Annexe 1 :

Indicateurs macroéconomiques

|

année

|

Taux de croissance du PIB

|

Exportation/PIB

|

Importation/PIB

|

taux d'investissement privé

|

Taux d'inflation

|

|

1960

|

|

18,92

|

19,42

|

8,6

|

21,8

|

|

1961

|

-10,85

|

9,86

|

9,39

|

9,2

|

21,75

|

|

1962

|

21,2

|

7,75

|

7,44

|

9,7

|

17,88

|

|

1963

|

5,21

|

31,8

|

31,68

|

10,3

|

105,19

|

|

1964

|

-2,44

|

33,5

|

37,3

|

13

|

53,18

|

|

1965

|

1

|

25,92

|

27,23

|

15,2

|

1,32

|

|

1966

|

6,78

|

31,12

|

38,02

|

13,7

|

23,85

|

|

1967

|

-0,99

|

15,55

|

16,37

|

14,4

|

15,63

|

|

1968

|

4,33

|

14,52

|

15,3

|

15,1

|

17,22

|

|

1969

|

9,33

|

13,18

|

14,23

|

18,6

|

0,50

|

|

1970

|

-0,25

|

15,46

|

18,22

|

8,6

|

1,61

|

|

1971

|

6,01

|

12,14

|

18,54

|

8,9

|

11,27

|

|

1972

|

0,15

|

11,25

|

15,78

|

11,4

|

12

|

|

1973

|

8,14

|

13,44

|

15,88

|

7

|

11,25

|

|

1974

|

3,13

|

16,18

|

19,03

|

7,7

|

26,37

|

|

1975

|

-4,98

|

9,96

|

15,09

|

11,5

|

60,99

|

|

1976

|

-5,31

|

12,15

|

19,65

|

7,8

|

43,43

|

|

1977

|

0,76

|

10,33

|

19,67

|

14,8

|

61,06

|

|

1978

|

-5,35

|

12,35

|

9,2

|

7,7

|

57,38

|

|

1979

|

0,43

|

12,65

|

10,04

|

5,6

|

111,13

|

|

1980

|

2,19

|

16,48

|

16,35

|

3,7

|

47,19

|

|

1981

|

2,35

|

14,14

|

17,14

|

4,6

|

39,22

|

|

1982

|

-0,46

|

12,15

|

13,95

|

6,9

|

37,92

|

|

1983

|

1,41

|

16,24

|

17,29

|

7,2

|

71,90

|

|

1984

|

5,54

|

26,01

|

26,12

|

6,7

|

58,63

|

|

1985

|

0,47

|

27,51

|

25,63

|

7,8

|

13,06

|

|

1986

|

4,72

|

24,71

|

24,03

|

8,8

|

57,90

|

|

1987

|

2,68

|

25,98

|

28,86

|

9

|

84,32

|

|

1988

|

0,47

|

25,5

|

27,82

|

7,9

|

72,79

|

|

1989

|

-1,27

|

25,49

|

24,84

|

7,9

|

24,42

|

|

1990

|

-6,57

|

29,5

|

29,2

|

8,9

|

19,65

|

|

1991

|

-8,42

|

20,38

|

24,12

|

3,5

|

1141,33

|

|

1992

|

-10,5

|

16,68

|

17,52

|

4,3

|

2729,79

|

|

1993

|

-13,47

|

11,33

|

9,11

|

1,4

|

4583,08

|

|

1994

|

-3,9

|

22,63

|

19,89

|

7

|

9796,9

|

|

1995

|

0,7

|

28,48

|

23,73

|

5,3

|

370,27

|

|

1996

|

-1,02

|

30

|

30,31

|

4,6

|

692,96

|

|

1997

|

-5,62

|

18,75

|

15

|

2

|

13,76

|

|

1998

|

-1,62

|

29,79

|

32,89

|

2

|

134,84

|

|

1999

|

-4,27

|

23,54

|

17,56

|

2

|

483,72

|

|

2000

|

-6,9

|

22,38

|

21,37

|

3

|

511,21

|

|

2001

|

-2,1

|

18,65

|

20,69

|

5,1

|

313,72

|

|

2002

|

3,47

|

21,16

|

26,07

|

8

|

38,09

|

|

2003

|

5,79

|

26,13

|

33,35

|

9,5

|

12,87

|

|

2004

|

6,64

|

30,35

|

39,17

|

10

|

3,99

|

|

2005

|

6,46

|

34,49

|

42,73

|

|

21,32

|

|

2006

|

5,08

|

30,68

|

44,36

|

|

18,2

|

|

2007

|

6,26

|

27,17

|

37,94

|

|

27,6

|

|

2008

|

6,2

|

23,31

|

38,56

|

|

9,96

|

|

2009

|

2,83

|

9,25

|

20,9

|

|

53,4

|

|

2010

|

7,24

|

15,49

|

34,3

|

|

|

Source : Banque Centrale et Banque Mondiale

Annexe 2 : Liste des banques en 2010.

|

n°

|

Banques

|

siège social

|

Succursales ou agences

|

|

1

|

Banque commerciale du Congo (BCDC)

|

Kinshasa

|

Bukavu, Butembo, Fungurume, Goma, Kananga, Kisangani,

Kinshasa, Kolwezi, Likasi, Lubumbashi, Matadi, Mbuji-Mayi.

|

|

2

|

banque congolaise (BC)

|

Kinshasa

|

Beni, Boma, Bukavu, Butembo, Goma, Isiro, Kisangani, Kolwezi,

Lubumbashi et Uvira.

|

|

3

|

Afriland First Bank Congo Democratic (First Bank CD

|

Kinshasa

|

-

|

|

4

|

Banque Internationale pour l'afrique au Congo

|

Kinshasa

|

-

|

|

5

|

Citi group

|

Kinshasa

|

-

|

|

6

|

Stanbic Bank Congo (SBC)

|

Kinshasa

|

-

|

|

7

|

Access Bank (AB)

|

Goma/Nord Kivu

|

-

|

|

8

|

Banque Internationale de crédit (BIC)

|

Kinshasa

|

Beni, Boma, Bukavu, Butembo, Lubumbashi, Matadi, Mbanza Ngungu

et Muanda.

|

|

9

|

Procrédit Bank Congo

|

Kinshasa

|

-

|

|

10

|

Raw Bank

|

Kinshasa

|

Fungurume, Kolwezi, Likasi, Lubumbashi et Matadi.

