1

Foreign Exchange Reserve Management in

Algeria:

Opportunities and Challenges.

Prepared by :

Abdelhamid MERGHIT

Lecturer of economics at

Mohamed Seddik Benyahia University, jijel ,Algeria

E-mail: merghit @

hotmail.com.

Abstract

Algeria's foreign exchange reserves vigorous growth has been

driven by higher hydrocarbon production, and record-high oil prices, especially

since2000,which by the end of 2010 were around US$162 billion (103 percent of

GDP). By contrast, the global economic crisis of 2008-09 has underscored the

importance of holding an adequate level of reserves, under which countries can

strengthen the ability to absorb external shocks.This paper analyzes Algeria's

foreign reserves management policy in recent years, especially in light of the

global economic crisis. It reviews some of the major stands of the recent

debate about whether part of the reserves should be infected by the

implications of this crisis.Hence, Traditional Measures for Assessing Reserve

Adequacy are utilized to show whether Algeria's reserve holding are still in an

adequate level from a precautionary perspective.An important finding of the

paper is that Algeria current levels of foreign reserves are still comfortable

and safe, as it exceeds all international norms and standards. However,the

paper emphasized that sound reserve management policy,is essential for helping

Algeria to promote policies and practices that contribute to stability and

transparency and to reduce external vulnerabilities.

2

1. introduction

The oil sector has been a dominant feature of Algeria's

economy for decades making it vulnerable to changes in world oil markets

.hydrocarbons in Algeria accounted for 95percent of exports, 60percentof

government revenues, and 30percent of GDP.

The first decade of the 21st century was very positive for the

Algerian economy. During the past10 years, the economy recovered from the deep

socioeconomic crisis of the1990s. Between 2000 and 2010, real GDP and

nonhydrocarbon GDP grew respectively at an annual average of 3.7 and5.6

percent, whereas real GDP per head increased by 22 percent, and unemployment

fell from 29.5 percent to 10.2 percent.The recent economic growth has been

driven by higher hydrocarbon production and accelerating activity in services,

construction, and public works. The reasons for this success were prudent

fiscal and monetary policies, combined with a period of high oil

prices,contributed to build a comfortable financial position, with large

external reserves, substantial savings in an oil stabilization fund, and very

low public and external debt.

However, Algeria's foreign exchange reserves vigorous growth

has been driven by higher hydrocarbon production, and record-high oil prices,

especially since2000,which by the end of 2010 were around US$162 billion (103

percent of GDP). The Algerian reserve management policy has been in focus since

the onset of the credit crisis in the US financial markets and its contagion

effect on the other economies leading to global financial crisis during the

second half of 2008 and during 2009.Indeed, an important debate has begun as to

whether part of the reserves should be infected by the implications of the

global financial crisis. Furthermore, the global economic crisis has

underscored the importance of holding an adequate level of reserves, under

which countries can strengthen the ability to absorb external shocks.

The ambition of this paper is to shed light on the issue of

reserve management policy in Algeria, itsopportunities and challenges. It

also,analyzes Algeria's foreign reserves management policy in recent years,

especially in light of the global economic crisis.Hence, traditional measures

forassessing reserve adequacy are utilized to show whether Algeria's reserve

holding are still in an adequate level from a precautionary perspective. In

order to discuss these issues the present article is divided in to four

sections:Section1: present abrief exposition of the conceptual framework of

reserves management. Section 2 provides ananalysis of reserve adequacy in the

Algerian economy. Section 3 describes the framework ofreserve management and

practice followed by bank of Algeria, and reviews some of the major stands of

the recent debate about the Implications of the 2008finacial crisis. And

section4concludes.

2 . Foreign Exchange reserve management: A Conceptual

Overview

This section presents a brief exposition include some basic

concepts of foreign exchange reserves, and the risks associated with reserves

management.

2.1. The definition of Official foreign exchange

reserves

According to the international monetary fund, the Official

foreign exchange reserves«are those external assets that are readily

available to and controlled by monetary authorities for

3

direct financing of payments imbalances, for indirectly

regulating the magnitudes of such imbalances through intervention in exchange

markets to affect the currency exchange rate, and/or for other purposes»

[1].

