ANNEXES

a) Tableaux

Tableau 6 : Intervention de la BRH sur le marché

des changes pendant l'exercice 2008/2009

|

Mois

|

Achats de devises

|

Ventes de devises

|

|

Montant en $

|

Montant en

gourdes

|

Taux moyen

|

Montant en $

|

Montant en

gourdes

|

Taux moyen

|

|

Oct. 98

|

1,700,000.00

|

28,447,250.00

|

16.7337

|

1,450,000.00

|

24,249,375.00

|

16.7237

|

|

Nov. 98

|

0.00

|

0.00

|

-

|

250,000.00

|

4,164,000.00

|

16.6560

|

|

Déc. 98

|

3,055,000.00

|

50,684,900.00

|

16.5908

|

1,280,000.00

|

21,246,600.00

|

16.5989

|

|

Janv. 99

|

1,800,000.00

|

30,560,000.00

|

16.9778

|

275,000.00

|

4,634,375.00

|

16.8523

|

|

Fév. 99

|

1,600,000.00

|

27,165,875.00

|

16.9787

|

100,000.00

|

1,705,000.00

|

17.0500

|

|

Mars 99

|

8,860,000.00

|

149,989,525.00

|

16.9288

|

0.00

|

0.00

|

-

|

|

Avril 99

|

8,150,000.00

|

137,347,250.00

|

16.8524

|

560,000.00

|

9,453,500.00

|

16.8813

|

|

Mai 99

|

8,200,000.00

|

138,158,975.00

|

16.8487

|

200,000.00

|

3,368,000.00

|

16.8400

|

|

Juin

|

8,500,000.00

|

143,189,000.00

|

16.8458

|

1,000,000.00

|

16,872,500.00

|

16.8725

|

|

Juil. 99

|

3,100,000.00

|

52,624,000.00

|

16.9755

|

2,750,000.00

|

46,735,100.00

|

16.9926

|

|

Août 99

|

1,150,000.00

|

19,451,150.00

|

16.9140

|

2,050,000.00

|

34,686,150.00

|

16.9201

|

|

Sept. 99

|

0.00

|

0.00

|

-

|

3,500,000.00

|

60,116,770.00

|

17.1762

|

|

Total

|

46,115,000.00

|

777,617,927.00

|

16.8626

|

13,415,000.00

|

227,231,370.00

|

16.9386

|

Sources : BRU

84

Tableau 7 : Evolution de la masse monétaire en

millions de gourdes et de l'indice des prix à la consommation d'octobre

1999 à septembre 2010.

85

Tableau 8 : estimation des paramètres du VAR(3)

à partir du logiciel EVIEWS

Vector Autoregression Estimates Date: 04/15/13 Time: 13:36

Sample (adjusted): 2000M02 2010M09

Included observations: 128 after adjustments Standard errors in (

) & t-statistics in [ ]

|

DLLOGIPC

|

DLLOGM3

|

|

DLLOGIPC(-1)

DLLOGIPC(-2)

|

[

[

|

0.379259

(0.09183)

4.13017]

0.047620

(0.09756)

0.48812]

|

|

-0.172862 [-0.90423] -0.014161 [-0.06972] (0.19117) (0.20310)

|

|

DLLOGIPC(-3)

|

|

0.046905

|

|

0.334842

|

|

|

(0.08785)

|

|

(0.18289)

|

|

[

|

0.53393]

|

[

|

1.83084]

|

|

DLLOGM3(-1)

|

|

0.115169

|

|

0.005950

|

|

|

(0.04325)

|

|

(0.09004)

|

|

[

|

2.66291]

|

[

|

0.06608]

|

|

DLLOGM3(-2)

|

|

0.087284

|

|

0.073478

|

|

|

(0.04375)

|

|

(0.09108)

|

|

[

|

1.99508]

|

[

|

0.80672]

|

|

DLLOGM3(-3)

|

|

0.035182

|

|

0.173005

|

|

|

(0.04437)

|

|

(0.09236)

|

|

[

|

0.79299]

|

[

|

1.87308]

|

|

C

|

|

0.002485

|

|

0.007956

|

|

|

(0.00147)

|

|

(0.00305)

|

|

[

|

1.69531]

|

[

|

2.60674]

|

|

R-squared

|

0.328458

|

0.066702

|

|

Adj. R-squared

|

0.295159

|

0.020423

|

|

Sum sq. resids

|

0.011441

|

0.049589

|

|

S.E. equation

|

0.009724

|

0.020244

|

|

F-statistic

|

9.863739

|

1.441301

|

|

Log likelihood

|

415.0200

|

321.1613

|

|

Akaike AIC

|

-6.375312

|

-4.908770

|

|

Schwarz SC

|

-6.219342

|

-4.752799

|

|

Mean dependent

|

0.010582

|

0.012821

|

|

S.D. dependent 0.011582

|

0.020454

|

|

Determinant resid covariance (dof adj.)

|

3.80E-08

|

|

Determinant resid covariance

|

3.40E-08

|

|

Log likelihood

|

737.3499

|

|

Akaike information criterion

|

-11.30234

|

|

Schwarz criterion

|

-10.99040

|

Sources : calcul de l'auteur, EVIEWS 5.0

Tableau 9 : estimation des paramètres du VAR(1)

à partir du logiciel EVIEWS

86

Sources : calcul de l'auteur, EVIEWS 5.0

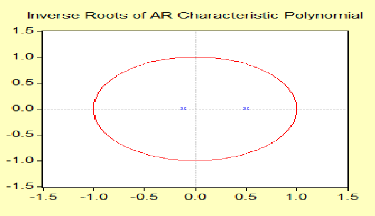

Graphique 10 : Inverse de la racine associée

à la partie AR

87

Sources : Calcul de l'auteur à partir de

données provenant de l'IHSI et de la BRH

Modèle 3 : Ici, on commence par :

- Estimation du modèle.

