ILS Instrument Landing System

INS Inertial navigation system

ITU International Telecommunication Union

L

LORAN Long Range Air Navigation

M

MET Meteorological services for air navigation

METAR Aviation routine weather report

MLS Microwave Landing System

MODE S Mode Select

N

NDB Non-directional beacon

NOTAM Notice To Airmen

NPA Non-precision approach

NSE Navigation System Error

O

OPMET Operational Meteorology

P

PDN Paquet data Network

PIRG Planning and Implementation Regional Group

R

RIMS Ranging Integrity Monitoring Station

RNAV Area Navigation

RNP Required Navigation Performance

RPK Revenue Passenger Kilometre

RTK Revenue Tonne Kilometre

RVSM Reduced Vertical Separation Minimum

S

SAM South American Region

SARPs Standards and Recommended Practices

SAS Scandinavian Airways

SAT South Atlantic

SATCOM Satellite Communication

SBAS Satellite-based augmentation system

SID Standard Instrument Departure

SIGMET Significant Meteorological event

SIGWX Significant Weather

SITA Société Internationale de

Télécommunications Aéronautiques

SSR Secondary Surveillance Radar

T

TACAS Terminal Access Controller Access Control System

TACAN Tactical Air Navigation

TAF Terminal area forecast

TDMA Time Division Multiple Access

TMA Terminal Manoeuvring Area

TSE Total System Error

V

VDL VHF Data Link

VFR Visual flight rules

VHF Very High Frequency

VOR VHF Omnidirectional Radio Range

W

WGS-84 World Geodetic Reference System 1984

Chapter 1 : Introduction to Thesis

The aim of this chapter is to introduce the research topic and to

present the objectives and the methodology used to respond to the research

question.

1.1. Background

Agency for Air Navigation Safety in Africa

(ASECNA1) is a regional publicly held establishment that provides

navigation services to 15 West and Central African Countries2, plus

Madagascar and the Comoro islands in the Indian ocean.

The region is relatively poor. Economic characteristics are those

of developing countries. Some of the less advanced countries are located

there.

ASECNA covers an area of 16 million square

kilometres3, most of which is unoccupied and dominated by the Sahara

desert, oceans and forests.

The Air Transport Industry has changed significantly over the

past decade. These changes were dictated by a combination of factors, mainly

operational and financial, following a succession of crisis4. The

airline industry is increasingly sensitive to the cost of doing business.

Efficiency

Air carriers demand direct routes, flight level optimization,

efficient in-flight and improved en-route fuel5 consumption. Figure

1.1 below shows the projected upwards evolution of crude oil prices. That means

airlines' fuel bill will significantly increase. Cost reduction is one aspect

of mitigating the effects of fuel high price. It explains why airspace users

want more efficiency. It is one of the factors that led them

to incite suppliers, such as air navigation service providers (ANSP) to improve

their effectiveness and the quality of service provision.

1 In the present study designates both the agency or the

geographic region

2 Benin, Burkina Faso, Cameroon, Central African Republic, Chad,

Congo Brazzaville, Equatorial Guinea, Gabon, Ivory Cost, Mali, Mauritania,

Niger, Senegal, Togo. France is also an observer member.

3 Equivalent to almost 66 times Great Britain size.

4 September Eleven, SARS, Bird Flu, Second Golf War...

5 Crude oil price was around 50 dollars per barrel in 2005

Figure 1.1: Short-term evolution of crude oil

prices

Source: IATA, 2006

Capacity

Air travel and air traffic are continuously growing. The

number of aircraft movements has increased by 5.3 per cent per year on average

over the past 15 years in ASECNA region, which is in line with worldwide

trends. The growth is forecast to continue at an estimated yearly pace of 5 per

cent. That activity means an increasing pressure will be put on airports and

air navigation systems, which may raise airspace and airport capacity

concerns.

Safety

Safety records are worrying in Africa. The

continent represents only about 3 per cent of global traffic.

Nevertheless, statistics show that almost one third of fatal

accidents over the past ten years occurred in Africa according to

IATA.

Air Transport is a catalyst for development and trade.

Efficiency, Capacity and Safety of air navigation systems are

therefore strategic components for a viable regional6 air transport

industry and growing national economies.

The important question is whether ASECNA will manage to

overcome the current and future challenges. Will they respond to users'

requirements while delivering a safer service, in the interest of regional air

transport?

The agency has embarked on a modernisation programme since

1994. It is implementing modern air navigation systems, known as Future Air

Navigation Systems (FANS) or CNS/ATM (Control, Navigation, Surveillance and Air

Traffic Management).

CNS/ATM systems are a complex and interrelated set of

technologies and concepts largely based on satellite communication. They are

the response brought forward by the aviation community, under the aegis of the

International Civil Aviation Organisation (ICAO), in response to the challenges

described above. Regional work groups have been put in place to coordinate

efforts. ASECNA is member of AFI7 Planning and Implementation

Regional Group (APIRG), which regroups African and Indian Ocean countries

The thesis intends to investigate current systems' performance

in ASECNA. It highlights regional shortcomings and needs, and examines the

agency's modernisation strategy, CNS/ATM adopted solutions, and their

implications on service provision for the next 15 years.

1.2. Research Questions

The main research question of the thesis is: Will ASECNA meet

the needs of African Air Navigation for the 21st Century?

Responding to that question requires that the following

intermediate questions are dealt with:

6 ASECNA region

7 Africa and Indian Ocean

1. What are the needs and the priorities of African Air

Navigation for the 21st century?

2. Are CNS/ATM systems the suitable tool with regard to regional

characteristics?

3. Will ASECNA's modernisation strategy respond effectively to

the needs?

