ROLE OF SOCIAL SECURITY FUND SCHEME

IN ENHANCING THE SOCIO-ECONOMIC DEVELOPMENT OF RWANDA.

(CASE STUDY: SSFR HEADQUARTER KIGALI

RWANDA)

BY

RUSIBANA CLAUDE

MBA/19037/72/DF

A Thesis submitted to the School of Post

Graduate Studies in Partial Fulfilment for the Award of

a

Master of Business Administration (MBA)

degree

of Kampala International University.

March 2010

Table of Contents

Pages

TABLE OF CONTENTS

I

DECLARATION

V

APPROVAL

VI

DEDICATION

VII

ACKNOWLEDGEMENTS

VIII

ABSTRACT

IX

LIST OF ABBREVIATIONS

XI

LIST OF TABLES

XII

LIST OF GRAPHS

XIII

CHAPTER ONE

1

INTRODUCTION

1

1.1. BACKGROUND TO THE STUDY

1

1.2. BACKGROUND OF THE CASE

STUDY

3

1.2. STATEMENT OF THE PROBLEM

4

1.3. PURPOSE OF THE STUDY

4

1.4. OBJECTIVES OF THE STUDY

4

1.5. RESEARCH QUESTIONS

4

I.6. SCOPE OF THE STUDY

5

1.7. SIGNIFICANCE OF THE STUDY

5

1.8. THEORETICAL FRAMEWORK

5

PENSION (OLD AGE BENEFIT)

