|

THE UNIVERSITY OF BIRMINGHAM

School Of Government and Society

International Development Department

Public debt of Togo: an attempt to identify the

explanatory factors.

Presented by TENGUE KOKOU EDEM (student ID:

1189657)

Supervisor: Mr. Jackson Paul

Number of words: 13833

Submitted on 30th August 2013

Program of Study:

Master of Science in Public Administration and Development

2011-2013 Academic Years

Public debt of Togo: an attempt to identify the

explanatory factors.

Acknowledgement

3

Abstract

4

1 Methodology and research question &

brief presentation of Togo

7

1.1 Methodology and research question

7

1.2 Brief presentation of Togo

8

2 PUBLIC DEBIT: FROM LITERATURE TO THE

SITUATION IN TOGO

9

2.1 PUBLIC DEBT AND ITS EFFECTS IN

LITERATURE

9

2.1.1 Introduction to public debt,

sustainability or debt viability

9

2.1.2 CAUSES, CONSEQUENCES AND MOTIVES OF

PUBLIC DEBT

12

2.2 DESCRIPTIVE ANALYSIS OF THE LEVEL OF

PUBLIC DEBT IN TOGO

15

2.2.1 STRUCTURE OF THE DEBT AND DESCRIPTIVE

STUDY OF THE EXTERNAL DEBT OF TOGO

15

2.2.2 Domestic debt

18

3 ECONOMETRIC ANALYSIS OF THE DEBT

22

3.1 EMPIRICAL AND ECONOMETRIC ANALYSES

22

3.1.1 RESULTS OF EMPIRICAL ANALYSES AND

SPECIFICATION OF MODEL

22

3.1.2 Estimation and model validation

26

3.2 INTERPRETATION OF FINDINGS AND

RECOMMENDATIONS OF ECONOMIC POLICIES

30

3.2.1 Interpretation of results

30

3.2.2 ECONOMIC POLICY RECOMMENDATIONS

34

Acknowledgement

I am grateful to my family my Father Djehoue , my mother

Philomene , my wife Marlene and my Two children Ashley and Bradley who have

suffered a lot for my long working hours coupled with studies during nights and

week end . I also thank the ministry of economics and finance in Togo for their

grate support in providing some data for the analysis. I also want to extend my

praise to Andrea and Linda for their support trough the program and also to my

supervisor Mr. Jackson for his comprehension and assistance.

1 Abstract

Togo is a formal French colony independent since 1960 .The

focus of the dissertation will be the public debt of this young country with a

particular emphasis on the period from 1980 to 2008 which represents a period

of 29 years. During this period the amount of the foreign public debt has

increased despite payments done and annulations obtained In itself the increase

of the public debt it is not an issue, the real issues are its budgetary and

economical consequences which invariably leads to social consequences. A high

public debt is often associated with higher financing costs (due to the

deterioration of the country credit rating), a trade deficit (to which

economists referred to as a twin deficit), a high taxation in the country which

limits the economic growth (seen from a liberal perspective) and a problem of

equilibrium between generations (younger generations obliged to pay for public

deficit generated by their elders).

The objective of this dissertation is to identify or more

precisely to confirm some of the explaining factors of the public debt by an

empirical testing of a model that assumes that foreign public debt is explained

by importations, the service of the debt, the demographic growth, the rate of

exchange between the CFA and the dollar.

The devaluation of the CFA francs and the effect of the

suspension of international cooperation with the country are integrated to the

analysis by the means of dummy variables.

If the explaining factors are retained by the econometric

model, we will formulate recommendations in order to reduce the debt and its

socio-economical consequences.

Introduction

Over the past two decades, the economic context of all the

Heavily Indebted Poor Countries (HIPC) in general, and Togo in particular, has

been marked by unprecedented debt. The debt crisis in developing countries

continues to hit the headlines around the world. It is considered to be one of

the factors delaying the economic development of poor countries.

The international economic environment has played a

predominant role in the worsening of the crisis: fluctuation of exchange rates,

decrease in raw materials prices and declining terms of trade, rising interest

rates and decrease in loans facilities accompanied by concessional terms. In

addition, this crisis is due to internal policies: mismanagement of public

debt, misallocation of resources and lack of strict financial discipline.

After the Second World War, Europe was rebuilt thanks to the

«Marshall Plan1(*)». Inspired by this example, in the second decade

of 1970, countries got indebted in order to cope with a desire for intensive

investment to achieve high growth rates of GDP. This is the hope that the

economic growth that started would create the necessary resources for the

repayment of loans. Such was not the case, for it has rather led to a circle of

indebtedness. This was supported by both internal factors (debt mismanagement

and allocation of resources, lack of a sound financial discipline) and external

factors (fluctuation of exchange rates, decline in commodity prices,

deterioration of terms of trade, devaluation ...).

This environment has led the country to unbearable deficits

and low growth rates.

In 1981 the global recession occurred and oil prices declined.

On August 12, 1982, Mexico notified its creditors that its central bank had

depleted its reserves and it could no longer honor the scheduled payments on

the foreign debt. Then, after Mexico, Countries such as Argentina and Brazil

took over. This was the beginning of the debt crisis. The solutions to enable

to get out of the crisis include: concerted lending, debt relief, debt

rescheduling, Structural Adjustment Programs, (SAPs) and the Brady Plan.

Countries whose debt was rescheduled used to borrow from the IMF and would give

their agreement on stabilization programs inspired by the latter.

A year earlier, the implementation in progress of the SAPs in

the 80s was conducted notably with the support of the World Bank (WB) and the

International Monetary Fund (IMF).

In the mid 1990s, mechanisms for debt relief (the Brady

Plan2(*) and option menus

combining debt reduction and refunding), and all measures to reduce borrowing

requirements were not sufficient to reduce indebtedness to a bearable level. In

1996, the Breton Woods Institutions (IMF and WB) launched a joint initiative

for the HIPC in order to propose a sustainable solution to the debt problems of

poor countries.

Togo did not escape that debt crisis. Thus, as at 31 December

1978, the external outstanding debt amounted to 179 billion FCFA of which 22

billion of arrears of repayment. The debt has trended upward despite

repayments, discounts and cancellations obtained. It went from 213.4 billion in

1980 to 349.4 billion FCFA in 1993 that is an increase in real terms of 61%

(Debt Directorate, 2008).

In 1994, following the devaluation of the CFA franc in

January, the outstanding debt went from simple to double.

Compared to export revenues, pre rescheduling service gives a

ratio of 44.2%, while after-rescheduling service is 27%, whereas the threshold

allowed is 20%. In this proportion, the debt service is a heavy burden for the

Togolese economy.

Since 1984, significant budget adjustment efforts, the results

of Structural adjustment Programs (SAPs) initiated by the IMF and the World

Bank have yielded positive growth rates reaching 4.1% in 1989. Also, from 1979

to 2008, has Togo benefitted from eleven visits to Paris3(*) Club. The outstanding public

debt of Togo is estimated at 1 106.384 billion CFA Francs as at December

31, 2008.

Despite its exports, the Country will face a difficult

economic and financial situation. From the period 1994 to 2008, the ratio of

external debt to GDP and public debt to GDP moved from 116.38% to 46.89% and

from 123.78 to 79.19% exceeding the tolerable limits (50%). This is due to the

birth, next to the foreign debt, of a domestic debt increasing since 1990 due

to the sociopolitical and economic environment.

If there is agreement that the search for an appropriate

solution to the debt issue necessarily requires knowledge of the factors that

influence it, then it is worthwhile to consider the explanatory causes of

Togo's debt. This raises a number of questions: How is the public debt of Togo

and key ratios? What are the causes of the increase in public debt in Togo? Is

there a better strategy to manage government debt?

Hence the interest in the topic: «Public debt in Togo: an

attempt to identify explanatory factors»

The overall objective of the research is to identify factors

explaining the evolution of public debt in Togo.