1.3. Objectives

The objectives of the study are to:

1. Examine the state and the performance of air navigation

service provision in

ASECNA

2. Study the potential benefits of CNS/ATM systems to the

region

3. Analyse ASECNA's modernisation plans

1.4. Methodology

This research is based on an analytical approach to assessing

ASECNA's capability to respond to airspace users' needs and requirements and

regional air transport's interests. To answer to the first research

question that aims at defining the needs and the priorities of African

Air Navigation, we process as follows:

First, the region's air transport industry is assessed.

This is done by examining local air transport characteristics:

1. Analysis of air travel demand

2. Assessment of air carriers types

3. Examination of air carriers performance

4. Examination of airport and alternative transport

infrastructures

5. Overview of regulations and the factors that influence air

traffic.

Secondly, the air navigation system's performance is

studied, by analysing key performance areas and related indicators:

Chapter 1 Introduction to Thesis

1. Traffic demand, Capacity, Delays

2. Complexity, Safety, Aircraft proximities

3. Performance of CNS and Met systems.

4. Fragmentation, Cost Effectiveness

5. Flight efficiency

6. Cooperation.

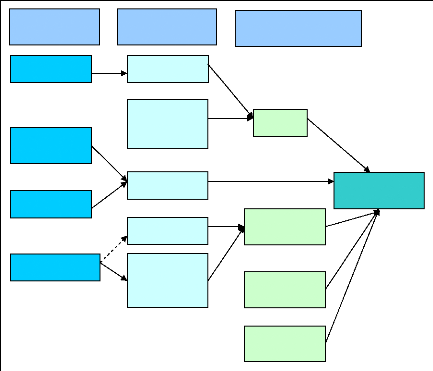

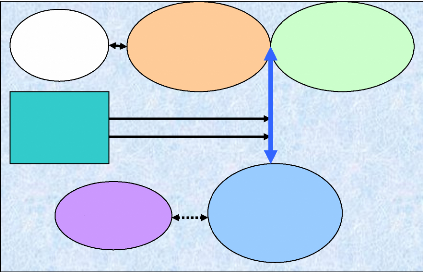

The analytical framework used is described in figure 1.2

below. The structure is based on a model developed by the Eurocontrol

Performance Review Commission to assess European Air Traffic Management

performance. It has been adapted for the present study.

Figure 1.2: Analytical Framework of ASECNA's performance

analysis

Performance

Drivers

Performance

indicators

ANS Key

performance Areas

Service

provision

cost

Flight

Efficiency

Fragmentation

Cooperation

Safety

Complexity

Traffic demand

AIRPROX

CNS Met

Systems

Availability

Delays

Productivity

Capacity

Cost

Effectiveness

ASECNA performance

Source: Eurocontrol, Performance Review Report 8, 2005

Finally, the impact of traffic growth is estimated. We apply

forecasted growth rates to current data, in this case 2003.

To answer to the second research question, which

aims at determining the relevance of CSN/ATM systems in ASECNA, we adopt the

following method:

Based on the system's deficiencies and local characteristics

drawn from the previous performance analysis:

1. Identification of potentially suitable CNS/ATM

technologies and systems based on FANS performance during worldwide trials.

These trials are performed under certain geographic and operational conditions;

some of them match ASECNA area's characteristics.

2. Their affordability is assessed At last, the third

research question is dealt with as follows:

1. Assessment of the technology solutions adopted

2. Assessment of the implementation process, and we analyse the

strategies in the areas listed below:

a. Communication

b. Navigation

c. Surveillance

d. Met

e. Air Traffic Management

f. Training

g. Programme financing

h. Cooperation

3. Assessment of the timeframe by confronting the predicted

timetable and realized projects.

When quantifiable data are not available, interviews allow to

have an idea of the situation. Interviewees are ASECNA's high profile staff,

airlines directors, and other ANSPs' personnel.

1.5. Structure of Thesis

The choice of performance areas is discussed in chapter 1. The

overview of ASECNA region's air transport industry is discussed in Chapter 2.

An insight of regional characteristics is given, which provides a better

understanding of the operational environment and the context, as well as the

importance of a performing air navigation system for the region. A detailed

analysis of air navigation systems' performance is provided in Chapter 3. Local

navigation characteristics are discussed, and predefined performance areas

presented in chapter 1 are examined. That allows highlighting the areas that

require improvements and to define what should be the priorities for the

region. Chapter 4 presents CNS/ATM systems and concepts and looks at their

potential benefits, with regard to local characteristics. Finally, the strategy

adopted by the agency to respond to those priorities is examined in chapter

5.

1.6. Data Sources

The instruments for this study include a one

week visit to ASECNA's headquarter in Dakar, Senegal, to collect data and

documents, to discuss with professionals involved in daily operations and to

observe the actual state of the implementation of the strategy on the ground.

Telephone interviews, email-statements, internet documentation are intensively

used. Key internet documents come from ICAO, ASECNA, IATA, and

CANSO8's CNS/ATM related literature.

1.7. Key Assumptions

The geographic boundaries of the study are clearly the region

covered by ASECNA. However, as ASECNA9 is part of the wider

geographic entity, the study of this region naturally implies to investigate

its interactions with the neighbourhood.

8 Civil Air navigation Services Organisation

9 Seen here as a region, not the organization itself

A key assumption in the study is that average economic and air

traffic prospects that are applicable to the African continent are applicable

to ASECNA. This is a sensitive approach as the economic characteristics of the

region are similar to the continent's patterns. However, the average growth

figures may be driven up by air transport leading countries. In particular, air

transport is less developed in ASECNA then Southern, Eastern Africa, and North

Africa.

Another key assumption is that the relative importance of

individual countries' air transport performance is frozen over the period

studied. Therefore, the relative importance of airports size and spatial

distribution of traffic flows within the region is supposed to remain

unchanged.

