2.3 Air Transport industry

A developed air transport industry is a driving force for

economy, and a catalyst for development and trade. It facilitates exchanges

between countries in which air transport substitutes, the road

and rail systems are underdeveloped.

Passenger aviation is the principle mean of transport for

business and tourism travellers. Airports link the movement of passengers and

goods to national economies; they serve as a primary hub for the tourism

industry, and as key logistical centre for international trade.

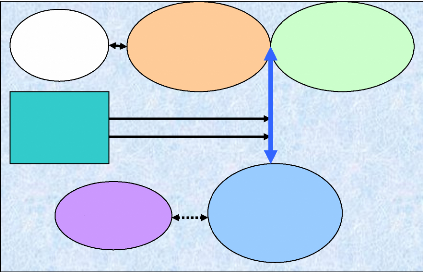

Stakeholders in ASECNA are the states, airlines, ANSPs,

airports and international institutions. The study focuses on the relation

between ANSPs and other stakeholders (Figure 2.3).

States are represented by civil aviation authorities and

Governments. They make air transport policies, on the basis of strategic

objectives, through legislations applying to all the others stakeholders in the

region.

Airlines are of different types: International, Domestic, and

Regional. Both ASECNA originated airlines and the others are considered.

Airports are divided into main and secondary airports.

The region only air navigation service provider is ASECNA. The

institution has links with others neighbouring ANSPs.

Figure 2.3: The stakeholders2

Policy Makers

Governments

Civil

Aviation

Authorities

Air Travel

Customers

Other ANS

Providers

Policy

Objectives

Cooperation

Airlines

Domestic

Regional

International

Legislations

Institutions

Air Navigation

Provider

ASECNA

Performance

Airports

Main

Secondary

2.3.1 Airport Infrastructure Main

Airports

The airport infrastructure (airstrips, air terminals, aircraft

hangars) of ASECNA member states comprises about 25 international airports

(2400 to 3500 m of tarred runways) regularly used. The main airports are Dakar,

Abidjan, Douala, Libreville, Brazzaville and Antananarivo. They are served by

major regional, continental and intercontinental airlines. The service provided

is acceptable, but is far from being good.

The airport sector is not free from financing, safety and

security problems. Built for the

most part in the 1960s and 1970's, they

present deficiencies. These vary from State to

State.

Runways are generally in a bad state, taxiways and parking

areas are often

2 All the stakeholders are not taken into account:

Ground Handling, Maintenance, Catering... etc

unsuitable; passenger terminals are cramped

or saturated in peak hours. There are insufficient cargo hangars, refrigerating

warehouses and fencing (African Union, 2005). There are needs for the updating

of these installations to meet international standards. The inexistence of

airport fences or in disrepair poses serious security and safety problems.

Secondary Airports

The region counts about 150 domestic airports (runways of 1000

to 2000 m, usually unpaved) and about 200 other national aerodromes (poorly

maintained), with for several of them inexistent traffic. These airports do not

often have adequate navigation aids, or basic airport commodities, which

constrains their accessibility.

2.3.2 Airlines

In West Africa, and particularly in ASECNA, the liquidation of

Air Afrique after 40 years of existence marked the end of a symbol of African

airline integration.

Data from Air Transport Intelligence show that nearly

81 per cent of airlines serving ASECNA are African. 50 per cent are from member

states and 31 per cent from other continents.

The main local carriers are Air Madagascar, Air Senegal

international, Cameroon Airlines, Air Gabon, Air Ivoire, Air Burkina, Air

Mauritania, Air Togo, and Toumai Air Tchad.

Domestic Airlines

The poor domestic markets are served by national carriers or very

small companies of which the fleet is often constituted by a single

aircraft.

Regional Airlines

Air Senegal International, Bellview (Nigeria), Air Ivoire,

Cameroon Airlines, Toumaï Air Chad and Air Burkina have put in a lot of

efforts to fill up the vacuum left following the demise of Air Afrique. These

airlines propose flights to travel within the region from and to the main

cities in the regions.

International Airlines

The region can be divided into two groups of countries:

1) Those that no longer have national long-haul carriers with

their market largely dominated by foreign companies.

2) Countries that still have national airlines but these are

facing strong competition from foreign companies (Cameroon, Gabon, and

Madagascar).

Local Airlines

Cameroon Airline, Air Gabon, Air Madagascar and Air Senegal

International are the three main local flag carriers. They link the respective

countries to Africa and mainly Western Europe and less regularly the Middle

East (During the hajj3)

Foreign Airlines

Air France-KLM is the dominant carrier on the long haul

market. It serves all ASECNA's main airports. Swiss, SN Brussels, Iberia,

Lufthansa and Alitalia also regularly flight to the region. An

important figure to highlight is the percentage of international traffic

ensured by Western airlines. In fact, according to ASECNA about 80 per cent of

the commercial traffic is operated by these carriers4.

