|

CERTIFICATION

This is to certify that this Project entitled

« Assessing the Impact of Risk Management in Reducing the

Risks of Financial Institutions in Cameroon » presented by

Cédric DALLE Paul (UB 021149) meets the project

requirements and regulations governing the Award of a Bachelor of Science

(B.Sc.) degree in Banking and Finance at the University of Buea and is

Therefore approved for its contributions to scientific knowledge and literacy

presentation.

Sign: ............................

Date: ....................

Mr MBU S. Agbor

(Supervisor)

Sign: ............................

Date: ....................

Dr MOLEM C. SAMA

(Head of Department)

DEDICATION

I dedicate this work to the DALLEs

Papa, Sandrine and Steve

And also to

My grand mother EWOMBE Regine.

Thanks for all.

ACKNOWLEDGEMENTS

I cannot start this section without giving a SPECAL THANK to

the ALMIGHTY GOD for his blessing on me and my family.

Special acknowledgements go to my supervisor Mr MBU S. Agbor

for all his efforts and devotion to make sure that the Researches will be

carried out effectively.

My uncle DIHEPE Alain is not left out; he helped me in giving

me advice on how to carry out my researches.

Exclusive acknowledgement to my friends of the group FUTUREX,

Guyzo, Stef, le Fotue, le Kalbe, Baisetcha, Didier and Lucile, lets build

together.

Special thank to Mathe and Jo for their moral support and

assistance. Thanks ladies.

I also would like to thank my programme coordinator for the

convivial atmosphere that exists during his lectures, thanks Mr NDENKA.

I would like to thank all the persons that contributed a lot

not only in my life but also in the realisation of this Project, especially the

NJOH family.

I will this tome express my thanks to all my friends: NJALEU

Alain, TCHENA NDJENG Theodore, ESSAM J.P.B, Emilie NKOUEMOU, Charlise MINKEU,

Carole KAMGUIA, Hermine FOKEM, SANAMA, Caroline, Charlotte, EDU Nora, Claude,

EBOLE Annick, Charline, METCHETCH, Claude-Maurelle, WEMBE Cyrille, Eric and

Arlette, Laura, Alice, Amina, Guy-franck and Romy.

Any thanks go to my Cousin EPOTO SONGA Ange Annick, for her

assistance in all aspect of my life in UB.

I am specially indebted to my great friend Winnie NZOUATCHA

for her spiritual support, spiritual encouragement and for being there when she

was needed

Finally I would like to thanks all those who participated

directly or indirectly to the realisation of this project especially the Staff

of the Library of the University of Buea.

DECLARATION

I hereby declare that this project is written by me and it

represents a record of my own research efforts. It has not been presented

before in any application for a degree or any reputable presentation. All

borrowed ideas have been duly acknowledged by means of references and quotation

marks.

Sign: ..............................

Date: ......................

Cédric DALLE Paul

This above declaration is confirmed by:

Sign: ..............................

Date: ......................

Mr MBU S. Agbor

(Supervisor)

ABSTRACT

This work «Assessing the Impact of Risk Management in

Reducing the Risks of Financial Institutions in Cameroon» seeks to study

and evaluate the relationship between Risk Reduction strategy and the

profitability of Financial Institutions in Cameroon for the period 1997-2005.

Given the problem statement, does risk management have an

impact on risky shift through reduction of bad loans in the Cameroonian

financial system? The study was aimed at finding out whether Risk Management

relates negatively with profitability of financial institutions in Cameroon.

The null hypothesis were raised from the problem statement; Risk Management

does not affect effectively returns in financial institutions

Most of the data was collected through secondary sources found

in publications, books and internet. These data were analysed using the trends

analysis, table analysis, ratio analysis and standard deviation analysis to

verify the relationship between Risks Management and Return of Financial

institutions in Cameroon.

Risks Managers should try to keep adequate liquidity level in

order to meet some uncertain issues related to the withdrawals of funds or

bankruptcy.

TABLE OF CONTENTS

Contents

Pages

CERTIFICATION..........................................................................i

DEDICATION

............................................................................ii

ACKNOWLEDGEMENTS

............................................................iii

DECLARATION

.........................................................................iv

ABSTRACT

................................................................................v

TABLE OF CONTENTS

...............................................................vi

CHAPTER ONE: INTRODUCTION

1.1 Background Information

............................................................1

1.2 Problem Statement

...................................................................2

1.3 Objectives of the Study

..............................................................2

1.4 Hypotheses of the Study

.............................................................3

1.5 Significance of the Study

............................................................3

CHAPTER TWO: LITTERATURE REVIEW

2.1 Definitions of Financial Institution

.................................................5

2.2 types of Financial Institutions and their associated

functions ..................7

2.3 Financial Institutions in Cameroon

...............................................12

2.4 The Concept of Risk

................................................................17

2.4.1 The Nature of Risk

...............................................................17

2.4.2 Type of Risk

.......................................................................18

2.4.3 Evaluating Risks

..................................................................19

2.4.4 Forms of Risks encountered in the Financial Milieu

.........................19

2.4.4.1 Liquidity Risk

...................................................................20

2.4.4.2 Credit Risks

.....................................................................20

2.4.4.3 Inflation or Price risks

.........................................................20

2.5 Understanding Risk Management

.................................................20

2.5.1 Scope and Objectives

............................................................21

2.5.2 The Role of Risk Management

..................................................21

2.6 Theoretical Literature Review

.....................................................22

2.6.1 The Use of Financial Instruments in Risk Reduction

........................22

2.6.2 The Management of Price Risk in Finance

.....................................23

2.6.3 Theories of Credit Risk

..........................................................24

2.6.4 Risky Shift Theories

..............................................................25

2.7 Empirical Evidence

.................................................................26

CHAPTER THREE: METHODOLOGY OF THE STUDY

3.1 Introduction

..........................................................................28

3.2 Background Information to the Study Area

.....................................28

3.3 Data Collection and Data Sources

................................................31

3.4 Sampling Design

....................................................................32

3.5 Method of Analysis

.................................................................32

3.6 Variables of Interest

................................................................33

CHAPTER FOUR: DATA PRESENTATION AND ANALYSIS

4.0 Introduction

..........................................................................35

4.1 Qualitative Analysis

................................................................35

4.1.1 Assessing the Impact of Risk Management on Credit Risk

.................35

4.1.2 Assessing the Impact of Risk Management on Liquidity Risk

.............38

4.2 Quantitative Analysis

...............................................................40

4.2.1 Investigating the impact of risk Management on the

Profitability of Financial Institutions

....................................................................41

4.2.2 Assessing the Impact of Risk Management on the Overall

Credit Risk Policy

......................................................................................43

4.2.3 Relationship Between Credit Risks and Profits: the case

of Afriland First Bank

.......................................................................................44

4.24 Investigating the Impact of Risk Management on the

Liquidity Position of Financial Institutions

....................................................................45

CHAPTER FIVE: SUMMARY, RECOMMENDATIONS AND CONCLUSION

5.1 Summary of Findings

...............................................................48

5.2 Recommendations

..................................................................49

5.3 Conclusion

...........................................................................50

BIBLIOGRAPHY

....................................................................51-52

CHAPTER 1

INTRODUCTION

1.1BACKGROUND INFORMATION

The path of financial activity, which concerns banking,

insurance, savings and loans associations, etc, had always been paved with

numerous contingencies. Contingencies are referred to here as risks that

symbolises a situation that cannot be controlled or perfectly foreseen (S.R.

