|

My dear parents.

uman beings who are the most to me dear:

Nothing in the world could compensate the sacrifices you have

made for my

education and for my welfare so I can focus me on my studies.

Able to God, the

Almighty provides you with health, prosperity and

longevity.

Thank you for your help, your support and your patience. I

dedicate this modest work

as a sign of recognition and of

admiration.

I would like to express my gratitude and respectful appreciation

to everyone who helped me close or far in the achievement of this work, and

more particularly to:

Honorable Senator Professor Dr. RWIGAMBA BALINDA, Founder and

President of ULK, for his initiative and innovation for the development of

education in our country.

We also wish to thank the Rector of ULK Dr. Alphonse NGAGI and

Faculty of ULK more specially those of the Faculty of Economics and Management,

especially those of the Economics Department for the scientific support we

receive from them.

My gratitude will also to CCA Mme Brigitte GAJU, my direct

supervisor for the follow-up given to the conduct of this work: I am very

grateful have framed me, lead this work and to ensure its development in not

gentle your time or your advice. Be ensured, expensive Supervisor, yours and

have my deep respect.

To my classmates of the 4th year in economics at

ULK, promotion 2008 / 2009. We spent of pleasant brotherhood, of camaraderie,

effort and perseverance, I hope you all will have one long career in economics

and a better life both in terms Professional staff. To all those showing me

their sympathy and that I consider as friends full.

Besides my project, I really enjoyed my stay at the NBR,

appreciated all the people I worked with and spent good moments with them.

That's why I also thank Mr. Boniface MUTABAZI manager of middle office and

Pascal MUNYANKINDI for all kind of help. Can God bless you and enables you to

perform all your projects and your aspirations!

Ferdinand GAKUBA

ADF: Augmented Dickey Fuller AER: Average Exchange rate

ARCH: Autoregressive Conditional Heteroskedasticity

BNR: National bank of Rwanda CCI: Continuous commodity index CIF:

Cost, insurance and freight COLA: Cost of Living Allowance COLI: Cost of living

index

CPI: Consumer price index

CRB: Commodity research bureau ECI: Employment cost index

ECM: Error correction model

EURO: European Money

GBP: Great Britain Pound

GDP: Gross domestic production IMF: International Monetary

Fund LR: Likelihood ratio

MINECOFIN: Ministère de la finance NSSF: National

social security fund OLS: Ordinary Least square

PCEPI: Personal consumption expenditure price index

PPI: Producer price index

RBD: Real bill doctrine

RWF: Rwanda franc

ULK: Université Libre de Kigali

ULC : Unit labour cost.

USA: United State of America

VAR: Vector autoregressive

VECM: Vector error correction model

XDR: Exchange data

Representation

Table 2: ADF Statistics for Testing for a Unit

Root in all Time Series 34

Table 3: Cointegration analysis in the mark-up

model 35

Table 4: Results using OLS

36

Table 5: Properties of VAR residuals

37

Table 6: Standardized adjustment coefficients

38

Table 7: Properties of cointegration vector

38

Table 8: Results for long run inflation model

40

Table 9: Heteroskedasticity test

41

Table 10: Ramsey RESET test

42

Table 11: White test 48

Table 12: ARCH test 48

Table 13: Breusch -Godfrey Test

48

Table 14: Ramsey test 2 49

Table 15: Diagnostic test 52

Table 16: Prevision results

59

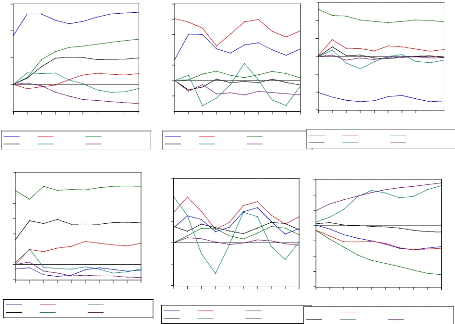

Figure 1: Evolution of Inflation in Rwanda

25

Figure 2: Evolution of money supply and CPI

26

Figure 3: Evolution of import prices and

domestic prices 27

Figure 4: Evolution of Output and inflation

29

Figure 5: CUSUM Test 42

Figure 6: CUSUM squared test

43

Figure 7: CUSUM stability test (Brown, Durbin,

Ewans) 49

Figure 8: CUSUM squared stability test

49

Figure 9: Residuals test 52

Figure 10: Cusum test for Engle- Granger ECM

53

Figure 11: Cusum of squared test for Engle-

Granger ECM 53

Figure 12: Inflation forecasting criteria

54

Figure 13: Response function of variables on

LIPC 57

Appendix 1: Data description

Appendix 2: Data

Appendix 3: Residuals properties

Appendix 4: VECM results

Appendix 5: Variance decomposition

Appendix 6: Recursive coefficient test

Appendix 7: ECM with Hendry results

Appendix 8: ECM with Engle- Granger results

Acknowledgment iiList of acronyms and

abbreviations iiiLIST OF TABLE iv

LIST OF FIGURE v

LIST OF APPENDIX v

TABLE OF CONTENTS vii

Abstract 1

GENERAL INTRODUCTION 2

1. Interest and choice of subject. 2

1.1. Choice 2

1.2. Interests 3

2. Scope of the study

3. Problem statement 3

4. ASSUMPTIONS 4

5. RESEARCH PURPOSE 5

6. RESEARCH TECHNIQUES AND METHODS 5

6.1. TECHNICAL 5

6.1.1. TECHNICAL DOCUMENTARY 5

6.1.2. TECHNICAL INTERVIEW 6

6 .2. METHODS 6

6.2.1. ANALYTICAL METHOD 6

6.2.2. COMPARATIVE METHOD 6

6 .2 .3. STATISTICAL METHOD.