|

|

11

|

Trust Merchant Bank (TMB)

|

Lubumbashi

|

Kasumbalesa, Kinshasa, Kolwezi et Likasi

|

|

12

|

Solidaire Banque Internationale (SBI)

|

Kinshasa

|

-

|

|

13

|

Ecobank

|

Kinshasa

|

-

|

|

14

|

Mining Bank Congo (MBC)

|

Kinshasa

|

-

|

|

15

|

First International Bank (FI Bank)

|

Kinshasa

|

-

|

|

16

|

Invest Bank Congo

|

Kinshasa

|

-

|

|

17

|

Sofi Banque

|

Kinshasa

|

-

|

|

18

|

La cruche Banque

|

Goma/Nord Kivu

|

-

|

|

19

|

Advans Banque Congo

|

Kinshasa

|

-

|

|

20

|

Bank of Africa (BOA)

|

Kinshasa

|

-

|

|

21

|

Banque gabonnaise française

|

Kinshasa

|

-

|

|

22

|

United Bank Congo

|

Kinshasa

|

-

|

Source : Banque Centrale du Congo, Rapport annuel

2010

Annexe 3 : Indicateurs financiers

|

année

|

RM2_Ratio

|

Taux d'intérêt

|

taux d'épargne

|

|

1960

|

28,6521288

|

3,25

|

4,97

|

|

1961

|

30,4688974

|

3,25

|

5,73

|

|

1962

|

32,6206973

|

3,25

|

1,92

|

|

1963

|

26,6706217

|

3,25

|

18,65

|

|

1964

|

21,220908

|

3,25

|

15,21

|

|

1965

|

18,8523702

|

3,25

|

15,55

|

|

1966

|

16,7132477

|

3,25

|

1,43

|

|

1967

|

19,1216777

|

3,25

|

11,2

|

|

1968

|

19,1940568

|

3,25

|

10,46

|

|

1969

|

19,8980465

|

3,25

|

11,78

|

|

1970

|

20,2891328

|

3,25

|

12,16

|

|

1971

|

19,5990985

|

3,25

|

12

|

|

1972

|

20,485727

|

3,25

|

14,12

|

|

1973

|

33,9270835

|

3,25

|

14,29

|

|

1974

|

30,8422315

|

5

|

14,24

|

|

1975

|

25,8047685

|

5

|

12,69

|

|

1976

|

22,8502356

|

12

|

6,97

|

|

1977

|

20,3943499

|

12

|

12,05

|

|

1978

|

20,1234537

|

12

|

15,08

|

|

1979

|

15,1172628

|

12

|

15,35

|

|

1980

|

13,0043968

|

12

|

10,08

|

|

1981

|

11,8625004

|

26

|

7,5

|

|

1982

|

13,4287223

|

26

|

6,52

|

|

1983

|

14,4325795

|

29

|

8,27

|

|

1984

|

13,1296439

|

37

|

10,39

|

|

1985

|

12,8154905

|

50

|

14,38

|

|

1986

|

12,8390368

|

45

|

13,88

|

|

1987

|

13,0131335

|

55

|

11,28

|

|

1988

|

12,5419175

|

55

|

12,11

|

|

1989

|

16,3538816

|

95

|

14,95

|

|

1990

|

34,4638653

|

145

|

9,35

|

|

1991

|

71,4936

|

125

|

1,83

|

|

1992

|

147,150715

|

238

|

6,05

|

|

1993

|

171,815119

|

13

|

3,98

|

|

1994

|

162,111444

|

22

|

10,63

|

|

1995

|

144,041508

|

120

|

14,13

|

|

1996

|

124,241274

|

120

|

27,54

|

|

1997

|

138,309904

|

140

|

6,25

|

|

1998

|

151,558989

|

24

|

-1

|

|

1999

|

146,487957

|

8

|

9,07

|

|

2000

|

148,6609

|

14

|

4,46

|

|

2001

|

7,4

|

140

|

3,17

|

|

2002

|

5

|

24

|

4,05

|

|

2003

|

4,9

|

8

|

5,02

|

|

2004

|

5,4

|

14

|

3,97

|

|

2005

|

11,04

|

28

|

5,95

|

|

2006

|

24,6

|

40

|

-0,64

|

|

2007

|

|

22,5

|

8,78

|

|

2008

|

|

40

|

8,61

|

|

2009

|

|

70

|

17,06

|

|

2010

|

|

22

|

|

Source : Banque Mondiale et Banque Centrale du Congo

ANNEXE 3 : Questionnaire d'enquête

Dans le souci de contribuer à la recherche scientifique

sur l'épargne, et de doter aux ménages d'instruments

nécessaires pouvant assurer l'amélioration de leur

bien-être, nous avons estimé bon de travailler sur

« l'épargne et bien-être des ménages : une

analyse microéconomique et macroéconomique ». Le

présent questionnaire nous permettra de cerner la réalité

du phénomène sous-étude. Nous vous garantissons que vos

réponses resteront confidentielles et serviront unique pour des fins de

la recherche.

A. Ville ou cité ?

1. Mbanza-Ngungu 2. Inkisi/kisantu

I.1. CARACTERISTIQUES DU CHEF DE MENAGES

1. Quel est l'âge du chef de ménage ?

2. Quel est votre sexe ?

1. Masculin 2. Féminin

3. Quel est votre état matrimonial ?

1. Célibataire 2. Marié(e) 3.

Divorcé(e) 4. Veuf (ve)

4. Quel est votre niveau d'instruction ?

1. sans instruction 2. Primaire 3. Secondaire 4. Graduat

5. Licence

6. Post universitaire

5. Quelle est votre activité principale ?

1. employé du secteur public 2.

Employé du secteur privé formel

3. Employeur du secteur informel 4. Employé du

secteur informel

5. Inactif ou chômeur

6. Exercez-vous une ou plusieurs activités

secondaires ?

1. oui 2. Non

7. Si oui, laquelle (lesquelles)

1. Location maison 2. Propriétaire taxi 3. Petit

commerce 4. Agriculture 5. Autres

8. Si non pourquoi ?

1. le revenu est suffisamment 2. Contraintes de l'employeur

3. Autres

I.2. CARACTERISTIQUES DU MENAGE

9. Quelle est la taille du ménage

10. Quel est le nombre d'enfants de 0 à 18 ans

11. Combien d'enfants fréquentent l'école

(université)

12. Votre maison comporte combien de chambre à

coucher ?

13. Combien des membres de votre ménage exercent une

activité ?

14. Quel type d'activité exercent-ils ?

1. Contrat à temps plein formel 2. Contrat à

temps partiel formel 3. Agriculture

4. Petit commerce 5. Autres à préciser

I.3. CONDITIONS DE VIE ET PATRIMOINE DU

MENAGE

15. Votre maison est-elle pavée en ciment gris ou

carreaux ?

1. oui 2. Non

16. Etes-vous raccordé en

électricité ?

1. oui 2. Non

17. Avez-vous l'accès aux soins de

santé ?

1. oui 2. Non

18. Disposez-vous d'un appareil de communication ?

1. oui 2. Non

19. Disposez -vous des appareils

électroménagers ?

1. Oui 2. Non

20. Lequel(s)

1. Radio 2. TV 3. Parabole 4. DVD 5. Ordinateur

6. Réfrigérateur

7. Cuisinière 8. Micro-onde 9. Machine à

laver 10. Fer à repasser 11. ventilateur-climatiseur 12.

Réchaud

21. Avez-vous un cheptel ?

1. oui 2. non

II. REVENU DES MENAGES

22. Quel est le revenu mensuel de l'activité principale

du chef des ménages ? _______

23. Quel est le revenu mensuel de l'activité secondaire

du chef des ménages ? ______

24. Quel est le revenu des membres des ménages qui

travaillent ? __________

28. Recevez-vous des transferts auprès des autres

ménages évoluant au pays ?