More specifically it will be

· describe the evolution of the public debt of Togo;

· analyze the cause of the evolutions;

· identify explanatory factors that reduce or encourage

public debt of Togo

· Propose solutions to reduce public debt.

To achieve the objective of our study, we hypnotized that

there is a positive correlation between the debts ratio and economic

performance indicators such as foreign debt service, the ratio of imports / GDP

and population growth.

Thus, this dissertation will consist of two technical (2)

parts. The first part will be devoted to debt in literature, then we will

proceed with the inventory in Togo; the second past will deal with the results

of empirical analyses of public debt, estimation and interpretation of an

econometric model. These two technical parts will be preceded by a description

of the methodology and a brief presentation of Togo as a country to enable the

readers to have a precise idea of the geographic and social context of the

country.

2 Methodology and research question & brief presentation of

Togo

2.1 Methodology and

research question

The dissertation will start by short presentation of Togo to

enable the readers to situate themselves geographically, historically,

culturally and socially

The method that will be use for identifying the explaining

factors of the Togolese foreign debt will involve the method of last squares

combined with validation tests but before that we must prove that the debt has

indeed increased. More precisely we will:

· Define what a public debt is and at which level can it

be considered as being excessive .We will define the key terms usually used in

the economic literature in relation with debt such as the term Debt itself,

public debt, foreign debt, foreign gross debt, foreign public debt, domestic

debt, domestic public debt, the service of the debt, concerted loans, the

outstanding, the stock of debt, the interest of the debt, the gift element,

public indebtness.

We will refer to the international monetary funds conception

of what is an excessive debt and we will borrow from RAFFINOT (1998) the

conditions that must be respected in order to be able to payback a public

debt.

· We will make a review of the literature about public

debt in order to identify the main causes of the debt according to researchers,

from this review we will choose the factors that we consider pertinent as

explaining factors in our econometric model.

· We will reviewing the consequences of the public debt

on the economy and the society in order to justify why it is important to

reduce it and the choice of the topic of this dissertation.

· Based on data collected we will analyse the structure

and the evolution of the public debt of Togo together with the evolution of

some pertinent indicators such as the ratio of foreign debt/ gross domestic

product, service of the debt/exportations, foreign debt/exportations, service

of the debt/gross domestic product, the evolution of the degree of openness of

the economy, and the evolution of the importations compared to the gross

domestic product.

· Specify the proposed econometric model by

précising the explained variable, the explaining variables, the

mathematical form of the model. The data consist of time series data, thus it

is important for the reliability of the model to make some important tests such

as staionarity test and cointegration test.

The source of the data that will be use for the analysis will

be :

· International monetary funds statistics

· Togo ministry of economy and finance data

· World banks website data

The main question that this dissertation is trying to answer

are :

· Can one identify the explaining factors of the public

debt of Togo by using an econometric analysis ?

· Can we explain the debt by importations trough the

ratio of importation divided b the public debt ? because This ratio reflects

the level of the importations compared to the capacity of creation of wealth of

the country and expresses the level of outflow of foreign currencies compared

to the total available resources of the country since importations are in

general paid in foreign currencies.

· What is the impact of demography on the level of the

foreign public debt?

· If the demographic growth tends to increase the debt,

what about the Gross domestic product per capita?

2.2 Brief presentation

of Togo

Togo is a country of 56,000 Km2 situated on the West African

coast between Ghana on the west side and Benin on the East side. Togo shares on

the north side border with Burkina Faso. Togo politics has been dominated for

the last 45 years by the same party. The Political situation in Togo is not

totally stable with street demonstrations going on almost every week for

different reasons. The current major issues are around the organization of the

next parliamentary elections with the opposition calling for profound

constitutional and institutional changes as well as changes in the conditions

of organization of the elections. According to the World Bank, Togo economic

growth was estimated at 3.7% in 2010 and has risen to 3.9% thanks to improved

rain fall, improved power supply and an increase in port activities . In fact

Togo is very dependent on mining, agriculture and sea port activities. Still

according to the World Bank, agriculture employs two third of the Togolese

population but accounts only for 45% of the GDP, services dominated by commerce

and transport employ 21% of the population and represents 33% of the GDP. In

January 2013, the two main markets of Togo have burned impacting adversely the

service sector which represents 21% of the GDP. There is therefore a fear that

the activities of Maersk Togo, mainly the import side will be negatively

affected unless there is a governmental plan to rescue the service sector. Togo

is also a net importer. The total container volumes exported equals to 12 550

FFE (forty foot equivalent) while the total import is equivalent to 52880

FFE.(5) Imports represent 83% of the containerised volumes handled in the port

of Lomé in 2012, evidencing the fact that Togo is a net importer.

The economic activities in Togo are heavily impacted by the

political and economic situation in the neighbouring countries which are Ghana,

Côte d'Ivoire and Benin. The political situation in Côte d'Ivoire

from 2002 to 2010 is for example an explanation of the sudden growth in the

import and export in Togo. The growth in export market was made of export of

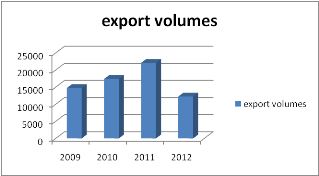

Cocoa from Côte d'Ivoire routed via Burkina Faso. The below graph is a

comparison of the containerised export volumes for the years 2010, 2011 and

2012(6). The increase in 2010 and most importantly in 2011 is explained by the

electoral crisis in Côte d'Ivoire and the reduction in 2012 is explained

by the return to normal in this neighbouring country after a decade of

political instability.

The impact of the situation in the neighbouring countries also

impacts the import side of economic activities; Togo has for example seen an

increase in the containerised volumes in the month of January in 2012 compared

to the same period in 2013 and also in preceding years due to a congestion in

the port of Cotonou as a result of a project of building a quay. There is also

an infrastructure competition between the different ports on the coast and

volumes to Hinterland countries shift from one port to another if there is the

adequate infrastructure to facilitate the handling of the goods and their

haulage up to the landlocked countries which are Burkina Faso, Mali and Niger.

There are two projects of building new quay in the port of Lome which will

impact the business of Maersk Togo in the future.

3 PUBLIC DEBIT: FROM LITERATURE TO THE SITUATION IN TOGO

The first part of our study includes two chapters. The first

chapter includes the theoretical aspect of indebtedness. The second part is

devoted to the descriptive analysis of public debt in Togo.

The first chapter includes in its first section the notion of

public debt; in the second section, the causes, consequences and reasons of

public debt will be presented. The second chapter is on the descriptive

analysis of the level of indebtedness in Togo. Thus, external debt in examined

in the first section and the second section is on the analysis of domestic

debt.

3.1 PUBLIC DEBT AND

ITS EFFECTS IN LITERATURE

4 Introduction to public debt, sustainability or debt

viability

4.1.1.1 Notions of debt and debt

sustainability

4.1.1.1.1 Notions of debt

Debt means any commitment represented by a financial

instrument or any other legal equivalent4(*).

Public debt is the debt incurred by a State with individuals,

banks, companies and States. External public debt and domestic public debt are

all public debts.

External debt of a State represents all loans incurred by the

public powers/authorities of a country with creditors (private, public,

bilateral or multilateral) external or non residents. It can be public or

private, bilateral or multilateral; it can also be commercial.

Gross external debt is equal to the amount, at a given

date, of the actual and unconditional current outstanding commitments involving

the obligation for the debtor to make one or payments to repay the major part

and/or repay interests at one or several times in the future and that are owed

to non residents by residents of an economy5(*).

According to the World Bank, the external public debt is any

debt payable in foreign currencies to foreign creditors whose initial or

extended maturity date exceeds one year, and is either incurred directly by a

public organization of the borrowing country, or is guaranteed by the State.

The domestic debt of a country is all the commitments made by

the State to stakeholders residing in the country and expressed in local

currency.

The ·domestic public debt· means debt

instruments issued by public authorities (Central government, regional and

local authorities and public enterprises).6(*)

The debt service includes all payments made in settlement of a

particular liability notably of the principal, interests and late payment

charges.