It is worth noting that the official foreign exchange reserves

include foreign currency assets and gold, this later must be held by the

monetary authorities as monetary gold to be recognized as part of official

reserves.

Furthermore, these reserves are held to exercise the basic

function as shocks absorber in order to support and maintain confidence in the

monetary and exchange rate policies, including the capacity to intervene in

support of the national currency [2]

Moreover, Reserve management policy can defined as«the

process by which public sector assets are managed in a manner that provides for

the ready availability of funds, the prudent management of risks, and the

generation of reasonable return on the funds invested» [1].

Usually, the central banks laws defined the investment policy

of these reserves, and permits the following investment categories:

-deposits with other central banks and the Bank for International

Settlements; -deposits with foreign commercial banks;

- Investments in bonds/treasury bills, which represent debt

obligations of highly rated sovereigns and supranational entities;

- Dealing in certain types of derivatives. ; and

- Other instruments / institutions as approved by the Board of

the central Bank

In the majority of countries, the preservation of the long-

term value of the reserves in terms of purchasing power and the need to

minimize risk and volatility in returns, are the main principles governing the

foreign reserves management.

2.2. The most important risks associated with managing

foreign exchange reserves

The word Risk means the possibility of

financial or other losses arising from an entity's financial exposures and/or

the failure of its internal control systems. So, There should be a framework

that identifies and assesses the risks of reserve management operations and

that allows the management of risks within acceptable parameters and levels.

The risk management functions are aimed at ensuring

development of sound governance structure in line with the best international

practices, improved accountability, a culture of risk awareness across all

operations and efficient allocation of resources for development of in-house

skills and expertise.Typically, official foreign exchange reserves are faced to

a range of risk, including [3] :

a. Credit risk

Credit risk is defined as the potential that a borrower or

counterparty will fail to meet its obligation (loans or other financial assets)

in accordance with agreed terms. the investment of

4

foreign exchange reserves in bonds/treasury bills or Placement

of deposit with Bank for International Settlements is also considered credit

risk-free.

Credit risk has been in focus since the onset of the credit

crisis in the US financial markets and its contagion effect on other economies

leading to global financial crisis during the second half of 2008 and during

2009.

b. Market risk

Market risk arises on account of exchange rate and interest rate

movements. b.1.Currency Risk: Currency risk arises due to

uncertainty in exchange rates.

It also arises with an appreciation of the domestic currency

reduce the domestic currency value of international reserves.

b.2.Interest Rate Risk: The crucial aspect of

the management of interest rate risk is to protect the value of the investments

as much as possible from the adverse impact of the interest rate movements.

This risk involves the adverse effects of increases in market yields that

reduce the present value of fixed interest investments in the reserve

portfolio.

C/ Liquidity Risk

Liquidity risk involves the risk of not being able to sell an

instrument or close a position

when required without facing significant costs.

In other words it refers to the possible difficulties in

selling large amounts of assets quickly, in a situation where market conditions

are also unfavorable, resulting in adverse price movements. A highly liquid

portfolio is a necessary constraint in the investment strategy because reserves

need to maintain a high level of liquidity at all times in order to be able to

meet any unforeseen and emergency needs.

D/ Operational Risk

A range of different types of risks, arising from

inadequacies, failures, or nonobservance of internal controls and procedures

that threaten the integrity and operation of business systems[1]. This risk

includes: the risk of the collapse of the internal control systems, risk of

financial mistakes....

3. Evolution and Adequacy of foreign exchange reserves in

Algeria

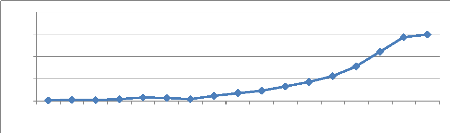

Algeria's foreign exchange reserves have grown (as Figure 1

indicates ) significantly since 1993. The reserves, which stood at US$ 1.5

billion at 1993 increased gradually to US$ 8 billion by 1997. Thereafter, the

reserves declined to US$ 4.4 billion by 1999.The growth continued in the first

half of the 2000s with the reserves touching the level of US$ 18 billion by

2001. Subsequently, the reserves increased to US $ 162.2 billion by 2010.

5

Figure1

Algeria Foreign Exchange Reserves1993-2010 (US $

billions)

200

150

100

50

0

1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005

2006 2007 2008 2009

Source: Bank of Algeria.

