4.2.3 ROA

4.2.3.1 ROA Tested by Time and Specialization

We applied the same tests for ROA than for ROE. The time effect

was first tested as well as

specialization to see if it was necessary to

isolate their effects on the ROA. The results were very

similar than for the

ROE, which is really logical as ROE and ROA have the same numerator. Again,

the

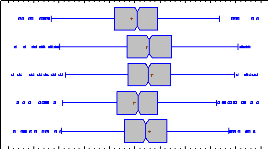

box and whisker plot in Figure 21 illustrates that year 2006

and 2009 were bad in terms of results for farming in Isère with ROA

median close to 1%, which is lower than the 1.5% inflation in 2006 (Le

Monde.fr, 2007).

Kruskal-Wallis Test for ROA by YEAR

|

YEAR

|

Sample Size

|

Average Rank

|

|

2006

|

568

|

1253,72

|

|

2007

|

568

|

1552,39

|

|

2008

|

568

|

1545,22

|

|

2009

|

568

|

1269,77

|

|

2010

|

568

|

1481,39

|

Test statistic = 73,6591 P-Value = 0 Mood's Median Test

for ROA by YEAR Total n = 2840

Grand median = 0,034619

|

YEAR

|

Sample Size

|

n<=

|

n>

|

Median

|

90,0% lower CL

|

90,0% upper CL

|

|

2006

|

568

|

339

|

229

|

0,00945275

|

-0,000555481

|

0,0218933

|

|

2007

|

568

|

242

|

326

|

0,0570648

|

0,0460463

|

0,0689174

|

|

2008

|

568

|

248

|

320

|

0,0528593

|

0,0436125

|

0,0621654

|

|

2009

|

568

|

327

|

241

|

0,0121847

|

0,000872383

|

0,0184358

|

|

2010

|

568

|

264

|

304

|

0,044225

|

0,0338877

|

0,0561194

|

Test statistic = 58,6901 P-Value = 5,46618E-12

B-andW hier P

Figure 21 : Box and whisker plots with median notch for

ROA by years (means are shown with a red cross)

Therefore, we had to isolate the time effect to isolate its

effect on the ROA.

Regarding the effect of specialization, once again the

P-Values were really low, illustrating that we cannot reject the hypothesis

that medians are significantly different at 99% confidence. The two tables of

the Kruskal-Wallis and Mood's median tests illustrate that cattle's ranching

presented significantly lower results than all other production in

Isère.

Kruskal-Wallis Test for ROA by SPECIALIZATION

|

SPECIALIZATION

|

Sample Size

|

Average Rank

|

|

Dairy production

|

705

|

1487,12

|

|

Cattle ranching

|

225

|

1124,15

|

|

-0i4 -0i3

-0i

Grains production

|

630

|

0i2

1494,56

|

|

Diversified production

|

RO

1280

|

1399,45

|

Test statistic = 40,0263 P-Value = 1,05194E-8

Mood's Median Test for ROA by SPECIALIZATION

Total n = 2840

Grand median = 0,034619

|

SPECIALIZATION

|

Sample Size

|

n<=

|

n>

|

Median

|

90,0% lower CL

|

90,0% upper CL

|

|

Dairy production

|

705

|

331

|

374

|

0,0427384

|

0,0344119

|

0,0510433

|

|

Cattle ranching

|

225

|

153

|

72

|

-0,00207533

|

-0,0192198

|

0,012193

|

|

Grains production

|

630

|

292

|

338

|

0,0464268

|

0,0350341

|

0,0583288

|

|

Diversified production

|

1280

|

644

|

636

|

0,0337455

|

0,0277409

|

0,0419674

|

Test statistic = 35,1914 P-Value = 1,10992E-7

Therefore, we had to isolate the effect of specialization also on

ROA. The tests were performed for each specialization and each year

separately.

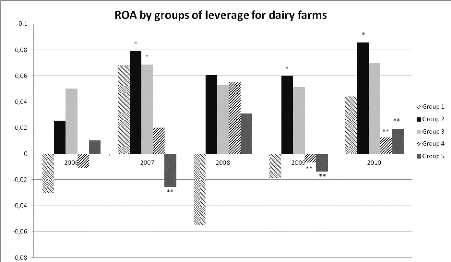

4.2.3.2 ROA for Dairy Producers

The farms analyzed here are the same than the ones for the ROE

for dairy producers: 141 dairy farms of Isère. Figure 22 presents the

results of the different tests performed to compare the median ROA for dairy

farms between 2006 and 2010. The results are close to what can be observed for

the ROE: groups 2 and 3 seem to over-perform the other groups.

Figure 22 : ROA for each year and each group of leverage

for dairy producers * means significantly higher than **

For year 2007, the group 2 and 3 are significantly better than

the group 5. For 2009 and 2010, group

2 is significantly higher than group 4 and 5. Group 1 median on

the contrary is lower than group 2 or

3 for all years, and has the lowest median of all groups in

2006, 2008 and 2009. We cannot affirm that this difference is significant as

the standard deviations are really high for group 1 (Appendix 11 page 103).

However, these elements are clear signs of financial distress.

|