The Libyan carrier, Afriqiyah Airways is now operating to most

of the defunct Air Afrique member countries transforming Tripoli into a hub for

passengers connecting to Europe and the Middle East. Tunisia has also started

flying to Bamako and Abidjan. Royal Air Maroc (RAM) has opened routes to Dakar,

Douala and Gabon.

Ethiopian, South African Airways, Kenyan Airways and Air

Inter5 also have regular connections with ASECNA.

2.3.3 Fleet

A study by Boeing showed that about 75 per cent of African

fleet is composed by

regional jets or single aisle aircraft (Boeing, 2005).

This does not take into account

secondary airports exclusively exploited by

very small aircraft (Less than 30 seats).

3 Pilgrimage to Mecca

4 Air France-KLM, TAP, Alitalia, SN Bruxels, SWISS,

Iberia, Lufthansa...

5 South African carrier

Most intra African routes are operated with narrow bodies, or

very small jets or turbo propellers.

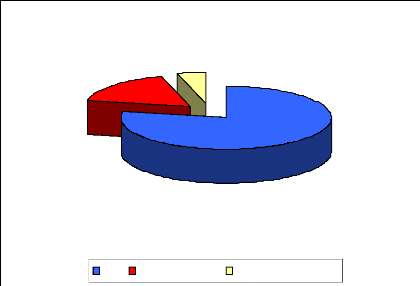

Figure 2.4: Proportion of Aircraft types in

Africa

415

78%

92

17%

24

5%

Jets Turbo PropellersSmall size aircraft

Source: Afraa, 2005

Figure 2.5: Intra African market Fleet (Jets + Turbo

Propellers)

Source: Ambraer, 2006

|

New

|

Average

|

Old

|

Total

|

% of Old

|

|

Africa

|

162

|

111

|

316

|

589

|

54

|

|

America

|

1654

|

2581

|

1301

|

5536

|

24

|

|

Europe

|

1768

|

1363

|

237

|

3368

|

7

|

|

Asia

|

1154

|

969

|

295

|

2418

|

12

|

|

Middle East

|

240

|

144

|

155

|

539

|

29

|

|

Pacific

|

155

|

102

|

15

|

272

|

6

|

|

WORLD TOTAL

|

5371

|

5529

|

2712

|

13 612

|

20

|

Table 2.2: Situation of aircraft operated in the

world

Source: African Union, 2006

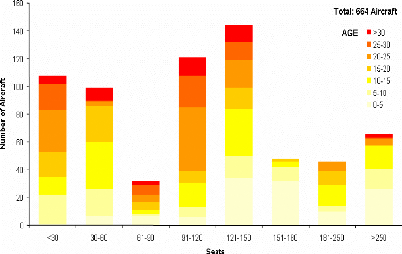

About 54 % of aircraft operated in Africa are considered to be

old or very old. Nearly 45 % of aircraft are more than 15 years old. 20 % are

between 10 and 15. 13 % are aged between 5 and 10. Around 22 % are less than 5

years olds (figure 2.5). The average age of the fleet is comprised

between 16 and 20 years old. A large proportion of aircraft still

operated are aged over 25 and even 30. These aircraft are largely fuel

inefficient.

Figure 2.6: African fleet annual utiization

2500

2000

3000

1500

1000

500

0

(Flights Hours per Aircraft)

Fleet age (Years)

45

40

25

20

35

30

5

0

15

10

TP20 TP35 J35 J44 TP50 J50 TP70

J70 J80 J100 J120 J150 J175 J250 J>300

African annual fleet utilization African Fleet Average Age

Source: Ambraer, 2006

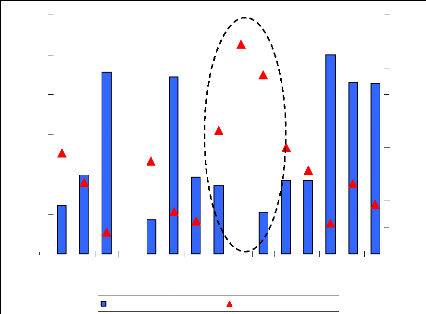

The average annual utilization is 1167 hours per aircraft. There

is a strong correlation between fleet utilization and fleet age (Coefficient of

correlation equal to «- 0.8»).

Figure 2.7: African fleet Evolution from 2003 to

2023

392

Growth

309

Replaced

332 Stay

60

641 aircraft

701

Source: Airbus, 2005

Airbus estimates that African airlines will take delivery of

about 641 new aircraft to replace the current fleet or to sustain growth

(Figure above).