1.8. Choice of performance indicators

A large number of indicators could be used to assess ASECNA's

performance. How ever, for this study, several factors influenced the choice of

indicators:

The availability of data: several other indicators

could have been used but ASECNA does not collect the corresponding data.

Moreover, some chosen indicators could have been broken down into more detailed

data, but that has not been possible.

The effectiveness of chosen indicators in assessing an

ANSP's performance:

Safety, Capacity, Flight efficiency, Cost Effectiveness, cross

border cooperation are aspects of an ANSP operation that effectively evaluate

the quality of service provision.

Safety

Safety performance measures are hardly available in ASECNA.

However, indicative incidents reports are used to assess the safety level. A

comparison with other Regions' safety records with respect to the level of

traffic gives an idea of ASECNA's performance.

Capacity

Capacity is closely related to delays and the level of traffic.

Although delays data are not available, interviews allow having an idea of

influent factors.

Chapter 1 Introduction to Thesis

Flight Efficiency

The availability of a maximum number of direct routes and the

possibility to chose optimum flight levels are crucial to airlines as it allows

reducing their fuel bill.

Cost effectiveness

The bill paid by airlines for service provision depends on

ASECNA's ability to maintain low operating costs.

Cooperation

The level of technical and political cooperation indicates how

states and ANSPs work together to avoid unnecessary costs to airlines, and make

the airspace as seamless as possible.

1.9. Summary

This chapter laid the foundations for the thesis. It

introduced the research problem and questions: Will ASECNA meet the needs of

the African Air Navigation for the 21st century? In addition, what

are the problematic and the challenges related to the achievement of that

mission? The research was justified, and the methodology, based on an

analytical approach was detailed. Performance indicators have been presented

and discussed. Key assumptions were presented.

Chapter 2: ASECNA's Air Transport Industry

The aim of this chapter is to find out the region's air

transport industry's characteristics. This is an important step as it helps to

understand in which environment ASECNA evolves, and the factors that may

influence its activities. Further details on ASECNA as an organization and its

history are included in appendix 1.

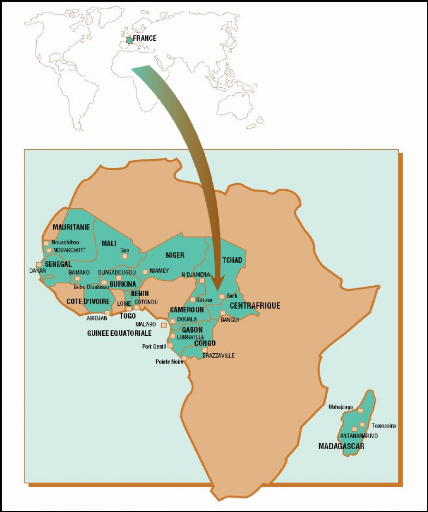

Figure 2.1: ASECNA area in this report

Source: ASECNA

2.1 Economic Characteristics

ASECNA comprises developing countries, mainly located in

western or Central Africa, except Madagascar and the Comoros Islands located in

the Indian Ocean (See map above). Their Economies are relatively weak. Mali,

Niger, Chad, Burkina Faso Togo and the Central African Republic (CAR) are among

the poorest country in the world. The general picture is one of

underdevelopment, political instability, economic volatility and high poverty.

Comparative Gross Domestic Products and populations between ASECNA, the world

average and UK's performance reflect that situation (Table below).

|

Region

|

GDP

($ billion)

|

GDP /Capita

($ thousand)

|

Population

(million)

|

|

ASECNA1

|

93

|

1.7

|

141

|

|

WORLD

|

43920

|

9.5

|

6,526

|

|

UK

|

2218

|

31

|

60

|

Table2.1: Comparative GDP and

populations;

Source: CIA World fact book, 2006

The region accounts for just 0.2 per cent of world

GDP. But in contrast to its low share of economic activity worldwide,

as the table above shows it, 141 million people live in ASECNA, which is 2.2 %

of world population. That combination of low input and high population means

the GDP per capita in ASECNA is the lowest among the world regions (1700

dollars). UK for instance is 24 times wealthier, and its GDP per capita is 26

times ASECNA's average. 46 per cent of the population lives under the poverty

line in the region.

Countries in ASECNA remain to a large extent producers of raw

materials. They export agricultural goods such as coffee, cocoa and cotton, or

mineral such as crude oil and copper. Trade exchanges in ASECNA region tend to

be dominated by agricultural exports.

1 Data compiled from CIA world Fact book 2006

However, economic development is not

homogeneous within the region. Noticeable disparities between

countries exist. For example, while Equatorial Guinea represents only 0.4 per

cent of regional population, it accounts for 8.3 per cent of GDP. In contrast,

Madagascar that contains 13 per cent of total population accounts only for 4.9

per cent of regional GDP. (Figure 2.2)

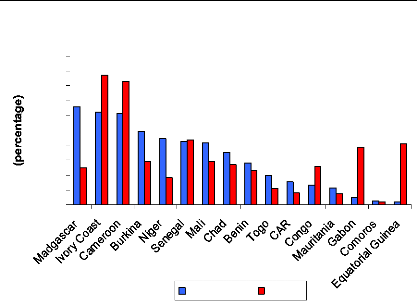

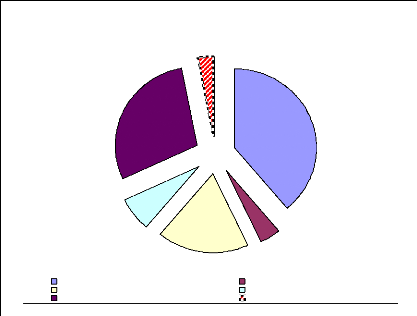

Figure 2.2: Share of Population and GDP by

country

20

18

16

14

12

10

8

6

4

2

0

% Population %GDP

Source: CIA fact book 2006

Ivory Coast, Cameroon, Senegal, Gabon and Equatorial Guinea

account for almost 60 percent of ASECNA GDP and one third of the population,

while Comoros, Niger, Mauritania, Togo, and CAR own 9.3 per cent of GDP and

host 20 per cent of population.