5

LUMP-SUM ALLOCATION

6

FREE MEDICAL CARE

6

DAILY SICKNESS ALLOWANCES

7

INCAPACITY SOCIAL SECURITY BENEFITS

7

INCAPACITY LUMP SUM BENEFITS

7

FUNERAL LUMP ASSISTANCE

8

1.9. CONCEPTUAL FRAMEWORK

8

CHAPTER TWO LITERATURE REVIEW

10

2.1. OVERVIEW

10

2.2. REVIEW OF RELEVANT LITERATURE

REVIEW

10

2.3 DEVELOPMENT

10

2.4 GOALS AND MEANS OF DEVELOPMENT

11

2.5 ECONOMIC GROWTH

11

2.6 SUSTAINABLE DEVELOPMENT

12

2.7. MEASURING DEVELOPMENT

12

2.8 SOCIO-DEVELOPMENT INDICATORS

13

2.9. ECONOMIC DEVELOPMENT INDICATORS

14

2.10 MEANING OF SOCIAL SECURITY

14

2.11. SAVING: SOCIAL SECURITY

15

2.12. SOCIAL SECURITY IN OTHER

COUNTRIES

15

CHILE

15

USA VS JAPAN

16

MAURITIUS

16

SOCIAL SECURITY IN UGANDA

16

SOCIAL SECURITY IN RWANDA

17

INVESTMENT

18

RETURN ON INVESTMENT

18

PORTFOLIO INVESTMENT

18

CHAPTER THREE RESEARCH METHODOLOGY

19

3.1. OVERVIEW

19

3.2 SOURCES AND DATA COLLECTION

19

3.3.1. PRIMARY SOURCES OF DATA

20

3.3.2. SECONDARY SOURCES OF DATA

20

3.4. RESEARCH DESIGN

21

3.5. STUDY POPULATION

21

3.6. SAMPLING TECHNIQUE

21

3.7. DATA COLLECTION INSTRUMENTS

22

3.8. DATA COLLECTION PROCEDURES

22

3.9 DATA ANALYSIS

22

3.10 QUANTITATIVE DATA ANALYSIS

23

3.11 QUALITATIVE DATA ANALYSIS

23

3.12 ETHICAL CONSIDERATIONS

24

3.13 LIMITATION OF THE STUDY

24

CHAPTER FOUR PRESENTATION AND ANALYSIS OF

RESEARCH FINDINGS

25

4.1. OVERVIEW

25

4.2. ANALYSIS OF CHARACTERISTIC OF

RESPONDENTS

25

4.3 ANALYSIS OF BENEFICIARIES AFFILIATED IN

SSFR

28

4.4 ANALYZING THE IMPORTANCE OF BEING

INSURED IN SSFR

28

4.5. ANALYSIS IF BENEFITS ARE PAID ON

TIME

29

4.6 INVESTIGATION OF THE BENEFITS PAID TO

THE RETIREES AT THE TIME OF RETIREMENT

31

4.7. TO FIND OUT HOW THE CONTRIBUTIONS

FUNDS ARE INVESTED TOWARDS THE SOCIO-ECONOMIC DEVELOPMENT OF RWANDA

34

4.7.1 INVESTMENT VEHICLES AT SSFR

35

4.7.2. PERMISSIBLE INVESTMENTS

35

4.7.3. PERMISSION

36

4.7.4. CONTROLS

36

4.7.5. SSFR INVESTMENT RESTRICTIONS

36

4.7.6 HOLDING LIMITS

37

4.8 REAL ESTATE PROJECTS

42

4.9. INVESTIGATION IMPACT THE SSFR HAS ON

INDIVIDUALS

43

4.9. ANALYSIS OF THE ORGANIC LAW WHICH IS

APPLICABLE FOR PENSION OF 2003 MODIFYING THE LAW OF 1974 CONVENIENT TO

PENSIONERS.

47

CHAPTER FIVE CONCLUSIONS AND

SUGGESTIONS

49

5.1. CONCLUSION

49

5.2. SUGGESTIONS

49

REFERENCES

51

APPENDICES

53

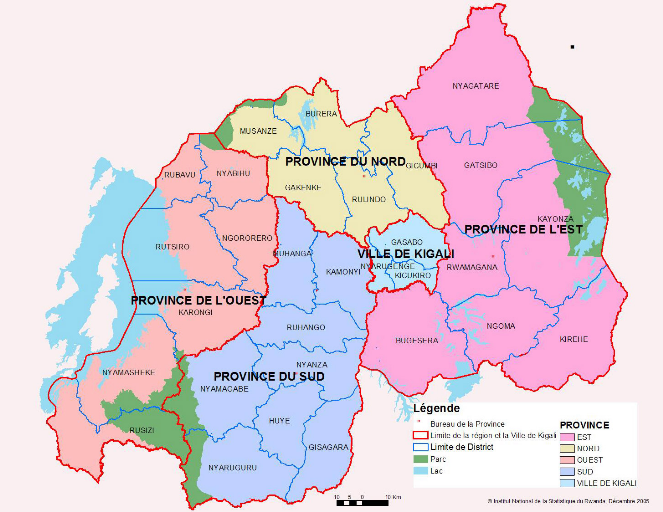

MAP OF RWANDA

54

MAP OF GASABO DISTRICT

55

APPENDIX 3: QUESTIONNAIRE FOR THE TOPIC OF

STUDY

56

SECTION A. SOCIAL CHARACTERISTICS OF THE

RESPONDENTS.

56

SECTION B. QUESTIONNAIRE ADRESSED TO THE

SSFR BENEFICIARIES AND STAFF

57

DECLARATION

I, RUSIBANA CLAUDE, declare that this

dissertation has never been submitted for a degree award in this university or

any other institution of higher learning. All the information in this report is

based on my findings and observations and where I have used the work of other

persons due acknowledgement has been given.

Signature _________________________

Date: ....../......./2010

RUSIBANA CLAUDE

Researcher

APPROVAL

This work has been done under my supervision as a University

supervisor, and submitted with my approval.

Signed ...................................................

MUSA NYAKORA (PhD)

Date ......................................................

DEDICATION

I dedicate this work and the effort that went into it to the

most understanding and caring people I know: My Parents, UMUHOZA Antoinette my

beloved wife, MUTSINZI William, NTIHEMUKA Enos and IBAMBASI Eugene, when times

are good, they make me laugh uncontrollably. When times are tough, the smile

doesn't leave my face because of the unconditional love and joy they bring to

my heart

ACKNOWLEDGEMENTS

I take this opportunity to acknowledge the great support and

help I received from the following people who are involved to successfully

complete this work.

Particularly thanks go to William MUTSINZI, IBAMBASI Eugene

for moral support and encouragements. Great thanks are also extended to my

parents, sisters, brothers, uncles and aunties who have always been there to

pray for me.

I am grateful to the management and staff of Kampala

International University, and I am very grateful to my colleagues (Omar

Habimana, Benjamin Nsengiyumva, Celestin Mutumayi, and John Mugabo) who

manifested great teamwork during our students' life

Thanks to MUSA NYAKORA (PhD) for the valuable

advice, guidance and more important for the encouraging comments you always

suggested to me.

Great thanks are extended to the family of Mr. NTIHEMUKA Enos,

for their encouragement, help and support.