DIACON, 1984). These risks cannot be predicted accurately and this therefore

gives rise to the involvement of a careful management.

The Cameroonian financial framework, as any other financial

system in the world, deals highly with risks in its every day management. As a

reason for this, we can mention the fact that there are factors that are not

under the control of managers such as globalisation, world changes or market

variables like price changes or stock exchange trends.

Historically the banking and finance management in Cameroon

has always been subject to some major risks, the careful management of which

has always led to survival in the financial sector. Many Cameroonian financial

houses handle these risks on a daily basis in order to grow and encounter rapid

changes. Therefore, risks must be understood and carefully managed for a proper

decision making in the Cameroonian financial system.

1.2 PROBLEM STATEMENT

In 2005, 7 of 11 banks were found to be in a good or solid

standing (CEMAC, surveillance report, 2005).Furthermore, the liquid ratio of

the whole financial system was 2 in 2004 and 0.58 in 2005. This information

highlights the problem of liquidity risks encountered by banks in Cameroon.

Furthermore the amount of bad/non-performing loans was 13.1

billions in 2004 and an increase in 2005 (COBAC and staff calculations) and an

increase in the amount from 2004 to 2005 by 0.8 billions.

An analysis of these statistics shows an increase in the

banking and finance activity in Cameroon. For the past three years as a result

of a fall in the amount of bad debt from 2004 to 2005. This may imply that the

minimisation of credit risks has increased the amount in savings accounts by

0.8 billions. Here we have mentioned the level of bad loan in relation to the

risk analysis. This therefore helps us in asking ourselves the following

fundamental questions four our study.

- Is there any relationship between the risk management and

the growth of financial institutions in Cameroon?

- Does risk management have an impact on risky shift through

reduction of bad loans in the Cameroonian financial system?

1.3 OBJECTIVES OF THE STUDY

The main objective of this study is to investigate the impact

of risk management in reducing the risks of financial institutions in Cameroon.

To better cope with main objective, we may need to focus on the following

specific objectives.

- Investigating the impact of risk management on financial

institutions profitability.

- Assessing the impact of risk management on the overall

credit policy of financial institutions.

- Studying the effect of risk management on the liquidity

level of financial institutions.

- Making necessary recommendations on how to minimise risks in

the financial environment.

1.4 HYPOTHESIS OF THE STUDY

The following are the hypothesis of our study;

Ho: there is no relationship strategy between risks management

or risk reduction strategy and the growth of financial constitutions in

Cameroon.

H1: there is a relationship between risk management in risk

reduction strategy and the growth of financial institutions in Cameroon.

1.5 SIGNIFICANCE OF THE STUDY

The study on the impact of risk management in reducing the

risk of financial institutions in Cameroon is an important study, attractive

and actual. This is because it helps us in finding how and what is the impact

of risk management in the financial industry of our country

More so this study will help in answering actual question

about the way in which risks are inherent in every aspect of the life

especially in the financial area. Furthermore, a study of this importance will

help us to find how financial institutions in Cameroon prevent or handle

calamity in order for us to give advices on how these materials can better be

improved.

Scope and limitation of the study

The topic under study may not be easy to conduct and therefore

may not be properly achieved. This is merely because of the fact the there are

a number of obstacles encountered in gathering data, ranging from limitations

of time and finance, to deliberate boarding of information poor documentation

bureaucracy doubtfulness of available data etc.

The relationship between risk management and the growth of

financial institutions in Cameroon will be investigated from the period 2000 to

2005.

CHAPTER 2

LITERATURE REVIEW

In this section of our work; we are concerned with coming

along with all necessary theories that suggest the possibility of the existence

of a relationship between risk management and the risk reduction strategy of

financial institutions in Cameroon. Here we are making a survey of borrowed

academic materials, which might help us in better understanding the core issue

of our research project.

A general understanding of the concept of financial

institutions

2.1 DEFINITION OF FINANCIAL INSTITUTION

According to Millard F. Long (1919), financial institutions

make use of a widely accepted medium of exchange which reduces the cost of

transaction, facilitate trade and encourage specialisation as well as

production efficiency. In addition, Ndenka Aaron (2005) add by saying that

financial institutions or financial intermediaries are simply economic units

whose main function is to handle the financial assets of the households and

firms in our society.

In other words, they are business entities that specialises in

managing deposits from savers or depositors and give these deposits out as

loans to borrowers. Their main tool of raising financial profits is through

credit, which is the process by which loanable funds are allocated to borrowers

from lenders. The use of credit by financial institutions that enters in a

legal course of action, of course, need or necessitate the establishment of

legal instruments called credit instruments. The most commonly used credit

instruments are of two types: promises to

pay and order to pay. They include

letter of credit, bills of exchange, cheques, bonds, stocks and securities.

Furthermore, credit instrument confer to its owner the three

following characteristics that are a yield, liquidity and safety (Aaron Ndenka,

2005).

The following diagram represents a summary of the functioning

of financial institutions in their lending process.

FIGURE 1: THE LENDING PROCESS OF FINANCIAL

INSTITUTIONS

ULTIMATE

LENDER

ULTIMATE

BORROWER

Direct

borrowing

Direct

lending.

Indirect lending

FINANCIAL

INTERMEDIARY

Money

Money

Evidence of debt

evidence of debt

Source: Foundations of Banking and Finance, 2005.

2.2 TYPE OF FINANCIAL INSTITUTION AND THEIR ASSOCIATED

FUNCTIONS

The term financial institutions can be applied to a variety of

institution some of which are:

2.2.1 THE CENTRAL BANK

The central bank is the most important institutions in a

financial system. It occupies a unique position in the monetary and banking

system of the country in which it operates. The central bank is always inspired

by the principle of national welfare and in order to achieve this it must be

done not under the influence of government, the reason being that the economy

problem of the country cannot be satisfactorily solved without the fullest

co-operations between the central bank and the government (Foundations of

banking, 2005)

The central bank should under no circumstances compete with

other banks that is receiving deposits from the public or extending loans to

needy borrowers. If it competes with other banks, this will conflict with its

important function of being the bankers' bank, controller of credit and lender

of last resort (comparative banking systems, 2005).

Furthermore, the special powers of the central bank are

designed to help it to control the volume and availability of currency and

demand deposit in the best interest of the economic life of the nation. The

group of special powers comprises the power to issue legal tender currencies,

to control the volume of reserves available at the commercial banks and to cat

as the principal financial adviser to the national government (Ndenka Aaron,

2005).

Kaufman George, Larry Mote and Harvey Rosenblum stated during

a conference in 1982 in Chicago that the means as tools used by central banks

in carrying out their duties in order to control the money in circulation can

include the granting or refusing to grant loans to the commercial banks. This

will affect their reserve requirements and therefore the credit. Secondly, by

presenting a reserve ratio, a central bank can influence the amounts of

reserves available to commercial banks. Thirdly, by buying and setting

securities in an open market operation (OMO). The central bank can also affect

the size of reserves of commercial banks. Here heavy reliance is put on loans

to commercial banks because of the narrowness of financial markets.