Regional integration processes are on the

way. ASECNA members countries located in West Africa are part of ECOWAS

(Economic Community of West African States). Those located in Central Africa

are members of CEMAC (Central Africa Economic and Monetary Union). The level of

integration varies significantly. The ECOWAS is much more advanced than the

CEMAC. But the two entities are confronted to the economic

disparities described above, which slow the pace of

integration. The lack of a real political will in CEMAC, or persisting

political instability and civil wars in key countries such as Ivory Coast, and

the Republic of Congo have also had a damaging impact on regional economic and

political integration.

In other respects, bad Governance is a common

practice at the state level and in public companies. States continue to own a

high number of companies in strategic sectors such Telecommunications, Water,

Energy and Transports, although privatisations are spreading across the region,

mainly on the basis of International Monetary Funds Recommendations (IMF). It

is generally admitted that state ownership, «poor management and

monitoring, and anti-competitive arrangements have bred corruption in

Africa» and particularly in the ASECNA area (Morrell, 2005)

These factors, combined with the low level of investments

(Foreign Direct Investments are among the lowest in the world), contribute to

explain the underdevelopment of basic infrastructures, particularly in the

transport sector.

2.2 Transport infrastructure

2.2.1 Roads

Roads are the predominant mode for freight and pas senger

transport in Africa (World Bank, 2005). But within individual countries, very

often, only the main cities are linked by paved roads. Regional interconnection

is very limited. There are only 3 9,000 Kilometres of paved roads in the entire

region, which represents 18 percent of total road network. Moreover, these

roads are often in a relatively bad state due to poor maintenance. In

comparison, UK alone has 392,931 Kilometres of highways, which is ten times

more. That situation renders economic exchanges very difficult and slows their

intensity as well as it limits regional integration.

2.2.2 Railways

Railway links are very poor or do not exist within and between

countries. Two third of the actual rail infrastructure were inherited from the

colonial period (OEDC, 2005, P.22).

There are only 8228 Kilometres of railways in ASECNA countries

(17300 in the UK). Some states such as Niger, Chad, Equatorial Guinea, Comoros,

and CAR have simply no railway infrastructure, which means their economic

activity depends heavily on the road system.

2.2.3 Ports

There are a dozen key ports in ASECNA. The most important of

them is Dakar, with about 10 millions tonnes of goods. The essential of ASECNA

countries trade activities is carried out through these ports. For instance, 98

per cent of exchanges between Cameroon and the outside world are done through

Douala autonomous port, with about 5.2 millions tonnes per year (Mission

Economique, 2006)

But, the reliability and the speed of exchanges of goods and

mobility of people is a crucial factor for regional integration. Given the

under performance of road, and rail systems, and the slowness of sea transport,

the availability of an adequate air transport infrastructure is therefore of

paramount importance for ASECNA countries as they try to integrate into the

world economy.

2.3 Air Transport industry

A developed air transport industry is a driving force for

economy, and a catalyst for development and trade. It facilitates exchanges

between countries in which air transport substitutes, the road

and rail systems are underdeveloped.

Passenger aviation is the principle mean of transport for

business and tourism travellers. Airports link the movement of passengers and

goods to national economies; they serve as a primary hub for the tourism

industry, and as key logistical centre for international trade.

Stakeholders in ASECNA are the states, airlines, ANSPs,

airports and international institutions. The study focuses on the relation

between ANSPs and other stakeholders (Figure 2.3).

States are represented by civil aviation authorities and

Governments. They make air transport policies, on the basis of strategic

objectives, through legislations applying to all the others stakeholders in the

region.

Airlines are of different types: International, Domestic, and

Regional. Both ASECNA originated airlines and the others are considered.

Airports are divided into main and secondary airports.

The region only air navigation service provider is ASECNA. The

institution has links with others neighbouring ANSPs.

Figure 2.3: The stakeholders2

Policy Makers

Governments

Civil

Aviation

Authorities

Air Travel

Customers

Other ANS

Providers

Policy

Objectives

Cooperation

Airlines

Domestic

Regional

International

Legislations

Institutions

Air Navigation

Provider

ASECNA

Performance

Airports

Main

Secondary

2.3.1 Airport Infrastructure Main

Airports

The airport infrastructure (airstrips, air terminals, aircraft

hangars) of ASECNA member states comprises about 25 international airports

(2400 to 3500 m of tarred runways) regularly used. The main airports are Dakar,

Abidjan, Douala, Libreville, Brazzaville and Antananarivo. They are served by

major regional, continental and intercontinental airlines. The service provided

is acceptable, but is far from being good.

The airport sector is not free from financing, safety and

security problems. Built for the

most part in the 1960s and 1970's, they

present deficiencies. These vary from State to

State.

Runways are generally in a bad state, taxiways and parking

areas are often

2 All the stakeholders are not taken into account:

Ground Handling, Maintenance, Catering... etc

unsuitable; passenger terminals are cramped

or saturated in peak hours. There are insufficient cargo hangars, refrigerating

warehouses and fencing (African Union, 2005). There are needs for the updating

of these installations to meet international standards. The inexistence of

airport fences or in disrepair poses serious security and safety problems.

Secondary Airports

The region counts about 150 domestic airports (runways of 1000

to 2000 m, usually unpaved) and about 200 other national aerodromes (poorly

maintained), with for several of them inexistent traffic. These airports do not

often have adequate navigation aids, or basic airport commodities, which

constrains their accessibility.