Finally, many other people helped in the production of this

work. While they remain anonymous, I will never forget their invaluable

assistance

Abstract

Social security development is one of the measures that have

been adopted by developing countries to overcome poverty related challenges.

The relevancy of social security in promoting economic growth and poverty

reduction stems from its roles in saving mobilization, capital market

development and income redistribution. The experience of European countries

reveals that if social security is considered in socio-economic and poverty

reduction programs, significant progress can be made in improving standards of

living in the developing world.

Owing to this noble role in poverty reduction and economic

development, social security reforms are being undertaken in different parts of

the world to align social security systems and programs to economic growth and

development. The ultimate objective is to develop a social security system that

responds to country needs and priorities.

For the last 15 years, Rwanda's economic development has been

a success story to many in the region with tremendous developments in all

sectors of the economy. Though this rapid economic transformation can be

attributed to many factors, the Social Security Fund of Rwanda (SSFR) played a

significant role. It is this central place of social security in the country's

socio-economic progress that has prompted the government to improve social

security administration and systems by conducting reforms. The administrative

reform introduced the merging of existing social security institutions into one

national body while social security system reform introduced the provident

fund.

While there is a general appreciation of the role of Rwanda's

social security scheme in the country's on-going economic transformation, no

study has been conducted to quantitatively illustrate the contributions of the

scheme to Rwandan economy.

This research analyses the role of SSFR toward the

socio-economic development. The problem focused on the issue of retirement

benefits of Social Security fund toward the social economic Development of

Rwanda. The Researcher wants to investigate the Social Security Program and its

impact on contributors towards their retirement. The objectives of the research

are To investigate the benefits paid to the retirees at the time of retirement

or death;

1. To find out how the contributor's funds are invested

towards socio-economic development of the country;

2. To find out how the contributor's funds are invested

towards socio-economic development of the country;

3. Investigate the impact the SSFR has on individuals.

To achieve the objectives

that have been set, the researcher has the following questions

1. How are the SSFR's benefits of the retirees handled at time

of retired or death which come early?

2. What are some of the methods of investing the contributions

to boast socio-economic development?

3. What impact does the SSFR in economic status has on

individual members?

The study made use of secondary data from SSFR Annual reports

for periods of 2003-2008, policies with accordance to the social security

scheme. The study show that the role of SSF toward the socio economic

development of Rwanda is due to the factors that SSFR invest reserves in many

dimensions like investment in portfolio, investment in land, investment in

mortgage and in different Real Estate projects, and provide benefits to old age

in their period of retirement and continue to survive even though they don't

earning any income. This social development is measured by the health,

education, agriculture and livestock.

It is recommended here that SSFR should revise the current law

governing benefits and thereby calculates benefits with interests instead of

dumping the money in the coffers which is not for the benefit of the

contributor, SSFR should design project that aligns with the middle income

earners; SSFR should give advance to pensioners in order to start project at

their energetic time. Government should reinforce measures for total adhesion

to pension schemes for all workers in formal sector, and in informal sector,

The Government shall merge SSFR and RAMA (eventually MMI and the Mutuelle de

Santé) under one national umbrella body: the RWANDA Social Security

Board (RSSB)

LIST OF ABBREVIATIONS

MMI : Military Medical Insurance

MBA : Master of Business Administration

SSFR : Social Security Fund of RWANDA

MINECOFIN : Ministry of Finances and Economic planning

CEO : Chief Executive officer

VAT : Value Added Tax

TPR : Pays as you earn

% : Percentage

FRW : Rwandan Francs

UTC : Union Trade Center

USA : United State of America

SONARWA : National Insurance Company of RWANDA

B.K : Bank of Kigali

RWANDATEL: RWANDA Telecommunication

SA : Anonymous Society

SARL : Society on limited Responsibilities

MGs : Millennium Goals

HIV : Human Immunodeficiency Virus

AIDS : Acquired Immunodeficiency Syndrome

RAMA : La RWANDAise d'Assurance Maladie

EDPRS : Economic Development Poverty Reduction Strategies

GDP : Gross Domestic Product

R.F.TZ : RWANDA Free Trade Zone

R.F.I : RWANDA Foreign investment. Company

PFP : Provident Fund» Pillar

RSSB : RWANDA Social Security Board

LIST OF TABLES

Table 4.1: Age characteristic of respondents

26

Table 4.2: Level of education for respondents

27

Table 4.3: Occupation characteristics of the

respondents 27

Table 4.4: Analysis of beneficiaries affiliated in

SSFR 28

Table 4.5: Awareness of importance of SSFR

29

Table 4.6: Analysis of benefits paid on

time..................................................................................27

