TABLE OF CONTENT:

Declaration..................................................................................i

Certification................................................................................................ii

Dedication..................................................................................................iii

Acknowledgement........................................................................................iv

TABLE OF CONTENT:

1

LIST OF TABLES

3

LIST OF FIGURES

4

ABSTRACT:

5

CHAPTER ONE:

6

INTRODUCTION

6

I. BACKGROUND

INFORMATION

6

II. STATEMENT OF

PROBLEM AND RESEARCH QUESTIONS

9

III. OBJECTIVES OF

THE STUDY

10

IV. RESEARCH

HYPOTHESES

10

V. SIGNIFICANCE OF

THE STUDY

10

CHAPTER TWO:

11

LITTERATURE REVIEW

11

I. DEFINITION OF

IMPORTANT CONCEPTS

12

A. COST TERMS, CONCEPTS AND

CLASSIFICATION.

12

1. Cost

12

2. Cost Objective or cost object.

13

3. Cost Centre

13

4. Cost allocation and apportionment

13

5. Cost drivers

14

6. Cost classifications

14

COSTS CLASSIFIED ACCORDING TO THEIR NATURE

15

b) COST CLASSIFICATIONS ACCORDING TO THEIR

FUNCTION

18

c) COSTS CLASSIFICATION ACCORDING TO THEIR

BEHAVIOUR

21

II. THEORY OF

COSTING: METHODS AND TECHNIQUES

25

A. COSTING METHODS

25

1. Specific order costing:

26

2. Continuous operation or process

costing:

26

a) Job costing

26

b) Batch costing.

26

c) Process costing.

26

B. COSTING TECHNIQUES

27

1. ABSORPTION COSTING

27

2. VARIABLE COSTING

28

III. PRICING

DECISIONS BASED ON COST INFORMATION

30

1. Pricing objectives

30

a) Survival:

30

b) Profit maximisation

30

c) Turn over maximisation

31

d) Growth maximisation

31

e) Goodwill and image preservation

31

2. Pricing techniques

31

a) Total cost-plus pricing

31

b) Manufacturing cost-plus method

31

c) Decision-relevant cost-plus method

32

Limitations of cost based pricing

32

IV. THE THEORY OF

JOB COSTING

33

V. EMPIRICAL STUDIES

ON JOB COSTING

34

VI. THE MECHANICS OF

JOB COSTING

34

1. Purchases of raw materials

35

2. Issue of raw materials

35

3. Labour costs

35

4. Manufacturing overheads

36

5. Non-manufacturing overhead costs.

37

6. Jobs completed.

37

CHAPTER THREE:

37

METHODOLOGY

37

I.

INTRODUCTION

37

II. BACKGROUND

INFORMATION ON THE STUDY AREA

38

OBJECTIVES OF SOPECAM AT ITS CREATION

39

THE SOURCES OF FUNDS OF SOPECAM

39

STRUCTURE OF SOPECAM

39

III. SAMPLING

PLAN

40

a) Sampling technique

40

b) Data collection

40

c) Variables of the study:

40

d) Data analysis

40

e) Model specification

40

CHAPTER FOUR:

42

PRESENTATION AND ANALYSIS OF THE RESULTS

42

I.

INTRODUCTION

42

II. SOPECAM'S COST

STRUCTURE

43

III. DETERMINATION

OF THE UNIT COST

48

A. ABSORPTION COSTING

48

B. MARGINAL COSTING

55

VII. ANALYSIS OF THE

DATA

63

CHAPTER FIVE:

66

SUMMARY OF FINDINGS, CONCLUSION AND

RECOMMENDATIONS

66

I. SUMMARY OF FINDINGS

66

II.

CONLUSIONS

66

III.

RECOMMENDATIONS

69

IV. LIMITATIONS OF

THE STUDY

70

V. PROPOSITIONS FOR

FURTHER STUDIES

70

BIBLIOGRAPHY

71

LIST OF TABLES

Table 4-1 Hourly rates for the various

departments

43

Table 4-2 Editorial staffs salaries

44

Table 4-3 Administrative and selling

expenses

46

Table 4-4 Materials used for the

production

46

Table 4-5 Balance sheet extract

47

Table 4-6 Overhead expenses

47

Table 4-7 Machine-hours used for the

production of the newspaper

48

Table 4-8 OAR for the various overhead

costs

48

Table 4-9 Unit cost determination using

absorption costing (income statement format)

50

Table 4-10 Marginal costing for the

determination of the unit cost of Cameroon Tribune (income statement

format)

57

Table 4-11 Recap of the information

63

LIST OF FIGURES

Figure 2-1Cost assignment methods

13

Figure 2-2: COST FLOW AND CLASSIFICATIONS IN

A MANUFACTURING COMPANY

16

Figure 2-3 The behaviour of total variable

cost

22

Figure 2-4 The behaviour of Unit variable

cost

22

Figure 2-5 Curvilinear concave variable

cost

22

Figure 2-6 Curvilinear convex variable

cost

23

Figure 2-7 The behaviour of Total Fixed

costs

23

Figure 2-8 The behaviour of unit fixed

cost

23

Figure 2-9 The behaviour of semi-variable

cost

24

Figure 2-10 The behaviour of semi-fixed

cost

24

Figure 2-11 Circular reasonning in cost

based-pricing

32

Figure 4-1 Unit cost determination

scheme

45

Figure 1-2 Evolution of the unit cost

(absorption costing)

55

Figure 4-3 Evolution of the unit cost

(variable costing)

63

Figure 5-1 Relative importance of the cost

components in SOPECAM's cost Structure (absorption costing).

67

Figure 5-2 Relative importance of the cost

components in SOPECAM's cost structure (marginal costing).

68

ABSTRACT:

One of the most important challenges to Cameroonian companies

today is the strong competition they face due to the free trade agreements and

other manifestations of the globalisation of the world's economies. They thus

need to adopt effective and efficient management techniques that may help them

to comply with the standards required in the world market place.

This study focuses on the application of job costing in the

printing industry in Cameroon and specifically at SOPECAM, a Nationalised

printing company. It is designed to determine the unit cost of their main

product, the newspaper Cameroon Tribune so as to propose a more reliable

basis for future pricing decisions in the company and also to analyse the cost

structure of the company for its management to take effective measures to

control those costs.

During the study, primary data were collected at SOPECAM

through the interview of the company executives and secondary data have been

gathered from the company accounting records. These data were analysed using

the absorption and variable costing techniques and the Student's

T-Distribution.

The unit cost of Cameroon Tribune was found to be FCFA 474 and

FCFA 325 using absorption and marginal costing respectively, and as such the

company should use absorption costing for its pricing decisions and marginal

costing for the cost control programmes.

Recommendations concerning the setting up of a managerial

accounting department, and for an increase in the selling price of the product

have been made.