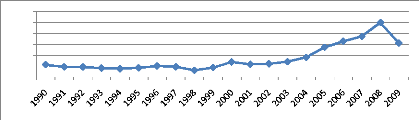

Algeria's foreign exchange reserves vigorous growth has been

driven by higher hydrocarbon production, and record-high oil prices, especially

since2000 (see figure2). The Algerian crude oil export unit value which was

22.6 US$/barrel in 1990, increased to 27.6 US$/barrel in2000, Thereafter the

oil price touching the level of100 US$/barrel in 2008.

Figure 2

Algerian crude oil export unit value (1990-2010)

(US$/barrel)

120

100

40

80

60

20

0

Source : International Financial statistics, IMF.

3.2. Adequacy of Reserves in Algeria

To make sure that the current levels of international reserves

are still comfortable and safe, there are four applicable measures for

assessing the adequacy of reserves [4] : - The traditional measure of import

covers of reserves. The optimal level is about three

months at least.

- The ratio of money supply to the foreign

exchange reserves. The optimal level is at least 20%.

- The ratio of short-term debt to the foreign exchange

reserves. The optimal level is at least 150%.

6

- Foreign exchange reserves should exceed at least the

non-resident deposits in foreign currencies, in the banking system.

This section provides a complete assessment of these measures in

the context of the Algerian economy.

3.2.1. Import Cover of Reserves

Table 1

Algeria's Import Cover of Reserves (1993-2009)

|

Years

|

Foreign Reserves (US $ billion)

|

Months of Imports

|

|

1993

|

1.5

|

1.9

|

|

1994

|

2.6

|

2.9

|

|

1995

|

2.1

|

2.1

|

|

1996

|

4.2

|

4.5

|

|

1997

|

8

|

9.4

|

|

1998

|

6.8

|

7.6

|

|

1999

|

4.4

|

4.6

|

|

2000

|

11.9

|

12

|

|

2001

|

18

|

14.9

|

|

2002

|

23.1

|

17

|

|

2003

|

32.9

|

18.1

|

|

2004

|

43.1

|

19

|

|

2005

|

56.2

|

26.5

|

|

2006

|

77.8

|

28

|

|

2007

|

110.2

|

27.4

|

|

2008

|

143.1

|

35.2

|

|

2009

|

148.9

|

36.4

|

Source: international Financial statistics, IMF.

The table 1 show that the import cover of reserves indicator,

which fell to a low of three months of imports at 1993, rose to 12 months of

imports at 2000, and increased further to 36.4 months of imports (or about

three years) at 2009.

7

It is clear that record-high oil prices have translated into huge

foreign reserves especially since 2000 .So , Algeria foreign exchange reserves

are in a very comfortable level in comparison to the optimal limit (three

months at least).

3.2.2. The Ratio of Money Supply to the Foreign Exchange

Reserves Table 2

The Ratio of Money Supply to the Foreign Exchange Reserves

(1993-2009)

|

Years

|

Foreign Reserves

(US $ billion) (1)

|

M2

(DZD billion) (2)

|

The exchange rate

(DZD/USD)

(3)

|

M2

(US $ billion)