In addition, debt repayment depends on the level of interest

rates and exchange rates, since a significant portion of the outstanding debt

is quoted in dollars, and at variable rates.

Concerted loans are loans that are granted against the will of

the lender.

Outstanding debt is part of a current loan that has

effectively been released.

The stock of the debt provides a useful and rapid measure of

the future charge of the debt related to the existing debt.

Debt interest means the main charge to pay on a loan, which is

calculated on the disbursed and non reimbursed part of the capital, for penalty

obviously.

Grant element (or element of concession) is the

«subsidy/grant» component of the loans granted to development

assistance organizations. According to the classification of the IMF and World

Bank, a loan is concessional if it comes with a grant element of at least

35%.

Public debt means all assistance requested by a Government

from partners (bilateral, multilateral, financial institutions, financial

markets, etc.) to fund development activities that have not been supported by

the national budget.

4.1.1.1.2 Concept of debt sustainability or viability

The external debt of a country is viable or sustainable in the

medium and long term if the Country is able to meet all its current and future

liabilities on foreign debt without resorting to an exceptional funding (IMF,

2001).

The analysis of the foreign debt sustainability is carried out

through: export related debt, ratio of GDP related debt, the ratio of the NPV

of debt to budget revenue and the debt service to exports ratio.

When the debt is accrued at a rate faster than the ability to

pay, in such a way that at a certain moment the Country will not be able to

cope with the debt service7(*), the burden of the external public debt can be

described as non-viable.

The debt sustainability is the ability of a debtor Country to

fully meet its current and future external liabilities without resorting to

rescheduling or accumulation of arrears.

According to RAFFINOT (1998), if the following conditions are

not met, difficulties in meeting liabilities become highly probable:

- debt outstanding / GDP; this ratio must inferior to 50%.It

is an indicator of liquidity,

- the ratio (debt service/exports of goods and services non

factors of production) should be inferior to 20%, and

- the ratio (debt outstanding/exports) must be inferior to

150%. It is an indicator of solvency.

4.1.1.2 The different concepts of public

debt

The different theoretical arguments of indebtedness will be

classified into two concepts groups, and then will be presented the motives of

indebtedness.

4.1.1.2.1 Classical and Keynesian views

Classics assimilate indebtedness to future tax and attribute a

negative connotation to the State. According to Ricardo (1817)8(*), citizens see in a loan a tax

differed in the future/as time goes by.

They behave as if they were compelled to pay a tax later in

order to repay this loan, whatever the intergenerational gap.

In other words, the behavior of economic agents is guided by

an anticipation to tax increase.

However, a reservation may be made depending on the nature and

quality of expenditures (transfer or investment expenditures) financed by the

loan.

For Keynesians, indebtedness does not cause any charges either

for future generations or for present ones because of the investments that it

generates. In this approach, debt resulting in the boosting of the demand

causes by the accelerating effect a more than proportional increase in

investment, which in turn induces an increase in production.

The budget deficit which, led by successive flows to increase

the stock of debt, produces the expansion of the economic cycle by demand and

autonomous investments. The deficit to which the loan corresponds stimulates

demand and can reduce the cost of repayment. This argument is plausible as

underemployment of productive resources exist, according to Keynesian9(*) theory.

4.1.1.2.2 The other conceptions

4.1.1.2.2.1

Alternative approaches to Keynesian theory

For proponents of this hypothesis10(*), if in a country there are two

parties that are potentially in position to access the power frequently these

parties have different preferences regarding the nature of public spending. The

ruling party may decide to increase public spending today by borrowing, in

order to satisfy its electorate, at the best to remain on power and at the

worst not to make life easier for its opponent. By so doing, it creates

conditions so as to interfere further its political opponent in terms of

managing the budget, if the latter were to gain power. It now undertakes future

tax revenues and therefore reduces the potential future expense of its opponent

especially if the debt happened to be significant.

4.1.1.2.2.2 The concept of the school of rational

expectations

According to R. Barro (1974), a budget deficit policy financed

by the loan has no stimulating effect on the economy, since the agents are not

victims of fiscal illusion. These agents then anticipate an increase of the

taxes intended to repay the loan by providing a savings equivalent to public

debt (theorem of equivalence or of Barro- Ricardo)11(*). Thus, whatever the modalities

of financing deficits, the long-term effects are equivalent. This general

proposition therefore means the neutrality of public debt in the long-term

(fiscal and budget multiplier showing a trend toward zero).

According to Robert Lucas (1972), the idea of rational

expectations is that the agents are able to take advantage of all available

information to form their expectations, so that in stochastic average, they are

not wrong.

4.1.2 CAUSES, CONSEQUENCES AND MOTIVES

OF PUBLIC DEBT

4.1.2.1 Causes of

public debt

The weakness of domestic savings and the importance of funding

requirements very often justify the resort to external financing. But debt

sometimes appears as the result of a deliberate policy choice. Public debt may

come from exogenous or endogenous causes.

4.1.2.1.1 Exogenous causes

Following the economic slowdown in the late 70s in

industrialized countries, incomes in developing countries declined not only

because their growth rate slowed down but also because the prices of their

exported raw materials diminished compared to the prices of their exports. This

has led developing countries to resort to external loan to make up for the

deficit in resources.

With the oil crisis of 1973-1974, the huge surpluses

of oil-exporting countries resulting from the rise in oil prices

should be «recycled» to finance the current deficit of the rest of

the world. Oil producing countries invested their funds in developed countries

and commercial banks and the latter found it profitable to lend them in their

turn to developing countries. The resort to credit granted by commercial banks

has two advantages:

First: the loans granted by commercial banks

do not bind the transfer of funds to the implementation structural adjustment

policies.

Secondly: the freedom to allocate the funds

received.

The conditions were such that even if loan premiums were

added, developing countries would be confronted to historically low interest

rates for foreign loans: that encouraged them to borrow abroad.

4.1.2.1.2 Endogenous causes

The current deficit of non-oil producing developing countries

increased rapidly between 1974 and 1978.

These countries adopted and pursued expansionary policies:

they encouraged ambitious investment projects and maintained high growth rates.

They developed these measures by significant and persistent deficits: they

borrowed heavily abroad to maintain their spending above their incomes. Among

internal causes of the resort to foreign debt, after corruption, there are many

others.

The choice of a growth model driven by the outside could lead

to an increasing indebtedness, for this was one of the conditions of

reliability.

The continuing deficit of the balance of payments of

developing countries has been partially funded by foreign debt. Over time, the

interests paid by these countries become the major cause of the structural

deficits of their current accounts. These countries have then entered into a

vicious circle, in the sense that external debt increases the current account

deficit and hence the balance of payments, while the current account deficit

requires more foreign indebtedness.

The loans were used for the construction of infrastructures

(roads, dams, etc.) whose purpose is not necessarily to generate resources;

there are also white elephants such as oil refineries, iron and steel industry,

etc. The loans were sometimes mobilized according to the requirements of

national development but according to the needs of the leading country. The aid

was then used to create an outlet for the products of the lending country or a

market for its business (aid related).

4.1.2.2

Consequences, motives and effectiveness of public debt

4.1.2.2.1 Consequences of public

debt

4.1.2.2.1.1 Economic consequences

A large debt is usually accompanied by higher funding costs,

which are reflected in turn by a higher debt service. Notwithstanding the risks

to future economic conditions, the importance of debt service limits the margin

of maneuver of the government. It takes up a large share of fiscal revenues and

thus limits the government's spending choices.

In a small open economy, public deficits and debt service

reduce public savings, which requires a greater reliance on foreign savings or

foreign direct investments. This results in a reduction in trade surplus, or

systematically, increasing trade deficits. This is why economists often refer

to public and trade deficits as «twin deficits». the real effects of

public debt are however less important in a small open economy than in a large

open economy or in a closed economy, where the reduction in public savings

leads to higher real interest rates and lower private investments (crowding),

which in turn affects the growth of the capital stock and ultimately, the

potential output.

