|

September 2013

E-commerce capabilities assessment:

-Security of

e-payment systems-

Case of the Democratic republic of

Congo

Master Thesis

Author: Esperant NGONGO

Supervisor: Prof. Roberta Bernardi

Page | 2

Outline

E-commerce capabilities assessment: security of e-payment

systems. Case of the Democratic republic of Congo

Table of Content

Abstract Preface

Acknowledgement

1. Introduction 6

1.1. Introduction 6

1.2. Motivation of the subject 6

1.3. Problem statement 7

1.4. Research questions 7

1.5. Scope and limitations 7

1.6. Methodology 8

2. Literature review 9

2.1. Overview 9

2.2. Definition of e-commerce 9

2.3. Types of e-commerce 10

2.4. M-commerce 12

2.5. E-commerce capabilities overview 12

2.6. Information system capabilities 13

2.6.1. Introduction 13

2.6.2. Information system capabilities overview 13

2.6.3. Information system capabilities in the scope of

e-commerce 15

2.6.4. Information technology infrastructure for e-commerce

16

2.7. Information security capabilities for e-commerce 18

2.7.1. Introduction 18

2.7.2. Overview of the security of e-commerce 18

2.7.3. Overview of the security of e-commerce network 26

2.8. Securing e-payment systems for B2C e-commerce 28

2.8.1. Payment cards 29

2.8.2. Electronic cash 30

2.8.3. Stored-value card 31

2.8.4. E-checking 31

2.8.5. Security of mobile payment 33

2.9. Conclusion on the literature review 33

3. Research methodology 34

3.1. Introduction 34

3.2. Research design and justification 34

3.2.1. Introduction 34

3.2.2. Choice of the methodology 36

3.3. Data collection and sampling 37

3.3.1. Sampling technique 37

3.3.2. Sampling definition 38

3.3.3. Data collection method 39

Page | 3

3.4. Data analysis 40

3.4.1. Introduction 40

3.4.2. Data analysis method 41

4. Research findings 42

4.1. Response rate 42

4.2. Research findings 42

4.2.1. Working experience of respondents 42

4.2.2. Job position 43

4.2.3. E-payment services offered 44

4.2.4. Issues faced by e-payment systems 44

4.3. Specific findings for CIA security concept 45

4.3.1. Confidentiality 45

4.3.2. Integrity 46

4.3.3. Availability 48

4.4. Summary 49

5. Conclusion and recommendations 50

5.1. Introduction 50

5.2. Conclusion 50

5.2.1. E-payment system 50

5.2.2. E-payment system security 50

5.3. Recommendations 52

5.4. Areas for further studies 53

5.5. Study limitations 53

6. References / Bibliography 54

7. Appendix 57

7.1. List of abbreviations 57

7.2. List of figures 58

7.3. List of table 58

7.4. Questionnaire 69

Statement of originality

In presenting this dissertation for assessment, I declare that

it is a final copy including any last revisions. I also declare that it is

entirely the result of my own work other than where sources are explicitly

acknowledged and referenced within the body of the text. This dissertation has

not been previously submitted for any degree at this or any other

institution.

Page | 4

Esperant NGONGO MBULI

Page | 5

Abstract

This research study investigates to what extend the e-payment

systems are secured in order to contribute to the development of e-commerce

capabilities in the Democratic Republic of Congo (DRC). This study has also

assesses the existence of adequate e-commerce capabilities in terms of

e-payment systems and how their security can be leveraged to really contribute

to their effective use in the electronic payment transaction.

The research uses the survey method with questionnaire based

on closed questions built from the checklist published by the International

Standards Organization (ISO) as framework for information security

assessment.

The major conclusion of this study is that some capabilities

for e-commerce such as e-payment systems are available in the country but their

security must be enforced and managed for the advert of e-commerce era which is

yet in its inception phase.

Acknowledgement

I would like to thank the following people who provided to me

significant support for the completion of my MBA program and this research,

namely:

- Professor Roberta Bernardi, my supervisor, she has been a

great source of advice and guidance in the development of this research and her

valuable

support on reading material was highly appreciated. Thank you so

much.

- My lovely wife, Tina who has been an important pillar and

source of motivation through my MBA program and during this research. Thank you

for your patience and lovely commitment shown.

- My children, Grace, Kelly, Joyce, Marie-Rose and Esperance

Junior to whom I missed during the time I was involved in my journey to MBA and

for the fun time sacrificed to the benefit of this research. This study is

dedicated to you as source of motivation and inspiration for your studies as

well.

- The professors at Robert Kennedy College who gave us

valuable intellectual foods and reading materials for the acquisition of

knowledge in Advanced Information Technology and Business Management. Thank you

for your devotion.

- Above all, the Mighty GOD for the blessing given to the

success of this achievement

Page | 6

Chapter 1: Introduction

I.1. Introduction

Modern electronic commerce (e-commerce) is one of the biggest

commercial activities using the internet as channel of diffusion. The advance

and continuing development of internet technologies in telecommunications and

mobile applications has propelled the growth of E-commerce. Consequently making

it much easier to do business over the internet and reach mass audiences

globally and even in remote places.

E-commerce is now part of our lives and companies trading via

the internet are exposed in a high speed changing environment where business

opportunities changed frequently, according to the customer needs and

technology innovations.

How this technology can be implemented in least developed

country with poor telecommunication infrastructure, poor electronic payment

systems, lack of regulation and capabilities in the subject matter?

Despite the fact that many studies focused on showing that

less developed countries face a lack of telecommunication infrastructures and

electronic payment systems, recent developments of mobile telephony in Africa

change the way e-commerce can be perceived in this part of World because of the

opportunities discovered in this emerged market.

So the question is not only about the infrastructures for

e-commerce, which really exist, but in term of the existence of capabilities

for e-commerce and how they can be leverage to develop the e-commerce.

I.2. Motivation of the subject

E-commerce is a new form of digital economy development where

no physical boundary and face-to-face interaction are necessary to do

commercial transaction.

In the Democratic republic of Congo (DRC), the fact that the

growth of mobile technology and the large penetration of mobile telephony

companies in the country, despite the fact that the telecommunication

infrastructure in not well developed, can constitute an opportunity for the

e-commerce development.

However, there is no research available to assess effectively

the capabilities readiness of the country for the development of e-commerce.

The aim of this work is to assess if adequate e-commerce

capabilities exist in the country and how they can be leveraged to the

development of e-commerce. The focus will be given to the payment systems and

their security.

I.3. Page | 7

Problem Statement

E-commerce is related to Internet technologies and electronic

payment systems which are not well developed in most of the least developed

countries like the Democratic republic of Congo (DRC). However, the development

of the mobile telephony market offers some opportunities of getting internet

access and m-commerce facilities in most of urban and suburban areas with high

concentration of population.

The objective of this work is to define how e-commerce can be

implemented in DRC taking into account all constraints of e-commerce

capabilities.

Because the internet access in only present in urban areas,

the research will focus only on companies located in such areas.

The poor penetration of the internet and the lack of

electronic payment systems can be recognized as a detriment to the development

of e-business in the country. Even if there is a regulation board for

telecommunication and information technology, there are no rules defined for

electronic commerce and electronic payment.

I.4. Research Question

Among many research questions which can be raised in the

e-commerce field in the developing country like DRC, the choice for this

research is to respond to the most fundamental question regarding e-commerce

capabilities.

