|

NGUYEN Kim - MARTOT Cédric - PALLIN

Olivier

PIZZONI Nicolas - ZAPPULLA Damien

ESCT - Promo 2008 - DA

![]()

Introduction

I) Company profile

v Air France: Background

v KLM Royal Dutch Airline: Background

v Air France - KLM Group: `Highways To

Success'

v Mission Statement

v Vision 2010

v SWOT

II) Successful merger through network

management

v New Business Model (course network

strategy)

v The merger becomes a necessity

v Results and next major challenges

III) Sky Team Alliance: «Miles» your

flight

v Skyteam : Mile's your flight !

v Connecting strategy to relationship

IV) Air France - KLM: new leader of low cost

airlines?

v Low cost traffic isn't marginal!

v Transavia: Air France-KLM strikes back (Netherlands

low cost airline company)

![]()

Introduction

Few inventions have changed how people live and experience the

world as deeply as the invention of the aircraft. During the both World Wars,

government subsidies and demands for new aircrafts vastly improved techniques

for designing and building them. Now, the industry has progressed to the point

where it would be hard to think of life without air travel.

During dozen of years, the airline industry was either partly

or wholly government owned. This is still true in many countries, but in Europe

and in the United States, all major airlines are private. This major shift has

definitely changed the situation on the market for both airlines and

travelers.

If the airline industry could be described in three words,

they would be `intensively competitive market'. In recent years, more and more

airlines have appeared which has forced `historic' airlines to enhance their

competitiveness. Thanks to this process of democratization, more people than

ever before travel by airplane nowadays, and more airlines are starting to

offer longer non-stop flights.

At the time of global warming, it appears that the air travel

growth contributes significantly to climate change. Globally, the world's

16,000 commercial jet aircraft generate more than 600 million tones of carbon

dioxide (CO2), the world's major greenhouse gas, per year. Indeed,

aviation generates nearly as much CO2 annually as that from all

human activities in Africa.

At the beginning of the century, it was about technical

challenge. Then, at the turning point of the twenty-first century, the airline

industry is facing the environmental challenge... the most critical challenge

of the humanity. Nowadays, the sustainable development is not just a notion but

a real objective.

To the people who see the possibilities,

And who, sometimes with courage, sometimes with faith and

hope -

But always with effort, perseverance, and energy

(despite self-doubt) -

Strive to make the possible become reality.

Dreams can come true.

I) Company profile

Air France: Background

On 7 October 1933, five French airlines merged to become

officially Air France. These airlines were Air Orient, Air Union,

Société générale de transport aérien

(formerly Farman), the CIDNA (formerly Franco-Roumaine) and Aéropostale.

1946-1960: Soaring High

At the end of the war, Air France renewed its fleet, became

state-owned and introduced scheduled services to New-York. First hostesses were

hired in 1946..

In 1948, an act of parliament created Compagnie Nationale Air

France on June 1948. Air France became then a state-owned carrier. Max Hymans

was appointed CEO of Air France. During 13 years, he implemented a policy to

modernize the fleet with the introduction of state-of-the art jet aircraft.

On 12 November 1952, Air Inter was founded with the aim of

«promoting a coherent network of domestic air routes».

1960-1970: The Jet Era

On 23 February 1960, the French government transferred Air

France's domestic monopoly to Air Inter, compensated by a stake in Air

Inter.

In 1963, Air France had to share routes with its private

sector rivals. In fact, the French government decided the division based on a

law. Under this act, Air France had to withdraw all services for many routes

which were exclusively allocated to the newly formed Union de Transport

Aérien (UTA).

1970-1990: Maturity

In 1976, Air France operated its inaugural supersonic

transport (SST) service on the Paris Charles de Gaulle to Rio route.

By 1983, Air France was the fourth-largest scheduled passenger

airline and the second-largest scheduled freight carrier in the world.

1990-2004: The Merger

Air France, UTA and Air Inter were merged into the new holding

company, Air France Group. This second merger reflected the 1933 merger. The

French government supported the creation of a national carrier to counter

potential threats, resulting from the liberalisation of the EU's internal air

transport market.

The Head Office was relocated to Roissy at the heart of its

operations. This major change was mainly due to Stephen Wolf, a former United

Airlines CEO, appointed as adviser to the Chairman, Christian Blanc. Despite

this, Air France had to wait until 1997 to become again profitable.

In 1999, the status of Air France changed accordingly and the

airline evolved from a national carrier to an Airline major.

In 2000, the SkyTeam global alliance was set up. SkyTeam

offers one of the world's most extensive networks, with four strategically

located hubs in Asia, the United States, Latin America and Europe.

On 5 may 2004, Air France and KLM tied the knot: two of

Europe's oldest airlines which had both witnessed the dawn of international air

transport.

2004-2007: Open Skies

On 17 October 2007, Air France and Delta Air Lines signed a

joint venture agreement to share revenues and costs on their trans-Atlantic

routes. By 2010, the agreement will be extended to all trans-Atlantic flights

operated by Air France and Delta between Europe and the Mediterranean on one

side and North America on the other side.

KLM Royal Dutch Airline: Background

On 7 October 1919, KLM was founded for the Netherlands and

colonies by Albert Plesman, with the consent of Queen Wilhelmina. The airline

then bore the royal seal and was called the Royal Dutch Airlines. This makes

KLM the oldest carrier in the world still operating under its original name.

During that first year, 1920, KLM carried 345 passengers and

25 tons of mail and cargo. In 1921 KLM started regularly scheduled services. By

1926, KLM offered flights to Amsterdam, Rotterdam, Brussels, Paris, London,

Bremen, Copenhagen, and Malmo.

In 1945, KLM resumes services after World War II, initially

only on domestic routes. On 21 May 1946, KLM was the first continental European

airlines to launch scheduled service to New-York.

On 1 November 1958, KLM opened its first flight via the polar

route to Japan. This new polar route avoided the former route via India and

saved 14 hours in flight time. The flight distance was also reduced from 15,815

kms to 13,565 kms.

In February 1971, KLM was the first airline to put the Boeing

747 into service, as the start of «wide-body age».

In 1990, KLM carried 16,000,000 passengers. In 1991, KLM

founds new strong regional airline: KLM Cityhopper. In the same year, KLM

extends its share in Transavia from 40% to 80%. As part of a joint venture, all

KLM and Northwest Airlines flights between Europe and the USA are operated in

1993. Then, in March 1994, both KLM and Northwest introduced World Business

Class on intercontinental routes.