According to the Ricardian equivalence, public debt is

accompanied by an increase in private savings which offsets the reduction in

public savings, households anticipating future tax increases and saving

accordingly. Ricardian equivalence as well as the interest rate parity in small

open economy is limiting the extent of actual macroeconomic impacts of public

debt;

4.1.2.2.1.1.1

Economic effectiveness problems

High public debt results in a high tax burden. This high tax

burden acts as a break and causes a slowdown in economic activity. Another

effect is the potential impairment of the performance of the tax base for the

government (avoidance, tax evasion) and uncertainty about future tax conditions

and scope of public services that will be available in the future. This

uncertainty may adversely affect the retention and attraction of the workforce

and capital.

When used appropriately, public debt as a means of financing

public investments is a fairness factor.

However, it may become a factor of inequity when used to shift

the burden of current spending onto future generations of taxpayers12(*). Public debt also has

potentially important distributional impacts not only between generations but

also between members of the same generations (Osberg, 2004).

4.1.2.2.1.2 Social and political consequences

Public debt and the many problems it can cause are likely to

influence the political landscape. For example, a problem that can arise is the

difference between the taxes paid by individuals and the services they receive

in return. When there is a balanced budget, the debt service introduces a gap

between taxes paid and public services received by taxpayers. This gap feeds

into the population the impression that taxpayers «do not get their

money»13(*)

.Therefore, the profitability of the tax base may be affected, as well as the

support for government programs.

4.1.2.2.2 Reasons for debt

4.1.2.2.2.1 The reasons for debt

«Loans to fund unprofitable investments or import of

consumer goods, can lead to debts that borrowers cannot repay «(Krugman,

1996). Several reasons may justify the debt.

In literature, debt is related to an imbalance. Three likely

reasons may lead a country to borrow:

·- To finance a high level investment: a country with

a potential productive investment and which has not a very sufficient domestic

savings to finance this investment can borrow;

·- To smooth fluctuations in consumption in case of

loss of income : a theoretical current account deficit may result from negative

exogenous chocks such as declining terms of trade, a recession or a natural

disaster. Thus, to overcome these problems, a country may incur external debt

to maintain the level of absorption;

·-To avoid facing an adjustment to internal and

external imbalances: the unsustainable current account deficit must be adjusted

by changes in economic policies.

Domestic loan has three main reasons:

-financing of budget deficit, public spending being higher

than the State revenue;

-Implementation of monetary policy (open market operations:

purchases or sales of bonds to absorb or inject liquidity);

-Development of the financial market which requires a constant

supply and a range of financial instruments to be traded.

4.1.2.2.3 Effectiveness of external

debt

Contrarily to the ideas developed above, some economists wonder

rather on the ability of external funding to develop a country (since if a

country borrows, it is necessarily to achieve its development projects).

Especially for radicals, external funding can only be

impoverishing for the recipient economy since it is nothing other than a new

manifestation of imperialism at the highest stage of developing capitalism in a

state of perpetual enslavement.

For liberals, external funding is the manifestation of the spirit

of solidarity of the so-called developed countries who generously put at the

disposal of developing countries funds that can enable them to meet both their

savings and development deficit, and thus hoisting them on the royal road to

economic growth and development.

4.2 DESCRIPTIVE

ANALYSIS OF THE LEVEL OF PUBLIC DEBT IN TOGO

4.2.1 STRUCTURE OF THE DEBT AND

DESCRIPTIVE STUDY OF THE EXTERNAL DEBT OF TOGO

4.2.1.1 Structure

of the public debt, external debt structure and its evolution

4.2.1.1.1 Structure of public /

government debt

The Togolese public debt is divided in to domestic debt (35.84%)

and external debt (64.05%) at 31 December 2008. These figures are explained in

the table below:

Table 1: Distribution of the public debt Togo on

31/12/2008

|

CREDITORS

|

AMOUNT (in CFA Francs)

|

PERCENTAGE

|

|

DOMESTIC DEBT

|

396,507,600,000

|

35.84%

|

|

EXTERNAL DEBT

|

709,876,453,787

|

64.16%

|

|

TOTAL

|

1 106 384 053 787

|

100.00%

|

Source: Directorate of Public Debt

4.2.1.1.2 Structure and evolution of the

external debt

4.2.1.1.2.1 Structure of the external public debt

Togo`s external debt is mostly a long term debt. It comes

mainly from public loan for development and structural adjustment loans; and

then if need be from private origin (commercial debt).

Togo `s external debt is divided into multilateral debt,

bilateral debt with Paris Club, bilateral debt with non Paris Club and Private

debt owed to private banks.

4.2.1.1.2.2 Evolution of Togo's external debt between 1980

and 2008

Over that period, the external debt of Togo evolved in two

steps:

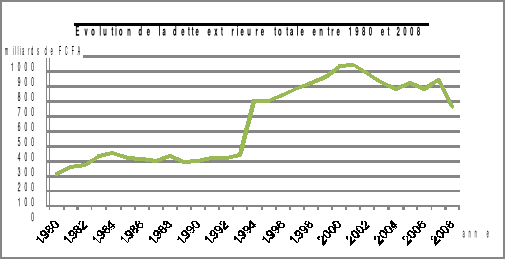

Graph 1: Evolution of the total external debt of Togo

between 1980 and 2008

Billion CFA francs

Evolution of the total external debt of Togo between

1980

Year

Source: Author based on data from the Directorate of

Public Debt

The first period runs from 1980 to 1993

- The outstanding debt has trended upward despite the

repayments, discounts and cancellations obtained. It moved from 213.4 to 349.4

billion CFA francs in 1990, which is an increase in real terms of 61%. This

increase is the result of the combined effects of three factors including:

1 - Capitalization of interests in the contexts of

consolidation agreements.

2 - New commitments of the State

3 - Changes in exchange rates of some major currencies

including the dollar, pound sterling, the Swiss franc, etc.

The second period runs from 1994 to 2008

- In 1994, following the devaluation of the CFA franc in

January, the loans outstanding went from single to double as the exposure is

denominated in foreign currency for nearly all loans. On January

1st, 1994, the loans outstanding were 349.4 billion CFA francs and

on 31 December 1994 it amounted to 707.5 billion CFA francs.

- From 1995 to 2008, the increase in debt was irregular and

can be explained by the breakdown of international cooperation with some

donors. It is however mitigated by the efforts made by the government refund,

cancellations from member countries of the Paris Club and the substantial

discounts that have been granted by friendly countries. December 31, 2008, the

outstanding external debt of Togo was about 709.88 billion CFA francs.

4.2.1.1.3 Evolution of some weighty

indicators of the external debt from 1980 to 2008

4.2.1.1.3.1 Evolution of the outstanding external debt / GDP

The approach by this ratio shows that over 100% of the GDP was

needed to repay the debt if it became due in 2000. Chart N°1 in Appendix 1

shows that the debt-equity ratio was greater than 50% (critical threshold) over

the period from 1980 to 2008. We deduce that the level of external debt is very

high because beyond 50%.

However, from 2001, this ratio decreased gradually. This

improvement was due to the depreciation of the dollar against the euro.

4.2.1.1.3.2 2. Evolution of the ratio of external debt

service /exports

The evolution of this ratio (chart 2, appendix 1) shows a saw

tooth evolution. A cyclical phenomenon can also be deduced from this. Its

improvement over time can be explained by the depreciation of the currencies in

which the loans granted to Togo are denominated.

Prior to 1997, this ratio was above the critical threshold of

20%.Then, the trend has reversed. Thus the burden of debt service has not

resulted in reduced consumption possibilities and productive investment in the

nation since 1997.

4.2.1.1.3.3 Evolution of the external debt / exports

ratio

The external debt / exports ratio was almost always higher

than the threshold of 200% (chart N°3, appendix 2).The graphical analysis

of this ratio enables to notice that the weight on the national economy was

almost always heavy. Below the threshold before 1989, this ratio has evolved

and reached its highest level at about 500% in 1993.This ratio shows a downward

trend. Since 2004, this ratio has been below critical level.