CHAPTER ONE:

INTRODUCTION

I. BACKGROUND INFORMATION

As Cameroon progressively comes out of he deep economic

depression of the 1980's and 1990's, and as we are heading towards the

challenges set by the globalisation of the world's economies, there is a

pressing need for Cameroonian companies to adapt themselves to the world's

accounting and financial standards so that they will be able to compete with

their foreign opponents. One of the ways through which these companies could

become very competitive is by adopting recognised business practices as part of

their procedures for treating and processing data in order to obtain good

information that will improve the decisions made by their managers. In fact,

the afore-mentioned business practices are the accounting, finance, management

and economic tools, methods and techniques presently used in the business world

and that are of great importance to the success of any enterprise. These are

made up of quantitative as well as qualitative models that are used to analyse

business situations and help in the decision-making processes of the companies

concerned.

For this study, we will be dealing with the

Managerial and Cost

accounting standards and principles. Managerial and cost accounting are with

financial accounting the three parts of the broad science of Accountancy. While

financial accounting is concerned with «The classification and recording

of monetary transaction of an entity in accordance with established concepts,

principles, accounting standards, legal requirements and presentation of a view

of those of transactions during an accounting period.» Lucey1(*) (1993); Garrison &

Noreen2(*) (2003) defines

Managerial accounting as «the phase of accounting concerned with providing

information to managers for use in planning and controlling operations and in

decision making. Finally, cost accounting is defined by Lucey (1993) as «

the establishment of budgets, standard costs, and actual costs of operation,

processes, activities or products; and the analysis of variances, profitability

on the social use of funds.» Cost accounting is usually designed to help

managers control manufacturing and production costs and thus can be see as a

subset of managerial accounting. Some other differences can be established

between these three divisions of accounting; these differences are based on the

kind of information produced by those the accounting information system from

the data provided by the each of these accounting divisions.

Financial accounting generally provides:

· Figures in totals

· Information meant for external reporting

· The system itself is historic in nature.

Cost accounting on its own has the following characteristics

concerning the type of information provided:

· There is a breakdown of figures in the information

provided

· The information are usually meant for internal

reporting

· These are very current information necessary to

evaluate the present situations.

· The system itself is historic in nature.

Managerial or management accounting's features relating to the

information requirements could be summarised as providing information useful

for future strategic planning. Strategic planning being the process of

selecting an organisational goal, determining the policies and programmes

necessary to achieve en route the goals and establishing the methods necessary

to assure that the policies and strategic programmes are implemented. (Stoner

& Wankel3(*): 1986).

This is the reason why Horngren4(*) (1981) states that: «It emphasises the

preparation of reports of an organisation for its internal users such as

presidents, deans and head physicians.» It is by making use of the

information provided by the Management Accounting Information System (MAIS),

which is an information system that produces output information using inputs

and processes needed to satisfy specific management objectives, that the

preparation of reports can be achieved. The afore-mentioned processes are the

heart of the MAIS and are used to transform the inputs into outputs that

satisfy the firm's objectives. These processes are described by the activities

such as collecting, measuring, storing, analysing, reporting and managing

information. Outputs include special reports, product costs, customer's costs,

budgets, performance reports and even personal communication.

Hansen and Mowen5(*) (1997) have identified three main objectives of a

MAIS, these are:

1. To provide information for costing out services, products,

and other objects of interest to management.

2. To provide information for planning, control and

evaluation.

3. To provide information for decision-making.

From these definitions and characteristics, it appears that a

company, apart from taking care to the proper recording and classification of

its operations through financial accounting, it must give considerable

attention to the monitoring of its various costs of operations. There is

therefore a pressing need to devise and adopt objective and accurate costing

methods and systems that will provide the company with a reliable figure of its

products' unit cost. This is generally the job of the Managerial and

Cost accounting departments of the company.

Having spent three months last year at the Cameroon News and

publishing Corporation as an intern, we had the time to observe and analyse

that company accounting procedures and practices and we realised that the

managerial accounting department, though in existence, was not yet operational,

leaving the company without the required tools necessary for the company

management to appreciate the profitability of each of its products and

activities. The Cameroon News and Publishing Corporation, usually known under

its French acronym SOPECAM, is a State-owned enterprise specialised in printing

works and whose main product is the daily newspaper Cameroon Tribune. As

we are interested in the method of objectively costing a company's product and

since we are really preoccupied by the survival and growth of the SOPECAM, our

main focus will therefore be to determine which costing method or technique is

better applicable to this company.

From the literature available in the cost accounting, it has

been decided to analyse the possibility of using the Job-order costing

method in costing SOPECAM's products. This is because the printing industry is

among those that can easily use the job costing method as a mean for costing

their products Horngren & Foster6(*) (1991).

Horngren7(*) (1999) defines Job costing as a costing system in

which the cost of a product or service is obtained by assigning costs to a

distinct unit, batch or lot of a product or service. The above definition of

job costing makes little difference between job and batch costing; a more

concise and specific definition of it is given by the CIMA Terminology8(*), which considers job costing as

a costing method applicable where goods and services result from a sequence of

continuous or repetitive operations or processes. This is a product

costing method and in product costing we are generally interested in

determining the unit cost of a product or service. This unit cost can be

particularly helpful for various purposes such as the pricing decisions,

planning and control decisions or cost control programmes.

For this study, we will be interested in the usefulness of the

unit cost evaluation for the pricing decision, even though many other factors

are to be considered when setting the price of a product.

II. STATEMENT OF PROBLEM AND

RESEARCH QUESTIONS

The purpose of this study is to devise an objective basis for

costing SOPECAM's printing works such as the newspaper Cameroon Tribune

and also to set its selling price using the cost information obtained. The main

difficulty will concern the allocation and application of the company overheads

to the units of production. To perform this task in the right way, we need to

have adopted an objective and appropriate costing method such as the job

costing method that will help us in this task. The central problem of this

study will therefore be to provide the SOPECAM management with reliable and

accurate and scientific information about the unit cost of their main product

so that they will be able to evaluate the performance of that product and also

set a price that will reflect the real situation.

This study will be centred around three main research

questions:

Ø How to apply job costing to the company processes?

Ø What are the factors that should be taken into

account when costing the newspaper Cameroon Tribune?

Ø Finally, how could the results of job costing be used

in the pricing and cost control processes?

III. OBJECTIVES OF THE STUDY

This study has as a main objective, the determination of a

reliable and precise figure for the unit cost of the newspaper Cameroon

Tribune using job costing, so that the pricing process will be conducted on

an accurate and objective basis.

The figure will be determined from two approaches: the

Marginal and Absorption costing approaches to the job costing

method.

Apart from the afore mentioned main objective, there are also

objectives of smaller scope such as:

Ø Determining the right allocation bases for the

company overheads.

Ø Measuring with great accuracy the amounts of raw

materials, labour time and other costs to be used in the production of the

newspaper.

Ø Finally, show the importance of a managerial and cost

accounting department in a company.

IV. RESEARCH HYPOTHESES

The study being oriented towards the determination of a unit

cost using two approaches to the job costing method, that is the marginal and

absorption costing approaches, we will therefore be interested in the

usefulness of each of these approaches to the pricing process and the company

cost control programmes.

The first hypothesis of this study will then assume that any

of these approaches can be used for both the pricing process and the cost

control programmes without distinction; that is the mean unit cost will be the

same for the two methods. This will be the «No difference

hypothesis».