6

7. SUBDIVISION OF WORK 7

CHAPTER I LITERATURE REVIEW 8

1.1. Introduction 8

1.1.1 Inflation 8

1.1.2 Modeling inflation 9

1.1.3 Forecasting inflation 9

1.1.4 Measures of inflation 9

1.2. .Theory of inflation 10

1.2.1 Keynesian view 11

13

ons theory 14

1.2.4 Austrian theory 14

1.2.5 The theory of real bills doctrine 15

1.2.6. Anti-classical or backing theory 16

1.3 The tools for controlling the inflation

16

1.3.1. Monetary policy 16

1.3.2 Fixed exchange rates 17

1.3.3 Wage and price controls 17

1.3.4 Cost-of-living allowance 18

1.4 The history of modeling and forecasting inflation

process 19

1.4.1 Some critical issues for modelling 22

1.4.2 Overview of forecasting 22

1.4.2.1 Monetary transmission 23

1.4.2.2. Flexible price equilibrium 24

CHAPTER II. INFLATION MODELLING AND CONCEPTUAL FRAMEWORK

25

2.1. Rwanda's inflation experience 25

2.1.1. Foreign factors 27

2.1.2 Domestic factors 28

2.2. Conceptual framework 29

2.2.1. LONG- RUN RELATIONSHIPS 30

2.2.1.1. Mark up 30

2.2.1.2 Money supply determinants 31

2.2.2. Data descriptions 32

2.3. Estimation of inflation models 33

2.3.1. Mark up 33

2.3.1.1 Integration 33

2.3.1.2. Cointegration 34

2.3.2 Excess money supply 37

2.4 THE LONG RUN MODEL OF INFLATION 38

2.4.1 Interpretation of coefficients 41

2.4.2 Classical Tests 41

CHAPTER III FORECAST INFLATION OF RWANDA USING ECM

45

3.1 Introduction 45

inflation 45

45

3.2.1.1 Long run and short run elasticity 46

3.2.1.2 Significativity of error correction model

47

3.2.2 The ECM with Engle - Granger 50

3.2.2.2 The model properties 52

3.3. Forecasting inflation using VECM 55

3.3.1 Why a VECM? 55

3.3.2. Forecasting performance 56

3.3.2.1 The variance decomposition 58

.3.3.2.2 Forecast results 58

General conclusion 59

Discussion 63

References 64

APPENDIX 67

Inflation constitutes one of the major economic problems in

emerging market economies that requires monetary authorities to elaborate tools

and policies to prevent high volatility in prices and long periods of

inflation. Analysis of inflation and its relationship with the important

macroeconomic indicators is an arduous task due to data problems (availability,

measurement errors, biases, etc.) and complexity of the transition process

experienced by the economy of Rwanda. In order to model inflation dynamics we

use the general-to-specific approach. The advantage of this approach is its

ability to deliver results based on underlying economic theories of inflation,

which are also consistent with the properties of the data. A three steps

procedure is followed. In the first step, the long-run sectoral analysis of

inflation sources is conducted, yielding long-run determinants of inflation

(excess money, nominal effective exchange rate, nominal wages expressed as unit

labor cost, import prices, oil prices index and the nominal GDP). In the second

step, we estimate an equilibrium error correction model first of all by

following Hendry procedures, then building ECM by Engle Granger and compare

forecasting criteria of inflation deploying among other variables of interest

for the long-run solutions derived in the first step. Lastly, equilibrium error

correction model obtained will serve for structural model-based inflation

forecasting. Forecasting performance of the model will be compared to other

models often utilized for forecasting inflation suggests that markup and excess

money relationships are very important for explaining the short-run behaviour

of inflation, as well as the output, nominal effective exchange rate, oil

prices and import prices in Rwanda.

1. Interest and choice of subject

1.1. Choice

The aim of this paper is to construct a quarterly inflation

model and forecasts quarterly-year ahead inflation for Rwanda. Inflation is

considered to be a major economic problem in transition economies and thus

fighting inflation and maintaining stable prices is the main objective of

monetary policy makers. The negative consequences of inflation are well known.

Inflation can result in a decrease in the purchasing power of the national

currency leading to the aggravation of social conditions and living standards.

High prices can also lead to uncertainty making domestic and foreign investors

reluctant to invest in the economy. Moreover, inflated prices worsen the

country's terms of trade by making domestic goods expensive on regional and

world markets.

To develop an effective monetary policy, central banks should

possess information on the economic situation in the country, the behaviour and

interrelationships of major macroeconomic indicators. Such information would

enable the central bank to predict future macroeconomic developments and to

react in a proper way to shocks the economy is subject to. Thus, studying

inflationary processes is an important issue for monetary economists all around

the world. However, it is not an easy task, especially in developing countries,

where economic processes are highly unstable and volatile. Moreover, the

macroeconomic data on developing countries can be unreliable due to many

reasons: measurement error, imperfect methods of measuring, etc. Nevertheless,

there exist a number of empirical studies on inflation factors in developing

countries.

Since inflation is a phenomenon that characterizes almost all

economies as it is developed or not, but particularly developing countries

including our country is, within this framework that we considered relevant to

the topic, hence the rationale for choosing this subject.

At academic level, this work will constitute an important source

of data, both theoretical and practical, researchers, students from different

faculties, professors, and all the whole community who will look for modelling

and forecasting inflation in their research. This topic has the interest to

deepen our understanding of inflation models and its prediction in the context

of developing economy and make our contribution to science. This topic has the

interest to know the relationship of inflation with others macroeconomic

variables

2. Scope of the study

Our research as any other scientific work is limited in time,

space and in the domain. In time, we focused our analysis on the period from

1995 to 2009 because the period allowed us to search recent data related to our

subject.

Regarding the delimitation of space, our study focuses on

Rwandan territory. In the field, our study focuses on macroeconomic.

3. Problem statement

Since Rwanda covered its monetary sovereignty the monetary

policy followed was with a direct character thus straightforwardly to manage

the banking function this means that the development of its activities was to

be contained within the limits deemed compatible with the overall trend of

discounting the economy to avoid any risk of deviation1.

This policy has been unchanged until the end of the Eighties

years but like almost everywhere in the world, managed finance proved in Rwanda

inefficient and its prevalence has violated not only the conditions of

financing the economy but also, and especially, the allowance of the financial

resources available and hence two major consequences could appear; the absence

of optimal allowance of the financial resources available and sometimes even by

monetary creation ex nihilo (excess

1 Ia politique

monétaire au Rwanda; une mutation constante pour une efficience accrue,

juin, 2003

g 1990 its was the first foreground of structural

chanism started coming into force then replace the procedures

of administrative management. The direct control operated before on both sides

by the concerned official structures thus had to disappear gradually and free

plan of the supply and the demand were to allow the determination of the

different price level of the various markets.

The monetary policy of Rwanda was the subject of a deep change

with the imminent emergence of new instruments of the monetary policy which had

some modification of the structure to even giving a more and more accentuated

at indirect character.

Final objective is the price stability (ultime objective) but

the achievement of this objective is conditioned by another intermediate

objective that constitutes a walking point which is a vital crossing point of

the action of central bank initiated in this context. It acts in the case of

Rwanda by controlling the evolution of money supply expressed in a broad sense

(M2). Achieving the goal also requires an intermediate operational target which

in the context of Rwanda is the monetary base by considering the multiplier

stable.

Monetary management ensured by the central Bank of Rwanda

still faced major obstacles which affecting more the quality of the results

obtained because the lack of a management model that can serve as tool for

projecting future, this hampers monetary policy and reach on the price

volatility persistence which is his ultimate goal.

The aim of this study is to build a model for the money supply

and to build a model of inflation which can be used to forecast the future

uncertain. This allows as formulating the following assumptions;

H1: «Inflation is everywhere and always a monetary

phenomenon» we wonder if this is same case in Rwanda and what are main

causes of inflation in Rwanda?

H2: How can we use these variables to forecast future inflation

in Rwanda?

4. HYPOTHESIS

A hypothesis is an early response to questions that arose in the

problem and must be confirmed to achieve a result.

hypotheses:

d by excess money supply, However there are other factors like,

low level of production, high wages, high level of import rising market prices,

nominal exchange rates, and macroeconomic instability, etc.

· . In this way presenting a set of four-step-ahead

forecasts bounded by estimated confidence bands we can present an outlook that

is more informative about the development of the general direction of prices,

and one that explicitly recognizes the uncertainty inherent in forecasting

inflation with a long lead. Accordingly, we argue that monetary policy is

probably best served by drawing on models that summarize different paradigms of

the transmission mechanism, or that use different technical approaches to

represent the transmission mechanism. Taking such strategy, diversified

approach to inform policy judgements is likely to reduce the risk of making

serious policy errors.

5. RESEARCH OBJECTIVES

The main objective of our work is to construct the inflation

model which could be

used in short -term forecasting inflation in Rwanda.

In our work we pursue the following specific objectives:

· Show the different variables which explain inflation in

Rwanda

· Propose economic policies to fight against inflation in

Rwanda

· Give the model of inflation which should be used as

forecast tool

6. RESEARCH TECHNIQUES AND METHODS

6.1. TECHNIQUES of inflation deploying, among

other variables of interest

A technique is defined as all resources and processes that

enable researchers to gather data and information on the research

topic2.

Thus, we preferred the following techniques:

6.1.1. DOCUMENTARY TECHNIQUE

2 WELMAN J. C and KRUGER

S.J.(2001) : Research methodology course for the business and administrative

sceines , 2nd edition , Paris, Durod , page 34

s a systematic search of all that is written related with the

research area such as books, pamphlets, monographs, unpublished documents,

reports, budgets, public records etc. the documentary technical allows us to

choice among the books available what are useful for our research and help to

use the best resources.

6.1.2. TECHNIQUE OF INTERVIEW

This technique is to maintain discussions and dialogues with

people who provide the researcher's information on his research topic. This

technique allowed us to interact with senior officials of the Rwanda Revenue

Authority, those of MINECOFIN and BNR those of us who have talked about

everything that is related to inflation in Rwanda.

6 .2. METHODS

A method is defined as an ordered set of rules and principles of

intellectual operations to do the analysis to achieve a result3.

At the completion of our work, we have chosen the following

methods:

6.2.1. ANALYTICAL METHOD

This method allows to systematically analyzing all information

and data collected. It allowed us to systematically analyze the inflation's

relationship with others macroeconomic variables, to interpret and draw the

conclusion.