2.2.2 COMMERCIAL BANKS

These are credit establishments which has as a focus enhancing

financial services to the public, they have as goal the collection of deposits

in order to give them out as loans in order to finance the economic activity

(Microsoft Encarta, 2006)

Commercial banks play the following economic functions:

- they facilitate the formation and allocation of capital

- they transform the risk of financial assets

- They promote market efficiency (D. Carter, 2004) commercial

banks are easily the largest and the most diversified of the financial

intermediaries in terms of assets and liabilities. About the only major asset

that they do not hold is corporate stock, which law prohibits them for

acquiring (Foundations of Banking,2005)

2.2.3 INVESTMENT BANKS AND DEVELOPMENT BANKS

These are financial institutions which are concerned with

giving out loans which has to do with the financing of infrastructure in a

given area (Microsoft Encarta, 2006)

Investment banks are often compared with development banks.

Both institutions are specialised in investment. But their difference in the

range of their activities but it is important to note that investment banks are

concerned primarily where there are infrastructural problem while development

banks refers to the financing of industrial project in geographical areas where

there are development problems (Barth J.L, 1999)

2.2.4 RECONSTRUCTION BANKS

Reconstruction banks are financial institutions which enhance

funds for reconstruction and development to the country which they are engaged

(Rendall, 1978)). In today's world there are many calamities that can occur and

hamper the infrastructures of a country such as war, Tsumani, volcanic

eruption... it is the role of a reconstruction bank to allow loans to countries

in order for the lathers to reconstruct their country and develop necessary

industries achieve economic growth. Examples of reconstruction banks include

IBRD (international banks for reconstruction and development).

2.2.5 SAVINGS AND LOANS ASSOCIATIONS

For Bonacossi di Patti (2001), savings and loan or building

and loan associations are financial intermediaries, which accept savings from

the public and invest those savings mainly is mortgages loans. Today, savings

and loans associations (S and Ls) are very similar to bank. They have

continuous life as some loans are paid off, new loans are made. Traditional

distinction between banks and S and Ls are steadily blurring. Banks are today

more than ever before turning to real estate loans. The S and Ls are now

acquiring more liquidity than they formerly had and their system resembles the

banking system in a number of aspects. As explained below, they have their own

central banks from which they may borrow. Most S and Ls are growing in

popularity and this may be due to their low interest rate on borrowed funds.

2.2.6 MUTUAL SAVINGS BANKS

Honotran P.(1997) address that mutual savings banks issue

claims against themselves in the form of relatively small savings and time

deposits, and the recent years in form of negotiable orders of withdrawal (NOW)

accounts, which are legally payable on short notice. Their assets are

predominantly long term, with real estate mortgages comprising about two thirds

of their assets. They also hold modest amount of corporate bonds and united

values of Cameroon bonds of government.

2.2.7 LIFE INSURANCE COMPANIES

They issue claims in the form of life insurance and annuity

policies and acquire long-term direct securities such as real estate mortgages

and corporate bonds and notes. Although nearly three fourths of their assets

presently are held in these instruments, the composition of their portfolio has

changed markedly (Foundations of banking, 2005)

2.2.8 CREDIT UNION

Credit union promotes thrift among their members and makes

loans to them mainly for the purchase of consumers' goods such as automobiles.

Credit union issue savings deposit claims against themselves (Foundations of

banking, 2005)

2.2.9 FACTORS

Companies that finance the accounts receivable (not instalment

contract) of the borrowers are important sources of credit for some businesses,

and the factor manage their receivable so that they could recover them

(Foundations of banking, 2005).

2.2.10 SECURITY EXCHANGES

Stock exchange does not distribute new issue but they

facilitate trading in issues already outstanding (Foundations of banking,

2005). These security exchange may be primarily local concerns, dealing mostly

in the stocks of company in the vicinity that rare primarily owned by local

residents. However, security exchange companies are the case with the NYSE (New

York Stock Exchange).

2.2.11 TRUST INSTITUTIONS

They include the trust companies and the trust departments

operated by many banks. The principal function of any trustee is to hold

properly and administer it for the benefit of others (Foundations of

banking).

2.3. FINANCIAL INSTITUTIONS IN CAMEROON

In this section of our study, we are going to come about with

concrete examples of the above-mentioned type of financial institutions in

Cameroon and how they function, the basis on which the business is carried out

and the legal framework of finance regulations in Cameroon.

2.3.1 CENTRAL BANKING

Cameroon's banking system is closely related to the

development of banking in the central African sub-region that is set out to

perform his function of a central bank and controller of the monetary and

banking policies of the sub-region.

The central bank of central African states (BEAC) is the bank

that performs the role of central bank in Cameroon (

www.beac.int). The structure of its

management and administration includes a committee of six member's countries

(i.e. Cameroon, Equatorial Guinea, Gabon, Central Africa Republic, Congo and

Chad). The BEAC also comprise a governor appointed at the conference of the

heads of states for CEMAC. The governor and this staff are responsible of the

monetary policies of the monetary union of the central Africa sub-region.

Monetary policy in Cameroon is conducted by BEAC and its aim is to maintain the

external and internal value of currency (comparing banking systems, 2005). The

banking commission of central African states (COBAC) is an organ of the code

with regard to accountability and public assurances of integrity COBAC assures

bank supervision and the coverage of non-blank deposits taking financial

institutions by the commercial banks is their accounts and establish necessary

reserves requirements.

Commercial banking in Cameroon is controlled by the BEAC.

The BEAC is also the institute of emission of the FCFA and controls the

stability of the currency (Mark Debels, 2003)

2.3.2 COMMERCIAL BANKING IN CAMEROON

The economic crisis of the 80s has highly affects the banking

sector and this has led to the strengthening plan of 1989-19925. The

liquidation of the banks and the creation of the SRC (Societe de Recouvrement

des Creances du Cameroon), the re-foundation of BICIC (Banque Internationale du

Commerce ET de l'Industrie du Cameroun) and of the SGBC (Societe Generale des

banques au Cameroun). After the devaluation of the franc CFA in 1994, new

reforms were undertaken. After a wave of liquidation (First investment banks,

Meridien BIAO bank Cameroon, Credit agricole du Cameroun, closings or failure

(International Bank Africa Cameroon, BICIC now BICEC) and recapitalisation

(SGBC, Standard Chartered Bank), new banks have been created (Mission

economique de Yaounde, 2003).

In Cameroon, 10 commercial banks are authorised by COBAC.

These banks include:

- Amity bank, which is constitute of 100 % of private

Cameroonians investors.

- BICEC; (Banque Internationale du Cameroun pour l'Epargne ET

le Credit) has been privatised in 2000 by the French group Natexis- Banques

populaires.

- CBC, commercial bank of Cameroon, whose capital is owned at

90 % by Cameroonians and at 10 % by the German Cooperation

- Afriland First Bank,

- NFC

- Credit Lyonnais Cameroon, 65 % Credit Lyonnais France and 35

% of Cameroonians state. But this bank has been liquidated in March 2007. Now

it is CA-SCB which is Credit Agricole Societe Camerounaise de Banque (Cameroon

Tribune, March 2007).