Do adequate e-commerce capabilities exist in the

country and how to leverage them to the development of e-commerce? Does

adequate security of payment systems exist in order to promote online

payment?

I.5. Scope and limitation

This research in not intended to examine all capabilities

involved in the development of e-commerce. According to the actual stage of

telecommunication infrastructure development in the country, the adoption of

the mobile telephony system as primary telecommunication media and the

opportunity currently exploited by three major operators in mobile fund

transfer system, the scope of this work will be limited to the main

capabilities which are likely to be preponderant to an effective e-commerce

development.

The following capabilities will be covered by the study:

1. Information and communication technology (ICT) which will

include telecoms and computer infrastructure.

2. Payment systems capabilities which must be used for online

transactions.

3. Security of the identified payment systems which can be

used for the development of e-commerce.

Of course some aspect of regulation will be considered also as

governance capabilities.

Page | 8

The study will be limited to the capital city of the country,

Kinshasa, where there is a potentiality of e-commerce development according to

the fact it is the first business center in the country where most of big

businesses and banks have their head quarters.

Findings and recommendations will be then easily replicated to

the most of urban areas of the country where minimal capabilities are

available.

I.6. Methodology

There are no available statistics published in the country

about e-commerce; the e-commerce is not yet in inception phase. This work will

be among the first step in the research about the e-commerce development in the

country.

Therefore, the objective of the research can only be achieved

by collecting data from different available sources of information in areas

where e-commerce capabilities are likely to be present ; academic researches,

special journal in IS and web resources. The research will also use data

collected from survey via interviews of organizations which will be involved in

the e-commerce development, mostly banks, regulation board and Mobile

operators.

Page | 9

Chapter 2: Literature review

II.1. Introduction

This chapter will discuss e-commerce terminologies involve in

the good understanding of the key concepts of e-commerce like its definition,

forms and organization. It'll also provide a clear understanding of

capabilities which are necessary for the development of e-commerce.

There are a lot of reading resources available covering the

e-commerce subject but a very few manual about e-commerce capabilities have

been available for this research. Most of available information has been

collected through master or doctoral thesis and form special technological

journal.

II.2. Definition of e-commerce

Many authors defined e-commerce by designing a commercial

activity conducted by the use of internet and/or electronic systems (Turban et

al. 2008, Laudon and Laudon, 2006, Cobham, 2005).

Among the definitions chosen, Turban et al. (2008: p4)

describe e-commerce as «a process of buying, selling, transferring, or

exchanging products, services, and/or information via computer networks,

including the Internet».

The Laudon's used the term Internet and web for the business

transaction to define e-commerce (K. Laudon & J. Laudon, 2006), while a

year before Graham Curtis and David Cobham (2005, p212) defined e-commerce in

its broadest context as «any exchange of information or business

transaction that is facilitated by the use of information and communication

technologies».

In the same vision as Curtis and Cobham, Beynon-Davies (2002)

separate the concept e-commerce which constitute the exchange of goods and

services between businesses, individuals or groups by the use of Information

and Communication technology (ICT) and I-commerce which is the use of internet

technologies to enable e-commerce.

It means that the development of e-commerce couldn't be

possible without the development of ICT and specially the Internet technology

which is one of the key drivers for e-commerce development.

Page | 10

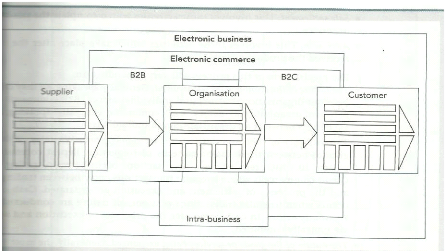

II.3. Types of e-commerce

It is better to know how e-commerce is classified to

understand the different business models provided by this new economy.

Turban et al. 2008, K. Laudon and J. Laudon, 2006, David

Cobham, 2005) classify electronic commerce by the nature or the way the

participants involve in the electronic transaction. According to this point of

view, three forms of e-commerce are identified:

1. Business-to-consumer e-commerce (B2C)

2. Business-to-business e-commerce (B2B)

3. Consumer-to-consumer e-commerce (C)

However, with the development of mobile and wireless

technologies, the use of e-commerce, which was primarily conducted through

fixed computers and networked terminals, can now be conducted wirelessly. This

new development gives a new concept of e-commerce called Mobile commerce or

m-commerce (Turban et al. 2008).

II.3.1. B2C e-commerce

It is an e-commerce between a company and its customers (Paul

Beynon-Davies, 2002). Turban et al. (2008) and Kenneth C. Laudon and Jane P.

Laudon (2006) also describe B2C e-commerce as retailing transaction of goods or

services from a business to individual shoppers.

In this category of e-commerce, customers are using ICT

capabilities to buy goods and/or services from businesses and making payment

online without intermediary.

This kind of e-commerce is the most suitable to the less

developed countries because of its ease of implementation. In fact, in this

e-commerce model the infrastructure is not so sophisticated like for the B2B

e-commerce which requires advanced technology for the interaction among

business partners.

In this model, customer needs just internet connectivity and

web browser (special program to read web page) to participate to e-commerce

transactions.

Page |11

II.3.2. B2B e-commerce

As it is cleared described in the designation, B2B e-commerce

involves participation of businesses or organizations in the e-commerce

transaction.

Turban & al. (2008: p219) defines B2B e-commerce as

«transactions between businesses conducted electronically over the

internet, extranets, intranets, or private networks».

This definition shows implication of advanced technologies

which are used in the B2B e-commerce to support and operate transactions among

businesses.

II.3.3. C e-commerce

C e-commerce is the form of e-commerce where participants to

electronic transactions are individuals, not businesses.

It is «e-commerce model in which consumers sell directly

to other consumers» (Turban et al. 2008, p400).

Because consumers can't have their own infrastructure to

implement a particular e-commerce infrastructure, this form of e-commerce in

conducted using auctions which are implemented by specialized

intermediaries.

Figure 1: form of e-commerce

Source Paul Beynon-Davies (2002, p 487)

II.4. Page | 12

Mobile Commerce (M-commerce)

The definitions of e-commerce given in previous sections

stated the use of ICT to conduct commercial transaction; these technologies use

fixed computer or network access terminal.

Turban et al. (2008, p431) defines Mobile commerce as

«any business activity conducted via wireless telecommunications network.

This includes B2C and B2B commercial transaction as well as the transfer of

information and services via wireless mobile devices».

The advert of Smartphones with full keyboard capabilities and

web browser application, coupled to the new standards of broadband mobile

telecommunication (3G and 4G) which offer large bandwidth on handheld

equipments make the technology mature to conduct business online with

mobility.

II.5. E-commerce capabilities overview

Technology plays a major role in the development of the

e-commerce. However, regarding the nature of the e-commerce activity, many

other capabilities must be considered for the development of e-commerce.

To better understand capabilities concept in e-commerce it is

good to have a clear understanding of e-commerce framework as described in the

figure below.

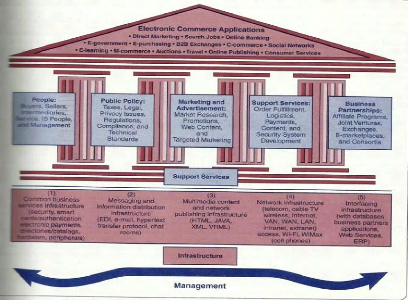

Fig 2. E-commerce framework. Source Turban et al. (2008, p7)

Page | 13

In this framework the e-commerce is represented like a

building with three main components:

- Roof: represents the e-commerce applications

- Walls: which sustain applications represent all support

services for the e-commerce

- Foundation: represents the e-commerce infrastructure.