1. oui 2. Non

25. Si oui, à combien pouvez vous l'estimer

1. 0$ 2. Moins de 100$ 3. 100-200$

4. 200-300$ 5. 300-400$ 6. 500 et plus

26. Qui opèrent ces transferts ?

1. les enfants 2. Les amis 3. Les autres membres de

famille

27. Recevez-vous des transferts auprès des autres

ménages évoluant à l'extérieur du pays ?

1. oui 2. Non

28. Qui opèrent ces transferts ?

1. les enfants 2. Les amis 3. Les autres membres de

famille

III. CONSOMMATION DES MENAGES

29. Combien de fois mangez-vous le jour?

1. une fois 2. Deux fois 3. Trois fois 4. Quatre fois

30. Etes-vous locataire ou propriétaire

1. oui 2. non

31. Quelles sont les dépenses mensuelles ?

1. Alimentation _______________ 2. Logement (pour les

locataire)______________

3. habillement _____________ 4.

Santé___________ 5. Education _____________

6. eau et électricité____________ 7.

Télécommunication____________

8. tourisme et loisir ____________ 9 autres

_______________

32. Le revenu du ménage permet-il de faire face

à toutes ses dépenses ?

1. oui 2. Non

33. Sinon, comment faites-vous pour les réaliser ?

1. emprunt 2. Désépargne 3.

Transferts 4. Autre

34. Quel est le niveau de votre endettement

_____________________

35. Quels sont vos différents créanciers ?

1. banque 2. Microcrédit 3. Amis et famille 4.

Votre employeur 5. Banque Lambert

6. Autres

36. Payez-vous des intérêts sur ces

emprunts ?

1. oui 2. Non

37. Si oui, quel est le taux

1. moins de 10% 2. 10 -20% 3. 20-30% 4. 30-40% 5.

40-50 6. 50% et plus

IV. EPARGNE DES MENAGES

38. Epargnez-vous en argent ?

1. Oui 2. Non

39. Si oui, dans quelle institution financière ou

monétaire le faites-vous ?

1. Banque 2. Coopérative d'épargne et de

crédit 3. Tontine 4. Garde fonds

40. Quel est le niveau de votre épargne ?

____________________

41. En quelle monnaie épargnez-vous ?

1. Monnaie nationale 2. Monnaie étrangère

3. Les deux

42. Epargnez-vous en nature ?

1. oui 2. Non

43. Quels sont les actifs que vous détenez ?

1. Stock marchandises 2. Cheptel 3. Maisons 4. Terres

agricoles 5. Voitures

6. Autres biens durables

44. Etes - vous assuré ?

1. oui 2. Non

45. Si oui quel type d'assurance ?

1. assurance maladie 2. Assurance véhicule 3.

Assurance vie 4. Assurance incendie

5. autres

46. Pourquoi épargnez-vous ?

1. Pour motif de précaution (faire face aux

dépenses imprévues)

2. Accumuler du capital (fond de démarrage d'une

activité)

3. Préparer la retraite

4. Acheter des biens durables (maisons, voitures,

télévisions, ...)

5. Taux d'intérêt (gagner dans le futur)

47. Le revenu tiré de votre activité principale

vous permet-il d'épargner ?

1. Oui 2. Non

48. Si non, comment faites-vous pour épargner ?

1. Activités secondaires 3. Autres à

préciser.

2. Réception de fonds venant des amis et familles

49. Gardez-vous de l'argent chez vous au-delà des

besoins immédiats ?

1 = Oui 2 = Non

50. Etes-vous membre d'une tontine ?

1. Oui 2. Non

56. Si Oui, combien cotisez-vous à la tontine par

Période ? __________________

51. Avez-vous un compte d'épargne ?

1. Oui 2. Non

52. Si Oui, combien avez-vous à la caisse

d'épargne ? _________________

53. Avez-vous de l'argent auprès des gardes fonds ?

1. Oui 2. Non

54. Si oui, combien avez-vous _____________________

55. Avez-vous un compte bancaire ?

1. Oui 2. Non

56. Si Oui, combien avez-vous en banque ?

_______________________

57. Cotisez-vous à l'INSS ?

1. OUI 2. NON

58. Si oui, êtes-vous capable de vérifier le

montant de votre épargne retraite auprès de cette

institution ?

1. OUI 2. NON

59. Pouvez-vous compter sur cette épargne pour la

retraite ?

1. OUI 2. NON

60. Si non, comment allez-vous en sortir ?

1. enfants 2. Epargne constituée auprès des

autres institutions 3. Epargne en actifs réels 4. Autres à

préciser

61. Si vous n'épargnez pas, pourquoi ne le faites-vous

pas ?

1. Faiblesse de revenu

2. Faiblesse du taux d'intérêt (faible

rémunération de l'épargne)

3. Manque d'information

4. Manque de confiance vis-à-vis du Secteur

financier

5. Autres raisons.

Merci

ANNEXE 4 : Guide d'entretien

A. Institution micro finance ou bancaire

1. Quels sont les instruments d'épargne que vous offrez

aux épargnants ?

2. Quels sont les avantages de chaque instrument ?

3. Quel est le volume de l'épargne de votre

institution ?

4. Comment faites-vous pour attirer les agents économiques

à épargner dans votre organisation ?

5. Quel est le dépôt minimum pour un agent qui veut

ouvrir un compte d'épargne ?

6. Exigez-vous au récipiendaire d'avoir un

parrain ?

7. Quelles sont les exigences d'octroi des crédits aux

épargnants

8. Je peux accéder à vos bilans

d'exploitation ?

9. Fixez-vous de taux d'intérêt en Francs, en

dollars ?

10. Comment procédez-vous pour fixer le taux en dollar

d'autant plus que la banque centrale fixe son taux uniquement en

Francs ?

Merci

B. Sonas

1. Quels sont les différents types d'assurance dont vous

disposez ?

2. Comment fonctionne ces instruments ?

3. Quels sont d'après vous les avantages liés

à chaque instrument ?

4. Pensez vous qu'un ménage peut préparer sa

retraite en comptant sur vos services ?

Merci

C. INSS

1. Comment fonctionne votre service de sécurité

sociale ?

2. Comment est ce que vous indemnisez les

retraités ?

3. Pensez vous qu'un ménage peut préparer sa

retraite en comptant sur votre service ?

