|

COLLEGE OF EUROPE BRUGES CAMPUS European Economic Studies

Impact of Eco-innovation on firms'

competitiveness

An Empirical study based on Mannheim

Innovation Panel

Thesis presented by Abdelfettah BITAT

Supervisor: Klaus RENNINGS

for the

Degree of Master of Arts in European Economic Studies

Specialisation: European Economic Integration and Business

Statutory Declaration

I hereby declare that this thesis has been written by myself

without any external unauthorised help, that it has been neither presented to

any institution for evaluation nor previously published in its entirety or in

parts. Any parts, words or ideas, of the thesis, however limited, and including

tables, graphs, maps etc., which are quoted from or based on other sources,

have been acknowledged as such without exception.

Moreover, I have also taken note and accepted the College rules

with regard to plagiarism (Section 4.2 of the College study regulations).

<10 120 word>

Abstract

Environmental issues have become of prime importance nowadays

so that they are a recurrent subject at the table of the world's most powerful

committees. Hence, the relationship between environmental regulation,

eco-innovation and firms' competitiveness has always been equivocal. The

concerned groups of interest all claim to have the right argument without a

clear analytical proof. The present thesis will shed some light on one of the

most controversial hypothesis in the last couple of decades: the Porter

Hypothesis. In fact, Harvard Business School Professor Michael E. Porter wrote

a one page article in the beginning of 1990s claiming, against the current

trend in that time, that environmental regulation will actually trigger

eco-innovation (weak Porter hypothesis) which will in turn increase the

competitiveness of businesses (strong Porter hypothesis). Needless to say this

argument has been immediately captured by politician and environmentalists to

support stringent environmental regulation. At the same time several

counter-articles were published to refute the Porter Hypothesis claiming

metaphorically that there is no 10 dollars bill on the ground because if it was

there it would have been already picked up, referring to the idea that

businesses would not miss an opportunity to improve their competitiveness on

the basis of profit maximising paradigm. The current thesis will limit itself

to the empirical test of the strong Porter Hypothesis explaining the

relationship between eco-innovation and firms' competitiveness using Mannheim

Innovation Panel (MIP) part of the European Community Innovation Survey. The

Ordered Probit Model will test six different hypotheses to compare between

eco-innovative and non-innovative firms concerning the impact of each of access

to green market, environmentally friendly products differentiation,

eco-innovation technological rent, materials and energy efficiency, cost of

capital and labour productivity variables on the return on sales as an index of

competitiveness. The thesis is structured as follow: After the introduction,

section 2 will briefly define eco-innovation and its drivers and expose more

extensively a literature review on the Porter hypothesis, section 3 will setup

the theoretical foundations for each of the six hypotheses, while section 4 and

5 will describe and test the empirical model respectively. The empirical

results confirmed only partly the strong Porter hypothesis with an overall

positive effect of environmental innovation on return on sales whereas from the

six different sub-hypotheses only four were verified leading to a rejection of

the remaining ones, namely the green products differentiation and patent

stock.

Keywords

Eco-innovation

Porter hypothesis Competitiveness Environment

Ordered Probit Model

Table of Contents

Statutory Declaration ii

Abstract iii

Keywords iv

List of Tables vii

List of Figures viii

List of Abbreviations ix

1 Introduction 1

2 Literature review of the academic background

4

2.1 Introduction 4

2.2 Eco-innovation 4

2.2.1 Definition 4

2.2.2 Determinant for eco-innovation 5

2.3 The Porter hypothesis 6

2.3.1 The weak Porter hypothesis 7

2.3.2 The strong Porter Hypothesis 8

2.3.3 Critics of the Porter hypothesis 12

2.4 Conclusion 14

3 Hypotheses of the theoretical model 16

3.1 Better access to markets 16

3.2 Product differentiation 16

3.3 Technological rent 17

3.4 Cost of materials and energy 18

3.5 Cost of capital 18

3.6 Cost of labour 19

4 Empirical setting 21

4.1 Data description 21

4.2 Variable definitions 22

5 Empirical estimation 26

5.1 Estimation model 26

5.2 Empirical results 27

5.3 Model discussion 27

6 Conclusion 29

Bibliography 31

ANNEX I 35

ANNEX II 38

List of Tables

Dimensions of Environmental Innovation Distinguished in MIP 2009

...4

Variables definition 26

Probit Estimation 28

List of Figures

Spill-over effect of innovation 11

Schematic representation of the Porter hypothesis 12

List of Abbreviations

CIS Community Innovation Survey

ER Environmental Regulation

EU European Union

MIP Mannheim Innovation Panel

OECD Organisation for Economic Co-Operation and Development

PH Porter Hypothesis

R&D Research and Development

US United States of America

1 Introduction

Environmental issues are at the core of most of the economic

and political debates nowadays. The problem is so important that it has become

a recurrent subject of most of the world's top level committees such as the G8.

The current economic context has also brought to the table the discussion about

the competitiveness of the developed economies, with the businesses at their

core, and how governments may revive the comparative advantage of their

countries through well-designed regulation. All in all, one can notice that all

of these three aspects are linked one another in a certain way. Intuitively,

the starting point would be that the governments would intervene via the

regulation in order to reduce the environmental externalities, but the matter

of businesses' competitiveness is not less of importance in the point of view

of politicians seeking democratic legitimacy. Moreover, the classical economic

mind-set of the market economies is that the government shall not intervene in

the private economic field unless the intervention is justified by a market

failure or for redistributional purpose. Interestingly enough, Professor

Michael E. Porter came, at the beginning of the 1990s, with a revolutionary

idea defying all preconceptions: `Environmental regulation will trigger

innovation and thus increase the competitiveness of businesses.' The idea was

absolutely astonishing for economists at that time and the politicians took

immediately this hypothesis as a chief argument to support more Environmental

Regulation (ER). Porter argued that even if the impact of stringent ER might be

«challenging for the national industry at the very beginning», the

long run result would be an enhanced competitive position at the global level

for innovative business developing new environmental technologies to improve

their products and processes (Blind, 2011). The Porter Hypothesis quickly

became a counterhypothesis to the existing paradigm which stipulates the ER

will necessarily impact negatively the business competitiveness as it bound the

innovative projects of the firms to a limited scope of activities, in this case

environmental issues, and thus, will only lead to supplementary costs.

Consequently, during the last two decades a vivid debate has

been raised opposing the two different perspectives. On one hand, the

ground-breaking view correlating ER is with enhanced competitiveness rather

than the traditional view of an adverse effect as a result of additional costs

imposed to the businesses, on the other hand. Many managers and analysts have

begun to convey the idea that it is imperative for companies to financially

care about the environment (Lanoie and Laplante, 1992), either to protect their

reputation or improve their access to capital markets. Beyond these indirect

effects, a growing number of examples

started to show that certain activities related to

environmental management can have a direct positive effect on the financial

situation of companies. In other words, some activities may be cost effective

and bring a "green return" while helping to protect the environment at the same

time.

In light of the preceding arguments, the objective of this

thesis is as simple as humble. Instead of analysing the Porter hypothesis as a

whole, the investigation will be limited only to the second part of the effect.

To put it differently, the hypothesis will be dismantled into two chains: the

first one is how ER may trigger eco-innovation and the second one is how

eco-innovation may improve firms' competitiveness. In this context, the main

problematic of current thesis will be:

Does eco-innovation impact positively the firms'

competitiveness?