- Test de Significativité du trend. H0 : â=0 et

H1 :â?0. Deux possibilités : Si Tc=Ttab ou Proba>0.05, on

accepte H0, donc le trend est non significatif. Dans ce cas, on passe au

modèle 2. Si au contraire, Tc>Ttab ou Proba<0.05, on rejette H0,

donc le trend est significatif. Dans ce cas, on garde le modèle 3 et on

effectue le test de RU.

- Test de Racine Unitaire. H0 : ö=0 ou ñ=1

(série non stationnaire)

H1 : ö<0 ou /ñ/<1 ( série

stationnaire). Deux possibilites : Si ADF=Ttab, on accepte Ho, donc la

série est non stationnaire. Si au contraire, ADF<Ttab, on rejette H0,

donc la série est stationnaire.

Modèle 2 : Ici, on commence par :

- Estimation du modèle.

-Test de Significativité de la constante. H0 :

á=0 et H1 :á?0. Deux possibilités :. Si Tc=Ttab ou

Proba>0.05, on accepte H0, donc la constante est non significative. Dans ce

cas, on passe au modèle 1. Si au contraire, Tc>Ttab ou Proba<0.05,

on rejette H0, donc la constante est significative. Dans ce cas, on garde le

modèle 2 et on effectue le test de RU

- Test de Racine Unitaire. H0 :ö=0 ou ñ=1

(série non stationnaire) et H1 : ö<0 ou /ñ/<1 (

série stationnaire). Deux possibilites : Si ADF=Ttab, on accepte Ho,

donc la série est non stationnaire. Si au contraire, ADF<Ttab, on

rejette H0, donc la série est stationnaire.

Modèle 1 : Ici, on effectue le test

:

- Test de Racine Unitaire. H0 :ö=0 ou ñ=1

(série non stationnaire) et H1 : ö<0 ou /ñ/<1 (

série stationnaire). Deux possibilités : Si ADF=Ttab, on accepte

Ho, donc la série est non stationnaire. Si au contraire, ADF<Ttab, on

rejette H0, donc la série est stationnaire.

Test ADF (3 Modèles)

Modèle 3 : Ici, on commence par :

- Estimation du modèle.

- Test de Significativité du trend. H0 : â=0 et

H1 :â?0. Deux possibilités : Si Tc=Ttab ou Proba>0.05, on

accepte H0, donc le trend est non significatif. Dans ce cas, on passe au

modèle 2. Si au contraire, Tc>Ttab ou Proba<0.05, on rejette H0,

donc le trend est significatif. Dans ce cas, on garde le modèle 3 et on

effectue le test de RU.

- Test de Racine Unitaire. H0 : ö=0 ou ñ=1

(série non stationnaire) et H1 : ö<0 ou /ñ/<1 (

série stationnaire). Deux possibilites : Si PP=Ttab, on accepte Ho, donc

la série est non stationnaire. Si au contraire, PP<Ttab, on rejette

H0, donc la série est stationnaire.

Modèle 2 : Ici, on commence par :

- Estimation du modèle.

- Test de Significativité de la constante. H0 :

á=0 et H1 :á?0. Deux possibilités :. Si Tc=Ttab ou

Proba>0.05, on accepte H0, donc la constante est non significative. Dans ce

cas, on passe au modèle 1. Si au contraire, Tc>Ttab ou Proba<0.05,

on rejette H0, donc la constante est significative. Dans ce cas, on garde le

modèle 2 et on effectue le test de RU

- Test de Racine Unitaire. H0 :ö=0 ou ñ=1

(série non stationnaire) et H1 : ö<0 ou /ñ/<1 (

série stationnaire). Deux possibilités : Si PP=Ttab, on accepte

Ho, donc la série est non stationnaire. Si au contraire, PP<Ttab, on

rejette H0, donc la série est stationnaire.

Modèle 1 : Ici, on effectue le test

:

- Test de Racine Unitaire. H0 :ö=0 ou ñ=1

(série non stationnaire) et H1 : ö<0 ou /ñ/<1 (

série stationnaire). Deux possibilités : Si PP=Ttab, on accepte

Ho, donc la série est non stationnaire. Si au contraire, PP<Ttab, on

rejette H0, donc la série est stationnaire.

Test PP (3 Modèles)

88

Tableau 10 : Récapitulatif des stratégies

et des règles de décision des tests de racine

unitaire

89

b) Présentation des résultats des

différents tests de Dickey-Fuller effectués sur les séries

LOGIPC et LOGM3 (en niveau et en différence première) à

partir du logiciel EVIEWS 5.0 :

Null Hypothesis: LOGIPC has a unit root

t-Statistic Prob.*

Augmented Dickey-Fuller test statistic 0.087090

0.9969

Exogenous: Constant, Linear Trend

Lag Length: 1 (Automatic based on SIC,

MAXLAG=12)

Test critical values: 1% level -4.030157

10% level -3.147221

5% level -3.444756

*MacKinnon (1996) one-sided p-values.