Merci

ANNEXE 5 : Outputs

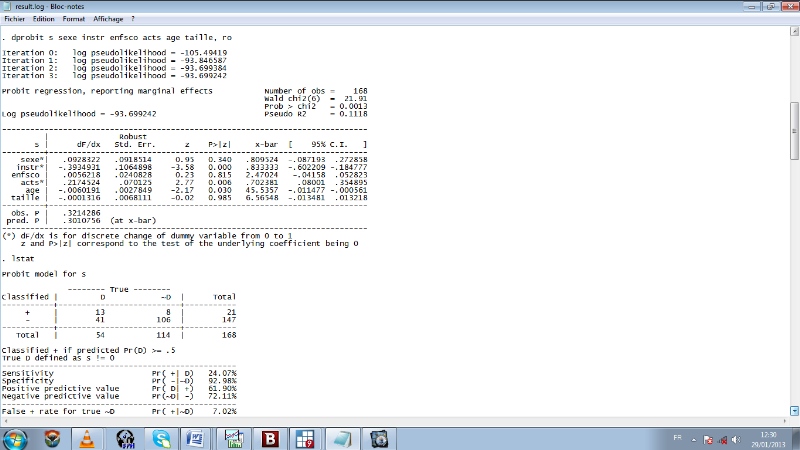

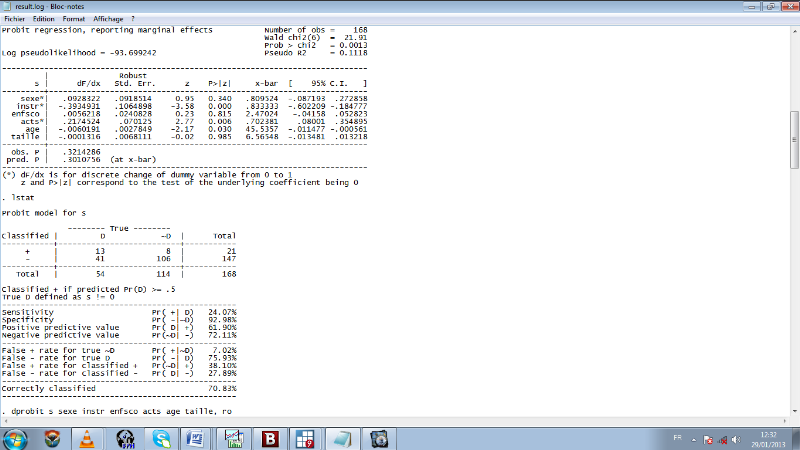

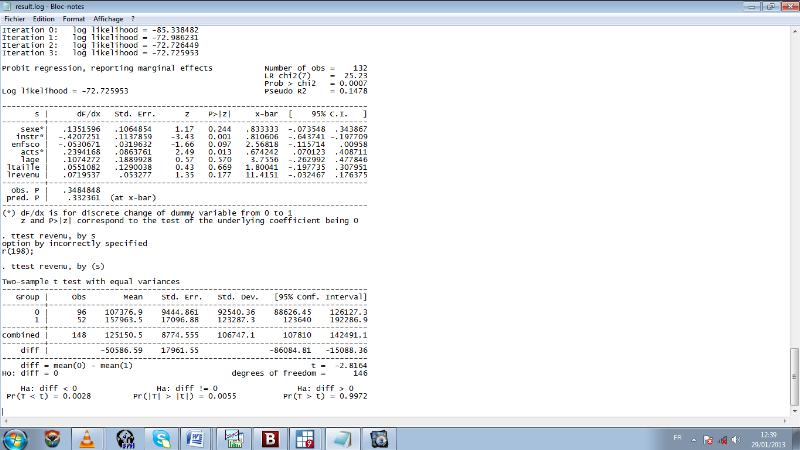

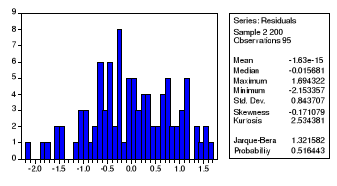

5.1. Outputs des estimations

macroéconomiques

5.1.1. Etude de la stationnarité

|

Null Hypothesis: SL has a unit root

|

|

|

Exogenous: Constant, Linear Trend

|

|

|

Lag Length: 0 (Automatic based on SIC, MAXLAG=1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

-3.196979

|

0.1020

|

|

Test critical values:

|

1% level

|

|

-4.252879

|

|

|

5% level

|

|

-3.548490

|

|

|

10% level

|

|

-3.207094

|

|

|

|

|

|

|

|

|

|

|

|

|

*MacKinnon (1996) one-sided p-values.

|

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller Test Equation

|

|

|

Dependent Variable: D(SL)

|

|

|

|

Method: Least Squares

|

|

|

|

Date: 01/22/13 Time: 19:05

|

|

|

|

Sample (adjusted): 1971 2008

|

|

|

|

Included observations: 34 after adjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

SL(-1)

|

-0.478534

|

0.149683

|

-3.196979

|

0.0032

|

|

C

|

10.14669

|

3.166232

|

3.204659

|

0.0031

|

|

@TREND(1970)

|

-0.021749

|

0.010062

|

-2.161556

|

0.0385

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.249929

|

Mean dependent var

|

-0.009333

|

|

Adjusted R-squared

|

0.201538

|

S.D. dependent var

|

0.555114

|

|

S.E. of regression

|

0.496032

|

Akaike info criterion

|

1.519743

|

|

Sum squared resid

|

7.627468

|

Schwarz criterion

|

1.654422

|

|

Log likelihood

|

-22.83563

|

F-statistic

|

5.164719

|

|

Durbin-Watson stat

|

1.886513

|

Prob(F-statistic)

|

0.011590

|

|

|

|

|

|

|

|

|

|

|

|

Null Hypothesis: D(SL) has a unit root

|

|

|

Exogenous: Constant, Linear Trend

|

|

|

Lag Length: 0 (Automatic based on SIC, MAXLAG=1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

-6.059590

|

0.0001

|

|

Test critical values:

|

1% level

|

|

-4.284580

|

|

|

5% level

|

|

-3.562882

|

|

|

10% level

|

|

-3.215267

|

|

|

|

|

|

|

|

|

|

|

|

|

*MacKinnon (1996) one-sided p-values.

|

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller Test Equation

|

|

|

Dependent Variable: D(SL,2)

|

|

|

|

Method: Least Squares

|

|

|

|

Date: 01/22/13 Time: 19:05

|

|

|

|

Sample (adjusted): 1972 2005

|

|

|

|

Included observations: 31 after adjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

D(SL(-1))

|

-1.231326

|

0.203203

|

-6.059590

|

0.0000

|

|

C

|

0.026697

|

0.211398

|

0.126287

|

0.9004

|

|

@TREND(1970)

|

-0.000909

|

0.010572

|

-0.086025

|

0.9321

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.567648

|

Mean dependent var

|

-0.008762

|

|

Adjusted R-squared

|

0.536765

|

S.D. dependent var

|

0.836573

|

|

S.E. of regression

|

0.569383

|

Akaike info criterion

|

1.803238

|

|

Sum squared resid

|

9.077513

|

Schwarz criterion

|

1.942011

|

|

Log likelihood

|

-24.95020

|

F-statistic

|

18.38100

|

|

Durbin-Watson stat

|

1.998934

|

Prob(F-statistic)

|

0.000008

|

|

|

|

|

|

|

|

|

|

|

|

Null Hypothesis: LOG(INT) has a unit root

|

|

|

Exogenous: Constant, Linear Trend

|

|

|

Lag Length: 0 (Automatic based on SIC, MAXLAG=1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

-2.901860

|

0.1733

|

|

Test critical values:

|

1% level

|

|

-4.219126

|

|

|

5% level

|

|

-3.533083

|

|

|

10% level

|

|

-3.198312

|

|

|

|

|

|

|

|

|

|

|

|

|

*MacKinnon (1996) one-sided p-values.

