3.3.3 Other key structural features

CDS tenor choice

Another crucial structural feature of the DPPI is the tenor

investment rule that allows to adapt CDS tenors depending on market spread

levels. Let us call e(S(t), t) the potential tenor of any CDS investment done

on date t, where e is defined below:

e : [0, 1] x [0, T] -? {3, 5, 7, 10} (x,t) 7-? e(x,t)

Removal

of downgraded assets

In order to manage the default risk inherent in owning

leveraged long CDS positions, we shall apply a specific asset-removal rule

based on rating observations: as soon as an obligor's rating has been staying

below a given threshold, say Ba2, for more than 3 straight months, then all CDS

long positions on that obligor must be removed from the portfolio and replaced

by equivalent positions on another obligor whose rating is investment grade,

i.e above or equal to Baa3.

Early cash-in events

The DPPI structure shares with earlier CPPI products an early

cash-in feature that allows the deal to be unwound before the scheduled

maturity date if the deal's NPV is high enough to cover all future liabilities,

i.e future coupons, fees, and principal payments, until the scheduled maturity

date (10 years). However, our DPPI incorporates two extra early cash-in

triggers based on shorter maturity dates, namely 5 years and 7 years. Those

three barrier conditions allow the structure to avoid adverse scenarios where

the NPV would plummet and break the bond floor, hence cash-out, after reaching

its TRV level.

Subordinated note

We add to the DPPI structure an sl := 2% thick subordinated

note, the payoff of which is similar to that of a CSO equity tranche. The

relatively high yield served on that tranche, 250 bps, compensates the

subordinated noteholder for bearing the first loss risk of the structure.

3.4 A study of the DPPI's sensitivities

Given Moody's modelling and calibrating assumptions on risk

factors, we wish to study the DPPI's behaviour as a function of its main

structural features, such as the spread over EURIBOR served to the senior

investor, the CDS tenor investment rule or the parametres of the Target

Notional Exposure function.

Unless otherwise stated, we base our analysis on the portfolio

described in figure (12), on the DPPI optimized parametres listed in figure

(11) on the set of Moody's parametres listed in figures (8), (9) and (10). All

numerical results are based on C++ code developped by both Bear Stearns and

Moody's. As a starting point we plot hereafter the DPPI's simulated discounted

loss and lock-in times distributions based on 30,000 draws..

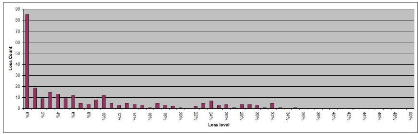

Figure 3.3: DPPI base-case loss distribution conditional on the

structure not cashing in

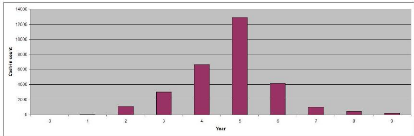

Figure 3.4: Distribution of cash-in times

The Moody's Metric of the base case scenario is 2.697, which is

equivalent to an Aa2 rating.

3.4.1 Tailor-made structural features to achieve target

rating

Senior rated coupon level

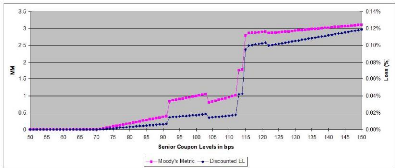

The level of the senior rated coupon is obviously a key

parametre in achieving the target rating. The graph below plots the estimated

expected loss and Moodys Metric as a function of S, the senior rated premium

paid above EURIBOR rate and measured in basis points. One shall point out the

jumps in the graph, stemming from the various triggers introduced in the

pay-off loss function L. The rather linear relationship outside jumps is also

fairly straightforward: between two jumps, the subset of cash-out scenarios is

fixed. However, given that the bulk of the loss is explained by scenarios that

cash-out at maturity without paying any single coupon, one would find that the

average loss on those scenarios is proportional to the senior coupon level, as

is the price of a bond paying EURIBOR plus the senior coupon.

Figure 3.5: Estimated expected loss as a function of S. CDS tenor

choices

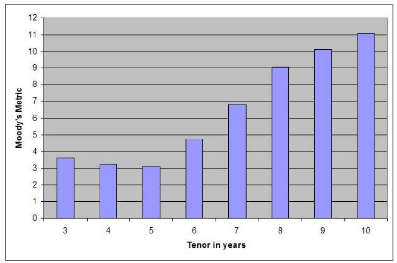

Initial and reinvestment CDS tenors have a significant impact

on the shape of the loss distribution and eventually on its expected level. We

now assume that e(.,.) is constant and equal to 0. We then plot the expected

loss level as a function of 0 E {3, 4, .., 10}. The reverse-bell shape of the

diagram accounts for the fact that:

· for short tenors, the lower MtM volatility of the DPPI

does not fully compensate for the loss in contracted CDS spread premia due to

the upward sloping shape of the term structure;

· for long tenors, the gain in contracted CDS spread premia

does not fully offset the impact of a higher MtM volatility.

Figure 3.6: Estimated expected loss as a function of è

(2000 simulations per coupon level)

Target Notional Exposure parametrization

In order to get the intuition on how the expected loss behaves

with respect to the

Target Notional Exposure function TNE(.), one shall

slightly simplify the latter and

assume that opportunity leverage and target

multiplier functions, OL(.) and TM(.),

are constant and equal to respectively OL and TM. We then plot

TNE as a function

of both parametres OL and TM. S1 stands for TM = 20 and S9 for

TM = 40 with Si+1 - Si constant.

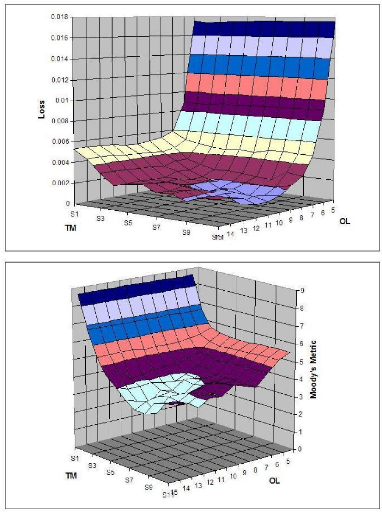

Figure 3.7: Loss and Moody's Metric as a function of OL and TM,

1000 simulations per couple of parametres

One shall point out from the graphs that even with the best

combination of fixed

Opportunity Leverage OL and Target Multiplier TM parametres,

the structure's

Moody's Metric remains significantly higher than 2.697

obtained with dynamic OL

and TM functions. Also, we clearly see that there is a

tradeoff between OL and TM

that allows the structure to improve its rating:

too high values for both parametres

lead to a sub-optimal leverage function,

reflecting the fact the extra MtM volatility

induced by a higher leverage has a negative fat tail effect on

the loss distribution L(M).

|