All these capabilities must be managed and governed in a best

way for a successful e-commerce development.

For the context of this study, payment systems can be included

in the IT capabilities for the nature of the infrastructure used for the

payment systems. Their importance for e-commerce development motivates the

choice of studying it as particular capability because it is a vital part of

the e-commerce infrastructure.

II.6. Information system capabilities

II.6.1. Introduction

This section will present definitions of capabilities and

resources which are two concepts which will be used in this work regarding

capabilities.

Day (1994) and Grant (1996) cited by Abhay N. Misha and Ritu

Argarwal (2010) define capabilities as «firms capabilities, skills, and

accumulated knowledge that enable it to repeatedly perform task that create

value».

It emerges from this definition the concept of resource which

includes «all assets, capabilities, organizational process, attributes,

information knowledge, etc, controlled by a firm that enable the firm to

conceive and implement strategies that improve its efficiency and effectiveness

(Draft 1983)» (Barney 1991,p101) cited by Aurelio Raverini (2010).

II.6.2. Information system (IS) capabilities

overview

Resources and capabilities in information system concept can

be «termed as Information system capabilities» which are

«skills, competences and abilities, upon which the value of the physical

Information technology (IT) resource can be leveraged» (N.F. Doherty and

M. Therry, 2009, p4).

According to Collis, D. J.(1994) cited by T. Ravichandran and

C. Lertwomgsatien (2005), «capabilities are social complex routines that

determine the efficiency with which firms transform inputs into

outputs».

Page | 14

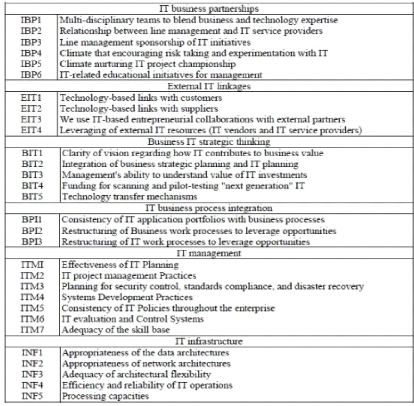

Figure 3. Initial structure of IT capabilities (Bharadwaj,

1999)

Source: A Raverini (2010, p87)

In his research A. Raverini (2010, p.99) gives a broadest and

complete definition of IT capability in these terms: «IT capability is the

capacity, diffused within the whole organization, to plan, use and manage the

resources based on IT-complementarily and jointly with the other resources and

capacities of the organization- in order to achieve a specific organizational

objective and obtain a competitive and sustainable advantage over

competitors».

Page | 15

II.6.3. Information system capabilities in the scope of

e-commerce

II.6.3.1 Overview of the information system capabilities

for e-commerce

According to the framework presented by Turban (Turban et al.

2008, p7), among the five (5) groups of infrastructures presented in his book,

the first category called «Common business services infrastructures»

includes; security, smart card/authentication, electronic payments,

directories/catalogs, hardware and peripherals.

From this framework, this study will focus on the security of

e-payment systems because it is the core of the electronic commerce capability

which allows the concretization of the transaction.

From this choice of e-payment systems as a prime focus of this

research, another implication is that it is not easy to talk about electronic

payment systems that are using IT capabilities (systems, software, and human)

without having a look at the way online transactions are to be secured in order

to enable effective e-commerce development.

That's why this particular aspect of the IT capabilities of

e-payment systems which consists on security of online payment system is the

focus of this research about e-commerce capabilities readiness in DRC.

The target of this research in the bank sector will be focused

on the following payment systems; online banking payment system and the local

(private) and international well known bank cards provided by local commercial

banks.

It must be understood that in the scope of this research, some

local banks are using well known international cards such as Visa and

MasterCard that are used worldwide as payment system (online and offline) and

therefore providing some confidence to the user because of their brand name

recognition and the existence of payment systems installed at the banks and

shops.

This study will also assess the security readiness of the

e-payments systems and any other online payment system proposed by local

commercial banks in order to leverage them for an effective e-payment system

for the development of e-commerce in RDC.

Also, as stated previously in this section, the advert of

mobile network with gsm operator providing money transfer facility via mobile

phone handsets, a new e-payment system is born in the country which is of big

interest on e-commerce development; mobile payment which is described below.

Page | 16

II.6.3.2 Mobile payment (M-payment)

The development of mobile network opens an opportunity to

mobile operators to provide money transfer and payment system facilities using

available communication credit loaded into the sim card.

Mobile phone users can then, as for the stored-value card,

store money as telecommunication credit in their mobile phone which can be used

to pay goods and services to merchants, participating as partners of mobile

operators.

In DRC, some mobile operators are working with banks to link

m-payment account to real bank account.

This payment system is used to pay salaries for public

administration's staff in areas without banking facilities.

Because this activity is not developed by the government;

regulation is the main concern for this payment system. However, in this study,

as for the other e-payment systems described in the research, security of the

m-payment system will be assessed for its effective participation in e-commerce

transaction.

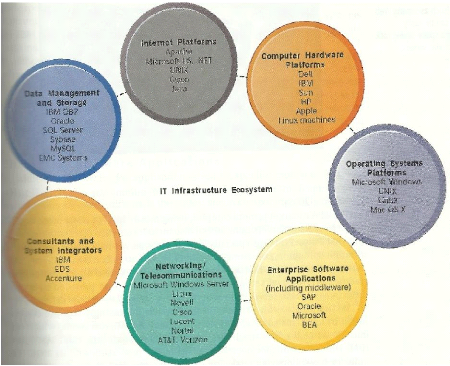

II.6.4. Information technology infrastructure for

e-commerce

E-commerce, as defined earlier in this work embedded new

processes which require necessary physical IT infrastructure, managerial and

organizational capabilities in order to succeed.

All definitions of e-commerce show its dependency to

information system infrastructure and processes to conduct business activities

online. There is an evident relationship between e-commerce capabilities and IS

infrastructure (Kevin Zhu, 2004).

P. Weill and M. Broadbent (1998) cited by Kevin Zhu (2004)

define IT infrastructure as a technology platform and information foundation

from which enterprise applications emanate and it includes «hardware,

software, networks, and data processing architecture».

E-payment systems will use IT infrastructure to enable

processing of payment transactions

Figure 4: IT infrastructure component.

Source: Kenneth C. Laudon and Jane P. Laudon, 2006, p185

Page | 17

Page | 18

II.7. IT security capabilities for e-commerce II.7.1

Introduction

There are many capabilities required and needed to implement an

effective e-commerce business, among which most important are:

+ Web servers hardware and software

+ Electronic commerce software

+ Electronic commerce security systems

+ Electronic commerce payment systems

II.7.2 Security of online payment systems used for

e-commerce

E-commerce security is a vast subject covering:

+ Securing online transaction

+ Securing clients computers and internet access devices like PDA

and smart

phone.

+ Securing communication channels between computers

+ Securing servers.

Security, in the context of e-commerce is an important attribute

and one of the key

elements for its adoption, that's why server infrastructure and

software used for e-

commerce need to be secured.

