Chapter 7: Portfolio Theory in Private Equity

When we think about an investment fund, we immediately think

«portfolio». And a series of questions arise in my mind:

- What is the typology of the portfolio in terms of risk and

return?

- What are the constituents of the portfolio? Ad how many?

- What is the impact of the constituents' nature on the

performance of the portfolio?

- How these portfolio constituents have bee selected? And why?

- How much time these constituents will be kept in the portfolio?

And why?

If I summarize those questions, I'll be right in the Portfolio

Theory core considerations. That's why this chapter deals with this discipline.

My intention here is not to get in the details of «modern portfolio

theory» and the way of thinking of its originators and masterminds such as

Sharpe or Markowitz. My purpose here is to unveil how the PE industry stands

from the perspective of portfolio theory when it sets up its funds. For sure

they consider a risk return pattern but do they build a model that underpins

this pattern? In another terms, are the investment decisions linked on to

another to stick to this certain pattern, or are they independent and in such

case the pattern is just a target yet there is plenty of flexibility for

whether to reach or not this target.

Again, as we discussed in the previous chapter about «risk

management», and from my experience, I never heard or met a PE fund that

applies «portfolio theory» in the strict sense of the term. Yet, the

basic principles of portfolio theory are indeed followed in terms of

diversification of assets and portfolio risk decreasing.

Let's first define «Modern Portfolio Theory» (MPT) and

mention for which investment vehicles does it apply the most to draw some

differences and answer why PE funds don't use modern portfolio theory in a

strictly manner but rather some basic principles.

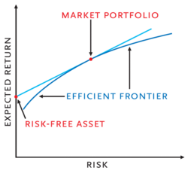

MPT proposes how rational investors will use diversification to

optimize their portfolios, and how a risky asset should be priced. The basic

concepts of the theory are Markowitz diversification, the efficient frontier,

capital asset pricing model, the alpha and beta coefficients, the Capital

Market Line and the Securities Market Line. MPT models an asset's return as a

random variable, and models a portfolio as weighted combination of assets; the

return of a portfolio is thus the weighted combination of the assets' returns.

Moreover, a portfolio's return is a random variable, and consequently has an

expected value and a variance. Risk, in this model, is the standard deviation

of the portfolio's return.

MPT is

generally applied by «Mutual Funds» investing in big caps on the

markets and aiming to bring income and retirement solutions to individual and

institutional investors wishing to invest revenues or excess liquidities for a

certain period of time and for specific purposes.

In fact,

the main difference between PE funds and Mutual Funds (especially with big caps

focus) is because they only invest in non public and closely held companies.

Therefore, they don't deal with «market risk» or «systematic

risk» associated within the publicly listed companies; again remains the

«non market» or «unsystematic risk» to deal with for the PE

funds.

But, PE

funds and MF resemble in the way they deal with the «non market» and

diversifiable risk. Indeed, «modern portfolio theory» being the way

to construct «optimal portfolios» in terms of «risk-return»

couple using «diversification» as a main tool to reduce «non

market risk» and in consequence drive down the return as an immediate

answer to satisfy the principle of «the less the risk the less the

return» in an efficient financial market; the PE funds will also focus on

constructing optimal portfolios using diversification and reduce the

«unsystematic risk» associated with the failure of one or several

companies, yet without forgoing an excess return.

Let me

explain a bit more this point. Whereas MF invest in public companies considered

at mature life stage (especially big caps MF), PE funds rather invest in non

public and closely held companies considered more in a development or growth

stage or sometimes in what we call in the PE jargon a «turnaround»

stage meaning a shift from a core business to another. Growth companies are

more likely to realize excess returns than any of the mature companies. That's

why when investing in growth and development stage companies, PE funds have a

highest probability of making excess returns than MF do.

Then, we

can understand that increasing the number of portfolio companies in a PE fund

will not decrease the probability of making astonishing returns because each

stand alone company has a high probability of making those returns which is not

the case for MF especially those investing in big caps. Hence, increasing the

number of companies or investing in different industries will decrease the

risks of the portfolio but will not decrease the probability of excess returns

since each company has the capacity to achieve those returns. This last point

also involves the experience of the PE fund team, because the more seasoned the

team, the less the probability that the company won't meet the expectations in

terms of returns.

Actually,

we stressed the notion of MF investing in big caps because some MF behave like

PE funds in the sense that they invest in small and mid caps not yet in the

mature stage, hence with an important growth potential. In this case, their

stance to MPT is the same than PE funds, but those MF are just different

because they are open-ended not closed-ended funds.

Also,

in a PE fund, risks are very high but so are the excess returns. This is

actually the «financial model» of any PE fund and also partially

explains the reasons why PE funds don't follow MPT in the strict sense. By

being able to make growing and sustainable Cash Flows in their portfolio

companies, PE funds could offset the unsystematic risks associated within those

companies by selling at an opportune time and capturing the returns

«today» based on the future growth and cash inflow of their

companies.

The second

part of the discussion regarding PE funds and MPT consists in the philosophy of

investing regarding PE and MF funds. Whereas the MF (especially big caps MF)

generally adopt a «buy-to-hold» strategy and don't try to time the

market; PE funds rather adopt a «buy-to-sell» strategy that is

independent from the financial market. Therefore, MF's look at their portfolio

with a timetable that is different from the PE funds timetable. MF's try to

enhance the «risk-return» function by acting «marginally»,

meaning that they change their perimeter to push the frontier of their

portfolio to a better «risk-return» curve; whereas PE funds act

«globally» (and don't push marginally) to create ad hoc an optimal

portfolio that fit the best their risk-return target.

Hence, in

terms of modern portfolio theory consideration, there is less need for the PE

funds to apply the theoretical concepts of risk-returns models to achieve

optimal portfolios than for the MF's. In reality, PE funds don't have

risk-returns models, as we described here, they only target an excess return

rate measured by the IRR of the fund and try to reach it by first selecting

good prospects and second helping the executives reach the forecasted

objectives.

|