After 5 years, KLM-Northwest Airlines alliance has been

honored with `Airline of the Year Award' by influential US trade magazine Air

Transport World. With the repurchase of all regular shares from the Dutch

state, KLM became completely private owned.

In 2004, KLM and Air France decided to join forces. More than

seven months later, the countdown ended and May 5 stands as the official

birthday of the Air France-KLM Group. In 2005, Air France-KLM introduced its

new frequent flyer programme, Flying Blue. It is the first example in history

of two major European airlines combining their loyalty programmes.

Air France - KLM Group: `Highways To Success'

As a world leader in the air transport industry, Air

France-KLM is pursuing long-term profitable growth. By capitalizing on the

complementary assets of Air France and KLM, the Group has built a balanced

network, organized around its hub airports at Paris-Charles de Gaulle and

Amsterdam Schiphol, two of Europe's largest hubs.

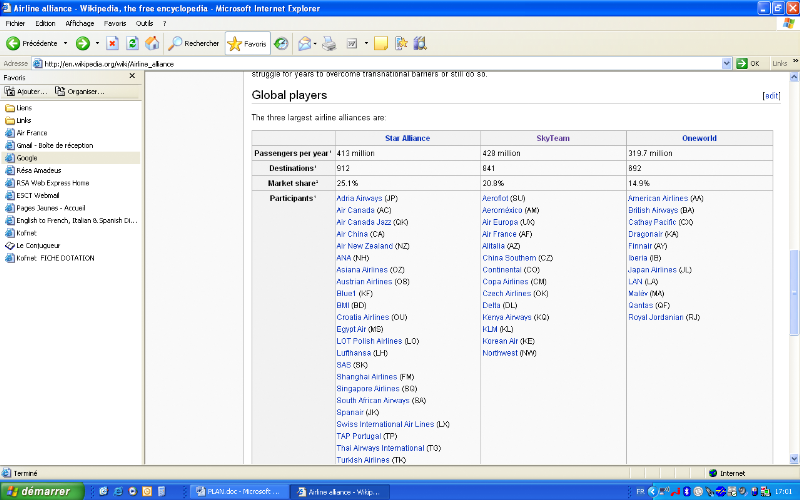

Air France and KLM play key roles in the SkyTeam alliance, the

world's second largest alliance in terms of market share, together with ten

European, American and Asian partners.

The Air France corporate headquarters was located at

Roissy-Charles de Gaulle to the North of Paris. This is where the headquarters

of Air France-KLM is now located.

Air France and KLM are also accredited by IATA with the IATA

Operations Safety Audit (IOSA) for its safety practices.

» Key Figures:

· 103,000 employees throughout the world

· 569 aircrafts in operation

· 73.5 million passengers carried

· 240 destinations worldwide

» In Brief:

The Group is the world leader in terms of

international passenger traffic. Then, it ranks second

worldwide for its cargo activities and is one of the

world's major maintenance service provider.

|

Rank

|

Airline

|

Turnover 20061(*)&2(*)

|

|

1

|

Air France-KLM

|

30.81

|

|

2

|

Lufthansa Swiss

|

26.51

|

|

3

|

American Airlines Inc.

|

22.37

|

|

4

|

FedEx Express Corp.

|

22.07

|

|

5

|

Japan Airline Corp.

|

19.35

|

|

6

|

United Airlines

|

18.85

|

|

7

|

Delta Airlines Inc.

|

17.13

|

|

8

|

British Airways

|

16.73

|

|

9

|

Continental

|

13.13

|

|

10

|

ANA Group

|

12.67

|

» TOP TEN AIRLINES BY TURNOVER (USD

BILLION)

Face to face with competition and other

transports

Source : IATA World Air Transport Statistics and

Financial Reports from the industry 2006

In its long-haul business, the Group has to cope with the

traditional competition from European airlines, with the international

redeployment of United States airlines, as well as the emergence of

fast-growing newcomers such as the Gulf airlines and those based in Asia's

emerging countries.

|

Rank

|

Airline

|

RPK 2006

|

|

1

|

American Airlines

|

224,330

|

|

2

|

Air France-KLM

|

195,227

|

|

3

|

United Airlines

|

188,684

|

|

4

|

Delta Airlines

|

158,952

|

|

5

|

Lufthansa Swiss

|

136,748

|

|

6

|

Continental Airlines

|

122,712

|

|

7

|

Northwest Airlines

|

116,845

|

|

8

|

British Airways

|

114,896

|

|

9

|

Southwest Airlines Co.

|

108,935

|

|

10

|

Japan Airlines International

|

89,314

|

TOP TEN AIRLINES BY PASSENGER TRAFFIC in million

Revenue Passenger Km (RPK)

In Europe, Air France-KLM also has to confront competition

from low-cost airlines and TGV high speed trains on its short- and medium-haul

routes and medium-distance journeys and from road and maritime transport in the

cargo sector.

Source : IATA World Air Transport Statistics and

Financial Reports from the industry 2006

» Air France - KLM Group: Two airlines, Three

businesses

|

Rank

|

Airline

|

RFTK 2006

|

|

1

|

FedEx Express Corporation

|

15,145

|

|

2

|

Air France-KLM

|

10,571

|

|

3

|

United Parcel Service

|

9,341

|

|

4

|

Lufthansa Swiss

|

9,130

|

|

5

|

Korean Airlines Co. Ltd

|

8,764

|

|

6

|

Singapore Airlines

|

7,991

|

|

7

|

Cathay Pacific

|

6,914

|

|

8

|

China Airlines

|

6,099

|

|

9

|

Cargloux

|

5,237

|

|

10

|

EVA Air

|

5,160

|

The Group has leadership positions in each of its three

businesses:

· Passenger Transport

· TOP TEN AIRLINES BY CARGO TRAFFIC in million

Revenue Freight Tonne Km (RFTK)

Cargo Transport

· Aircraft Maintenance Services

Source : IATA World Air Transport Statistics and

Financial Reports from the industry 2006

It is noticed that passenger transport is the Group's main

business, accounting for 80% of turnover (2006-07 financial year). Then, cargo

transport and aircraft maintenance services represent 14% and 4%, respectively

of total revenues, with other activities - including transavia.com and Servair

- contributing 2%.

· Passenger

Passenger transport is both the biggest and most visible of

the Group's business operations, with a consolidated turnover of 16.9 billion

euros. In addition, the Group has developed innovative fare structures, termed

fare combinability, enabling passengers to combine an outbound flight on Air

France with an inbound flight with KLM - or vice versa - and to benefit from

the most convenient schedule and/or the most attractive fares.