The security framework of the information technology which is

considered in this

research is ISO 27001 framework that presents eleven (11)

high-level objectives for

the security standards (Timothy P. Layton, 2007, pp77-113):

O Security policy

O Organization of information security

O Asset management

O Human resources security

O Physical and environment security

O Communications and operations management

O Access control

O Information systems acquisition, development and maintenance

O Information security incident management

O Business continuity management

O Compliance.

Page | 19

II.7.2.1 Overview of the framework for security and

control of Information system

For the security of information technology, protection of

information resources is defined through a set of standards for security and

controls published as norm by the International Standards Organization (ISO)

and the International Electro technical Commission (IEC), grouped in joint

committee, under the norm ISO/IEC 17799 which is the reference code of practice

about the security of information system (Kenneth C. Laudon and Jane P. Laudon,

2006 and Anthony Tarantino, 2008).

The definition of the international security management system

(ISMS) standard under the reference ISO/IEC 27001:2005 (called ISO 27001) in

replacement of the British standard institute code of conduct in IS security

«BS 77799-2:2002» inaugurates the new era of information security

management (Anthony Tarantino, 2008, p169).

ISO 27001 titled «Information technology -

security techniques - information security management systems -

requirements», is not a technical specification but a management

system which is a first of international security standards, defined by ISO

which have number series ISO 27000 (A. Tarantino, opcit, p172).

The ISO/IEC 17799:2005 (ISO 17799) later named ISO 27002, has

been developed under the title «Information technology - security

techniques - code of practice for information security

management» as a set of guidelines for the implementation of the

ISO 27001security standards.

According to ISO 27002, there are three fundamental attributes

of an information asset (data representing a value for an organization);

confidentiality, availability and integrity which can

be impacted by risks from a wide range of threats: fraud or criminal activity,

system failure, user errors, etc (A. Tarantino, 2008, p174).

For this research the concept of security of the information

is the one provided by ISO 27002: «information is characterized within ISO

17799» (ISO 27002) «as the preservation of:

? Confidentiality - Ensuring that information is accessible

only to those authorized to have access to it,

? Integrity - safeguarding the accuracy and completeness of

information and processing methods,

? Availability-Ensuring that authorized users have access to

information and

associated assets when required» (IT Governance Institute,

2006).

II.7.2.2 Security of online e-commerce transaction

The highest worry about e-commerce users is that their

personal information, especially credit card number, bank account details, can

be stolen when proceeding online transaction or on the server of the company

running the online business.

According to Timothy P. Layton (2007, p100), ISO 27001

controls about e-commerce include fraud, insurance, confidentiality,

and authorization to data access while the control related to online

transaction is related to «the security and protection of data and

information involved in network transactions».

II.7.2.3 Security Policy

Why security policy is important in the context of security of

e-payment systems?

As described above in this research, security of Information

system is defined within a framework of guidance and requirements developed by

ISO/IEC under the ISO 27001/2 framework for the development of an Information

Security System Management (ISMS).

Figure 5: Level of acceptable security for

e-commerce

Source: Gary Schneider, 2011, p443

Page | 20

Page | 21

The most important for the security policy development is to

make sure that answers can be provided to the following questions:

V' Who is accessing the site? => Authentication of

the user

V' Who is allowed to connect and access to the site?

=> Access control V' Who is granted access to information? =>

Confidentiality or security V' Who is allowed to modify information?

=> Integrity

V' Who or what causes a specific event to occur on

the system and when it happens? => Audit

These fundamental questions will be the drivers for en

effective security policy implementation for an e-commerce information

system.

II.7.2.4 Computer security overview

This research considers computer security in the context of

all kinds of threats that an information system can face that is able to

destroy abuse or corrupt the information: unauthorized access, use,

modification or deletion of information.

To protect against threat, countermeasure; «physical or

logical procedure that recognizes, reduces, or eliminates a threat», must

be taken to ensure that the risk associated to the so called threat is

mitigated. (Gary Schneider, 2011, p440).

In today's computer use, the big threat is called hackers or

crackers who are able to break security of information system and gain

unauthorized access to computers or servers to steal information or damage the

system.

II.7.2.5 Overview of the client computer security

Client computers (laptop and desktop) or wireless devices are

used to connect to the internet in order to participate to the e-commerce.

These client machines or devices must be protected against threats or harmful

programs contained in web sites.

In this section an overview of web sites contents which

represent a threat to the client computers such as cookies, web bugs, active

contents, java applets, java script, active control, and graphics or plug in,

viruses and worms will be discussed.

Cookies

In the context of security, the definition that describes well

cookie is provided by Turban (Turban et al., 2006, p.165) who defines a cookie

as «a data file that is placed on a user's hard drive by a remote web

server, frequently without disclosure or the user's consent that collects

information about the user's activities at the site».

This definition states clearly that a cookie is like a spy who

observes user's online activity, therefore susceptible to illegal activity on a

client machine.

Page | 22

For e-commerce, web server's cookies store useful information

about user activity such as shopping card information which will be required by

the payment processing system.

Web bugs

Turban et al. (2006) and G. Schneider (2011) identify web bugs

as «tiny graphics» which can be embedded in web pages or emails to

store cookies on a user's computer in order to monitor his activity on the

web.

Active content, java applets, active

control

G. Schneider (2011, p446) defines active content as

«program that are embedded transparently in web pages and cause action to

occurs», to extend the functionality of html.

In the context of e-commerce, active content permits for

example to place items in a shopping cart, calculate the total amount of the

invoice and deduct the tax, add shipping cost and any other fees automatically

when a user shop online.

Active content can be java applets, JavaScript, Vbscript and

active controls which are used on the web site to implement automation or

execution of some actions.

Activex control is to be associated to object on the web page

in which programs and properties have been embedded.

Active content, java applets, active control can implement

malicious instructions which can break security of the client computers.

Viruses, worms, antivirus

Virus is program that attaches itself to another program in

the computer to cause damage in the host computer every time when this

application program will be executed.

A worm is a «type of virus that replicates itself on the

host machine» to spread out the infection. (G. Schneider, 2011).

The countermeasure against virus and worm is antivirus

software installed on all computers and servers in the network.

Page | 23

Digital certificate, digital

signature

Like for the epistolary communication with signed letters or

documents to identify the sender by its signature, electronic communication

uses digital signature in place of the personal signature.

Digital signature uses the encryption technology to ensure

that only authenticated users can access to the resource.

Digital certificate or digital ID is defined by G. Schneider

(2011, p455) as «an attachment to an email message or a program embedded

in a web page that verifies that the sender or web site is who or what it

claims to be».

Digital signature and digital certificate are used to ensure

confidentiality of the transaction on the web site; they can help to ensure

secured online transaction for e-commerce.

II.7.2.6 Overview of the security of the communication

channel

Data packets flowing to the internet are not using the same

path to reach the server. Information sent over the net can be intercepted,

altered or deleted before it can reach the receiver.

E-commerce will face integrity, confidentiality and

availability threat inherent to the nature of the Internet as communication

channel.

Confidentiality threat

The main concern of confidentiality is to make sure that

information is protected against unauthorized disclosure, while the privacy is

concerned by the legal instrument and policy to ensure the protection of

private information.

The theft of sensitive information or personal data such as

credit card number, names, and addresses is one of the most important threats

for e-commerce. Therefore, e-commerce infrastructure must address this threat

with highest priority.

One of the technology solutions used to ensure data

confidentiality is the encryption tools and solutions.

What is the encryption?