6.2.2. COMPARATIVE METHOD

This method allowed us to compare model adopted with others to

identify the link between those.

6 .2 .3. STATISTICAL METHOD

3 WELMAN J. C and KRUGER

S.J.(2001) : Research methodology course for the business and administrative

sceines , 2nd edition , Paris, Durod , page 36

ing the data, synthesizing the results of research by first.

Second, it allowed us to present these results as graphs, tables, to facilitate

reading and understanding of our work.

7. ORGANIZATIONAL OF WORK

Besides the general introduction, this work is organised as

follows. In chapter one we will state some empirical literature. Chapter 2

illustrates the identification of the inflation models. Chapter 3 gives the

description of Error correction models, forecasting principles and the

estimation results. In that version of the VECM, some variables are exogenous

or became unstable in simulations over the long run. In the extended version of

the VECM developed here, we impose sensible long-run conditions that help to

determine the behaviour of the inflation for Rwanda, interest rates, and the

exchange rate. As result, we should be able to have more confidence in the

long-run and dynamic properties of the model.

The third chapter deals with the analysis of inflation; we

consider the forecast accuracy of the extended VECM in an unconditional,

out-of-sample exercise. We also illustrate that a more informative way to

present inflation forecasts than simply providing the point estimate of the

model is to include as well a statement about the probability distribution of

potential outcomes. By drawing on the model's estimated variance covariance

matrix, we generate confidence intervals around a set of 4-stepahead forecasts,

with each forecast projecting the one quarter inflation rate six-quarter

further into the future.

Finally, we will close our work with a general conclusion and

discussion.

EW

1.1.Introduction

1.1.1 Inflation

In economics, inflation is a rise in the general level of

prices of goods and services in an economy over a period of time4.

When the price level rises, each unit of currency buys fewer goods and

services; consequently, inflation is also erosion in the purchasing power of

money a loss of real value in the internal medium of exchange and unit of

account in the economy5. A chief measure of price inflation is the

inflation rate, the annualized percentage change in a general price index

(normally the consumer price index over time).

The term "inflation" usually refers to a measured rise in a

broad price index that represents the overall level of prices in goods and

services in the economy. The Consumer Price Index (CPI), the Personal

Consumption Expenditures Price Index (PCEPI) and the GDP deflator are some

examples of broad price indices6. The term inflation may also be

used to describe the rising level of prices in a narrow set of assets, goods or

services within the economy, such as commodities (which include food, fuel,

metals), financial assets (such as stocks, bonds and real estate), and services

(such as entertainment and health care). The Reuters-CRB Index (CCI), the

Producer Price Index, and Employment Cost Index (ECI) are examples of narrow

price indices used to measure price inflation in particular sectors of the

economy. Asset price inflation is a rise in the price of assets, as opposed to

goods and services7. Core inflation is a measure of price

fluctuations in a sub-set of the broad price index which excludes food and

energy prices8. The Federal Reserve Board uses the core inflation

rate to measure overall inflation, eliminating food and energy

4 Abel & Bernanke

(1995); Inflation determinants in transition economy, November

,2006

5 Walgenbach P. H., Norman

E. Dittrich and Ernest I. Hanson, (1973), The Measuring Unit principle,

Page 429

6 Blundell-Wignall,

A.(ed.)(1992), Inflation, Disinflation and Monetary Policy, Reserve Bank

of Australia, Sydney, page 112

7

http://en.wikipedia.org/wiki/Asset_price_inflation

8 Robert Rich, Charles

Steindel (2005):A Review of Core Inflation and an Evaluation of Its

Measures (Staff Report, Federal Reserve Bank of New York

|

rm price fluctuations that could distort estimates of the

general economy9.

|

|

1.1.2 Modeling inflation

Modeling inflation is a simplified representation of

inflation system or phenomenon, as in the sciences or economics, with any

hypotheses required to describe the system or explain the phenomenon, often

mathematically10.

1.1.3 Forecasting inflation

The forecasting inflation is one of the tools which can be

used with the policy makers when the policy adopted by central bank has

inflation as ultime objective for monetary purpose it helps by explaining its

uses and how it relates to planning and formulate the problem to the use of the

forecast11.

1.1.4 Measures of inflation

Inflation is usually estimated by calculating the inflation

rate of a price index, usually the Consumer Price Index. The Consumer Price

Index measures prices of a selection of goods and services purchased by a

"typical consumer" The inflation rate is the percentage rate of change of a

price index over time12

Other widely used price indices for calculating price inflation

include the following:

· Cost-of-living index (COLI) is index similar to the

CPI which is often used to adjust fixed incomes and contractual incomes to

maintain the real value of those incomes.

· Producer price index (PPI) which measures average

changes in prices received by domestic producers for their output13.

This differs from the CPI in that price subsidization, profits, and taxes may

cause the amount received by

9 Kiley, Michael J. (2008).

Estimating the common trend rate of inflation for consumer prices and

consumer prices excluding food and energy prices, Federal Reserve

Board

10 Encyclopedia

11 Armstrong J. S

(2001):Principles of forecasting; A handbook for researchers and

practitioners, USA 2001

12 Taylor & Hall

1993

13 Encyclopedia

what the consumer paid. There is also typically a

e in the PPI and any eventual increase in the CPI. Producer

price index measures the pressure being put on producers by the costs of their

raw materials. This could be "passed on" to consumers, or it could be absorbed

by profits, or offset by increasing productivity.

· Commodity price indices, which measure the price of a

selection of commodities. In the present commodity price indices are weighted

by the relative importance of the components to the "all in" cost of an

employee.

· Core price indices: because food and oil prices can

change quickly due to changes in supply and demand conditions in the food and

oil markets, it can be difficult to detect the long run trend in price levels

when those prices are included.

Other common measures of inflation are:

· GDP deflator is a measure of the price of all the

goods and services included Gross Domestic Product (GDP). The Rwanda Commerce

Department publishes a deflator series for Rwanda GDP, defined as its nominal

GDP measure divided by its real GDP measure.

Asset price inflation is an undue increase in the prices of

real or financial assets, such as stock (equity) and real estate. While there

is no widely-accepted index of this type, some central bankers have suggested

that it would be better to aim at stabilizing a wider general price level

inflation measure that includes some asset prices, instead of stabilizing CPI

or core inflation only. The reason is that by raising interest rates when stock

prices or real estate prices rise, and lowering them when these asset prices

fall, central banks might be more successful in avoiding bubbles and crashes in

asset prices14.

1.2..Theory of inflation

Historically, a great deal of economic literature was

concerned with the question of

what causes inflation and what effect it has.

There were different schools of thought

as to the causes of inflation. Most

can be divided into two broad areas: quality

theories of inflation. The quality theory of inflation

ler accepting currency to be able to exchange that currency

at a later time for goods that are desirable as a buyer. The quantity theory of

inflation rests on the quantity equation of money, that relates the money

supply, its velocity, and the nominal value of exchanges. Adam Smith and David

Hume proposed a quantity theory of inflation for money, and a quality theory of

inflation for production.

Currently, the quantity theory of money is widely accepted as

an accurate model of inflation in the long run. Consequently, there is now

broad agreement among economists that in the long run, the inflation rate is

essentially dependent on the growth rate of money supply. However, in the short

and medium term inflation may be affected by supply and demand pressures in the

economy, and influenced by the relative elasticity of wages, prices and

interest rates15.

The question of whether the short-term effects last long

enough to be important is the central topic of debate between monetarist and

Keynesian economists. In monetarism prices and wages adjust quickly enough to

make other factors merely marginal behavior on a general trend-line. In the

Keynesian view, prices and wages adjust at different rates, and these

differences have enough effects on real output to be "long term" in the view of

people in an economy.

