C/ Liquidity Risk

Liquidity risk involves the risk of not being able to sell an

instrument or close a position

when required without facing significant costs.

In other words it refers to the possible difficulties in

selling large amounts of assets quickly, in a situation where market conditions

are also unfavorable, resulting in adverse price movements. A highly liquid

portfolio is a necessary constraint in the investment strategy because reserves

need to maintain a high level of liquidity at all times in order to be able to

meet any unforeseen and emergency needs.

D/ Operational Risk

A range of different types of risks, arising from

inadequacies, failures, or nonobservance of internal controls and procedures

that threaten the integrity and operation of business systems[1]. This risk

includes: the risk of the collapse of the internal control systems, risk of

financial mistakes....

3. Evolution and Adequacy of foreign exchange reserves in

Algeria

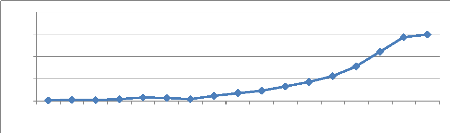

Algeria's foreign exchange reserves have grown (as Figure 1

indicates ) significantly since 1993. The reserves, which stood at US$ 1.5

billion at 1993 increased gradually to US$ 8 billion by 1997. Thereafter, the

reserves declined to US$ 4.4 billion by 1999.The growth continued in the first

half of the 2000s with the reserves touching the level of US$ 18 billion by

2001. Subsequently, the reserves increased to US $ 162.2 billion by 2010.

5

Figure1

Algeria Foreign Exchange Reserves1993-2010 (US $

billions)

200

150

100

50

0

1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005

2006 2007 2008 2009

Source: Bank of Algeria.

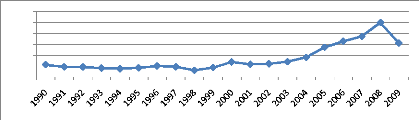

Algeria's foreign exchange reserves vigorous growth has been

driven by higher hydrocarbon production, and record-high oil prices, especially

since2000 (see figure2). The Algerian crude oil export unit value which was

22.6 US$/barrel in 1990, increased to 27.6 US$/barrel in2000, Thereafter the

oil price touching the level of100 US$/barrel in 2008.

Figure 2

Algerian crude oil export unit value (1990-2010)

(US$/barrel)

120

100

40

80

60

20

0

Source : International Financial statistics, IMF.

3.2. Adequacy of Reserves in Algeria

To make sure that the current levels of international reserves

are still comfortable and safe, there are four applicable measures for

assessing the adequacy of reserves [4] : - The traditional measure of import

covers of reserves. The optimal level is about three

months at least.

- The ratio of money supply to the foreign

exchange reserves. The optimal level is at least 20%.

- The ratio of short-term debt to the foreign exchange

reserves. The optimal level is at least 150%.

6

- Foreign exchange reserves should exceed at least the

non-resident deposits in foreign currencies, in the banking system.

This section provides a complete assessment of these measures in

the context of the Algerian economy.

3.2.1. Import Cover of Reserves

Table 1

Algeria's Import Cover of Reserves (1993-2009)

|

Years

|

Foreign Reserves (US $ billion)

|

Months of Imports

|

|

1993

|

1.5

|

1.9

|

|

1994

|

2.6

|

2.9

|

|

1995

|

2.1

|

2.1

|

|

1996

|

4.2

|

4.5

|

|

1997

|

8

|

9.4

|

|

1998

|

6.8

|

7.6

|

|

1999

|

4.4

|

4.6

|

|

2000

|

11.9

|

12

|

|

2001

|

18

|

14.9

|

|

2002

|

23.1

|

17

|

|

2003

|

32.9

|

18.1

|

|

2004

|

43.1

|

19

|

|

2005

|

56.2

|

26.5

|

|

2006

|

77.8

|

28

|

|

2007

|

110.2

|

27.4

|

|

2008

|

143.1

|

35.2

|

|

2009

|

148.9

|

36.4

|

Source: international Financial statistics, IMF.

The table 1 show that the import cover of reserves indicator,

which fell to a low of three months of imports at 1993, rose to 12 months of

imports at 2000, and increased further to 36.4 months of imports (or about

three years) at 2009.