- ECOBANK, holding Ecobank Transnational Togo Citibank 100 %

Citibank USA standard bank, 66% standard chartered 34 % state of Cameroon.

- SGBC (Societe Generale de banques au Cameroun) 74 % French

group societe generale and associates, 26 % by Cameroon state.

- Union bank of Cameroon, which comes from a group of

cooperative credit union (CAMCUL) they are represented in other countries of

the sub-region such as Gabon, Congo Brazzaville, Chad and Equatorial Guinea.

Source: Mission économique de

Yaoundé, (2003).

According to investigation carried out by Economia in the

classification of the firsts' African banks, it appears that among the 25 first

banks, 6 are Cameroonians (Economia, 2002).

2.3.3 DEVELOPMENT BANKS

In Cameroon, the African development bank (ADB) is in charge

of development and reconstruction plans. But since the Cameroonian member state

of the World Bank, the international bank for reconstruction and development

(IBRD) can also play that role (Microsoft Encarta, 2006)

2.3.4 SAVINGS AND LOANS ASSOCIATIONS AND CREDIT UNIONS

Savings and loans associations and credit union are know in

Cameroon as microfinance institutions, in 2001 the Cameroon has registered 652

microfinance institutions, but only 601 were actually existing in 2003( COBAC

surveillance, 2003). Furthermore the microfinance sector was actually touching

more than 300 000 clients i.e. 7% of the potential market. The mobilised

savings were 35.9billions of FCFA, and 25.4 billions CFA of credit were granted

by those institutions.

The principal micro financial institutions in Cameroon are:

- CAMCUL ( Cameroon cooperative credit union league)

- MC2 (Mutuelle Communautaires de Croissance)

- CVECA (Caisses Villageoises d'Epargne et de

Crédit).

- CAPCOL. They were having on their account more than 62% of

the collected savings in Cameroon by the microfinance institutions and 64% of

client (BIM n°- 09 Mai 2006).

2.3.5 STOCK EXCHANGE COMPANIES

In the Cameroonian financial sector, it is the Douala stock

exchange which plays the role of stock exchange in Cameroon since 2002(COBAC

surveillance, 2003). It focuses transferring shares of companies from buyers

and sellers. And these transactions occur in a legal framework.

2.3.6 INSURANCE COMPANIES

Insurance companies in Cameroon account for the most important

activity in the CEMAC zone. They specialise in issuing insurance policies to

the public and government:

- satellite insurance company

- Chanas Assurance

- Société Camerounaise d'Assurance et de

Réassurance (SOCAR)

- GML (Groupement Mutuelle des Cadres)

- CAMINSUR (Cameroon Insu rance Company)

Are the most important ones since they capitalise 63% of the

policy issue in Cameroon (Economia, 24). The insurance activity is regulated by

the CIMA code which is the constitution of insurance activity in central

Africa.

2.4 THE CONCEPT OF RISK

2.4.1 THE NATURE OF RISKS

For S.R.Diacon (1988). Risks are present whenever human beings

are unable to control or perfectly foresee the future. For example, risk of

theft, firing, natural disaster. Similarly, there are risks in running a

business, because no business man can guarantee that he will make profits

rather than losses. But although we cannot measure the risks we can to some

extend measure it the term uncertainty is used where future alternatives and

hence are not known, such as in speculative ventures like the outcome of space

research or of possible new inventions.

2.4.2 TYPES OF RISKS

Fundamental and particular risks

Fundamental risks affects either society in general or of

people and cannot be controlled (in partially by any one person where as

particular risks refers to those future out come that we can control partially

(though not predictably) (S.R.Diacon, 1988).

Pure and speculative risks

Speculation risks are present if either beneficial or adverse

outcomes could stem from a specific event whereas if possible harm is the only

alternative to the present status quo, the situation is known as pure risk

(S.R. Diacon, 1988).

Uninsurable risks

In practise, not all risks can be insured. The insurability of

risks depends on number of factors which are:

- measurable in money terms

- pure risks only

- a large number of independent exposures

- Fortuitous losses or accidental losses. (S.R. Diacon and

L. Carter, 1988.)

2.4.3. EVALUATING RISKS

Measuring risks is difficult, and even experts are not agreed

on exactly how it should be done. Several tools of analysis exist but the most

used ones are:

Profitability distributions

Probability in the chance of occurrence of a particular event

over a total range on number of event its mathematical formula is:

Pr = B/Ù; where B is the outcome of

one event and Ù is the total possible outcomes.

The standard deviation technique

It is symbolised by and it is found by adding the squared of

the deviation by the individual values from the mean of the distribution.

The mathematical formula is

? (X - u)

2

S or ó = v

N

Where X is the actual variable, u is the mean of all the

variables and N is the total of all the variables.

2.4.4. FORMS OF RISKS ENOUNTERED IN THE FINANCIAL

MILIEU

Since financial institutions deals in the money market, they

have to be liquid at any point in time in order to cover their debt in the

short term. The following are risks that the financial institution can face.

2.4.4.1 LIQUIDITY RISKS

Also called bankruptcy risks, it is the risks that a firm

will be unable to repay depositors therefore leading to insolvency or default (

www.specialinvestors.com).

2.4.4.2. CREDIT RISKS

This is the most common type of risk faced by financial

institutions in the money market. It is the risk that an issuer of debt

securities or a borrower may default on his obligations or that the payment of

the interest or the principal or both may not be made on a negotiable

instrument (

www.specialinvestors.com).

2.4.4.3. INFLATION OR PRICE RISKS

This is the risk that arises when the values of a portfolio

(security) will decline in the future or a type of mortgage pipeline risk

created in the product segment when loans terms are set for the borrower in

advance of terms being set for secondary market sale. If general level of rate

rises during the product cycle, lender may have to sell his original loan at

discount and this could lead to a loss (

www.specialinvestors.com)

specialised financial dictionary online.

These three forms of risk will be the central importance in

our study, although not all forms have been highlighted in this study.

2.5 UNDERSTANDING RISK MANAGEMENT

2.5.1 SCOPE AND OBJECTIVES

Risk management introduces the modern theory of planning or

decision making under uncertainty that is contingency planning (S.Schwartz,

2001).managers in the past have always use financial ratios is quantifying

risks. Decision making involve making decision now about what will happen in

the future. In this light, decisions in the future may turnout to have a

negative effect on actual result or vice-versa or actual results can prone to

be very different from expected results. Risk management is therefore concerned

with the identification of potential problems and eliminating or reducing the

damage which they may result in if the problem materialises.

The objectives of risk management is an efficient planning for

risks and this therefore formally addresses the identification, which may alter

the implementation of company's policy (ies) yet towards achievement of company

objectives. Risk management is a proactive approach rather than a reactive

approach.

2.5.2 THE ROLE OF RISK MANAGEMENT

Risks management is a staff function; in a management

environment it helps an organisation in the following ways:

a- It identifies, captures, processes and communicates risks

management information to management concerning the operation of the

organisation.

b- It helps to analyse the nature of the cost associated with

the management of risks.

c- It allows the management team the opportunity to achieve

its objectives as planned. In a company environment where risks management is

absent, management plans is disrupted by the occurrence of some unseen

events.

d- It disposes management of all situation of risks which may

prevent a company of achieving its objectives

e- It is therefore presented with careful planning, arranging

and controlling of operations and resources in order to minimise the impact of

risks.