In 2005, the two airlines combined their customer loyalty

programs in a sole one - Flying Blue - with over 11 million members.

· Cargo

With a consolidated turnover of 2.9 billion euros, Air

France-KLM is one of the world's leading company in air freight. Besides, cargo

activity is growing at 5% a year over the long term.

The Joint Cargo Team allows the Group to offer customer

companies a single point of contact for its integrated services, with flights

out of both its hubs. This is intended to strengthen its international

positioning and to comply with its customers' needs.

· Maintenance

Air France Industries and KLM Engineering & Maintenance

provide the entire spectrum of aircraft MRO - Maintenance, Repair, Overhaul -

services for selected aircraft types. Some 150 third-party airline customers,

representing over 950 aircrafts, are customers of the Group, which is aiming to

be a significant player in the global maintenance market.

Mission Statement

By striving to attain excellence as an airline and by

participating in the world's most successful airline alliance, KLM intends to

generate value for its customers, employees and shareholders.

Vision 2010

The "Vision 2010" strategic plan is rooted in the Company's

corporate history and provides a vision of an open and progressive near future.

The plan is based on four major challenges to be addressed by Air France:

Achieve best in class service for our customers: Operational

performance and the quality of customer relations are two inseparable

components for leveraging service excellence. In operational terms, the

challenge is to make Paris-Charles de Gaulle airport the European hub of choice

for passengers. When it comes to customer relations, the challenge is first and

foremost to guarantee that the customer experience matches the promises related

to the product and the brand. After this, the aim is to actively provide

information and seek to make good the inconvenience suffered by customers in

the event of the irregularities and unforeseen circumstances that are part and

parcel of airline operations.

Strengthen our competitiveness through change management : It

is important to stay out in front, and to actively adjust our offering to

changing customer expectations, by maintaining our lead over our competitors

where possible. To do that we will make sure that our aircraft are visibly more

innovative in all areas and that all stakeholders are better aware of the

fact.

Set the example in corporate social responsibility and

sustainable development:

Ø With respect to corporate social responsibility

(CSR), Air France will continue to deploy its contract-based policy rooted in

dialogue with the trade unions, integration through employment, and promote

diversity and the fight against all forms of harassment.

Ø In the societal arena, Air France will pursue its

corporate stewardship initiatives, notably by providing support for the

development of the regions where it operates, requiring CSR credentials of its

suppliers and subcontractors, and pursuing its humanitarian and co-development

initiatives.

Ø With respect to the environment, the airline industry

makes a limited but growing contribution to greenhouse gas emissions, whose

correlation to global warming is now an established fact. Air France aims to

respond to this in part by pursuing its fleet modernization policy, by reducing

the impact of its emissions from operations, deploying environmental plans in

every part of the Company, and backing the European Union's Emissions Trading

Scheme and actively contributing to environmental protection programmes.

Together with KLM successfully develop the Group of

tomorrow: The aim is to improve our economic efficiency by achieving €500

million-worth of additional cost-synergies over the next four years. The

resulting changes in the Group's future modus operandi should provide us with

more robust, more streamlined decision-making processes. A continued focus on

building trust among teams will remain a priority.

A real vision or a dream?

First of all, it brought out the fact that the company wants

to achieve best in class service for its customers. Paradoxically, low cost

airlines take more and more market shares in short and medium-haul routes.

Besides, these airlines are successful, while offering a poor service to

customers. In this way, this vision does not take into account this growing

parameter. Air France-KLM should take over or set up a low cost airline in

order to compete other same airlines. A such airline could help the company to

take market shares in the leisure sector.

Then, one of its objectives is to make Paris-Charles de Gaulle

airport, the first European hub. With regard to the competitors, such as London

Heathrow, Schiphol and Francfort airport, it appears an unrealistic objective.

Unless, the company increases dramatically the number of its routes toward the

United States and Asia. Indeed, the Transa-Atlantic flights represent an

opportunity in order to enhance the position of PCG airport. That is why, it

seems that the company should find an American partner. This would enhance the

number of passengers at the airport.

After that, Air France-KLM wants to ensure that `the

customer experience matches the promises related to the brand and

product'. In a first approach, it seems a realisable. However, the airline

could face some troubles. In fact, there is an important risk that the French

staff goes on strike, according to the past events. Besides, in December 2007,

customers had to experience a strike. This could damage the brand image with

regard to troubles that customers had suddenly to face. Nevertheless, we can

add that the company reacted in an appropriate way. Indeed, the airline made

exceptional commercial incentives in order to keep most of its customers. In

this way, even in troubles, the company can show its ability to ensure that the

customer experience matches the promises. Last, it is noticed that Air France

handled rightly with its customers when irregularities came. So, it appears

that the company has already matched a part of its vision.

Afterwards, how the company can ensure constant dialogue with

trade unions, although these ones do no want to discuss. In regard to the last

strike, the CEO had to threat trade unions in order to be able to discuss about

the matters. So, it seems quite difficult to carry out this objective with

regard to French trade unions.

Last, Air France-KLM has what it needs to satisfy the

objectives in terms of sustainable development. Since 2005, Air France-KLM is

the sole airline group to be included in the main sustainability indices,

namely Dow Jones Sustainability Index, the FTSE4Good and ASPI indices. In

addition, the agreement `Open Sky' offers good opportunities for the airline

group in order to reach `Vision 2010'.

SWOT

Strengths

|

Weakness

|

Activities and turnover in progress

Success of the merger

Dynamism of successful SkyTeam

Hubs cover

Supply network

Well-balanced network

Joint Venture with Delta Air Lines

|

Debt raised by KLM

Delay on the "e-services"

Unstable social climate

Domestic flights and medium-haul unprofitable

|

Opportunities

|

Threatens

|

Agreement « open sky » Europe/USA

Low -costs

Markets in strong growth

Differentiation by the reliability

A380 in 2008

Ecology/Sustainable Development

|

Durable increase of the oil price

External Shocks :

» Economic situation

» International disasters

Intensification of the competition:

» Low- cost

» HST

» US Companies

|

Since the merger between Air France and KLM, Air France

strengthened its position on the world market-place, by increasing its

activities and results. Then, Air France tempts to develop loyalty among its

customers thanks to the extension of its network of Hubs and to the dynamism of

the SkyTeam alliance. In 2006, for the second consecutive year, SkyTeam was

again elected " better alliance of the year " by the readers of the American

monthly magazine Global Traveller Magazine. This allows Air France to have a

well-balanced network. In spite of the promotion of Air France KLM, it is

noticed that the KLM debt has still raised and short and medium-haul flights

are not profitable.