Augmented Dickey-Fuller Test Equation

Dependent Variable: D(LOGIPC)

Method: Least Squares

Variable Coefficient Std. Error t-Statistic Prob.

Date: 12/10/12 Time: 13:30

Sample (adjusted): 1999M12 2010M09

Included observations: 130 after adjustments

LOGIPC(-1) 0.000839 0.009635 0.087090 0.9307

D(LOGIPC(-1)) 0.453664 0.080975 5.602525 0.0000

C 0.006284 0.036354 0.172866 0.8630

@TREND(1999M10) -6.59E-05 0.000118 -0.557720 0.5780

R-squared 0.289434 Mean dependent var 0.010561

Adjusted R-squared 0.272516 S.D. dependent var

0.011494

S.E. of regression 0.009803 Akaike info criterion

-6.381938

Sum squared resid 0.012109 Schwarz criterion

-6.293706

Log likelihood 418.8260 F-statistic 17.10781

Durbin-Watson stat 2.038036 Prob(F-statistic)

0.000000

90

Null Hypothesis: LOGIPC has a unit root

Lag Length: 1 (Automatic based on SIC, MAXLAG=12)

t-Statistic Prob.*

Test critical values: 1% level -3.481217

5% level -2.883753

10% level -2.578694

Exogenous: Constant

*MacKinnon (1996) one-sided p-values.

Augmented Dickey-Fuller test statistic -2.262753

0.1857

Dependent Variable: D(LOGIPC)

Method: Least Squares

Augmented Dickey-Fuller Test Equation

LOGIPC(-1) -0.004422 0.001954 -2.262753 0.0253

D(LOGIPC(-1)) 0.466231 0.077565 6.010807 0.0000

C 0.025890 0.009240 2.802129 0.0059

Date: 12/10/12 Time: 13:31

Sample (adjusted): 1999M12 2010M09

Included observations: 130 after adjustments

Variable Coefficient Std. Error t-Statistic

Prob.

R-squared 0.287680 Mean dependent var 0.010561

Adjusted R-squared 0.276462 S.D. dependent var

0.011494

S.E. of regression 0.009777 Akaike info criterion

-6.394857

Sum squared resid 0.012139 Schwarz criterion

-6.328683

Log likelihood 418.6657 F-statistic 25.64531

Durbin-Watson stat 2.048777 Prob(F-statistic)

0.000000

91

Exogenous: None

Lag Length: 1 (Automatic based on SIC, MAXLAG=12)

t-Statistic Prob.*

Null Hypothesis: LOGIPC has a unit root

Augmented Dickey-Fuller test statistic 3.976333

1.0000

Test critical values: 1% level -2.582872

5% level -1.943304

10% level -1.615087

*MacKinnon (1996) one-sided p-values.

Augmented Dickey-Fuller Test Equation

Method: Least Squares

Date: 12/10/12 Time: 13:32

Dependent Variable: D(LOGIPC)

LOGIPC(-1) 0.001010 0.000254 3.976333 0.0001

D(LOGIPC(-1)) 0.538400 0.075098 7.169334 0.0000

Sample (adjusted): 1999M12 2010M09

Included observations: 130 after adjustments

Variable Coefficient Std. Error t-Statistic

Prob.

R-squared 0.243640 Mean dependent var 0.010561

Adjusted R-squared 0.237731 S.D. dependent var

0.011494

S.E. of regression 0.010035 Akaike info criterion

-6.350251

Sum squared resid 0.012889 Schwarz criterion

-6.306135

Log likelihood 414.7663 Durbin-Watson stat

2.089920

92

Lag Length: 0 (Automatic based on SIC, MAXLAG=12)

t-Statistic Prob.*

Null Hypothesis: D(LOGIPC) has a unit root

Exogenous: Constant, Linear Trend

Augmented Dickey-Fuller test statistic

-6.929208 0.0000

Test critical values: 1% level -4.030157

5% level -3.444756

10% level -3.147221

*MacKinnon (1996) one-sided p-values.

Augmented Dickey-Fuller Test Equation

Sample (adjusted): 1999M12 2010M09

Dependent Variable: D(LOGIPC,2)

Method: Least Squares

Date: 12/10/12 Time: 13:32

@TREND(1999M10) -5.58E-05 2.39E-05 -2.332003

0.0213

Included observations: 130 after adjustments

Variable Coefficient Std. Error t-Statistic Prob.

D(LOGIPC(-1)) -0.544760 0.078618 -6.929208 0.0000

C 0.009445 0.002180 4.331590 0.0000

R-squared 0.274637 Mean dependent var -4.02E-05

Adjusted R-squared 0.263214 S.D. dependent var

0.011376

S.E. of regression 0.009765 Akaike info criterion

-6.397262

Sum squared resid 0.012110 Schwarz criterion

-6.331088

Log likelihood 418.8220 F-statistic 24.04238

Durbin-Watson stat 2.039518 Prob(F-statistic)

0.000000

93

Lag Length: 0 (Automatic based on SIC, MAXLAG=12)

t-Statistic Prob.*

Augmented Dickey-Fuller test statistic -1.915043

0.6410

Null Hypothesis: LOGM3 has a unit root

Exogenous: Constant, Linear Trend

Test critical values: 1% level -4.029595

5% level -3.444487

10% level -3.147063

*MacKinnon (1996) one-sided p-values.

Augmented Dickey-Fuller Test Equation

Sample (adjusted): 1999M11 2010M09

Dependent Variable: D(LOGM3)

Method: Least Squares

Date: 12/10/12 Time: 13:33

@TREND(1999M10) 0.000449 0.000265 1.697009

0.0921

Included observations: 131 after adjustments

Variable Coefficient Std. Error t-Statistic Prob.