4.2.1.1.3.4 Evolution of external public debt to GDP

Graph N°4 in appendix 2 shows the curve of service debt

to GDP. It shows a good performance of our repayments capacity from 2000 to

2006.This can be explained by the increase in GDP over the period. Given this

graph, it appears that the payment of debt service in Togo has not dramatically

worsened the already precarious situation of the economy and the population.

The ratio is very low between 2000 and 2006. It did not capture the large share

of government revenues.

4.2.1.1.3.5 Evolution of the degree of openness

The degree of openness is calculated by the following formula

(exports + imports) /GDP). The observation of the trend (graph 5, Appendix 2)

between 1980 and 2008 reveals a downward trend. This trend reflects the

difficulties of the country to acquire foreign currencies that can allow it to

facilitate the repayment of the debt charges. The highest openness degree was

reached in 1982 and the lowest was observed in 1993.Since 2006, the trend went

downward again. As reasons, we can mention among others, the increase in oil

prices, floods and their consequences (broken bridges, soaring of foodstuffs

prices).

4.2.1.1.3.6 Evolution of export in relation to GDP

Chart N°6 in appendix 3 shows the release of foreign

currencies in relation to the resource base of a downtrend. Between 1980 and

2008, an average of 50.4% of GDP was allocated to imports. Given that imports

deteriorate the trade balance with a significant decrease in the ratio of

reserves to imports, national income should find itself reduced by the game of

the multiplier effect of foreign trade; this has resulted in an increase of

external debt for their financing.

4.2.2 Domestic debt

Until 1989, Togo's domestic debt was not significant. This

debt was partly due to technical and administrative problems and not to cash

tensions. But since 1990, as a result of socio-political unrest characterized

by the paralysis of economic activities and resource scarcity, the arrears have

increased. They went from 1.32 billion CFA francs in 1990 to about 396.508

billion CFA francs at 31 December 2008.

4.2.2.1 STRUCTURE

AND EVOLUTION OF DOMESTIC DEBT

4.2.2.1.1 Structure of the domestic

public debt

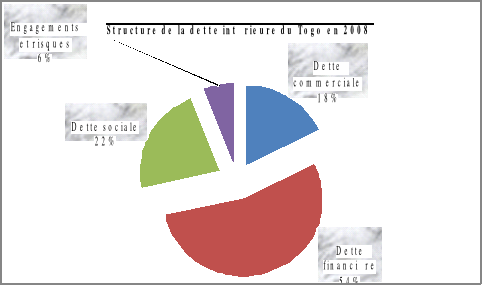

At 31 December 2008, the stock of the domestic debt of Togo

accounted for 32.29o/o to GDP. It consisted of a

commercial debt (18.40o/o) owed to private creditors and

public enterprises, financial debt (52.33°/0), which is the set

of financial aid granted by banks and public enterprises as well as the bond

loans, social debt (23.100/0) constituted of social

contributions owed to the National Social Security Fund and the Pension Fund of

Togo and finally, commitments and risks (6.16o/o) mainly

owed to the Central Bank of West African States and depositors of funds with

the Treasury of Togo.

Financial debt 54%

Social debt 22%

Commitments and risks 6%

Commercial debt 18%

Structure of Togo's domestic debt in 2008

- Graph NO 2 : Structure of Togo `s

domestic debt as at 31 December 2008

Source: Author based on data from the Directorate of

Public Debt

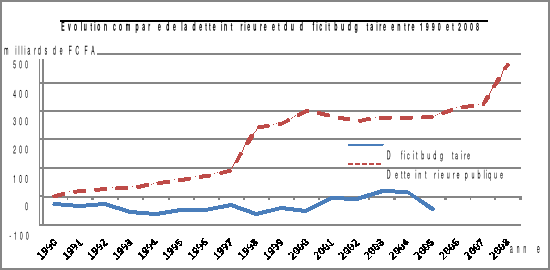

4.2.2.1.2 Comparative evolution of

Togo's domestic debt and budget deficit between 1990 and 2008

Domestic debt trended upward and budget deficit has been

stranding between 1990 and 2007.

Graph N0 3 : Comparative evolution of domestic

debt and budget deficit between 1990 and 2003

Comparative evolution of domestic debt and budget deficit

between 1990 and 2008

Billion CFA francs

Year

Budget defict

Domestic public debt

Source: Author based on data from the Directorate of

Public Debt

The opposite evolution reflects the close link between budget

deficit and debt. Both clusters have evolved unevenly.

The causes of massive increase in domestic debt are mainly

lower raw materials prices (coffee, cocoa, cotton, phosphates), the Gulf war,

the low level of tax revenue, the prices charged by suppliers, suspension of

cooperation with the European Union (EU) and the accumulation of arrears.

Domestic debt is thus a real obstacle to the resumption of

growth.

4.2.2.2 Evolution

of some ratios of domestic debt and domestic debt causes

4.2.2.2.1 Evolution of some ratios

domestic debt

4.2.2.2.1.1 Trend of the domestic debt / GDP ratio

Domestic debt related to GDP (graph N°7, Appendix 3)

between 1998 and 2008 was over 28% of GDP. Its trend was upward until 2000 when

it reached its highest rate which was 32.38% of GDP. In late 2008, it was

32.29% of GDP that year. The weight of domestic debt is not at a good level

because domestic debt is almost one- third of GDP.

4.2.2.2.1.2 Trend of the domestic debt/ Revenue ratio

The analysis of the curve representing the ratio of domestic

debt to income reveals that domestic debt exceeds revenue (Graph N°8,

Appendix 3). This reflects the difficulties of the State in the collection of

taxes; so this explains this mismanagement in some state-owned companies. We

should also consider the inconvenience caused by the energy crisis and the

breakdown of financial relations determined by Togo's partners for about

fifteen years.

4.2.2.2.2 CAUSES OF DOMESTIC DEBT

The causes are both structural and cyclical.

4.2.2.2.2.1 Structural causes

The main cause of domestic debt is the financing of budget

deficit. For many years, State spending was not covered by tax and non-tax

revenues. The budget deficit has widened in the early 90s because of the

deterioration of terms of trade. Togo has failed to reduce its budget deficit

despite the rescheduling agreements on its external debt.

The State relied on domestic debt to finance its fiscal

imbalance.

The budget deficit is explained among other things by:

- the rising of global interest rates;

- the government's efforts to accelerate development and

industrialization through economic activities at the expense of the private

sector;

- the embezzlement of public funds by some officials;

- false certification of service rendered:

- the substantial subsidies to State enterprises;

- individuals who received loans under the policy of food self

- sufficiency became insolvent;

- mismanagement in some State - owned companies has led to the

increase of public expenditure according to the need of these companies;

- the energy crisis;

- exceeding the ceiling of BCEAO Statutory advances (20% of

tax revenues in the previous year). Statutory advances increased from three

billion CFA francs at the end of 1993 to six billion CFA francs in July, and

- military spending in the logic of preserving the integrity

of the territory and ensure peace for citizens.

4.2.2.2.2.2 Cyclical causes

Regarding cyclical causes it is the socio-political unrest of

1993 which contributed to widening the budget deficit.

Indeed, the long general strike launched on 16 November 1992

paralyzed economic activity in the country. This strike deprived the government

and private sector of resources. Secondly the socio-political events of 1994

led to the failure of financial relations with the EU, depriving the country of

foreign aid for about fifteen years.

The devaluation of the CFA franc has also worsened the

situation in the country. External debt was simply multiplied by two. This has

reduced the State's capacity to borrow abroad. These causes have led to an

explosion of domestic debt. Thus, to finance the needs of the country, the

authorities turned to domestic financing by borrowing.

5 ECONOMETRIC ANALYSIS OF THE DEBT

The second part of our study consists of two chapters. The

fist chapter focuses on the results of empirical studies on debt. The second

part is devoted to the econometric study of Togo's external debt. This chapter

contains two sections. The first one deals with the econometric study of Togo's

debt which will be carried out from the macroeconomic data of Togo. The second

section is reserved for interpretations and suggestions.

