4.2 Impact of

monetary policy on Consumer Price Index (CPI)

In this study, we have used variables like Money supply,

Nominal interest rate and the nominal exchange rate in order to measure the

impact of monetary policy on Consumer Price Index (CPI). The monetary policy

affects an economy by causing inflation which discourages production in the

country. But before that, it is better to analyze the evolution of those

variables in Rwanda such as: Consumer Price Index, Money supply, Nominal

interest rate and the nominal exchange rate.

4.2.1 Evolution of CPI, money supply,

Nominal interest rate and nominal exchange rate in Rwanda

This part of the study analyzes trends of different variables

that are used in the following part of the study:

Table 1: Consumer price

index (CPI) in Rwanda

|

|

|

1985

|

11.00181

|

|

1986

|

10.87891

|

|

1987

|

11.32854

|

|

1988

|

11.66598

|

|

1989

|

11.78383

|

|

1990

|

12.27708

|

|

1991

|

14.68795

|

|

1992

|

16.09218

|

|

1993

|

18.08027

|

|

1994

|

35.96796

|

|

1995

|

38.63368

|

|

1996

|

43.27568

|

|

1997

|

45.96313

|

|

1998

|

44.85729

|

|

1999

|

46.60651

|

|

2000

|

48.1645

|

|

2001

|

49.12422

|

|

2002

|

52.78382

|

|

2003

|

59.25022

|

|

2004

|

64.59108

|

|

2005

|

70.3286

|

|

2006

|

76.71494

|

|

2007

|

88.56351

|

|

2008

|

97.74297

|

|

2009

|

100

|

|

2010

|

105.6707

|

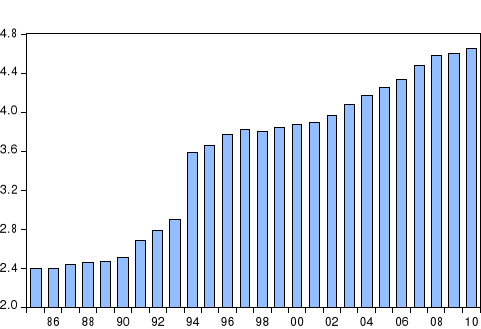

Figure 4: Consumer Price

Index (CPI) in Rwanda

Source: Eviews7

As it can be seen, from 1985 to 2010, the CPI of Rwanda was

generally increasing. This increase in is due to different causes which may be

internal and external. The continual increase in prices discourages production

of a given country. Normally, other things being equal, increases in domestic

price discourage production while decreases in price encourage production.

Table 2: Money Supply in

Rwanda

|

M2

|

|

1985

|

2.33E+10

|

|

1986

|

2.65E+10

|

|

1987

|

2.92E+10

|

|

1988

|

3.14E+10

|

|

1989

|

3.01E+10

|

|

1990

|

3.17E+10

|

|

1991

|

3.35E+10

|

|

1992

|

3.77E+10

|

|

1993

|

3.86E+10

|

|

1994

|

3.72E+10

|

|

1995

|

6.3E+10

|

|

1996

|

6.85E+10

|

|

1997

|

8.84E+10

|

|

1998

|

9.15E+10

|

|

1999

|

9.87E+10

|

|

2000

|

1.14E+11

|

|

2001

|

1.27E+11

|

|

2002

|

1.43E+11

|

|

2003

|

1.65E+11

|

|

2004

|

2.15E+11

|

|

2005

|

2.53E+11

|

|

2006

|

320972.6

|

|

2007

|

425211.5

|

|

2008

|

466146.4

|

|

2009

|

491194.6

|

|

2010

|

617709.7

|

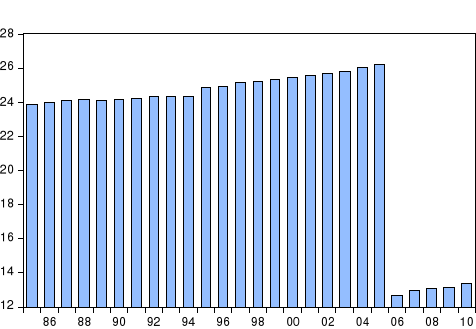

Figure 5: Money Supply in

Rwanda

Source: Eviews7

As it can be seen from the figure above, from 1985 up to 2005,

the money supply was increasing but not significantly, but it decreased

considerably in 2006, however, from that year, the money supply started

increasing again. Normally, as it is known that, much money in circulation is

most of the time associated with inflation but also; little money in

circulation can be associated with problem. The central bank of Rwanda must

have strong reasons of reducing money in such a way, may be because of

inflation which was increasing significantly as seen in figure above.