Air France considers remedied in these weaknesses by

the implementation of Low cost and the project " vision 2010 ". The project

vision 2010 articulates around four big challenges which the company has to

raise:

- Achieve best in class service for our customers

-

Strengthen our competitiveness through change management

- Set the example

in corporate social responsibility and sustainable development

- Together

with KLM successfully develop the Group of tomorrow

At the level of the opportunities of the market, Air

France cannot neglected the strong growth of the market and the evolution of

low cost. Air France, since the end of year 2006 succumbs to Low cost. The

airline company goes displayed the wings of its new strategy of flights cheap

by 2/3 the years. She will be proposed via a new activity and a web site

declined from a subsidiary of her Dutch partner KLM. KLM Air France has to

seize the opportunities on the differentiation by the security and on the

environment.

KLM Air France is rapidly expanding and wants to become

leader in all its domains, in spite of its strong evolution, the group has to

pay attention on the durable increase of the oil, in possible economic

situation, in the catrastrophe internation and especially in the strong

competition of low cost, HST and US company.

II) Successful merger through network management

New Business Model (course network strategy)

In the late 90's it was said that 'The Network is the

computer,' meaning that a single computing device, by virtue of its inclusion

on the internal network or the Internet, increased its value by orders of

magnitude. The computer's value proposition changed completely once it was part

of the network.

Today the same is happening with entire businesses. The

idea of the network organization model is not new, but with the mature

Internet, this business model has started to flourish.

The key to managing the network is collaboration. Not

collaboration as some touchy-feely new found way of doing business. But

collaboration as the necessary quick, decisive, mostly automatic communications

that must happen correctly in the network in order for orders to be filled,

customers billed, service issues rectified, vendors notified of drop ships and

of course the movement of cash from one end of network to the other.

The merger becomes a necessity

INSIDE Europe, the regulatory system has radically

changed in the last few years. In line with former EU President Jacques Delors'

vision of Europe, backed by all the major European countries, Europe decided to

dismantle all its regulatory barriers and create a huge single market among the

European countries. This strategy - that of a Single Market - has now been

applied to European air transport. For the last 10 years, there have been no

regulatory barriers. Any European carrier benefits from total freedom to

acquire traffic rights and establish itself in another European country.

Contrary to preconceived ideas, there are no more protectionist barriers inside

Europe.

Tomorrow, Lufthansa or British Airways can launch a new

service between Paris and Rome and AF can do the same between any two European

cities. And it is because of this liberalization of the European market that

low-cost carriers have been able to establish themselves and grow in the

European market.

Ever since the 1st of January 1993, all European

carriers have known that the days when European air transport was organized

around national champions are over.

This is because the regulators themselves encouraged

the emergence of major

European players to match the size of today's European

market, by creating a competitive environment.

So why did Air France have to wait 10 years - that is

to say, from 1993, when the new principles of the European regulatory system

were designed - to 2003, date of the announcement of the first cross-border

merger with KLM ?

This gap is certainly due to three major factors: the

first is very human - the force of habit. After decades of operating in a

highly regulated framework, it took the prestigious European flag carriers a

long time to realize that things had changed, and that they would have to

change with it. It was a painful process for all but KLM, who immediately

understood the need for change.

The second factor is rather more legal. Today Europe

only recognizes one reality- a European air carrier. Whether the operator is

Spanish, German or British is irrelevant. It's a European carrier.

However, all the non-European countries (for example

Brazil, USA, Chile, etc.) refuse to recognize the European status and only take

into account the nationality of the carrier. Consequently, if, for example,

British Airways were to take over Iberia, a non-European country could say that

they will withdraw the traffic rights they gave to Spain, because they will now

be exploited by a British and not a Spanish carrier. This major contradiction

between European and international law, which still exists, continues to hamper

mergers and groupings.

The third factor is of a more emotional nature. These

flag carriers embody the spirit and pride of a nation. They are often an

integral part of the history of their country and the people remain extremely

attached to them. The extraordinary adventure started by Albert Plesman in 1919

is part and parcel of Dutch history - as is that of Didier Daurat, Mermoz and

Saint Exupéry in France. The Chairmen of these airlines have always

feared - and quite rightly so - the negative reactions of the nation's citizens

or the airline's staff. They would no doubt have considered these mergers as a

form of betrayal of the vital interests of their country.

All these factors explain the very specific form of

merger decided by Air France and KLM. Leo van Wijk and Jean Cyril Spinetta

decided that, given the changing situation in air traffic relations, it was

very unlikely that a non-European State would use the merger as a pretext to

withdraw the traffic rights that it had granted to KLM. It was still legally

possible, but the risk was low. Air France and KLM considered that they could

take the risk of merging. And so far they have been proved right, as no

non-European State has made signs of wishing to withdraw its traffic

rights.

One reason for this changing trend dates back to March

2000. At this time, the European Union Heads of States and Governments met in

Lisbon and agreed to make the EU «the most competitive and dynamic

knowledge-driven economy in the world» by 2010. This was a very ambitious

goal and gave rise to a lot of initiatives. The aim was to create a

pan-European innovation system. The idea was to shift from the creation of

national champions to more pan-European enterprises. So Air France and KLM

combination spearheaded this trend.

The two companies quickly realized that theyshared

exactly the same vision of the future of our business:

v Firstly that

consolidation was necessary, particularly in Europe. This was because they

needed to create pan-European leaders to match the size of the huge Single

Market.

v Secondly, for

the sake of economic efficiency, they had to have a common bottom line.

They also had to take into account the emotional

factor. This is why they quickly realized that the only possible organization

was to create a new concept of one group - AF-KLM - which involved merging

shareholdings and sharing the same bottom line - and two companies, which

implied coordination rather than integration. That covered the emotional

side.

Air France and KLM were two efficient airlines - KLM

was reaping the benefits of a radical recovery plan, and Air France was

consistently posting profits - but they were at risk.

This might seem contradictory, but in fact it's not.

They were at risk because they were middleweight champions in a heavyweight

contest. In an increasingly global industry, they needed to gain critical

size.

The consensus view is that world air transport will

ultimately be organized around three major alliances - Star, SkyTeam and

Oneworld.