5.1 EMPIRICAL AND

ECONOMETRIC ANALYSES

5.1.1 RESULTS OF EMPIRICAL ANALYSES AND

SPECIFICATION OF MODEL

5.1.1.1 EMPIRICAL

ANALYSES RESULTS

The works of Barry and Portes (1996) were interested in

identifying the determinants of the stock of the debt of about thirty countries

at a certain moment of their economy. They conclude that excessive debt and

default payment tend to reduce the rate of real growth and credibility of the

State. Ojo (1989) in «Debt capacity model of sub-Saharan Africa» by

an econometric approach, shows that the ratio of outstanding debt/ GDP of

thirty African countries during the period 1976-1984 is determined by: the

variation of exports (X), the ratio of imports/ GDP, the population (Pop) and

the growth rate of GDP (y). He concluded that the ratio of debt outstanding/

GDP is negatively related to the change in exports, the growth rate of GDP and

the ratio of positive imports/ GDP and population growth (Pop).

Ajayi (1991) analyzes the impact of external and internal

factors of Nigeria's debt. Indeed, he chose as determinants of the debt /

exports ratio, the following variables: terms of trade, the growth rate of

industrialized countries' income, the actual interest rate, the ratio of budget

deficit/ GDP and trend. He affirms that we should expect that a worsening of

budget deficits will increase the debt / export ratio. The estimation results

of his model confirm this fact.

N'Diaye (1993); shows that the debt of Senegal is explained

positively by the stock of existing debt and negatively by the level of deficit

of the current balance. Also, the appreciation of the average exchange rate of

CFA/US (dollar?) reduces the debt service. Considering the virtual absence of

reserve in Senegal, equation attempts to explain currency movement composed of

transaction account, draw on IMF and the contribution of primary banks to

finance the balance of payments. He found out that despite the weakness of the

correlation coefficient, this explanation of currency movements by the current

account and the net direct investment can be retained.

In view of this result and the evolution of the debt in

relation to the current account, it is difficult to justify the level of

indebtedness of Senegal by looking for a balance of macroeconomic variables.

This means that Senegal does not borrow to balance its current account or to

increase its investments, because the model shows that the impact of the debt

stock on the latter is very low. He also believes that the explanation of

currency movements (transaction account) by the balance of the current account

and net direct investments is not satisfactory from the point of view of

statistical results.

Rougier (1994) found mixed results in African countries.

According to his econometric analyses, the debt to GDP has a depressive effect

on growth in Côte d'Ivoire, Mali, and Chad for the period 1970-1991.

However, the effect is positive for Niger, Madagascar and Kenya.

Cohen (1996) shows empirically that the debt has weighed on

growth in developing countries. However, the impact of the debt on growth

reduction is negligible for Burkina-Faso, Kenya, Mauritius, Rwanda, South

Africa, Zaire, Zimbabwe and Mali.

Coulibaly and al. (2001) in a study on Mali's debt showed that

statistical indicators such as interest rate, financing of imports, especially

consumer goods and cumulative process of debt have a positive effect on the

level of indebtedness of Mali.

RAFFINOT and VENET (2001) found through a panel of 21

countries in sub-Saharan Africa for the period 1978-1997 that there is no

significant casualty between trade openness and debt. They concluded that these

results should not be generalized because of the specificity of economies in

this part of Africa (exports mainly consisted of basic products and their quasi

impossibility to borrow from international private donors).

YAPO (2002) in a study found that for Côte d'Ivoire over

the period 1975-1999, the import/GDP ratio is not significant. In addition, he

shows that the debt of Côte d'Ivoire is positively influenced by the

deterioration of terms of trade and finds that the primary deficit is not

significant.

AGBERE (2006) found that in Togo the debt ratio is positively

affected by the population growth rate and the ratio of debt service to

exports, negatively by the growth rate to actual GDP. According to his study,

the fiscal balance ratio to GDP has not had a significant impact.

Studies conducted on a panel of countries such as the studies

of Eichengreen and Portes (1986), Elbadawi and. al (1996), Patillo and al.

(2004) and Clemens and al (2003), have all found that excessive debt has a

negative effect on growth rate.

Building on the literature review and empirical tests or

validations made by various studies on the determinants of external public

debt, we can make the following assumptions H1 and H2 to meet the concern of

this long essay which is an attempt to identify factors explaining public debt

in Togo.

H1: The reported debt service to exports, the

ratio of imports to GDP, exchange rate and the population positively explain

the level of debt.

H2: The devaluation of the CFA, the break

down of cooperation and GDP per capita negatively explain debt level.

5.1.1.2 Mode

specification and series study

Let us proceed to the specification of a model, its estimation

and validation.

5.1.1.2.1 Model specification

The specification of an econometric model consists in

translating into mathematic form the theory or economic phenomena examined. The

specification requires the identification of variables and determining the form

of the equation that connects them.

5.1.1.2.1.1 The model variables

In the light of economic theory and empirical studies; the

variables selected for this study are:

·dependent variable or explained variable:

The weight of Togo's external debt will be approximated by the

ratio of outstanding debt at the period end in percentage of GDP

(DTPIB).

·independent variable or explanatory variables likely

to influence positively or negatively Togo's external debt

Import to GDP (MPIB) reflects the ratio of

imports relating to the income generating capacity of the economy as a whole.

They also express the level of output of foreign currencies relating to

resource base. The expected sign is positive. OJO (1989) and YAPO (2002)

achieved the same results.

The ratio between debt service and export

(DSEX) reflects the level of debt service relating to the

volume of income in foreign currencies available to the entire economy. The

expected sign is positive. AJAYI (1991) and YAPO (2002) achieved the same

results.

The population growth rate (POP) .Demographic pressure tends

to encourage debt. The expected sign is positive OJO (1989) and YAPO (2002)

came to same conclusions.

Either (GDPC), GDP per capita. Population

growth is an important variable in the grounds of debt. Demographic pressure

tends to encourage debt. Indeed, the population growth rate reduces the wealth

of the nation (GDP per capita). The expected sign is negative.

(TCH), the exchange rate of CFA/Dollar (the

exchange rate of the CFA franc against the dollar)

If the CFA franc is appreciated, the total external debt

converted into dollar decreases. It is important to note that Togo's external

debt is incurred in several currencies. The estimated sign is positive. KRUGMAN

(1988) and N'DIAYE (1993) achieved the same results.

The dummy variable (DUM93) will assess the

effect of the suspension of cooperation with key partners in the development of

Togo. It took the value zero (0) before 1993 and one (1) after. The expected

sign is negative.

The dummy variable (DUM94) that will capture

the effect of the devaluation of the CFA franc against the French franc

It takes the value zero (0) before 1994 and one (1) after. The

expected sign is positive.

5.1.1.2.1.2 Mathematical forms of the model

Our empirical model is based on that of OJO (1989) by the

introduction of other variables. Suppose Y the explanatory variables to the

dependent variable DTPIB.

The variable GDPH (GDP per capita) was expressed in

naperian/natural logarithm in order to avoid problems related to the effects of

magnitude and facilitate interpretations.

The shape of our model can be written as follows:

D(LDTPIB)t = C1*LDTPIB(t-1) +

C2*D(LTCH)t + C3*LTCH(t-1) +

C4*D(LMPIB)t + C5*LMPIB(t-1)

+C6*D(LPOP)t + C7*LPOP(t-1)

C8*D(LPIBH)t + C9*LPIBH(t-1) +

C10*D(LDSEX)t + C11*LDSEX(t-1) +

C12*DUM93 + C13*DUM94 + C0 + Ut

D(.) is the operator of the first difference defined by

D(Xt) = Xt - Xt-1

The coefficient C0 is the constant of the model

The coefficient C1 is the coefficient of error

correction (restoring force toward equilibrium / balance).

The coefficients C2, C4, C6,

C8, C10 represent the short-term dynamics.