The second hypothesis, which is the «Alternative

Hypothesis» states that the marginal approach is better for the cost

control programmes while the absorption approach provides more accurate and

reliable data for the pricing process.

By the end, the results of this study will guide us for the

conclusion to adopt as far as these hypotheses are concerned and we will

therefore know which of these approaches to use in each situation.

V. SIGNIFICANCE OF THE STUDY

This research work is primarily designed to contribute to the

evolution and the wide spreading of universally recognised accounting practices

in the Cameroon's business environment; as such we are interested in studying

the application and the use of the job costing method in a State-owned printing

company, this is because we wish to avoid the occurrence of bankruptcy in

another Parastatal printing enterprise as this has been the case with the

National Printing Press whose activities are now reduced to their mildest

level, because of many factors among which the lack of professionalism.

Concerning the scientific contribution of this research work,

this study is aimed at many goals. The first one is the achievement and

completion of a research work as the peak to three years of intense training at

the University of Buea department of Economics and Management.

Secondly, in conducting this research work, we were interested

in studying the public sector of the Cameroonian economy and therefore draw the

relevant conclusion as it concerns its chances to succeed in the extremely

competitive business environment.

Finally, this study can be particularly helpful as it provides

a case study to the use of an accounting principle and thus it can be regarded

as a valuable tool for tutorials or illustrations for cost and managerial

accounting classes.

CHAPTER TWO:

LITTERATURE REVIEW

The main objective of this chapter as its name suggests is an

explanation and a brief exposé of the concepts, studies and theories

related to the topic under study. Throughout this chapter we will try as much

as possible to give you an insight into the mechanics, processes, procedures

and theories related to job costing.

This chapter will be made up of three main parts:

· Some definitions of the important concepts

· The theory of job costing

· The results of studies conducted on job costing and the

use of other costing methods (Empirical literature).

I. DEFINITION OF IMPORTANT CONCEPTS

These are some of the terms, expressions and words that will

be used during the study and as such which need to be carefully analysed and

explained so that they will serve as a guide for the good understanding of the

topic. These explanations will be divided into two main parts: the first one

will focus on the cost terms and the various costs classifications, the second

one will be devoted to introducing the reader to the concepts of costing

methods and techniques.

A. COST TERMS, CONCEPTS AND

CLASSIFICATION.

From the accounting point of view, management main focus and

interest is on the costs of the company. For management to be able to plan that

is setting objectives and outlining how to attain these objectives, but also to

control activities and operations effectively, that is, taking steps to ensure

that objectives are realised (Garrison & Noreen, 2003), it must have

figures, data and information relating to the costs incurred by the company.

These costs are of various types; nature, use and they may be classified using

different parameters such as their nature, their function or their behaviour.

In order to determine what will be made of any cost data, we must therefore

have a good knowledge of its characteristics.

1. Cost

In everyday language, a cost may be defined as «the price

to be paid or amount of money to be incurred for something.» This

definition seems to be too simple for this study, in a more accounting sense, a

cost is defined by Needles, Anderson and Caldwell9(*) (1981) as the exchange price associated with a

business transaction at the point of recognition. This second definition is

quite more complete than the previous one but it is still not very accurate and

precise. Another expert, namely Lucey (1993) defines the cost, as the amount of

expenditure be it actual or notional, incurred on, or attributable to a

specified thing or activity.

All these definitions show that costs are measures of what it

takes a company or an entity to perform an activity, they measure and evaluate

the efforts directed towards the achievement of an objective; this implies

that, without information relating to costs we may not be able to evaluate the

success or failure of an entity or activity.

2. Cost Objective or

cost object.

A cost is used to achieve a certain objective; this objective

is termed cost object. It is defined by Garrison and Noreen (2003), as anything

for which cost data is desired. That is any activity that requires information

about the costs involved in performing that activity. Horngren and Foster

(1991) define a cost objective as any activity or item for which a separate

cost measurement is desired. It appears that a cost object is any activity on

which cost can be measured and it is of great importance in accounting because

it helps in assigning and allocating costs to various cost centres.

3. Cost Centre

Garrison and Noreen (2003) define a cost centre as a business

segment whose manager has control over costs but not revenue and investment

funds. This definition relates to those of revenue centre, profit centre and

investment centre.

A revenue centre is a segment of an organisation, mainly a

decentralised one whose manager is responsible of revenue generation.

A profit centre is defined as a business segment whose manager

has control over costs, revenues, but he does not have control over investment

funds.

Finally, an investment centre is the segment of an

organisation whose manager has control over costs, revenues and investment on

operating assets.

All these terms are grouped under the expression

Responsibility centres, and these centres are of great importance to

the cost accounting department of the an organisation because they are used in

the process of decentralising and delegating authority in an organisation and

as such they are a good yardstick for allocating and assigning costs.

4. Cost allocation and

apportionment

Lucey (1993) defines cost allocation as that part of cost

attribution which charges a specific cost to a cost centre or cost unit. The

purpose of allocating costs to cost units or cost centres is to determine with

accuracy the amount of costs used to perform a particular activity; this is

done with the goal of easing the unit cost determination. Cost allocation is

one of the methods used to assign costs to costs objects, the others are direct

tracing and driver tracing.

Direct tracing is quite the most accurate method of cost

assignment; it relies on physical observable causal relationships.

The next best method in terms of accuracy is diver tracing;

this method relies on causal factors called drivers to assign costs to costs

objects, the precision of the method depends on the casual relationship

described by the driver. But this method is very costly because it requires the

identification of drivers and the assessment of the quality of the causal

relationship.

Allocation has the advantage of being simple and of having a

low cost of implementation.

Graphically, the three methods could be summarised as such:

Figure 2-1Cost assignment methods

COST OF RESOURCES

Through physical observation

Convenience asumed linkage

Using activity drivers

Allocation

Driver Tracing

Direct tracing

COST OBJECTS

Source: Hansen, D.R., &Mowen, M.M.,(1997), Management

Accounting (4th edition), p 32, South-western College Publishing,

Cincinnati, Ohio

5. Cost drivers

Costs are always incurred when pursuing certain goals. These

goals must be subject to some factors that influence the level of cost

incurred. Such factors are called cost drivers. As such Drury10(*) (1992) defines a cost driver

as the events or forces that are the significant determinants of the cost of

the activities. This is an important aspect of Activity-based costing,

which is a generic term used to describe costing methods that assume that costs

are subject to changes in their level due to some forces or events as stated

above.

Cost drivers according to the nature of the cost being

studied, we may have costs that vary with the level of output or some that vary

with the level of inputs used such as the number of machine-hours or

labour-hours.

These variations in the level of costs lead us to the desire

to study their characteristics such that we may predict their behaviour with

reasonable certainty.

6. Cost

classifications

There are a variety of reasons why we need to classify costs.

Among the most important are the prediction of their behaviour, the tracing of

these costs to the various cost units or cost centres or the valuation of

inventories. Depending on the kind of company under study, we have different

types of costs in the picture; the costs identified in a manufacturing company

may not be the same as those of a service company, a retailer may not have the

same costs as his supplier dealing in the wholesale business.