To investigate this central problematic, several sub-questions

will be tackled in order to better understand how eco-innovative firms may

outperformer their non-innovative competitors. The following sub-questions will

be then addressed:

Do eco-innovative firms have access to more markets than their

competitors?

Does green product differentiation explain a higher return for

firms investing in ecoinnovation?

Do they benefit from innovation by trading their new technologies

in the environmental innovation market?

Is the cost efficiency for materials and energy at the origin of

their competitive advantage? Do they have access to lower capital cost?

Do they enjoy a higher labour productivity?

As an a priori answer to the central questions, the following

general hypothesis will be formulated:

Eco-innovation does have a positive return on the competitiveness

of the companies. Following the same logic, the six sub-hypothesis are:

Eco-innovative firms have access to green markets compared to

their competitors. By differentiating their green products firms may apply a

higher mark-up.

The patent stock of green technologies represents a rent for

eco-innovative firms. Product and process eco-innovation diminish wasted inputs

and increase efficiency. Shareholders value the environmental implication of

the firms.

Thanks to a better commitment of the employees to the company's

value, the eco-innovative firm's labour-productivity is higher than its

competitors, ceteris paribus.

The methodology used to explore this subject is descriptive

and analytical with a literature review of some of the most important empirical

and academic works in the field. The test of the PH will be conducted via an

empirical model based on innovation data of German companies from the Mannheim

Innovation Panel, with an ordinal limited dependant variable model, more

precisely an Ordered Probit Model ideal for data collected via

surveys.1

Following the present introduction, section 2 will, after a

brief definition eco-innovation and its determinants, summarise the results of

some key empirical paper written by economic academia to either confirm or

refute the PH. Section 3 will setup the theoretical foundations for each of the

six hypotheses. Section 4 will present the dataset and define the variables

used for the empirical model. In section 5, the steps of the model building

will be exposed together with the empirical results and their discussion.

Finally, the conclusion will comprise a summary recalling the main results of

the thesis.

1 In this context I would like to thank very much

my academic supervisor Professor Klaus Rennings and my analytical supervisor

Professor Christian Rammer for all their valuable advice, their helpful

assistance and especially for giving me the opportunity to visit the ZEW and

have access to the Mannheim Innovation Panel (2009) without which the current

thesis could not have been conducted. Not to mention Professor Eric De Souza

for his econometric assistance and his availability.

2 Literature review of the academic background

2.1 Introduction

In the following section the key concepts for a thorough

understanding of the subject of the present thesis will be exposed. It will

start with a relatively short definition of ecoinnovation from three different

perspectives, followed by a discussion of the drivers of innovation in general

and eco-innovation in particular. Right after, the Porter Hypothesis (PH) will

be introduced. In order to have a better focus on the object of the thesis, the

PH will be dismantled, according to a common methodology in the literature,

into two main hypotheses: The `weak' PH and the `strong' PH. The former is

often, in its turn, decomposed into two hypotheses including a `narrow' one.

Since the main problematic is about the strong PH, a particular attention will

be given to this part with arguments for and against as well as an objective

critic of the PH as a whole.

2.2 Eco-innovation

2.2.1 Definition

Klemmer (1999) defined eco-innovations as all the

«techno-economic, organisational, social and institutional changes leading

to an improved quality of the environment». He made a clear distinction in

his article between end-of-pipe and integrated production techniques which may

concern either product or process innovation (Rennings, 2000). The conventional

comprehension of product innovations is, as articulated in the Manual of Oslo

(OECD/EUROSTAT, 2005), the innovation that may lead to novel products or

enhanced ones. Nevertheless, the scope of product eco-innovation includes the

application of known technologies for new utilisations or the investment in new

technologies in order to enhance current products with improved environmental

impact, for example products that need fewer inputs. Thus, the main difference

between environmental and conventional product innovation is that the former

abates the environmental problems. It is important to note that sometimes

businesses achieve product eco-innovations even without a clear purpose of

preventing environmental externalities. Consequently, product eco-innovation

is, before anything else, a wise business decision that associates cost cutting

strategy with environmental benefits (Triebswetter & Wackerbauer, 2008).

Kemp and Pearson (2008) suggested a more exhaustive definition

of eco-innovation with three main characteristics, namely the novelty, the aim

and the state of art compared to alternatives:

«Eco-innovation is the production, application or

exploitation of a good, service, production process, organizational structure,

or management or business method that is novel to the firm or user and which

results, throughout its life cycle, in a reduction of environmental risk,

pollution and the negative impacts of resources use (including energy use)

compared to relevant alternatives».

2.2.2 Determinant for eco-innovation

Determinants of innovation in general and eco-innovation in

particular are usually divided in the literature in two distinct components:

the supply side and demand side drivers. In case of the supply side, the

crucial importance of innovation for businesses is supposed to push mangers to

seize the opportunity to develop new technologies, and this is known as the

`technology push'. On the other hand, the demand for new products will force

the businesses to adapt themselves and innovate, this is known as the `demand

pull'. Likewise, the supply push and the demand pull are considered by the

evolutionary theory of innovation as the main drivers for innovation (Nelson

and Winter, 1977; Pavitt, 1984), as pointed out by Triebswetter &

Wackerbauer (2008):

«Already Schumpeter (1942) further differentiates the

innovation process according to market power. He assumes a positive

relationship between market power and innovation, suggesting that large firms

are more innovative than small ones. According to Schumpeter, monopolists are

more innovative because they enjoy superior access to capital, have better

possibilities to pool risks and can exploit economies of scale in maintaining

costly R&D structures.»

Other authors consider `technological opportunities' as a main

driver of innovation, meaning that if there is room to develop technologies not

yet discovered, businesses will immediately invest in innovation in order to

grasp this opportunity (Cohen and Levinthal, 1989) but only under minimum

conditions of intellectual protection as patents, privacy rights, etc.

Likewise, the first mover advantage, `learning curve effects', and economies of

scale (Dosi, 1988) or via regulation by created new demand for instance

constitute other important drivers for innovation.

Consequently, ER constitutes a relevant eco-innovation driver,

as suggested above; together with the push-pull effects of both market sides'

factors that encourage ecoinnovation (Kemp, 1993). Admittedly,

«profit-maximising firms will seek ways to reduce their production costs

for a given level and quality of output, including environmental aspects.»

(Triebswetter & Wackerbauer, 2008)

In fact, according to Türpitz (2004) ER has played a

great role in the development of eco-innovation and thusly reducing the

environmental externalities. Another research found that for proactive

innovative companies, the «anticipation of upcoming legislation is a

decisive factor for environmental innovations» (Rehfeld et al., 2004).

Krozer, (2002) argues that «none of the other drivers

(e.g. new technology, incentives, information or knowledge transfer) have been

found to be as significant as the legislative push for eco-innovations.»

Since, ER offers a «clear time lines and certainty of regulation»

which is much valued by managers. Clayton et al. (1999) came to the same

conclusion about the positive effect of ER on eco-innovation; however they

added that it should be adapted to the specific features of each industry.

Finally, Ashford (2002) pointed out the critical importance of the design of ER

(whether it is market-based or Command & Control) in order to limit the

trade-off between environmental protection and competitiveness.

