|

PROTESTANT INSTITUTE OF ARTS AND SOCIAL SCIENCES

(PIASS)

FACULTY OF EDUCATION

DEPARTMENT OF BUSINESS STUDIES

CONTRIBUTION OF MICROFINANCE INSTITUTIONS ON WOMEN

EMPOWERMENT.CASE STUDY VISION FINANCE COMPANY Ltd

NYARUGURU

Dissertation submitted to the faculty of education in

partial fulfillment for the award of bachelor's degree with honor in business

studies with education.

By Albert RUTAYISIRE

REGISTRATION NO: PIASS/13/0817

SUPERVISOR: Mr. BASHIMUBWABO J. Pierre

HUYE, September 2016

DEDICATION

I dedicate this work to the Almighty God who enables me

for any commitment.

Special dedication to my Father, siblings, aunt, cousin

and friends for their unprecedented support through my life, and to all friends

for their devotion and courage that have led to the completion of my studies

and this research.

DECLARATION

I, Albert RUTAYISIRE hereby declare that the

study on «Contribution of microfinance institutions on women

empowerment». A Case Study: VISION FINANCE COMPANY Ltd NYARUGURU Branch

is my original work, that has not been, to my best knowledge,

submitted and presented to any university of higher learning for a similar

award, and that all sources I have used and quoted have been acknowledged by

complete references.

Signature.................................

Albert RUTAYISIRE

Date: ....../......./2016

DECLARATION

I, BASHIMUBWABO J.Pierre

acknowledge that this research project entitled «Contribution of

microfinance on women empowerment: A case study of Vision Finance Company Ltd

» was conducted by Mr. Albert RUTAYISIRE and has been done

under my supervision.

Supervisor: BASHIMUBWABO J.Pierre

Date.............../................../2016

Signature:

ACKNOWLEDGEMENTS

The final product of this research project is not the result

of the effort of one person but a combination of participation of different

persons.

First and foremost I thank the Almighty God who has been

taking care of me and keeping me strong and done everything for my best.

My special thanks go to my father, my aunt, cousin and to my

siblings for their moral and financial support along my education. Your love

has made me what I am today.

My sincere gratitude goes to Mr. BASHIMUBWABO

J.Pierre who kindly accepted to supervise me and for his

enrichment advices regardless of his duties.

I also desire to express and proof my sincere appreciation to

the Protestant Institute of Arts and Social Sciences and Faculty of Education

in general, and especially to the teaching staff in the department of Business

studies, for the huge support accorded to me during my courses. This was

evidenced through material and moral support settled to me.

I would like to thank all those who contributed in one or more

way to the achievement of my study.

I'm highly grateful to the VFC ltd contributing toward the

successful completion of my research project. To Branch manager and to all

staff of VFC Ltd Nyaruguru, I am tremendously appreciative of the support you

gave me.

It is not possible to thank all of you in person, as this may

not be sufficient or exhaustive in coverage, extent and depth.

However, special thanks go to my fellow friends who have been

together with me during my studies, and who managed to provide any kind of

support during this period.

May God bless you all!

Albert RUTAYISIRE

ABASTRACT

In the world a men dominated society, women have always been

underestimated and discriminated in all domains of life be it their family and

social life or their economic and political life. Furthermore, the traditional

duties of managing households make interruptions in their social and economic

empowerment. Over the years various efforts have been made by many Government

and Non-Government organizations to promote women empowerment in general and

especially in rural areas. One such effort is the microfinance intervention.

Many microfinance aims to promote self-sufficiency and economic development

among people who don't have access to the traditional financial sector. They do

this primarily by extending small loans without the strict requirements of

traditional lenders. Recipients are usually the poor and "unbanked," but they

also include people who are not poor but who lack the credit standing to borrow

money to start or grow a business, most of these populations includes women.

This study sought the contribution of microfinance institutions on women

empowerment. It addressed specifically the analysis of the role of microfinance

institutions on women empowerment and their family life in nyaruguru District,

especially in Kibeho, Muganza, Ngera, Cyahinda, Rusenge, Nyagisozi and Ngoma Sectors and it investigated to identify

various determinants of women empowerment in Nyaruguru district. Researcher

took a sample of 64 respondents that were selected from study only target

population made of 919 VFC women clients in Nyaruguru District within 1509

total VFC clients in Nyaruguru including men. The study used both qualitative

and quantitative approaches. The analysis was made via purposive sampling. The

researcher employed analytical method, descriptive methods and synthetic

method. The data collection techniques used includes questionnaire,

documentation, and interview. The study found that all

respondents agreed that after receiving the loan from VFC their income and

saving culture have been increased and their management skills have been

increased after acquiring the loan from VFC Ltd and carrying out their

business, 62.5% confirmed that women economically-developed change gender role

and status within household and community, (95.3%) agreed that most women may

be economically self-sufficiency due to microcredit without the men, 79.7% of

respondents confirmed that Business held by women is competitive with others,

100% agreed that Women empowerment involves the family and community

development have highest the important in the family promotion, 85.9% were

particularly proud of the financial contribution of the loan received to their

empowerment especially in their family, increases personal income, access to

basic needs, and improved welfare of households. The researcher suggested that

Microfinance institutions should try to extend more credit facilities to

clients to expand their businesses. It was also suggested that MFIs should

raise-up the loan amount for supporting the business of their target group. The

Government should provide some fund and subsidies to MFIs in order to help MFIs

delivering financial services at low price.

Abbreviations and Accronyms

PIASS: Protestant institute of arts and social sciences

MFIs: Microfinance institutions

VFC: vision finance company

Ltd: Limited

SMEs: small and medium enterprises

FAO: Food and agriculture organization of the United Nation

UN: united Nations

SEWA: Self Employed Women's Association

WWF: Working Women's Forum

ILO: International Labor Organization

SACCOs: Savings and Credit Cooperatives

EDPRS 2: Second Economic Development and Poverty Reduction

Strategy

EICV: Enquête Intégrale sur les Conditions de Vie

des Ménages (Integrated Household Living Conditions Survey)

MDG: Millennium Development Goals

NISR: National Institute of Statistics of Rwanda

RPHC4: Fourth Rwanda Population and Housing Census (2012)