2.3.2 Airlines

In West Africa, and particularly in ASECNA, the liquidation of

Air Afrique after 40 years of existence marked the end of a symbol of African

airline integration.

Data from Air Transport Intelligence show that nearly

81 per cent of airlines serving ASECNA are African. 50 per cent are from member

states and 31 per cent from other continents.

The main local carriers are Air Madagascar, Air Senegal

international, Cameroon Airlines, Air Gabon, Air Ivoire, Air Burkina, Air

Mauritania, Air Togo, and Toumai Air Tchad.

Domestic Airlines

The poor domestic markets are served by national carriers or very

small companies of which the fleet is often constituted by a single

aircraft.

Regional Airlines

Air Senegal International, Bellview (Nigeria), Air Ivoire,

Cameroon Airlines, Toumaï Air Chad and Air Burkina have put in a lot of

efforts to fill up the vacuum left following the demise of Air Afrique. These

airlines propose flights to travel within the region from and to the main

cities in the regions.

International Airlines

The region can be divided into two groups of countries:

1) Those that no longer have national long-haul carriers with

their market largely dominated by foreign companies.

2) Countries that still have national airlines but these are

facing strong competition from foreign companies (Cameroon, Gabon, and

Madagascar).

Local Airlines

Cameroon Airline, Air Gabon, Air Madagascar and Air Senegal

International are the three main local flag carriers. They link the respective

countries to Africa and mainly Western Europe and less regularly the Middle

East (During the hajj3)

Foreign Airlines

Air France-KLM is the dominant carrier on the long haul

market. It serves all ASECNA's main airports. Swiss, SN Brussels, Iberia,

Lufthansa and Alitalia also regularly flight to the region. An

important figure to highlight is the percentage of international traffic

ensured by Western airlines. In fact, according to ASECNA about 80 per cent of

the commercial traffic is operated by these carriers4.

The Libyan carrier, Afriqiyah Airways is now operating to most

of the defunct Air Afrique member countries transforming Tripoli into a hub for

passengers connecting to Europe and the Middle East. Tunisia has also started

flying to Bamako and Abidjan. Royal Air Maroc (RAM) has opened routes to Dakar,

Douala and Gabon.

Ethiopian, South African Airways, Kenyan Airways and Air

Inter5 also have regular connections with ASECNA.

2.3.3 Fleet

A study by Boeing showed that about 75 per cent of African

fleet is composed by

regional jets or single aisle aircraft (Boeing, 2005).

This does not take into account

secondary airports exclusively exploited by

very small aircraft (Less than 30 seats).

3 Pilgrimage to Mecca

4 Air France-KLM, TAP, Alitalia, SN Bruxels, SWISS,

Iberia, Lufthansa...

5 South African carrier

Most intra African routes are operated with narrow bodies, or

very small jets or turbo propellers.

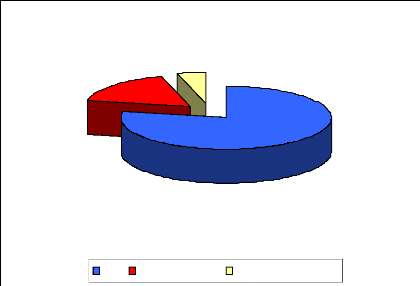

Figure 2.4: Proportion of Aircraft types in

Africa

415

78%

92

17%

24

5%

Jets Turbo PropellersSmall size aircraft

Source: Afraa, 2005

Figure 2.5: Intra African market Fleet (Jets + Turbo

Propellers)

Source: Ambraer, 2006

|

New

|

Average

|

Old

|

Total

|

% of Old

|

|

Africa

|

162

|

111

|

316

|

589

|

54

|

|

America

|

1654

|

2581

|

1301

|

5536

|

24

|

|

Europe

|

1768

|

1363

|

237

|

3368

|

7

|

|

Asia

|

1154

|

969

|

295

|

2418

|

12

|

|

Middle East

|

240

|

144

|

155

|

539

|

29

|

|

Pacific

|

155

|

102

|

15

|

272

|

6

|

|

WORLD TOTAL

|

5371

|

5529

|

2712

|

13 612

|

20

|

Table 2.2: Situation of aircraft operated in the

world

Source: African Union, 2006

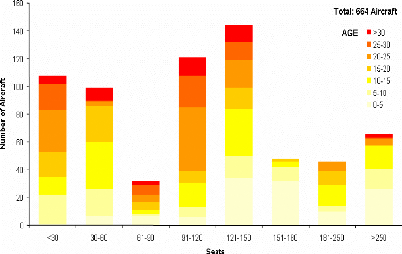

About 54 % of aircraft operated in Africa are considered to be

old or very old. Nearly 45 % of aircraft are more than 15 years old. 20 % are

between 10 and 15. 13 % are aged between 5 and 10. Around 22 % are less than 5

years olds (figure 2.5). The average age of the fleet is comprised

between 16 and 20 years old. A large proportion of aircraft still

operated are aged over 25 and even 30. These aircraft are largely fuel

inefficient.

Figure 2.6: African fleet annual utiization

2500

2000

3000

1500

1000

500

0

(Flights Hours per Aircraft)

Fleet age (Years)

45

40

25

20

35

30

5

0

15

10

TP20 TP35 J35 J44 TP50 J50 TP70

J70 J80 J100 J120 J150 J175 J250 J>300

African annual fleet utilization African Fleet Average Age

Source: Ambraer, 2006

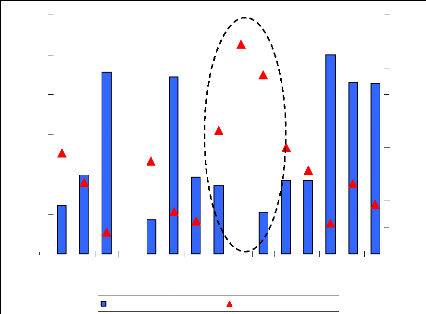

The average annual utilization is 1167 hours per aircraft. There

is a strong correlation between fleet utilization and fleet age (Coefficient of

correlation equal to «- 0.8»).