2.3 The Porter hypothesis

According to Lundgren & Marklund (2010), the common

argument against strict ER is that companies are obliged to decrease

production, or shift capital investment to particular assets that might be less

productive. Therefore, both the level and the growth of the productivity might

be hindered, and consequently the competitive position of the firm and its

revenues. In other terms, the ER is not appreciated by managers since they

consider only the considerable incremental costs caused to their business.

Nonetheless, Michael Eugene Porter, Harvard Business School Professor, looked

critically into these arguments (Porter, 1991) and came to the conclusion that

«right kind stringent environmental regulation», such as market based

instruments i.e. «pollution taxes, tradable permits, and deposit-refund

schemes» (Porter and van der Linde. 1995, p. 111), might on the contrary

increase the competitiveness of businesses. This argument is known nowadays as

the Porter Hypothesis. This premise is detailed in the article written by

Porter with the collaboration of van der Linde (1995). The authors exposed as

their main argument the fact that the link between business's competitiveness

and ER must not be observed from a static point but rather for a dynamic one.

The dynamic understanding of this relationship allows figuring out the positive

impact on the performance of business through `over-time adjustments'. To put

it differently, firms must adapt themselves in order to comply with the ER by

incorporating process and technological innovation that that will enhance

business competitiveness. Henceforth, the profit increase may be so important

that the costs of compliance induced by the ER are

offset. In view of that, ER has an ultimate positive effect on

both the business through enhanced competitiveness and the society with less

environmental damages. This situation is commonly called the

«win-win» PH or the double dividend, furthermore, this

«win-win» situation is seen in the academic literature as the

«strong» Porter hypothesis. Likewise, the situation where ER will

stimulate only certain kinds of eco-innovations without a direct effect on the

competitiveness of the firm is presented as the «weak» Porter

Hypothesis (Jaffe and Palmer, 1997). A third version of the PH is the

«narrow» one; it stresses the fact that flexible ER is more likely to

achieve the expected results than command and control type of environmental

policies. (Lanoie, et al., 2011)

2.3.1 The weak Porter hypothesis

The neoliberal economic view is that economic agents (firms,

consumers) behave effectively under the rules the free market. Supply and

demand will determine the prices on each market which will send a signal to

economic agents so that they can take the right decisions. In fact, if the

market works perfectly, scare resources available to the company will be

allocated optimally (Lanoie & TANGUAY, 1999).

If this is the case then government intervention in economic

affairs is to be avoided since the market is efficient. Indeed, government

intervention will only be useful for redistributional activities or when

markets do not play well their role, in other words, in case of a market

failure (Lanoie & TANGUAY, 1999). This is precisely what happens in the

case of environmental externalities. In fact, one of the essential features of

the well-functioning of the markets is the existence of well-defined property

rights (Coase, 1960). Clearly, in case of environmental resources such as air

and water where property rights are very difficult to define, the governmental

intervention is necessary. Since, air and water belong to no one (and everyone

at the same time), the economic agents can use them at a zero cost, while the

actual cost for the whole society is far from being null. The polluters are

given the wrong incentives and, as they use these resources without paying for

their real cost, they intend to overuse them. Therefore, the market mechanisms

alone generate too much pollution compared to what is desirable or optimal.

Government intervention is legitimate in order to control pollution and reduces

it to a level that is tolerable. To do so, the regulator has an array of

instruments such as regulation or taxation that can ensure that the polluters

receive the right signal and face the true costs of the environmental

externalities that they cause (Lanoie & TANGUAY, 1999).

In light of this reasoning, the consideration of the

environmental externality and its internalisation is necessarily associated

with increased costs for companies that used to pollute without suffering any

consequences. The environmental protection is perceived as a trade-off between

those who desire stricter environmental standards and those who have to comply

with these norms, namely the businesses. The challenge is consequently to

balance the desires of society for a cleaner environment and the additional

costs imposed on firms.

2.3.2 The strong Porter Hypothesis

Brännlund and Lundgren (2009, p. 9) defined the strong PH

as the productivity gains induced by the ER so that the whole costs of

attaining it are, at least, compensated by the productivity increases. In this

context, it is relevant to point out that Porter (Porter, 1991; Porter and van

der Linde, 1995) has the credit of giving an approach that deviates from the

dominant design in those days. Porter's argument was that: appropriate

government environmental intervention can trigger innovations that can offset

the costs of compliance with the regulations. As a result of strict ER,

companies will reconsider their production process and will develop new

approaches to reduce the pollution while lowering their costs and / or

increasing their production. The possibility that regulation encourages

innovation imply that firms decisions are not always the optimal choices as

there is a high level of information imperfection and a certain inertia while

organisational opportunities and technologies are developed continuously. Thus

many innovation opportunities are overlooked by firms as their level of

awareness is limited. If ER stimulus to eco-innovation is sufficiently

important then ER would offer the possibility to improve environmental

conditions at zero cost or negative net costs by improving productivity.

Consequently, by stimulating innovation, ER may actually make businesses more

competitive. As an example, regulations on recycling products could lead to the

recovery of valuable materials more easily. Both consumers and producer could

then end up winners when disposing of the consumed product. (Lanoie &

TANGUAY, 1999)

Undoubtedly, such a view has received close attention from all

stakeholders who want stronger environmental policies, such as

environmentalists. If ER may be without costs or even with negative costs then

regulation is good for both the environment and the businesses.

Porter initially expressed his argument in a one-page article

(Porter 1991) and then extensively formulated it in a common article with van

der Linde (1995) and later on with Esty (1998). According to Porter (1991)

«strict environmental regulations do not inevitably

hinder competitive advantage against foreign rivals (p.

96)». And «... the environment-competitiveness debate has been framed

incorrectly (Porter & van der Linde 1995, p. 97)». The authors

emphasised the crucial role of innovations as their core argument. Wagner

(2004) indicated that: «In reality, one is faced with a dynamic

competition process, rather than a framework of static optimization.»

Because firms are «... currently in a transitional phase of industrial

history where companies are still inexperienced in dealing creatively with

environmental issues (Porter & van der Linde 1995, p. 99)», which

implies incomplete information and organisational inertia. Wagner (2004) adds:

«In such a situation properly designed regulation can have an influence on

the direction of innovation in that (Porter & van der Linde 1995, p.

99-100):

- It signals to firms resource inefficiencies and possibilities

for technological improvement;

- If focused on information provision, it can increase firms'

awareness for improvement potentials;

- It reduces the uncertainty of net paybacks from investments;

- It «... motivates innovation and progress» (Porter

& van der Linde 1995, p. 100);

- It provides a `level playing field' and is necessary in

situations with incomplete offsets.»

The idea underlying the reasoning of Porter is that pollution is

generally associated with resources and raw materials that are not fully

utilised or wasted energy.