VUP: Vision 2020 Umurenge Programme

NGOs: Non-Government Organizations

VFC Ltd: Vision Finance Company Limited

CGAP: Certified Government Auditing Professional

Vol.: Volume

SHG: self help group

CIDA: Canadian International Development Agency

RMF: Rwanda Microfinance Forum

MIGEPROF: Ministry of Gender and Women Promotion

NGO: Non-government organization

UNFPA: United Nations Population Fund

UNIFEM: United Nations Development Fund for Women

TABLE OF CONTENT

DECLARATION

I

DECLARATION

III

ACKNOWLEDGEMENTS

IV

ABASTRACT

V

TABLE OF CONTENT

VIII

LIST OF TABLES

XII

LIST OF FIGURE

XIII

LIST OF APPENDICES

XIV

CHAPTER ONE: INTRODUCTION

1

1.1.BACKGROUND OF THE STUDY

1

1.2.PROBLEM STATEMENT

1

1.3. OBJECTIVES OF STUDY

1

1.3.1. General objective

1

1.3.2. Specific objectives

1

1.4. RESEARCH QUESTIONS

1

1.5. SIGNIFICANCE OF THE STUDY

1

1.5.1. To the researcher

1

1.5.2. To the government and government

agency

1

1.5.3. To the VFC ltd's management

1

1.5.4. To the Academicians/ researchers

1

1.6. SCOPE OF THE STUDY

1

1.6.1. Geographical scope

1

1.6.2. Content scope

1

1.6.3. Sample scope

1

1.6.4. Time scope

1

1.7. CONCEPTUAL FRAMEWORK

1

1.8. STRUCTURE OF THE STUDY

1

CHAPTER TWO: LITERATURE REVIEW

1

2.1. THE DEFINITION OF KEY CONCEPTS

1

2.1.1. What is contribution

1

2.1.2. Microfinance

1

2.1.3. Institutions

1

2.1.4. Microfinance institution

1

2.1.5. Concept of empowerment

1

2.1.6. Women

1

2.2. VFC LTD AND VARIOUS CREDIT LENDING MODELS

1

2.3. ROLE OF MICROFINANCE IN WOMEN EMPOWERMENT

1

2.3. THEORETICAL FRAMEWORK

1

2.4. RELATED LITERATURE REVIEW

1

2.4.2. Characteristics of financial Services

that meet Women's needs

1

2.4.3. Challenges to Empowerment through

Microfinance

1

2.4.3.1. Economic and political-organizational

challenges

1

2.4.3.2. Ideological challenges

1

2.4.3.3. Cultural challenges

1

2.5. CRITICALLITERATURE VIEWS

1

2.6. CONCEPTUAL FRAMEWORK

1

CHAPTER THREE: RESEARCH METHODOLOGY

1

3.1. RESEARCH DESIGN

1

3.2. CASE STUDY

1

3.3. AREA OF THE STUDY

1

3. 4. POPULATION OF THE STUDY

1

3.5. SAMPLE SIZE AND SAMPLING TECHNIQUES

1

3.5.1. SAMPLE SIZE

1

3.5. 2. SAMPLING TECHNIQUES

1

3.6. CLASSIFICATION AND SOURCES OF DATA

1

3.6.1. Secondary Data Sources

1

3.6.2. Primary data sources

1

3. 7. DATA COLLECTION TECHNIQUES

1

3.7.1. QUESTIONNAIRE FOR CLIENTS

1

3.7.2. INTERVIEWS FOR KEY STAFF

1

3.7.3. DOCUMMENTATION

1

3.8. DATA PROCESSING, ANALYSIS, AND

INTERPRETATION

1

3.8.1. EDITING

1

3.8.2. CODING

1

3.8.3. TABULATION

1

3.9. LIMITATIONS OF THE STUDY

1

CHAPTER FOUR: PRESENTATION OF KEY FINDINGS

AND DATA ANALYSIS

1

4.1. INTRODUCTION

1

4.2. IDENTIFICATION OF PARTICIPANTS

1

4.3. PRESENTATION OF RESULTS FROM

QUESTIONNAIRES

1

4.4. DISCUSSION OF RESULTS

1

4.4.1. DISCUSSION OF RESULTS FROM

QUESTIONNAIRES

1

4.4.2. DISCUSSION OF RESULTS FROM INTERVIEW

1

4.4.2.1. IMPACT OF MICROFINANCE ON WOMEN

EMPOWERMENT

1

4.4.2.2. CHALLENGES EXPERIENCED BY VISION FINANCE

COMPANY LTD IN OFFERING CREDIT

1

4.4.2.3. CHALLENGES EXPERIENCED BY BENEFICIARIES

(Women)

1

CHAPTER FIVE: CONCLUSION AND

RECOMMANDATIONS

1

5.1. INTRODUCTION

1

5.2. CONCLUSION

1

5.3. RECOMMENDATIONS

1

5.4. SUGGESTIONS FOR FURTHER RESEARCH

1

REFERENCES

1

APPENDICES

1

LIST OF TABLES

TABLE 1: RESPONDENTS NUMBERS IN THE SECTORS

1

TABLE2. IDENTIFICATION OF RESPONDENTS

1

TABLE3: MAJOR CAUSES OF POVERTY AMONG WOMEN ACCORDING

THE RESPONDENTS

1

TABLE4: NUMBER OF RESPONDENT WHO RECEIVED ANY LOAN

FROM VFC LTD

1

TABLE5: NUMBER OF LOAN CYCLES FROM VFC LTD

1

TABLE 6: THE USE OF LOAN FROM VFC LTD

1

TABLE7: VIEWS ON EMPOWERMENT OF THE RESPONDENT AFTER

GETTING LOAN FROM VFC LTD

1

TABLE 8: AFTER RECEIVING THE LOAN FROM VFC THEIR

INCOME AND SAVING CULTURE HAVE BEEN INCREASED

1

TABLE 9: MANAGEMENT SKILLS HAVE BEEN INCREASED AFTER

ACQUIRING THE LOAN FROM VFC LTD AND CARRYING OUT THEIR BUSINESS

1

TABLE10: WOMEN USE SAVINGS AND CREDIT IN ECONOMIC

ACTIVITY FOR THEIR EMPOWERMENT

1

TABLE 11: WOMEN ECONOMICALLY-DEVELOPED CHANGE GENDER

ROLE AND STATUS WITHIN HOUSEHOLD AND COMMUNITY

1

TABLE 12: MICROCREDIT PROVIDED BY VISION FINANCE

COMPANY LTD MFI IS ENOUGH TO WOMEN EMPOWERING

1

TABLE 13: WOMEN APPRECIATE THE SHORT-TERM LOAN FROM

VFC LTD FOR THEIR EMPOWERMENT PURPOSE

1

TABLE 14: WOMEN MAY BE ECONOMICALLY SELF-SUFFICIENCY

DUE TO MICROCREDIT WITHOUT THE MEN SUPPORT

1

TABLE 15: SOCIO-DEMOGRAPHICS VARIABLES SUCH AS

EDUCATION LEVEL, AGE, MARITAL AND PROFESSIONAL STATUS LEAD TO SUCCESS OF

MICROCREDIT IN WOMEN EMPOWERMENT

1

TABLE 16: BUSINESS HELD BY WOMEN IS COMPETITIVE WITH

OTHERS

1

TABLE 17: MICROCREDIT OFFERED TO WOMEN IMPROVES THE

FAMILY STANDING

1

TABLE 18: WOMEN EMPOWERMENT INVOLVES THE FAMILY AND

COMMUNITY DEVELOPMENT

1

TABLE 19: FAMILY ECONOMY MAY BE BASED ON THE WOMEN

EMPOWERMENT DUE TO SAVINGS AND CREDIT THROUGH MICROFINANCE

1

LIST OF FIGURE

FIGURE 1. CONCEPTUAL FRAMEWORK

1

LIST OF APPENDICES

COVER LETTER TO RESPONDENTS

I

QUESTIONNAIRE ( ENGLISH VERSION)

I

INTERVIEW QUESTIONS

I

IBIBAZO BY'UBUSHAKASHATSI( IGICE CY'IKINYARWANDA)

I

CHAPTER ONE: GENERAL

INTRODUCTION

Since 2000, Rwanda has made tremendous progress in achieving a

number of development objectives including building strong institutions,

maintaining macroeconomic stability, and decreasing poverty through increasing

access to basic services. The Rwandan Government aspires to build on this

trajectory and increase financial penetration and inclusion as a key vehicle to

sustained economic growth. Insufficient access to finance, particularly with

SMEs has been a challenge. Rwanda's financial inclusion is still shallow with

11% of adults in Rwanda (around 0.7 million individuals) do not use any

financial products or lacking access to formal financial services (FinScope

Survey 2016), a large portion are covered by women compared to men. To

encourage Microfinance institutions and The «Women and Youth Access to

Finance Program» have been prepared with an objective to contribute in

addressing this challenge.