Table 4.7: Analysis of SSFR benefits alocation

30

Table 8. Awareness Of Importance Of SSFR

36

Table 9. Analysis On Benefits To Be Paid On

Time 37

Table 10. Analysis Of SSFR Benefits

Allocation 38

Table 11. Analysis Of SSFR Toward The Social

Development Of RWANDA 40

Table 12. Analysis Of What SSFR Contribute To The

Social 40

Table 13. SSFR Social Corporate

Responsibilities 41

Table 14. SSFR»S Projects Job Creation

43

Table 15: SSFR Contribution In Fiscal Collections In

Rfw 44

Table 16: SSFR Shareholding As At 31st May

2009 44

LIST

OF GRAPHS

Graph 4.1: Trends on how benefits

20

Graph 2: Different Types Of Benefits Paid

21

Graph 3: Trend Of Contribution From 2003-2008

22

Graph 4. Comparison On How Benefits Are

Allocated 39

CHAPTER ONE

INTRODUCTION

1.1. Background to the study

Social security is one of America's most successful government

programs. It has helped millions of Americans avoid poverty in old age, upon

becoming disabled, or after the death of a family wage earner. Social security

is one of the greatest achievements of the American government and one of the

deepest commitments to the American people said President Bush (Peter A,

Diamond &Peter R. Orszag, 2004:1). Social security has the economic benefit

of correcting market failure, in that the private sector is unable alone to

redistribute income, to alleviate poverty, and to promote social welfare and

stability of the population and promote investment. But there may be also

negative consequence of social security including roles on labour markets and

savings (E. PHLIP DAVIS, 2004; p.18). Social security pensions are also subject

to political risk, that benefit promises will be reneged upon. This study

covers the contributions of the SSFR toward the socio-economic development of

RWANDA and the population in large. Where by Socio-economic Development means

''improvement in a country's economic and social conditions''. More

specifically, it refers to improvements in ways of managing an area's natural

and human resources in order to create wealth and improve people's live.

Geographers often compare levels of development between different countries or

regions and the people who live in them - talking about more

economically-developed countries and less economically-developed countries.

Development is considered in terms of either economic or human development, and

ways of measuring development are called development indicators.

.

Clearly, RWANDA is an example of a country that has suffered

the most devastating roles of bad governance. However, after the 1994 genocide

there has been an emphasis on creating more accountable and transparent

systems, which need further support.

Communities have the right to decide how to utilize small

amounts of resources using participatory planning approaches. In addition, the

government of RWANDA has significantly developed its public finance systems in

order to monitor, execute, and audit spending programs. The money is used

differently according to the needs of the population to satisfy their basic

needs such as health, education and infrastructure.

Social security development is one of the measures that have

been adopted by developing countries including RWANDA to overcome poverty

related challenges. The relevancy of social security in promoting economic

growth and poverty reduction stems from its roles in saving mobilization,

capital market development and income redistribution. According to monetary

studies reveal that if social security is considered in socio-economic and

poverty reduction programs, significant progress can be made in improving

standards of living in the developing world. Owing to this noble role in

poverty reduction and economic development, social security reforms are being

undertaken in different parts of the world to align social security systems and

programs to economic growth and development. The ultimate objective is to

develop a social security system that responds to country needs and

priorities. For the last 15 years, RWANDA's economic development has been

a success story to many in the region with tremendous developments in all

sectors of the economy. Though this rapid economic transformation can be

attributed to many factors, the Social Security Fund of RWANDA (SSFR) played a

significant role.

It is this central place of social security in the country's

socio-economic progress that has prompted the government to improve social

security administration and systems by conducting reforms. The administrative

reform introduced the merging of existing social security institutions into one

national body while social security system reform introduced the provident

fund. While there is a general appreciation of the role of RWANDA's social

security scheme in the country's on-going economic transformation, no study has

been conducted to quantitatively illustrate the contributions of the scheme to

Rwandan economy. This article is therefore intended to demonstrate how the

Social Security Fund of RWANDA has contributed to the development of RWANDA's

economy, hence justifying the aforementioned attempt by developing countries to

develop social security as a strategy of achieving accelerated socio-economic

progress.