(4)

|

The ratio

(1/4)

|

|

1993

|

1.5

|

625.2

|

23.36

|

26.76

|

0.05

|

|

1994

|

2.6

|

723.5

|

35.09

|

20.61

|

0.12

|

|

1995

|

2.1

|

799.5

|

47.68

|

16.76

|

0.12

|

|

1996

|

4.2

|

915.1

|

54.77

|

16.76

|

0.25

|

|

1997

|

8

|

1081.5

|

57.73

|

18.73

|

0.42

|

|

1998

|

6.8

|

1287.9

|

58.74

|

21.92

|

0.31

|

|

1999

|

4.4

|

1789.4

|

66.5

|

26.9

|

0.16

|

|

2000

|

11.9

|

2025.1

|

75.3

|

26.89

|

0.44

|

|

2001

|

18

|

2475.2

|

77.2

|

32.06

|

0.56

|

|

2002

|

23.1

|

2905.8

|

79.7

|

36.45

|

0.63

|

|

2003

|

32.9

|

3357.9

|

77.4

|

43.38

|

0.75

|

|

2004

|

43.1

|

3742.5

|

72.1

|

51.9

|

0.83

|

|

2005

|

56.2

|

4142.4

|

73.4

|

56.43

|

0.99

|

|

2006

|

77.8

|

4933.7

|

73.7

|

66.94

|

1.16

|

|

2007

|

110.2

|

5994.6

|

69.2

|

86.62

|

1.27

|

|

2008

|

143.1

|

6955.9

|

64.6

|

107.67

|

1.32

|

|

2009

|

148.9

|

7173.1

|

72.5

|

98.93

|

1.50

|

Source: author's calculations using data available from

bank of Algeria statistics.

The Data from the table above Indicate that the ratio of money

supply to the foreign exchange reserves increased slightly from 5 per cent at

1993 to 99 per cent as at 2005, the

8

ratio further increased to 150 per cent at the end of

2009.This results show clearly that the current foreign reserves level exceed

the international standards for this indicator (at least 20%).

3.2..3. The Ratio of Short-Term Debt to the Foreign

Exchange Reserves Table 3

The Ratio of Short-Term Debt to the Foreign Exchange Reserves

(1996-2009)

|

Years

|

Foreign Reserves

(US $ billion) (1)

|

Short-Term Debt

(US $ billion) (2)

|

The Ratio

(1/2)

|

|

1996

|

4.2

|

0.328

|

12.8

|

|

1997

|

8

|

0.162

|

49.38

|

|

1998

|

6.8

|

0.186

|

36.55

|

|

1999

|

4.4

|

0.195

|

22.56

|

|

2000

|

11.9

|

0.222

|

53.60

|

|

2001

|

18

|

0.199

|

90.45

|

|

2002

|

23.1

|

0.108

|

213.88

|

|

2003

|

32.9

|

0.146

|

225.34

|

|

2004

|

43.1

|

0.410

|

105.12

|

|

2005

|

56.2

|

0.707

|

79.49

|

|

2006

|

77.8

|

0.550

|

141.45

|

|

2007

|

110.2

|

0.717

|

153.7

|

|

2008

|

143.1

|

1.304

|

109.73

|

|

2009

|

148.9

|

1.492

|

99.8

|

Source: author's calculations using data available from

bank of Algeria statistics.

The table 3 show that t the ratio of short-term debt to the

foreign exchange reserves increased from 1280 per cent at 1996 to 22534 per

cent at 2003.later, the ratio decline to 9980 per cent as at 2009.

The table above indicates that this indicator has exceeded the

optimal level in accordance with international standards which is 150%.This

means that foreign exchange reserves in Algeria allow enough cover to its short

external debt and insure its safety and financial solvency.

9

3.2.4 . Non-Resident Deposits Cover of Reserves

It is important to note here, that the lack and incomplete

information on non- resident foreign currency deposits in the Algerian banking

system, pushed us to used the foreign currency deposits as a proxy in order to

calculate this indicator for the period 2000-2009.the results are presented in

the table4.