About 11% of adults in Rwanda (around 0.7 million individuals)

do not use any financial products or services (neither formal nor informal) to

manage their financial lives, i.e. they are financially excluded. Levels of

exclusion vary considerably across the country from 22% to 3% in all districts.

Traditionally vulnerable groups such as the poor, those residing in remote

rural areas, women, and the youth are more likely to be financially excluded

(FinScope Survey 2016).

At the same time, microfinance is being promoted as a key

poverty alleviation strategy to enable poor women and men to cope with the

adverse economic and social impacts of structural adjustment policies and

globalization, Mayoux (2001).

According to S.Sarumathi1 and Dr.K.Mohan (2011), the main aim

of microfinance is to empower women. Women make up a large proportion of

microfinance beneficiaries. Traditionally, women (especially those in

underdeveloped countries) have been unable to readily participate in economic

activity. Microfinance provides women with the financial banking they need to

start business ventures and actively participate in the economy. It gives them

confidence, improves their status and makes them more active in

decision-making, thus encouraging gender equality. According to CGAP,

long-standing MFIs even report a decline in violence towards women since the

inception of microfinance.

The limitation of access to finance for women is largely

skewed towards non-financial barriers. These include conditions in the broader

business environment like limited management capacity, lack of collaterals,

perception of lending institutions towards women and limited incentives to

reach out to more women. Significant attention and resources will be drawn

towards capacity building and empowering more women.

1.1. BACKGROUND OF THE STUDY

Rwanda is among the African developing countries still

characterized by over dependence on agricultural activities in rural areas, low

savings and low investments, low income groups and the economy highly depending

on agricultural (Source IMF web:

Regional

Economic Outlook(2014). Where the populations dependent on subsistence

agriculture cover 70% on entire population, (Finescope report Rwanda (2016).

In Rwanda, women comprise (57%) of 11,533,446of the entire

population. However, most of these Rwandan women are illiterate and this limits

their employment opportunities and financial ability to take care of their

families of which 25.5% of households were reported to be headed by females

while 6.4% of households were headed by females in the absence of a male head

in 2013/14.Considering poverty status, it was observed that female-headed

households are slightly more likely to be poor than male-headed households,

with 44% of female-headed households being poor compared to 37% of poor

male-headed households in 2013/14. De facto female-headed households had a

higher poverty rate (47%) than other households. ((EICV4 Thematic Report -

Gender (2014).

According to FAO report 2014, Women living in rural areas face

many obstacles, mainly in their access to education and schooling, employment

opportunities, land ownership and access to other productive resources such as

all forms of financing. In view of these unequal opportunities, rural women are

limited to modest and lower yielding activities, and work mainly in the

informal economy. This limits their production capacity and impacts negatively

on them, as well as on their families and rural areas communities in general.

It is increasingly recognized that the effective empowerment of rural women

implies comprehensive strategies to overcome the persistent obstacles they

face. The lack of gender-specific analysis, of awareness about socio-economic

issues and of political will result in policies and programs that only

replicate the systemic obstacles and hamper women empowerment and their

involvement as fully fledged economic players.

Kabeer, quoted in Mosedale (2003) states that women need

empowerment as they are constrained by «the norms, beliefs, customs and

values through which societies differentiate between women and men». She

also states that empowerment refers to the «process by which those who

have been denied the ability to make strategic life choices acquire such an

ability», where strategic choices are «critical for people to live

the lives they want (such as choice of livelihood, whether and who to marry,

whether to have children, etc)» (Kabeer, 1999). Therefore MFIs cannot

empower women directly but can help them through training and awareness-raising

to challenge the existing norms, cultures and values which place them at a

disadvantage in relation to men, and to help them have greater control over

resources and their lives.

Littlefield, Murduch and Hashemi (2003) state that access to

MFIs can empower women to become more confident, more assertive, more likely to

take part in family and community decisions and better able to confront gender

inequities. However, they also state that just because women are clients of

MFIs does not mean they will automatically become empowered.

Hulme and Mosley (1996) also make this point when they refer

to the «naivety of the belief that every loan made to a woman contributes

to the strengthening of the economic and social position of women».

However, with careful planning and design women's position in the household and

community can indeed be improved.

According to Littlefield, Murduch and Hashemi (2003), the

Women's Empowerment Program in Nepal confirmed that women were making decisions

on buying and selling property, sending their daughters to school and planning

their family, all decisions that in the past were made by husbands. They refer

to studies in Ghana and Bolivia, which indicated that women involved in

microfinance projects, had increased self-confidence and had an improved status

in the community.

Women have been the most neglected and discriminated strata of

the society not only in Rwanda but all over the world. Inspire of all

Government and Non-Governments' efforts, they have been highly inactive clients

of the financial sector. In the recent times, microfinance has been developed

as a powerful tool for empowering women particularly; the women that have

little financial ability. Apart from the informal sector of finance, the formal

and semi-formal sectors like commercial banks, NGOs are taking much interest in

providing microfinance services to women in order to promote them. Women are

also participating in the microfinance movement by availing the microfinance

services being provided by the various financial networks (Adeline

K., (2013)

Women empowerment is one of the most important issues that

have been in the focus of various policies and programs introduced by the

Government. Microfinance is one such effort that has been emerging as a

powerful tool of women empowerment. It has been observed through the available

literature, that most of the studies related to microfinance have been carried

out in the all province regions of the country (Rwanda) particularly and

worldwide in general. The present study aims to fill in the gap in the

available literature. It is uncertain attempt to analyze the contribution of

microfinance on women empowerment and the satisfaction level of the women

towards microfinance services.

1.2. PROBLEM STATEMENT

Basing on historical background, After the TUTSI genocide of

1994, women in Rwanda took huge responsibilities that made it difficult for

women to be able to hold up themselves in absence of their spouses. This

explain how women are vulnerable to poverty especially those women heading the

family.

According to Adeline K. (2013) In general, Rwanda women make

up the majority of the low income earners, unorganized informal sector of the

economy and bigger number of them are gaps left overdue by the 1994 genocide

tragedy, others are illiterate and have been marginalized by poverty and

negative cultural practices.

According to Finescope Report Rwanda (2016), there is a gender

gap in terms of financial inclusion in Rwanda, which is smaller in comparison

to the rural divide. In general, there are slightly higher levels of financial

inclusion among males compared to females due to a number of reasons (e.g.

economic, social, legal, and cultural).

(Mjomba, 2011) studied the development of micro-finance in

Kenya by specifically considering micro finance on financial empowerment of

women in Kenya. This study though identified the impact of micro financing as

empowering women positively, it majored on Kenya Women Finance Trust and was

also bias to women only.

International aid donors, governments, scholars, and other

development experts have paid much attention to microfinance as a strategy

capable of reaching women and involving them in the development process. The

microfinance industry has made great strides toward identifying barriers to

women's access to financial services and developing ways to overcome those

barriers. The microfinance institutions have been developed to fill these gaps,

with increasing assistance from the various financial institutions and other

donors, microfinance service is emerging as a powerful tool to reduce poverty

and improve access to financial services for the poor women of Rwanda Cheston,

susy Kuhn, Lisa (2002).

It is against this background that the researcher intends to

carry out a study in order to analyze the outreach and impact of microfinance

on the VFC women clients in Rwanda especially those leaving in Nyaruguru

district. The findings will be drawn from an in-depth analysis of data obtained

from microloan delivered to women beneficiaries of VFC Ltd Nyaruguru.

1.3. OBJECTIVES OF STUDY

1.3.1. General objective

To determine the contribution of

microfinance on women empowerment in Rwanda

1.3.2. Specific objectives

· To identify various determinants of

women empowerment in Nyaruguru district.

·

To find out the impact of microcredit in women development.