LOGM3(-1) -0.041029 0.021425 -1.915043 0.0577

C 0.432743 0.217405 1.990493 0.0487

R-squared 0.036108 Mean dependent var 0.013177

Adjusted R-squared 0.021047 S.D. dependent var

0.020487

S.E. of regression 0.020270 Akaike info criterion

-4.936682

Sum squared resid 0.052593 Schwarz criterion

-4.870838

Log likelihood 326.3527 F-statistic 2.397485

Durbin-Watson stat 1.930151 Prob(F-statistic)

0.095020

94

Lag Length: 0 (Automatic based on SIC, MAXLAG=12)

t-Statistic Prob.*

Null Hypothesis: LOGM3 has a unit root

Exogenous: Constant

Augmented Dickey-Fuller test statistic -1.373908

0.5933

Test critical values: 1% level -3.480818

5% level -2.883579

10% level -2.578601

*MacKinnon (1996) one-sided p-values.

Augmented Dickey-Fuller Test Equation

Date: 12/10/12 Time: 13:33

Dependent Variable: D(LOGM3)

Method: Least Squares

C 0.070600 0.041833 1.687642 0.0939

Sample (adjusted): 1999M11 2010M09

Included observations: 131 after adjustments

Variable Coefficient Std. Error t-Statistic

Prob.

LOGM3(-1) -0.005245 0.003817 -1.373908 0.1719

R-squared 0.014422 Mean dependent var 0.013177

Adjusted R-squared 0.006782 S.D. dependent var

0.020487

S.E. of regression 0.020417 Akaike info criterion

-4.929700

Sum squared resid 0.053777 Schwarz criterion

-4.885804

Log likelihood 324.8954 F-statistic 1.887624

Durbin-Watson stat 1.956048 Prob(F-statistic)

0.171853

95

Exogenous: None

t-Statistic Prob.*

Null Hypothesis: LOGM3 has a unit root

Test critical values: 1% level -2.582734

5% level -1.943285

10% level -1.615099

Lag Length: 0 (Automatic based on SIC,

MAXLAG=12)

*MacKinnon (1996) one-sided p-values.

Augmented Dickey-Fuller test statistic 7.269761

1.0000

Dependent Variable: D(LOGM3)

Variable Coefficient Std. Error t-Statistic Prob.

Augmented Dickey-Fuller Test Equation

LOGM3(-1) 0.001192 0.000164 7.269761 0.0000

Method: Least Squares

Date: 12/10/12 Time: 13:33

Sample (adjusted): 1999M11 2010M09

Included observations: 131 after adjustments

R-squared -0.007338 Mean dependent var 0.013177

Adjusted R-squared -0.007338 S.D. dependent var

0.020487

S.E. of regression 0.020562 Akaike info criterion

-4.923129

Sum squared resid 0.054964 Schwarz criterion

-4.901181

Log likelihood 323.4649 Durbin-Watson stat

1.926039

96

Lag Length: 0 (Automatic based on SIC, MAXLAG=12)

t-Statistic Prob.*

Augmented Dickey-Fuller test statistic -11.01484

0.0000

Null Hypothesis: D(LOGM3) has a unit root

Exogenous: Constant, Linear Trend

Test critical values: 1% level -4.030157

5% level -3.444756

10% level -3.147221

*MacKinnon (1996) one-sided p-values.

Augmented Dickey-Fuller Test Equation

Sample (adjusted): 1999M12 2010M09

Dependent Variable: D(LOGM3,2)

Method: Least Squares

Date: 12/10/12 Time: 13:35

@TREND(1999M10) -4.71E-05 4.85E-05 -0.971557

0.3331

Included observations: 130 after adjustments

Variable Coefficient Std. Error t-Statistic Prob.

D(LOGM3(-1)) -0.983543 0.089292 -11.01484 0.0000

C 0.016037 0.003980 4.029042 0.0001

R-squared 0.488684 Mean dependent var 0.000117

Adjusted R-squared 0.480632 S.D. dependent var

0.028630

S.E. of regression 0.020633 Akaike info criterion

-4.901081

Sum squared resid 0.054065 Schwarz criterion

-4.834907

Log likelihood 321.5703 F-statistic 60.68941

Durbin-Watson stat 1.973888 Prob(F-statistic)

0.000000

97

Lag Length: 0 (Automatic based on SIC, MAXLAG=12)

t-Statistic Prob.*

Null Hypothesis: D(LOGM3) has a unit root

Exogenous: Constant

Augmented Dickey-Fuller test statistic

-10.97669 0.0000

Test critical values: 1% level -3.481217

5% level -2.883753

10% level -2.578694

*MacKinnon (1996) one-sided p-values.

Augmented Dickey-Fuller Test Equation

Dependent Variable: D(LOGM3,2)

Date: 12/10/12 Time: 13:35

Sample (adjusted): 1999M12 2010M09

Method: Least Squares

Included observations: 130 after adjustments

Variable Coefficient Std. Error t-Statistic Prob.