In order to provide management with accurate information about

costs we therefore need to analyse them into logical sections that will be more

meaningful than the current bulk of data.

The three major ways of classifying costs use three

parameters, namely: the nature, function and behaviour.

COSTS CLASSIFIED ACCORDING TO THEIR

NATURE

The nature of a cost is related to its traceability,

relevance, and its sensitivity to management actions in the decision making

process. Here is a brief description of the different types of costs listed

according to their nature.

Direct cost:

This is an expression used to describe costs that can be

easily and conveniently traced to the particular cost object under

consideration. (Garrison & Noreen 2003). It is generally used along side

with the concept of indirect cost.

Indirect cost:

This is simply the contrary of the direct cost and Garrison

and Noreen (2003) refer to it as the cost that cannot be easily and

conveniently traced to the particular cost object under consideration.

Costs are generally classified as direct or indirect when we

need to devise a means for the assignment of costs to the cost objects. This is

very helpful as it gives the manager the opportunity to evaluate either the

profitability or implement cost control programmes for the cost object

concerned, as he will have valid information on the amount of resources

consumed by that cost object.

Product and period costs:

The nature of the cost here relate to the timing of their

liquidation as expenses on the income statement. This distinction between

product and period costs is mainly due to the Matching principle of

financial accounting, Drury (1992). This principle is based on the accrual

concepts and it states that: «Costs incurred to generate a particular

revenue should be recognised as expenses in the same period that the revenue is

recognised.» So the difference between product and period cost will be due

to the purpose for which the costs are incurred; if it is a cost used to

produce or acquire an item that may be sold then it will be considered as

product cost otherwise it is a period cost. We can therefore agree with the

definition of Garrison and Noreen (2003), that a product cost

includes all costs that are involved in the acquisition or making of a product.

Taking the example of a manufacturing company, product costs are the direct

materials, direct labour and manufacturing overhead costs that are used to

manufacture a particular item.

These costs have a double treatment according to the time and

financial account. Since these costs are incurred while acquiring or making a

product, they will be used in the valuation of the stocks of that product until

it is sold. This means that, before the sale, these costs are treated as assets

in the balance sheet of the company. Once the sale has been performed, the

revenue earned from their sales must be matched against the costs incurred for

during their production; these costs are then treated as expenses on the income

statement to match them to the sales revenues and obtain the margin or

contribution to the overall profits of the company. So these can be

called inventoriable costs as they are used for stock valuation

purposes.

Garrison and Noreen (2003) define a period cost as all the

costs that are not included in product costs. Since these costs are not used

for acquiring or making products, the company considers them as expenses in the

period in which they are incurred. Some examples of this type of costs include

selling and administrative costs, office rent or financial charges.

To better illustrate the concept of product and period cost,

let us draw a diagram that will show how costs may be classified and how they

flow into the various accounts of a company.

Figure 2-2: COST FLOW AND CLASSIFICATIONS IN A

MANUFACTURING COMPANY

Finished goods inventory

Raw materials inventory

Product costs

Work in progress inventory

Selling and administrative expenses

Goods completed (cost of goods manufactured)

Direct materials used in production

BALANCE SHEET

COSTS

Raw materials purchases

Direct labour

Manufacturing overhead

Period costs

Cost of goods sold

INCOME STATEMENT

Selling and administrative

Source: Garrison R. H., Noreen E. W., Managerial Accounting,

Mc-Graw Hill, New York, 2003, p 50

Relevant, irrelevant, differential, opportunity and

sunk costs:

In this situation, the nature of the cost will be tied to its

usefulness in the decision making process.

Differential or incremental cost

Incremental analysis is a valuable tool in accounting as in

finance and economics. Incremental simply means additional. Generally in the

business environment, we are faced with many alternatives ways of performing an

activity. A differential analysis is therefore essential to select which

alternative to take on. This differential analysis focuses on the costs and

revenues associated to each alternative. A differential cost is therefore the

difference in cost between any two alternatives, so it is not a constant

figure; it depends on the couple of alternatives selected. It refers to the

cost that may be avoided if the alternative is rejected so it can be called

avoidable cost.

Opportunity cost

As outlined by Garrison and Noreen (2003), it is a concept

that is not usually entered in accounting records; nevertheless, every manager

when making decisions must consider it. Samuelson and Nordhaus11(*) (2000) state that this concept

is much broader when defined in economic terms, but it refers to the potential

benefit that is given up when one alternative is selected over another. It is

the cost of the forgone alternative.

Sunk cost

Garrison and Noreen (2003) define it as a cost that has

already been incurred and that cannot be changed by any decision made now or in

the future. This can also be termed unavoidable cost. It is

not very relevant when making decisions as it cannot be changed or avoided

through a decision made by management; examples of this are the cost of

acquiring fixed assets.

Controllable and uncontrollable costs.

When decentralising an organisation and delegating the

authority to its various segment managers it becomes easier to evaluate and

judge their respective performances. In order to achieve this task, senior

management needs to identify the costs that can be monitored by those managers.

Such a situation leads to a new classification of costs as either controllable

or uncontrollable.

Controllable costs

Anthony & Reece 12(*)(1975) states that an item of cost is controllable if

the amount incurred in (or assigned to) a responsibility centre is

significantly influenced by the actions of the manager of the responsibility

centre. Controllable costs refer to all those cots that are under a manager's

authority, it means that this manager has the authority to modify them

depending on his plans. As an example a manager may have authority over

supervisors employed in his department, but he may not be able to fire or hire

them, so the supervisory costs of that department will not be classified as

controllable costs for the department's manager.

Uncontrollable cost

This is simply the contrary of the controllable cost. It is

one that is not under the regulation of a particular manager as the supervisory

cost of the previous example.

This classification of cost as either controllable or

uncontrollable must be used alongside with budgeted costs. These budgeted costs

will serve as standards for comparison against the actual performance. In order

to evaluate a manager's performance, we must have a yardstick or a measuring

rod that will ease the process and this measuring rod must be a Cost

Budget established at the beginning of the accounting period.

b) COST CLASSIFICATIONS ACCORDING TO THEIR

FUNCTION

The activities performed in a manufacturing company generally

encompass all the activities performed in all other forms of enterprises. In a

manufacturing company, for products to come out of the production lines a

number of processes must be completed. Each of these processes is performed in

a particular department or segment of the company; these are generally

described as functional departments controlled by specific

specialists; this division of the company into functional departments creates

the need to differentiate and classify costs according to the functional

department in which they are incurred.

Such a classification is made to come out with the various

departmental costs which will be used for stock valuation, control and decision

making purposes.

Manufacturing costs

This is generic term used to describe all the cost items that

enter into the production of a particular good. It usually consists of three

elements, namely: direct materials, direct labour and manufacturing

overheads.

Direct materials

Garrison and Noreen (2003) describe direct materials as those

materials that become an integral part of the finished product and that can be

physically and conveniently traced to it. The direct materials costs are an

integral part of the direct costs previously discussed under the nature of

costs. Direct materials refer to those costs that are incurred in the

assembling area of the production process, it consists of all those items that

are used to manufacture a product and that are specific to that product such as

the sheets of paper used to print a newspaper.