1.2.1 Keynesian view

Keynesian economic theory proposes that changes in money

supply do not directly affect prices, and that visible inflation is the result

of pressures in the economy expressing themselves in prices. The supply of

money is a major, but not the only, cause of inflation. There are three major

types of inflation, as part of what Robert J. Gordon calls the "triangle

model16":

14 Mankiw (2002):

Macroeconomics principles,, p. 22-32

15 Federal Reserve Board's semiannual Monetary Policy

Report to the Congress Round table; Introductory statement by Jean-Claude

Trichet on July 1, 2004

16 Robert J. Gordon

(1988), Macroeconomics, Addison Wesley, 2002 ISBN

0-201-77036-9

caused by increases in aggregate demand due to

overnment spending, etc17. Demand inflation is

constructive to a faster rate of economic growth since the excess demand and

favorable market conditions will stimulate investment and expansion.

· Cost-push inflation, also called

"supply shock inflation," is caused by a drop in aggregate supply (potential

output). This may be due to natural disasters, or increased prices of inputs.

For example, a sudden decrease in the supply of oil, leading to increased oil

prices, can cause cost-push inflation. Producers for whom oil is a part of

their costs could then pass this on to consumers in the form of increased

prices18.

· Built-in inflation or structural

inflation is an economic term referring to type of inflation that result from

past events and persists in the present. It thus might be called hangover

inflation, expectations, and is often linked to the "price/wage spiral". It

involves workers trying to keep their wages up with prices (above the rate of

inflation), and firms passing these higher labor costs on to their customers as

higher prices, leading to a 'vicious circle'. Built-in inflation reflects

events in the past, and so might be seen as hang over

inflation19.

Some Keynesian economists also disagree with the notion that

central banks fully control the money supply, arguing that central banks have

little control, since the money supply adapts to the demand for bank credit

issued by commercial banks20. This is known as the theory of

endogenous money, and has been advocated strongly by post-Keynesians as far

back as the 1960s. It has today become a central focus of Taylor rule

advocates. This position is not universally accepted banks create money by

making loans, but the aggregate volume of these loans diminishes as real

interest rates increase. Thus, central banks can influence the money supply by

making money cheaper or more expensive, thus increasing or decreasing its

production.

A fundamental concept in inflation analysis is the

relationship between inflation and unemployment, called the Phillips curve.

This model suggests that there is a trade-off

17

http://www.bized.co.uk/virtual/bank/economics/mpol/inflation/causes/theories1.htm,Retrieved

1/11/2009

18 Encyclopedia Britannica,

"The cost-push theory"

19

http://en.wikipedia.org/wiki/Built-in_inflation,

Retrieved 1/11/2009

oyment. Therefore, some level of inflation could be

minimize unemployment. The Phillips curve model described the

U.S. experience well in the 1960s but failed to describe the combination of

rising inflation and economic stagnation (sometimes referred to as stagflation)

experienced in the 1970s21

1.2.2 Monetarist view

Monetarists believe the most significant factor influencing

inflation or deflation is the management of money supply through the easing or

tightening of credit. They consider fiscal policy, or government spending and

taxation, as ineffective in controlling inflation22.

Monetarists assert that the empirical study of monetary

history shows that inflation has always been a monetary phenomenon. The

quantity theory of money, simply stated, says that the total amount of spending

in an economy is primarily determined by the total amount of money in

existence. This theory begins with the identity:

Where;

M is the quantity of money.

V is the velocity of money in final expenditures;

P is the general price level;

Q is an index of the real value of final expenditures;

In this formula, the general price level is affected by the

level of economic activity (Q), the quantity of money (M) and the velocity of

money (V). The formula is an identity because the velocity of money (V) is

defined to be the ratio of final expenditure to the quantity of money (M).

Velocity of money is often assumed to be constant, and the real

value of output is

determined in the long run by the productive capacity of

the economy. Under these

20 Gordon, Robert J.

(2000), "Does the 'New Economy' measure up to the great Inventions of the

Past?", Journal of Economic Perspectives 14 (4): 49-74

21 Mankiw

2002,Macroeconomics principles, p. 65-77

f the change in the general price level is changes in

nstant velocity, the money supply determines the value of

nominal output (which equals final expenditure) in the short run. In practice,

velocity is not constant, and can only be measured indirectly and so the

formula does not necessarily imply a stable relationship between money supply

and nominal output. However, in the long run, changes in money supply and level

of economic activity usually dwarf changes in velocity. If velocity is

relatively constant, the long run rate of increase in prices (inflation) is

equal to the difference between the long run growth rate of money supply and

the long run growth rate of real output23.

1.2.3. Rational expectations theory

Rational expectations theory holds that economic actors look

rationally into the future when trying to maximize their well-being, and do not

respond solely to immediate opportunity costs and pressures24. In

this view, while generally grounded in monetarism, future expectations and

strategies are important for inflation as well.

A core assertion of rational expectations theory is that

actors will seek to "head off" central-bank decisions by acting in ways that

fulfill predictions of higher inflation. This means that central banks must

establish their credibility in fighting inflation, or have economic

actors25 make bets that the economy will expand, believing that the

central bank will expand the money supply rather than allow a recession.

1.2.4 Austrian theory

The Austrian School asserts that inflation is an increase in

the money supply, rising prices are merely consequences and this semantic

difference is important in defining inflation26

Austrian economists believe that there is no material

difference between the

concepts of monetary inflation and general price

inflation. Austrian economists

22 Lagassé, Paul

(2000).Columbia encyclpedia,ISBN-10 0787650153 page 556-558

23 Mankiw 2002,

Macroeconomics principles, pp. 81-107

24 Dowyer,J.and R. Lam (1994), Economic and Financial

Research in the Reserve Bank in 1994

25 Sargent, Thomas J. Rational Expectations and

Inflation. New York: Harper and Row, 1986.

26 Shostak, Ph. D, Frank

(2002-03-02). "Defining Inflation". Mises Institute.

http://mises.org/story/908.

Retrieved 2009-10-10

lculating the growth of new units of money that are change, that

have been created over time27.

This interpretation of inflation implies that inflation is

always a distinct action taken by the central government or its central bank,

which permits or allows an increase in the money supply28. In

addition to state-induced monetary expansion, the Austrian School also

maintains that the effects of increasing the money supply are magnified by

credit expansion, as a result of the fractional-reserve banking system employed

in most economic and financial systems in the world29

Austrians argue that the state uses inflation as one of the

three means by which it can fund its activities (inflation tax), the other two

being taxation and borrowing. Various forms of military spending is often cited

as a reason for resorting to inflation and borrowing, as this can be a short

term way of acquiring marketable resources and is often favored by desperate,

indebted governments30.

1.2.5 The theory of real bills doctrine

Within the context of a fixed species basis for money, one

important controversy was between the quantity theory of money and the real

bills doctrine (RBD). Within this context, quantity theory applies to the level

of fractional reserve accounting allowed against specie, generally gold, held

by a bank. Currency and banking schools of economics argue the RBD, that banks

should also be able to issue currency against bills of trading, which is "real

bills" that they buy from merchants. This theory was important in the 19th

century in debates between "Banking" and "Currency" schools of monetary

soundness, and in the formation of the Federal Reserve. In the wake of the

collapse of the international gold standard post 1913, and the move towards

deficit financing of government, RBD has remained a minor topic, primarily of

interest in limited contexts, such as currency boards. It is generally held in

ill repute today, with Frederic Mishkin, a governor of the Federal Reserve

going so far as to say it had been "completely discredited." Even so, it has

theoretical support from a few

27 Joseph T. Salerno, (1987),

Austrian Economic Newsletter, "<a href="

http://www.mises.org/journals/aen

Retrieved 2009-10-10

28 Ludwig von Mises

Institute, "True Money Supply; page 456

29 Joseph T. Salerno,

(1987),Quarterly Journal of economics Facts, Discussion Forum

-356

at see restrictions on a particular class of credit as nciples of

laissez-faire, even though almost all libertarian economists are opposed to the

RBD.

The debate between currency, or quantity theory, and banking

schools in Britain during the 19th century prefigures current questions about

the credibility of money in the present. In the 19th century the banking school

had greater influence in policy in the United States and Great Britain, while

the currency school had more influence "on the continent", that is in

non-British countries, particularly in the Latin Monetary Union and the earlier

Scandinavia monetary union31.