D(LOGM3(-1)) -0.974104 0.088743 -10.97669 0.0000

C 0.012780 0.002146 5.956124

0.0000

R-squared 0.484884 Mean dependent var 0.000117

Adjusted R-squared 0.480860 S.D. dependent var

0.028630

S.E. of regression 0.020628 Akaike info criterion

-4.909060

Sum squared resid 0.054466 Schwarz criterion

-4.864945

Log likelihood 321.0889 F-statistic 120.4877

Durbin-Watson stat 1.978996 Prob(F-statistic)

0.000000

98

Présentation des résultats des

différents tests de Phillips-Perron effectués sur les

séries LOGIPC et LOGM3 (en niveau et en différence

première) à partir du logiciel EVIEWS 5.0 :

Null Hypothesis: LOGIPC has a unit root

Exogenous: Constant, Linear Trend

Adj. t-Stat Prob.*

Bandwidth: 6 (Newey-West using Bartlett kernel)

Phillips-Perron test statistic 0.218607 0.9980

Test critical values: 1% level -4.029595

5% level -3.444487

10% level -3.147063

*MacKinnon (1996) one-sided p-values.

Residual variance (no correction) 0.000116

HAC corrected variance (Bartlett kernel) 0.000279

Phillips-Perron Test Equation

Dependent Variable: D(LOGIPC)

Method: Least Squares

|

Date: 12/10/12 Time: 13:22

Sample (adjusted): 1999M11 2010M09

Variable

|

Coefficient

|

|

|

|

Included observations: 131 after adjustments

LOGIPC(-1)

|

0.013402

|

0.010448 1.282712

|

|

|

C

|

-0.034218

|

0.039709 -0.861716

|

|

|

@TREND(1999M10)

|

-0.000252

|

Std. Error t-Statistic

0.000126 -1.993729

|

Prob.

|

|

R-squared

|

0.106506

|

Mean dependent var

|

0.2019

|

|

Adjusted R-squared

|

0.092545

|

|

0.3905

|

|

0.010918

|

Akaike info criterion

|

0.0483

|

|

Sum squared resid

|

0.015257

|

|

|

|

Log likelihood

|

407.4114

|

F-statistic

|

0.010516

|

|

S.E. of regression

Durbin-Watson stat

|

1.109030

|

S.D. dependent var

Prob(F-statistic)

|

0.011461

-6.174221

|

99

Null Hypothesis: LOGIPC has a unit root

Exogenous: Constant

Adj. t-Stat Prob.*

Bandwidth: 6 (Newey-West using Bartlett kernel)

Phillips-Perron test statistic -2.195905 0.2088

5% level -2.883579

10% level -2.578601

Test critical values: 1% level -3.480818

*MacKinnon (1996) one-sided p-values.

Residual variance (no correction) 0.000120

HAC corrected variance (Bartlett kernel)

0.000312

Phillips-Perron Test Equation

Dependent Variable: D(LOGIPC)

Method: Least Squares

|

Date: 12/10/12 Time: 13:23

Variable

|

Coefficient

|

|

|

|

Sample (adjusted): 1999M11 2010M09

LOGIPC(-1)

|

Included observations: 131 after adjustments

-0.007009

|

0.002111 -3.320918

|

|

|

C

|

0.042603

|

0.009710 4.387412

|

|

|

R-squared

|

0.078759

|

Std. Error t-Statistic

Mean dependent var

|

Prob.

|

|

Adjusted R-squared

|

0.071618

|

|

0.0012

|

|

0.011043

|

Akaike info criterion

|

0.0000

|

|

Sum squared resid

|

0.015731

|

Schwarz criterion

|

|

|

Log likelihood

|

405.4083

|

F-statistic

|

0.010516

|

|

Durbin-Watson stat

|

1.053910

|

S.D. dependent var

Prob(F-statistic)

|

0.011461

|

100

Bandwidth: 7 (Newey-West using Bartlett kernel)

Adj. t-Stat Prob.*

Null Hypothesis: LOGIPC has a unit root

Exogenous: None

5% level -1.943285

10% level -1.615099

Phillips-Perron test statistic 5.323932 1.0000

Test critical values: 1% level -2.582734

*MacKinnon (1996) one-sided p-values.

Residual variance (no correction) 0.000138

HAC corrected variance (Bartlett kernel) 0.000469

|

Variable

|

Coefficient

|

|

|

|

Phillips-Perron Test Equation

Dependent Variable: D(LOGIPC)

LOGIPC(-1)

|

0.002205

|

0.000224 9.846570

|

|

|

Method: Least Squares

Date: 12/10/12 Time: 13:23

R-squared

|

-0.058709

|

Mean dependent var

|

|

|

Sample (adjusted): 1999M11 2010M09

Adjusted R-squared

|

-0.058709

|

|

|

|

Included observations: 131 after adjustments

0.011793

|

Akaike info criterion

|

|

|

Sum squared resid

|

0.018078

|

Schwarz criterion

|

|

|

Log likelihood

|

396.2984

|

Std. Error t-Statistic

Durbin-Watson stat

|

Prob.

|

101

Adj. t-Stat Prob.*

Phillips-Perron test statistic -6.903092 0.0000

Null Hypothesis: D(LOGIPC) has a unit root

Exogenous: Constant, Linear Trend

Bandwidth: 2 (Newey-West using Bartlett kernel)

10% level -3.147221

*MacKinnon (1996) one-sided p-values.