7

It is clear that record-high oil prices have translated into huge

foreign reserves especially since 2000 .So , Algeria foreign exchange reserves

are in a very comfortable level in comparison to the optimal limit (three

months at least).

3.2.2. The Ratio of Money Supply to the Foreign Exchange

Reserves Table 2

The Ratio of Money Supply to the Foreign Exchange Reserves

(1993-2009)

|

Years

|

Foreign Reserves

(US $ billion) (1)

|

M2

(DZD billion) (2)

|

The exchange rate

(DZD/USD)

(3)

|

M2

(US $ billion)

(4)

|

The ratio

(1/4)

|

|

1993

|

1.5

|

625.2

|

23.36

|

26.76

|

0.05

|

|

1994

|

2.6

|

723.5

|

35.09

|

20.61

|

0.12

|

|

1995

|

2.1

|

799.5

|

47.68

|

16.76

|

0.12

|

|

1996

|

4.2

|

915.1

|

54.77

|

16.76

|

0.25

|

|

1997

|

8

|

1081.5

|

57.73

|

18.73

|

0.42

|

|

1998

|

6.8

|

1287.9

|

58.74

|

21.92

|

0.31

|

|

1999

|

4.4

|

1789.4

|

66.5

|

26.9

|

0.16

|

|

2000

|

11.9

|

2025.1

|

75.3

|

26.89

|

0.44

|

|

2001

|

18

|

2475.2

|

77.2

|

32.06

|

0.56

|

|

2002

|

23.1

|

2905.8

|

79.7

|

36.45

|

0.63

|

|

2003

|

32.9

|

3357.9

|

77.4

|

43.38

|

0.75

|

|

2004

|

43.1

|

3742.5

|

72.1

|

51.9

|

0.83

|

|

2005

|

56.2

|

4142.4

|

73.4

|

56.43

|

0.99

|

|

2006

|

77.8

|

4933.7

|

73.7

|

66.94

|

1.16

|

|

2007

|

110.2

|

5994.6

|

69.2

|

86.62

|

1.27

|

|

2008

|

143.1

|

6955.9

|

64.6

|

107.67

|

1.32

|

|

2009

|

148.9

|

7173.1

|

72.5

|

98.93

|

1.50

|

Source: author's calculations using data available from

bank of Algeria statistics.

The Data from the table above Indicate that the ratio of money

supply to the foreign exchange reserves increased slightly from 5 per cent at

1993 to 99 per cent as at 2005, the

8

ratio further increased to 150 per cent at the end of

2009.This results show clearly that the current foreign reserves level exceed

the international standards for this indicator (at least 20%).

3.2..3. The Ratio of Short-Term Debt to the Foreign

Exchange Reserves Table 3

The Ratio of Short-Term Debt to the Foreign Exchange Reserves

(1996-2009)

|

Years

|

Foreign Reserves

(US $ billion) (1)

|

Short-Term Debt

(US $ billion) (2)

|

The Ratio

(1/2)

|

|

1996

|

4.2

|

0.328

|

12.8

|

|

1997

|

8

|

0.162

|

49.38

|

|

1998

|

6.8

|

0.186

|

36.55

|

|

1999

|

4.4

|

0.195

|

22.56

|

|

2000

|

11.9

|

0.222

|

53.60

|

|

2001

|

18

|

0.199

|

90.45

|

|

2002

|

23.1

|

0.108

|

213.88

|

|

2003

|

32.9

|

0.146

|

225.34

|

|

2004

|

43.1

|

0.410

|

105.12

|

|

2005

|

56.2

|

0.707

|

79.49

|

|

2006

|

77.8

|

0.550

|

141.45

|

|

2007

|

110.2

|

0.717

|

153.7

|

|

2008

|

143.1

|

1.304

|

109.73

|

|

2009

|

148.9

|

1.492

|

99.8

|

Source: author's calculations using data available from

bank of Algeria statistics.

The table 3 show that t the ratio of short-term debt to the

foreign exchange reserves increased from 1280 per cent at 1996 to 22534 per

cent at 2003.later, the ratio decline to 9980 per cent as at 2009.

The table above indicates that this indicator has exceeded the

optimal level in accordance with international standards which is 150%.This

means that foreign exchange reserves in Algeria allow enough cover to its short

external debt and insure its safety and financial solvency.

9

|