Before discussing the aforesaid roles, it is important at this

stage to briefly describe the Social Security Fund of RWANDA. The Social

Security Fund of RWANDA (Peter A, Diamond &Peter R. Orszag, 2004:1),

hereinafter referred to as the Fund is a public institution created in 1962 to

administer two branches of pension and occupational risks. Its principle

functions are; to collect contributions from members, pay benefits to

qualifying members and productively invest the surplus. The contribution rates,

according to existing legislation are 6% for pension branch and 2% for

occupational risks. These employee savings constitute a pool of resources the

Fund has used to significantly contribute to RWANDA's economic recovery as

expounded in the section that follows.

The Law n° 60/2008 of 10/09/2008 determining the

responsibilities, organization and functioning of RWANDA social Security fund

of RWANDA, Article 3 relating to the responsibilities of the SSFR indicates

that SSFR has responsibilities of assessing and collecting pension

contributions from both the employers and employees; Distributing benefits to

pensioners, invalids and/or their beneficiaries; Investing the excess revenues

in the most responsible manner to ensure that the funds grows and contributes

to economic growth of the country; Mobilizing long-term savings; Gathering

appropriate statistics necessary to facilitate the planning and implementation

of the above mentioned core functions. (Guide of insurers 2002, p.8).

1.2.

Background of the case study

The SSFR «Social Security Fund of RWANDA» was

established and maintained under the Decree law of August 22, 1974 concerning

organization of social security and Law no 06/2003 of 22/03/2003 modifying and

completing the Decree law of August 22, 1974 concerning organization of social

security. The purpose of the Fund is to provide occupational hazards and

disease benefit, old age pensions and death pensions, retirement benefits and

other social security benefits to employees of the public and private sector.

Benefits are based on the above mentioned laws; the Board is the trustee of the

Fund. The Board authorizes all the major investments of the fund. Member

contributions are paid into the Fund and increase annually with the return on

investment; Fund benefits and administration costs are paid out of the Fund

1.2. Statement of the problem

The problem focused on the issue of retirement benefits of

Social Security fund toward the social economic Development of Rwanda. The

Researcher wants to investigate the Social Security Program and its impact on

contributors towards their retirement.

1.3. Purpose of the study

This study will present the

analysis of the impact of the social security fund of RWANDA towards the social

economic development of the country, through benefits received by old age.

1.4. Objectives of the study

The objectives are the following:

i. To investigate the benefits paid to the retirees at the

time of retirement or death;

ii. To find out how the contributor's funds are invested

towards socio-economic development of the country;

iii. Investigate the impact the SSFR has on individuals.

1.5. Research questions

The research questions are the following:

How are the SSFR's benefits of the retirees handled at time of

retired or death which come early?

What are some of the methods of investing the contributions to

boast socio-economic development?

What impact does the SSFR in economic status has on individual

members?

I.6.

Scope of the study

This study will be conducted in SSFR Headquarter Kigali and

the analysis will be done only to the benefits which paid to old age and

survivors eligible. This study covers only issue relating to the role of SSF

scheme in enhancing socio-economic development in Rwanda.

1.7. Significance of the study

This study is significant in the following ways:

1. Workers or Employee will know the role of SSF in enhancing

the socio-economic development in RWANDA

2. Pensioners will gain more information about how SSFR works

and operate;

3. Stakeholders will get interpretation on how SSFR invest

contributions of the ensured

This Research will be the tool of Government to measure the

saving rate.

Besides this, the research is a requirement for the award of

a Masters of Business Administration .The research is also an addition to

other studies carried out in the field of socio-economic development.

1.8.

Theoretical Framework

The following terms are going to be defined, explained and

discussed in order to get information on their meaning and contribute to the

well understanding of the topic.

Pension (Old Age benefit)

The Social Security code of low N0 06/2003/ of 2006 regulating

pension and occupational hazards, repealing low of 22 August 1974 on

organization of social security in RWANDA, indicates that The Social security

Fund begin to give benefits of retired as he early as age of 55 years of age or

the pension age fixed by particular statutory arrangements, Beneficiary have

been insured with the S.S.F.R for at least 15 years, Beneficiary have stopped

all salaried activities (Social security Guide 2002, p.53).

Lump-sum allocation

The Social Security code of low N0 06/2003/ of 2006 regulating

pension and occupational hazards, repealing low of 22 August 1974 on

organization of social security in RWANDA, indicates that The Social security

Fund begin to give benefits of retired as he early as age of 55 years of age or

the pension age fixed by particular statutory arrangements, Beneficiary have

been insured with the S.S.F.R for at least one year, Beneficiary have stopped

all salaried activities. And the amount of Beneficiary old age lump-sum

allocation depends on the duration of beneficiary justified. The determination

of the duration of Beneficiary insurance is obtained by counting the number of

months beneficiary were subjected to contributions deductions for pension

insurance: by month of insurance is meant any month during which beneficiary

worked at least less than 15 years of his contribution while subjected to

insurance. .