Figure 2.7: African fleet Evolution from 2003 to

2023

392

Growth

309

Replaced

332 Stay

60

641 aircraft

701

Source: Airbus, 2005

Airbus estimates that African airlines will take delivery of

about 641 new aircraft to replace the current fleet or to sustain growth

(Figure above).

2.3.4 Performance

Figure 2.8: RPK, ASK (Billion) and Passengers load

factors in Africa

Source: AFRAA, 2005

Load factors, RPK and ASK are improving. But the overall

industry's health remains critical in Africa. Load factors may look remarkably

high, but they highlight the airlines' dilemma in the African operating

climate. The problem is that break even load factors remain higher.

Financial Performance

A sample of 8 airlines serving ASECNA region, comprising South

African Airways, Royal Air Maroc, Ethiopian Airlines, Kenya Airways, Air

Mauritius, Bellview airways, and Tunisair, made a net profit of over $200

million in 2005 (AFRAA, 2005, p.4). These are encouraging and remarkable

results in a world where airlines made huge losses in the recent past But they

do not reflect the real picture of the industry's performance. Most airlines,

some very small, some bigger, are facing serious difficulties.

Excessive debts, uncoordinated operating networks,

liquidation, bankruptcy, are examples of discrepancies generally observed

(African Union, 2005). Airlines post very poor financial results. The

issue of profitability is crucial in the region: as the market

is narrow; it is difficult for local airlines to raise the necessary investment

required by the standards of modern airlines. These airlines often

operate the same routes. That competition leads to a price war resulting merely

in weakening the economic health of these companies which have difficulties in

covering their operating costs. Air Afrique6 best

represents the airline industry's situation in the area. Air Afrique

officially lost 194 million dollars between 1984 and 1996. It almost

never made significant profit. In 2002, after years of financial crisis, the 11

states that owned the pan-African airline decided to file for bankruptcy. The

Bankruptcy came after the failure of a restructuring plan brokered by the World

Bank.

The Yaoundé treaty countries have revised their

national carriers by designating them as the flag carriers. But they are left

under the control of private interests, like Air Ivoire, Air Senegal

International, Toumaï Air Chad... etc. Cameroon Airlines and Air Gabon,

once the two leading carriers in the region, are now being liquidated or

privatized.

High Fuel prices

Fuel price is constantly rising. Fuel represents on average 25

per of operating costs. One

barrel costs on average 70$ world wide and up to

90$ in Africa (2005). The trend is

6 Air Afrique was established in 1961 to provide

passenger and cargo service within the 12 West African Nations of Benin,

Burkina Faso, Central African Republic, Cote d'Ivoire, Congo, Mali, Mauritania,

Niger, Senegal, Chad, Togo & Guinea Bissau.

expected to last. These sky-rocketing fuel prices are devastating

the industry. As airlines are struggling to improve their bottom lines, fuel

efficiency is critical.

Figure 2.9: Trend in Aviation fuel cost

Source: Airbus, 2005

Yields and Unit Costs

Figure 2.10: Yields and Unit costs in Key

markets

14,0

|

12,0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10,0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8,0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6,0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0,0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Europe Southern Europe Western Within Europe North Atlantic

Africa Africa

Yield Unit Cost Yield Cost Margin

Source: Airbus, 2005

Yields are declining and the margins remain low. The Southern

Africa - Europe market has the lowest unit cost but also the lowest yields, and

the lowest margins. Europe - Western Africa is a healthy market for efficient

airlines, mainly European, with relatively high yields. Yields are also low in

the domestic market. The industry is not expecting a significant improvement of

yield.

Most African airlines are inefficient. This results into high

unit costs as the figure below shows it. These airlines possess old fleets

which are highly oil-consuming. High unit costs reflect low aircraft

utilization rates, high maintenance, rental and insurance costs. High air

navigation and airport unit costs reflect their old avionics, and their low

aircraft utilization.

Figure 2.11: African Airlines 7 Operating

costs (Unit cost $ per tonne per Km)

0,5 0,4 0,3 0,2 0,1

0

0,6

Fuel & Oil Flight Equipment Airport and Navigation

Charges

Avg inefficient Airline Avg Efficient Airline Avg Efficient

Worldwide

Source: Airbus, 2005

7 Flight Equipment comprises maintenance, insurance,

and rental. The others operating expenses are not mentioned here. But it's

interesting to note that administration unit costs for non efficient airlines

are extremely high, almost twenty times higher than an efficient airline' unit

costs.

2.4 Regulatory

In the absence of valid local carriers, ASECNA states have

liberalized their skies because bilateral agreements (Principle of reciprocity)

are no longer functioning. Although the deregulation process is on the way,

with the ongoing implementation of the Yamoussoukro8 liberalisation

decision, the open sky agreements, civil aviation codes are still obsolete and

not harmonised. Texts on competition are not fully applied:

Current regulations impose restrictions over the number of operating

airlines, and frequency and capacity.

Western carriers want more liberalization, and would like to see

the process speeded up, as they are in a position to dominate the market

further.

8 Ivory Coast, 1999

2.5 Air Travel demand

2.5.1 Traffic figures

Africa accounts for about 3% of global air traffic in term of

Passenger Kilometres performed (African Union, May 2005).