In this study, the definition given by G. Schneider (2011,

p465) is considered: «Encryption is the coding of information by using a

mathematically based program and a secret key to produce a string of characters

that is unintelligible».

Encrypted information can travel around the internet to ensure

that it can't be disclosed easily.

Page | 24

Integrity threats

An integrity threat appears when information or data can be

object of unauthorized modification, alteration, creation or deletion.

Cyber vandalism is one of the examples of integrity violation

because it destroys or modifies information on existing web sites.

Integrity prevention can be achieved by intrusion

detection systems which monitor suspicious activity on the network or

computer to prevent unauthorized access to information stored on the system or

transmitted on the network.

Availability threats

Turban et al. (2006, p517) defines availability as

«assurance that access to data, website, or other electronic commerce data

service is timely, available, reliable, and restricted to authorized

users».

The availability threat consists of all events which cause

delay or deny access to data. The most known is the Denial-of-Service (DOS)

attack which trouble normal operation of a computer or server and can conduct

on abnormal slowness of the server, network or electronic systems such as

Automated Teller Machine (ATM).

E-payment systems must be protected by IDS or Firewall able to

stop these kinds of attacks.

Authentication, authorization and non repudiation

To conclude on the communication channels, it is clearly

described in the previous sections that e-commerce relies on the

confidentiality, integrity and availability (CIA) of information and the

business web site (Turban et al., 2008, p. 517).

These functions depend on the authentication which is a

process to «assure the real identity of an entity which can be a user

computer, program, website or any Information resource (Turban et al. 2008, p

517).

Authorization is the process of ensuring that the

authenticated entity has been granted rights to access resource and which

operations it'll perform on it.

The non repudiation will ensure that authenticated entity

cannot falsely deny action it conducts online.

For e-commerce perspective non repudiation will be the

«assurance that online customers or trading partners cannot falsely deny

(repudiate) their purchases or transactions». (Turban et al, 2008,

p518).

Page | 25

Threats to physical security of the internet

communication channels The packet-switching infrastructure permits

to have many links to the internet.

In case of physical attack to one of the link; data packets

will be routed to another link to the internet.

For e-commerce business the countermeasure to this threat

will be to use redundant links to different Internet Service Providers

(ISPs) which in their turn have many different links to

internet.

Threat to Wireless network

Wireless access points (WAP) provide network connectivity to

computer (mostly laptops) and other mobile devices within a short range of

hundred meters to access to a shared resource, in the case of this study, the

internet.

If the wireless access point is not protected, anyone can

connect to the network and gain access to the resources on the network.

The security on wireless is implemented via a wireless

encryption protocol (WEP) which permits to encrypt and decrypt data over

wireless transmission.

Threat to server computer

There is no system which can be hundred percent secured, even

if strong security policies and measures are implemented, web servers will have

vulnerabilities which can be exploited to compromise them.

The confidentiality can be compromised by the web server

itself if it allows automatic display of directory listings and the folder

names are revealed to the web browser. (G. Schneider, 2011, p.474).

Web servers are connected to back-end storage server (database

servers) where valuable information about products and customers are stored; in

case of unauthorized access, that information can be disclosed.

Modern database management systems (DBMS) have security

features to authenticate users. This login information can be stolen by hidden

malicious programs installed by hackers in the servers.

Also, some organization will keep default DBMS credentials

which are provided by the editor; this will keep a security hole to the

database which can be exploiting by the hackers.

Page | 26

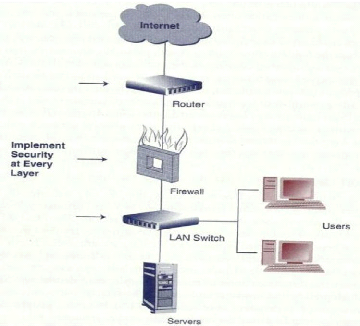

II.7.3. Overview of security of E-commerce network

In the previous sections, the research presents an overview of

threats that e-commerce and e-payment systems are likely to face.

Because of the diversity of threats and the way the networks are

attacked in today's internet era, organization or business cannot rely on a

single security technology; it must use security technologies at different

layers of the network.

Figure 7 below shows the three layers of the network which needs

to be protected.

Figure 6: layered security

Source: Turban et al. 2008, p 532

- Router level : perimeter security to internet

- Firewall: isolation of traffic communication between the

internet and the LAN - LAN switch: access security on local resources

Page | 27

II.7.3.1 Firewalls

Turban et al. (2008, p 533) defines firewall as a network

resource «consisting of both hardware and software that isolates a private

network from a public network».

Firewall examines all packets passing through it and allows or

denies the traffic according to the rules defined by the network

administrator.

Firewall can protect against many threats such as unauthorized

access, viruses, spams, harmful macro, applications backdoors, etc.

In e-commerce environment, firewall is used to block all

packets coming from un-trusted source or accessing to a specific resource on

the LAN.

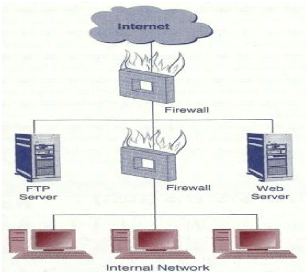

II.7.3.2 Demilitarized zone (DMZ)

Demilitarized zone is defined by Turban (Turban et al., 2008,

p534) as «a network area that sits between an organization's internal

network and the internet, providing physical isolation between the two networks

that is controlled by rules enforced by a firewall».

In e-commerce infrastructure web server will sit in the DMZ,

publicly accessible area and the database server will be installed in the

internal LAN protected by another firewall. In such deployment, network has two

firewalls to hardener the security.

Figure 7: DMZ deployment

Source: Turban et al.,2008, p535

Page | 28

II.7.3.3 Personal firewalls

Actually many home users have broadband connection to the

internet which allows them to get permanent connection to the Internet. This

permanent exposure to internet expose computer to attacks.

Personal firewall have been developed to protect desktop or

laptop by monitoring traffic flowing on the LAN interface card and taking

action according to the rule defined by the user.

II.7.3.4 Virtual Private Network (VPN)

G. Schneider (2011, p 86) defines a Virtual Private Network as

«an extranet that uses public networks and their protocols to send

sensitive data to partners, customers, suppliers, and employees using a system

called IP tunneling or encapsulation».

IP tunneling creates a private communication channels on the

internet in which information is encrypted to make it invisible to the other

internet users which are not involved in the communication transaction.

Protocol tunneling permits to encrypt data packets and

encapsulate them into packets to ensure confidentiality and integrity of data,

to be transmitted over the internet.

II.7.3.5 Overview of intrusion detection systems (IDS)

The necessity of monitoring the Information system for

unauthorized access permits the development of special systems and software

that can monitor activity on the network and detect illegal activities.

These appliances and software are called Intrusion prevention

system (IDS). II.8. Securing e-payment systems for B2C e-commerce

E-commerce needs a special payment system to enable online

payment of goods and services sold online.

According to the Laudon's (Kenneth C. Laudon and Jane P.

Laudon, 2006, p416), «electronic payment systems for the internet include

systems for digital credit card payments, digital wallets, accumulated balance

payment systems, store value payment systems, digital cash, peer-to-peer

payment systems, digital checking and electronic billing presentment

systems».

With the development of mobile telephony, another payment

system is available and consists of paying good and service using mobile phone.

This is known as m-payment system and will be developed shortly in e-commerce

transaction.