The occupational

hazards

While at work, the worker may fall off a ladder, the worker

may cut his hand, finger, arm etc. the worker may get burnt, The vehicle he

drives may skid resulting into serious accident, Fire may burn the building in

which he is Working, A piece of metal or a brick may fall on his head etc. all

these events constitute accidents at the place of work. While going to work,

while on beneficiary way home from work or returning to work from having meals

or to and from receiving beneficiary salary: A vehicle may knock beneficiary

down, beneficiary may fall off a bicycle, Beneficiary may slip and fall etc.

all these events are called the accidents due to work-related journey.

As a result of his work, The worker may catch a disease due to

the place or conditions in which he is working (Social

security fund of RWANDA guide 2002, p44).

Free

Medical care

All beneficiary medical care is provided by the S.S.F.R once

it is confirmed that beneficiary are a victim of work-related accident or

work-related disease. This medical care consists of : Medical and surgical

assistance, X-rays and Laboratory Medical examinations, Pharmaceutical

products, Treatment in approved hospital plus feeding, Dental health care,

Supply and renewal of prosthesis and Orthopedics, Transport expenses from the

place of accident to medical centre, hospital or beneficiary residence (Social

security fund of RWANDA Guide 2002, p.47).

Daily

sickness allowances

During the duration of beneficiary not working, the employer

may stop paying beneficiary. In this case the S.S.F.R will give beneficiary

some daily allowance. This daily allowance is calculated with role from the day

after beneficiary accident. The daily allowance is equal to 75% of the average

of beneficiary daily remuneration. It is paid at the same intervals as the

salary. The payment of this daily allowance does not go beyond the period of

180 days. To calculate the daily allowance reference is made to the salaries of

the 3 months before the month during which the accident occurred (Social

security fund of RWANDA Guide 2002, p.47).

Incapacity social security benefits

The disability benefit is a social security benefit in money

form paid periodically. There is a table of rates of incapacity to which

doctors must refer for fixing the degree of incapacity to work. These rates are

in percentage form. When the degree of incapacity resulting from beneficiary

work-related accident or work-related disease is equal or more than 15%,

beneficiary will be entitled to incapacity social security benefits which will

be accorded to beneficiary with role from the date of healing or consolidation

of injuries on condition that there is loss of salary revenue due to

accident.

Incapacity Lump sum benefits

When beneficiary degree of incapacity is less than 15%,

beneficiary will be entitled to a lump sum benefit which will be given to

beneficiary once only on condition that there is loss of salary revenue due to

accident. This Lump sum will be equal to 3 annuities of social security

disability benefits corresponding to beneficiary degree of disability or

incapacity (Social security fund of RWANDA Guide 2002, p.48).

Funeral lump assistance

Funeral expenses shall be met by Social Security Fund of

RWANDA. An accident befalling a worker at the occasion of a crime or an

offence committed by the worker or an intentional fault on his or her part is

not covered by social security. The eligible survivors are the non-divorced

legitimate wife, married at least six months before beneficiary death. All the

children, who are not married and are not working for a salary, and are either

the deceased's legitimate children or those legally adopted or those born

outside legal marriage but recognized by law as his or hers and are less than

18 years old or less than 25 years old if still at school, or without age limit

if they are disabled physically or mentally, and cannot work for a salary.

Beneficiary own biological parents or legally adopted ones. 2006 2007

Average salary

1.9. Conceptual

framework

In this research we have Independent variables, dependent

variables and Intervening variables, whereby the independent variable is what

the researcher (or nature) manipulates a treatment or program or cause, it

influences, predict, control and determine the dependent variables. The

dependent variable is what is affected by the independent variable, the roles

or outcomes and the intervening variables work with the independent variables

to influence the dependent variables. An intervening variable is a hypothetical

internal state that is used to explain relationships between observed

variables, such as independent and dependent variables, in

empirical

research. An intervening variable facilitates a better understanding of the

relationship between the independent and dependent variables when the variables

is likely not to have a definite connection.