1.2.6. Anti-classical or backing theory

Another issue associated with classical political economy is

the anti-classical hypothesis of money, or "backing theory". The backing theory

argues that the value of money is determined by the assets and liabilities of

the issuing agency32. Unlike the Quantity Theory of classical

political economy, the backing theory argues that issuing authorities can issue

money without causing inflation so long as the money issuer has sufficient

assets to cover redemptions.

1.3 The tools for controlling the inflation

A variety of methods have been used in attempts to control

inflation.

1.3.1. Monetary policy

Monetarists emphasize keeping the growth rate of money steady,

and using monetary policy to control inflation (increasing interest rates,

slowing the rise in the money supply). Keynesians emphasize reducing aggregate

demand during economic expansions and increasing demand during recessions to

keep inflation stable. Control of aggregate demand can be achieved using both

monetary policy and fiscal policy (increased taxation or reduced government

spending to reduce

30 Ludwig von Mises, The

Theory of Money and Credit, page23-56

31 Selgin, G. A, "The

Analytical Framework of the Real Bills Doctrine",Journal of Institutional

and Theoretical Economics, volume 145, (1989), p. 489.

32 Ron Paul, "The Case for

Gold, page 45-56

l for controlling inflation is monetary policy. Most ping the

federal funds lending rate at a low level.

1.3.2 Fixed exchange rates

Under a fixed exchange rate currency regime, a country's

currency is tied in value to another single currency or to a basket of other

currencies (or sometimes to another measure of value, such as gold). A fixed

exchange rate is usually used to stabilize the value of a currency,

vis-à-vis the currency it is pegged to. It can also be used as a means

to control inflation. However, as the value of the reference currency rises and

falls, so does the currency pegged to it. This essentially means that the

inflation rate in the fixed exchange rate country is determined by the

inflation rate of the country the currency is pegged to. In addition, a fixed

exchange rate prevents a government from using domestic monetary policy in

order to achieve macroeconomic stability.

Under the Bretton Woods agreement, most countries around the

world had currencies that were fixed to the US dollar. This limited inflation

in those countries, but also exposed them to the danger of speculative attacks.

After the Bretton Woods agreement broke down in the early 1970s, countries

gradually turned to floating exchange rates. However, in the later part of the

20th century, some countries reverted to a fixed exchange rate as part of an

attempt to control inflation. This policy of using a fixed exchange rate to

control inflation was used in many countries in South America in the later part

of the 20th century (e.g. Argentina (1991-2002), Bolivia, Brazil, and

Chile)33.

1.3.3 Wage and price controls

Another method attempted in the past has been wage and price

controls ("incomes policies"). Wage and price controls have been successful in

wartime environments in combination with rationing. However, their use in other

contexts is far more mixed. Notable failures of their use include the 1972

imposition of wage and price controls

33 Edwards, Sebastian. (2002)

The Great Exchange Rate Debate after Argentina, The North American

Journal of Economics and Finance, Volume 13, Issue 3, pp. 237-252

essful examples include the Prices and Incomes enaar Agreement in

the Netherlands.

In general wage and price controls are regarded as a temporary

and exceptional measure, only effective when coupled with policies designed to

reduce the underlying causes of inflation during the wage and price control

regime, for example, winning the war being fought. They often have perverse

effects, due to the distorted signals they send to the market. Artificially low

prices often cause rationing and shortages and discourage future investment,

resulting in yet further shortages. The usual economic analysis is that any

product or service that is under-priced is over consumed.

However, in general the advice of economists is not to impose

price controls but to liberalize prices by assuming that the economy will

adjust and abandon unprofitable economic activity. The lower activity will

place fewer demands on whatever commodities were driving inflation, whether

labor or resources, and inflation will fall with total economic output. This

often produces a severe recession, as productive capacity is reallocated and is

thus often very unpopular with the people whose livelihoods are destroyed.

1.3.4 Cost-of-living allowance

The real purchasing-power of fixed payments is eroded by

inflation unless they are inflation-adjusted to keep their real values

constant. In many countries, employment contracts, pension benefits, and

government entitlements (such as social security) are tied to a cost-of-living

index, typically to the consumer price index35. A cost-ofliving

allowance (COLA) adjusts salaries based on changes in a cost-of-living index.

Salaries are typically adjusted annually. They may also be tied to a

cost-of-living index that varies by geographic location if the employee

moves.

Annual escalation clauses in employment contracts can specify

retroactive or future

percentage increases in worker pay which are not tied

to any index. These

34Richard Milhous Nixon

(January 9, 1913 - April 22, 1994) was the 37th President of the United States

(1969- 1974) and is the only president to resign the office. He was also the

36th Vice President of the United States (1953-1961). See bibliography USA

president

colloquially referred to as cost-of-living adjustments

se of their similarity to increases tied to

externally-determined indexes. Many economists and compensation analysts

consider the idea of predetermined future "cost of living increases" to be

misleading for two reasons:

(1) For most recent periods in the industrialized world,

average wages have increased faster than most calculated cost-of-living

indexes, reflecting the influence of rising productivity and worker bargaining

power rather than simply living costs, and

(2) Most cost-of-living indexes are not forward-looking, but

instead compare current or historical data.

1.4 The history of modeling and forecasting inflation

process

Since inflation was an economic issue numerous attempt to

model inflation in developed countries as well as developing countries was

made. For example, Juselius (1992) in her seminal paper on inflation modeling

in a small open economy studied the inflationary processes in Denmark. De

Brower and Ericsson (1998) wrote an appealing paper on inflation modeling in

Australia.

Both studies serve as important theoretical and methodological

references for our later empirical research in the field of macroeconomic

modeling. Welfe (2000) modeled inflation in Poland, accounting for a number of

important features that characterize a transition economy. Besides these, worth

noting are Ramakrishnan and Vamvakidis (2002)who worked on a model to forecast

inflation behavior in Indonesia, and Callen and Chang (1999) who conducted an

empirical study on inflation in India.

Most of the literature in the field constitutes empirical

studies for modeling inflationary processes in different countries and

inflation factors in general. These studies follow approaches based on

different economic theories, choosing the most appropriate for the economy

investigated.

35 DeLong, Brad.

«Why Not the Gold Standard?»

http://www.j-bradford-

delong.net/Politics/whynotthegoldstandard.html.

Retrieved 2009-09-25.

nflation, the study by Loungani and Swagel (2001)

s a starting point for understanding inflation in developing

countries. The authors present stylized facts about inflation behavior in

developing countries, focusing primarily on the relationship between the

exchange rate regime and the sources of inflation. Another important study of

inflationary processes was accomplished by Fischer, Sahay, and Végh

(2002) on the experiences of hyper and high inflations in various countries.

The authors found that there is a very strong relationship between money growth

and inflation both in the long and short run.

Golinelli and Orsi (2002) study the inflation processes in

three new EU member countries: the Czech Republic, Hungary and Poland. All

three countries possess a similar historico- conomic background and similar

economic context: they were administrative economies before and have undergone

major systemic changes during the transition to a market economy. Investigating

inflationary processes in these countries is of great importance because all

countries experienced high inflation episodes during the years of transition,

and price stabilization policies played an important role in their successful

transition to a new economic system. The authors follow a methodology very

close to that of Juselius (1992) in modeling inflation behavior in the

countries under consideration. They use the multivariate VAR approach, grouping

together those determinants that belong to main inflation theories: cost pushed

inflation, foreign prices and exchange rates, and excess money. Further, a

vector equilibrium correction model specification is used since it enables

capturing short-term dynamics by including stationary variables and past

imbalances, i.e.the «gaps» detected by previous cointegrated

relationships.

