3.5. BENEFITS OF «PEOPLE» FOR FINA BETTER

BANKING SERVICES

Personnel management is not the sole responsibility of the

personnel department, with in FINABANK. It is the business of all managers. All

levels of management from first line supervisors up to and including the CEO

are in tune with and manage FINABANK's employees in a manner consistent with

published practices, policies and procedures which are in harmony with the

needs of the workforce. All functions related to people management are

co-ordinated, follow a common philosophy and be part of a process that

effectively contributes to the achievement of the goals of FINABANK.

The only competitive advantage FINABANKA has the ability to

improve the performance of its people at all levels. Therefore HR management

always takes on a whole new meaning and is regarded by senior management as a

key component of FINABANK's activities and is given the requisite high profile

in the development of its long term strategies.

In the years ahead, in addition to increasing business

competitiveness there will be increasing competition for a shrinking workforce.

Employees will be attracted to organizations which practice imaginative and

enlightened management and avoid "management by best-seller" which gives rise

to the contradictions discussed earlier.

Within FINABANK, when revising, updating and redefining the

roles of employees and development training plans, particular attention is paid

to the people at the lower levels. It is the customer service reps, drivers,

order clerks and receptionists who frequently are the first interface with the

customers.

No matter how wise the CEO, or how great the product or

service, the battle for customer loyalty is fought by FINABANK front-line

troops - those employees at the lower levels of the organization structure.

Hence it is critical that due care and consideration be given those employees

when developing HR policies and training programs.

To become more productive, employees have to be motivated. In

this context, FINABANK after applying MASLOW's Needs Hierarchy as the

motivation tool, as presented in the second chapter, employees became more

productive as it is illustrated in the following figure:

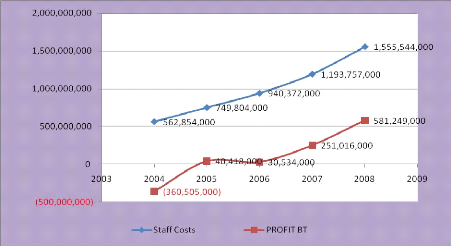

Figure 23: Impact of people to FINA

performance

Source: FINABANK, Financial Statement, 2004-2008

As it is shown by the above figure, FINABANK has spent, in one

hand, more on its personnel in 2005 (749,804,000Rwf) than the previous year

2004 (562,854,000Rwf) that's to say an increase of 33.21% and the same during

the following years cost on staff has been increased as far as the company

grows: 940,372,000Rwf; 1,193,757,000Rwf and 1,555,544,000Rwf respectively for

years 2006, 2007 and 2008 what determines respectively an increase of 25.42%,

26.95%, 30.31%.

In other hand, FINABANK has gained positively in 2005

(40,418,000Rwf) compared to year 2004 where it loosed (360,505,000Rwf) but the

following year (2006) its profit has decreased to 30,534,000Rwf and it has

recorded an increase in profit of 251,016,000Rwf, 581,249,000Rwf respectively

for years 2007 and 2008 what determines an increase of 722.09% and 131.56%

respectively.

FINABANK has recorded a high difference in profit between 2006

and 2007, as it comes to be presented, from 30,534,000Rwf to 251,016,000Rwf;

because in 2005 and 2006 had to cover first the big losses registered in

previous years.

Statistically, FINABANK roughly spent 1,000,466,200Rwf on its

personnel and gained 108,542,400Rwf, annually. The standard deviation of that

cost is 388,400,562Rwf and the one of profit is 344,413,256Rwf. The more money

spent on staff is 1,555,544,000Rwf and the more money gained is 581,249,000Rwf

while the less amount of money spent on staff is 562,854,000Rwf and the less

profit recorded is the loss equal to -360,505,000; all of this, is in the range

of 2004 to 2008, the interval of this research.

So, as it was well presented on the above graph, as far as the

cost of staff increases, the profit of that year increases also, because the

personnel is motivated and produces more to generate the high profit; what to

say, there is a significant and positive correlation of 0.966120088 between

cost on FINABANK's staff and the profit recorded in the period of 2004 up to

2008.

|