Figure 2.12: Regional share of global international

scheduled air passenger traffic

Europe Latin America and Caribbeans

North America Middle East

Asia Pacific Africa

587,998 (29%)

132,934 (7%)

Percentage share by region

( Passenger-kilometres

performed in millions, 2004)

354,353 (18%)

64,326 (3 %)

88,027 (4%)

785,828 (39%)

Source: UNESCAP, 20059

This situation reflects its low income, and the lack of air

transport infrastructure. This being said, the situation of air transport in

Africa is not uniform. It varies from one region to another. Northern, Southern

and Eastern Africa's air transport performance is good (Kenyan airways, South

African, Ethiopian and Royal Air Maroc). ASECNA area remains in a difficult

situation with less traffic and unreliable structures. ASECNA's figures show

that the region generates about 7 million passenger traffic per year (2003),

which is below what South Africa alone represents in term of annual air

passengers.

9 United Nation Economic and Social Commission for

Asia Pacific

Propensity to travel

Given the low level of incomes, and the widespread of poverty

across the region, the propensity to travel is very low. Moreover, the tariffs

are «very high», 20 to 30% higher than the rest of the world

according to the African Union. High air travel fares reflect the low level of

traffic, and limited load factors in most of the routes. Moreover, there are

little frequencies between city pairs. That increases aircraft operating

costs.

Passenger Traffic10

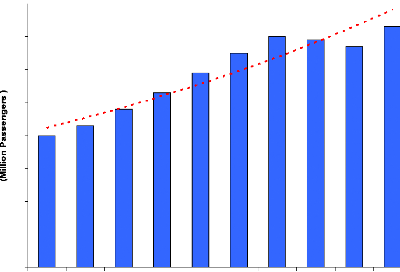

Figure 2.13: Evolution of passenger traffic

(1994-2003)

8,0

7,0

6,0

5,0

4,0

4,0

7,3

3,0

2,0

1,0

0,0

1994 1995 1996 1997 1998 1999 2000 2001 2002 2003

(Year)

Source: ASECNA, annual reports (1994-2003)

Passenger traffic has grown by about 75% from 1994 to 2003,

increasing from about 4 million to around 7 million in 2003.

This evolution is due to a sustained economic growth on the continent

and worldwide. Traffic recovery is particularly significant in some countries.

After recent political unrests in Madagascar and Congo, passenger traffic in

main airports grew respectively by 70 and 17 per cent between 2002 and 2003.

The increase of figures in the region is also driven by oil- related activities

in Chad and

10 Ässengers Traffic in ASECNA main Airports

Equatorial Guinea. The construction of the pipeline between that

country and the oceanic coast through Cameroon has stimulated traffic.

Passenger Traffic by Airport

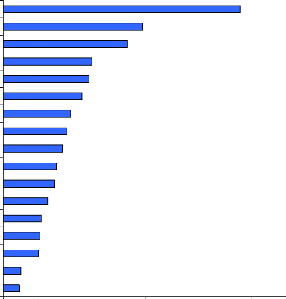

Figure 2.14: Average Airport Passenger Traffic

(2000-2004)

Dakar (Senegal)

Abidjan (Ivory Coast)

Libreville (Gabon)

Douala (Cameroun)

Brazzaville (Rep Congo)

Antanarivo (Madagascar)

Pointe Noire (Rep Congo)

Bamako (Mali)

Malabo (Guinea)

Port Genrtil (Gabon)

Cotonou (Benin)

Yaounde (Cameroon)

Ouagadougou (Burkina)

LOME (Togo)

Nouakchott (Mauritania)

Ndjamena (Chad)

Niamey (Niger)

787

700

500

484

1336

0 200 400 600 800 1000 1200 1400 1600

(Thousand Passengers)

Source: ASECNA, annual reports (2000-2004)

Among the main airports, Dakar airport is the first in the

region with more than 1 million passengers per year. It's has been the fastest

growing airport in term of passenger volume. The important tourism activity in

Senegal is the major factor that explains this performance. The traffic is

globally increasing in other airports.

Secondary airports in ASECNA receive insignificant passenger

traffic and are often served by very small aircraft.

Domestic passenger traffic

Domestic markets are particularly poorly developed across the

region. People tend to travel by road or rail despite the poor state of the

network. Only the elite, and business men who can afford it, use air travel to

move within countries. Only Gabon has a relatively developed domestic market

with more than 340,000 passengers in 2003 (Bergonzi, 2006, P7).

Regional passenger traffic

While regional traffic has significantly increased within the

other African regions, it has stagnated in West and Central Africa from 1994 to

2001.

Political trips, seminars, regional emigration and business

travels are the main drivers of regional traffic. However, the mobility from

one country to another remains extremely difficult. It's sometimes easier to

reach another country within the region through Paris for instance. On the 276

regional city pairs, only 5 per cent of them have 150 passengers per day (table

below). The busiest city-pair is Abidjan - Dakar.

|

Daily passenger

|

Number of

city pairs

|

Percentage (%)

|

|

More than 150

|

14

|

5

|

|

70 - 150

|

28

|

10

|

|

30 - 70

|

69

|

25

|

|

10 - 30

|

69

|

25

|

|

Less than 10

|

96

|

35

|

Table 2.3: Daily passenger traffic between city

pairs.

Source: Délia Bergonzi, 2006

The most frequent connections in ASECNA are: Dakar-Bamako,

Dakar-Abidjan, Bamako-Abidjan, Douala-Libreville, and Cotonou - Pointe Noire.

They all have more then 100,000 passengers per year. Dakar and Abidjan are the

two destinations with the highest regional passenger traffic, performing

respectively 350000 and 200000 passengers per year (OEDC, 2005). Dakar has 15

direct links with others regional cities and Abidjan is directly linked to 12

others West African cities. The heaviest traffic flows are the Gulf of Guinea

(Abidjan-Accra-Lagos corridor), then the Dakar/Abidjan axis.

The lack of air links in the Central and

Western regions is at a damaging situation with the presence of a number of

landlocked states (e.g. Congo, Central African Republic, Chad, Mali, Niger),

where aviation is needed most.