|

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller Test Equation

|

|

|

Dependent Variable: D(LOG(INT))

|

|

|

Method: Least Squares

|

|

|

|

Date: 01/22/13 Time: 19:06

|

|

|

|

Sample (adjusted): 1971 2008

|

|

|

|

Included observations: 38 after adjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

LOG(INT(-1))

|

-0.376554

|

0.129763

|

-2.901860

|

0.0064

|

|

C

|

0.988352

|

0.388174

|

2.546155

|

0.0154

|

|

@TREND(1970)

|

0.013916

|

0.014111

|

0.986178

|

0.3308

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.198963

|

Mean dependent var

|

0.066059

|

|

Adjusted R-squared

|

0.153189

|

S.D. dependent var

|

0.900074

|

|

S.E. of regression

|

0.828269

|

Akaike info criterion

|

2.536699

|

|

Sum squared resid

|

24.01103

|

Schwarz criterion

|

2.665982

|

|

Log likelihood

|

-45.19728

|

F-statistic

|

4.346678

|

|

Durbin-Watson stat

|

1.876278

|

Prob(F-statistic)

|

0.020603

|

|

|

|

|

|

|

|

|

|

|

|

Null Hypothesis: D(LOG(INT)) has a unit root

|

|

|

Exogenous: Constant, Linear Trend

|

|

|

Lag Length: 1 (Automatic based on SIC, MAXLAG=1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

-6.706278

|

0.0000

|

|

Test critical values:

|

1% level

|

|

-4.234972

|

|

|

5% level

|

|

-3.540328

|

|

|

10% level

|

|

-3.202445

|

|

|

|

|

|

|

|

|

|

|

|

|

*MacKinnon (1996) one-sided p-values.

|

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller Test Equation

|

|

|

Dependent Variable: D(LOG(INT),2)

|

|

|

Method: Least Squares

|

|

|

|

Date: 01/22/13 Time: 19:07

|

|

|

|

Sample (adjusted): 1973 2008

|

|

|

|

Included observations: 36 after adjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

D(LOG(INT(-1)))

|

-1.589842

|

0.237068

|

-6.706278

|

0.0000

|

|

D(LOG(INT(-1)),2)

|

0.440614

|

0.160451

|

2.746093

|

0.0098

|

|

C

|

0.370823

|

0.322814

|

1.148719

|

0.2592

|

|

@TREND(1970)

|

-0.012798

|

0.013982

|

-0.915299

|

0.3669

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.636145

|

Mean dependent var

|

0.015982

|

|

Adjusted R-squared

|

0.602034

|

S.D. dependent var

|

1.366117

|

|

S.E. of regression

|

0.861809

|

Akaike info criterion

|

2.644874

|

|

Sum squared resid

|

23.76689

|

Schwarz criterion

|

2.820820

|

|

Log likelihood

|

-43.60772

|

F-statistic

|

18.64905

|

|

Durbin-Watson stat

|

2.307929

|

Prob(F-statistic)

|

0.000000

|

|

|

|

|

|

|

|

|

|

|

|

Null Hypothesis: LOG(INF) has a unit root

|

|

|

Exogenous: Constant, Linear Trend

|

|

|

Lag Length: 0 (Automatic based on SIC, MAXLAG=1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

-2.605859

|

0.2800

|

|

Test critical values:

|

1% level

|

|

-4.219126

|

|

|

5% level

|

|

-3.533083

|

|

|

10% level

|

|

-3.198312

|

|

|

|

|

|

|

|

|

|

|

|

|

*MacKinnon (1996) one-sided p-values.

|

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller Test Equation

|

|

|

Dependent Variable: D(LOG(INF))

|

|

|

Method: Least Squares

|

|

|

|

Date: 01/22/13 Time: 19:08

|

|

|

|

Sample (adjusted): 1971 2008

|

|

|

|

Included observations: 38 after adjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

LOG(INF(-1))

|

-0.311489

|

0.119534

|

-2.605859

|

0.0134

|

|

C

|

1.551559

|

0.592206

|

2.619965

|

0.0129

|

|

@TREND(1970)

|

-0.009666

|

0.020291

|

-0.476364

|

0.6368

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.191091

|

Mean dependent var

|

0.047956

|

|

Adjusted R-squared

|

0.144867

|

S.D. dependent var

|

1.429553

|

|

S.E. of regression

|

1.321956

|

Akaike info criterion

|

3.471758

|

|

Sum squared resid

|

61.16484

|

Schwarz criterion

|

3.601041

|

|

Log likelihood

|

-62.96340

|

F-statistic

|

4.134068

|

|

Durbin-Watson stat

|

1.953614

|

Prob(F-statistic)

|

0.024448

|

|

|

|

|

|

|

|

|

|

|

|

Null Hypothesis: D(LOG(INF)) has a unit root

|

|

|

Exogenous: Constant, Linear Trend

|

|

|

Lag Length: 0 (Automatic based on SIC, MAXLAG=1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

-6.827590

|

0.0000

|

|

Test critical values:

|

1% level

|

|

-4.226815

|

|

|

5% level

|

|

-3.536601

|

|

|

10% level

|

|

-3.200320

|

|

|

|

|

|

|

|

|

|

|

|

|

*MacKinnon (1996) one-sided p-values.

|

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller Test Equation

|

|

|

Dependent Variable: D(LOG(INF),2)

|

|

|

Method: Least Squares

|

|

|

|

Date: 01/22/13 Time: 19:09

|

|

|

|

Sample (adjusted): 1972 2008

|

|

|

|

Included observations: 37 after adjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

D(LOG(INF(-1)))

|

-1.143061

|

0.167418

|

-6.827590

|

0.0000

|

|

C

|

0.411652

|

0.504812

|

0.815456

|

0.4205

|

|

@TREND(1970)

|

-0.020200

|

0.022242

|

-0.908222

|

0.3702

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.578399

|

Mean dependent var

|

-0.080139

|

|

Adjusted R-squared

|

0.553599

|

S.D. dependent var

|

2.134957

|

|

S.E. of regression

|

1.426434

|

Akaike info criterion

|

3.625837

|

|

Sum squared resid

|

69.18024

|

Schwarz criterion

|

3.756452

|

|

Log likelihood

|

-64.07798

|

F-statistic

|

23.32251

|

|

Durbin-Watson stat

|

1.984198

|

Prob(F-statistic)

|

0.000000

|

|

|

|

|

|

|

|

|

|

|

|

Null Hypothesis: LOG(PIBHAB) has a unit root

|

|

|

Exogenous: Constant, Linear Trend

|

|

|

Lag Length: 1 (Automatic based on SIC, MAXLAG=1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

-1.899465

|

0.6347

|

|

Test critical values:

|

1% level

|

|

-4.226815

|

|

|

5% level

|

|

-3.536601

|

|

|

10% level

|

|

-3.200320

|

|

|

|

|

|

|

|

|

|

|

|

|

*MacKinnon (1996) one-sided p-values.

|

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller Test Equation

|

|

|

Dependent Variable: D(LOG(PIBHAB))

|

|

|

Method: Least Squares

|

|

|

|

Date: 01/22/13 Time: 19:11

|

|

|

|

Sample (adjusted): 1972 2008

|

|

|

|

Included observations: 37 after adjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