· To analyze the role of microfinance in family empowerment

by women.

1.4. RESEARCH QUESTIONS

This study was designed to emphasis on the following

questions:

What are the various determinants of women empowerment in

Nyaruguru district?

What is the impact of microcredit to women development?

What is the role of microfinance in family empowerment by

women?

1.5. SIGNIFICANCE OF THE STUDY

Rwanda was encouraging the practice of microfinance

institutions to enhance women empowerment especially in rural areas for the

purpose of poverty reduction.

1.5.1. To the researcher

This study was important to the researcher as it equipped him

with the knowledge on the contribution of microfinance institutions to the

available data for women empowerment. It further helped in designating proper

solution for identified problems

1.5.2. To the government and government agency

This study was an important element that helped the government

policy maker, women council, and Nyaruguru district to assess if their planned

goals for poverty reduction and empowering women are in process to be achieved.

As to empower women is the key for poverty reduction, and will help to assess

if the microfinance institutions contribute in women empowerment.

1.5.3. To the VFC ltd's management

The microfinance institutions are formed with the mission of

providing financial and non financial services to the vulnerable Rwandese

especially women through their small business. There are several Rwandan women

who fall under the bracket of low income earners. Microfinance institutions aim

at ensuring that all these citizens who are low income earners including women

are catered for in terms of provision of financial services. It is therefore

necessary for the institutions to understand the perceptions of the women on

the contribution of the microfinance services they are offering and the level

of awareness of the public on the existence of microfinance institutions and

their services.

This information may be used by the management of the

microfinance institutions in determining areas for improvement and to who

empowered and determining the product that feat with the level of the clients,

so as to ensure their success.

1.5.4. To the Academicians/ researchers

Little research has been done in Rwanda to directly identify

the contribution of microfinance in economic change. Considering the benefits

credited to microfinance institutions in economic development and the rapid

development of these institutions, impact of microfinance has received

attention of researchers and academicians. Therefore a study on the

contribution of microfinance on women empowerment in Rwanda, with major focus

on Nyarugurudistrict, may therefore attract researchers and academicians who

are in need of educating more and providing solutions to lack of access to

financial services in Rwanda.

The information from the study will also form basis for

literature for other researchers and academicians who are willing to carry out

studies in the same field in Rwanda.

1.6. SCOPE OF THE STUDY

1.6.1. Geographical scope

The research information wascaptured within VFC Ltd in

Nyaruguru district,but as it was introduce their product in all sectors of

Nyaruguru, the information gathered especially in the sampled sectors Kibeho,

Cyahinda, Rusenge, Muganza, Nyagisozi, Ngera sector.Because, it is one of the

sectors where VFC Ltd introduces their products.

1.6.2. Content scope

This research analyzed and highlighted the contribution of

MFIs on women empowerment, through VFC Ltd view.

1.6.3. Sample scope

The targeted population was the VFC ltd women Clients in

Nyaruguru district and VFC Ltd staffs in Nyaruguru branch

1.6.4. Time scope

This study dealt with information within period from 2012 to

2015 to assess how Microfinance institutions contribute on women empowerment.

Especially these period was helped us to generate the information as VFC Ltd

introduced their activities in Nyaruguru from 2012.

1.8. STRUCTURE OF THE STUDY

This study comprises five chapters. Chapter one dealt with

general introduction including Background of the study, problem statement,

research purpose, research question, and significance of the study, scope of

the study and structure of the study.

The second chapter dealt with literature review which

discusses the definitions of key concepts, theoretical frame work and related

literature conceptual framework.

The third chapter is research methodology in this includes

research design, population and sample size, sampling techniques, data

collection and techniques, data analysis, ethical issues and limitation of the

study.

Fourth chapter concerns data presentation, data analysis and

interpretation. Finally the fifth chapter concerns discussion; conclusion and

recommendations.

CHAPTER TWO: LITERATURE REVIEW

This chapter of our research helped to discuss on the

following points: the definition of key concepts, theoretical framework, and

related literature

2.1. The definition of key concepts

2.1.1. Contribution

According to oxford dictionary contribution is gift or payment

to a common fund or collection

According to merriam-webster.com/dictionary contribution is

the act of giving something or something given:

donation

2.1.2. Microfinance

Microfinance is the provision of financial services to

low-income clients, including women and the self- employed, who traditionally

lack access to banking and related services. Microcredit, or microfinance, is

banking the un-bankable, bringing credit, savings and other essential financial

services within the reach of millions of people who are too poor to be served

by regular banks, in most cases because they are unable to offer sufficient

collateral. In general, banks are for people with money, not for people

without.» (Gert van Maanen, (2004) is based on the premise that the poor

have skills which remain unutilized or underutilized. Microcredit fits best to

those with entrepreneurial capability and possibility. Ultimately, the goal of

microfinance is to give low income people an opportunity to become

self-sufficient by providing a means of saving money, borrowing money and

insurance.

According to the RMF (Rwanda Microfinance Forum) (2002;6) is

defined as development instrument by which populations excluded from the

standard banking systems access decentralized financial services.

Therefore, microfinance programs generally target poor people

who do not have access to classic banking and financial services to help them

improve their financial situations. It enables poor people to meet them need

for financial services and improve their standards of living. Financial

services for the poor are the powerful instrument poverty reduction that

enables the poor to build assets, increase incomes and reduce their

vulnerability to economic stress.

2.1.3. Institutions

Institutions are "stable, valued, recurring patterns of

behavior." As

structures or

mechanisms of

social order, they

govern the

behavior of a set of

individuals within a

given community. Institutions are identified with a

social purpose,

transcending individuals and intentions by mediating the rules that govern

living behavior.

The term "institution" commonly applies to a custom or

behavior pattern important to a

society, and to particular

formal organizations of the

government and public

services. As structures and mechanisms of social order, institutions are a

principal object of study in

social sciences

such as

political

science,

anthropology,

economics, and

sociology (the latter

described by

Émile

Durkheim as the "science of institutions, their genesis and their

functioning"). Institutions are also a central concern for

law, the formal mechanism for

political rule-making and enforcement

According to Geoffrey M. Hodgson (2006) Institutions are the

kinds of structures that matter most in the social realm: they make up the

stuff of social life. The increasing acknowledgement of the role of

institutions in social life involves there cognition that much of human

interaction and activity is structured in terms of overt or implicit rules.

Without doing much violence to the relevant literature, we may define

institutions as systems of established and prevalent social rules that

structure social interactions. Language, money, law, systems of weights and

measures, table manners, and firms (and other organizations) are thus all

institutions.

2.1.4. Microfinance institution

Microfinance institution, according to Otero (1999) is

«the provision of financial services to low-income poor and very poor

self-employed people». These financial services according to Ledgerwood

(1999) generally include savings and credit but can also include other

financial services such as insurance and payment services. Schreiner and

Colombet (2001) define microfinance as «the attempt to improve access to

small deposits and small loans for poor households neglected by banks.»

Therefore, microfinance involves the provision of financial services such as

savings, loans and insurance to poor people living in both urban and rural

settings who are unable to obtain such services from the formal financial

sector.

CGAP Occasional paper (2004).Microfinance institution

is a broad category of services, which includes

microcredit.

Microcredit is provision of credit services to poor clients.

Microcredit is one of

the aspects of microfinance and the two are often confused. Critics may attack

microcredit while referring to it indiscriminately as either 'microcredit' or

'microfinance'. Due to the broad range of microfinance services, it is

difficult to assess impact, and very few studies have tried to assess its full

impact. Proponents often claim that microfinance lifts people out of poverty,

but the evidence is mixed. What it does do, however, is to enhance

financial

inclusion

2.1.5. Concept of empowerment

What do we mean by empowerment? When does the well-being of a

person improve? Sen (2001) explains that the freedom to lead different types of

life is reflected in the person's capability set. The capability of a person

depends on a variety of factors, including personal characteristics and social

arrangements.