Table 4

Forgein Currency Deposits Cover of Reserves

(2000-2009)

|

Years

|

Forgein Currency Deposits

(DZD billion) (1)

|

The exchange

rate (USD/DZD)

(2)

|

Forgein Currency Deposits

(US $ billion) (3)

|

Foreign Reserves

(US $ bllion) (4)

|

The Ratio

(4/3)

|

|

2000

|

116.9

|

75.3

|

1.55

|

11.9

|

7.67

|

|

2001

|

154.4

|

77.2

|

2

|

18

|

9

|

|

2002

|

168.8

|

79.7

|

2.11

|

23.1

|

10.94

|

|

2003

|

170.8

|

77.4

|

2.2

|

32.9

|

14.95

|

|

2004

|

218.8

|

72.1

|

3.3

|

43.1

|

14.22

|

|

2005

|

231.7

|

73.4

|

3.15

|

56.2

|

17.84

|

|

2006

|

240.8

|

73.7

|

3.28

|

77.8

|

23.71

|

|

2007

|

229.5

|

69.2

|

3.31

|

110.2

|

33.29

|

|

2008

|

251.2

|

64.6

|

3.88

|

143.1

|

36.88

|

|

2009

|

265.7

|

72.5

|

3.66

|

148.9

|

40.68

|

Source: author's calculations using data available from bank of

Algeria statistics.

The table 4 shows that this indicator has marked strong

development. After it was covers more than seven times the deposits in hard

currency in 2000, it rose significantly in 2009 to reach more than 40 examples

of these deposits.

At the end of this section ,our analysis shows that Algeria

current levels of foreign reserves are still comfortable and safe, as it

exceeds all international norms and standards. So, this adequacy also allow for

Algeria to strengthen their ability to absorb external shocks.

4. Reserve Management In Algeria, and The Implications

of The 2008Finacial Crisis.

This section exposes first some available information related

to Algeria policy frameworks for reserve management. Secondly, it studies the

Impact of the global financial crisis of 2008 on Algeria foreign reserves, and

third it offer an evaluation to Algeria reserve management practices.

10

4.1. The Framework for Reserves Management in

Algeria

Given the absence of publications and official reports

undertaken by the bank of Algeria to inform the public yearly about the

management of foreign exchange reserves ,and its dealing with this issue

confidentially with the lack of transparency and disclosure.However,the main

aspects of the policy and operational matters relating to the management of the

reserves in Algeria, were presented in speech delivered by The Governor of the

Central Bank,Mr. Mohammed Laksaci in2011including the following areas[5] :

A/ Algeria has managed its official foreign exchange reserves

soundly and prudently, by adopting the following primary objectives:

- The preservation of the reserves capital value: in terms of

reducing the risk of loss in assets market value, and maintain a diversified

assets portfolio with high quality (i.e. the credit rating), and application of

appropriate practices to mitigate risks; - Maintaining a high level of

liquidity: through investments of these reserves in assets close to maturity or

that can re-sell quickly without loss of value; - Return optimization, with a

respect to safety and liquidity, which constitute the twin objectives of

reserve management in Algeria.

B/ the bank of Algeria permits the following investment

categories:

deposits with other central banks and the Bank for

International Settlements (BIS),and deposits with high rating quality foreign

commercial banks .

C/ The demands placed : in this regard, 98 percent of

investment operations of foreign reserves in the US and Europe were proceeded

in the form of sovereign bonds portfolio, which Algeria has bought between 2004

and 2007 when the international interest rates were high.

D/The interest rate of the aforementioned bonds hit 3 percent

in 2010, a bit lower than the rate recorded in 2008 and 2009.

E/ Algeria has invested only 1.75 percent of its foreign

exchange reserve in deposits with foreign commercial banks, contrary to

previous years when it used to invest up to 20 percent . This investment

framwork reflect the diversification strategy undertaken by Algerian

authorities since2004 in order to secure the reserves from external shocks.

While safety and liquidity constitute the twin objectives of reserve management

in Algeria, return optimization becomes an embedded strategy within this

framework.

F/ the reserves investment policy include the selling of

Foreign Currency Assets that are maintained as a multi-currency portfolio

comprising major currencies, such as, US dollar, Euro. In 2010 for example: the

dollar represent 47.96%,and 41.38% for the euro. This diversification of

currencies, countries and institutions is part of the policy of securing these

assets

G/ The Bank of Algeria has established an institutional

framework for managing foreign reserves, in order to face world interest rates

historical decline, especially after the global financial crisis of 2008.in

this context Algeria has adopted a prudent approach in the

11

management of its reserves since the global financial crisis

2008 and, this policy has proven its effectiveness because of the investments

non-affected during the period of crisis.

