ANNEXE II.4-MODÈLE À CORRECTION

D'ERREUR

Tableeau II.4.1 : output du

modèle à correction d'erreur à la

Hendry

|

Dependent Variable: DLTCHOM

|

|

|

|

Method: Least Squares

|

|

|

|

Date: 11/30/13 Time: 15:28

|

|

|

|

Sample (adjusted): 1991 2011

|

|

|

|

Included observations: 21 after adjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

C

|

2.294032

|

0.798374

|

2.873380

|

0.0105

|

|

DLTINFL

|

0.034941

|

0.014358

|

2.433581

|

0.0263

|

|

LTCHOM(-1)

|

-0.607449

|

0.208458

|

-2.914011

|

0.0097

|

|

LTINFL(-1)

|

0.030208

|

0.012376

|

2.440922

|

0.0259

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.488296

|

Mean dependent var

|

-0.001099

|

|

Adjusted R-squared

|

0.397995

|

S.D. dependent var

|

0.121653

|

|

S.E. of regression

|

0.094389

|

Akaike info criterion

|

-1.713136

|

|

Sum squared resid

|

0.151459

|

Schwarz criterion

|

-1.514180

|

|

Log likelihood

|

21.98793

|

Hannan-Quinn criter.

|

-1.669958

|

|

F-statistic

|

5.407440

|

Durbin-Watson stat

|

1.953585

|

|

Prob(F-statistic)

|

0.008490

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ANNEXE II.5- VALIDATION DU MODÈLE

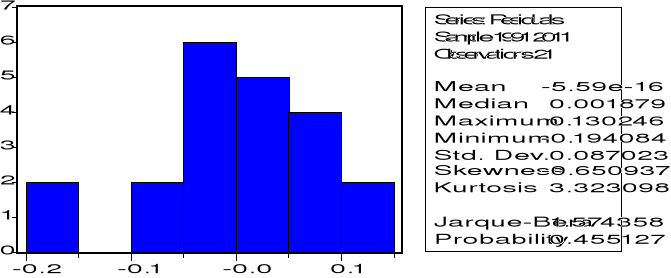

Figure II.5.1 : output du test de

normalité des résidus de Jarque-Bera

Tableau II.5.2 : output du test

d'hétéroscédasticité de White

|

Heteroskedasticity Test: White

|

|

|

|

|

|

|

|

|

|

|

|

|

F-statistic

|

1.348344

|

Prob. F(9,11)

|

0.3151

|

|

Obs*R-squared

|

11.01517

|

Prob. Chi-Square(9)

|

0.2747

|

|

Scaled explained SS

|

8.384707

|

Prob. Chi-Square(9)

|

0.4959

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

sTest Equation:

|

|

|

|

|

Dependent Variable: RESID^2

|

|

|

|

Method: Least Squares

|

|

|

|

Date: 01/05/14 Time: 14:36

|

|

|

|

Sample: 1991 2011

|

|

|

|

Included observations: 21

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

C

|

-4.933231

|

4.072778

|

-1.211269

|

0.2512

|

|

DLTINFL

|

0.184123

|

0.084852

|

2.169928

|

0.0528

|

|

DLTINFL^2

|

-0.002509

|

0.001373

|

-1.827245

|

0.0949

|

|

DLTINFL*LTCHOM(-1)

|

-0.045266

|

0.021978

|

-2.059628

|

0.0639

|

|

DLTINFL*LTINFL(-1)

|

-0.000440

|

0.001482

|

-0.296938

|

0.7720

|

|

LTCHOM(-1)

|

2.567833

|

2.083548

|

1.232433

|

0.2435

|

|

LTCHOM(-1)^2

|

-0.336292

|

0.267122

|

-1.258943

|

0.2341

|

|

LTCHOM(-1)*LTINFL(-1)

|

0.023616

|

0.019846

|

1.189934

|

0.2591

|

|

LTINFL(-1)

|

-0.072201

|

0.071348

|

-1.011960

|

0.3333

|

|

LTINFL(-1)^2

|

-0.001880

|

0.001067

|

-1.762703

|

0.1057

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.524532

|

Mean dependent var

|

0.007212

|

|

Adjusted R-squared

|

0.135512

|

S.D. dependent var

|

0.011264

|

|

S.E. of regression

|

0.010473

|

Akaike info criterion

|

-5.974227

|

|

Sum squared resid

|

0.001207

|

Schwarz criterion

|

-5.476836

|

|

Log likelihood

|

72.72939

|

Hannan-Quinn criter.

|

-5.866281

|

|

F-statistic

|

1.348344

|

Durbin-Watson stat

|

1.748279

|

|

Prob(F-statistic)

|

0.315095

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tableau II.5.3 : output

du test de RESET de Ramsey

|

Ramsey RESET Test:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F-statistic

|

3.497862

|

Prob. F(1,16)

|

0.0799

|

|

Log likelihood ratio

|

4.152038

|

Prob. Chi-Square(1)

|

0.0416

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Test Equation:

|

|

|

|

|

Dependent Variable: DLTCHOM

|

|

|

|

Method: Least Squares

|

|

|

|

Date: 11/30/13 Time: 15:32

|

|

|

|

Sample: 1991 2011

|

|

|

|

Included observations: 21

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

C

|

2.586407

|

0.761697

|

3.395584

|

0.0037

|

|

DLTINFL

|

0.026323

|

0.014177

|

1.856798

|

0.0818

|

|

LTCHOM(-1)

|

-0.685352

|

0.199055

|

-3.443034

|

0.0033

|

|

LTINFL(-1)

|

0.041327

|

0.012995

|

3.180130

|

0.0058

|

|

FITTED^2

|

-5.152058

|

2.754733

|

-1.870257

|

0.0799

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.580094

|

Mean dependent var

|

-0.001099

|

|

Adjusted R-squared

|

0.475118

|

S.D. dependent var

|

0.121653

|

|

S.E. of regression

|

0.088136

|

Akaike info criterion

|

-1.815614

|

|

Sum squared resid

|

0.124287

|

Schwarz criterion

|

-1.566919

|

|

Log likelihood

|

24.06395

|

Hannan-Quinn criter.

