Annexe IV

Test de cointegration de Johansen pour les

séries annuelles :

|

Sample(adjusted): 1972 2006

|

|

Included observations: 35 after adjusting endpoints

|

|

Trend assumption: Linear deterministic trend

|

|

Series: LINF LPP IMEX LPPIMP LPPEXP

|

|

Lags interval (in first differences): 1 to 1

|

|

Unrestricted Cointegration Rank Test

|

|

Hypothesized

No. of CE(s)

|

Eigenvalue

|

Trace

Statistic

|

5 Percent

Critical Value

|

1 Percent

Critical Value

|

|

|

None

|

0.458224

|

57.82384

|

68.52

|

76.07

|

|

|

At most 1

|

0.310450

|

36.37224

|

47.21

|

54.46

|

|

|

At most 2

|

0.256802

|

23.36218

|

29.68

|

35.65

|

|

|

At most 3

|

0.210856

|

12.97443

|

15.41

|

20.04

|

|

|

At most 4 *

|

0.125315

|

4.686198

|

3.76

|

6.65

|

|

|

*(**) denotes rejection of the hypothesis at the 5%(1%) level

|

|

Trace test indicates no cointegration at both 5% and 1%

levels

|

|

Hypothesized

No. of CE(s)

|

Eigenvalue

|

Max-Eigen

Statistic

|

5 Percent

Critical Value

|

1 Percent

Critical Value

|

|

|

None

|

0.458224

|

21.45160

|

33.46

|

38.77

|

|

|

At most 1

|

0.310450

|

13.01006

|

27.07

|

32.24

|

|

|

At most 2

|

0.256802

|

10.38775

|

20.97

|

25.52

|

|

|

At most 3

|

0.210856

|

8.288228

|

14.07

|

18.63

|

|

|

At most 4 *

|

0.125315

|

4.686198

|

3.76

|

6.65

|

|

|

*(**) denotes rejection of the hypothesis at the 5%(1%) level

|

|

Max-eigenvalue test indicates no cointegration at both 5% and 1%

levels

|

Estimation du modèle VAR(1) pour les

séries annuelles :

|

Vector Autoregression Estimates

|

|

Date: 09/19/07 Time: 11:27

|

|

Sample(adjusted): 1972 2006

|

|

Included observations: 35 after adjusting endpoints

|

|

Standard errors in ( ) & t-statistics in [ ]

|

|

D(LINF)

|

D(LPP)

|

D(IMEX)

|

D(LPPIMP)

|

D(LPPEXP)

|

|

D(LINF(-1))

|

-0.673783

|

0.146250

|

-0.044063

|

0.020177

|

0.042643

|

|

(0.08148)

|

(0.11311)

|

(0.03657)

|

(0.09316)

|

(0.06803)

|

|

[-8.26944]

|

[ 1.29299]

|

[-1.20481]

|

[ 0.21659]

|

[ 0.62678]

|

|

D(LPP(-1))

|

0.556400

|

0.116582

|

-0.056557

|

0.132894

|

0.217385

|

|

(0.18156)

|

(0.25205)

|

(0.08150)

|

(0.20758)

|

(0.15160)

|

|

[ 3.06450]

|

[ 0.46254]

|

[-0.69397]

|

[ 0.64020]

|

[ 1.43390]

|

|

D(IMEX(-1))

|

-1.461713

|

-0.076578

|

-0.199980

|

0.617312

|

0.663078

|

|

(0.47499)

|

(0.65938)

|

(0.21320)

|

(0.54306)

|

(0.39661)

|

|

[-3.07737]

|

[-0.11614]

|

[-0.93797]

|

[ 1.13673]

|

[ 1.67186]

|

|

D(LPPIMP(-1))

|

0.343766

|

-0.051400

|

-0.028818

|

-0.558920

|

-0.334210

|

|

(0.27220)

|

(0.37787)

|

(0.12218)

|

(0.31121)

|

(0.22729)

|

|

[ 1.26291]

|

[-0.13603]

|

[-0.23586]

|

[-1.79595]

|

[-1.47043]

|

|

D(LPPEXP(-1))

|

-1.260647

|

-0.139653

|

0.235840

|

0.212745

|

0.040447

|

|

(0.33727)

|

(0.46820)

|

(0.15139)

|

(0.38560)

|

(0.28162)

|

|

[-3.73782]

|

[-0.29828]

|

[ 1.55785]

|

[ 0.55172]

|

[ 0.14363]

|

|

C

|

-0.093508

|

0.077769

|

0.038896

|

0.007921

|

-0.068061

|

|

(0.04723)

|

(0.06556)

|

(0.02120)

|

(0.05399)

|

(0.03943)

|

|

[-1.98000]

|

[ 1.18622]

|

[ 1.83488]

|

[ 0.14670]

|

[-1.72596]

|

|

R-squared

|

0.750562

|

0.071027

|

0.201073

|

0.132070

|

0.144974

|

|

Adj. R-squared

|

0.707555

|

-0.089141

|

0.063327

|

-0.017573

|

-0.002445

|

|

Sum sq. resids

|

1.595439

|

3.074637

|

0.321448

|

2.085497

|

1.112362

|

|

S.E. equation

|

0.234553

|

0.325610

|

0.105283

|

0.268167

|

0.195850

|

|

F-statistic

|

17.45226

|

0.443453

|

1.459735

|

0.882564

|

0.983416

|

|

Log likelihood

|

4.380633

|

-7.100023

|

32.41681

|

-0.306882

|

10.69225

|

|

Akaike AIC

|

0.092535

|

0.748573

|

-1.509532

|

0.360393

|

-0.268128

|

|

Schwarz SC

|

0.359166

|

1.015204

|

-1.242901

|

0.627024

|

-0.001497

|

|

Mean dependent

|

-0.006977

|

0.096363

|

0.019334

|

0.012237

|

-0.044158

|

|

S.D. dependent

|

0.433730

|

0.312001

|

0.108783

|

0.265842

|

0.195611

|

|

Determinant Residual Covariance

|

2.15E-08

|

|

|

|

|

Log Likelihood (d.f. adjusted)