LOG(PIBHAB(-1))

|

-0.087747

|

0.046195

|

-1.899465

|

0.0663

|

|

D(LOG(PIBHAB(-1)))

|

0.727242

|

0.121421

|

5.989407

|

0.0000

|

|

C

|

0.514399

|

0.282465

|

1.821105

|

0.0777

|

|

@TREND(1970)

|

-0.003480

|

0.002206

|

-1.577689

|

0.1242

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.530289

|

Mean dependent var

|

-0.033505

|

|

Adjusted R-squared

|

0.487588

|

S.D. dependent var

|

0.055519

|

|

S.E. of regression

|

0.039742

|

Akaike info criterion

|

-3.510994

|

|

Sum squared resid

|

0.052122

|

Schwarz criterion

|

-3.336841

|

|

Log likelihood

|

68.95340

|

F-statistic

|

12.41864

|

|

Durbin-Watson stat

|

2.083356

|

Prob(F-statistic)

|

0.000013

|

|

|

|

|

|

|

|

|

|

|

|

Null Hypothesis: D(LOG(PIBHAB)) has a unit root

|

|

Exogenous: Constant, Linear Trend

|

|

|

Lag Length: 0 (Automatic based on SIC, MAXLAG=1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

-2.541404

|

0.3078

|

|

Test critical values:

|

1% level

|

|

-4.226815

|

|

|

5% level

|

|

-3.536601

|

|

|

10% level

|

|

-3.200320

|

|

|

|

|

|

|

|

|

|

|

|

|

*MacKinnon (1996) one-sided p-values.

|

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller Test Equation

|

|

|

Dependent Variable: D(LOG(PIBHAB),2)

|

|

|

Method: Least Squares

|

|

|

|

Date: 01/22/13 Time: 19:11

|

|

|

|

Sample (adjusted): 1972 2008

|

|

|

|

Included observations: 37 after adjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

D(LOG(PIBHAB(-1)))

|

-0.314826

|

0.123879

|

-2.541404

|

0.0158

|

|

C

|

-0.021435

|

0.014953

|

-1.433481

|

0.1609

|

|

@TREND(1970)

|

0.000545

|

0.000635

|

0.858860

|

0.3964

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.175442

|

Mean dependent var

|

2.96E-05

|

|

Adjusted R-squared

|

0.126938

|

S.D. dependent var

|

0.044135

|

|

S.E. of regression

|

0.041238

|

Akaike info criterion

|

-3.461290

|

|

Sum squared resid

|

0.057821

|

Schwarz criterion

|

-3.330675

|

|

Log likelihood

|

67.03387

|

F-statistic

|

3.617104

|

|

Durbin-Watson stat

|

1.949153

|

Prob(F-statistic)

|

0.037650

|

|

|

|

|

|

|

|

|

|

|

|

Null Hypothesis: D(LOG(PIBHAB),2) has a unit root

|

|

Exogenous: Constant, Linear Trend

|

|

|

Lag Length: 0 (Automatic based on SIC, MAXLAG=1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

-6.787861

|

0.0000

|

|

Test critical values:

|

1% level

|

|

-4.234972

|

|

|

5% level

|

|

-3.540328

|

|

|

10% level

|

|

-3.202445

|

|

|

|

|

|

|

|

|

|

|

|

|

*MacKinnon (1996) one-sided p-values.

|

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller Test Equation

|

|

|

Dependent Variable: D(LOG(PIBHAB),3)

|

|

|

Method: Least Squares

|

|

|

|

Date: 01/22/13 Time: 19:12

|

|

|

|

Sample (adjusted): 1973 2008

|

|

|

|

Included observations: 36 after adjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

D(LOG(PIBHAB(-1)),2)

|

-1.148683

|

0.169226

|

-6.787861

|

0.0000

|

|

C

|

-0.007203

|

0.016487

|

-0.436899

|

0.6650

|

|

@TREND(1970)

|

0.000430

|

0.000719

|

0.597555

|

0.5542

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.583452

|

Mean dependent var

|

0.001538

|

|

Adjusted R-squared

|

0.558207

|

S.D. dependent var

|

0.066716

|

|

S.E. of regression

|

0.044345

|

Akaike info criterion

|

-3.313987

|

|

Sum squared resid

|

0.064893

|

Schwarz criterion

|

-3.182027

|

|

Log likelihood

|

62.65176

|

F-statistic

|

23.11128

|

|

Durbin-Watson stat

|

1.851318

|

Prob(F-statistic)

|

0.000001

|

|

|

|

|

|

|

|

|

|

|

|

Null Hypothesis: LOG(ESPER) has a unit root

|

|

|

Exogenous: Constant, Linear Trend

|

|

|

Lag Length: 1 (Automatic based on SIC, MAXLAG=1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

-4.597210

|

0.0039

|

|

Test critical values:

|

1% level

|

|

-4.226815

|

|

|

5% level

|

|

-3.536601

|

|

|

10% level

|

|

-3.200320

|

|

|

|

|

|

|

|

|

|

|

|

|

*MacKinnon (1996) one-sided p-values.

|

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller Test Equation

|

|

|

Dependent Variable: D(LOG(ESPER))

|

|

|

Method: Least Squares

|

|

|

|

Date: 01/22/13 Time: 19:13

|

|

|

|

Sample (adjusted): 1972 2008

|

|

|

|

Included observations: 37 after adjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

LOG(ESPER(-1))

|

-0.054854

|

0.011932

|

-4.597210

|

0.0001

|

|

D(LOG(ESPER(-1)))

|

0.912898

|

0.049883

|

18.30076

|

0.0000

|

|

C

|

0.209272

|

0.045540

|

4.595392

|

0.0001

|

|

@TREND(1970)

|

7.18E-05

|

2.68E-05

|

2.679967

|

0.0114

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.927574

|

Mean dependent var

|

0.002123

|

|

Adjusted R-squared

|

0.920989

|

S.D. dependent var

|

0.004805

|

|

S.E. of regression

|

0.001351

|

Akaike info criterion

|

-10.27458

|

|

Sum squared resid

|

6.02E-05

|

Schwarz criterion

|

-10.10042

|

|

Log likelihood

|

194.0797

|

F-statistic

|

140.8784

|

|

Durbin-Watson stat

|

0.283296

|

Prob(F-statistic)

|

0.000000

|

|

|

|

|

|

|

|

|

|

|

|

Null Hypothesis: BACO has a unit root

|

|

|

Exogenous: Constant, Linear Trend

|

|

|

Lag Length: 0 (Automatic based on SIC, MAXLAG=1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

-6.309767

|

0.0000

|

|

Test critical values:

|

1% level

|

|

-4.226815

|

|

|

5% level

|

|

-3.536601

|

|

|

10% level

|

|

-3.200320

|

|

|

|

|

|

|

|

|

|

|

|

|

*MacKinnon (1996) one-sided p-values.