«Pollution is the emission or discharge of a (harmful)

substance or energy form into the environment. Fundamentally, it is a

manifestation of economic waste and involves unnecessary, inefficient or

incomplete utilization of resources, or resources not used to generate their

highest value. In many cases, emissions are a sign of inefficiency and force a

firm to perform nonvalue-creating activities ... Innovation offsets will be

common because reducing pollution is often coincident with improving the

productivity with which resources are used.» (Porter and van der Linde,

1995, p. 98)

Thus there is room for innovation in order to prevent

pollution and reduce the waste. Specifically, Porter refers to two broad

categories of innovations. Firstly, process improvements when reducing

pollution is associated with higher productivity through material savings,

reduced energy needs and reduce costs of disposal; a typical example is to find

ways to use waste, scrap and residues as new combustion source. Secondly, there

are also gains to be made at products level where reducing pollution is

accompanied by a design

product of higher quality, safer, cheaper, with more value for

the consumer or is less costly to the trash. (Lanoie & TANGUAY, 1999)

The academic research conducted by Sinclair-Desgagné

and Gabel (Sinclair-Desgagné 1999; Gabel & Sinclair-Desgagné

2001; 1993) came to a similar conclusion, they considered in fact ER as

«... an industrial policy instrument aimed at increasing the

competitiveness of firms, the underlying rationale for this statement being

that well- designed environmental regulation could force firms to seek

innovations that would turn out to be both privately and socially profitable

(Sinclair-Desgagné 1999, p. 2)». Moreover they proposed a number of

conclusions such as «... [it is] inconsistent, albeit convenient, to

assume that markets are flawed but that firms are perfect (Gabel &

Sinclair-Desgangé 2001, p. 149)». Another conclusion was that

although «standard neoclassical-economics models do not support the

systematic presence of low-hanging fruits (Sinclair-Desgagné 1999, p.

3)» the authors indicated that «[I]nnovation itself is not free, and

if one prices managerial time and all other in puts correctly at their

opportunity costs, it should become clear that putting stronger environmental

requirements on polluting firms generally increases their production cost more

than their revenue (Sinclair-Desgagné 1999, p. 2)». Ambec and Barla

(2006) observed that the management tend to be `present-biased' and may delay

investment in costly assets even if they may be productive («low-hanging

fruits»):

«Because the cost of innovating is for «now»

while the benefit is «later,» a present-biased manager will tend to

postpone any investments in innovation. By making those investments more

profitable or requiring them, environmental regulations help the manager

overcome this self-control problem, which enhances firm profits» (Ambec,

et al., 2010).

In addition, according Gabel & Sinclair-Desgangé

(2001) «[It] is logically most likely in situations where the firm is far

from the efficiency frontier, where the burden of the compliance cost is light,

and where the shift to the frontier can be made cheaply» (p. 152).

Finally, Xepapadeas & de Zeeuw (1999) concluded that «basic argument

nevertheless remains the X-efficiency argument that external shocks caused by

stringent environmental regulations may reduce inefficiencies and failure

within the firm».

Another way to look at the situation is to suppose that

businesses might operate under their potential because of bad management and

lack of perfect information. A clear definition of property rights (Coase,

1960) with regulation to limit information asymmetries (Akerlof, 1970), may

lead to Porter's the win-win or positive sum game with Pareto

improvement. In practice, however, regulation usually has been

associated with decreased competitiveness, deterring innovative activities

(Cerin, 2006).

Ambec and Barla (2007) explain, through a game theory

application, the spill-over effect of R&D investment that justifies the

Porter hypothesis. Consider two firms with the same technology and each with a

monopoly on two separate markets. They get a profit of ðp. Each

firm must decide whether to invest in research and development (R&D) to

achieve a more productive and cleaner technology that allows it to achieve a

gross profit of ðV with ðV >ðp. The cost

of developing this new technology is I. Consider the extreme case where the

spill-over is complete so that a company has a perfect access to results of

another firm at no cost. In other words, innovation is a public good. A company

can have access to new technology at no cost if its competitor invests in the

project. If the two companies perform R & D investment that each should

I/2. The game is represented by the following matrix:

Spill-over effect of innovation

Firm 2 No R&D R&D

Firm 1 NoR&D

R&D

ðp, ðp

|

ðv, ðv -I

|

|

ðv -I , ðv

|

ðv -I/2, ðv -I/2

|

Figure1: Ambec and Barla (2007)

So if ðv-I <ðp but

ðv-I/ 2> ðp, then this is exactly the

situation of the so-called classic `prisoner's dilemma': the Nash equilibrium

is `no firm invests' while if they could cooperate, both would benefit from the

jointly developed the new green technology. Environmental regulation as a

standard that forces the adoption of new technology could therefore benefit

both players. Other environmental regulations a priori costly for the company

such that a carbon tax or a system of emission permits would lead to the Nash

equilibrium where both firms invest in R&D. They save on the costs of

R&D spill-over, the new technology requires an investment of individual

I/2. Their final gain is ðv-I/2, greater than the gain before

regulatory Nash equilibrium ðp. (Ambec & Barla, 2007)

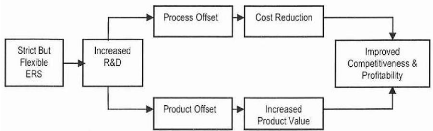

Schematic representation of the Porter hypothesis

Figure2: Ambec & Barla, (2006)

2.3.3 Critics of the Porter hypothesis

The controversy around Porter's hypothesis has animated

several debates among economics academia. The motives are different: Firstly,

the questioning of the basic paradigm that the firms maximise their profit

under free market condition with no need to any supplementary restraints,

otherwise these constraints will rather increase their costs and consequently

impact their competitiveness negatively. Secondly, the lack of analytical proof

in Porter's work based on case studies of some companies in selected sectors,

which does not allow for generalising. «Is it really in all areas that the

`profitability green' is possible?» According to Palmer et al. (1995),

before concluding that more stringent ER has to be applied, one should first

answer the previous question. Thirdly, the governmental intervention in the

private sector is subject of a debate among economic researchers in order to

identify business opportunities. For Palmer et al. (1995) «if

opportunities exist, the state does not have to intervene to encourage

companies to identify them, they will do it for themselves given that firms are

aware of systematic improvements production process or technology». Many

researchers agree that ER may trigger eco-innovations; however this case would

be «the exception rather than the rule». Thus, even if businesses may

overlook new cleaner and cheaper processes, it is dubious that regulators are

better capable to assess the innovative potential than company management.

In the same vein, while defining competitiveness broadly,

Jaffe et al. (1995) have identified one hundred studies on the effects of

environmental regulations on competitiveness. There is little empirical

evidence that supports the hypothesis that the regulation has had an adverse

effect on the competitiveness of firms. If the long-term costs of regulations

can be high, including high costs on productivity, studies measuring the

effects of regulation on net exports, trade flows and the

decisions (re) location of firms have produced estimates that are generally

insignificant. The reasons given by economists have little to do with

compensating innovations. Except for the most polluting industries, the costs

of the environmental regulatory compliance represent a small proportion of

total costs. Moreover, firms seem reluctant to (re) locate for reasons of

environmental standards. (Lanoie & TANGUAY, 1999)

Similarly, the relationship between ER and competitiveness has

been largely debated among academics. Fundamentally, two main visions are

opposed concerning this link between competitiveness and ER. On one hand, the

traditional school which main concern is the possible negative effect that

would have a governmental intervention on productivity and competitiveness of

private economic agents (Palmer et al., 1995). On the other hand, the defenders

of the `win-win' situation generated by the ER as a stimulus for

eco-innovation, leading ultimately to both a decrease in environmental

externalities and a boost of business productivity (Porter and van der Linde,

1995). Several empirical analyses have been conducted to show the

dissimilarities between the two views. The empirical results concerning the

test of PH on the link between ER and competitiveness are quite equivocal. The

most influential articles found in the literature would be «Stewart,

(1993); Gray and Shadbegian, (1995); Repetto, (1995); Boyd and McClelland,

(1999); Wagner, (2004), King and Lennox, (2002); Sharma and Arragon-Correa,

(2005)» (Triebswetter & Wackerbauer, 2008). However, a strong

empirical support of PH is hardly found (Murty and Kumar, 2001).