Direct labour

This is another element of the direct costs. Drury (1992)

defines it as the labour costs that can be specifically traced or identified

with a particular product; it is sometimes called Touch labour

since it generally requires direct labour workers to touch the product while it

is being made.

Direct expenses

It is very difficult to find this item in the cost structure

of many companies. Inman13(*) (2001) states that they refer to the services that

can be clearly and directly associated with a specific output or service.

Examples of this type of costs are copyright expenses, patent rights, royalties

or the cost of hiring a machine.

Manufacturing overheads

We have already defined the direct items of the cost incurred

to produce or make a particular product. There are also some costs that are

quite of the same origin as the direct costs but which are used for the whole

department or the company and cannot therefore be trace to specific units of

output; such costs are known as manufacturing overheads. Synonyms for these

cost items are factory overheads or factory burden. It

generally includes the lighting and heating costs, property taxes, insurance or

depreciation of the company assets. As it can be seen, it applies to the costs

incurred by the company to enable the processing of all its activities not only

a single one.

From these items of manufacturing costs, we can derive two

important concepts: prime cost and conversion cost.

Prime cost refers to the combination of direct materials,

direct labour and direct expenses required to produce a particular item. It is

a very important concept when making the cost structure of an entity. It is the

primary cost of a product, it constitute the basic requirement for its

production.

Conversion cost is the combination of direct labour cost and

manufacturing overheads; it is called conversion cost because it refers to the

elements required to convert direct materials into finished goods. As we know,

direct materials constitute the heart of the product; direct labour and

manufacturing overheads just serve as facilities to ease the production of the

required item.

The company, as stated above may be divided into multiple

departments, the core one being the manufacturing department. Others could be

termed as non-manufacturing departments and this terminology will help us in

describing the costs incurred in these non-manufacturing departments.

Non-manufacturing costs

Administrative costs

Garrison & Noreen (2003) states that it includes all

executive, organisational and clerical costs associated with the general

management of an organisation rather than with the manufacturing, marketing or

selling activities of the company. It is another kind of overhead cost; they

are incurred by the administrative staff of the company and are not traceable

to any particular product, cost object or processing department.

Marketing and selling and distribution costs

These are the costs incurred to make sure that customers

receive their orders safely; that is they are the costs incurred by the company

during the promotion, advertising, sales and follow-up activities. They are

also called order getting and order-filling costs.

Research and development costs

These are the costs associated with the research and

development departments of the company. In that department, the aim is to

discover new products, devise new processes, improved means pf production. In

fact it is a matter of innovation. This is a very important department of the

company as it helps the company to differentiate its products and services form

those of competitors. So the costs of making such improvements should also be

taken into consideration when making certain decisions.

Quality cost

The image of a company is generally judged based on the

quality of its products and services. Companies would like to have defects-free

products in order to satisfy their customers and to reduce the after-service

and warranty costs. The need arises therefore to prevent, detect and reduce the

defects that may be found in the production. The costs associated with these

activities are known as quality costs; the quality costs can be divided into

four categories (Garrison and Noreen: 2003)

The first two categories are prevention and appraisal

costs which are incurred in an effort to avoid defective products from

being produced.

The last two categories are internal failure and

external failure costs which are incurred for the purpose of reducing

the effects of the production of defective items.

This description of costs from the functional point of view

has helped us in identifying various types of costs; but these costs can be

analysed from another point of view, namely their behaviour when related to

changes n the level of activity.

c) COSTS CLASSIFICATION ACCORDING TO THEIR

BEHAVIOUR

This classification of costs deals with the way costs react to

changes in some factors. The most important factors that cause some costs to

change are the level of activity and the time factor.

As it concerns the level of activity, generally costs are

incurred because of performing a particular activity, this activity may

consists of various processes among which a major one that is sometimes

regarded as the main cost driver. It is that one whose changes will result to

very significant changes in the level of costs. It becomes possible at that

point to relate the level of activity of that cost driver to the level of costs

and as such the behaviour of that cost will be linked to the cost driver.

Concerning the time factor, costs do not behave the same way

in the long run as in the short run. As time elapses, there may be changes in

the market conditions such as inputs costs, level of demand or production

procedures. Such changes in the market situation over time will lead to a need

to a new analysis of costs depending on the time span of the plans we are

making.

These two factors have led experts to classify costs as:

· Variable

· Fixed

· Semi-variable

· Semi-fixed

· Short-term variable

· Long-term variable

Variable costs

Lucey (1993) defines a variable cost as a cost that tends to

vary with the level of activity. Garrison and Noreen more precisely define it,

as a cost that varies in total in direct proportion to changes in the level of

activity. An important aspect of this definition is the fact that variable

costs vary in total, this is because on a per-unit basis the variable costs are

constant and it is only when the level of activity, which may be the output, or

the number of hours worked changes that the total variable cost also changes.

This explains why the variable cost is always expressed in relation to a

particular factor. The figure drawn below depicts that relationship between the

level of activity and the behaviour of variable cost.

Figure 2-3 The behaviour of total

variable cost

Total Cost

Level of activity

Figure 2-4 The behaviour of Unit variable

cost

Unit cost

Level of activity

Such descriptions of variable costs are only a linear

approximation of real-life situations. This is because, in real life, variable

costs are rarely completely linear; they may also be curvilinear. A

curvilinear variable cost is one which varies ion total in either «less

than» or « more than» proportionate variation with the level of

activity.

When an increase in the level of activity leads to a

«less than» proportionate increase in the level of costs, this cost

is referred to as concave curvilinear variable cost. The

opposite is a convex curvilinear variable cost. They are

illustrated in the graphics below.

Figure 2-5 Curvilinear concave variable cost

Level of activity

Figure 2-6 Curvilinear convex variable cost

Level of activity

Fixed cost

Garrison and Noreen (2003) define this, as a cost that remains

constant in total regardless of changes in the level of activity. On a per-unit

basis, fixed costs continuously decrease as the level of activity increases.

This is because there are constant amount of costs to be incurred by the

company whatever the level of activity is and as such, the greater the level of

activity, the greater the distribution of fixed costs over the units of

output.

Here is a graphical illustration of the behaviour of fixed

costs.

Figure 2-7 The behaviour of Total Fixed costs

Total costs

Level of activity

Figure 2-8 The behaviour of unit fixed cost

Unit cost

Level of activity

Semi-variable cost

This is a type of cost that has both fixed and variable

components. A semi-variable cost is one which remains constant up to a certain

level of activity and which becomes variable for any activity level above that

level.

Graphically, a semi-fixed cost looks the following way:

Figure 2-9 The behaviour of semi-variable cost

Level of activity

Total cost.

Fixed cost component

Semi-fixed cost

These are costs that remain constant during short time periods

but which vary in the long run. They are also described as step fixed costs.

This type of cost is subject to changes at various critical level of activity;

as long as the company remains in a certain range of activity, these costs are

fixed, but they change when the company shifts to a new critical level.