CONCEPTUAL FRAMEWORK

Independent Intervening

Dependent

Variable Variables

Variables

-Government policy

on the Scheme

-Political stability

-Infrastructure

-Members awareness

on savings

Socio-economic Development

-income distribution

-Poverty reduction

-Social Welfare promotion

-

-

-Wealth creation

-Improved style of living

-Accelerated

Socio-economique development Progress

A A

A A A

B

For the purpose of this

research, the Independent variables are wealth creation, improvement style of

living and accelerate socio-economic development. The dependent variables in

this research are income distribution, poverty alleviation, social welfare

promotion and investment for savings. Intervening variables may include,

Political stability, Infrastructure, Government policy on the scheme, and

members' awareness on savings.

CHAPTER TWO LITERATURE REVIEW

2.1. Overview

This chapter deals with the different documented evidence

regarding social security fund toward social economic development of RWANDA and

overcome poverty reduction. This information helps to shed more light on issues

related to best practices in social security within the environment in which

security is implemented. An attempt is made to analyze the issues that may

hinder or facilitate social economic development of RWANDA via Social Security

Fund of RWANDA. Since SSFR concepts tend to be indistinct, and sometimes

controversial, the major concepts used in this research are defined.

2.2.

Review of Relevant literature review

Since social science concepts tend to be indistinct, and

sometimes controversial, the major concepts used in this chapter will be

defined.

2.3 Development

Are you sure that you know what «development» really

means with respect to different countries? (Rwanda Statistics, 2006: p12)And

can you determine which countries are more developed and which are less? It is

somewhat easier to say which countries are richer and which are poorer. But

indicators of wealth, which reflect the quantity of resources available to a

society, provide no information about the allocation of those resources--for

instance, about more or less equitable distribution of income among social

groups, about the shares of resources used to provide free health and education

services, and about the roles of production and consumption on people's

environment. Thus it is no wonder that countries with similar average incomes

can differ substantially when it comes to people's quality of life:

access to education and health care, employment opportunities,

availability of clean air and safe drinking water, the threat of crime, and so

on. With that in mind, how do we determine which countries are more developed

and which are less developed?

2.4 Goals and Means of

Development

Different countries have different priorities in their

development policies. But to compare their development levels, you would first

have to make up your mind about what development really means to you, what it

is supposed to achieve. Indicators measuring this achievement could then be

used to judge countries' relative progress in development. Is the goal merely

to increase national wealth, or is it something more subtle? Improving the

well-being of the majority of the population? Ensuring people's freedom?

Increasing their economic security. Recent United Nations documents emphasize

«human development,» measured by life expectancy, adult literacy,

access to all three levels of education, as well as people's average income,

which is a necessary condition of their freedom of choice. In a broader sense

the notion of human development incorporates all aspects of individuals'

well-being, from their health status to their economic and political freedom

(MINECOFIN, 2008-2012, p.38)

2.5 Economic growth

It is true that economic growth, by

increasing a nation's total wealth, also enhances its potential for reducing

poverty and solving other social problems. But history offers a number of

examples where economic growth was not followed by similar progress in human

development. Instead growth was achieved at the cost of greater inequality,

higher unemployment, weakened democracy, loss of cultural identity, or

overconsumption of natural resources needed by future

generations. As the links between economic growth and social and environmental

issues are better provided by nature, such as pollution absorption and resource

regeneration. Moreover, economic growth must be constantly nourished by the

fruits of human development, such as higher qualified workers capable of

technological and managerial innovations along with opportunities for their

efficient use: more and better jobs, better conditions for new businesses to

grow, and greater democracy at all levels of decision making, if environmental

and social/human losses resulting from economic growth turn out to be higher

than economic benefits (additional incomes earned by the majority of the

population), the overall result for people's wellbeing becomes negative. Thus

such economic growth becomes difficult to sustain politically. Second, economic

growth itself inevitably depends on its natural and social/human conditions. To

be sustainable, it must rely on a certain amount of natural resources and

services.

2.6 Sustainable

Development

Sustainable development is a term widely used by politicians

all over the world, even though the notion is still rather new and lacks a

uniform interpretation. Important as it is, the concept of sustainable

development is still being developed and the definition of the term is

constantly being revised, extended, and refined.

According to the classical definition given by the United

Nations World Commission on Environment and Development in 1987, development is

sustainable if it «meets the needs of the present without compromising the

ability of future generations to meet their own needs.» It is usually

understood that this «intergenerational» equity would be impossible

to achieve in the absence of present-day social equity, if the economic

activities of some groups of people continue to jeopardize the well-being of

people belonging to other groups or living in other parts of the world.