H/ according to the bank of Algeria 2010 report, Algeria has

collected $4.60 billion in 2010 from investing exchange reserves abroad,

comparing to $4.74 billion in 2009 and $5.13billion in 2008, $3.8billion in

2007 and $2.42billion in 2006 [6] .

4.2. Algeria's Foreign Reserves and the Implications

of The 2008 Global Financial Crisis

Many observers to Algeria economic situation said that

Algeria, may not be affected by the2008 financial crisis, because of several

external and internal factors.According to the International Monetary Fund,

Algeria's prudent fiscal and monetary policies contributed to maintaining

inflation low, and, combined with a period of increasing oil prices, allowed

Algeria to build a solid financial position, with large external reserves,

sizable budgetary savings in an oil stabilization fund, and low public and

external debts. The support to economic growth, which helped to weather the

impact of the global crisis in2009, should not be withdrawn too quickly. The

prudent macroeconomic management of the past decade has given Algeria an

important margin to face external shocks and absorb sharp falls in hydrocarbon

prices. However, the global crisis also showed Algeria's financial

vulnerability to prolonged periods of low oil prices. At the same time, the

authorities should remain vigilant about risks of potential inflationary

pressures [7].

Other Algerian economists like the former Ministers of Economy

Mr.Hocine Benissad and Mr.abdellatif Benachenhou , found that Algeria is

currently far from the international turmoil because of the following reasons[8

,9] :

(i) Algeria good external solvency

The record-high oil prices since 2001 have translated into huge

current account surpluses, soaring foreign reserves. So, the authorities were

able to guard against external shocks, by proceeding to the prepayment of its

external debt. This situation leads to a significant drop in foreign debt, and

strengthened Algeria external solvency, through which Algeria is currently far

from the blow of the crisis.

Furthermore, taking advantage of the steady rise of the

Revenue Regulation Fund (established in 2000 by the government), estimated in

2008 at 4,200 billion dinars and foreign currency reserves have reached $ 135

billion in late October2008, Algeria was able to acquire its external solvency

until 2015.

(ii) Algerian financial system disconnected from the

international financial center The Algerian financial system is

dominated by the banking sector which accounts for 93 percent of total

financial system assets. Public banks continue to overwhelm the system,

representing 90 percent of total banking assets. The insurance sector is

insignificant account for less than 3 percent of total financial system assets.

However, lending by state-owned banks, mostly to public entities, still

dominates financial intermediation. financial markets

12

remain in their infancy because of highly opaque financial

information, banks' inability to provide investors with information, and small

institutional investors[10].

Unlike the various emerging economies opened to international

financial markets, Algeria restrictions and controls are maintained on many

capital account payments and transfers. So , the Algerian financial system

remain disconnected from the international financial center and as result

insulated from the global financial crisis contagion effects, which spread

rapidly to various international banks through the mechanism of

"securitization".

(iii) The safety of Foreign exchange reserves invested

abroad

The question of the impact of the global financial crisis on

foreign exchange reserves back to their forms of investment. Generally, these

deposits are available in principle paid or subscription of securities. Unless

the custodian from slipping into bankruptcy, deposits are not at risk of not

returning. As for the underwriting of government bonds (like U.S. Treasury

bills or French), their repayment may be not a concern. The only major concern

to have, thanks to this crisis, could make the volatility of exchange rates.

Exchange rates volatility may bring about losses. But this concern is not new,

it is part of the operation of the foreign exchange market, and foreign

exchange dealers of the Bank of Algeria are prepared for this type of

turbulence.

Despite that international reserves stood at a very

comfortable level, prudent management of these reserves remain highly necessary

,because they are the result of an exogenous factor, which is the price of oil

which has been unstable due to soaring speculation stakeholder unregulated,

uncontrolled markets... Algeria s foreign exchange reserves are so fragile.