Another argument against the PH is brought by Simpson &

Bradford III (1996), showing that typically stricter ER leads will not enhanced

firms' competitiveness because it governmental intervention will rarely trigger

the right eco-innovation. They add: «... it is by no means clear that the

benefits will repay the investment in the necessary innovation ... innovation

as the mechanism by which stringent environmental regulation is translated into

long-run competitive advantage (Simpson & Bradford III 1996, p. 283)».

They justify their analysis on the basis of incremental costs, assuming that in

order for a firm to improve its competitive position it has to decrease its

marginal costs but they found that regulation would rather increase the

marginal costs on what they called «direct effect», while the

indirect effect would be a decrease in variable costs «and thus marginal

costs through innovation». They made the assumption that«...the

government's objective is to maximise a domestic firm's profits net of the

(presumed) environmental externalities it imposes (Simpson & Bradford III

1996, p. 283)». The authors came to the conclusion that even if «it

is possible to develop a model in which effluent taxes in excess of marginal

external

damages are optimal (Simpson & Bradford III 1996, p.

284)» it will not be easy to define the right design for ER so that it

will trigger eco-innovation, and if so it will be valid only for some specific

situations and therefore it may create collateral disadvantages for other

industries for instance. Henceforth, «even if tougher environmental

regulations did serve to enhance competitive advantage, the same objective

might be achieved more effectively by more direct and conventional policies

(Simpson & Bradford III 1996, p. 284)», consequently

«...tightening regulation to induce advantage may be extremely dubious as

practical policy advice (Simpson & Bradford III 1996, p. 284)».

Another major critic addressed to the PH by its opponents is

the (implicit) assumption of overlook opportunity to `voluntarily' enhance

their competitiveness through environmental innovation. The metaphor used is

that there is no «10-Dollar bill on the ground because if it was there,

somebody else would have picked it up already» (Wagner, 2004). The other

questionable assumption is the one arguing that the governmental regulator is

more able to define the most effective ER in order to encourage eco-innovation

without negative impact on firms' competitiveness. In the same context, other

economists challenged the PH by the assumption of profit maximisation and the

other metaphor of the "low hanging fruit", arguing that if it was any

opportunity for firms to increase their profit there is no need for regulation

since the economic agents are rational (Wagner, 2004).

According to Palmer & al. (1995), even if RE may

eventually increase the competitiveness of businesses through eco-innovations

«these cases would be the exception rather than the rule». They argue

that the return of R&D investment is hardly determined «ex-ante»;

«it may be that, by chance, a company is equipped with technology that ex

post turned out to be profitable». They added that Porter and van der

Linde procedure of listing some "success stories" is far from proving the

presence of a «systematic link between ER positive and

profitability». In this context, Palmer & al. (1995) concluded that

«one could equally find cases where firms have seen their costs and

increase their profits shrink». (Ambec & Barla, 2006)

2.4 Conclusion

To close this section, a brief recall of different points

exposed seems relevant. In fact the first subsection made the difference

between product eco-innovation and process ecoinnovation with a clear

definition of both of them. Secondly, the different drivers of ecoinnovation

were detailed including the so-called push/pull effect of the both sides of the

market for environmental innovation. Finally, the part concerning the PH

touched to its the

different configuration, namely the weak PH with a clear

impact of environmental regulation on eco-innovation (which is somehow a must

happen effect since one would certainly expect firms to adapt if they have to

comply with compulsory standards), the narrow PH with a distinction of the

effects on innovation depending on the design of the environmental regulation,

and finally the strong PH, subject of the current thesis, where no robust

conclusions could be drawn since the results were varying so much from one

study to another. This may also be due to the difficulty to measure empirically

the strictness of the regulation and compare the gains with the compliance

costs to check the total or partial offset. At last, one of the major critics

to the PH remains the fact that the initial hypothesis relies on case studies

rather than empirical evidence which does not allow generalising.

3 Hypotheses of the theoretical model

3.1 Better access to markets

Improving environmental performance may facilitate access to

certain markets. In general, reducing pollution and other environmental impacts

can revive the image or the overall business prestige, thereby increasing

customer loyalty and supporting sales. In particular, if one wants to evaluate

the potential to reach more customers of green companies , it is useful to

scrutinise the policies of public and private organisations that are focusing

more on the environmental performance (or performance in terms of sustainable

development) as a purchasing criterion when selecting suppliers of goods and

services (demand pull). This phenomenon is also known as `buy green'. Many

companies now take into account in their purchasing decisions, considerations

related to social responsibility. Indeed, according to an OECD survey,

involving over 4000 facilities in seven different countries, 43% of these

latter evaluate the environmental performance of their suppliers (Lanoie, et

al., 2007).

The magnitude of the green public procurement is difficult to

assess, but it is clear that this phenomenon does exist. Also, in May 2001, the

Environment Ministers of the OECD countries have adopted an Environmental

Strategy for the first decade of the 21st century that contains a

recommendation to «improve the environmental performance of procurement

practices public.» It seems that by improving their environmental

performance, some companies have actually an easier access to certain markets.

At this stage, given that green procurement seems more present in the public

sector, the companies that are most the likely to benefit from it are those who

sell to the public organisations (construction, energy, transportation

equipment, medical products and office equipment). Taking into account this

theoretical background, one can formulate the following hypothesis:

H1: Firms investing in eco-innovation have a better access to

certain green markets compared to their conventional competitors.

3.2 Product differentiation

When companies decide to stand out by creating products and

services more environmentally friendly, they can hope that, in the future, it

will allow them to exploit lucrative niches within their industry and therefore

benefit from increased revenues and they can pass on the extra cost incurred to

customers willing to pay products or services more environmentally friendly.

Thus, Sinclair-Desgagné (2004, p. 6) writes that «many companies

(like McDonald's, Exxon, etc...) learned the hard way that

consumer loyalty to their products depends largely on the perception that they

are environmentally benign.» It is clear that consumer behaviour can have

a significant impact on sales. It appears that the differentiation strategy is

more likely to be effective if: 1) information about the environmental

attributes of the product is credible (e.g. eco-label), 2) consumers are

willing to pay and 3) innovation is protected from imitation by competitors.

Various examples suggest that a wide range of businesses can actually improve

their environmental performance and achieve higher incomes by using this

strategy. Even companies that produce goods rather homogeneous and usually

difficult to differentiate, such as agricultural products and energy, can also

achieve similar results (Lanoie, et al., 2007).Therefore, and after examining

this condition the following hypothesis may be stipulated:

H2: Eco-innovative firms have a higher return on sales since

they are able to differentiate themselves than other firms.

3.3 Technological rent

Resolution of environmental problems has become an important

business opportunity for companies specialising in this field. This is often

referred to as the `environmental industry'. The important aspect here is to

identify the situations where a company which wants to improve its

environmental performance has optimised its manufacturing or waste management

through the development of technologies for pollution control. This may lead to

the development of technologies that may eventually be sold to other firms.

Companies adopting such a strategy may also receive a benefit from being the

first player («first-mover advantage») and lobby governments in

favour of tighter regulation according to their higher and thus export their

eventual competitive disadvantage.