Page | 29

II.8.1 Payment cards systems

Payment cards are cards with payment of financial information

embedded in an electronic chip and which can be used for payment.

Three kinds of cars are currently used: (Turban et al., 2008,

p551)

? Credit card ? Debit

? Charge card

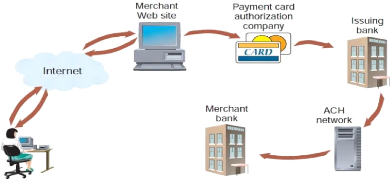

Card processing overview

Card payment processing consists on authorization of the

transaction and the settlement of the money.

Authorization is the phase during which verification is done to

check the validity of the card and the availability of the fund to be paid for

the transaction.

Settlement is the phase which consists on the transfer of money

from the buyer's card bank account to the seller's account.

Payment processing is a service offered by payment processing

service Provider (PSP).

Figure 8: Processing of a card transaction

Source: Gary

Schneider, 2011, p.501

Page | 30

The most threat for payment card is «the

fraud»; and tools have been developed to combat it (Turban et

al., 2008, pp 553-554).

> Address verification system (AVS): seller compare the

shipping address entered on the e-commerce portal with the address contained in

file at the cardholder's bank.

> Manual review: staffs review manually suspicious

transactions orders to detect fraudulent transaction. This method can be used

on business with small amount of transactions.

> Fraud screens and automated decision models: Intelligent

systems which use automated rules to determine if the transaction can be

accepted rejected or suspended.

> Card verification number (CVN): this number is printed on

the back of the credit card; the verification will ensure that the buyer has

the card into his hands. This verification will not be useful in case of stolen

number.

> Card association payer authentication services. This

service is provided by card issuer and offers the possibility for the card

holder to register with the system to ensure the protection of the card.

Merchant web portal will interact with this service to validate the

authenticity of the card. Mastercard offers «Mastercard securecode»

and Visa the «verified by visa» to authenticate and certify their

cards.

> Negative file. Customer and information about the

connection such as IP address name, shipping or billing address, contact

numbers, etc are stored in a file. When the transaction takes place on the web

portal it is matched against the information contained in the file and flag in

case of problem.

II.8.2 Electronic cash

Electronic cash (e-cash or digital cash) is «a general

term that describes any value storage and exchange system created by a private

(non-governmental) entity that doesn't use paper documents or coins and that

can serve as a substitute for government issued physical currency» (G.

Schneider, 2011, p502).

Security issue of e-cash

As for the credit card payment, privacy and security

of the transaction is the most important issue for e-cash

implementation in the e-commerce business.

Fraud is a big concern for e-cash; therefore

security system must be in place to prevent double spending which can happen

while the electronic cash is submitted twice for the same cash amount to two

different merchants.

To prevent this situation, cryptographic algorithms are

creating tamperproof electronic cash that can trace back the transaction to its

origin.

Page | 31

The e-cash has a significant disadvantage because it doesn't

provide an audit trail and can be used as money-laundering (conversion of

illegal owned money to cash) system.

E-cash needs to be supported by a strong regulation to

define standards with the supported secured system and banking in order to be

widely accepted as an alternative to credit/debit card.

II.8.3. Stored-value card

Stored-value card looks like a credit/debit card and function

like credit/debit card, however it has a currency value (amount) preloaded in

the electronic chip or magnetic strip.

Same security concerns as for the credit card systems must be

addressed for this e-payment system.

. II.8.4 E-checking

E-check is a valid electronic copy of the paper check which

contains all information contained on the paper check; however it requires a

special infrastructure to be in place.

The processing of e-check is done by an Automatic Clearing House

(ACH) which has its Information system connected to the different banks.

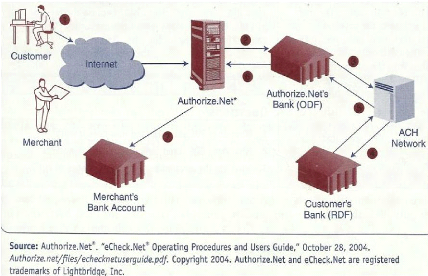

Figure 9: E-checking processing using

Authorize.net

Source: Turban et

al. 2008, p 567

Page | 32

E-check security

As for the manual check, e-check security concern is the

fraud. The system must make sure that the check is signed by the authorized

person and the bank account has sufficient amount of money to pay the

transaction.

E-check payment system security will consist mostly on:

? digital signature and validity of e-check

? authorization of the transaction

? security of the transaction

? verification of the availability of the amount

? Effective policy to drive the ACH.

II.8.5 Security of M-payment

Mobile phone with integrated sim card which load encrypted

information, offers security and privacy, but for its use in the e-commerce

other security concerns have to be considered.

The lack of standards and disparity of the existing systems

are the main concerns for the use development of this payment system in online

transaction despite the fact that identification, security and authorization of

the transaction are already implemented in the m-payment systems.

To effectively use m-payment in e-commerce development, strong

partnership between banks, mobile operators and businesses must be developed

for the integration of their information systems to provide dynamic and secured

mobile payment system (P. Candance Deans, 2005, p 84).

This integration will raise issue of security of Information

systems that has been described in this work to ensure security of the online

transaction.

The nature of the mobile phone which can be stolen any time or

broken, the malfunction of mobile network because of technical issues will

surely raise issues such as fraud, repudiation of the transaction and

availability of service.

That's why, on top of all security measures which can be

implemented, this emerging system needs to have law and regulation in place.

Page | 33

II.9 Conclusion on the literature review

The literature review gives a broad view and understanding of

e-commerce concepts and Information technology capabilities.

Capabilities in e-commerce link together Information

technology capabilities with organizational processes to respond to the highly

changing nature of the e-commerce because of the dynamic changes involved in

its development.

The diversity of the payment systems studied in this research

and the challenge of their security is the fundamental element which will be

used in this research to assess the e-commerce capabilities in the Democratic

republic of Congo (DRC).

A particular attention will be given to the mobile payment

systems which appear as an emerging innovation in the country with the

development of the mobile networks.

The study will analyze the security of the existing e-payment

systems such as credit/debit card and other online payment offered by local

banks and their organizational processes to assess their readiness to the

emergence of e-commerce in DRC.

Security according to the CIA concept (Confidentiality,

integrity and availability) as described in the ISO 27001/2 framework and other

sources cited in the section II.7.2 of this work will be the driver for the

assessment which will be used in this study.

The objective of this research is to assess the status of

e-commerce capabilities in DRC with a specific focus on online payment systems

security in order to better understand how such capabilities can be better

leveraged for an effective development of e-commerce in DRC.

Page | 34

Chapter 3: Research Methodology

III.1 Introduction

This chapter discusses the methodology used to collect

information and the overall research design and justification. It also defines

the sampling; population used for data collection and the questionnaire

design.

The security of the payment system is the main concern which

must be addressed in order to bring confidence for the user. In their books

according to electronic payment systems for e-commerce the Laudon's (K. Laudon

and J Laundon, 2008) and G. Shneider (2011) presented the concept of CIA

(Confidentiality, integrity and availability) as a quality to which a payment

system must conform. So this research will use this concept to assess security

of online payment systems in DRC

The concept of the security of the information system as

provided by the ISO 27001/2 standards as described in the previous chapter of

this study highlights the important place taken by the CIA concept in terms of

the security of the online transaction used for the e-commerce in general and

particularly for e-payment systems. Of course the other elements of the

security focusing on human, physical infrastructure, etc are most likely to be

easy to set up and should exist in most of the bank IT infrastructure in the

country.