(iv) The use of oil Stabilization Fund to balance the

budget Against a background of volatile oil revenues, the attainment

of a growth path with a balanced industry structure would require the

implementation of a prudent fiscal policy strategy that smoothes government

expenditure over time, with the aim to minimize fluctuations in domestic

absorption.

In this regard the Revenue Regulation Fund (oil stabilization

funds) that the government had the wisdom to create in 2000 play an important

role in dealing with the economic consequences of natural resource booms, to

ensure that government savings are accumulated at the fund in periods of strong

oil revenues, would be essential, to balance the state budget in period of oil

price decline.

Algeria s2008 budget stand with oil at $ 37 ,and the balance

of the budget of 2009 was provided with a barrel to 60 dollars, but if the

price drops to $ 37( the reference price of the2009 Budget Law), the 2009

budget envisages the use of Revenue Regulation Fund , estimated in 2008 at

4,200 billion dinars to balance the state budget and cover investment projects

underway. The Revenue Regulation Fund will hold for three years, so there is no

fiscal risk until 2012.

13

(v). The non Setting Up of sovereign wealth funds

Many oil-producing countries has accumulated enormous reserves thanks

to the record-high oil prices.but these countries don't have the ability to

absorb this soaring foreign reserves at the level of their economies, because

to the lack of diversified production system on a competitive basis and the

absence of any industrial policy. However, the best way to prepare the post-oil

stage is the Setting Up of sovereign wealth funds .

Sovereign wealth funds for these purposes are separate pools

of international assets owned and managed (directly or indirectly) by

government to achieve various economic objectives, such as stabilization of the

macro economy or contributing to a process of saving and intergenerational

wealth transfer. Sovereign Wealth Funds are special purpose investment vehicles

to generate higher returns[11].

Although security is never absolute, under the global

financial crisis of 2008, the sovereign wealth funds suffered heavy losses

when, for example, companies - which they held shares - experienced a severe

market value devaluation. Some of them continue to count their losses while

others have scaled back their investment plans. In the case of Algeria, it was

far from these consequences because it doesn't create such sovereign funds.

4.3. The main shortcomings of Algeria's foreign reserves

management policy

The main potential issues and shortcomings raised by Algeria's

management of its

international assets can consider the following

points:

-The Lack of transparency and disclosure in the reserves management

policy ,due to the absence of data and annual reports an operational matters

relating to the management of the reserves ,especially: currencies,

instruments, issuers and counterparties , earnings ,losses.Its appear that

Algeria deals with reserve management file as state secrets, despite, the Money

and credit Act gives the Bank of Algeria Governor the responsibility for the

conduct of exchange reserves.

- The absence of legal framework for the management of the

country's Gold reserves notably:gold holdings, the purchase and sales

operations, the deposits custody, the rate of

earnings on gold...

- The diversification strategy in the

deployment of foreign exchange reserves include only the portfolio currency

composition, but the investment policy focus on The safest reserve asset i.e.

treasury bills, which pays the lowest rates of return.

- Despite that Sovereign Wealth Funds have become important

forms of external assets and its role in generate higher returns and developing

the national industrial policy through the acquisition of the high technology.

The Algerian authorities still reject the idea of Setting Up of sovereign

wealth.

-The management of foreign reserves by the Algerian government

focuses on the short-term vision, animated by a desire to provide liquidity to

cover the years of importation,which

14

means the lack of strategic vision (the new trends: from

liquidity to return) in the management of these reserves.

- The framework for the risk management practices followed by

the Bank of Algeria and the strategy for managing and controlling the exposure

to financial and operational risks associated with deployment of reserves are

absent.

- It seems that Algeria's Foreign reserves suffer from the

phenomenon of depletion because of the imports bill, which increased

dramatically to $ 40 billion over two years (2009/2010) . given that the most

indicators of the Algerian economy such as economic growth, demographic growth,

inflation, consumption, unemployment, productivity and the limited absorptive

capacity of the Algerian economy( $ 15 billion annually) did not change

significantly during the period (2004/2009) and therefore, cannot explain this

excessive increase in imports, which grew during the same period by 300%.