|

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller Test Equation

|

|

|

Dependent Variable: D(BACO)

|

|

|

|

Method: Least Squares

|

|

|

|

Date: 01/22/13 Time: 19:14

|

|

|

|

Sample (adjusted): 1972 2008

|

|

|

|

Included observations: 37 after adjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

BACO(-1)

|

-1.072203

|

0.169928

|

-6.309767

|

0.0000

|

|

C

|

-3.308370

|

1.944585

|

-1.701325

|

0.0980

|

|

@TREND(1970)

|

0.040873

|

0.083728

|

0.488166

|

0.6286

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.540200

|

Mean dependent var

|

-0.027002

|

|

Adjusted R-squared

|

0.513153

|

S.D. dependent var

|

7.791891

|

|

S.E. of regression

|

5.436749

|

Akaike info criterion

|

6.301844

|

|

Sum squared resid

|

1004.980

|

Schwarz criterion

|

6.432459

|

|

Log likelihood

|

-113.5841

|

F-statistic

|

19.97257

|

|

Durbin-Watson stat

|

2.011207

|

Prob(F-statistic)

|

0.000002

|

|

|

|

|

|

|

|

|

|

|

|

Null Hypothesis: LOG(CREDIT) has a unit root

|

|

|

Exogenous: Constant, Linear Trend

|

|

|

Lag Length: 0 (Automatic based on SIC, MAXLAG=1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

-4.049968

|

0.0152

|

|

Test critical values:

|

1% level

|

|

-4.219126

|

|

|

5% level

|

|

-3.533083

|

|

|

10% level

|

|

-3.198312

|

|

|

|

|

|

|

|

|

|

|

|

|

*MacKinnon (1996) one-sided p-values.

|

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller Test Equation

|

|

|

Dependent Variable: D(LOG(CREDIT))

|

|

|

Method: Least Squares

|

|

|

|

Date: 01/22/13 Time: 19:14

|

|

|

|

Sample (adjusted): 1971 2008

|

|

|

|

Included observations: 38 after adjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

LOG(CREDIT(-1))

|

-0.646091

|

0.159530

|

-4.049968

|

0.0003

|

|

C

|

1.838332

|

0.544199

|

3.378047

|

0.0018

|

|

@TREND(1970)

|

-0.031770

|

0.015575

|

-2.039826

|

0.0490

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.319156

|

Mean dependent var

|

0.011874

|

|

Adjusted R-squared

|

0.280251

|

S.D. dependent var

|

1.061582

|

|

S.E. of regression

|

0.900625

|

Akaike info criterion

|

2.704202

|

|

Sum squared resid

|

28.38942

|

Schwarz criterion

|

2.833485

|

|

Log likelihood

|

-48.37984

|

F-statistic

|

8.203401

|

|

Durbin-Watson stat

|

2.182835

|

Prob(F-statistic)

|

0.001198

|

|

|

|

|

|

|

|

|

|

|

|

Null Hypothesis: D(LOG(CREDIT)) has a unit root

|

|

Exogenous: Constant, Linear Trend

|

|

|

Lag Length: 0 (Automatic based on SIC, MAXLAG=1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

-10.23328

|

0.0000

|

|

Test critical values:

|

1% level

|

|

-4.226815

|

|

|

5% level

|

|

-3.536601

|

|

|

10% level

|

|

-3.200320

|

|

|

|

|

|

|

|

|

|

|

|

|

*MacKinnon (1996) one-sided p-values.

|

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller Test Equation

|

|

|

Dependent Variable: D(LOG(CREDIT),2)

|

|

|

Method: Least Squares

|

|

|

|

Date: 01/22/13 Time: 19:15

|

|

|

|

Sample (adjusted): 1972 2008

|

|

|

|

Included observations: 37 after adjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

D(LOG(CREDIT(-1)))

|

-1.512583

|

0.147810

|

-10.23328

|

0.0000

|

|

C

|

-0.011530

|

0.332161

|

-0.034713

|

0.9725

|

|

@TREND(1970)

|

0.000945

|

0.014651

|

0.064465

|

0.9490

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.754969

|

Mean dependent var

|

0.009732

|

|

Adjusted R-squared

|

0.740556

|

S.D. dependent var

|

1.867989

|

|

S.E. of regression

|

0.951473

|

Akaike info criterion

|

2.815994

|

|

Sum squared resid

|

30.78023

|

Schwarz criterion

|

2.946609

|

|

Log likelihood

|

-49.09589

|

F-statistic

|

52.37903

|

|

Durbin-Watson stat

|

2.021742

|

Prob(F-statistic)

|

0.000000

|

|

|

|

|

|

|

|

|

|

|

5.1.2. Test de cointégration de

Johansen

|

Date: 01/22/13 Time: 19:19

|

|

|

|

|

Sample: 1970 2008

|

|

|

|

|

Included observations: 30

|

|

|

|

|

Series: SL LOG(INT) LOG(INF) LOG(PIBHAB) LOG(ESPER) BACO

LOG(CREDIT)

|

|

Lags interval: 1 to 1

|

|

|

|

|

|

|

|

|

|

|

Selected (0.05 level*) Number of Cointegrating Relations

by Model

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Data Trend:

|

None

|

None

|

Linear

|

Linear

|

Quadratic

|

|

Test Type

|

No Intercept

|

Intercept

|

Intercept

|

Intercept

|

Intercept

|

|

No Trend

|

No Trend

|

No Trend

|

Trend

|

Trend

|

|

Trace

|

5

|

4

|

3

|

5

|

4

|

|

Max-Eig

|

3

|

3

|

2

|

2

|

2

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*Critical values based on MacKinnon-Haug-Michelis

(1999)

|

|

|

|

|

|

|

|

|

Information Criteria by Rank and Model

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Data Trend:

|

None

|

None

|

Linear

|

Linear

|

Quadratic

|

|

Rank or

|

No Intercept

|

Intercept

|

Intercept

|

Intercept

|

Intercept

|

|

No. of CEs

|

No Trend

|

No Trend

|

No Trend

|

Trend

|

Trend

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Log Likelihood by Rank (rows) and Model (columns)

|

|

|

|

|

|

0

|

2.253491

|

2.253491

|

13.62406

|

13.62406

|

20.93141

|

|

1

|

28.70612

|

35.99960

|

43.69675

|

51.16769

|

58.37436

|

|

2

|

52.10709

|

62.35695

|

70.03821

|

77.79694

|

82.79531

|

|

3

|

70.53452

|

80.79510

|

86.07789

|

94.00155

|

98.85067

|

|

4

|

80.39123

|

93.95339

|

99.19375

|

107.4405

|

111.8416

|

|

5

|

88.42999

|

102.0189

|

105.1095

|

120.3129

|

123.9886

|

|

6

|

92.23725

|

107.4158

|

109.2085

|

125.9649

|

127.8417

|

|

7

|

93.75920

|

109.2397

|

109.2397

|

129.1647

|

129.1647

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Akaike Information Criteria by Rank (rows) and Model