Table 3: Nominal Interest

Rate in Rwanda

|

NIR

|

|

1985

|

13.875

|

|

1986

|

14

|

|

1987

|

13

|

|

1988

|

12

|

|

1989

|

12

|

|

1990

|

13.16667

|

|

1991

|

19

|

|

1992

|

16.66667

|

|

1993

|

15

|

|

1994

|

16.77

|

|

1995

|

16.77

|

|

1996

|

18.54

|

|

1997

|

16.22

|

|

1998

|

17.13

|

|

1999

|

16.84

|

|

2000

|

16.99

|

|

2001

|

17.29

|

|

2002

|

16.37

|

|

2003

|

17.05

|

|

2004

|

16.48

|

|

2005

|

16.08

|

|

2006

|

16.07

|

|

2007

|

16.11

|

|

2008

|

16.51

|

|

2009

|

16.09

|

|

2010

|

16.67

|

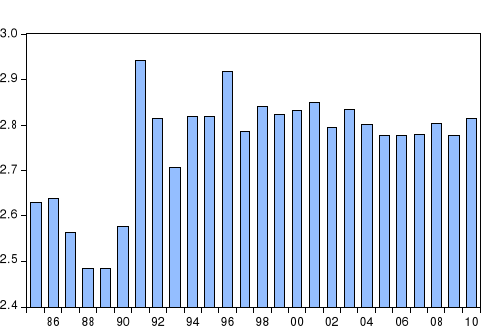

Figure 6: Nominal Interest

Rate in Rwanda

Source: Eviews7

From 1986 to 1989, the Nominal interest rate was decreasing.

From 1989 up to 1991, it was increasing but it decreased gradually until 1993.

From 1995, the nominal interest rate was also increasing until

1996 and after that year, the interest rate in Rwanda almost stabilized in many

years.

Normally, the high nominal interest rate is a sign of refusal

by commercial banks to offer credits to borrower, most of the time, that

results from the discount rate charged by the central bank to commercial banks.

That desire is always associated by a desire of the central bank to reduce

money in circulation and stabilize economy in order to avoid inflation. The

low nominal interest rate is a sign that commercial banks are giving loans to

those who need them and event is associated by the central bank which reduces

the discount rate charged to commercial banks in order to increase money in

circulation with a desire of stimulating production.

Table 4: Nominal Exchange

Rate in Rwanda

|

EXCH

|

|

1985

|

101.2447

|

|

1986

|

87.59092

|

|

1987

|

79.46065

|

|

1988

|

76.44774

|

|

1989

|

80.14898

|

|

1990

|

83.7041

|

|

1991

|

125.1642

|

|

1992

|

133.9386

|

|

1993

|

144.237

|

|

1994

|

140.7038

|

|

1995

|

262.1823

|

|

1996

|

306.82

|

|

1997

|

301.5298

|

|

1998

|

312.3141

|

|

1999

|

333.9419

|

|

2000

|

389.6962

|

|

2001

|

442.9919

|

|

2002

|

475.3652

|

|

2003

|

537.655

|

|

2004

|

577.449

|

|

2005

|

557.8226

|

|

2006

|

551.7103

|

|

2007

|

546.955

|

|

2008

|

546.8487

|

|

2009

|

568.2813

|

|

2010

|

583.1309

|

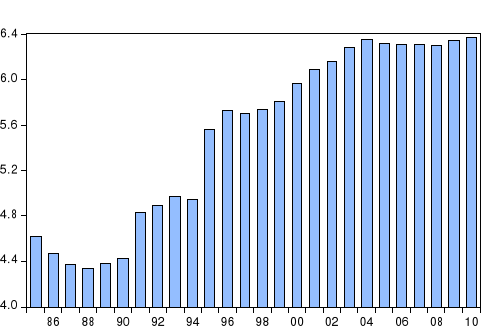

Figure 7: Nominal

Exchange Rate in Rwanda

Source: Eviews7

From 1985, the Rwandan currency was being appreciated, but

from 1988, it started depreciating in general and it became almost stable from

2005 up to 2007. From 2008, the Rwandan currency was generally

depreciating.

|