Test critical values: 1% level -4.030157

5% level -3.444756

Residual variance (no correction) 9.32E-05

HAC corrected variance (Bartlett kernel) 9.16E-05

|

Phillips-Perron Test Equation

Dependent Variable: D(LOGIPC,2)

Variable

|

Coefficient

|

|

|

|

Method: Least Squares

D(LOGIPC(-1))

|

-0.544760

|

0.078618 -6.929208

|

|

|

Date: 12/10/12 Time: 13:24

C

|

0.009445

|

0.002180 4.331590

|

|

|

Sample (adjusted): 1999M12 2010M09

@TREND(1999M10)

|

-5.58E-05

|

2.39E-05 -2.332003

|

|

|

Included observations: 130 after adjustments

R-squared

|

0.274637

|

Mean dependent var

|

|

|

Adjusted R-squared

|

0.263214

|

Std. Error t-Statistic

|

Prob.

|

|

0.009765

|

Akaike info criterion

|

|

|

Sum squared resid

|

0.012110

|

Schwarz criterion

|

0.0000

|

|

Log likelihood

|

418.8220

|

F-statistic

|

0.0000

|

|

Durbin-Watson stat

|

2.039518

|

Prob(F-statistic)

|

0.0213

|

102

Adj. t-Stat Prob.*

Null Hypothesis: LOGM3 has a unit root

Exogenous: Constant, Linear Trend

Bandwidth: 4 (Newey-West using Bartlett kernel)

Phillips-Perron test statistic -2.019091 0.5852

Test critical values: 1% level -4.029595

5% level -3.444487

10% level -3.147063

*MacKinnon (1996) one-sided p-values.

Residual variance (no correction) 0.000401

HAC corrected variance (Bartlett kernel) 0.000498

|

Phillips-Perron Test Equation

Variable

|

Coefficient

|

|

|

|

Dependent Variable: D(LOGM3)

Method: Least Squares

LOGM3(-1)

|

-0.041029

|

0.021425 -1.915043

|

|

|

Date: 12/10/12 Time: 13:25

C

|

0.432743

|

0.217405 1.990493

|

|

|

Sample (adjusted): 1999M11 2010M09

@TREND(1999M10)

|

0.000449

|

0.000265 1.697009

|

|

|

Included observations: 131 after adjustments

R-squared

|

0.036108

|

Mean dependent var

|

|

|

Adjusted R-squared

|

0.021047

|

Std. Error t-Statistic

|

Prob.

|

|

0.020270

|

Akaike info criterion

|

|

|

Sum squared resid

|

0.052593

|

Schwarz criterion

|

0.0577

|

|

Log likelihood

|

326.3527

|

F-statistic

|

0.0487

|

|

Durbin-Watson stat

|

1.930151

|

Prob(F-statistic)

|

0.0921

|

103

Bandwidth: 3 (Newey-West using Bartlett kernel)

Adj. t-Stat Prob.*

Phillips-Perron test statistic -1.314582 0.6216

Null Hypothesis: LOGM3 has a unit root

Exogenous: Constant

5% level -2.883579

10% level -2.578601

*MacKinnon (1996) one-sided p-values.

Test critical values: 1% level -3.480818

Residual variance (no correction) 0.000411

HAC corrected variance (Bartlett kernel) 0.000474

|

Phillips-Perron Test Equation

Variable

|

Coefficient

|

|

|

|

Dependent Variable: D(LOGM3)

LOGM3(-1)

|

-0.005245

|

0.003817 -1.373908

|

|

|

Method: Least Squares

Date: 12/10/12 Time: 13:26

C

|

0.070600

|

0.041833 1.687642

|

|

|

Sample (adjusted): 1999M11 2010M09

R-squared

|

0.014422

|

Mean dependent var

|

|

|

Adjusted R-squared

|

Included observations: 131 after adjustments

0.006782

|

|

|

|

0.020417

|

Akaike info criterion

|

|

|

Sum squared resid

|

0.053777

|

Std. Error t-Statistic

Schwarz criterion

|

Prob.

|

|

Log likelihood

|

324.8954

|

F-statistic

|

|

|

Durbin-Watson stat

|

1.956048

|

Prob(F-statistic)

|

0.1719

0.0939

|

104

Exogenous: None

Bandwidth: 4 (Newey-West using Bartlett kernel)

Adj. t-Stat Prob.*

Null Hypothesis: LOGM3 has a unit root

Test critical values: 1% level -2.582734

5% level -1.943285

10% level -1.615099

Phillips-Perron test statistic 6.520607 1.0000

*MacKinnon (1996) one-sided p-values.

Residual variance (no correction) 0.000420

HAC corrected variance (Bartlett kernel) 0.000521

|

Variable

|

Coefficient

|

|

|

|

Phillips-Perron Test Equation

Dependent Variable: D(LOGM3)

LOGM3(-1)

|

0.001192

|

0.000164 7.269761

|

|

|

Method: Least Squares

R-squared

|

-0.007338

|

Mean dependent var

|

|

|

Date: 12/10/12 Time: 13:26

Adjusted R-squared

|

-0.007338

|

|

|

|

Sample (adjusted): 1999M11 2010M09

|

0.020562

|

Akaike info criterion

|

|

|

Sum squared resid

|

Included observations: 131 after adjustments

0.054964

|

Schwarz criterion

|

|

|

Log likelihood

|

323.4649

|

Std. Error t-Statistic

Durbin-Watson stat

|

Prob.

|

105

Bandwidth: 3 (Newey-West using Bartlett kernel)

Adj. t-Stat Prob.*

Phillips-Perron test statistic -11.06023 0.0000

Null Hypothesis: D(LOGM3) has a unit root

Exogenous: Constant, Linear Trend

10% level -3.147221

*MacKinnon (1996) one-sided p-values.