In his study on the determinants of inflation in Ukraine, the

author, Lissovolik (2003), studies the factors of inflation in Ukraine during

the period from 1993 to 2002, the so-called «transition period». The

most relevant stylized facts important for modeling inflation behavior in

Ukraine appear to be domestic financial instability, external disequilibria,

seasonality of the economy, and allowance for an increase in administered

prices. The resulting equation of an inflation model is a version of a

long-term markup of prices over wages, the exchange rate, administrative

prices, short-term factors and dummy variables.

are concerned with the problem of significant dollarization in

transition economies, and its impact on the money demand and inflation. In

particular, the authors study the case of Russia, and illustrate that all the

measures of money aggregates that exclude foreign currency are negatively

correlated with the nominal depreciation rate. This could suggest that foreign

currency has been an important substitute for domestic money. The authors

estimate an equilibrium correction model (ECM) for inflation in order to

identify how the short-term dynamics of inflation are affected by deviations

from the long-term money demand equation. They found that inflation does not

react significantly to the excess supply of monetary aggregates that exclude

foreign currency. Payne (2002) explores inflationary dynamics in Croatia using

vector auto regression over the period January 1992-December 1999. The VAR

incorporated four variables: broad money supply, retail price index1, nominal

net wage per employee and the nominal effective exchange rate36. The

model results suggest that wage increase and currency depreciation are

positively correlated with inflation rates.

Building on Paynes model, BotriL and Cota (2006) model

Croatian inflation dynamics using structural vector

autoregression37. Thay found that terms of trade and balance of

payment shocks have the strongest impact on prices. The authors find

justification for such result in Croatia being a small open economy with high

import dependency and uncompetitive economic structure. In order to contrast

these findings, the authors also re-estimated Paynes model. While Paynes

conclusion on influence of wages and currency depreciation on prices still

holds, in newly estimated four-variable VAR positive correlation between broad

money and prices and some inflation inertia also emerged.

36 Payne, James E., 2002, «Inflationary Dynamics

of a Transition Economy: the Croatian

Experience», Journal of Policy Modeling, 24(3), pp.

219-30.

37 Botri[I, Valerija and Boris Cota, 2006,

«Sources of Inflation in Transition Economy: The Case of

Croatia», Ekonomski pregled, 57(12), pp. 835-855.

The quantitative macroeconomic modelling fell out of favour

during the 1970s for two related reasons: First, some of the existing models,

like the Wharton econometric model and the Brookings model, failed

spectacularly to forecast the stagflation of the 1970s. Second, leading

macroeconomists levelled harsh criticisms of these frameworks. Lucas (1976) and

Sargent (1981), for example, argued that the absence of an optimization-based

approach to the development of the structural equations meant that the

estimated model coefficients were likely not invariant to shifts in policy

regimes or other types of structural changes. Similarly, Sims (1980) argued

that the absence of convincing identifying assumptions to sort out the vast

simultaneity among macroeconomic variables meant that one could have little

confidence that the parameter estimates would be stable across different

regimes. These powerful critiques clarified why econometric models fit largely

on statistical relationships from a previous era did not survive the structural

changes of the 1970s.

1.4.2 Overview of forecasting

Forecasting inflation is clearly of critical importance to the

conduct of monetary policy, regardless of whether or not the central bank has a

numerical inflation target.There are many literatures about inflation forecast

for example using the generalized Phillips curves (i.e. using forecasting

models where inflation depends on past inflation, the unemployment rate and

other predictors) developed by Dimitris K.(2009)38 This literature

is too voluminous to survey here, but a few representative and influential

papers include Ang, Bekaert and Wei (2007), Atkeson and Ohanian (2001), Groen,

Paap and Ravazzolo (2008) and Stock and Watson (1999). The details of these

papers differ, but the general framework involves a dependent variable such as

inflation (or the change in inflation) and explanatory variables including lags

of inflation, the unemployment rate and other predictors.

Recursive,regression-based methods, have had some success. However, three

issues arise when using such methods.

38Gary K. and Dimitris

K.(2009); Forecasting Inflation Using Dynamic Model Averaging,

University of Strathclyde, June 2009

edictors can change over time. For instance, it is commonly

thought that the slope of the Phillips curve has changed over time. If so, the

coefficients on the predictors that determine this slope will be changing

(Stock and Watson, 1996).

Second, the number of potential predictors can be large. For

instance, Groen, Paap and Ravazzolo (2008) consider ten predictors. Researchers

working with factor models such as Stock and Watson (1999) typically have many

more than this. The existence of so many predictors can result in a huge number

of models.

Third, the model relevant for forecasting can potentially

change over time. For instance, the set of predictors for inflation may have

been different in the 1970s than now or some variables may predict well in

recessions but not in expansions. This kind of issue further complicates an

already difficult econometric exercise39.

Among other things, we describe the key differences with

respect to the earlier generation of macro models. In doing so, we highlight

the insights for policy that these new frameworks have to offer. In particular,

we will emphasize two key implications of these new frameworks.

1.4.2.1 Monetary transmission

Monetary transmission depends critically on private sector

expectations of the future path of the central bank's policy instrument, the

short-term interest rate. Ever since the rational expectations revolution, it

has been well understood that the effects of monetary policy depend on private

sector expectations. This early literature, however, typically studied how

expectations formation influenced the effect of a contemporaneous shift in the

money supply on real versus nominal variables (for example, Fischer, 1977;

Taylor, 1980).

In this regard, the new literature differs in two important

ways. First, as we discuss

below, it recognizes that central banks typically

employ a short-term interest rate as

the policy instrument. Second, within

the model, expectations of the future

39 Stock, J. and Watson M., 1999. Forecasting

inflation: Journal of Monetary Economics 44, 293-335.

er the structural equations, since these aggregate

king decisions by individual households and firms. As a

consequence, the current values of aggregate output and inflation depend not

only on the central bank's current choice of the short-term interest rate, but

also on the anticipated future path of this instrument. The practical

implication is that how well the central bank is able to manage private sector

expectations about its future policy settings has important consequences for

its overall effectiveness. Put differently, in these paradigms the policy

process is as much, if not more, about communicating the future intentions of

policy in a transparent way, as it is about choosing the current policy

instrument. In this respect, these models provide a clear rationale for the

movement toward greater transparency in intentions that central banks around

the globe appear to be pursuing.

1.4.2.2. Flexible price equilibrium

The natural (flexible price equilibrium) values of both output

and the real interest rate provide important reference points for monetary

policy and may fluctuate considerably. While nominal rigidities are introduced

in these new models in a more rigorous manner than was done previously, it

remains true that one can define natural values for output and the real

interest rate that would arise in equilibrium if these frictions were absent.

These natural values provide important benchmarks, in part because they reflect

the (constrained) efficient level of economic activity and also in part because

monetary policy cannot create persistent departures from the natural values

without inducing either inflationary or deflationary pressures. Within

traditional frameworks, the natural levels of output and the real interest rate

are typically modeled as smoothed trends. Within the new frameworks they are

modelled explicitly.

This book has two broad goals. The first goal is to present

econometric evidence on which type of monetary policy rule is likely to be both

efficient and robust when used as a guideline for the conduct of monetary

policy in Rwanda. The second goal is to answer several current monetary policy

questions such as the effects of uncertainty about potential GDP growth or the

role of the inflation rate in the setting of interest rates that are most

naturally addressed within a framework of monetary policy rules.

ELLING AND CONCEPTUAL FRAMEWORK

A main objective of this chapter is to find the relevant long-

run relationships of inflation and economics variables which driver the Rwanda

inflation and to examine whether we can come up with a reasonable inflation

function by imposing these relationships as equilibrium corrections terms. This

chapter will help to answer the first of assumption which state as; inflation

is in Rwanda a monetary phenomenon? And what are the drivers it in Rwanda?

2.1. Rwanda's inflation experience

Inflation in Rwanda over the past fifteen years has been

mainly influenced by the excess money supply and the nature of import

arrangement and the country's openness. Over these fifteen years ago the

evolution of inflation has been notably similar to that in developed countries

and some in developing countries in the region.