2.6 THEORETICAL LITTERATURE REVIEW

The theoretical aspect of our L.R. stresses the relevant

theories that have been elaborated concerning the risk management in financial

institutions and its relation with risk reduction. This will be done by

highlighting the research of various authors in order to come out with an

objective analyses of the topic understudied.

2.6.1 THE USE OF FINANCIAL INSTRUMENTS IN RISK

REDUCTION

Stijn Claessens and Ronald C. Duncan (1993) highlighted the

starting point to manage commodity risks, including any the uses financial

instruments is by setting clear objectives which do not interfere with

efficient allocation of resources within the country. Financial risks

management instruments always above is one of the condition for successful

price stabilisation.

Hugher-Harlettand and Ramanujan (1990) pointed out that

instrument for managing commodity risks hedge only against price risks

therefore leaving quantity risks and that buffer stock hedge against revenue

risks. Furthermore, CLaessens and Duncan (1993) added that the financial

commodity risks in the absence of a directly available matching counter swap,

manage the price risks on the swap by using short-dated futures and option

markets. By dynamic hedging, through the use of short dated instruments, the

intermediary can duplicate a long term hedge risk arising from changes in the

relation between spot and future prices. That is: Basis risk = 1 -

correlation coefficient (spot and future price coefficient)

2.6.2 THE MANAGEMENT OF PRICE RISKS IN FINANCE

Christopher L. Gilbert (1993) stated that the first 3 measures

aiming at insulating the economy against price shocks are either by stabilizing

international commodity prices( first measure) or by transferring risks to

third parties. The transfer of risks could be accomplished either by hedging

(second measure) or by transferring funds i.e. borrowing or lending (third

measure). The last measure aims at reducing the impact of commodity price

changes on a certain domestic sector by forms or self insurance or domestic

diversification.

One approach that has been stressed up is the use of financial

derivatives instruments (forward, future option) to reduce the revenue

variability. It is suggested the producers could directly via dealer use the

market to offset their exposure to price risks.

Toshiya Masouka (1998) added that for financial institutions

and corporations, assets liability management includes these activities that

attempt to control exposure to financial and other price risks. Institutions

and corporations examine the risk exposure of their assets and liabilities to

future price movements to develop their risk exposure profile because risk

management operations reduces the possibility of unanticipated deviations from

initial projection on economic variables.

2.6.3 THEORIES OF CREDIT RISK

For Millard F. Long (1989) the origin of financial distress

can be traced as far back the 1950s and 1960s when developing countries decided

to take over foreign investors' financial institutions then, mostly commercial

banks provided short-term command trade credits. Yet they were faced with

directed credit programs by the governments these latter were said to borrow

too much from banks risk concentration. Thus they were forced to become

insolvent or actually fell. E.g.: credit agricol bank in Cameroon and other

banks suffer large losses and actually failed. In Cameroon we are faced with

the problem of insolvency and thee most recent case was the liquidation of

BICIC which has been changed into BICEC. The causes of this failure might be

related to risk concentration or connected lending.

2.6.4. RISKY-SHIFT THEORIES

Michael and Frenkel Ulrich Heemmet (2000) argue that a trade

off between risks and returns has always exists so much so that more risks

yield more returns. If a bank takes more risks by investing in a credit

facility, the bank might have returns to the extend of the degree of risk they

have taken. But this will only be done when there is a good risk management

strategy to alleviate the effect of pure risks. For that reason banks must

avoid the following situation in order to earn higher returns:

a- risk concentration

This means making loans representing a high proportion of

banks capital to one single borrower or group of borrowers or to given sector

of the industry (Foundations of banking, 2005). This practise may by the result

of pour lending policies or of the free will of the banker (who believes in the

external health of a given borrowers).

b- connected lending

This means a situation where the bank lends to companies owned

(totally or partially) by the banker or by the bank (Foundations of banking,

2005). Lending to connected borrowers to the banker beyond certain limits is

fraudulent. In most cases, that kind of lending contains a high risk because of

the banker's tendency to use the bank as an instrument to finance his

businesses irrespective of their ability to repay and concentrate large

proportion of the bank lending on them.

c- Overextension

This means lending sum on money that are not in proportion of

the bank's capital (as a cushion for potential losses), or diversifying

activities to geographical or business areas. The bank is not well equipped to

manage (Ndenka Aaron, 2005).

An effective management of banks and financial institutions

requires a careful handling of possible risky outcomes. In order to handle

this, the management should summarize policies and strategies in a guideline

for business management. The policies which a manager can refer are as

follows:

- develop actions to fight the risks

- insurance or reinsurance

- evaluating control put in place to manage risks

- using short dated investment appraisal methods

- The use of capital rationing and ratio analysis.

(Managing Banks, 2005 by Aaron Ndenka)

2.7. EMPERICAL EVIDENCE

In empirical literature review, we examine some empirical

analysis made in risk and liquidity management and then consider the

performance of banking under the growing influence of globalisation.

In a research carried pout on the guiding principles of risk

management for U.S. commercial banks (2002), by the sub-committee on risk

management principles of a financial service roundtable aimed at testing how

active management of credit risk (as proxies by loans sales and purchases)

affects financial institutions growth (capital structure, sending profits ad

risks) detailed loan level data for a broad cross section of U.S. banks was not

from aggregate data and aggregate actions the data obtained includes the sale

and purchases of all loans originated by banks from June 1987-1995 including

residential real state and consumer loans.

The dependant variables were capital and liquidity

variables (capital/assets ratios, liquidity ratio).

The lending variables were commercial and individual

real state lending to asset ration.

The risk variables were time series standard

deviation of each banks return on equity (ROE), loan loss provision to total

assets.

The profit variables were time series mean of each

bank's ROE. The researchers came to the conclusion that large internal capital

markets do allow banks to operate with a smaller liquidity level. Thus the risk

management plays a role in the growth of financial institutions according to

that committee.

CHAPTER 3:

METHODOLOGY OF THE STUDY

3.1 INTRODUCTION

Having reviewed much of this work with regards to the

study in chapter 2, this chapter on methodology will analyse the methods and

procedures that will be employed in the course of the study. In this section,

the methods to be used in analysing the collected data are of great importance.

This work which examines the impact of risk management in reducing the risks of

financial institutions in Cameroon will involve both qualitative and

quantitative data, as the collected data will be used to testify the hypothesis

and the objectives underlying the study while tables are mostly used with

qualitative data, it will also be accompanied with charts like bar charts as

well as percentages and averages. It will also be accompanied by quantitative

statistical tools like standard deviation. The use of ratios will be done on

passed financial statements of randomly sampled selected financial institutions

to analyse the impact of risk on investment decision making in financial

institutions.

3.2 BACKGROUND INFORMATION TO THE STUDY AREA

3.2.1 SOCIAL BACKGROUND

Cameroon is a central African country open upon the world

through its sea and the Atlantic Ocean. It is a bilingual country where English

and French are coexisting in harmony as official languages. The political

capital is YAOUNDE and the Cameroon is a member of the commonwealth. In 2005,

the Cameroonian population was estimated to 16.4 millions inhabitants. The

annual growth rate of the population reaches 1.93%. In 2005 the fecundity

indices was high (43.5 children/woman) whereas the infant death rate was

estimated to 68%o and the life expectancy was 48 years. About 51% of

Cameroonians live in town in 2003. The major towns are YAOUNDE (1372800

inhabits) Douala (1448300 inhabits) in 1999. (Microsoft Encarta

2006.)