Since it is difficult to find examples of companies that have

benefited from technological opportunities as derivative trading, one would

assume that «the market of technology for pollution control» as a way

to turn an environmental problem in increasing revenue is not a widespread

phenomenon (Lanoie, et al., 2007). The only example would be the case of

companies which should already have research facilities, and many resources,

and eventually sell to other businesses the technology of pollution control

that they have developed for their own needs. In light of these findings, the

next hypothesis can be formulated as follow:

H3: Firms that invest in eco-innovation increase their

return on sales by selling their technologies to other firms.

3.4 Cost of materials and energy

Porter suggested that pollution is generally associated with

the waste of resources not fully utilised, or loss of energy (Porter 1991 and

Porter and van der Linde, 1995). He concludes that environmental policies both

more stringent and more flexible (e.g. taxes and tradable permits) would

benefit the economy, in a way that they stimulate innovations which will in

turn offset the costs of compliance with these policies. Similarly, Katz (2003)

shows, from a sample of 33 LEED (Leadership in Energy and Environmental Design)

certified green buildings that the financial benefits of green design reaches

more than 10 times the additional cost of environmentally friendly building. In

fact, the range of opportunities to reduce both pollution and energy costs of

equipment and services appear to be quite large. Over the past eight years,

Lanoie has collected more than 50 examples of firms that have succeeded in

reducing pollution as well as the costs of resources, energy and services. Such

opportunities are more likely to stand for companies whose production methods

are flexible and with effective means of communication in order to facilitate

the transmission of new ideas to decision makers. Furthermore, the likelihood

of success is greater for industries subject to fierce competition, hence the

cost reduction is more important in sectors where there are market based

environmental policies (for example, pollution taxes or tradable permits) to

trigger eco-innovation (Lanoie, et al., 2007). Subsequently, the next model

hypothesis is formulated this way:

H4: Eco-innovative firms increase their profit compared to

their non-innovative competitors by producing via more efficient

processes.

3.5 Cost of capital

According to Lanoie, & al. (2007) the capital lies at the

heart of any business. The funds needed to finance a new firm, its growth or

simply the continuation of its activities does not get easily and can be

costly. A company that maintains a positive environmental image may see its

task simplified in three distinct ways: access to green funds, the loan

facility from banks and improved performance in stock markets. Firstly, some

researchers in finance believe that the growing number of green (or ethical)

mutual funds had the effect of increasing the total funds available to

businesses that meet certain environmental criteria. In particular, investments

in U.S. funds subject to control socially rose by 258% between 1995 and 2005.

This exceeds the growth rate of other funds administered by professionals. In

France, the increase recorded was 92% between 2002 and 2006. Canada has also

increased sharply, investments from 65.5 to 500 billion dollars between 2004

and 2006. In 2005, about

10 dollars administered by professionals in the U.S., nearly $

1 (or 9.4%) was invested in a socially responsible fund. This percentage was

between 10 and 15% in Europe. In short, environmentally friendly companies have

access to a growing source of capital which reduces their cost of capital

compared to other similar firms. Secondly, companies that improve their

environmental performance can more easily get financed from banks. Given that

most of the major banks have now teams of experts in assessing the

environmental performance of potential borrowers and especially the potential

magnitude of responsibilities associated with contaminated resources. In

addition, some 40 international banks have adopted the "Equator Principles" in

order to ensure that the projects they fund are held in respect of the

environment, and 17 demonstrate appropriate practices of environmental

management. Thirdly, the shareholders in general may be influenced by

information related to the environmental performance of companies and their

reactions can be felt on the stock market. These movements can, in turn, affect

the cost of capital. Many empirical studies have attempted to identify the

stock market reaction to news about environmental performance. The literature

brings out three dominant approaches: a) portfolio analysis, b) the event

studies and c) the long-term studies using the regression analysis. The vast

majority of these studies indicate that better environmental performance is

associated with better stock market performance (at least, it is not worse).

Rising stock prices relative to the rest of the market may in turn reduce the

cost of capital. Companies listed on the Stock Exchange are more likely to

benefit from lower capital cost as a result of improved environmental

performance. In short, the following hypothesis will be examined

H5: By having access to cheaper capital, green innovative

firms increase their return on sale compared to other firms, ceteris

paribus.

3.6 Cost of labour

To be fully effective, a company must have a clear vision and

well-defined standards with ambitious goals. It would be difficult for any firm

to continue to operate if employees perceive that its products, processes and

objectives are harmful to mankind.

All point to conclusion that a better environmental

performance can reduce labour costs through lower sickness, absenteeism, staff

turnover, recruitment costs and improved productivity. Some analysts, like

Lankoski (2006), have used this argument in favour of reducing labour costs.

However, even if the argument is rather convincing, there is no direct

empirical evidence of this effect. To establish empirical evidence of cost

reductions related to a lesser degree of pollution, the dataset should reflect

the measurements of the costs of

labour, for example the rate of turnover and absenteeism, and

data on environmental performance. Intuitively, the type of companies that

could potentially cut labour costs by improving their environmental performance

would be: 1) those whose emissions may affect the health of their workers, 2)

those that seek to attract qualified workers, including scientists, engineers,

MBA and 3) those established in regions where sensitivity to environmental

concerns is more pronounced (Lanoie, et al., 2007). The last hypothesis of the

subsequent econometric model will be as follows:

H6: The eco-innovative firms will increase their return on

sales by both reducing their labour costs and increasing their productivity as

their employees as they are committed, compared to their competitors.

4 Empirical setting

4.1 Data description

The dataset used for the empirical model in the current thesis

is the German part of the Community Innovation Survey (CIS), also known as

Mannheim Innovation Panel (MIP). MIP is piloted by the Centre for European

Economic Research (Zentrum für Europäische Wirtschaftsforschung) in

Mannheim, on behalf of the German Federal Ministry of Education and Research.

It consists of a yearly mail survey, including an only response option.

Following the first contact by postal mail, if a firms does not answer it

receives a reminder by phone after six weeks with a second copy of the

questionnaire. After another six weeks, a second reminder follows. The sample

is constructed as a panel with lagged variables to allow the construction of

dynamic models. Considering the rather strict ER of Germany, the use of German

firms' data is ideal to test the PH (Rammer & Rexhauser, 2011).

The data used for the following model was collected in the

2009 MIP survey, particularly because it contains a set of relevant questions

on environmental innovations providing key variables for the model. Compared to

other CIS, the MIP has additional questions concerning firms' profitability and

other market structure information essential to build up a model with enough

control variables to avoid omitted variable bias (Rammer & Rexhauser,

2011).

The first wave in 1993 was only designed for the

manufacturing, mining, energy, water and construction sectors followed by

another wave in 1995 that included the service sector and more recently retail,

wholesale, telecommunication as well as consultancy firms. It is drawn from the

Creditreform database (a German credit-rating agency with the largest data base

on German firms) according to the following stratifying variables: firm size,

region, and industry. Every year the same set of firms are asked to participate

in the survey and to complete the questionnaire sent to them via mail. The

sample is updated every two years to account for exiting firms, newly founded

firms and firms that developed to satisfy the selection criteria of the sample.

Additionally a non-response analysis is performed via phone to check and

correct for non- response bias. The participation in the survey is voluntary

and the average response rate is about 25% (Vuong, 2011). According to Rammer

& Rexhauser (2011) «The survey adheres to the Oslo Manual which

provides guidelines for the definition, the classification and measurement of

innovation. The gross sample of the 2009 wave consists of 29,807 enterprises.