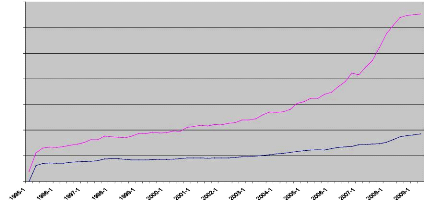

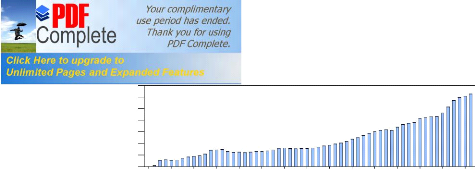

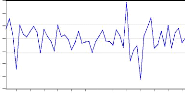

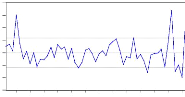

Figure 1: Evolution of Inflation in Rwanda

IPC

|

2.0 1.8 1.6 1.4 1.2 1.0 0.8 0.6

|

|

|

1996 1998 2000 2002 2004 2006 2008

|

Source: Author plotting (see appendix 2)

On the right side (axis) there evolution in year starting by

1995 until 2009 and on the left hand (absisse) are rate of increase by

quarterly basis as we see on the figure 1 since the 1995 the inflation rise

with a constant rate of 0.3% but during 2006 the rate change 0.6% which is high

movement of change until 2009 this was due to first of all the increase in

salaries in 2006 and 2008 the oil shocks.

in Rwanda started to rise in the middle of 2007 8 as result of

the oils price shocks. However the

rise observed in mid 1998 was due to genocide event which hit all

economics sector and kill around one million of Rwandan people and

demonetization process which took place during that period.

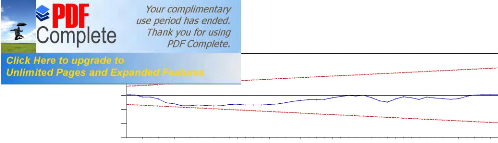

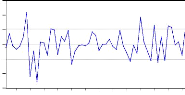

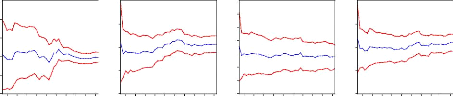

Figure 2: Evolution of money supply and CPI

700.00

600.00

500.00

400.00

300.00

200.00

100.00

0.00

ipc M2

Source: Author plotting (data see appendix 2)

On the right hand the evolution in year and on the left hand

the increase of money supply. From 1995 the money supply was tie to economic

activities and as the money supply increased, the inflation follow the speed of

money supply until 2001 but after this period the CPI slope (red on up) become

more positive compare to slope of money supply this mean that there other

factor which come into force to explain the increase of price level among those

for example is the decrease of national output and lack of food in many area

such as Bugesera, and others.

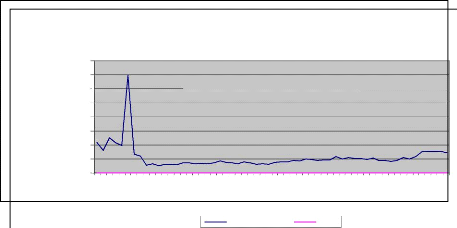

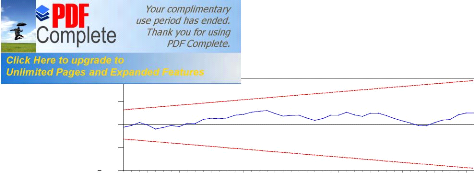

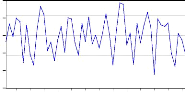

The close correspondence between domestic and foreign

inflation points to the importance of foreign factors (the role of import

arrangement) in underpinning Rwanda major inflationary episodes.

y and a variety of theoretical models give the result that for

a small country; foreign inflation will be fully imported in the long run under

a regime of fixed exchange rate. In effect, a small country with a fixed

exchange rate has very little choice but to accommodate foreign shocks to

price. Although since the Central bank hasn't this regime in Rwanda its use a

range of tools which may ameliorate the effects of foreign price shocks the

picture in Rwanda as in most other developing countries with similar

institutions structures is of the shocks originating in the balance of payments

and impacting through the exchange mechanism. With well over half of Rwanda

goods and services imported there remains a close correspondence between

foreign and domestic prices (see Figure 3).

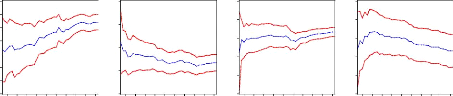

Figure 3: Evolution of import prices and

domestic prices

T

o

some in thousand

4000000

2500000

2000000

3500000

3000000

1500000

1000000

500000

1995-1 1996-1 1997-1 1998-1 1999-1 2000-1 2001-1 2002-1 2003-1

2004-1 2005-1 2006-1 2007-1 2008-1 2009-1

0

I lower the

import price IPC

period in years

port price

price. Since 1995 until 1996 the quantity imported was very high

and import price also was very big but at the same time the domestic price was

not very high because at this period the most commodities imported was not for

consumption. There were dominated by services and low materials to build and

medical stuffs. After the 1998 the situation change first of all by lack of

food because there was insecurity in whole country this impel people to

cultivate and making there daily activities the high level of price was due of

food products. Since the 2002 the speed in import price was is

e level on domestic market.

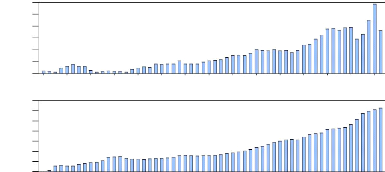

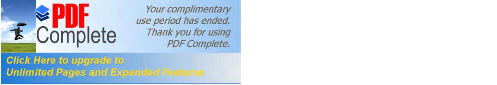

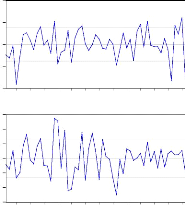

2.1.2 Domestic factors

Its have been seen foreign factors have played a dominant

role, domestic factors also appear to have underpinned inflation over much of

the period and have been particularly important during the keys period. The

nominal wage grew at an average annual rate of over six percent over the past

fifteen years while productivity grew on average of two percent. The result was

sustained growth in nominal unit labor cost which effectively put a floor under

domestic inflation( see Figure4) sharp increase in real wages particularly

during the 2006 appear to have intensified price pressure at the time.

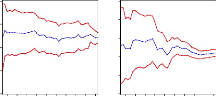

Figure4: Evolution of nominal wage and CPI

UUC

96 98 00 02 04 06 08

.018

.016

.014

.012

.010

.008

.006

2.0

0.8

0.6

1.8

1.6

1.4

1.2

1.0

96 98 00 02 04 06 08

IPC

Source: Author plotting (data appendix1)

One the right hand is the evolution in year and left

hand the rate of change in nominal wage and the consumer price index for

domestic goods. While broad movements in prices appear to have been largely

caused by import prices and domestic labour costs, there also appears to have

been a correlation with the cyclical pattern of output. Domestic business cycle

fluctuations often reflect a misalignment of demand and the productive capacity

of the economy. Excess demand is likely to generate price pressures in factor

and product markets (see Figure 5)

nflation

IIC

2.0

1.8

1.6

1.4

1.2

1.0

0.8

0.6

96 98 00 02 04 06 08

IIBC

|

6E-.-12 5E-.-12 4E-.-12 3E-.-12 2E-.-12 1E-.-12 0E-.-00

|

|

|

96 98 00 02 04 06 08

|

Source: Author plotting (data appendix1) 1

The figure above show the correlation between the increase in

out put on the right hand the two year evolution and the left hand the rate of

price level increased the expectation here is that the increase of price was

not due to increase of output but the output seems to be positive by the way

the level of domestic demand was not compensated by domestic production this

explain the need of import which was observed above.

Macroeconomic theory suggests different way to explain the

problem of inflation. The basic concept to be considered is the models

suggested by Brouwer and Neil R.Ericsson which reconciles the effects of

«demand-pull» and «cost -push» inflation theory.

2.2. Conceptual framework

Inflation is thought to be an outcome of various economic

factors. In Rwanda context we choice the factors from supply side that come

from cost-push or mark up relationships; the demand side factors that may cause

the demand pull inflation; monetary factors ; and foreign factors like exchange

rate effects. In order to capture the various determinants of inflation we will

combine the methodology developed in Brouwer and Neil R. Ericsson (1998) and

Juselius(1992). The mark up model has a

resence in economics generally; see Duesenberry 93).