3.2.2 EDUCATIONAL BACKGROUND

More than 60% of the population has less than 25 years. The

school is compulsory from 6 to 11 years. In 2002, 33 per cent of children were

registered in secondary education and only 5% had access to the higher

education. The University of YAOUNDE built in 1962, coexists with four other

universities such as BUEA, DOUALA, NGAOUNDERE and DSCHANG. Religious schools

are also of great influence in the country since they are subsidised partly by

the government. The alphabetisation rate was 81.1% in 2005 for the entire

population.

(Microsoft Encarta 2006)

3.2.3 POLITICAL BACKGROUND

Since 1990 and the instalment of multipartism, Cameroon has

encountered a hard democratisation of the regime. The president AHMADOU AHIDJO

in 1966, the CPDM (Cameroon popular democratic movement) whose actual leader is

Paul BIYA is the president of the country since 1982. The main opposition

parties are SDF (Social Democratic Front), Anglophone, and the CDU (Cameroon

Democratic Union). The political system is regulated by the constitution of

1972, revised in 1996. (Microsoft Encarta 2006)

3.2.4 CULTURAL AND RELIGIOUS BACKGROUND

About one quart of the population is animist. The Muslims

(22%) are living principally in the north whereas the Christians (33%

Catholics, 17% protestants) are living in the south. The francophone (78%) are

greater in number than Anglophones (22%). Sudanese languages are talked in the

north whereas Bantus languages are talked in the south.

(Microsoft Encarta 2006)

3.2.5 ECONOMIC BACKGROUND

Cameroon has vast resources, may it be agricultural as well as

mining and petroleum. It has witness an important growth between 1977 and 1985

(more than 10%/year) due to the valorisation of its oil resources and its

agricultural exportations. After an economic crisis period and durable due to

the degradation on general accord on trade (downswing of 44% between 86-89) and

due to the competition with its closest neighbour NIGERIA. Parallely to an

increase of public expenditures the country has engaged since1988 a structural

adjustment program under the supervision of the International Monetary Fund

(IMF). The devaluation of the FCFA in 1994 has enabled an increase in

exportations and stabilization of the economy. Cameroon has benefits from the

HIPC initiative in favour of highly indebted poor countries which has led to an

alleviation of debt in favour of the fight against poverty (in 2001, 40.2% of

the population was under the poverty level). Cameroon has reconciled with

economic growth from the period 1990 till now. The growth rate of the GDP was

2.70%. In 2003 GDP was estimated at 12.49 billions of dollars, and the per

capita GDP was 780 dollars.

(Microsoft Encarta 2006)

3.3 DATA COLLECTION AND DATA SOURCES

3.3.1 SECONDARY SOURCES

This will be the source of the bulk of our data. The data will

be collected from the web search. The data used for our investigation will come

mostly from BEAC publications, COBAC and Staff calculations and the use of

local and specialised press. We will also make use of financial statements from

AFRILAND FIRST BANK and SOWEFCU in order to run our analysis about the risk

evaluation.

3.4 SAMPLING DESIGN

Given a research of this nature we are intended to work with

samples of value since we cannot cover the entire financial industry in

Cameroon. To do so we are going to make use of purposive random sampling since

we are going to work with organisations which have a branches in almost every

province of the country. The sampling was made according to the level of

activity of the commercial banks such as AFRILAND FIRST BANK. We also noticed

the importance of micro-financial credit unions that is why our sampling

technique allowed us to work with SOWEFCU-KUMBA. Having sampled our target of

interest, we are now going to talk about the method of analysis.

3.4 METHOD OF ANALYSIS

In analysing our information we will make use of the following

tools of analysis:

3.4.1 RATIOS ANALYSIS

Ratio analysis is an important technique in assessing the

financial condition of a company and the relative attraction of its securities.

They are useful because they can briefly summarize relationships between items

in the financial statement which are significant.

We have for instance what is meant as profitability ratios

within which we can fund the liquidity ratio which is given as follows:

Currents

assets

Liquidity ratio =

Currents

liabilities

It attempts to measure the ability of a company to meet its

short-term commitments. Ratios are generally expressed in percentages and they

express the degree of variation or relationship between financial indicators of

the company.

3.4.2 STANDARD DEVIATION (ó)

Standard deviation is a statistical tool of analysis usually

computed to determine the risk figures. It is merely used in measuring the time

series deviations between two variables. It quantifies the risks in

mathematical terms and its expression is given as follows:

? (X - u)

2

S or ó = v

N

3.5 VARIABLES OF INTEREST

During our research we will focus on the following variables

of interest

3.5.1 INDEPENDENT VARIABLES:

- risks variables:

* Assets quality

* Time series standard deviation of liquidity ratios

* Liquidity ratios

* Amount of non performing loans

3.5.2 DEPENDANT VARIABLES

- Profitability variables:

* Return on Equity (ROE)

* Return on investment (ROI)

* Return on assets (ROA)

* Profitability margin

CHAPTER FOUR

DATA PRESENTATION AND ANALYSIS

4.0 INTRODUCTION

The main focus of this chapter is the presentation and

analysis of the data collected from the secondary sources. This chapter

embodies presenting and analysing the data collected qualitatively and

quantitatively following the objectives of the research stated in Chapter one.

Our analysis will be organised in two main parts: Analysis of the data

collected and Policies suggestion to financial body to reduce their risks and

increase their profitability level.

4.1 QUALITATIVE ANALYSIS

This refers to the use of tables and graphs to show how

variables have evolved over the years. This will be done for the period

2002-2005.

4.1.1 ASSESSING THE IMPACT OF RISK MANAGEMENT ON CREDIT

RISKS

The qualitative analysis made in this part of the study will

be a study which analyses the evolution of non performing loans as an indicator

to credit risks in the overall Cameroon Banking system.

The following table represents the evolution of non performing

loans and provision for bad loans as an indictor to credit risks.

Table 4.1 Cameroon: Banking system Indicators

(units indicators)

|

Years

|

2002

|

2003

|

2004

|

2005

|

|

Non performing loans

|

15.7

|

13.9

|

13.1

|

12.6

|

|

Provisions ( % of bad loans)

|

81.1

|

81.2

|

85.3

|

85.4

|

Source: Banking commission of Central Africa and

staff calculations.

The table above represents the key indicators of the banking

sector in Cameroon given as aggregates. More so it shows the evolution of non

performing loans over the years 2002-2005. The amount of non performing loans

are represented here as a percentage of the sum total of loans given out by the

banking sector. Going by the diagram, we can see that over the years the amount

of non performing loans (credit risk) is reducing .In 2002, the credit risk was

15.7 and in 2005 it was 12.6 indicating a reduction of credit risks of 3.1%.

This decrease can be explained by the action of the management team in their

effort to risk reduction.