Malhotra (2002) constructed a list of the most commonly used

dimensions of women's empowerment, drawing from the frameworks developed by

various authors in different fields of social sciences. Allowing for overlap,

these frameworks suggest that women's empowerment needs to occur along multiple

dimensions including: economic, socio-cultural, familial/interpersonal, legal,

political, and psychological.

The World Bank defines empowerment as «the process of

increasing the capacity of individuals or groups to make choices and to

transform those choices into desired actions and outcomes (

http://go.worldbank.org/VELLT7XGR0

visited on 04 June 2016).

According to Krishna (2003) empowerment means increasing the

capacity of individuals or groups to make effective development and life

choices and to transform these choices into desired actions and outcomes. It is

by nature a process and outcome.

Power is often related to our ability to make others do what

we want, regardless of their own wishes or interests (Weber, 1946). Traditional

social science emphasizes power as influence and control, often treating power

as a commodity or structure divorced from human action (Lips, 1991). Conceived

in this way, power can be viewed as unchanging or unchangeable. Weber (1946)

gives us a key word beyond this limitation by recognizing that power exists

within the context of a relationship between people or things. Power does not

exist in isolation nor is it inherent in individuals. By implication, since

power is created in relationships, power and power relationships can change.

Empowerment as a process of change, then, becomes a meaningful concept

According to S.Sarumathi1 and Dr.K.Mohan (2011), the main aim

of microfinance is to empower women. Women make up a large proportion of

microfinance beneficiaries. Traditionally, women (especially those in

underdeveloped countries) have been unable to readily participate in economic

activity. Microfinance provides women with the financial banking they need to

start business ventures and actively participate in the economy. It gives them

confidence, improves their status and makes them more active in

decision-making, thus encouraging gender equality. According to CGAP,

long-standing MFIs even report a decline in violence towards women since the

inception of microfinance.

Empowerment is the process of enhancing the capacity of

individuals or groups to make choices and to transform those choices into

desired actions and outcomes. Central to this process are actions which both

build individual and collective assets, and improve the efficiency and fairness

of the organizational and institutional context which govern the use of these

assets.

2.1.6. Women

Biologically, A woman is a

female

human being. According to Dr

Mamta Ch (2016)The term woman is usually reserved for an

adult, with the term

girl being the usual term for

a female

child or

adolescent. The term

woman is also sometimes used to identify a female human, regardless of age, as

in phrases such as "

women's rights".

"Woman" may also refer to a person's

gender identity.

Women with typical genetic development are usually capable of giving

birth from

puberty until

menopause. In the context

of gender identity,

transgender people who

are biologically

determined

to be

male and identify as

women cannot give birth. Some

intersex people who

identify as women cannot give birth because of either

sterility or

inheriting one or more

Y chromosomes. In

extremely rare cases, people who have

Sawyer

syndrome can give birth with medical assistance. Throughout history women

have assumed or been assigned various social roles.

2.2. VFC Ltd and Various Credit Lending Models

According to hope magazine(2016) Vision Finance company Ltd (VFC

Ltd) is the Christian microfinance subsidiary of World Vision and is one of the

largest microfinance institutions serving rural underprivileged communities in

Rwanda, many of which do not have access to formal financial services. VFC

started in 1997 as a microfinance department under World Vision Rwanda and has

since grown to become one of the largest regulated microfinance institutions in

Rwanda today.

VFC serves people and communities that are economically

productive but low-income, especially women in very rural areas. This includes

small business owners and salary earners who are looking for opportunities to

provide better lives for their families and a promising future for their

children.

The average client of VFC is a woman, often widowed,

looking after a family of 5-7, some of whom are orphans. She owns a small

business, usually a market stall in a market or a roadside kiosk. She believes

she can grow her business to support her family, sending her children to school

and to provide for their health and welfare.

A unique lending approach:

according to VFC

lending methodology manual 2014, VFC serves communities with 3 main types of

loans: community banks, solidarity groups and individual

loans.

a) Community banks create an opportunity for

the poorest entrepreneurs to obtain credit. These are self-selected groups of

10 - 30 borrowers who agree to cross-guarantee each other's loans. The group

screens potential borrowers and tracks each repayment, building their

leadership and sense of pride along the way.

b) Solidarity groups are designed for more

experienced entrepreneurs with slightly larger enterprises. They have fewer

members than community banks, with an average of 5 members who guarantee each

other's loans. Members who make repayments on time become eligible for larger

individual loans.

c) Individual loans go to borrowers who have

either grown their businesses successfully through a solidarity group or who

have medium-sized businesses that qualify for these larger loans. The

individual loans typically require either 2 guarantors or collateral. Borrowers

often create a multi-year business plan in consultation with their loan

officers

2.3. ROLE OF MICROFINANCE IN WOMEN EMPOWERMENT

According to UN Report (2000), Microfinance is a type of

banking service which provides access to financial and non-financial services

to low income or unemployed people. Microfinance is a powerful tool to

self-empower the poor people especially women at world level and especially in

developing countries. Microfinance activities can give them a means to climb

out of poverty. From early 1970's women movement in number of countries has

been increasing to alleviate poverty through microfinance programs. The problem

less access to credit by women was given a particular attention at First

International Women Conference in Mexico in 1975.

Microfinance services lead to women empowerment by positively

influencing women's decision making power at household level and their overall

socioeconomic status. By the end of 2000, microfinance services had reached

over 79318million of the poorest of the world (Women and Men). As such

microfinance has the potential to make a significant contribution to gender

equality and promote sustainable livelihood and better working condition for

women. (ILO Geneva report 2007)

It has been well documented that an increase in women

resources or better approach for credit facilities results in increased well

being of the family especially children. ( Maoux, 1997; Kabeer, 2001).

FinScope survey Rwanda, released in 2016, indicates that 87

%of women have access to financial services compared to 68 % in 2012. Although

women are considered to be good managers, the financial inclusion in Rwanda

2016 by Access to Finance Rwanda shows that only 24 % of women are banked,

while 39 % use other forms of banking, an average of 24 % of women uses

informal banking while 13 % totally excluded. The large portion covered by

MFIs.

Based on ILO Geneva report (2007), by the end of 2000,

microfinance services had reached over 79 million of the poorest of the world.

As such microfinance has the potential to make a significant contribution to

gender equality and promote sustainable livelihood and better working condition

for women. (ILO Geneva) It has been well documented that an increase in women

resources or better approach for credit facilities results in increased

wellbeing of the family especially children. Presently, in most of the

developing countries like Rwanda higher emphasis is being laid upon the

development of women as an entrepreneurs and their active participation in the

development process of their country. Women can be successful and better

entrepreneurs if given the much needed conducive environment and provided with

enough resources most importantly the required amount of capital. The studies

of rural women have proved their business excellence. They have been found to

be better in credit utilization than men but because of lack of access to

assets they are often more vulnerable to poverty than males.

From early 1970's women movement in number of countries

increasing to alleviate poverty through microfinance programs. The problem of

women less access to credit was given a particular concentration at First

International Women Conference in Mexico in 1975.

Really the user-owned financial cooperatives that offer

savings, credit and other financial services to their members are easy to

establish and are based on a common bond, a linkage shared by savers and

borrowers that can be based on a community, organizational, religious or

employee affiliation. They provide members the chance to own their own

financial institution and help Microfinance services lead to women empowerment

by positively influencing women's decision making power at household level and

their overall socioeconomic status.