The sample is stratified by sector (56 sectors), size class (8 classes

according to the number of employees) and region (West Germany and East

Germany). The target population are enterprises with 5 or more

employees from most economic sectors excluding farming and forestry, hotels and

restaurants, public administration, health, education, and personal and

cultural services with German headquarters.»

In the 2009 wave the total number of companies that replied

with usable information was 7,657, equivalent of 26 % response rate which just

above the mean of similar for voluntary mail surveys of this scale in Germany

(Grimpe and Kaiser, 2010), especially because the questionnaire is considered

as relative long. The final sample is fairly representative of the gross one in

terms of sectoral composition and firms' size distribution of the whole German

companies' population. Rammer & Rexhauser (2011) provide more inside

information on the process of data collection and, eventually, how they

controlled to limit the «selection bias between responding and

non-responding firms in terms of their innovation status». To do so, they

conducted another non-response survey «surveying 4,829 enterprises by

telephone. This survey revealed a higher share of innovating firms among the

non- responding firms (63.1 %) compared to the net sample of responding firms

(54.3 %).» The sample size of the current model is 3,809 observations.

The main dissimilarity with several other CIS panel data sets

is the pattern of individual response. In fact, according to Peters (2008) MIP

«is not a typical unbalanced panel for which information on individuals is

available for a certain time period without gaps. Instead, one observes a lot

of firms which, for example, respond in a certain year but then refuse to

participate for one or more years, only to join in the survey again at a later

date. This means that the time span for firms under observation is marked with

gaps.» He further explains this phenomenon by the possible problem due to

link between firm closures and firms' innovation behaviour that could induce a

selection bias (Peters, 2008).

A last noteworthy drawback of the MIP is that the

eco-innovation data is collected each odd year and not every year.

4.2 Variable definitions

In order to measure profitability variable for the model, the

proxy chosen is the 2008 pre-tax returns on sales. The data was collected from

firms with seven ordered categories with determined thresholds.

The definition of the dependent variable is inspired from

Cearnitzki & Kraft (2008): The starting point will be from the well-known

profit equation:

Profit = Sales-Labour cost-Capital cost-Material cost ... (1)

Next step is to divide the two sides of the equation by sales in

order to get the profit margin:

|

fit _ Sales--Labou r c ost--Capital c ost--M aterial c

|

... (2)

|

|

|

If one considers the unit Marginal Cost (MC) is equal to the

Average Cost (AC) in the long run then the equation (2) may be written as

follow:

... (3)

p and q being respectively the price and the quantity of

output.

According to the authors the methodology followed is the price

cost-margin, they add «the capital costs have been subtracted and need not

to be taken into account by capital divided by sales as an explanatory variable

in the empirical model» (Cearnitzki & Kraft 2008).

To explain return on sales they propose concentration in the

industry and market share arguing that one would expect a greater return on

sales in market with high concentration since firms can price at high levels.

Moreover they expect firms with high market shares to be more efficient and

thus earn higher return on sales. This methodology returns to what was treated

previously in the theoretical part concerning the effect of ecoinnovation on

competitiveness. Therefore, Environmental Innovation (EI) will be considered as

the main explanatory variable and the model will test whether it has a positive

or negative impact on return on sales as an index of competitiveness.

To do so, the definition of the explanatory variable EI will

follow the same methodology as the one used by Rammer & Rexhauser (2011),

where the authors defined EI as «product, process, marketing or

organizational innovations that lead to a significant reduction of

environmental burdens.» Rammer & Rexhauser did not distinguish between

the ecoinnovations which aim explicitly to diminish the environmental

externalities and the ones that are rather «a by-product of

innovations». The definition includes the environmental benefits at both

the firm and consumer level. Also there is no distinction between the new

technologies developed by the firm that are absolutely novel for the market as

whole or only the new use of existing technology by the firm. They argue that

«the rationale behind this view of innovation is that firms can hardly

distinguish whether a new used abatement technology is novel to the whole

market or only novel to the firm.»

The MIP differentiates between 12 distinct environmental

innovations whereas the harmonised CIS survey contains only nine dimensions.

Rammer & Rexhauser (2011) determine which dimensions are processes

innovations and which ones are products innovations.

Dimensions of Environmental Innovation Distinguished in MIP

2009

|

DIMENSION OF ENVIRONMENTAL

BENEFITS

|

SHARE IN

SAMPLE

|

TYPE OF ENVIRONMENTAL

INNOVATION

|

|

EFFICIENCY

IMPROVING

|

EXTERNALITY REDUCING

|

|

PROCESS INNOVATION

|

|

Reduced material use per unit of output

|

35.12 %

|

X

|

|

|

Reduced energy use per unit of output

|

40.82 %

|

X

|

|

|

Reduced CO2 emissions

|

32.16 %

|

-

|

X

|

|

Reduced other air emissions

|

22.86 %

|

-

|

X

|

|

Reduced water pollution

|

22.13 %

|

-

|

X

|

|

Reduced soil pollution

|

14.36 %

|

-

|

X

|

|

Reduced noise burden

|

23.22 %

|

-

|

X

|

|

Replaced materials with less hazardous substitutes

|

22.90 %

|

-

|

X

|

|

Improved recycling of materials, water, waste

|

35.44 %

|

-

|

X

|

|

PRODUCT INNOVATION

|

|

Reduced energy use for the customer

|

35.21 %

|

X

|

|

|

Reduced air, water, soil, noise pollution

|

27.64 %

|

-

|

X

|

|

Improved recycling of product after use

|

23.59 %

|

-

|

X

|

Table1: (Rammer & Rexhauser, 2011)

The main independent variable EI is used according to the

definition of Rammer & Rexhauser (2011); They authors explain in their

article that the data was collected according to the rating of asked companies

on a four grade scale from no environmental benefit to high environmental

benefit. Also, they pointed out the relevance of the variable measuring for the

«expected impact of energy saving product innovation on

profitability». They added «Although external to the firm, energy

efficiency of products could be rewarded by the market since it directly

reduces user costs and therefore could lead to higher profitability.» For

this purpose a dummy variable is created the following table will further

explain the functioning mechanism of certain relevant variables for the model.

The same logic is followed to measure for environmental innovations introduced

during the past year. In order to inspect he hypotheses of the model the

authors created a dummy variable for any type of environmental innovations

which takes the value 1 if a firm introduced either resource efficiency or

externality reducing innovations. Additional control variables are introduced

for sector specific unobserved cross-sectional differences by including 21

two-digit sectoral

dummies (Rammer & Rexhauser, 2011). Finally, according to

Czarnitzki and Licht (2006) an East Germany dummy should be is included since

«this part of the country is characterised by specific economic and

institutional structures resulting from the transformation process, including a

high level public support».