The coefficients C1 C3, C5,

C7, C9 et C11 characterize the long-term

equilibrium.

· the short-term elasticity is : C2,

C4, C6, C8 et C10

· the long-term elasticity are: -

C3/C1, - C5/C1, -

C7/C1, - C9/C1 and -

C11/C1.

· Ut is the error term.

5.1.1.2.1.3 Estimate of the function of Togo's external debt

This study mainly uses statistical and econometric tools for

the verification of assumptions. To this effect, the EVIEWSS software will be

used. We will now proceed to the study of the stationarity and possible

co-integration of the model variables. We then estimate by the method of the

least ordinary squares the parameters of the model.

5.1.1.2.1.4 Source of study data

The data used in this study are annual data from the database

of the Central Bank of West African States (BCEAO), the Directorate of Public

Debt (DDP), the Directorate of Economy (DE) and the General Directorate of

Statistics and National Accounts (DGSCN). These are time series covering the

period from 1980 to 2008 (that is 29 observations). The quality and reliability

of the estimates results are based on those data. Some variables will be

measured by approximations to overcome the unavailability of data and to reduce

the sizes at the same level as the dependent variable.

5.1.1.2.2 Studies of series

The study of the stationarity of the variables, if necessary,

their order of integration, is done in order to ensure reliable estimates.

5.1.1.2.2.1 Study of the Stationarity of the series

The properties of time series of these data will be determined

by the ADF test (Augmented Dickey-Fuller). Hypothesis testing is as follows:

H1: the process is non-stationary (presence of unit root)

H2: the process is stationary (no unit root)

The decision rule is to compare the test statistics ADF (ADF

test statistics) to the critical value (critical value). If the ADF value is

less than the critical value, then we accept the hypothesis of stationarity of

the series.

ADF stationarity tests revealed that the variables LDTPIB,

LDSEX, LMPIB, LTCH, LPCP and LPIBH are stationary in first differences. (Table

1, Appendix 6).

Given that all the series are not stationary there exists a

possible co-integration between the integrated variables of the same order.

5.1.1.2.2.2 Johansen co-integration test

A macroeconomic stationary series may be the result of a

combination of non-stationary variables, hence the importance of the

co-integration analysis. Since all variables are not integrated in same order,

there is a possible co-integration. Let us do Johansen co-integration test

(Table 2, Appendices 6 and 7)

Hypothesis testing is a follows:

H1: No co-integration (co-integration rank is zero)

H2: Co-integration rank higher than or equal to 1

LR: Likelihood ratio

CV: critical value

We accept the hypothesis of co-integration if LR is greater

than CV. this means that if the co-integration rank is greater than or equal to

one. We accept the hypothesis of co-integration.

We reject the hypothesis of co-integration otherwise.

Co-integration rank is 2; we accept the hypothesis of

co-integration between the variables in the model at 5%.

5.1.1.2.2.3 Choice of technique

The existence of a co-integration relationship between the

variables makes it possible to estimate en error correction model (ECM).

The ECM is used to determine the dynamics of short and

long-term relationship between the variables.

We will make an estimate of the error correction model the way

of Hendry (estimated in one step) by the ordinary least squares method.

(OLS)

5.1.2 Estimation and model validation

5.1.2.1 Model

estimation

We retain the estimation of Hendry's correction model as

follows (estimated in one step):

D(LDTPIB)t = C1*LDTPIB(t-1) +

C2*D(LTCH)t + C3*LTCH(t-1) +

C4*D(LMPIB)t + C5*LMPIB(t-1)

+C6*D(LPOP)t + C7*LPOP(t-1)

C8*D(LPIBH)t + C9*LPIBH(t-1) +

C10*D(LDSEX)t + C11*LDSEX(t-1) +

C12*DUM93 + C13*DUM94 + C0 + Ut

When estimating, the dummy variable DUM 93 was removed for

non-significance.

The results of the estimation of the ECM are given in the

table below.

|

Dependent Variable: D(LDTPIB)

|

|

|

Method: Least Squares

|

|

|

|

Date: 11/12/09 Time: 08:28

|

|

|

|

Sample (adjusted): 1981 2008

|

|

|

|

Included observations: 28 after adjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

LDTPIB(-1)

|

- 0.978852

|

0.197330

|

- 4.960490

|

0.0002

|

|

D(LTCH)

|

0.558390

|

0.118836

|

4.698839

|

0.0003

|

|

LTCH(-1)

|

0.554834

|

0.150469

|

3.687379

|

0.0022

|

|

LMPIB(-1)

|

0.177077

|

0.073918

|

2.395604

|

0.0301

|

|

D(LMPIB)

|

0.297150

|

0.079564

|

3.734712

|

0.0020

|

|

D(LPOP)

|

- 1.019847

|

0.439043

|

- 2.322887

|

0.0347

|

|

LPOP(-1)

|

- 1.549542

|

0.251331

|

- 6.165357

|

0.0000

|

|

D(LPIBH)

|

- 0.780145

|

0.166637

|

- 4.681709

|

0.0003

|

|

LPIBH(-1)

|

- 0.591862

|

0.134018

|

- 4.416280

|

0.0005

|

|

D(LDSEX)

|

0.146342

|

0.031735

|

4.611330

|

0.0003

|

|

LDSEX(-1)

|

- 0.037082

|

0.024915

|

- 1.488334

|

0.1574

|

|

DUM94

|

0.686178

|

0.104388

|

6.573314

|

0.0000

|

|

C

|

9.373836

|

1.778812

|

5.269717

|

0.0001

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.938316

|

Mean dependent var

|

- 0.022853

|

|

Adjusted R-squared

|

0.888968

|

S.D. dependent var

|

0.143416

|

|

S.E. of regression

|

0.047788

|

Akaike info criterion

|

- 2.939651

|

|

Sum squared resid

|

0.034256

|

Schwarz criterion

|

- 2.321128

|

|

Log likelihood

|

54.15512

|

F-statistic

|

19.01445

|

|

Durbin-Watson stat

|

2.035061

|

Prob(F-statistic)

|

0.000001

|

|

|

|

|

|

|

|

|

|

|

The coefficient associated with the resorting force is

negative (-0.978852) and significantly different from zero. So there is a

mechanism for error correction. The ECM is then valid.

Then we can perform all standard tests on this model. Then if

its predictive validity is good, it can possibly be used for forecasting.

5.1.2.2 Model

validation

To validate the results, we will proceed to the analysis of

the statistical and econometric validities of the model and then test the

predictive power of the model.

5.1.2.2.1 Statistical validity

5.1.2.2.1.1 Interpretation of the coefficient of

determination

The coefficient of determination R² is equal to 0.938316.

This means that 93.8316% of the fluctuations of the external

public debt of Togo are explained by the model.

5.1.2.2.1.1.1 Test

of significance

Fisher's exact test (overall model significance)

The model is globally significant because the value associated

with the probability of Fisher (f-Statistic = 0.000001) is less than 0.05. The

explanatory variables in this model generally have a significant effect on the

country's debt.

Testing student (test of individual significance of

coefficients)

The coefficients of the variables of the model are really

significant except that of LDSEX Long-term variable.

In view of the foregoing, the validity of the model is

accepted.

5.1.2.2.2 Econometric validity

5.1.2.2.2.1 Test of multicollinearity

This test is to compare the coefficient of determination of

the model estimated to the coefficient of simple correlation of the explanatory

variables taken two by two. The simple correlation matrix of explanatory

variables (see Table 3, Appendix 7) shows that all correlation coefficients

between the explanatory variables of the model are actually lower than R².

So the variables of the model used are not collinear.

5.1.2.2.2.2 Test of errors homoscedasticity

5.1.2.2.2.2.1 White

testing

Hypothesis testing is a follows:

H1: homoscedastic model

H2: heteroscedastic model

The model is homoscedastic if the two probabilities are all

greater than 5%.

Probability values are all greater than 5% (Table n°4,

Appendix 7) in this case the errors of the model are homoscedastic.