Test critical values: 1% level -4.030157

5% level -3.444756

Residual variance (no correction) 0.000416

HAC corrected variance (Bartlett kernel) 0.000467

|

Phillips-Perron Test Equation

Variable

|

Coefficient

|

|

|

|

Dependent Variable: D(LOGM3,2)

Method: Least Squares

D(LOGM3(-1))

|

-0.983543

|

0.089292 -11.01484

|

|

|

Date: 12/10/12 Time: 13:26

C

|

0.016037

|

0.003980 4.029042

|

|

|

Sample (adjusted): 1999M12 2010M09

@TREND(1999M10)

|

-4.71E-05

|

4.85E-05 -0.971557

|

|

|

Included observations: 130 after adjustments

R-squared

|

0.488684

|

Mean dependent var

|

|

|

Adjusted R-squared

|

0.480632

|

Std. Error t-Statistic

|

Prob.

|

|

0.020633

|

Akaike info criterion

|

|

|

Sum squared resid

|

0.054065

|

|

0.0000

|

|

Log likelihood

|

321.5703

|

F-statistic

|

0.0001

|

|

Durbin-Watson stat

|

1.973888

|

Prob(F-statistic)

|

0.3331

|

106

Bandwidth: 3 (Newey-West using Bartlett kernel)

Adj. t-Stat Prob.*

Phillips-Perron test statistic -11.02465 0.0000

Null Hypothesis: D(LOGM3) has a unit root

Exogenous: Constant

5% level -2.883753

10% level -2.578694

Test critical values: 1% level -3.481217

*MacKinnon (1996) one-sided p-values.

Residual variance (no correction) 0.000419

HAC corrected variance (Bartlett kernel) 0.000472

|

Phillips-Perron Test Equation

Variable

|

Coefficient

|

|

|

|

Dependent Variable: D(LOGM3,2)

D(LOGM3(-1))

|

-0.974104

|

0.088743 -10.97669

|

|

|

Method: Least Squares

Date: 12/10/12 Time: 13:27

C

|

0.012780

|

0.002146 5.956124

|

|

|

Sample (adjusted): 1999M12 2010M09

R-squared

|

0.484884

|

Mean dependent var

|

|

|

Adjusted R-squared

|

Included observations: 130 after adjustments

0.480860

|

|

|

|

0.020628

|

Akaike info criterion

|

|

|

Sum squared resid

|

0.054466

|

Std. Error t-Statistic

|

Prob.

|

|

Log likelihood

|

321.0889

|

F-statistic

|

|

|

Durbin-Watson stat

|

1.978996

|

Prob(F-statistic)

|

0.0000

0.0000

|

107

Quelques tentatives à partir des séries M1

et M2 : a) Résultats obtenus à partir de M1

DLLOGIPCt = 0.509803*DLLOGIPCt-1 + 0.062282*DLLOGM1t-1 +

0.004418

(6.77247] (2.1136] (3.61161]

DLLOGM1t = -0.130265*DLLOGIPCt-1 - 0.130815*DLLOGM1t-1 +

0.015368

(-0.56798] (-1.45707] (4.12359]

Les résultats de l'équation « DLLOGIPCt »

sont similaires aux résultats retrouvés dans le cadre de ce

présent travail en représentant le VAR à partir de M3.

Pour la stabilité du VAR

Toutes les racines sont à l'intérieure du cercle,

ce VAR est bien stationnaire.

108

Fonction de réponses aux impulsions

Suite à un choc de 1% sur M1, l'inflation réagit

à partir de la deuxième période avec une

variation de 0.2%.

Décomposition de la variance

La variance de l'erreur de prévision de DLLOGIPC est due

à 97% de ses propres innovations contre 3% de celles de DLLOGM1.

b) Résultats obtenus à partir de M2

DLLOGIPCt = 0.495975*DLLOGIPCt-1 + 0.097067*DLLOGM2t-1 +

0.004311

(6.52879] (1.86037] (3.41597]

DLLOGM2t = 0.129120*DLLOGIPCt-1 - 0.130815*DLLOGM2t-1 +

0.009473

(0.98305] (-1.45707] (4.34109]

109

La dans l'équation «DLLOGIPCt », le

coefficient de DLLOGM2 n'est pas statistiquement significatif.

110

Tableau #11 : Evolution des agrégats

monétaires Ml et M2 en millions de gourdes d'octobre 1999 à

septembre 2010.

|

1999-2000

|

2000-2001

|

2001-2002

|

2002-2003

|

2003 2004

|

2004-2005

|

|

Mois

|

Mien ME

|

M2enMG

|

Mien ME

|

M2enMG

|

M1enMG

|

M2enMG

|

M1enMG

|

M2enMG

|

M1enMG

|

M2enMG

|

M1enMG

|

M2enMG

|

|

Qcta re

|

7,389.75

|

16,6fi844

|

8,606.70

|

L3,491.11

|

9,542.35

|

21,206E7

|

..,56455

|

24,45229

|

14,137.93

|

3.0,7295.