So CIA remains a challenge because as it is well known, all

other security elements regarding e-payment systems have as prime objective to

ensure confidentiality, integrity and availability of the system.

III.2 Research design and justification III.2.1

Introduction

The research design or methodology describes the process and

actions taken to collect responses or data and the way these responses have

been analyzed to give an answer the research question.

For this research, the literature review didn't provide

relevant information to the research question for this study; therefore it is

difficult to use secondary data collection method.

In fact, because of the specificity of the subject and the use

of component elements of a framework to assess the security of e-payment

systems in the specified country, the primary data collection method is the

best one for this research. Data (responses) will be collected directly from

participants to the survey which will use questionnaire built from

checklists.

Page | 35

E-commerce is on its inception phase in the country, therefore

it is not already perceived as part of the economical live. For this reason,

the research will also use interviews as to get some responses in a

face-to-face interaction with stakeholders in the e-payment and e-commerce

planet.

Prior to justify which methodology is better for this

research, it is better to give an overview of the two methodologies used for

data collection; qualitative and quantitative.

Qualitative research methodology

Jackson (2010, p 101) defines qualitative research as a

research method that «focuses on phenomena that occur in natural settings,

and the data are analyzed without the use of statistics.

«Qualitative research generates text which is often

interpreted in a subjective way (although it is possible in certain

circumstances to convert textual information to numbers)» (Gabriel J.,

2012).

These two definitions indicate clearly that qualitative

research is based on observation of specific field or area of research without

statistical analysis in the mind.

For qualitative research data or response is collected by the

mean of questionnaire or interviews.

Quantitative research methodology

It has been stated by professor G. Jacobs (2012) that

«quantitative research generates measurable information that can be

converted into numbers and analyzed statistically. Data is often gathered in

questionnaire surveys».

In quantitative research, even though data can be collected

some time using interview like for the qualitative methodology, the focus is to

simplify, objectify or quantify the observation so that data collected can be

easily interpreted using statistical tools.

The difference between the two methodologies is given in the

table below provided by Malhotra (2004, cited by Mirza et al. (2011, p 53-54))

based on objective, sample data collection and analysis and the outcome

basis.

Page | 36

Table 1: Qualitative vs quantitative research

methodologies

Source: Mirza et al. (2011, p53-54)

|

Basis

|

Qualitative

|

Quantitative

|

|

Objective

|

To gain the qualitative

understanding of the underlying reasons and motivation

|

To quantify the data and generalize the results from the sample

to the population of interest

|

|

Sample

|

Small number of non representative cases

|

Large number of representative cases

|

|

Data collection

|

unstructured

|

structured

|

|

Data analysis

|

Non statistical

|

statistical

|

|

Outcome

|

Developed an initial understanding

|

Recommend a final course of action

|

III.2.2 Choice of the methodology

The choice of the research methodology depends on the nature

of the research area and the way data have to be collected and analyzed.

The two methodologies present some similarities, such as:

(Sherril L. Jackson, 2010, p 106):

4 The researcher makes some type of inference based on data

collected 4 Data is analyzed in order to draw a conclusion

4 Findings are published so that they can be reviewed by

others.

However the data collection and the sampling methods are the

determinant elements for this research; because of the specificity of its

research question which is based on perceived values of the concept CIA

(confidentiality, integrity and availability) applied to the e-payment systems

in the DRC (Democratic republic of Congo).

These characteristics of the e-payment systems to be assessed

are most likely to be quantified. For example confidentiality perception can be

quantified by a scale of numbers; 5= confidential, 4=somehow confidential,

3=not applied, 2=unknown, 1=non confidential.

Of course for this research some interviews will be used to

clarify some concepts developed in the questionnaire to avoid misunderstood or

confusions in responses, however, depending on the way the questionnaire will

be structured by the use of checklist, responses will be easily translated into

quantified information.

Page | 37

For example to assess the availability of e-payment system,

the checklist can be used to determine either or not the system is redundant,

and if the redundancy consists on high availability system or not.

It appears, in the light of the two examples provided above,

quantitative research method is the most appropriate for this research because

the collected information or responses will be analyzed statistically to assess

at which extend the e-payment systems in DRC are compliant with the CIA

concept.

The structured data collection method, the statistical data

analysis and the primary data collection method through surveys which will be

used in this research confirm the choice of the quantitative research method

approach of this study.

III.3. Data collection and sampling III.3.1 Sampling

technique

It is clearly indicated in the previous section that this

research will use the survey as primary data collection method; this involves

the organization of participants to the survey by using sample of

representative population to ensure that collected data can be generalized for

a reliable conclusion.

There are two main ways to define a sampling; probability and

nonprobability. Sherril L. Jackson (2010, p117-118) defines these two sampling

techniques as follow.

? Probability sampling is «a sampling technique in which

each member of the population has an equal likelihood of being selected to be

part of the sample».

? Nonprobability sampling is «a sampling technique in

which individual members of the population do not have an equal likelihood of

being selected to be member of the sample».

Which sampling method to be used by this study?

According to what was defined previously about the choice of

the methodology regarding the specific nature of the research question, the

nonprobability sampling technique will be used.

However, there are two kinds of nonprobability; the

convenience sampling and the quota sampling (Sherril L. Jackson, 2010,

p119).

For this research, the quota sampling will be used because it

is the one which ensures that the sample is like the population in some

characteristics, but uses convenience sampling to obtain the participants»

(Sherril l. Jackson, 2010, p119).

Page | 38

The research question by its nature limits the participants to

the survey to: + Banking sector: where e-payment system are likely to be

installed

+ Mobile operators: developing and implementing m-payment

systems.

Within these two sectors, participants are chosen in the area

of security (management, regulation and implantation):

+ Executive level: because the «complexity and

criticality of information security and its governance demand that it be

elevated to the highest organizational levels. As a critical resource,

information must be treated like any other asset essential to the survival and

success of the organization» (IT governance institute, 2006)

+ IT department: in charge of implementation, management and

maintenance of the IS security

+ E-payment system manager/sales: dealing with customers in

terms of banking services offered to customers

+ Information system auditors: ensuring that security policy

are followed and ensure audit of the IS.

This structure of the sampling in this study shows that

definitely, the research is using the quota sampling technique.

III.3.2 Sampling definition

The survey will be conducted to sixteen (16) commercial banks

located in the capital city of the DRC (Kinshasa), the Central Bank of the DRC

and the three (3) main mobile operators offering m-payment services.

Commercial banks are those implementing e-payment systems and

offering e-payment services to customers while mobile operators are

implementing m-payment systems and offering m-payment services. On top of these

two organizations, the Central Bank is acting as the monetary authority in the

country and de facto regulator of the banking system in the country and

therefore in charge of defining e-payments regulation and rules.

Page | 39

For the commercial banks and the mobile operators sectors, the

sample will consist of:

> 1 C-level member (CEO or COO)

> 1 IT director or IT manager, the head of the IT

department

> 1 IT security officer within the IT department

> 1 e-payment or m-payment business system manager or sales

manager

> 1 Information system auditor

For the central bank, as the guarantor of the financial

regulation, answers will be provided by:

> 1 C-level or board member (Governor or Managing director)

> 1 Director in charge of regulation

> 1 Director in charge of operations

> 1 IT Director

> 1 IT Security officer

> 1 IS Auditor

This sampling definition ensures that all the existing

commercial banks in the country will participate in the survey and therefore

constitute the whole population of possible informants for this research. The

size of the sample for which we are expecting respondents for this survey is

101.