5.1.2.2.2.2.2 ARCH

Test

Hypothesis testing is as follows:

H1: homoscedastic errors

H2: heteroscedastic errors

The errors of the model are homoscedastic if the probabilities

are greater than 5%.

In this case, the two possibilities are greater than 5%. The

errors of the model are homoscedastic (table 5, Appendix 7);

5.1.2.2.2.2.3

Breusch - Godfirey Correlation test of errors

Hypothesis test is a follows:

H1: uncorrelated errors

H2: Correlated errors

We accept Ho if the probabilities are all greater than 5%.

Both probabilities being greater than 5 % (Table 6, appendix

8), ECM errors are uncorrelated. Estimates obtained by OLS are optimal.

5.1.2.2.2.2.4

Ramsey specification test

ECM has lagged variables, instead of the Durbin - Watson test,

it is rather that of Ramsey that will tell us if the model is well specified or

not.

Hypothesis test is as follows:

H1: the model is well specified

H2: the model is not well specified.

We accept HO if the probability is greater than

50/0. The values of the two probabilities are greater

than 50/0 (Table7, Appendix 8); we accept HO; the model

is well specified.

5.1.2.2.2.2.5

Jarque - Bera test

The assumption of normality of the errors terms is essential

because it will classify the statistical distribution of the estimators. The

assumptions of the normality test are:

Hypothesis testing is as follows:

H1: the variables follow normal distribution N (m,

ó)

H2: the variables do not follow a normal distribution N (m,

ó)

In the threshold of 5%, we accept the hypothesis of normality

as soon as the value of probability is greater than 0.05%.

The value of probability is 0.606636 (Figure 9, Appendix 4).

The errors of the errors correction model thus follow a normal distribution.

In view of the foregoing, the model can be validated

econometrically.

5.1.2.2.2.2.6

Analysis of the Model's stability

5.1.2.2.2.2.6.1 Cusum stability test

(Brown, Durbin, Ewans)

The Cusum stability test can detect structural instabilities

In this case, the curve is not outside the corridor (Figure

11, Appendix 5). Then, the model coefficients are stable. The estimated ECM is

then structurally stable.

5.1.2.2.2.2.6.2 Cusum square test

This test can detect structural instabilities. In this case

the curve is not outside the corridor (Figure11, Appendix 5); model

coefficients are stable. We deduce that the ECM is regularly stable.

5.1.2.2.2.2.7

Evaluation of model predictive power

According to the criterion of Thiel, if U is zero, the

prediction is perfect.

If U = 1 the prediction method is considered good (Figure12,

Appendix5). It should be 0? U? 1

The result of evaluation of the predictive power of the model

(Figure12, Appendix5) shows that:

MAPE = 0.570525% (Average Absolute Errors in percentage) and

Criterion U= 0.003937 (close to zero) (See figure 12, Appendix7)

This error correction model can be used for the forecasting

purposes.

Conclusion:

The different tests allow us to come to the conclusion

of a correct specification of the model, its validity and predictive power.

Let's turn now to the interpretation.

5.2 INTERPRETATION

OF FINDINGS AND RECOMMENDATIONS OF ECONOMIC POLICIES

This section is devoted to explaining the results obtained in

order to learn from Togo's debt and make suggestions to debt actors.

The pattern of Togo's debt seems to be well explained by the

proposed model with a 95% confidence degree / level. We will try to emphasize

in this part on the interpretation of model results, the implication of

economic policies from the analysis of previous curves above and those arising

from the interpretation of the model, and then recommendations will follow.

5.2.1 Interpretation of results

5.2.1.1 Results of

estimations and interpretation of error correction coefficient

5.2.1.1.1 Estimation results

The results of the estimation of the model (ECM) are given in

the table below:

Summary of the estimation and calculation of elasticity:

|

Dependent Variable: D(LDTPIB)

|

|

|

Method: Least Squares

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Elasticités

|

Prob.

|

|

|

|

|

|

|

|

Court terme

|

Long terme

|

|

|

LDTPIB(-1)

|

- 0.978852

|

|

|

0.0002

|

|

D(LTCH)

|

0.558390

|

0.558390***

|

|

0.0003

|

|

LTCH(-1)

|

0.554834

|

|

0.5668***

|

0.0022

|

|

LMPIB(-1)

|

0.177077

|

|

0.1809**

|

0.0301

|

|

D(LMPIB)

|

0.297150

|

0.297150***

|

|

0.0020

|

|

D(LPOP)

|

- 1.019847

|

-1.019847**

|

|

0.0347

|

|

LPOP(-1)

|

- 1.549542

|

|

- 1.5830***

|

0.0000

|

|

D(LPIBH)

|

- 0.780145

|

-0.780145***

|

|

0.0003

|

|

LPIBH(-1)

|

- 0.591862

|

|

- 0.6046***

|

0.0005

|

|

D(LDSEX)

|

0.146342

|

0.146342***

|

|

0.0003

|

|

LDSEX(-1)

|

- 0.037082

|

|

|

0.1574

|

|

DUM94

|

0.686178***

|

|

|

0.0000

|

|

C

|

9.373836

|

|

|

0.0001

|

|

R-squared

|

0.938316

|

n

|

29

|

|

|

|

|

|

Durbin-Watson stat

|

2.035061

|

Prob(F-statistic)

|

0.000001

|

|

|

|

|

|

|

|

|

|

|

***(**) indicates that the significance level is 1% (5%)

Source: Author based on the results obtained on

Eviews5

The equation estimated is:

D(LDTPIB) = -0.979*LDTPIB(-1) + 0.558*D(LTCH) +

0.555*LTCH(-1) + 0.177*LMPIB(-1)

(-4.96)

(4.69) (3.69) (2.40)

+ 0.297*D(LMPIB) - 1.019*D(LPOP) -

1.549*LPOP(-1) - 0.780*D(LPIBH)

(3.73) (-2.32)

(-6.17) (-4.68)

- 0.592*LPIBH(-1) +

0.146*D(LDSEX) - 0.037*LDSEX(-1) + 0.686*DUM94 + 9.374 (-4.42)

(4.61) (-1.49) (6.57) (5.26)

( ) represents the statistics t

5.2.1.1.2 Interpretation of the Error

correction model

The Coefficient associated with the restoring force is

negative (-0.978852) and significantly different from zero at statistic

threshold of 5%. Its probability is equal to 0.0002 and less than 0.05. There

is therefore a mechanism for error correction.

In the long -term, imbalances between the debt ratios, the

exchange rate of the CFA expressed in dollars, GDP per capita, population,

imports relating to GDP and the debt service to exports ratio offset so that

their series have similar trends.

The coefficient - 0.978852 reflects the speed at which the

imbalance between the desired and actual levels of debt is absorbed in the year

following the shock. This means that we can happen to adjust 97.8852% of the

imbalance between the actual and desired levels of the external indebtedness of

Togo.

Thus, the shocks impacts on the external debt of Togo are

corrected at 97.8852% by the «feed-back» effect. In other words, a

shock observed during a year is completely absorbed after one year and one

month (1/0.978852 = 1.0216049 years).

5.2.1.2

Interpretation of elasticity

5.2.1.2.1 Interpretation of long-term

elasticity or semi-elasticity

The results show that only the variables: exchange rate, GDP

per capita and devaluation are crucial in explaining Togo's debt. It appears

the following observations:

·The exchange rate is positively correlated with

Togo's debt. Togo's external debt is in foreign currencies. The exchange rate

affects significantly the country's external debt.

·The elasticity of long-term debt relating to

exchange rates (CFA/US Dollar) LTCH is 0.5668.In the long term, a 10%

appreciation of the average exchange rate of CFA/US dollar reduces the debt

service. Empirically, N'Diaye (1993) reached the same conclusion in a model of

debt in Senegal.

·The elasticity of imports / GDP ratio is 0.1809.In

other words a 10% reduction in imports would reduce the level of debt by 1.809%

in the long term. This result indicates that any policy to reduce debt

including a reduction of imports would be effective.