2.2.1. LONG- RUN RELATIONSHIPS 2.2.1.1. Mark

up

We Investigate a mark up relationships following Brouwer and

Ericsson(1998) for Australia inflation. In the long-run the domestic general

price level in Rwanda is a mark up(cost- push) characterized by unit labor cost

, import prices and oil prices index which we will find by segmenting variables

a priori based on some sense of economic theory. Assuming linear homogeneity

the long-run relation of the domestic consumer price level to its determinants

is;

CPI = log (13) +p*UCL +6* IP +ip*PP (1)

Where CPI is consumer price index, UCL is the unit labor cost

of out put, IP is import price in domestic currency, PP is petroleum price

index in national currency, 3-1 correspond to a mark up .the

equation assumes that linear homogeneity hold in long-run. The value of

3-1 is the retail mark up over cost and both the mark up and

cost may vary over the cycle.

In formula, (1) is express in log- linear form:

cpi = log (13)

+p*ulc +6* ip

+(p*pp (2)

Where logarithms of variables are denoted by italic letters

the log- linear form is used in the error correction model below. Linear

homogeneity implies the following testable hypothesis.

p+ 6+ (p=1 (3)

This is unit homogeneity in all prices. Under that assumption,

(2) can be rewritten as

à = log (13) +p (ulc-cpi) +6 (ip-cpi) +cp(pp-cpi) (4)

The equation (4) links real prices in the labour, foreign

goods(import prices) and oil

prices index using this representation its will

allow as to interpret the empirical error

|

multiple markets influencing prices; Juselius (1992)

|

2.2.1.2 Money supply determinants

As we already define the mark up, we turn to monetary

determinant of inflation In order to measure the excess money that eventually

leads to inflationary pressures, we need to examine the long run relationship

between broad money supply(M2), CPI inflation, Nominal GDP, exchange rate

expressed in USD, landing interest rate in banking system. The estimated VAR

corresponds to Juselius (1992) and Sekine (2001).? The functional

structure of their model is given as;

Money supply (M2) = F(nwr, ngdp, cpi, tdc, echusd ) 5)

Changes in the price level (CPI) are modeled

as being positively related to the changes in broard money stock (m2),

exchange rate expressed in USA dollar (echusd),

lending rate (tdc), domestic wage rate expressed as percentage changes for

salaries (nwr), and negatively related to changes in

productivity expressed as nominal GDP (ngdp)40.

Some authors have argued that in an open economy, and

especially in a developing country, the money demand equation needs to be

augmented with the exchange rate41. That is why; our excess money

supply function above has the following functional form;

M2= a + ngdp +nwr +cpi+ tdc+ echusd +vt (6)

Where nwr is the nominal wage

constucted and echusd is the nominal exchange rate

measured in terms of RWF in USA dollar. The interest rate and the exchange rate

are in levels. If long-run money supply is stable, then the error term in the

above equation will be stationary. The long-run equilibrium level of board

money can be estimated by a long-run cointegrating relationship to see if its

has cointegrating vector.

40 BROWER, G.and ERICSSON

,N.R.(1995), Modeling inflation in Australia, Reserve Bank of Australia,

Research discussion Paper No 9510, Page 21

This section describes the data available and considers some

of their basic properties. Our sample period runs through the first quarterly

of 1995 to second quarterly of 2009. There is single indicator of price

movements in Rwanda Two different price indices are published in Rwanda: the

Consumer Price Index (CPI), and Producer Price Index (PPI). The movements in

primary articles are dominated by supply shocks, and the prices of fuel and

energy are administered. The central banks of Rwanda focus on core inflation

that excludes food and energy42. To take care of the issue of supply

shocks and administered price controls, we focus on the import price and oil

price index calculated by Laspeyres formula see appendix 1. We use the data

from BNR to evolution of money supply the quarterly data are available. Since

real GDP data are available only at an annual frequency, we use Eviews to get

the estimated quarterly data for nominal GDP. The interest rates in Rwanda were

administered prior to financial liberalization this imposes a problem in the

selection of an appropriate interest rate as an opportunity cost of holding

money. Moosa (1992) uses the call money rate as a measure of the opportunity

cost of holding money. The problem with using call money rate as an opportunity

cost of holding real money balance is that it is highly volatile and is

affected more by the weekly funding demands of commercial banks43.

Depending on availability of data we use the bank rate as opportunity cost of

holding real money balance (in banking system). The bank rate is the rate at

which the NBR lends liquidity to banks, broad money growth, and exchange rate

has been obtained from the NBR website unit labor cost was calculated by having

the gross salaries for all employees in central administration, local

administration, the voluntaries insured, public institutions, government

projects, mixed sector and private sector this sum was corrected by adding 5%

of contribution for employers as social contribution to pension and divided it

by nominal GDP (see appendix1).

41 Morling, S . (1997),

Modeling inflation in Fiji, Working paper , Reserve Bank of Fiji, No 23,

page 13

42 See economic Bulletin of

BNR of second quarterly 2008

els

2.3.1. Mark up

A situation is said to be an inflationary situation when,

either the prices of goods and services or money supply rise. Friedman

mentioned inflation as `always a monetary phenomenon'. But most of the

economists today, do not agree that money supply alone is the cause of

inflation. So other factors which drive inflation in developing countries could

be expressed as mark up.

2.3.1.1 Integration

Before modeling the CPI, it is useful to determine the orders

of integration for the variables considered. Table 1 lists fourth-order

augmented Dickey- Fuller (1981) (ADF) statistics for the CPI, unit labour

costs, import prices, and petrol prices index. Under standard optimizing

behaviour, the mark-up itself should be stationary. The deviation from unity of

the estimated largest root appears in parentheses below each Dickey-Fuller

statistic: this deviation should be approximately zero if the series has a unit

root. Unit root tests are given for the original variables (all in logs), for

their changes, and for the changes of the changes. This permits testing whether

a given series is I(0), I(1),or I(2), albeit in a pair wise fashion for

adjacent orders of integration44. Where k is the number of lags on

the dependent variable, augmented Dickey-Fuller statistic ADF, and (in

parentheses) the estimated coefficient on the lagged variable. That coefficient

should be zero under the null hypothesis that is I(1). For a null order of I(2)

(I(3)), the same pairs of values are reported, but from regressions where

replace in the equation above. Thus, these ADF statistics are testing a null

hypothesis of a unit root in {1% and 5%) against an alternative of a stationary

root in {1% and 5%). The sample is 1995(1)-2009(2) for all.

43 Mishkin, F. S. (1992), Is

the Fisher effect for real: A reexamination of the relationship between

Inflation and Interest rates , Journal of Monetary Economics 30: Page 185-

215

44 For k~0

if the notation I (k) indicates that a variable must

be differenced k times to make it stationary. That is, if CPI

is I(k), then {dcpi) is I(1).

|

Null order

|

cpi

|

ulc

|

ip

|

opi

|

|

I(0)

|

1.30**

|

-3.31*

|

-5.27*

|

-2.67**

|

|

( o.o4)

|

(0.32)

|

(-0.67)

|

(-0.23)

|

I(1)

|

-4.23

|

-4.12

|

-10.11

|

-5.19

|

|

(0.12)

|

(0.58)

|

(0.18)

|

(0.17)

|

I(2)

|

|

-4.90

|

-5.11

|

-17.66

|

-6.87

|

|

|

(0.11)

|

(0.11)

|

(0.16)

|

(0.25)

|

g for a Unit Root in all Time

Series45

Empirically, all variables appear to be integrated of order

one. Unit labour costs,CPI and petrol prices appear to be I(1), whereas the

import prices appear to be also I(1) if inferences are made on the

Dickey-Fuller statistics alone. Thus, all four price series are treated below

as if they are I(1), while recognizing that some caveats may apply.

Specifically, it may be valuable to investigate the cointegration properties of

the series.

2.3.1.2. Cointegration

Cointegration analysis helps clarify the long-run

relationships between integrated variables. Johansen's (1988, 1991) procedure