3.5.2. Target population and sampling methods

As of September 15th, 2009, there were 96 licensed

MFIs in Rwanda. These are the study population. They have, however, different

legal statuses, that is, 83 cooperatives (COOPEC), 2 private limited liability

companies (SARL) and 11 public limited liability companies (SA). However, only

SA was studied. The reason is because cooperatives are perceived to be in small

businesses while SARL and SA are in a «serious business».

IMF UNGUKA S.A. was studied because it is 100% financed by

individual shareholders. Indeed, it was awarded more than once by various

raters. As of DUTERIMBERE IMF S.A, it was begotten by DUTERIMBERE a.s.b.l, a

local non profit driven organization serving women entrepreneurs, as of now, it

is one of local MFIs which is serving, mostly women. Both of them, however,

were in existence by 2006 and survived the Rwanda microfinance crisis.

40 judgmentally selected respondents participated in the

filling of questionnaires, 20 from each MFI. Managing Directors filled

questionnaires too. Focus group was also used to gather information from other

respondents while Human Resource Managers were interviewed. They were selected

on a judgmental basis.

Human capital management in Rwanda: Challenges and prospects

for Microfinance Institutions 3.5.3. Data collection

instruments

Multiple sources of data were utilized to ensure validity as

well as to minimize potential biases in drawing conclusions. Four principal

data collection instruments were utilized for this research. They are

summarized in the following table:

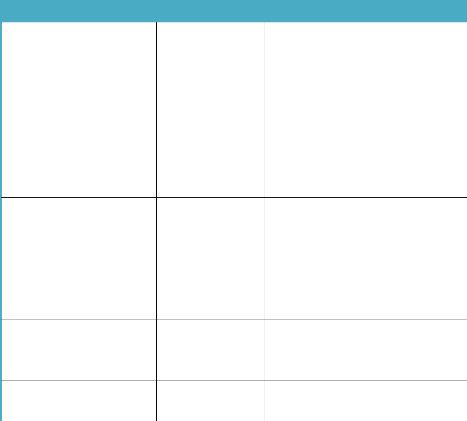

Table 3.1. Data sources

|

Secondary

|

Documentation

|

1. IMF UNGUKA S.A's business plan 2010 - 2014

2. DUTERIMBERE IMF SA

business plan 2010 - 2014

3. Government publications

4. Textbooks

5. Official reports

6. Online resources

|

|

Primary

|

Focus group

|

Experts were interviewed: 1 from the National Bank of Rwanda

(NBR), 1 from NBR licensed auditors, 1 former MFI manager who is currently a

consultant, and 1 from Association of Microfinance of Rwanda.

|

|

Primary

|

Oral interviews

|

They were conducted with managers who have human resources

management under their responsibilities

|

|

Primary

|

Questionnaires

|

Filled by 40 respondents and 2 MFI Managing Directors

|

Type of data Source of evidence Details

Source: Primary data

Human capital management in Rwanda: Challenges and prospects

for Microfinance Institutions 3.5.4. Data presentation and

analysis tools

To ensure valid results, the data were converted and

processed. A thorough examination of questionnaires and interview responses was

done to ensure consistency, accuracy and completeness of the responses. Using

qualitative and quantitative data handled and analyzed, the conclusion was

taken basing on the relationship found out between the dependent and

independent variables. Briefly, the following steps were followed:

Step one: Editing:

This was the first task in data processing. It consisted of

examining errors and omissions in the collected data and making necessary

corrections. It was partly carried out in the field and finally completed after

fieldwork. It involved pursuing through completed interviews schedule and

anomalies in reporting and recording rectified. It was done for responses as

entered in the questionnaire and where it contained only a partial or vague

answer. It means that some questions were not answered as expected, and the

responses were not consistent with the questions. So, the researcher had to

relate the answers to their respective questions and this ensured coherent and

logical answers.

Step two: Coding

After the editing of the data, the researcher had to thorough the

code the data. Coding was used in this study to summarize data by classifying

the different respondents given into categories.

A code sheet was prepared by writing down all responses that

were similar or closely related for open-ended questions and coding them. The

code established was as exhaustive as possible and included all the vital

responses. The coding frame chosen had to be in line with the objectives of the

study.

Before coding is finalized, the researcher checked thoroughly in

order to detect any coding differences and eliminate ambiguous or irrelevant

cases.

So, basically, coding thus was done in 2 phases: Specifying

the different categories of classes into which the responses were to be

classified; and allocating individual answers to different categories.

Step 3: Tabulating

After editing and coding, the summarizing data by constructing

frequency distribution table of answers to each closed-ended question had to be

carried out. In fact, this is putting data into some kind of statistical table

with percentage. The task is executed by drawing a matrix of codes in a such

way that questions of each coding frame are set against the respondents until

all items in the code sheet helped the researcher interpret the codes in the

matrix using tally symbols to get frequencies for each question. The matrix of

code helps a lot to gain in making comparisons as well as making frequencies

using tally system.

Step 4: Statistical Analysis

The calculation of percentages was done. This was a number of

the sample size then multiplied by a hundred divided by the frequency of the

respondents. Statistical analysis was done almost for all tables.

Another statistical analysis element is summation. In this

regard, the research is able to draw conclusions from the data processed and

presented in the table, after relating these findings from the field and

theoretical literature from various sources.

Dependent variables are capacity to attract skilled employees and

capacity to retain skilled employees.

They depend on independent variables that include dream to

work with MFIs; education level; education specialization; length of

professional experience; levels of employment in Rwanda; capacity to

effectively and efficiently recruit qualified employees; capacity to pay good

salaries and benefits; existence of teamwork in MFIs; quality of supervision;

organization ownership;

availability of funds; microfinance popularity; availability

of resource people; employees' age; management of the training programs;

promotion management; performance evaluation; availability of qualified

employees and career path clarity in microfinance.

|