(columns)

|

|

|

|

|

|

0

|

3.116434

|

3.116434

|

2.825063

|

2.825063

|

2.804573

|

|

1

|

2.286258

|

1.866693

|

1.753550

|

1.322154

|

1.241709

|

|

2

|

1.659527

|

1.109536

|

0.930786

|

0.546871

|

0.546979

|

|

3

|

1.364365

|

0.880327

|

0.794807

|

0.466563

|

0.409956*

|

|

4

|

1.640585

|

1.003107

|

0.853750

|

0.570633

|

0.477225

|

|

5

|

2.038001

|

1.465409

|

1.392700

|

0.712476

|

0.600761

|

|

6

|

2.717517

|

2.105612

|

2.052768

|

1.335674

|

1.277219

|

|

7

|

3.549387

|

2.984019

|

2.984019

|

2.122352

|

2.122352

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schwarz Criteria by Rank (rows) and Model (columns)

|

|

|

|

|

|

0

|

5.405056

|

5.405056

|

5.440631

|

5.440631

|

5.747087

|

|

1

|

5.228773

|

4.855914

|

5.023011

|

4.638321

|

4.838116

|

|

2

|

5.255934

|

4.799356

|

4.854138

|

4.563637*

|

4.797278

|

|

3

|

5.614664

|

5.270745

|

5.372052

|

5.183928

|

5.314147

|

|

4

|

6.544776

|

6.094124

|

6.084887

|

5.988597

|

6.035308

|

|

5

|

7.596084

|

7.257025

|

7.277729

|

6.831038

|

6.812736

|

|

6

|

8.929492

|

8.597826

|

8.591689

|

8.154835

|

8.143087

|

|

7

|

10.41525

|

10.17683

|

10.17683

|

9.642111

|

9.642111

|

|

|

|

|

|

|

|

|

|

|

|

|

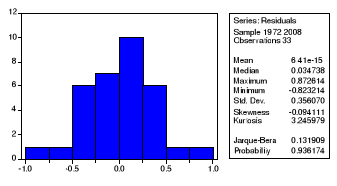

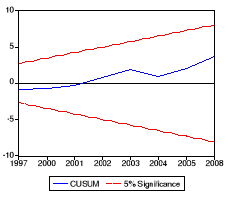

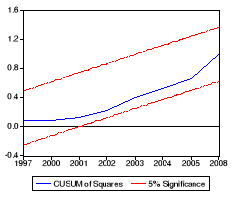

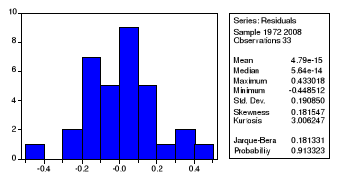

5.1.3. Estimation 1 et Tests

|

Dependent Variable: D(LOG(S))

|

|

|

Method: Least Squares

|

|

|

|

Date: 01/22/13 Time: 19:34

|

|

|

|

Sample (adjusted): 1972 2008

|

|

|

|

Included observations: 33 after adjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

C

|

-4.603817

|

24.78515

|

-0.185749

|

0.8546

|

|

D(LOG(INT))

|

0.020781

|

0.123451

|

0.168331

|

0.8681

|

|

D(LOG(INF))

|

-0.100340

|

0.079649

|

-1.259777

|

0.2230

|

|

D(D(LOG(PIBHAB)))

|

1.566020

|

2.101269

|

0.745273

|

0.4652

|

|

LOG(ESPER)

|

-46.78102

|

27.31560

|

-1.712612

|

0.1031

|

|

D(LOG(CREDIT))

|

0.022022

|

0.141890

|

0.155204

|

0.8783

|

|

BACO

|

0.026483

|

0.016840

|

1.572635

|

0.1323

|

|

LOG(S(-1))

|

-0.670678

|

0.213174

|

-3.146153

|

0.0053

|

|

LOG(INT(-1))

|

-0.065266

|

0.150741

|

-0.432969

|

0.6699

|

|

LOG(INF(-1))

|

-0.004422

|

0.080215

|

-0.055130

|

0.9566

|

|

LOG(PIBHAB(-1))

|

0.811569

|

0.376967

|

2.152891

|

0.0444

|

|

LOG(ESPER(-1))

|

47.41514

|

26.60020

|

1.782511

|

0.0907

|

|

LOG(CREDIT(-1))

|

-0.142402

|

0.183225

|

-0.777197

|

0.4466

|

|

BACO(-1)

|

-0.000700

|

0.018230

|

-0.038407

|

0.9698

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.610911

|

Mean dependent var

|

-0.033135

|

|

Adjusted R-squared

|

0.344692

|

S.D. dependent var

|

0.570835

|

|

S.E. of regression

|

0.462097

|

Akaike info criterion

|

1.590334

|

|

Sum squared resid

|

4.057146

|

Schwarz criterion

|

2.225216

|

|

Log likelihood

|

-12.24051

|

F-statistic

|

2.294768

|

|

Durbin-Watson stat

|

2.549007

|

Prob(F-statistic)

|

0.048716

|

|

|

|

|

|

|

|

|

|

|

|

White Heteroskedasticity Test:

|

|

|

|

|

|

|

|

|

|

|

|

|

F-statistic

|

0.895278

|

Probability

|

0.612988

|

|

Obs*R-squared

|

24.04680

|

Probability

|

0.458924

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Test Equation:

|

|

|

|

Dependent Variable: RESID^2

|

|

|

|

Method: Least Squares

|

|

|

|

Date: 01/22/13 Time: 19:45

|

|

|

|

Sample: 1972 2008

|

|

|

|

Included observations: 33

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

C

|

-6.127875

|

52.99098

|

-0.115640

|

0.9108

|

|

D(LOG(INT))

|

0.038730

|

0.097877

|

0.395696

|

0.7027

|

|

(D(LOG(INT)))^2

|

0.017461

|

0.171505

|

0.101808

|

0.9214

|

|

D(LOG(INF))

|

0.072118

|

0.065169

|

1.106620

|

0.3006

|

|

(D(LOG(INF)))^2

|

0.024516

|

0.052850

|

0.463884

|

0.6551

|

|

D(D(LOG(PIBHAB)))

|

0.137700

|

1.891907

|

0.072784

|

0.9438

|

|

(D(D(LOG(PIBHAB))))^2

|

3.067671

|

36.05643

|

0.085080

|

0.9343

|

|

LOG(ESPER)

|

-25.56550

|

62.19001

|

-0.411087

|

0.6918

|

|

D(LOG(CREDIT))

|

0.008262

|

0.232878

|

0.035479

|

0.9726

|

|

(D(LOG(CREDIT)))^2

|

0.002671

|

0.074436

|

0.035886

|

0.9723

|

|

BACO

|

0.012726

|

0.068172

|

0.186675

|

0.8566

|

|

BACO^2

|

0.000778

|

0.002872

|

0.270970

|

0.7933

|

|

LOG(S(-1))

|

0.230129

|

1.423713

|

0.161640

|

0.8756

|

|

(LOG(S(-1)))^2

|

-0.066239

|

0.313216

|

-0.211479

|

0.8378

|

|

LOG(INT(-1))

|

-0.314282

|

0.476655

|

-0.659350

|

0.5282

|

|

(LOG(INT(-1)))^2

|

0.038418

|

0.088345

|

0.434858

|

0.6752

|

|

LOG(INF(-1))

|

0.471936

|