International Passenger traffic

Almost 50% of passenger traffic (6 million out of 11 in 2003)

in western and central Africa is international. Traffic at major airports in

ASECNA is presented in table below.

|

2000

|

2001

|

2002

|

2003

|

|

Dakar

|

803.8

|

863.2

|

918.3

|

1005.6

|

|

Abidjan

|

744.6

|

6448

|

301.9

|

3127

|

|

Douala

|

198.8

|

252.9

|

246

|

283.5

|

|

Bamako

|

168.2

|

132.2

|

112.1

|

197.1

|

|

Antananarivo

|

198.2

|

209.9

|

98.5

|

176.1

|

|

Libreville

|

246.4

|

203.9

|

198.9

|

149.6

|

|

Malabo

|

42

|

64

|

73,9

|

100.2

|

Table 2.4: International traffic at major regional

airports (Thousand).

Source: ASECNA

In international traffic, for the West and Central Africa region,

and particularly in ASECNA, the dominant connection is towards Europe.

This traffic can be divided in 3 groups: The ethnic

Passenger Group, who has ties with the former European colonial powers,

France mainly, creates a natural emigration of workers in both directions

(South-North, North-South). The Leisure and Tourism group, concerns

high-income people who travel to Europe, America or Asia for reasons such as

shopping, Visits to family and friends. The Business travellers,

because of economic ties with Europe, and oil companies are also important

drivers for air traffic in the region. A large part of the traffic is also due

to governmental, non-governmental and international bodies' staff.

Traffic towards the Middle East is increasing, mostly due to

the attraction of Dubai and

pilgrimage to Mecca. North Africa / West and

Central Africa traffic is also increasing

due to the dynamism of Maghrebian airlines, which take a large

share of the 6th freedom11 traffic departing from Paris to

ASECNA.

There is also a significant traffic between African sub

regions and ASECNA, mainly towards South Africa. Traffic towards the United

States of America is carried out essentially via Europe.

Cargo Traffic

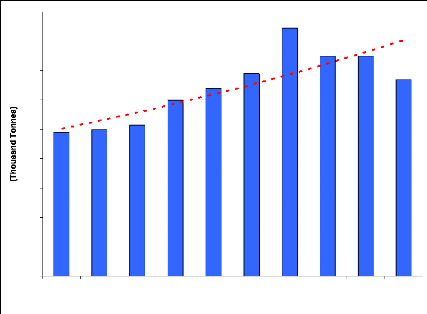

Figure 2.15: Evolution of Cargo traffic

(1994-2003)

1994 1995 1996 1997 1998 1999 2000 2001 2002 2003

(Year)

134

180

160

140

120

100

80

60

40

20

0

98

Source: ASECNA, annual reports (1994-2003)

Freight traffic has regularly increased from 1994 to 2000 due

to economic upturn. The

decrease observed since 2001 is

explained by a dramatic reduction of cargo traffic at

11 The right to carry passengers or cargo from a second country

to a third country by stopping in one's own country.

main cargo airports (Pointe Noire and Brazzaville in the republic

of Congo). But overall cargo traffic has increased by nearly 37 per cent since

1994.

2.6 Conclusion

The aim of this chapter was to introduce to ASECNA's air

transport industry, and to find out its main characteristics. This is what was

found.

1. ASECNA region is characterised by under development and

extreme poverty

2. Air Transport infrastructure is in a bad state or is largely

insufficient and the substitutes to air transport are poorly developed.

3. The airline industry is very weak, and mostly composed of

small aircraft

a. Local companies are facing economic and financial

difficulties

b. Operating costs are hit by soaring fuel costs, and low

aircraft utilisation

c. Yields and margins are low on the domestic market

d. Most local airlines are very small and very often

inefficient

e. The fleets are very old

f. The long haul and medium haul markets are dominated by

foreign carriers

g. The domestic market is insignificant

4. Air travel is still constrained

a. On the demand side by low incomes

b. On the supply side by regulations

5. Some changes are being observed

a. Aircraft manufacturers expect a fleet renewal over the next

years

b. Liberalization policies are slowly being adopted on the basis

of the Yamoussoukro decision

c. New entrants are expected, even low cost carriers

What do these characteristics mean for air navigation service

provision and for ASECNA?

The poor development of air transport substitutes means air

transport is crucial to ASECNA region and should be among the priorities. In

order to develop safely and orderly, the region's air transport industry needs

a reliable air navigation infrastructure and an adapted air navigation service

provision. Air transport cannot develop without these conditions.

Airlines facing difficulties need to improve their efficiency

to mitigate the effects of high fuel costs. With the very low level of yields

on the domestic markets and on some international routes, and given the ultra

competitive environment in a limited number of profitable routes in ASECNA, it

is unlikely that there is significant scope for a recovery in the yields in the

next years. Airlines are going to renew their assaults on costs according to

African Airlines Association (AFRAA). These include flying the shortest routes,

carrying optimum of fuel, cruising at optimum speed, minimizing flights at low

altitude during descend and climb. Therefore ASECNA must deliver enough

capacity and airspace flexibility to its customers

But efficiency also means that ASECNA must deliver a cost

effective service provision.

These airlines' fleets are often very old. Ageing fleet means

they are unable to cope with technological advancements and automation of

security and safety systems. However the fleet renewal expected by

manufacturers means higher speeds, and increased speed variability in ASECNA's

airspace.

The predominance of foreign carriers in ASECNA means the agency

must pay attention to their requirements as well as those of local airlines.

The liberalisation process and the growth of economies in the

region will have a positive impact on competition and on air travel. ASECNA

must anticipate these mutations, and their foreseeable impact on the air

navigation system, and articulate its strategy to match the other exigencies

mentioned above.

|