Obviously Air France and KLM had to belong to an

alliance but that's not enough. They also need to make themselves heard and to

influence the decisions to come. In the long-term, Air France would not have

been able to do this alone. Air France-KLM guarantees that a European carrier

will play a leading role in SkyTeam. This common ambition that Air France

and

KLM share did not come from a desire to dominate. It

came from a legitimate wish to ensure profitability for both airlines and to

play a global role in the air transport industry.

But governments and public opinion would most certainly

have refused the merger, if they hadn't respected national identities and

interests.

This is what prompted them to build a project that

surprised the financial community at the beginning, but which was the only

acceptable solution in today's Europe: one group but two different airlines,

each with its own brand, products and flag. They have a sort of «control

tower» to define the guidelines for the overall strategy - the Strategic

Management Committee - but each airline is responsible for the day-to-day

running of its own business.

So what is Air France-KLM Strategy and how are they

implementing it?

The new Air France-KLM Group ranks first worldwide in

terms of revenue (with a combined turnover of 21 billion euros in the IATA year

2005/2006). It carries over 70 million passengers a year, has a combined

workforce of some 100,000 employees, and operates 558 aircraft.

In designing the merger, Leo van Wijk and Jean-Cyril

Spinetta focused on profitable growth. They would partly achieve this by

winning market share from competitors, especially from European carriers. In

the past, many mergers have failed because they have concentrated too much on

cost-cutting and downsizing and not enough on growing market share and

revenues. Right from the beginning, they decided on an offensive rather than

defensive strategy. Some industry analysts were disappointed when the Group

decided NOT to cut back on capacity and staff. They work in a service industry,

where human resources are critical to the delivery of their joint products. If

they had cut back on staff, they would have lost the cooperation and support

they needed to implement the merger. And they would not have achieved the

growth they have today.

They are implementing this strategy by constantly

working to improve their competitiveness and productivity. This will ensure

that their growth is as profitable as possible, and will enable them to adapt

to the changing business climate. The first thing they did, was to identify

synergies in every possible area.

On the cost side, for example:

v They have

increased their bargaining power. Take aircraft purchasing: KLM's medium-haul

fleet consists of Boeing aircraft and Air France's medium-haul haul fleet of

Airbus aircraft. This gives them more leverage when negotiating to buy new

aircraft from the two aircraft manufacturers.

v They have

reduced their operating costs at outstations by integrating their international

operations in each country. This is done country by country, taking into

account the specificities of each region and the relative strengths of both

airlines.

v They have

rationalized their maintenance and overhaul costs with a more costeffective

allocation of resources. This optimizes the workload at their facilities and

reduces inventory costs.

v ·Another

extremely important source of synergies is KLM systems. Air France and KLM have

already aligned processes and aim to use the same systems in five years time.

With the rise of the internet and online sales and Air France growing reliance

on automated processes, it is essential for Air France to join up KLM systems.

Merger synergies can easily be wasted through technical incompatibility. So

this issue has to be addressed right from the start. In the airline industry,

they need to align the way they package and sell their services to customers,

and the way they serve their customers.

On the revenue side, they have identified synergies in

a number of areas.

First and foremost they have taken advantage of the

combined strengths of their two airlines, their market position and, above all,

their respective hubs, Schiphol and Paris-Charles de Gaulle.

Their strategic priority should be to simultaneously

reinforce the potential of Paris and AMS and not to develop one at the expense

of the other. In their agreement, they made a contractual commitment to ensure

fair development between the two hubs. Not because they wanted to reassure

people, but because it was the smartest solution from a strategic viewpoint.

Air France and KLM have built it strategy on an

integrated network around their two hubs using their two separate brands. This

means they can offer their European customers a choice of over 100 long-haul

destinations and, for their non-European customers, the best possible

connections through their two hubs to more than 150 European destinations.

Results and next major challenges

The year 2006-07 took place in an economic context

favorable to the air transport.

It was marked by:

v a growth of

the world economy which amounts to 4,9 %;

v a better

discipline of airline companies in capacity;

v steady

exchanges which generated an increase of 6 % traffic

This economic dynamism should go on in the years to

come.

In this environment, the group Air(Sight) France

KLM realized again a very good exercise with:

v a turnover in

increase of 7,6 % in 23,07 billion euro,

v an operating

profit in increase of 32,5 % in 1,24 billion euro,

v a clear(net)

891 million euro result.

It knew how to take advantage of the world growth

for:

v develop on

all the big markets,

v strengthen

its profitability by the control of the costs,

v and

continue to invest to prepare the future.

This exercise also encloses the first stage in the

merger of both companies AIR FRANCE and KLM. Today, a new step opens aiming at

an integration strengthened by the strategic functions for the group. It will

allow the group to improve still its profitability.

All the activities generated a 23,07 billion euro

turnover, in 7,6 % growth. This result places the group in the first world rank

of airline companies.

The group loosens one of the best margins among the

classic companies. These results were able to be obtained grace to the control

of the costs and a significant decline of the financial debts.

|

Fiscal year (M€)

|

Accumulation on March 31st

|

|

2007

|

Variation

|

|

Turnover current

Operating expenses

|

23 073

(21 833)

|

|

+7,6 %

+6,4 %

|

|

|

Operating profit

Sets the margins operational adjusted *

|

1 240

6,3%

|

|

+32,5% +0,9 pt

|

|

|

Result of the operational activities

|

1 233

|

|

ns

|

|

|

Cost of the net financial endettemet

|

(140)

|

|

(37,5%)

|

|

|

Net Result leaves the group

Net Result leaves the group (except

exceptional operation Amadeus)

|

891

891

|

|

(2,4%)

+80,4%

|

|

|

|

|

|

*Current operating profit adjusted on behalf of the

interest charges of the operational rents (34 %).

Distribution of the turnover by activity.

With the exception of the cargo boat which knew a difficult environment, all

the activities strongly progressed..

The activity passage believed in a steady rhythm as well as the external

activity of the maintenance; the activity "Other" concerns, among others,

transavia.com and to servair.

|

|

|

A progress continues of the

profitability

Since the merger with KLM, the operating profit was multiplied by

more than 3 and the margin by more than 2

|

|

|

A financial structure was

strengthened

Since the merger, the financial debt regularly decreased and the indebtedness

ratio was divided by 3.

|

|

|

III) Sky Team Alliance: «Miles» your

flight

Skyteam : Mile's your flight !

SkyTeam is the second largest airline alliance (an alliance is

an agreement between airlines to cooperate on commercial, operational and

technical aspects of their activity, including cross-participation in capital)

in the world, behind

Star Alliance,

partnering fourteen carriers from four continents.

Why an alliance between Airlines, which are competitors? We

can answer to this question with: «Partners as creators of value».