Graphically, it looks this way:

Figure 2-10 The behaviour of semi-fixed

cost

Total costs

Level of activity

Short and long term variable costs

These are two terms used to describe the behaviour of costs in

relation to the joint effects of the level of activity, the time factor and the

range of activity. Cooper and Kaplan14(*) (1987) defined a short-term variable cost as one that

varies with the production volume. These are the costs that are directly

affected by increases in the level of production. They are continuously

changing.

The long-term variable costs are those that are affected by

other factors than the level of activity and principally the range of items

produced. These costs are usually considered as fixed over short periods of

time but as the means and processes of producing various kinds of times change

in the long run, these costs obviously change and as such they will no more be

considered as simple fixed costs.

So, to conclude this discussion of cost behaviour, it is

important to note that the predominant aspect in analysing the behaviour of a

cost is the factor to which it is tied; the factor that really influence the

cost. There may not be only one factor, but as many as the number of cost

drivers.

II. THEORY OF

COSTING: METHODS AND TECHNIQUES

This study is concerned with the method of applying job

costing to the accounting procedures of SOPECAM. In the process of using job

costing, we shall take two approaches to the costing exercise, namely the

variable and absorption costing approaches. This simply means that we are

interested in studying a particular costing method and its use under two

costing techniques; we must therefore first of all understand what is meant by

costing methods and costing techniques and how they differ from each other.

A. COSTING METHODS

Lucey (1993) defines costing methods as the methods of costing

designed to suit the way goods are processed or manufactured or the way that

services are provided. It therefore refers to the various methods that can be

used to come out with the cost of an activity. It appears that the costing

method must suit the product or service to cost. This is the reason why we may

have two broad categories of costing methods, namely:

1. Specific order

costing:

This is a costing method applicable where the work consists of

separate jobs or batches. The main sub-divisions of specific order costing are:

job costing, contract costing and batch costing.

2. Continuous

operation or process costing:

This costing method applies where the goods or service

produced result from a sequence of conditions or repetitive operations or

processes to which costs are charged before being averaged over the units

produced during the period. Its main sub-divisions are: process costing

including joint product and by-product, and service/function costing.

a) Job costing

This is a traditional method of accounting for cost. This is a

method where the costs incurred are allocated, apportioned and absorbed by the

cost unit, which is the object to cost.

Here the company production is divided into jobs, which may be

of the same nature, but generally they are all different. The purpose here is

to determine the profit made on each job, as this will be helpful for future

planning.

b) Batch costing.

Being another type of specific order costing method, it is one

which applies when a quantity of identical items are manufactured as a batch.

It is very similar to job costing but the main feature of batch costing is that

the unit cost is the ratio of the total cost of the batch to the number of

units in the batch. This method is widely used in the footwear and clothing

industries where similar items are manufactured.

c) Process costing.

This is a costing method, which is used when the production

is essentially made of homogenous products, which are being produced on a

continuous basis. It is very close to job costing in that:

· They have the same basic purposes, the determination of

the unit cost.

· They use the same basic accounts

· The flow of costs through these accounts is quite the

same for the two methods.

The differences are due to two main factors:

· In process costing the flow of units is quite

continuous while job costing is concerned with separate and distinct

processes.

· Under process costing there is no need to try to

identify materials, labour or overhead costs with particular order since that

order is only part of the many that continuously flow.

Now that we know the different methods that can be used to

build a company costing system, we must now determine the techniques to be

employed depending on the destination of the output information.

B. COSTING TECHNIQUES

The costing techniques are the number of tools, processes and

procedures that may be used alongside with a costing method to come out with

the cost of an activity. There are several costing techniques among which:

absorption costing, marginal costing, standard costing or

activity-based costing.

For this study we will concentrate on the use of absorption

and variable costing used in conjunction with job costing to determine the unit

cost of the newspaper Cameroon Tribune. We therefore need to discuss each of

these methods to understand the mechanisms involved.

1. ABSORPTION

COSTING

Sometimes referred to as full costing, absorption

costing is a costing technique in which all costs are absorbed into the

production units and as such both fixed and variable costs are allocated to the

cost units. Drury (1992) states that in absorption costing, all manufacturing

costs are allocated to products, unsold stocks are valued at their total cost

of manufacture and non-manufacturing costs are not allocated to products but

are charged directly to the profit and loss account, so they should be excluded

from stock valuation.

The procedure to follow when preparing a profit statement

using absorption costing can be summarised as follows:

Sales ******

Less: costs

Opening stocks ***

Direct materials cost (fixed and variable) ***

Direct labour cost (fixed and variable) ***

Direct expenses cost (fixed and variable) ***

Indirect expenses (fixed and variable) ***

Less closing stocks ***

Cost of goods sold *******

Gross profit *******

Less:

Administrative costs ****

Selling and distribution costs ****

Finance expenses ****

Other non-manufacturing overhead costs**

*******

Net profit ********

Source: Coulthurst15(*) (2001)

The following are some of the arguments used by the proponents

for the use of absorption costing, Lucey, T (1992)16(*):

a) Fixed costs are a substantial and increasing proportion of

costs in modern industry. Production cannot be achieved without incurring fixed

costs, which thus form an inescapable part of production so they should be

included in stock valuations. Marginal costing may give the impression that

fixed costs are somehow divorced from production.

b) When production is constant, but sales fluctuate, net

profit fluctuations are less with absorption costing than with marginal

costing;

c) Where stock building is a necessary part of operations, the

inclusion of fixed costs in stock valuation is necessary and desirable.

Otherwise, a serious fictitious loss will be shown in earlier periods to be

offset eventually by excessive profits when the goods are sold.

d) The calculation of marginal cost and the concentration upon

contribution may lead to the firm setting prices which are below total cost

although producing some contribution. Absorption costing makes this less likely

to happen because of the automatic inclusion of fixed charges.

e) SSAP 9 which is about the stocks and Work in progress,

recommends the use of absorption costing for financial accounts because

revenues and costs much be matched in the period when revenues arise not when

the costs are incurred. Also, it recommends that stocks valuations must include

production overheads incurred in the normal cause of business even if such

overheads are time-related, that is fixed. The production overheads must be

based upon normal activity levels.

2. VARIABLE

COSTING

Also referred to as marginal costing, or in some other texts

as direct costing; variable costing as stated by Coulthurst (2001) is

a costing technique which places more emphasis on the behavioural

characteristics of the costs unlike absorption costing which focuses on the

functional nature of the those costs. The aim in variable costing is generally

to separate the costs into fixed and variable elements.

Copeland, Dasher et al (1995)17(*) defines variable costing as a form of cost

accumulation in which only the variable costs are accumulated with inventory as

it is being manufactured. Under variable costing, fixed overhead costs are not

accumulated with the inventory being manufactured; instead they are regarded as

period expenses. As shown in the above definition, unlike absorption costing

which assigns both fixed and variable costs to the cost units, variable costing

treats fixed costs as period costs and they are therefore not included in the

unit cost calculations.

