1 Significance of the Research

«Risk is like love; we all know what it is, but we don't

know how to define it»

J. STIGLITZ

According to Allen, Myers & Brealey (2008, pp. 966-967)

the capital asset pricing model (CAPM) and the Net Present Value (NPV) are ones

of the most important concepts in finance. The CAPM allows investors to

identify the non-diversifiable risks, by measuring the impact of a change in

the aggregate value of the overall economy on the value of their investments.

The NPV on the other side helps managers to choose between different projects,

or even to choose to kill or not a project. The CAPM relies on the calculation

of betas, and NPV relies on the choice of the discount factor. However, there

are many ways to evaluate this discount factor. First, when a manager has many

options or projects, he can set the discount factor at the opportunity cost of

capital which is the profitability of the best project to evaluate each

project. But this method does not take into account the risk associated with

each projects and is not helpful when a manager has only one project, or when

he just wants to evaluate the economic profitability of its company at a fair

market price. In the last case, the appropriate way to set the discount factor

is the CAPM and the calculation of the Weighted Average Cost of Capital (WACC)

formula (Brealey, Myers, & Allen, 2008).

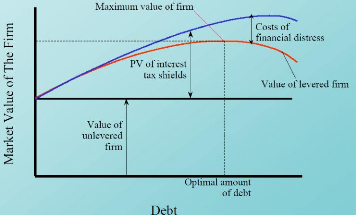

The WACC formula is of particular interest for our concerns,

because it gives a good estimation of the company cost of capital, which can be

reduced by financing the company using the optimal amount of debt as the

traditional approach suggests (Brealey, Myers, & Allen, 2008, p. 504).

Figure 1 illustrates this theory.

Figure 1: The optimal amount of debt to reduce the

company cost of capital Source: Principles of Corporate Finance

In the French farming industry, the NPV methodology is nearly

never used. When this method is

used, discount factors are chosen without

clear explanations, and we can observe important

variations between practitioners, even in the same business

unit. Is it because everyone considers that there is merely no risk in farming

business? However, such hypothesis does not make sense considering that a farm

manager needs to handle the weather risk, the crop's pests risk and the price

volatility risk. Is the WACC methodology not applicable in farming business, or

just the NPV method is not enough known and risks related to farming business

poorly assessed?

1.1 The Farming Business in France

French agricultural exportations represent USD 17.5 billion

(€ 13.2 billion) (Agreste, 2011; IMF.Stat, 2012), making France the

14th biggest exporter of agricultural products in 2010 (WTO, 2011).

Regarding food, France is the number three exporter in 2010, with USD 47.8

billion (€ 36.2 billion)(Agreste, 2011; WTO, 2011; IMF.Stat, 2012). France

is also the number one agricultural producer in Europe, with € 62.0

billion in 2009 over a global European production of € 327 billion

(Agreste, 2010). This high level of production and exportations is allowed by

two factors: productivity and surface. The total cultivated area (TCA) in

France represents 29.3 M ha in 2009, over the total 54.9 M ha of France

(Agreste, 2010), and wheat yields of 7.04 T/ha are 88% superior to the world

average of 3.74 T/ha (FAO, 2012).

However, the high level of production in France is not due to

the size of the farms, because the average farm in France is only 55 ha in 2010

(Agreste, 2011 b) against 350 ha for US farms (Ambassade de France à

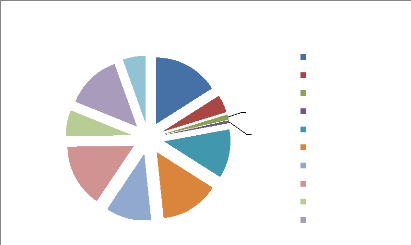

Washington, 2009). The diversity of production is really high in France as we

can see in Figure 1, as no production represent more than 16% of the overall

production in value.

Grains

Oilseeds and soyabean Sugar beet

Other plants

Fruits & vegetables Wines

Forage crops

Cattle

Poultry

Milk

Source: Insee 2011 in Billion euros

Agricultural production in France, 2010

4,1

10,1

8,8

7,3

3,6

10,5

9,4

7,8

2,8

0,8

0,4

Figure 2: Agricultural production in France,

2010

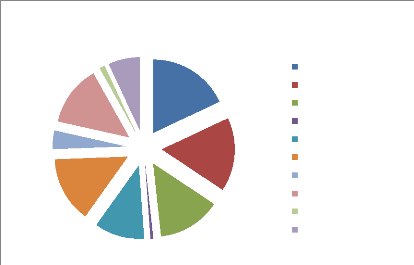

Regarding Isère, the production is also really

diversified as we can see in Figure 3. The overall production represents €

516 million for 2010, for a total GDP of around € 33 billion in

Isère for 2009 (CCI Rhône Alpes, 2011). The average size of the

farms in the department is smaller compare to France with only 38 ha in 2010

(Agreste, 2011 c), and the TCA in Isère (241 300 ha) represents only

0.8% of the national TCA.

3,0

Source: Agreste 2011 in Million euros

21,0

75,0

Agricultural production in Isère, 2010

69,0

6,0

57,0

36,0

72,0

93,0

84,0

Grains

Other plants

Fruits & vegetables Wines

Forage crops

Cattle Poultry Milk

Other animal productions Services

Figure 3: Agricultural production in Isère,

2010

|