The focus on women's empowerment in the context of

microfinance brings to light the significance of gender relations in policy

development circles more prominently than ever before. Role of women in the

development of today's growing word can never be forgotten. For this her

empowerment is very important, so that she can participate in the today's

competitive atmosphere. Asim (2008) evaluates the impact of micro credit

program on indicators of women empowerment in urban slums of Lahore district,

Pakistan. The author has chosen specialized institutions with women focusing

models.

In another view Hunt and Kasynathan (2002) describes that

microfinance programs for women have positive impact on economic growth by

improving women income generating activities. The data used was collected from

three NGO's in Bangladesh and one state from India. Most of women receiving

credit have no control over their loans due to low access to markets. The

author finds that the impact of Micro credit on female male education, marriage

practice, mobility, violence against women and self-respect. Moreover,

microfinance which is designed for the poorest, actually not reached to the

poorest people. So donors and NGO's must concentrate on the access of credit to

the poorest people.

«All efforts at improving an MFI's impact on women boil

down to really understanding a woman's needs her predicament and what she

dreams of. Even before all the questions can be answered, the basic question

that must first be answered is who she is?» (Noni S. Ayo). This quote sums

up a major concern and challenge that emerges in the context of microfinance

and women's empowerment. In exploring such empowerment, it is important to have

a clear understanding not only of the concept of empowerment but also of the

category of woman. In an effort to empower women through microfinance, caution

needs to be exercised that an excessive focus on `women' may come at the cost

of empowerment of a `woman'.

Although a woman's personal empowerment may not be effective

without collective empowerment tool. But treating women as a homogeneous

category may be an equally naïve approach. Listening to clients and

carefully evaluating their resource bases, strengths and vulnerabilities is

important if microfinance programmes are to realize the goal of women's

empowerment (Cheston and Kuhn 2002). Finally, this gender analysis of

microfinance includes an understanding of the empowerment impact of MFIs:

(i) On women as an exclusive category; and

(ii) On women in relation to men. In other words, it addresses

the question of how much is the effect of MFIs on women due to the fact that

they are women.

2.3. Theoretical framework

This section is a presentation of theoretical debates about

microfinance and poverty reduction and an illustrative analytical framework

that is relevant for understanding this study.

Empowerment theory

This study is based on Empowerment theory, the Empowerment is

both a value orientation for working in the community and a theoretical model

for understanding the process and consequences of efforts to exert control and

influence over decisions that affect one's life, organizational functioning,

and the quality of community life (Perkins & Zimmerman, 1995; Rappaport,

1981; Zimmerman & Warschausky, 1998).

A distinction between the values that underlie an empowerment

approach to social change and empowerment theory is necessary. The value

orientation of empowerment suggests goals, aims, and strategies for

implementing change. Empowerment theory provides principles and a framework for

organizing our knowledge. The development of empowerment theory also helps

advance the construct beyond a passing fad and political manipulation

2.4. Related literature review

The women empowerment has become the object of unparalleled

concentration now days both at national and international levels. As one of the

MDGs, elimination of poverty has become a key issue for all those interested in

development of the developing countries (Nalunkuuma, 2006), with microfinance

as one of the predominant methodologies for making finance accessible to the

poor especially women, among the donor community. Many donor agencies and

governments in developing countries are now funding a growing number of

microfinance organizations (Lont and Hospes 2004).

According to A. Kayiranga (2013); Microfinance is considered

to be a solution for overcoming poverty. Lack of savings and capital make it

difficult for many poor people who want jobs in the farm and non-farm sectors

to become self-employed and to undertake productive employment-generating

activities. Providing credit seems to be away to generate self-employment

opportunities for the poor. But because the poor lack physical collateral, they

have almost no access to institutional credit.

At the same time, informal lenders in many developing

countries often charge high interest rates, inhibiting poor households from

investing in productive income-increasing activities (Khandker, 1998).

It has been well-documented that an increase in women's

resources results in the well-being of the family, especially children (Mayoux,

1997; Kabeer, 2001; Hulme and Mosley, 1997). A more feminist point of view

stresses that an increased access to financial services represent an

opening/opportunity for greater empowerment. Such organizations explicitly

perceive microfinance as a tool in the fight for the women's rights and

independence.

2.4.2. Characteristics of financial Services that meet Women's

needs

1. Loans are available for trade and services as well as

manufacturing.

2. Collateral is not required because substitutes such as

solidarity groups, character references, and personal effects are acceptable.

3. Deposit services are offered.

4. Loans are available for short-term working capital.

5. Loans are available in small amounts.

6. Loan repayment schedules fit women's business cycles.

7. Loan sizes may be increased upon satisfactory repayment of

first-time loans.

8. Micro-enterprises with few employees are eligible.

9. Signature of spouse or male relative is not required.

10. Literacy is not a requirement.

11. Loans are easily and quickly processed.

12. Loan officers can assist women in completing forms.

13. Loans are given to home-based or ambulant businesses.

14. Location is convenient and safe for women.

15. The hours of operation of the institution are compatible

with women's business and domestic obligations.

16. Training is not required for disbursement of credit.

17. There are special arrangements to assist women borrowers

unfamiliar with formal financial service institutions. (

http://www.gdrc.org viewed

30/06/2016)

2.4.3. Challenges to Empowerment through Microfinance

While the empowering potential of

microfinance programmes remains strong, the evidence of challenges,

ineffectiveness and limitations of the potential is equally compelling.

Although microfinance has the ability to empower women, the connection is not

straightforward or easy to make. Significant research and much anecdota

evidence suggests that this link is certainly not automatic (Hunt and

Kasynathan 2001, 2002; Kabeer 1998; Mayoux 1998). Just handing money to women

and giving them access to financial assets and resources creates a new set of

challenges for women, thus balancing the experience of empowerment with the

experience of extra burdens. Others argue more strongly that access to

microcredit actually affects women's empowerment experience negatively by

leading to a certain kind of disempowerment. Yet another set of analyses

indicates that the goals of microfinance and its empowering potential are

intrinsically of conflicting natures. The argument is that focusing on women's

empowerment leads to dilution of efficiency and sustainability of MFIs, and

these results in reluctance to focus on women's empowerment when designing

their systems and programmes. Impressive literature exists that records the

challenges and gaps between the goals challenges emanate in the economic,

politico-organizational, ideological and cultural domains within which

microfinance institutions and microcredit lending programmes are embedded. This

section discusses the multidimensionality of these challenges.

2.4.3.1. Economic and Political - Organizational Challenges

The central issue here is whether the economic goals of

efficiency and sustainability of MFIs are rationally compatible with the goals

of empowerment. There are arguments pro and con. Those who support a finding of

compatibility have argued that targeting women is in fact more judicious,

because: (i) women's repayment rates are higher than men's; (ii) women are more

cooperative; and (iii) awareness of what clients have and what they need - and

empowering them - can actually increase sustainability, because MFIs can offer

loans that are appropriate and sustainable (Cheston and Kuhn 2002).

In the views and experience of Damian von Stauffenberg, founder

and chairman of Micro Rate, the first rating agency to specialize in

microfinance, "MFIs which concentrate exclusively on women may place

ideological goals ahead of technical competence. Whether this is true remains

to be proven". A related argument is that: MFIs fear that building empowering

elements into their programmes will threaten their financial sustainability

ratios and limit their access to funds from major bilateral and multilateral

donor agencies. Many donor agencies' funding criteria focus primarily on

outreach and institutional sustainability criteria and do not 'reward'

programmes that are able to demonstrate greater and more sustainable impact on

their clients. The incentive structures lead many MFIs to consider including

programme elements intentionally empowering for women as 'extras' or 'luxuries'

rather than as an integral part of their programme design and goals.