Variables definition

|

INDEPENDENT

VARIABLE

|

DISCRIPTION

|

|

Ost

|

Firms from the `new' German Länder (former East Germany),

(0=Western Germany, 1=Eastern Germany).

|

|

Iages

|

Development of innovation expenditure in the current year

1=increase, 2=steady, 3=decrease, 4=not yet known, 5=not possible to say

|

|

Qual

|

Quality improvement by process innovations: yes=1/no=0

|

|

Wett5

|

Products of competitors can easily be substituted by products of

the firm

|

|

Rek

|

Average costs reduced thanks to process innovations; 0=no,

1=yes

|

|

Ziel9

|

To reduce materials and energy consumption: 0=no importance,

1=little to 3=great importance

|

|

Ziel4

|

To gain access to new markets: 0=no importance, 1=little to

3=great importance

|

|

Mneu

|

Proportion of total turnover from new or clearly improved

products

|

|

Iapgtz

|

Expenditure on product and process design as well as other

preproduction costs linked to innovation projects: 0=no, 1=yes

|

Table2: Adapted from The Mannheim Innovation Panel: Manufacturing

and Mining & Services (2008)

5 Empirical estimation

5.1 Estimation model

Return on sales is collected in MIP survey as scale from 0 to

8 with known cut off points. Ordered Probit Model is the most suited for this

kind of dependant variables. According to Greene (2009), the general model

would be as follows:

The dependent variable in Ordered Probit Model is observed this

way:

Y=1 if Y*?å1

Y=2 if å1<Y*?å2

Y=3 if å2<Y*?å3

...

Y=7 if å6<Y*

In this case Y represents return on sales (Umren) and the cut off

points would be:

0 = 1, 0% to < 2% = 2, 2% to < 4% = 3, 4% to < 7% = 4,

7% to < 10% = 5, 10% to < 15% = 6, 15% and more = 7, estimation not

possible = 8

Y=1 if Y*=0%

Y=2 if 0%<Y*=2%

Y=3 if 2%<Y*=4%

Y=4 if 4%<Y*=7%

Y=5 if 7%<Y*=10%

Y=6 if 10%<Y*=15%

Y=7 if 15 %< Y*

The six independent variables corresponding to each hypothesis

are:

The control variables with a relevant theoretical impact on

return on sales are:

Three different models, M, M1 and M2, will be tested. M

representing the baseline without distinction between eco-innovative firms and

non-innovative firms. M1 being the model for eco-innovative firms and M3 for

the non-innovative firms in order to answer the central problematic of the

thesis.

5.2 Empirical results

Probit Estimation

|

Independent variables

|

Model M

|

Model M1

|

Model M2

|

|

Environmental Innovation

|

0.0822593**

(0.0403479)

|

|

|

|

Market share

|

0.0775999***

|

0.0862508**

|

0.0743373**

|

|

(0.022197)

|

(0.029501)

|

(0.0349319)

|

|

Product differentiation

|

0.0098879

|

0.0501308

|

-0.0946248

|

|

(0.0507557)

|

(0.0605704)

|

(0.0958762)

|

|

Patent stock

|

-0.0457845

|

-0.0516562

|

-0.0376007

|

|

(0.0494725)

|

(0.061838)

|

(0.0841409)

|

|

Martials and energy

|

-0.0692138**

|

-.0523971*

|

-0.1110295

|

|

efficiency

|

(0.0236537)

|

(.0284859)

|

(0.0447996)

|

|

Cost of capital

|

-0.0735411**

|

-0.0505324*

|

-0.2062648 ***

|

|

(0.0255448)

|

(0.0280471)

|

(0.0620886)

|

|

Labour productivity

|

0.8199367***

|

0.9515969***

|

.7446644***

|

|

(0.0427542)

|

(0.0678447)

|

(0.0558337)

|

|

Observations

|

3500

|

1966

|

1534

|

|

Likelihood Ratio

|

646.98***

|

348.64***

|

338.73***

|

|

Pseudo R2

|

0.480

|

0.0463

|

0.0572

|

Table3: Author's own calculation.

5.3 Model discussion

The empirical estimation provides a useful analytical tool to

judge the validity or not of the initial hypotheses postulated in the

introduction of the current thesis concerning the impact on eco-innovation on

firms' competitiveness with an insight of the key differences between

eco-innovative firms and non-innovative firms. The baseline model shows that

environmental innovation does have a significant positive effect

on return on sales which confirms the strong porter hypothesis.

The models M1 and M2 give more visibility of the key

differences between innovative and non-innovative firms in case of green

innovation, providing the reader with additional information concerning with

aspect of the eco-innovation does really explain a higher return on sales for

eco-innovative firms.

In fact, the higher return on sales of eco-innovative firms

compared to non-innovative firms is statistically explained by a greater

coefficient for market share, and labour productivity which confirms the two

hypotheses stipulated previously and lower additional cost (negative impact on

return on sales) in case of cost of capital and materiel and energy efficiency

(Porter justified it by that fact that the impact is actually dynamic rather

than static).

The coefficients of product differentiation, even if they are

not significant, they follow the same logic below with a positive effect for

eco-innovative firms and a negative one for other firms.

And lastly, the coefficient of patent stock has led to the

opposite conclusion but it is not statistically significant.

To put it differently, from the six initial hypotheses only

two were rejected and four confirmed. One may conclude that such results

support, even if only partly, the strong Porter hypothesis.

6 Conclusion

As a conclusion for the current Master thesis, it seems relevant

to recall briefly its content and the central problematic and the main

hypothesis tested:

Firstly, the section 2 allowed framing the subject of the

thesis by clearly defining eco-innovation, its determinants and its impact on

competitiveness through a relatively extensive literature review of the major

empirical works done in the field of the three versions of the Porter

hypothesis, namely the weak, the narrow and the strong one.

The conclusions drawn were not as precise as one would expect,

due primarily to technical limits such as measuring the stringency of

environmental regulation or the specificities of each economic context whether

sectoral, national or global.

Secondly, the hypotheses of the thesis were stipulated from

purely theoretical background and articulated in way that they could be tested

empirically. In this context, here is a reminder of the principal problematic

of the thesis:

Does eco-innovation impact positively the firms'

competitiveness?

More specifically, the model tested whether environmental

innovation (including process and product eco-innovation) has a positive impact

on return on sales as an index for competitiveness. The main hypothesis was

accepted with a significant positive coefficient in the first Ordered Probit

Model estimated.

The model was constructed on the basis of an wide theoretical

literature review which provided the essential assumption to define the

relevant independent variables, namely environmental innovation, market share,

product differentiation, patent stock, materials and energy efficiency, capital

intensity and labour productivity. Additional relevant control variables were

introduced to limit the omitted variable bias.

Among the six sub-hypotheses four of them were accepted and

only the two remaining rejected, mainly because the coefficients were not

statistically significantly different from zero which mean that the two models

were not statistically significantly different from each other.

Thus, one can finally conclude that the strong Porter hypothesis

was only partly confirmed and equally rejected, in respect of theoretical

hypotheses of the current study.

Perfectly aware of the limits of the present analysis, the author

justifies the formal errors by the limited time-frame and analytical resources.

Nevertheless, the originality of the

present paper resides in the fact that besides testing the

strong Porter hypothesis on verifying for the positive impact of eco-innovation

on firms' competitiveness, the analysis goes beyond by searching for the key

factors that differentiate the competitive position of ecoinnovative firms

compared to their non-innovative competitors. The preliminary results pending

further investigation confirmed three key factors that allows eco-innovative

firms to outperform their competitors, ceteris paribus, namely: access to green

market such as green public procurement, materials and energy efficiency

(Porter's main argument) and access to border sources of capital at a lower

cost either because stockholders valuate environmental implication of the firms

or by responding to the criteria of green mutual funds.