The stated benefits and goals of the alliance are:

v Easy frequent flyer mile collection and redemption across

carriers

v Reciprocal airport lounge access between carriers

v Guaranteed reservations for Elite Plus customers

v More available flights and easier connections between carriers

v More fare options

v Unified check-in for all carriers

v Consistent quality standards across carriers

v One reservation network for all members

v SkyTeam calls itself the "first alliance built around

customer needs. In 2005 and 2006, SkyTeam was the world's best airline

alliance, according to the readers of Global Traveler Magazine. The Alliance is

run by a Board and a Steering Committee. Decisions are taken on a consensus

basis, except in a few specific cases. Each member takes an equal part in all

discussions and decision-making.

Leo van Wijk, chairman of skyteam

Membership history

v 2000 --

Aeroméxico,

Air France,

Delta Air Lines, and

Korean Air launch the

SkyTeam alliance on June 22.

v 2001 --

CSA Czech

Airlines (in March) and

Alitalia (on July 27) join.

v 2004 --

Continental

Airlines,

KLM Royal Dutch Airlines and

Northwest

Airlines join on September 13. Their simultaneous entry has been the

largest expansion event in airline alliance history. As a result of the three

new members, SkyTeam passes

Oneworld to become the

second largest alliance.

v 2005 -- Even though current

member

CSA pledged to

help

Malév

Hungarian Airlines become an associate member of the alliance (as opposed

to a full member, an associate has no voting rights),

Malév

opts to join the

Oneworld alliance, signing

a Memorandum Of Understanding late in May. A few days later SkyTeam announces

four new associate members due to join by 2006, each one being "sponsored" by

an existing member:

Madrid-based

Air Europa (sponsored by

Air France),

Panama-based

Copa Airlines

(sponsored and partly owned by

Continental

Airlines),

Kenya Airways

(sponsored and partly owned by

KLM) and

Romania's

Tarom (sponsored by

Alitalia). Every associate

will adopt a

frequent flyer

program of a full member:

Copa Airlines already

uses

Continental's

OnePass while

Kenya Airways and

Air Europa use

Air France-

KLM's

Flying Blue.

v 2006 --

Aeroflot joins on April 14.

Middle East

Airlines is invited to become an associate member.

v 2007 --

Air Europa,

Copa Airlines,

Kenya Airways become

associate members of the alliance on September 1.

China Southern

Airlines joined SkyTeam on November 15 to become the 11th full member and

the first carrier from Mainland China to join a global airline alliance.

Matching capabilities and resources

For the customer

SkyTeam has two premium levels, Elite and Elite Plus, based on

a customer's tier status in a member carrier's

frequent flyer

program. Each of the member and associate airlines recognizes the elite

statuses, with a few exceptions. The statuses have no specific requirements of

their own; membership is based solely on the frequent flyer programs of

individual member airlines

Benefits of being an Elite member of SkyTeam:

v Priority reservations waitlisting

v Priority airport standby

v Priority boarding

v Priority airport check-in Preferred seating

v Priority baggage handling

v Additional checked luggage allowance

v Airport lounge access

v Guaranteed reservations on sold-out flights

For the airlines :

v An extended and optimised network: This is often realised

through

code sharing

agreements. Many alliances started as only a code sharing network:

v Cost reduction: This can include sharing of:

o Sales offices

o Maintenance facilities

o Operational facilities, for example catering or computer

systems.

o Operational staff, for example ground handling personnel, at

check-in and boarding desks.

o Investments and purchases, e.g. in order to negotiate extra

volume discounts

v Traveler benefits: Benefits for the traveler can be:

o Lower prices due to lowered operational costs for a given

route.

o More departure times to choose from on a given route.

o More destinations within easy reach.

o Shorter travel times as a result of optimized transfers.

o Faster mileage rewards by earning miles for a single account on

several different carriers.

o Round-the-world

tickets, enabling travelers to fly over the world for a relatively low

price.

Connecting strategy to relationship

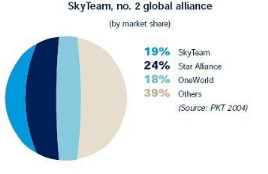

Air France launched, with AeroMexico, Delta AirLines and

Korean Air, the third global Airlines Alliance. After StarAlliance in 1997,

OneWorld in 1999, Skyteam was born on June 22, 2000. Seven years after,

Skyteam is the second Airline alliance with 19% of market share.

Thank to the alliance, airlines extend the SkyTeam brand to

key regions of the world, elevating the alliance's global presence and

strengthening its brand recognition.

The Member Program allows SkyTeam to leverage individual

member airline partnerships across the alliance, which provides for additional

codeshare and cooperation opportunities.

How the member airlines benefit:

Member airlines gain access to strategic SkyTeam resources.

· Member Airlines benefit from member airline experience

and expertise, including best practices.

· SkyTeam offers Member Airlines support and resources

for increasing traffic and improving customer service standards.

· Member Airlines integrate into the SkyTeam

infrastructure, including loyalty programs like SkyTeam FFP and the airport

lounge network.

· Member Airline status in the SkyTeam alliance affords

carriers opportunities for increased profitability, including:

· Possibility for developing new codeshare services with

alliance members with mimimal requirement for capital investment, both

financial and human resources.

How the passenger benefits:

· SkyTeam passengers benefit with expanded SkyTeam

loyalty programs, allowing customers to earn and redeem miles on flights

operated by additional carriers.

· SkyTeam international first or business class

passengers and SkyTeam Elite Plus members enjoy increased access to airport

lounges in destinations served by the Associate Airlines when flying on or

connecting to/from an international flight operated by a SkyTeam carrier.

· Customers of Associate Airlines enjoy the SkyTeam

standards of service, quality and safety associated with the number one

customer service-oriented airline alliance.

Difficulties

& Drawbacks

Although an Airline alliance offers a lot of benefits for

customers and airlines, an alliance may also create drawbacks for the traveler,

such as:

v Higher prices when all competition is erased on a certain

route.

v Less frequent flights, for instance when two airlines fly

each three times a day on a given route, the alliance might fly only four times

on the same route.

v A customer buys a flight through the airline he wants (Air

France for example), but the flight is actually operated by another Skyteam's

airline with different services quality

For the airlines, the abilities to form an alliance are often

restricted by laws and regulations or subject to approval by authorities.

Antitrust laws play a

large role. Sometimes political quid pro quo between governments is at hand.