|

-1.761641

|

|

F-statistic

|

5.525945

|

Durbin-Watson stat

|

1.801644

|

|

Prob(F-statistic)

|

0.005452

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tableau II.5.4 : output du test LM

de Breusch-Godfrey

|

Breusch-Godfrey Serial Correlation LM Test:

|

|

|

|

|

|

|

|

|

|

|

|

|

F-statistic

|

1.756087

|

Prob. F(2,15)

|

0.2064

|

|

Obs*R-squared

|

3.984171

|

Prob. Chi-Square(2)

|

0.1364

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Test Equation:

|

|

|

|

|

Dependent Variable: RESID

|

|

|

|

Method: Least Squares

|

|

|

|

Date: 11/30/13 Time: 15:34

|

|

|

|

Sample: 1991 2011

|

|

|

|

Included observations: 21

|

|

|

|

Presample missing value lagged residuals set to

zero.

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

C

|

-3.124822

|

1.969509

|

-1.586599

|

0.1335

|

|

DLTINFL

|

0.002738

|

0.015616

|

0.175359

|

0.8631

|

|

LTCHOM(-1)

|

0.816679

|

0.514333

|

1.587840

|

0.1332

|

|

LTINFL(-1)

|

-0.030661

|

0.021128

|

-1.451234

|

0.1673

|

|

RESID(-1)

|

-0.972394

|

0.590712

|

-1.646139

|

0.1205

|

|

RESID(-2)

|

-0.501630

|

0.308301

|

-1.627076

|

0.1245

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.189722

|

Mean dependent var

|

-5.76E-16

|

|

Adjusted R-squared

|

-0.080370

|

S.D. dependent var

|

0.087023

|

|

S.E. of regression

|

0.090452

|

Akaike info criterion

|

-1.733039

|

|

Sum squared resid

|

0.122723

|

Schwarz criterion

|

-1.434604

|

|

Log likelihood

|

24.19690

|

Hannan-Quinn criter.

|

-1.668271

|

|

F-statistic

|

0.702435

|

Durbin-Watson stat

|

1.968940

|

|

Prob(F-statistic)

|

0.630278

|

|

|

|

|

|

|

|

|

|

|

|

|

|

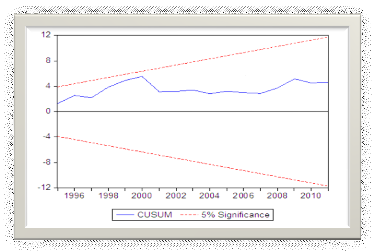

Figure II.5.2 : output du test CUSUM

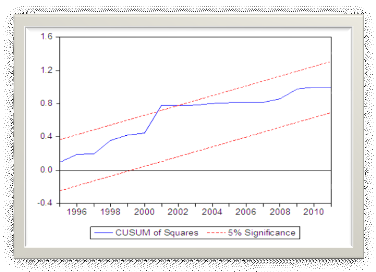

Figure II.5.3 : output du test

CUSUMSQ

Tableau II.6 : les données

utilisées pour l'estimation

|

Année

|

Taux de chômage

|

Taux d'inflation

|

|

1990

|

52,6

|

874,5

|

|

1991

|

49,4

|

2641,9

|

|

1992

|

56,3

|

2989,6

|

|

1993

|

68,7

|

4651,7

|

|

1994

|

67

|

9796,9

|

|

1995

|

69,2

|

370,3

|

|

1996

|

62,8

|

693

|

|

1997

|

53,6

|

13,7

|

|

1998

|

57,2

|

134,8

|

|

1999

|

64,2

|

483,7

|

|

2000

|

66,9

|

511,2

|

|

2001

|

49

|

135,1

|

|

2002

|

49,1

|

15,8

|

|

2003

|

48,5

|

4,4

|

|

2004

|

45,4

|

9,8

|

|

2005

|

49,4

|

21,3

|

|

2006

|

48,2

|

18,2

|

|

2007

|

47,2

|

9,96

|

|

2008

|

53,2

|

27,57

|

|

2009

|

60,8

|

53,4

|

|

2010

|

50,1

|

9,8

|

|

2011

|

51,4

|

23,4

|

Source: Banque Centrale Du Congo, Rapports Annuels (2009, 2010 et

2011) et Condencés des Informations Statistiques (2007).

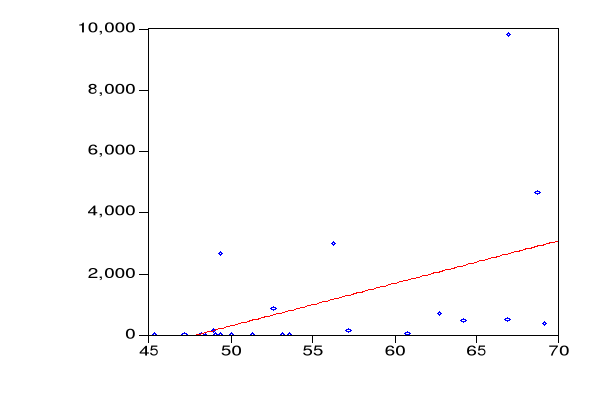

Graphique II.3- Ajustement entre l'inflation et le

chômage

|

|