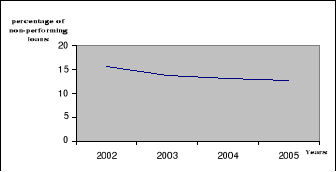

A- Trend Analysis

In this section, we are going to represent graphically the

data in the table 4.1 above in relation to the amount of non performing loans

which is presented as a percentage.

The following expression can therefore be derived:

Credit risks = (Amount of bad debt/ Amount of total

credit granted) X 100

This rate should be as low as possible since it the goal is to

minimise risks in order to make investments more profitable. The following

illustrates diagrammatically the evolution of credit risks.

FIGURE 4.1: Evolution of credit risk from 2002 to 2005

Source: Banking Commission of Central Africa and Staff

Calculations (COBAC), 2005.

The slope of this curve is negative showing that over the

years the amount of non performing loans is reducing. This therefore means that

the risk management has an impact on the credit risk, by reducing the size of

the non performing loans. This can be achieved for instance through an

effective credit policy.

4.1.2 ASSESSING THE IMPACT OF RISK MANAGEMENT ON LIQUIDITY

RISKS

a) Table Analysis

Our analysis in this part of our study will be based on the

table below, which represents the evolution of maturity transformation defining

the liquidity level of Cameroonian banks over the long run.

Table 4.2: Cameroon Banking system indicators

(unit indicators)

|

Years

|

2002

|

2003

|

2004

|

2005

|

|

maturity transformation

|

3

|

3

|

5

|

4

|

Source: Banking Commission of central Africa and Staff

Calculations, 2005

The maturity transformation is the ratio of the overall

solvency of the banking sector. By this ratio a company can determine how

liquid it is and how far it is coping with its long term obligations based on

its assets.

The following expression represents the ratio of maturity

transformation.

Maturity transformation = Long Term Assets / Long Term

Liabilities

The trick of this ratio is that organisations and of course

financial institutions must keep this ratio greater than one. This indicates

that if this ratio is higher it is a sign of solvency of the organisation,

since it can meet its long term obligations.

Going by the table above, we can say that the solvency ratio

in 2002 was 3 and that it has increased to 5 in 2004 and 4 in 2005, which means

that over the years the organisations are getting more solvent by increasing

their liquidity level.

Here the liquidity risk is lesser since it is expressed when

the solvency ratio tends to 0 or to a negative value. We ca therefore affirm

that the risks management of Banks in Cameroon is aware of the negative impact

of liquidity shortages and keep a high liquidity ratio in order to avoid

illiquidity. In brief the higher the liquidity ratio, the lesser the liquidity

risks.

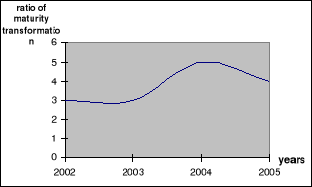

b) Trend Analysis

The figure below is represented on the data given in table4.2

above, which represents the evolution of maturity transformation for the entire

banking sector in Cameroon for the Period 2002-2005.

Figure 4.2 The evolution of Maturity Transformation, 2002-2005

Source: Banking Commission of Central Africa and Staff

calculations, 2005.

The curve drawn above represents the evolution of the

liquidity ratio of the Cameroon Banking sector over the years 2002-2005. In

2002 and 2003 the curve is constant meaning that the liquidity level remains

unchanged. But due to the action of risks managers in their tasks to maintain

adequate liquidity level, the ratio will increase in 2004 to 5 and decrease to

4 in 2005 while remaining higher than in 2002 and 2003. Given that the curve is

positive, the liquidity risks are diminished since adequate liquidity is kept n

Banks and Bankers can meet sudden upsurge withdrawals of creditors while not

affecting the overall profit of the financial institutions.

4.2 QUANTITATIVE ANALYSIS

In this section, we are going to make use pf practical

analytical tools such as ratio analysis and standard deviations analysis for

the period of past incomes and expenses. Since standard deviation will help us

to estimate the degree of risks, we will compare the evolution of these degrees

to the ratios of return on equity (ROE) and return on investment in order to

monitor the changes in risk level. For this to be feasible, we will make use of

two case studies in Cameroon which are SOWEFCU (south West Farmers Cooperative

Credit Union) with headquarters located in Kumba and Afriland First Bank which

is a commercial Bank operating in Douala and Yaoundé with several

branches in other provinces of Cameroon and all over Central Africa. The

information provided by these financial institutions will be provided in

appendixes.

4.2.1 INVESTIGATING THE IMPACT OF RISK MANAGEMENT ON THE

PROFITABILITY OF FINANCIAL INSTITUTIONS.

In this section of our study, we are going to rely on the case

of Afriland first Bank, which gives information in Appendix 2.

We all know that Banks make their profits on interests from

loans and advances granted. The profit margin will therefore be computed as the

amount of profit per amount of loans.

|

Profit + P/L brought forward

|

|

Net total Amount of Loans

|

Profit Margin = X 100

The data computed by using Appendix 2 give the following

results:

|

31/12/2004

|

31/12/2003

|

|

Profitability margin =

2, 061,664 + 15,73384, 008, 693

X100

=2.5%

PM = 2.5 %

|

Profitability margin =

1, 727,147 + 8,086 68, 773, 187

X 100

= 2.48 %

PM = 2.48 %

|

|

|

|

Table 4.3: Computation of Profitability Margin

Source: Afriland Financial statement and calculations,

2004

By the end of the year 2004, more loans are given out and the

corresponding profits were 2, 077, 377 whereas by the end of year 2003 the

profits are (1, 727, 147 + 8, 086) = 1, 733, 233 Fcfa, which is less than in

year 2004. The explanation of this increase in profitability is that risks

management applies an adequate credit risk policy since more loans are repaid

by debtors and this will enhance profits. We can further investigate the impact

of risk management on credit risk and establish a relationship with the

profitability level, all of this applied to the same case study which is

Afiland First Bank.

4.2.2 ASSESSING THE IMPACT OF RISK MANAGEMENT ON THE

OVERALL CREDIT RISK POLICY OF FINANCIAL INSTITUTIONS.

In our analysis, we are going to use provisions as the amount

of bad loans, since they represent amount kept by the enterprise in order to

overcome defaults payments.

The following can therefore stands for credit risks:

|

Provisions (loans)

|

|

amount of Total loans

|

Credit Risks =

X 100

(% of bad loans)

Using data in Appendix 2, we have got the following

results:

Table 4.4: Computation of Credit risk

|

31/12/2004

|

31/12/2003

|

|

Credit Risk:

13, 110, 61597, 119, 308

CR = X 100

= 13.5 %

|

Credit Risk:

11, 632, 69580, 405, 883

CR = X 100

= 14.5 %

|

Source: Afriland Financial Statements and calculations,

2004. Appendix 2

At the end of year 2003, the credit risk was evaluated at

14.5 % of the total amount of loans. This percentage has reduce by 1 % by the

end of year 2004, thus decreasing to 13.5 % of the total amount of Loans. Now

let's have a look at the effect of this risky-shift on the profitability of the

Afriland First bank.

4.2.3 RELATIONSHIP BETWEEN CREDIT RISKS AND PROFIT: THE

CASE OF AFRILAND FIRST BANK

As seen above the calculations were made for the period 2003

to 2004. The following table summarizes the relationship between default risk

and profit.