2.3.4 Performance

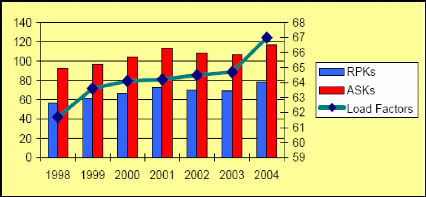

Figure 2.8: RPK, ASK (Billion) and Passengers load

factors in Africa

Source: AFRAA, 2005

Load factors, RPK and ASK are improving. But the overall

industry's health remains critical in Africa. Load factors may look remarkably

high, but they highlight the airlines' dilemma in the African operating

climate. The problem is that break even load factors remain higher.

Financial Performance

A sample of 8 airlines serving ASECNA region, comprising South

African Airways, Royal Air Maroc, Ethiopian Airlines, Kenya Airways, Air

Mauritius, Bellview airways, and Tunisair, made a net profit of over $200

million in 2005 (AFRAA, 2005, p.4). These are encouraging and remarkable

results in a world where airlines made huge losses in the recent past But they

do not reflect the real picture of the industry's performance. Most airlines,

some very small, some bigger, are facing serious difficulties.

Excessive debts, uncoordinated operating networks,

liquidation, bankruptcy, are examples of discrepancies generally observed

(African Union, 2005). Airlines post very poor financial results. The

issue of profitability is crucial in the region: as the market

is narrow; it is difficult for local airlines to raise the necessary investment

required by the standards of modern airlines. These airlines often

operate the same routes. That competition leads to a price war resulting merely

in weakening the economic health of these companies which have difficulties in

covering their operating costs. Air Afrique6 best

represents the airline industry's situation in the area. Air Afrique

officially lost 194 million dollars between 1984 and 1996. It almost

never made significant profit. In 2002, after years of financial crisis, the 11

states that owned the pan-African airline decided to file for bankruptcy. The

Bankruptcy came after the failure of a restructuring plan brokered by the World

Bank.

The Yaoundé treaty countries have revised their

national carriers by designating them as the flag carriers. But they are left

under the control of private interests, like Air Ivoire, Air Senegal

International, Toumaï Air Chad... etc. Cameroon Airlines and Air Gabon,

once the two leading carriers in the region, are now being liquidated or

privatized.

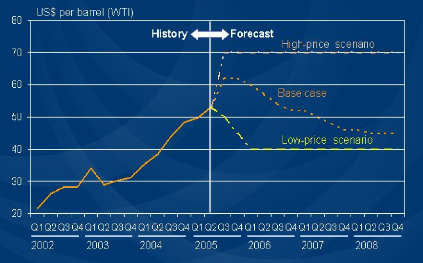

High Fuel prices

Fuel price is constantly rising. Fuel represents on average 25

per of operating costs. One

barrel costs on average 70$ world wide and up to

90$ in Africa (2005). The trend is

6 Air Afrique was established in 1961 to provide

passenger and cargo service within the 12 West African Nations of Benin,

Burkina Faso, Central African Republic, Cote d'Ivoire, Congo, Mali, Mauritania,

Niger, Senegal, Chad, Togo & Guinea Bissau.

expected to last. These sky-rocketing fuel prices are devastating

the industry. As airlines are struggling to improve their bottom lines, fuel

efficiency is critical.

Figure 2.9: Trend in Aviation fuel cost

Source: Airbus, 2005

Yields and Unit Costs

Figure 2.10: Yields and Unit costs in Key

markets

14,0

|

12,0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10,0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8,0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6,0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0,0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Europe Southern Europe Western Within Europe North Atlantic

Africa Africa

Yield Unit Cost Yield Cost Margin

Source: Airbus, 2005

Yields are declining and the margins remain low. The Southern

Africa - Europe market has the lowest unit cost but also the lowest yields, and

the lowest margins. Europe - Western Africa is a healthy market for efficient

airlines, mainly European, with relatively high yields. Yields are also low in

the domestic market. The industry is not expecting a significant improvement of

yield.

Most African airlines are inefficient. This results into high

unit costs as the figure below shows it. These airlines possess old fleets

which are highly oil-consuming. High unit costs reflect low aircraft

utilization rates, high maintenance, rental and insurance costs. High air

navigation and airport unit costs reflect their old avionics, and their low

aircraft utilization.

Figure 2.11: African Airlines 7 Operating

costs (Unit cost $ per tonne per Km)

0,5 0,4 0,3 0,2 0,1

0

0,6

Fuel & Oil Flight Equipment Airport and Navigation

Charges

Avg inefficient Airline Avg Efficient Airline Avg Efficient

Worldwide

Source: Airbus, 2005

7 Flight Equipment comprises maintenance, insurance,

and rental. The others operating expenses are not mentioned here. But it's

interesting to note that administration unit costs for non efficient airlines

are extremely high, almost twenty times higher than an efficient airline' unit

costs.

|