The preparation of a profit statement using marginal costing

can be done using the following format:

Sales *******

Less: costs

Opening stocks ****

Variable Production costs

Direct materials costs ****

Direct labour costs ****

Direct expenses ****

Indirect expenses ****

Less closing stocks ****

Add Non-manufacturing variable costs *****

Cost of goods sold *****

Contribution ******

Fixed manufacturing costs *****

Fixed non-manufacturing costs ******

******

Net profit ********

Source : Drury (1992) p184

Marginal costing also has its proponents who claim that:

a) It is simple to operate

b) No apportionment, which are frequently on an arbitrary

basis of fixed costs to products or departments. Many fixed costs are invisible

by their nature.

c) Where sales are constant, but production fluctuates,

marginal costing shows a constant net profit whereas absorption costing shows

variable amounts of profits.

d) Under or over absorption of overheads is almost entirely

avoided; the usual reason fro under or over absorption is the inclusion of

fixed costs into overhead absorption rates and the level of activity being

different to that planned.

e) Fixed costs are incurred on a time-basis and do not relate

to activity, therefore, it is logical to write them off in the period they are

incurred; this is done using marginal costing.

f) Accounts prepared using marginal costing more nearly

approach the actual cash flow position.

Using a particular costing technique will mainly depend on the

use that will be made of the output information. This cost information may be

used for external reporting, internal decision-making or future planning.

Costing techniques do not replace the costing methods; they

are always used together in order to have a complete costing system.

This paragraph ends our discussion on cost concepts. This

study is not only aimed at studying the cost structure of SOPECAM, it is also

designed to help management in the process of pricing their products. As such

we need to have an insight into the pricing theory based on cost information

and this will be the topic of the next paragraphs.

III. PRICING DECISIONS BASED ON COST INFORMATION

After having determined the unit cost of its products or

services, analysed other factors such as the expected demand or the market

structure, the company focuses on establishing a price that will lead the

maximisation of the profits. This is the essence of the pricing decision.

Pricing simply means setting a price for a product or service

as stated by Kotler and Dubois18(*) (1997). When setting a price for its products, a

company is surely seeking to achieve certain goals and for this to be done, the

company must follow some principles and techniques.

1. Pricing objectives

The objectives of the pricing policy which are also outlined

by the afore-mentioned book are as follows:

a) Survival:

Any company must set prices that will at least help it to

remain in the market even if the company is operating in a highly competitive

environment.

b) Profit

maximisation

The main objective of any business enterprise is to maximise

profits and as such any policy or method used by a company must first be aimed

at maximising these profits.

c) Turn over

maximisation

Since this is an indication of healthiness for companies where

it is difficult to evaluate costs, it must therefore be maximised to be sure

that the company is safely operating.

d) Growth

maximisation

This objective is mainly derived from the economies of scale

concept of the economists; this concept states that higher sales lead to long

term cost reductions and therefore greater profits.

e) Goodwill and

image preservation

This stems from the desire of the company to be regarded as

one maintaining a certain standard or policy in pricing; this standard or image

surely relate to the quality of the products or services offered by the

company.

2. Pricing techniques

Depending therefore on the objectives of the company, it can

adopt various pricing techniques. These techniques normally are based on a

great number of factors, but here we will be interested in studying those that

are based on the cost information provided to management. Pride, Hughes and

Kapoor 19(*)(1988) call

them cost-based or cost-plus pricing

techniques). We will focus on three of them namely:

Total cost-plus, manufacturing cost-plus, and decision-relevant

cost-plus method.

a) Total cost-plus

pricing

In this method, the future selling price is the result of the

addition of a desired set of mark up to the total unit cost of a product or

service. This method may be a good one, but the problem here is that it is

sometimes difficult in some industries to succeed in allocating overhead

expenses to the units of production.

b) Manufacturing

cost-plus method

It follows quite the same procedure as the previous one, but

here, the costs that are taken into account are the manufacturing costs and as

such overhead costs are left out of the calculations. A large mark up

percentage is therefore required to cover these overheads and allow for

reasonable profits for the firm.

Drury (1992) identified that this method has as main advantage

the fact that the cost figure used for pricing is the one used for stock

valuation. In this case, if the firm has been producing similar products in the

past, it may be easy to determine the estimate of the total manufacturing costs

by simply adjusting the old figures.

c)

Decision-relevant cost-plus method

It consists of basing the pricing policy the figures of the

incremental costs due to producing the new elements. Here what is required is a

perfect knowledge of the avoidable and unavoidable costs if the production of a

particular item is started. Since the fixed costs of the company will remain

constant for short period, then the mark up is added to the additional cost of

producing that new item.

The above three refer to the most popular methods of pricing,

there is another one based on activity-based cost, which just consists of

adding the mark up to the activity based-determined cost. That method is not

very different from the others, the main difference residing in the method of

determining the unit cost.

These costing methods as we have outlined at the beginning

ignore many factors and as such must be used alongside with other elements to

come out with a more reliable selling price. The following limitations of these

methods explain why they should not be solely used.

Limitations of cost based

pricing

Ø They ignore the market demand: these

methods do not take into account the price demand relationships characterised

by the economic concept of price-elasticity of demand.

Ø Circular reasoning: this is to say

that the selling price affects the volume of sales, which in turn affects the

unit fixed cost, which will also lead to further price changes. The figure

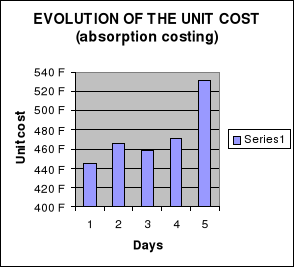

drawn below illustrates that situation.

Figure 2-11 Circular reasonning in cost

based-pricing

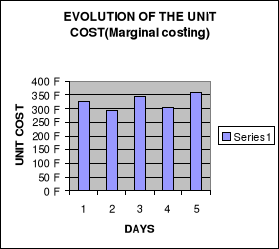

SALES ESTIMATES

PROPOSED SELLING PRICE

UNIT FIXED COST

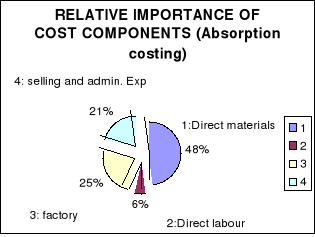

Source: Drury C. Management Accounting (2000)20(*)

Ø Common fixed costs: this limitation

is in relation to the method used to apportion costs and depending on the

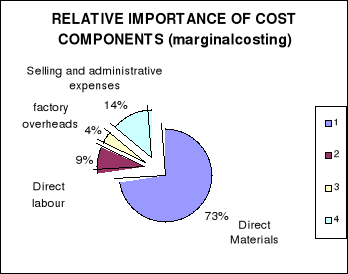

method used the cost obtained will be different and will therefore lead to a

different pricing decision.

Ø Pricing floor: generally, cost based

pricing is referred to as a method that gives the seller a little amount of

security against loses as the cost are always covered by the selling price. But

in real life situation, it is sometimes found that the sales of the product are

subject to fluctuations in demand and as such the total revenues may not be

able to cover the total costs at certain levels of sales other than the

budgeted ones.

Recalling again that these methods are used just as a guide

to final pricing decisions, we must not therefore pay too much attention to

their limitations, but understand that theses methods are helpful as initial

approximations of future selling prices.

IV. THE THEORY OF

JOB COSTING

Job costing is a costing method that has constituted the

central point of many studies conducted by various researchers.