- Cheston and Kuhn 2002 While there are certain studies showing

that better lives can be built by integrating microfinance programmes with

programmes such as education and health (Dunford 2001, 2) - certain microcredit

programmes such as WWF in India and Women's World Banking in the Dominican

Republic do combine empowerment goals with goals of 3 Quoted in Cheston and

Kuhn (2002).

2.4.3.2. Ideological Challenges

A topic to be discussed here is whether the concept of

empowerment and women's empowerment is an integral part of a given society or

is an imported phenomenon that is borrowed and imposed from the West on the

East. Since the primary interest of microfinance institution (MFI) is financial

sustainability, introducing empowerment issues is not only incompatible with

their goals; it is also an additional agenda in which MFIs would avoid

investing. Although governments and organizations such as the Self Employed

Women's Association (SEWA) and Working Women's Forum (India) (WWF) in India

have mobilized women for a long time to fight for women's rights, it does make

it easier for MFIs to avoid an empowerment agenda - as it sometimes mutually

suits the MFIs and other stakeholders such as national governments. Indeed,

there are reports that the MFI turmoil in Andhra Pradesh is more due to

government politicians' and officials' vested interests and lack of concern for

women's empowerment (Bellman 2010).

2.4.3.3. Cultural Challenges

The biggest cultural constraint on women's empowerment

through microfinance programmes doing research is the culture of patriarchy

pervasive throughout Asia. The patriarchal culture is dynamic and thus

exercises constraints in different contexts, in varied forms and at various

stages in the empowerment process. These include bargaining power and the

ability to make decisions on economic issues within the household, ability to

make decisions outside the household, control over loans, building of social

networks, responsibility for household chores, and power over one's time and

physical and emotional health and energy.

2.5. Critical literature views

But Burger (1989) observed that microfinance tends to

stabilize rather than increase income, and tends to preserve rather than create

jobs. In the same view, Arbuckle et al (2001) cited by Nalunkuuma (2006)

indicates that studies carried found little to recommend that micro credit has

any significant impact on enterprise incomes. Evidence by Coleman (1999)

suggested that the village bank credit did not have any significant impact on

physical asset accumulation; production and expenditure on education. The women

ended up in a vicious cycle of debt as they used the money from the village

bank for consumption and were forced to borrow from money lenders at high

interest rates to repay the village bank loans so as to qualify for more loans.

However, impact for women who had access to bigger cheaper loans from the

village bank was significant. The main conclusion of the study was that credit

is not an effective tool for helping the poor to enhance their economic

condition and that the poor are poor because of other factors (like lack of

access to markets, price shocks, un equitable land distribution) but not lack

of credit. A study of 13 MFIs in seven developing countries concluded that

households' income tended to increase at a decreasing rate, as the debtors

income and asset position improved (Mosley and Hulme 1998) cited by Okurutet al

(2004).Similarly, Hulme and Mosley (1996) cited by Lont and Hospes(2004) in a

study made on Twelve lending institutions providing micro-lending services in

seven countries found that the impacts of microcredit on the poor were on

average small or negative relative to the control group.

Results by Diane and Zeller (2001) in the study done in Malawi

also suggested that microfinance did not have significant effect on household

income. Fisher and Sriram (2002) stress that access to microfinance services

protects the poor against the often severe consequences of fluctuating incomes,

ill health, death and other emergency expenditures. Despite the overwhelming

claims that microfinance credit works best for the poor people, Johnson and

Rogaly (1997) argue that poorest borrowers become worse off as a result of

credit and that it makes them vulnerable and expose them to high risks.

Using gender empowerment as an impact indicator, some studies

argue that microcredit has a negative impact on women empowerment (Goetz and

Gupta, 1994). Goetz and Gupta (1994) as cited by Kabeer (2000) using a five

point index of `managerial control» over loans as their indicator of

empowerment. At one end of their index are women who are described as having

`no control' over their loans: these are women who either had no knowledge of

how their loans were used or else had not provided any labor into the

activities funded by the loan. At the other end are those who were considered

to have exercised `full' control, having participated in all stages of the

activity funded by the loan including the marketing of the produce. The study

found that the majority of women, particularly married women exercised little

or no control over their loans by this criterion.

Sebstad and Chen (1996) as cited by Lont and Hospes (2004) in

their summaries of the thirty-two research and evaluation reports found that

micro lending to women had positive impacts on their empowerment in Asian

countries. However, reports from African programs found very little or no

impacts of microcredit on the empowerment of women. In the same studies, credit

had a positive impact on households' income, but the impacts on health, on the

nutrition level of family members, and on children's attendance at schools were

not conclusive.

Also the view that it is the less badly-off poor who benefit

principally from microfinance has become highly influential and for example was

repeated in the World Development Report on poverty (World Bank, 2000) cited by

Montgomery and Weiss ( 2005).

Simanowitz and Alice (2002) put it clearly that, the

microfinance industry has concentrated not on reaching the poor but rather on

financial and situational performance. Meanwhile Mayoux (2001) argues that

microfinance institutions are undergoing a period of rapid innovations. They

are coming up with products and new methodologies for reaching the broader

category of poor people including the poorest of the poor. This will enable

microfinance to have a significant impact in achieving poverty reduction.

Also where group lending is used, the very poor are said to be

excluded by other members of the group, because they are seen as bad credit

risk, jeopardizing the position of the group as a whole. Similarly, it's argued

that when professional staff operates as loan officers, they may exclude the

very poor from borrowing, again on the grounds of the repayment risk

(Montgomery and Weiss, 2005).

Simanowitz in regard to groups points out that while the use

of the groups has the potential to build social capital, develop skills; the

way they are used varies considerably between MFIs. Some use them solely as

means for creating peer group pressure while others use them more deliberately

as vehicles of the empowerment (Simanowitz, 2003).

From the above discussions, we realize that core issues

remain how to make microfinance accessible to the poor and ensure that the

benefits are positive. For the purpose of this study, the above theoretical

debates form the bedrock to explore into the role of microfinance in poverty

reduction in Rwanda.

This analytical framework is build on the ground that if the

MFI mission and objectives are geared towards poverty reduction, then the

terms, conditions and methodology and product design have to be favorable for

the poor to access the microfinance products and services which will be

reflected in the outreach; how many poor people are reached (scale of

outreach), how poor are the clients (depth of outreach), in which economic

sectors are they engaged (breadth of outreach), where do they live

(geographical outreach) and the quality which is how the services fit the needs

of potential clients. Depending on whether the poor have been reached with

microfinance, then impact may be expected in terms of:

(i) Income generation,

(ii) asset building and reduced vulnerabilities defined as

increases in ownership of household's physical assets and reduced

vulnerabilities as the poor are encouraged to save and diversify their

livelihood activities,

(iii) empowerment which means enabling the poor to have

greater control over the resources and their lives and taking part in family

and community decisions,

(iv) Building social capital implying reduced isolation,

opportunity to share information and building the bond that was not previously

there.

(v) Good health in terms of improvement in nutrition and

afford medical care, and education of clients' children which is investing in

children's education as a result of new income from micro-enterprise. This will

in turn lead to poverty reduction on women and all family members.