Table 4.5: A Summary of the Relationship between Credit Risk and

Profit

|

Years

Variables

|

31/12/2004

|

31/12/2003

|

Changes

|

|

Credit Risks

(% of bad loans)

|

13.5 %

|

14.5 %

|

- 1 %

|

|

Profit Made

(Profit Margin ) % of Loans

|

Fcfa

2, 077, 377

(2.5 %)

|

Fcfa

1, 735, 133

(2.48 %)

|

+ 342, 114

+ 0.02 %

|

Source: Afriland Financial statements and calculations,

appendix2.

Going by the table above, we can see that since credit risks

are minimised, more profits are made on loans thus a 1 % reduction in credit

risk has led to an increase in profit of 342, 114 Fcfa. This therefore helps s

in rejecting H0 : there is no relationship between the risk

management and profitability of financial institutions in Cameroon and accept

the H1.

4.2.4 INVESTIGATING THE IMPACT OF RISK MANAGEMENT ON THE

LIQUIDITY POSITION OF FINANCIAL INSTITUTIONS IN CAMEROON

In order to make this investigation possible, we are going to

rely on data given in Appendix 1, relating to the financial ratios of SOWEFCU,

and its financial statements.

For us to compile the liquidity risks of SOWEFCU, we need to

assess the deviations between the liquidity ratios for various years in order

to determine the degree if liquidity risks.

The liquidity risk is therefore quantified as:

? (X - u) 2

S or ó = v

N

Where:

u = Mean of 3 years liquidity ratio

X =The actual amount of liquidity ratio

N = Number of years

Thus; u =

= 117.67

This will be the adequate liquidity level; the deviations from

this level will represent the risks of illiquidity.

ó 96/97 = v

= 14.7

ó 97/98 = v

= 10.2

ó 98/99 = v

= 4.43

furthermore, the operating income increased from Fcfa (4

millions) in 1996/1997 to Fcfa 1 million in 98/99, with a spike Fcfa 2 million

in 1997/1998, yielding a rate of return that ranged from -17% to 4% and

profitability rates from 13% to 21%.

Once more we can see that from years 96/97 till 98/99 the

risks are reducing from 14.7 to 4.43 and the corresponding results are the

increase in Returns On Equity (ROE) from -17% to 4% and profitability margin

rates from 13% to 21%.

The following table can therefore be drawn;

Table 4.6: Relationship Between Liquidity Risks, Profitability

and Return On Equity: The Case of SOWEFCU

|

Years

variables

|

96/97

|

97/98

|

98/99

|

|

Liquidity risk

(ó)

|

14.7

|

10.2

|

4.43

|

|

Return On Equity

ROE

|

-17

|

13

|

4

|

|

Profitability Rates

(net incomes/sales)%

|

13

|

21

|

/

|

Source: SOWEFCU Financial Statements and Calculations,

1999

When the risk management of SOWEFCU succeeded in reducing the

liquidity risks, the correspondent results were an increase in profitability

rates and Return on Equity thereby confirming the H1: there is a

relationship between risk Management and the growth of Financial Institutions

in Cameroon, while rejecting the H0.

CHAPTER FIVE

SUMMARY, RECOMMENDATIONS AND CONCLUSION

This chapter will summarize findings of the analyses of the

data collected. it will also involve proposals of possible recommendations with

a conclusion pertaining to the whole study will be drawn.

5.1 SUMMARY OF FINDINGS

The summary of findings can be examined as follows:

- It has been found that the relationship between risk

management and the profitability of financial institutions in Cameroon is

strong over the period 2002-2005.

This is explained by the fact that an increase in liquidity

position of the firm is related to a shift in credit as explained in figures

4.2 above:

- It has also been found that the higher the liquidity ratio,

the lower the liquidity risks and the higher profit margin and return on

equity.

- Another funding was that when the liquidity risks are high,

the return on equity is low due to the fact that as the assets of the firm are

not liquid, they can not make enough loans in order to get more profits and

since the exposure to risk is too high, borrowers will be discouraged to

request loans from the bank. This was proves from the period1996/1997 to

1998/1999 in SOWEFCU where liquidity risks was a negative function of

profitability.

- During the period of analysis, 2003-2004, we found that when

credit risks re reduced in commercial banks, the side effect is the increase in

profit margin. Since credit is the main tool of raising finance for the

commercial banks, any default will tend to reduce profit, hence yielding a

loss.

5.2 RECOMMENDATIONS

Based on the findings of this study that state that risk

management and profitability of financial institutions are perfectly related

over the period of study 2002-2005, the following recommendations can be

made:

· Financial institutions, may it be central bank,

commercial banks, micro financial houses, should practise a sound risk

management policy is their organisation. This will facilitate the handling of

risk and enhance huge profits to be made thus fostering growth in the

industry.

· The risk management of financial institutions must set

adequate liquidity level which will be as a standard over the years for the

sake of profitability, expansion financial worthiness and the public

credibility.

· Financial institutions must carefully plan for risks,

identifies, analyses and assess the potential trouble which may alter the

implementation of company's policy.

· Concerning credit risks, financial institutions must

investigate the credit demand from borrowers and assess whether they are

financially able to repay the loan in due terms in an optic of reducing credit

risk.

5.3 CONCLUSION

During the course of this study, a theoretical framework was

established to illustrate the theoretical relationship that exists between

variables involved in the study. This involved a brief review of related

literature, empirically the relationship between these variables was tested to

verify the influence of risk management on profitability and risk reduction

from 2002-205. After conducting the necessary data and carrying out the

necessary analysis, it was discovered that risk management has a strong impact

on the profitability of financial institutions from 2002-2005 in Cameroon.

BIBLIOGRAPHY

Aaron NDENKA (2005), Comparative Banking systems,

Design House, Limbe

Aaron NDENKA (2005), Foundations of Banking and

Finance, Design House, Limbe

Banque de France (2003), Rapport zone franc, La micro

finance dans la zone franc,

BLACK, S.E and STRAHAN (2002), Entrepreneurship and bank

credit availability, Journal of Finance, 57,287-2833,

BONACCORSI DI PATTI and P, E and G, GOBBI (2001) "The

effects of bank consolidation and market entry on small business lending"

Banca D'italia Temi di Discussione 404,

CARTER, D.A, J.E MACNULTY and J.A. VERBRUGGE (2004) "Do

small banks have an advantage in lending?" (An examination of risk adjusted

yields on Business at large and small banks), Journal of Finance service

research,

IMF Report (2007), Cameroon: Second review of the 3-year

arrangement under the poverty reduction and growth facility, IMF country Report

N° 07/129

KAUFMAN George, Larry MOTE and Harvey ROSENBLUM (1982),

Implications of Deregulation for product lines and geographic markets for

financial institutions,

Microsoft, Collection Microsoft Encarta, 2006,

Mission économique de Yaoundé (Annie BIRO and

Marc DEBELS, 2003), Le secteur bancaire au Cameroun,

S.R. DIACON and R.L. CARTER (1984-1988), Success in

Insurance (Second Edition), British library

Touina MAMA (1998), Mondialisation de l'économie

camerounaise, Université de Yaoundé

World Bank (August, 2002), Price risk management in the

cocoa industry of Cameroon (Phase II report),

|