Drury (1992) has described the procedures used in a job

costing system and the accounting entries necessary to record the transactions

taking place in a company using job costing. While analysing the various

costing methods, he stated that job costing should be used when the company

output is made of various jobs or orders from separate customers; he also

stated that there are two alternative ways of designing a job costing system:

either as an integrated cost accounting system or

as an interlocking cost accounting system. These

systems will be explained later in the chapter.

Drury (1992) advocated the use of an integrated cost

accounting system as this reduces or avoids the duplication of records as found

in an interlocking system.

Lucey (1993) also examined the mechanics of a costing system

where job costing is employed. He first stated that this system must be used

where the work to be performed is on customer's requirements. Secondly, this

system must be based on good records obtained from production, works

documentation, material and labour bookings. The documents used here are the

Material requisition forms, time tickets and the job cost sheet. Once prime

costs have been gathered, overheads must be charged to jobs and this can be

done using either the Traditional methods based on the labour

or machine hours overhead absorption rates or using

the cost drivers rates of an activity-based system. He finally pinpointed that,

for profits to be derived from a job costing system, it will depend on the

costing technique used.

Garrison and Noreen (2003) also contribute in the advancement

of the knowledge on job costing. They first identified the type of industries

where job costing can be used, namely: furniture, manufacturing, hospitals or

legal firms. These are industries where the companies offer a wide variety of

products or services.

From their point of view, material requisition forms, labour

time tickets must be used for the assignment of direct materials and labour to

the various jobs; then concerning the manufacturing overheads, they must be

assigned using he predetermined overhead rates. The predetermined overhead

rates generally use labour or machine time as the allocation bases.

They finally make a point in illustrating the flow of costs in

a job costing system, from the raw materials to the foods sold.

V. EMPIRICAL STUDIES ON JOB COSTING

As a product costing method, job costing has been mentioned in

various studies conducted by some researchers exploring the topic of product

cost determination.

One of them, Gorpinpaitoon21(*) (1982) made a study on the use of job costing in the

shipbuilding industry in Thailand.

His study was aimed at examining the costing method used by

shipbuilding firms in Thailand in order to ascertain the principle, the costing

method and its problems. This study was made through direct observation of the

actual operations and the interviews of the personnel involved in that

industry.

At the end of the study, it was realised that the costs of

direct materials and direct labour are charged to the job, but factory

overheads are accumulated and allocated to each job on the basis of direct

labour cost or as a percentage of work finished.

Ngu22(*)

(1997) conducted a study on the topic of product cost and in it, he identified

importance of a product cost to the decision making process of the company. The

data used were got from primary and secondary sources and had been analysed

using quantitative and qualitative means. In the study, he made the point to

differentiate the various costing methods that can be used to come out with the

product cost among which job costing. The study revealed that companies making

one of a kind or special order products use job costing.

The study finally showed that it is very important to

determine the cost of a product as this is of great importance to the decision

making process of the company.

VI. THE MECHANICS

OF JOB COSTING

Job costing is cost accounting method, and as such when using

it or adopting it in a company, we are required to follow a set of procedures

for the recording of the various transactions in the company.

This recording can be made using either an interlocking or an

integrated cost accounting system. An integrated cost accounting system is one

in which the financial and cost accounts are combined in one set of accounts.

In an interlocking cost accounting system, the financial and cost accounts are

maintained independently. As stated by Drury (1992), it is better to adopt an

integrated cost accounting system as this permits to avoid the duplication of

records.

In job costing, the basis for the recording of transactions is

a set of control accounts. A control account is a summary account where entries

are made from totals of a period's transactions; these totals come from the

individual accounts where the transactions are primarily recorded and these are

called subsidiary ledger accounts. In addition to posting these transactions in

the various accounts concerned, we will have to post them on a Job cost card or

job cost sheet.

The job cost sheet is a form prepared for each separate job

that records the materials, labour and overheads costs charged to the job.

The accounting procedures and mechanics of job costing will be

examined following the various steps involved in the manufacture of a product

by a manufacturing company, that is from the purchase of raw materials to the

selling of the finished goods, passing through the charging of labour and

overhead costs, Drury (1992) and Garrison & Noreen (2003).

1. Purchases of raw

materials

Following the double entry principle and the other rules of

financial accounting, if raw materials are acquired, this represents an

increase in current assets but also an increase in the level of current

liabilities until cash payment is made; this transaction will then be recorded

as such:

Dr stores ledger control

account......................******

Cr creditors control

account..................******

2. Issue of raw

materials

This transaction occurs when materials are needed in the

production department, the production department will request a particular

quantity of materials using a material requisition form on which the job number

will be specified. This form will be presented to the storekeeper, who in turn

will supply the materials requested.

Dr Work in progress

account.................*****

Cr stores ledger

account..............*****

The work in progress account represents the products that are

not yet completed and until a good is complete it is considered as part of the

work in progress stock and all the items entering in its production should be

posted on that account.

The above record concerned the issue of direct materials, if

some indirect material is issued, then the following record should be used:

Dr Factory overhead control

accounts...........*****

Cr stores ledger control

account.........*****

3. Labour costs

Once the payroll accounting has been done, that is the

determination of the gross pay for each employee and the calculation of

payments to be made to employees, government, pension funds and others. We can

now allocate labour costs to the various jobs, overhead accounts and capital

accounts.

The wages due to employees are computed from the records of

each employee time tickets. These tickets show the time periods spent on each

job and the various indirect labour hours. It is recorded as follows:

Dr works in progress

account...................................*****

Dr factory overhead

account...................................******

Cr salaries and wages payable

account..............******

4. Manufacturing

overheads

This concerns all the factory costs other than direct

materials, labour and expenses. They are entered into the factory overhead

account as they are incurred. This is done as follows:

Dr factory overhead account

...............******

Cr account payable.............

......****

Cr property tax payable account. ...****

Cr prepaid insurance

account...........****

Cr accumulated depreciation account...***

Now we must charge these costs to the various jobs, this needs

to be done following an objective measure. This measure is known as the

predetermined overhead absorption rate. The overhead

absorption rate is a kind of coefficient, which is used to allocate

manufacturing overhead costs to jobs. It is computed using an allocation base;

this allocation base refers to the most influential cost driver for that

particular cost. This means that there may be several overhead absorption rates

for various costs depending on the allocation base used. The overhead

absorption rate is determined at the beginning of the accounting period using

the formula:

Predetermined overhead absorption rate=estimated total

manufacturing overhead cost/ estimated total units in the allocation

base

Once we have obtained the overhead absorption rate (OAR),

assigning overheads to a job is done as such:

Overhead applied to a job= OAR*amount of the

allocation base incurred by the job

Given the OAR, we can then apply manufacturing overheads to

the jobs and this is reflected in the accounts as follows:

Dr Work in progress

account.........................*****

Cr factory overhead

account.................*****

Once all the entries have been posted into the factory

overhead control account, we can then reconcile the two sides of that account.

Normally if the two sides are equal, this will mean that the company charged

the same costs that it incurred. A larger debit side means that the company

charged less than what it actually incurred and the balance between the two

sides is referred to as the under absorbed overhead costs and