2.6. Conceptual

framework

Disempowerment of women due to oppressive social, cultural,

legal, economic and political structure

Types of impacts

Impact variable/indicator

Levels of impacts

Individual

MFIs (VFC Ltd)

Women empowerment

Economic variables

· Income

· Access to food

· Household assets

· Housing

Communities

Households

Human capital

· Skills

· Education

· Empowerment

· Confidence

Social capital

· Social networks

· Social mobility

CHAPTER THREE: RESEARCH

METHODOLOGY

3.1. RESEARCH DESIGN

This research methodology was designed in a simple way and

conducted using a detailed questionnaire and structured interviewed to gather

and systematically track the client's responses on the impact of microfinance

towards their economic empowerment.

Research methodology can be described as a course of action

which describes the tools that are used when conducting a research. This

chapter involves various methods, techniques and procedures of the data

collection, processing as well as data analysis that were used to collect,

analyze, and interpret data which gives an overview of how the entire study was

conducted to reach a final conclusion on how microfinance leads to women's

economic empowerment. It also discusses the case study, the population, sample

size, and sampling the techniques used during research study such as,

documentations, questionnaires and interviews. The chapter cannot conclude

without taking about various procedures for data processing and analysis. These

procedures include percentages, editing, coding, and tabulation, ethical

consideration and limitation of the study.

3.2. CASE STUDY

Through Vision Finance Company Ltd is the one of the

well-known Microfinance institutions in Rwanda. The researcher chose this

organization because of its outstanding performance in promoting economic

development of poor people in Rwanda especially the marginalized women. To this

point it serves as an important source of content for the researcher to achieve

the objective of her research topic. The MFI helps the unemployed women to get

microcredit loans to invest in small income generating activities to ensure

them with income self-sustenance result into economic empowerment of Rwandan

women.

3.3. AREA OF THE STUDY

An area of the study refers to the area in

which the research was conducted. The research was carried out the Vision

Finance Company Ltd in Nyaruguru. The reason for choosing to study the clients

of Vision Finance Company Ltd is because the majorities are women who are most

vulnerable and marginalized in Rwandan society. Secondly through Vision

Finance Company Ltd is one of pioneers' of women microfinance in Rwanda.

According to Vision Finance Company Ltd, its mission is to provide the

financial services (Saving and credit) and non-financial services to the

economically active poor people Rwandan especially women through their

microenterprise.

Both employees and clients of Vision Finance Company Ltd were

considered. The Vision Finance Company Ltd microfinance institution has many

clients located in almost all sectors of Nyaruguru district, but due to limited

time the researcher targeted clients in Kibeho, Cyahinda, Rusenge, Muganza,

Nyagisozi, Ngera sector in Nyaruguru district in mid of June 2016. In addition

these sectors were selected purposively because of the density of the credit

beneficiaries in the area. There are many microfinance institutions that

provide similar microfinance services, their coverage in this research would

therefore require enough time and fund to meet necessary requirement.

3. 4. POPULATION OF THE STUDY

The target populations were all

beneficiaries of Vision Finance Company Ltd 919 clients in Nyaruguru district

specifically Kibeho sector (82clients), Cyahinda sector

(149clients), Rusenge sector (132clients), Muganza sector

(168clients), Nyagisozi sector (154clients), and Ngera sector

(234clients). The clients from these sectors were chosen to represent other

groups due to the limited time and the fact that Vision Finance Company Ltd

had within that period planned a meeting with that group helped the researcher

to meet each group of respondents at a time and within short period.

3.5. SAMPLE SIZE AND SAMPLING TECHNIQUES

3.5.1. SAMPLE SIZE

According to (William G. Cochran, 1997: 126) a sample is a

part of population which is deliberately selected for the purpose of

investigation. Here the sample size was drawn from both the staff and clients

of through Vision Finance Company Ltd Nyaruguru. However, the study of whole

population was not possible due to limited time and resources.

According to Glen, D. Israel (2009) the following formula is

used to determine sample size

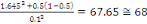

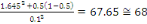

SS  no= no=

Where Z= is a confidence level of 90% value 1.645,

P= percentage picking a choice expressed as

decimal 0.5

C= confidence interval expressed as decimal of

0.1

SS= simple size

no= the sample size for a defined population

N= target population

That is why

no=

SS  =63.37 =63.37

The researcher as used 64 clients as a sample to represent

the whole population, however the researcher interviewed key members of Kibeho,

Cyahinda, Rusenge, Muganza, Nyagisozi, Ngera Through Vision Finance Company

Ltd, Microfinance Institution for their view. The purpose was to limit the

sample size to 64 persons.

Table 1: Respondents numbers in

the Sectors

|

Sectors

|

Total number of clients

|

Sample

|

|

Kibeho

|

82

|

6

|

|

Cyahinda

|

149

|

10

|

|

Rusenge

|

132

|

9

|

|

Muganza

|

168

|

12

|

|

Ngera

|

234

|

16

|

|

Nyagisozi

|

154

|

11

|

|

Total

|

919

|

64

|

3.5. 2. SAMPLING TECHNIQUES

A purposive sampling method Purposive sampling is a technique

widely used in qualitative research for the identi?cation and selection of

information-rich cases for the most effective use of limited resources (Patton

2002). The goal of purposive sampling is not to randomly select units from a

population to create a sample with the intention of making generalizations from

that sample to the population of interest. The researcher conducted study with

purpose in mind and targeted specific predetermined groups of women clients in

Vision Finance Company Ltd IMF. Six women groups were selected and from them

6 are from Kibeho, 10 clients from Cyahinda, 9 are

from Rusenge, 12 are from Muganza, 16 clients are from Ngera, and 11 clients

from Nyagisozi. Those clients were selected to fill the

questionnaires. This method was useful to the researcher in way that it enabled

him to target specific group which has basic information that he believed to be

critical for the research.

3.6. CLASSIFICATION AND SOURCES OF DATA

The tradition classification of data for

an empirical study like this was employed. Both primary and secondary data

sources were used for data collection.

3.6.1. Secondary Data Sources

Secondary data sources are the foundation for which the

theoretical and conceptual framework of the research is built. Relevant

literature from existing empirical studies and reports from the institutions,

library, websites, Government of Rwanda (relevant ministries) were contacted

for reports, papers on contribution of microfinance in women empowerment,

strategies in Rwanda, and Vision Finance Company Ltd IMF was visited for

reports on microfinance products, services and provision.

3.6.2. Primary data sources

Primary data refers to the original data compiled and studies

for specific purpose. The data was collected from the field by issuing

questionnaire and requesting the respondents to fill them. This involves

focusing on group sessions and primary document analysis and is used to

clarify, confirm or explain the results revealed by the secondary data or

sources and any other relevant information that could not be disclosed by the

existing records.

Questionnaires and interviews during the research process were

essential in the highlighting the contribution of microfinance on women

empowerment in Rwanda.

3. 7. DATA COLLECTION TECHNIQUES

This involves two types of data collection

technique notably questionnaire and interviews, with the help of Vision Finance

Company Ltd Loan field staff. Clients above were invited for training and this

gave the researcher an opportunity to distribute questionnaires. Since clients

were in groups, it was easier to fill questionnaires and return them within

short time. As result, the researcher managed to meet the six groups in 3 days.

Two groups on Monday, the second two groups on Wednesday, the last two groups

on Friday. This Implies that data collection involving interviews and

questionnaires look only four days but the whole process including organizing

and planning covered four weeks.

3.7.1. QUESTIONNAIRE FOR CLIENTS

According toResearch & Consultation

Guidelines; a questionnaire is simply a `tool' for collecting and recording

information about a particular issue of interest. It is mainly made up of a

list of questions, but should also include clear instructions and space for

answers or administrative details. Questionnaires should always have a

definite purpose that is related to the objectives of the research, and it

needs to be clear from the outset how the findings will be used. Respondents

also need to be made aware of the purpose of the research wherever possible,