5.Conclusion

At the end of this paper, some recommendations are presented

as conclusion, intended to strengthening Algeria policy frameworks for reserve

management so as to help increase its resilience to shocks that may originate

from global financial markets .these recommendations includes the following

areas:

-Algeria reserve management policy should ensure the

development of sound governance structure in line with the best international

practices, improved accountability, a culture of risk awareness across all

operations and efficient allocation of resources.

-The bank of Algeria must apply stringent credit criteria for

selection of counterparties. And the financial strength of counterparties must

constantly under watch in order to assess whether counterparty's credit quality

is under potential threat.

-The bank of Algeria should make available in the public

domain data relating to foreign exchange reserves, its operations in foreign

exchange market, position of the country's external assets and liabilities and

earnings from deployment of foreign currency assets and gold through periodic

press releases of its weekly statistical supplements, monthly bulletins, annual

reports, etc...

- In order to encourage transparency and disclosure in the

reserves management policy it will be necessary the setting up of an entity at

the bank of Algeria responsible for reserve management ,named for example " the

department of external investments and operations " . This entity may also have

a range of policy responsibilities and functions that focus on design of

appropriate reserve management policy in accordance with best international

practices .

- The Bank of Algeria must closely monitors the portion of the

reserves which could be converted into cash at a very short notice in order to

meet any unforeseen or emergent needs. -To insure the following of

international best practices on transparency in monetary and financial

policies, the bank of Algeria should adopted the Special Data Dissemination

Standards (SDDS) template of the IMF [12] ,in order to provide detailed data on

foreign

15

exchange reserves to the public. Such data should be available

on monthly basis on the central Bank's website.

- Thinking about the the best way to prepare the post-oil

stage, to transform the Nonrenewable oil wealth to other forms of renewable

wealth on the ground, through the using of these huge foreign reserves to

diversify the production system on a competitive basis (in price and quality),

this diversification is also the guarantee of greater economic and

political independence.

- Given that the foreign reserves

are a public savings, our believe is that the framework for its deployment must

be in accordance with the Algerian people religion (which is Islam) However, it

should respect the Islamic finance principle, where the interest rate is

prohibited.

References

[1] International monetary fund.(2004). Guidelines for

Foreign Exchange Reserve Management. Washington, DC: International

monetary fund.

[2] Mudher, M. S.(2009,June). Official foreign exchange

reserves management tasks and the national economic security. Iraq

Central Bank working paper. (Original work published in arabic)

[3].Reserve Bank of India.(2009). Half Yearly Report on

Management of Foreign Exchange Reserves April - September.

Department of External Investments and Operations, Central Office , Mumbai.

[4] International Monetary Fund. (2000). Debt- and

Reserve-Related Indicators of External Vulnerability, Retrieved

from

http://www.imf.org/external/np/pdr/debtres/index.html

[5] Laksaci, M.(2011,October 16). Développement

économiques et monétaires en 2010, et éléments

d'orientation du premier semester 2011. Retrieved from

http:// www.bank of

algeria.dz.

[6] Bank of Algeria.(2011). Evolution économique et

monétaire en Algérie en 2010. Retrieved from

http://www.bank of

algeria.dz

[7]International Monetary Fund.(2011, February). Algeria: 2010

Article IV Consultation-- Staff Report, IMF Country Report No. 11/39.

Washington, DC.

[8]Benissad, H .(2008,december 5). Les avoires exterieurs

officiels ne sont exposés qu'aux pertes de change

.ELWATTAN, p.5.

[9]Benissad, H. & Benachenhou A.(2008,december 6).

l'impact de la crise financière mondiale sur

l'Algérie. La Tribune, p.4.

[10]World Bank. (2004, July). Algeria Financial Sector

Assessment. Retrieved from:

http://www.world bank.org/

16

[11]Udaibir, S. D., Mazarei, A., & Hoorn, H.V.

(Eds.).(2010). Economics of sovereign wealth funds: issues for

policymakers., Washington, D.C: International Monetary Fund.

[12] Kester,A.Y.(2000,june) .Improving the Framework for

Reporting on International Reserves. Finance and development , 37

(2).