Also landing rights may not be owned by the airlines

themselves but by the nation in which their head office resides. If an airline

loses its national identity by merging to a large extent with a foreign

company, existing agreements may be declared void by a country which objects to

the merger.

The first known airline alliance started in the 1930s, when

Pan American Grace Airways and parent company Pan American World Airways agreed

to exchange routes to

Latin America. The

first large alliance which is still functioning started in

1989, when Northwest and KLM

Royal Dutch Airlines agreed to code sharing on a large scale. A huge step was

taken in

1992 when The Netherlands

signed the first

open skies agreement with

the United States, in spite of objections uttered by the

European Union

authorities. This gave both countries unrestricted landing rights on each

others' soil. Normally landing rights are granted for a fixed number of flights

per week to a fixed destination. Each adjustment takes a lot of negotiating,

often between governments rather than between the companies involved. The

United States was so pleased with the independent position that the Dutch took

versus the E.U. that it granted anti-trust immunity to the alliance between

Northwest and KLM. Other alliances would struggle for years to overcome

transnational barriers or still do so.

IV) Air France - KLM: new leader of low cost

airlines?

Low cost traffic isn't marginal!

The two main low-costs European Easy Jet and Ryan Air,

access to the forefront on traffic intra-European and domestic. Their growth

over the period 2000-2004 was respectively +31% to +46% per year!

During the same period, the traffic of normal remained

relatively stable. Easy Jet and Ryan Air, therefore, do not establish their

current positions by a massive transfer of traffic, but by the combination of

two phenomena:

On the one hand, induction of traffic, creating a new

kind of application (the trip "low-costs" attracting new customers, which so

far does not traveled, the voyage by substituting "pulse" of other forms of

entertainment consumption type);

On the other hand, confiscating a large part of the

natural growth in traffic linked to economic growth (including classic customer

and the business customer segment Affairs sensitive to the price).

"But the trees do not rise up to heaven ..." And

despite the exponential growth rate posted by the low-cost in recent years, it

would seem that there is a limit to this expansion: While EasyJet and Ryanair

may become No. 1 and 2 in terms of traffic intra and domestic, but the

characteristics of their model bear inherently limits their growth and the risk

of weakening profitability. Offering low prices, completely out of touch with

reality, induces a new leisure traffic, which is not prompted by a purchase

corresponding to a "need" but to drive a purchase. The bouquet of destinations

offered at the beginning of a market suffer the same economic rules as those

governing the fashion industry: while reflecting new product trends ephemeral

détrône the previous ... For a low-cost, supply creates demand and

the offer must be renewed promptly and regularly. The market is artificially

stimulated, and once the mature market issuer reached, the development of each

new destination is necessarily at the expense of existing destinations, as the

market has reached its size limit: some destinations have the potential to

retain their visitors, and constitute a substantive trade-for example Ryanair

Bergerac or Carcassonne- they are in other words the "basics" of the permanent

collection. Other destinations, not having these natural assets, may at the

discretion of modes and opportunities for the development of low-cost airlines

that operate, to be replaced today by cities on the Spanish coast, by tomorrow

cities in Eastern Europe ...

A record low cost

- They usually use planes of a single model, mostly Boeing

737-200 or 300, possibly bought used. These aircraft have indeed the lowest

cost to purchase or rent, and low operating cost per seat.

- They have only one class (as opposed to multiple aircraft

companies classics), which greatly reduces operating costs.

- They usually land on secondary airports, to speed up the

average time of rotation avoiding congestion, and to pay airport charges

reduced.

- They simplify as much as possible the procedures for loading

and unloading (unallocated seats), once again turns to accelerate and reduce

the need for staff. In this context, they also sell tickets directly by phone,

fax, but especially the Internet, and not by the computerized reservation

systems (CRS) and the travel agencies, more expensive. Tickets are paid for

prior to travel and non-refundable, income is certain and swift (no gap between

revenue and expenditure).

- To obtain a reduction in payroll, they employ personal

versatile, pay minimum wages, but introduce a premium of productivity and

sharing a stake in the company.

- They offer very limited service on board and fees.

The customers' business' interest in the low cost

Thanks to the tariffs, low costs are attracting not only a

part of the existing demand but they also create additional demand. Thus, the

Directorate General of Civil Aviation considers that on Paris-Dublin even

posing in Beauvais (72 km from Paris), the airline Ryanair has helped to

increase by 30% traffic of the line.

In addition, if the launch of a connection is largely due to a

clientele with capabilities contributory weak able to determine his movements

ahead, from a threshold of 2 to 3 frequencies per day, low-cost airline to

"get" the business clientele, especially if it is located near the major

economic centers, as is the case with Easyjet in Orly and Roissy Charles.

In Europe, in June 2002, the low-cost accounted for 8.65% of

traffic on the intra-market, which is 3 points higher than in 2000. By way of

comparison, the low-cost American up more than a quarter of American domestic

market in number of passengers carried.

In France, the development of these companies is a recent but

has been very rapid. Beginning in March 1996, Virgin Express opened a liaison

Nice-Bruxelles. Since then, other companies have come to join, which accounted

for 5 million passengers in 2002 (12% of intra-Community traffic french, 5% of

the traffic french total) compared to only 2.6 million passengers in 2001 (7%

french intra-Community traffic, 2.7% of total traffic french).

This share reached 23.2% in the province against 5.7% for

Parisian airports. However, as stated in a study by the Directorate of Air

Transport Ministry of Equipment introducing the figures over the last four

years of their presence in France, "it is still only 3% to Orly and Roissy

Charles confused because the companies are located there and more recently in a

limited way. "

TRAFFIC OF COMPANIES TO BAS-COÛTS AND ALLOCATION COUNTRY

OF ORIGIN AND DESTINATION

|

|

Passengers

|

Share

|

|

2001

|

2002

|

2001

|

2002

|

|

France

|

U.K.

|

1 909 791

|

3 020 188

|

69,1 %

|

58,9%

|

|

With traffic to and from London

|

1 641 369

|

2 453 046

|

59,4 %

|

47,8%

|

|

France

|

Switzerland

|

192 636

|

442 120

|

7,0 %

|

8,6%

|

|

France

|

Ireland

|

255 487

|

341 860

|

9,2 %

|

6,7%

|

|

France

|

Netherlands

|

217 189

|

318 442

|

7,9 %

|

6,2%

|

|

France

|

Belgium

|

190 041

|

307 599

|

6,9 %

|

6,0%

|

|

France

|

France

|

98

|

282 947

|

0,0 %

|

5,5%

|

|

France

|

Germany

|

70

|

205 048

|

0,0 %

|

4,0%

|

|

France

|

Sweden

|

0

|

174 341

|

0,0 %

|

3,4 %

|

|

France

|

Norway

|

0

|

32 955

|

0,0 %

|

0,6 %

|

|

France

|

Italy

|

190

|

4 204

|

0,0 %

|

0,1 %

|

|

France

|

Spain

|

0

|

171

|

0,0 %

|

0,0 %

|

|

|

Total

|

2 765 502

|

5 129 875

|

100,0 %

|

100,0 %

|

In addition, as noted in the study, "well enough recently

established in France, foreign companies to bas-coûts are present on 28

airports french," including small provincial airports, as Bergerac, Caen,

Dijon, Rouen or Tours, as these companies often contribute to the

revitalization. It is a deliberate strategy on the part of low-cost airlines,

including Ryanair, due to the scarcity of available slots in Paris and the cost

of operating routes to those airports.