|

60.66293

|

|

|

|

|

Akaike Information Criteria

|

-1.752167

|

|

|

|

|

Schwarz Criteria

|

-0.419012

|

|

|

|

Test de non causalité au sens de Granger pour

les séries annuelles :

|

Pairwise Granger Causality Tests

|

|

Date: 09/19/07 Time: 22:36

|

|

Sample: 1970 2006

|

|

Lags: 1

|

|

Null Hypothesis:

|

Obs

|

F-Statistic

|

Probability

|

|

D(LPP) does not Granger Cause D(LINF)

|

35

|

3.65538

|

0.06488

|

|

D(LINF) does not Granger Cause D(LPP)

|

1.95396

|

0.17178

|

|

D(IMEX) does not Granger Cause D(LINF)

|

35

|

5.46758

|

0.02578

|

|

D(LINF) does not Granger Cause D(IMEX)

|

1.85596

|

0.18260

|

|

D(LPPIMP) does not Granger Cause D(LINF)

|

35

|

0.04212

|

0.83869

|

|

D(LINF) does not Granger Cause D(LPPIMP)

|

0.04134

|

0.84018

|

|

D(LPPEXP) does not Granger Cause D(LINF)

|

35

|

0.99245

|

0.32662

|

|

D(LINF) does not Granger Cause D(LPPEXP)

|

0.41768

|

0.52270

|

|

D(IMEX) does not Granger Cause D(LPP)

|

35

|

0.03407

|

0.85472

|

|

D(LPP) does not Granger Cause D(IMEX)

|

0.02037

|

0.88739

|

|

D(LPPIMP) does not Granger Cause D(LPP)

|

35

|

0.21867

|

0.64322

|

|

D(LPP) does not Granger Cause D(LPPIMP)

|

0.19343

|

0.66304

|

|

D(LPPEXP) does not Granger Cause D(LPP)

|

35

|

0.37431

|

0.54498

|

|

D(LPP) does not Granger Cause D(LPPEXP)

|

0.84575

|

0.36464

|

|

D(LPPIMP) does not Granger Cause D(IMEX)

|

35

|

0.60872

|

0.44100

|

|

D(IMEX) does not Granger Cause D(LPPIMP)

|

0.64501

|

0.42783

|

|

D(LPPEXP) does not Granger Cause D(IMEX)

|

35

|

2.66012

|

0.11270

|

|

D(IMEX) does not Granger Cause D(LPPEXP)

|

0.96721

|

0.33275

|

|

D(LPPEXP) does not Granger Cause D(LPPIMP)

|

35

|

0.06192

|

0.80507

|

|

D(LPPIMP) does not Granger Cause D(LPPEXP)

|

0.09538

|

0.75945

|

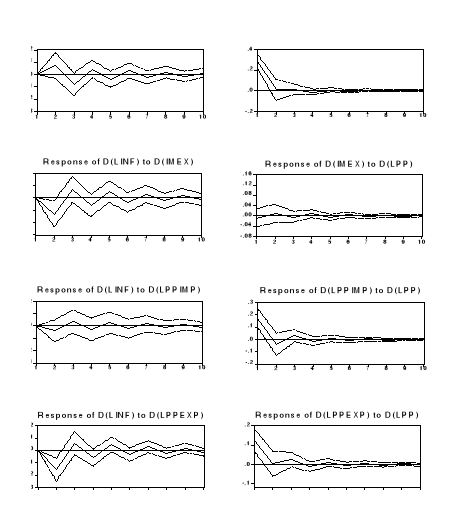

Fonctions de réponse impulsionnelles pour les

séries annuelles :

Décomposition de la variance pour les

séries annuelles :

|

Variance Decomposition of D(LINF):

|

|

|

|

|

|

|

|

Period

|

S.E.

|

D(LINF)

|

D(LPP)

|

D(IMEX)

|

D(LPPIMP)

|

D(LPPEXP)

|

|

1

|

0.234553

|

100.0000

|

0.000000

|

0.000000

|

0.000000

|

0.000000

|

|

2

|

0.336730

|

56.85692

|

4.764127

|

14.91821

|

1.328016

|

22.13273

|

|

3

|

0.366532

|

52.29157

|

8.428892

|

16.13626

|

2.092500

|

21.05078

|

|

4

|

0.386544

|

50.31889

|

8.893047

|

17.08671

|

2.450847

|

21.25050

|

|

5

|

0.398763

|

49.05070

|

9.328837

|

17.60375

|

2.698246

|

21.31846

|

|

6

|

0.406246

|

48.38135

|

9.550380

|

17.87605

|

2.852615

|

21.33961

|

|

7

|

0.410975

|

47.97151

|

9.675225

|

18.03845

|

2.951190

|

21.36362

|

|

8

|

0.413950

|

47.72057

|

9.751919

|

18.13457

|

3.014852

|

21.37809

|

|

9

|

0.415832

|

47.56506

|

9.798246

|

18.19292

|

3.055809

|

21.38797

|

|

10

|

0.417024

|

47.46752

|

9.826915

|

18.22883

|

3.082181

|

21.39455

|

|

Cholesky Ordering: D(LINF) D(LPP) D(IMEX) D(LPPIMP)

D(LPPEXP)

|

|

|

|

|

|

|

|