|

16,10951

|

35,05759

|

|

Novembre

|

7,437.0D

|

16,8602S

|

9,477.52

|

.3,38 20

|

9,5E5.24

|

21,27235

|

..,391.02

|

24,8fi0.75

|

14,783,84

|

31,729448

|

16,43429

|

34,99251

|

|

Décembre

|

8,15309

|

17,66633

|

9,052.13

|

20,069.47

|

10,31323

|

21,92155

|

13,065.3

|

26,191.07

|

15,95922

|

33,21561

|

17,361.1E

|

36,44561

|

|

Janvier

|

7,986.69

|

17,745.13

|

9,259.63

|

20,14762

|

10,247 26

|

21,792.73

|

13,07921

|

26,656.10

|

15,944.71

|

33,59103

|

17,214,83

|

36,537.92

|

|

Février

|

7,77E26

|

17,711.43

|

9,716.42

|

20,064.44

|

10,584.60

|

22,08234

|

13,728.72

|

27,95525

|

15,972.43

|

34,040.62

|

17,257.69

|

36,85662

|

|

Mars

|

7,946.11

|

12,116.44

|

9,936.71

|

20,539.74

|

10,3E4.69

|

21,919.12

|

13,53227

|

28,208.71

|

1fi,146.44

|

34,351.13

|

17,74355

|

37,569.64

|

|

Avril

|

8,022.0E

|

12,254,29

|

9,695.35

|

20,43357

|

10,30265

|

21,27256

|

14,10fi56

|

29,08351

|

15,969.42

|

34,034.27

|

:7,59E62

|

37,622.66

|

|

Mai

|

7,811.44

|

18,241.75

|

9,619.01

|

20,388.79

|

10,39E65

|

21,840.12

|

13,880,80

|

:3,.66.18

|

15,401E5

|

33,517.19

|

.7,588.49

|

37,53233

|

|

Juin

|

2,048.71

|

12;66E21

|

9,242.22

|

20,617.16

|

1441122

|

22,260.70

|

14,0E7.04

|

29,22726

|

15,010.61

|

33,455.E

|

18,227.24

|

32,192.65

|

|

Juillet

|

8,1&0.87

|

18,774.44

|

9,980.79

|

20/689.69

|

14,67490

|

22,71153

|

14,242.37

|

30,063E7

|

15,44922

|

34,04128

|

18,624.75

|

38,492.11

|

|

Août

|

8,157.01

|

10,79337

|

3,3E0.01

|

21,014.04

|

11,24625

|

23,251.09

|

14,23..s.

|

3.0,201.29

|

15,958.47

|

34,300.5.

|

18,75G.76

|

38,508.73

|

|

Septembre

|

2.527.87

|

19,3E721

|

9,303.35

|

21,02755

|

11,237.29

|

23,4E254

|

14,158,9

|

30.34539

|

15,906.0E

|

34,508,80

|

18,9990E

|

38,838E4

|

|

|

|

|

|

|

|

2005 200e

|

2005-2007

|

2007 200E

|

200E-2049

|

204E-2010

|

|

Mois

|

Mien ME

|

M2enMG

|

Mien ME

|

M2enMG

|

M1enMG

|

M2enMG

|

M1enMG

|

M2enMG

|

M1enMG

|

M2enMG

|

|

Octobre

|

12,91E52

|

35,352.24

|

19,253.=?

|

42,524.75

|

21,572.44

|

=5,235.33

|

25,2E7.75

|

50,54430

|

28,49E35

|

54,70304

|

|

Novembre

|

18,720.68

|

38,61128

|

=9,52.=.::

|

42,85fi5fi

|

21,805.36

|

=5,52L.=3

|

25,22521

|

51,029.17

|

28,111.45

|

54,2E3.42

|

|

Clkemhre

|

20,43E.39

|

40,48933

|

2=,03S.S2

|

44,625.02

|

23,713.29

|

47,2.:.SS

|

27,95E32

|

53,6E223

|

29,7950E

|

56,0E7.19

|

|

Janvier

|

20,448,84

|

44,994.43

|

2.0,144.fi7

|

44,14152

|

24,11950

|

42,253.32

|

27,4815.

|

53,04934

|

30,265.46

|

57,14653

|

|

Février

|

210,1E521

|

44,84829

|

.9,7G1.42

|

43,839.03

|

23,312.2fi

|

47,45958

|

27,477.03

|

53,715.49

|

31,65027

|

58,123.03

|

|

Mars

|

19,9479E

|

40,976.48

|

19,513.00

|

41,9859fi

|

24,096.0

|

42,37E52

|

27,475.07

|

53,33159

|

31,72420

|

59,10423

|

|

Avril

|

24,24357

|

41,35237

|

19,934.68

|

=2,28722

|

24,526.62

|

49,21050

|

26,373.69

|

52,73E68

|

32.795.02

|

60,5912fi

|

|

Mai

|

24,4.4.09

|

41,824.63

|

19,6133.7

|

42,393.07

|

24,72063

|

49,901.37

|

26,447.78

|

52,09251

|

::.=9420

|

51,285.4E

|

|

Juin

|

20,24823

|

41,64630

|

19,9E033

|

43,21E53

|

24,5E455

|

49,222.27

|

26,154.44

|

52,4E531

|

33,507.77

|

5.,581.72

|

|

Juillet

|

19,43E.09

|

40,81952

|

20,16923

|

43,753.64

|

24,99506

|

50,39955

|

26,14705

|

52,370.44

|

35,03537

|

53,21938

|

|

Août

|

19,511.76

|

40,833.67

|

2.O,67463

|

44,113.61

|

26,21957

|

51,4902

|

27,117.19

|

52,82537

|

34,518.25

|

52,892.41

|

|

Septembre

|

19,56153

|

42,E79,24

|

21,2E2.78

|

44,732.1fi

|

25,139.46

|

54,2543fi

|

28,959.3E

|

54,24621

|

37,45520

|

S6,4fi629

|

Source ; BRH

111

|