III.3.3 Data Collection method

For this research, the survey is the method of the data

collection.

Questionnaire uses closed-ended questions and checklists will use

likert rating scale which will provide all alternatives of the response.

The likert rating scale of 5 has been used for the alternative

responses in the way that 5 indicates the best option and 1 the worst option:

5=strongly agreed, 4=agree, 3=neutral, 2=disagree, 1=strongly disagree.

Surveys have been sent by email through the traditional mail

system (hands delivery to the reception) with an acknowledgement of the receipt

of the questionnaire.

For this reason, questions have been clearly explained to

allow self-explanation to the respondent. However, for the CEO and the IT

officer, some interviews have been requested to clarify particularity of

questions which have sensitive perception for them.

Page | 40

III.4. Data analysis method III.4.1 Introduction

Data collected through the survey have to be organized in such

way to be used by descriptive statistics tools because the research method used

is quantitative.

The first step consists of grouping data into tables;

therefore for this research the frequency distribution is the best method for

the organization of data collected.

The research question focuses on characteristics of e-payment

systems which are meaningful for its security. This limitation influences the

way collected data will be used to assess the security of e-payment systems.

In the literature review chapter, the research presented

elements that are likely to be considered in order to determine if the

information system on which e-payment system is built is compliant to the CIA

concept of this research.

Therefore, knowing the number of organizations involved in the

survey, the better way to represent the existence of specific element is the

frequency distribution. For example, the analysis will provide such information

like how many banks have firewall protecting their e-payment systems. This

information will be better represented in a frequency distribution.

The frequency distribution tables for some elements of the

survey will also be represented graphically using bars. Bar graphs will be used

instead of histogram because for this research responses collected through the

survey are «qualitative variable» which mean «categorical

variable for which each value represents a discrete category» (Sherril L.

Jackson, 2010, p218).

Page | 41

3.4.2 Data analysis technique

The descriptive statistics measures are most suitable to

analyze data for this research. Prior to mention which analysis technique is

used for this research, an overview of the three (3) main measures of central

tendency; mean, median and mode, is given in the table below.

Table 2: Types of central tendency measures

Source: Sherril

L. Jackson (2010, p225)

|

Mean

|

Median

|

Mode

|

|

Definition

|

The arithmetic average

|

The middle score in a distribution of scores organized from

highest to lowest or lowest to highest

|

The score occurring with greatest frequency

|

|

Use with

|

Interval and ration data

|

Ordinal, interval, and ratio data

|

Nominal, ordinal, interval or ratio

|

|

Cautions

|

Not for use with distribution with a few extreme score

|

|

Not q reliable measure of central tendency

|

For this research, data collected use the likert rating scale

with values ranging from 1 to 5; 5 being the best choice.

According to this rating, this research will use the mode as

data analysis technique because it is the appropriate method to assess the CIA

capability of the e-payment system by indicating the score occurring with the

highest frequency.

For example, if the survey returns that among sixteen (16)

banks 10 of them has a firewall in place, this information is more relevant

than the mean or the median.

However, to some extend, the mean can be used to define the

average of some capabilities according to the data collected and the element

which is assessed.

For example, to assess the existence of data backup capability

globally is the sample, it can be easier to say that this capability exists on

an average of 65%. This calculation uses the mean as data analysis technique to

assess the overall capability.

While the mode will be used to assess individual capability,

conclusion in the context of assessment of all the e-payments systems studied

will use the mean to state the average of organizations having such capability

implemented.

Page | 42

Chapter 4: Research findings

IV.1 Response rate

According to the sampling described in the previous chapter, a

questionnaire has been sent to sixteen (16) commercial banks and the three (3)

major mobile operators for five respondents per institution. This sampling gave

a number of ninety five (95) respondents. On top of this number, six

respondents were expected from the Central bank as regulator body of the

banking activity in the country.

From this sampling, only four (4) banks and two (2) mobile

operators responded to the questionnaire. From the banking sector, all expected

respondents filled the questionnaire while from the mobile operators, only one

CEO responded. This gives a total of twenty nine (29) respondents out of one

hundred and one (101), giving a response rate of 29 divided by 101,

representing 28.71% of response rate.

IV.2 Research findings

IV.2.1 Working experience of respondents

The number of years of experience of the respondents is key

information on the quality of the knowledge respondents possess in the subject

matter.

The table below summarizes the working experience of the

respondents

Table 3: repartition of respondents per working year

|

Year of experience

|

Number of respondent

|

percentage

|

|

<= 1

|

3

|

10.34%

|

|

1 - 5

|

5

|

17.24%

|

|

6 - 10

|

11

|

37.93%

|

|

>10

|

10

|

34.49%

|

|

Total

|

29

|

100%

|

From this table, more than 72% of respondents have more than 5

years of experience in the banking or e-payment sector and might have valuable

information in the use of electronic payment systems.

Page | 43

IV.2.2 Job position of respondents

The repartition of respondents according to their position in

the organization is given in the table below.

Table 4: Respondents by position in the company

|

Position

|

Number of respondent

|

percentage

|

|

CEO / Managing Director

|

5

|

17.24%

|

|

IT Director or IT Manager

|

6

|

20.69%

|

|

Information security Officer

|

6

|

20.69%

|

|

E-payment business manager

|

6

|

20.69%

|

|

Information system auditor

|

6

|

20.69%

|

|

Total

|

29

|

100%

|

The study results show that 41.38% of respondents occupy the

post within the IT department or Direction, 20.69% are business managers of

e-payment systems and 20.69% represent the IT auditor respondents. This implies

that respondents for this study have necessary technical and business expertise

in the e-payment system.

IV.2.3 E-payment services

The study reveals the e-payment methods in the table below.

Table 5: E-payment methods

|

services

|

Number of institutions

|

percentage

|

|

Visa

|

4

|

36.37%

|

|

Master Card

|

3

|

27.27%

|

|

Electronic cash (M-payment)

|

2

|

18.18%

|

|

Local debit card

|

2

|

18.18%

|

|

Total

|

|

100%

|

Page | 44

According to the table above, the most provided e-payment system

is Visa with 36% and MasterCard with 27% followed by M-payment and the local

debit card.

This result indicates that most of the banks use Visa or

MasterCard, both representing more than 63% of e-payment methods.

IV.2.3 Issues faced by e-payment systems

The table below indicates the main issues observed in the

different institutions assessed.

Table 6: List of issues faced by e-payment systems

|

Issues

|

Number of institutions

|

percentage

|

|

Fraud

|

4

|

18.18%

|

|

Theft

|

6

|

27.27%

|

|

Unavailability

|

6

|

27.27%

|

|

Disclosure of information

|

4

|

18.18%

|

|

Falsification

|

2

|

9.10%

|

|

Total

|

|

100%

|

The study reveals that all six institutions have faced issues

of theft of cards or mobile phones, and the unavailability of the e-payment

systems. These two main issues represent more than 54% of issues observed,

whereas the disclosure of confidential information represents 18% of total

responses and the falsification of the information is observed mostly on

m-payment system (9%).

Page | 45

IV.3 Specific findings regarding the Confidentiality,