The companies established in France now numbered 10: Goodjet,

Germanwings, bmibaby, My TravelLite and Ciao Fly, established in 2002 and

EasyJet, Ryanair and Buzz, Basiqair and Virgin Express, established in 2001.

The market is still highly concentrated, as the two major players that are

EasyJet and Ryanair hold 85% of the market.

This study confirms their progress on the french market:

"While traffic produced by these companies had already increased by 51% in 2000

and 44% in 2001, sales were up 85% in 2002 compared to 2001."

"Such an increase can be explained in a market economy only by

the combination of a large potential demand and a sharp increase in supply,

naturally with the original product attractive."

In 2002, the supply of low-cost airlines has improved through

an increase in the number of routes operated which went from 52 to 87 in 2002

(+67%) and an increase in the number of movements which have increased from

27405 to 50205 in 2002 (+ 83%). In three years the increase is consistent since

traffic has quadrupled (+ 299%) since 1999.

Outlook: groupings in perspective

While the vast majority of airlines "major" has posted

negative results during the fiscal year 2001-2002, mainly because of the

September 11 attacks, Ryanair, Easyjet and Virgin Express have registered

positive results and a sharp increase . This positive development and very fast

should be confirmed in the coming years, according to the Directorate General

of Civil Aviation.

Indeed, the draft order planes announced by these companies

tend to show that they intend to grow strongly in Europe: 100 firm orders and

50 options for Ryanair, a firm order for 120 aircraft for Easyjet.

But the risk of downward pressure on prices are not excluded,

if the creation of new low-cost airlines leads to excess supply. Competition

between low costs, and with the charters, is likely to be, and there should be

a number of groupings, such as Easyjet, which bought Go and DeutscheBA in May

2002, and that Ryanair repurchased Buzz in January 2003.

Transavia: Air France-KLM strikes back (Netherlands

low cost airline company)

About transavia.com in France

In the summer of 2007, France transavia.com four planes fly

with the departure of Paris-Sud. The new airline is aimed at both the French

market for charter services line and steals mainly to the Mediterranean

countries.

Collaboration

In late November 2006, Air France and transavia.com revealed

their intention to found a new airline named French transavia.com. The new

airline will be an independent company within the Air France-KLM Group. The

involvement of Air France amounted to 60%, that of the Netherlands

transavia.com to 40%. Transavia.com in France will be a French company to the

structure and prestige identical to those of transavia.com the Netherlands.

Transavia.com the Netherlands

Transavia.com is an airline Dutch medium-sized experiencing

some success. With more than 30 aircraft and about 1500 employees, the company

transports annually 4.8 million passengers. Transavia.com proposes especially

flights to vacation destinations and, over the years, improved the concept of

'cheap flights, quality attention. In collaboration with partners,

transavia.com offers other products that trip flights, for example hotels, cars

and transfers.

On the french market, the new company will follow the

standards and methods of successful transavia.com. This is an important first

step in the development plans of the mark transavia.com and strengthening its

presence on the podium European air.

Air France / KLM Launches Low Cost: Transavia.com

On 12 May this year took place on the first flight of the new

low cost French Transavia.com. A subsidiary of Air France / KLM, the new

company will specialize in the medium...

Liftoff

The "low cost" continue to have the wind in your wings.

Together with its Dutch partner KLM, Air France, carried by the current, has

just launched its subsidiary in low-cost flights: Transavia.com. The goal is

simple: to position on the medium leisure adapting to the market french a

formula that has proved successful in the Netherlands: there, and the company

is thriving for more than 40 years. It is also an opportunity for Air France to

"capitalize on the seriousness, the reliability and punctuality which have

already been demonstrated."

Currently, the fleet Transavia.com in France consists of four

Boeing 737-800 next generation, each with 186 seats, all in economy class. The

company provides for the hiring of three additional aircraft in 2008 and two in

2009.

The tender Transavia.com

The destinations will be those Transavia.com "traditionally

requested by the customer" leisure "French": Morocco, Tunisia, Spain and

Greece. For the moment, Porto is the only proposed at the outset of

Orly-Sud.

From 1 June: two new destinations, Girona (2 times a day,

starting at 39 € *) and Djerba (once a day by mid-day, from 69 €). As

of June 29 is Agadir (daily, from 79 €), Oujda (every Tuesday, Thursday

and Saturday from 59 €) and Monastir (daily except on Tuesdays and

Thursdays, from 69 €) to be served.

For this summer: Palermo and Catania are planned five flights

a week in the direction of Sicily, but also Heraklio in Crete. It will be the

first direct flight departing from Orly-Sud and will be provided twice a week

for 99 €.

In return for these rates competitive, in-flight services will

be reduced to its simplest expression, as is the case in other low-cost

airlines. The food and beverages will be charged but "quality". A new card will

be offered every three months. The seating will be systematic, which should

avoid the rush at the time of boarding. The planes will be equipped with

screens that can play movies.

For ticket sales, Transavia.com should focus on direct contact

with its customers through its website. Tickets will also be sold at usual

trading partners Air France.

Note: Check the Internet "suggested on the website. This

service allows you to record his luggage online for flights departing from the

airports Dutch. This option allows users to save time when boarding. In addit

ion, "Transavia Netherlands offers tickets at 1 €, offering what we may

find in France.

* All prices refer to a "one-way".

* Source: IATA World Air Transport

Statistics and Financial Reports from the industry 2006

1 For financial year ending 31/12/2006

except for Air France-KLM, ANA Group and British Airways at 31/03/2007

* 2 Exchange

rate : 1 USD=€1.33547

|

|