Imagine, for example, that emissions of greenhouse gases,

generated mainly by highly industrialized countries, lead to global

warming and flooding of certain low-lying islands--resulting in the

displacement and impoverishment of entire island nations

«Sustainable» development could probably be otherwise called

«equitable and balanced,» meaning that, in order for development to

continue indefinitely, it should balance the interests of different groups of

people, within the same generation and among generations, and do so

simultaneously in three major interrelated areas-economic, social, and

environmental. So sustainable development is about equity, defined as equality

of opportunities for well-being, as well as about comprehensiveness of

objectives.

2.7. Measuring

development

Studying development is essentially about measuring how

developed

(developed: economically, socially, culturally or

technologically advanced) one country is compared to other countries, or to the

same country in the past. There are many different ways of considering

development, but the two most important are economic

development and human development.

2.8 Socio-Development

indicators

There is no simple, single way to calculate the level of

development of a country, region, or people, because countries and economies,

cultures and peoples differ so much. Instead geographers use a series of

development

indicators: Development indicators are factors that are used to compare the

development of one region against another. Examples of indicators include GDP,

number of doctors per 1000 people, adult literacy, and life expectancy to help

them judge a country's level of development (RWANDA STATISTIC, 2006: p.46). For

example:

Health

Do all the people in a country have access to medical care?

What level of healthcare is available - basic or advanced? Is it free or paid

for?

Industry

What is the most common type of industry? A Less Economically

Developed Country has low levels of development, based on economic indicators,

such as gross domestic product (the country's. The most advanced countries tend

to focus more on tertiary industries - services businesses, such as banking and

information technology.

Education

With this aspect of development, you want to analyse if all

the people in a country have access to education? Is it free? What level of

education is available (ie primary education, secondary education or

further/higher education)? How many people can read and write? The animation

below shows examples of these indicators.

2.9. Economic development

indicators

In order to assess the economic development of a country,

geographers use economic indicators. The most important of

these indicators are listed below: (RWANDA STATISTIC, 2006, p.39)

Gross Domestic Product (GDP) measures the

wealth or income of a country. GDP is the total value of goods and services

produced by a country in a year.

Gross National Product (GNP) is another

measure of a country's wealth or income. GNP measures the total economic output

of a country, including earnings from foreign investments which are not

included in GDP.

GNP per capital is a country's GNP divided by

its population. (Per capital means per person.)

Economic growth measures the annual increase

in GDP, GNP, GDP per capita, or GNP per capital.

Inequality of wealth is an indication of the

gap in wealth and income between a country's richest and poorest people. It can

be measured in many ways (eg, the proportion of a country's wealth owned by the

richest 10% of the population, compared with the proportion owed by the

remaining 90%).

Inflation measures how much the prices of

goods, services and wages are increasing each year. High inflation (above a few

percent) is believed by many to be a bad thing, and suggests a government lacks

control over the economy.

Unemployment is measured by the number of

people who cannot find work.

Economic structure shows how a country's

economy is divided between

primary,

secondary

and

tertiary

industries.

2.10

Meaning of Social Security

Social security primarily refers to a

social insurance

program providing social protection, or protection against socially recognized

conditions, including poverty, old age, disability, unemployment and others.

Social security may refer to: Social insurance, where people receive benefits

or services in recognition of contributions to an insurance scheme. These

services typically include provision for retirement

pensions,

disability

insurance,

survivor

benefits and

unemployment

insurance. income maintenance mainly the distribution of cash in the event

of interruption of employment, including retirement, disability and

unemployment services provided by administrations responsible for social

security. In different countries this may include medical care, aspects of

social work and even industrial relations.

These programs operate together to provide workers and then

families with some monthly income when their normal flow of income shrinks

because of the retirement, disability or death of the person who earned that

income(Attorney Joseph Mattews, Dorothy Mattews 2008, p.11). Social security is

a series of connected programs, each with its own set of rules and payment

schedules. All of the programs have one thing in common: benefits are paid to a

retired or disabled worker, or to the worker's dependent or surviving family

based on the worker's average wages, salary, or self employment income from

work covered by social security policy in place.

2.11.

Saving: Social Security

Clearly, the system requires some adjustment. But most

discussion of this term saving, is giving the false impression that the system

is about to collapse, and the plan that recent administrations have to put

forth for this salvation is the diversion of a portion of social security

contributions into the stock market (CATHERINE CAPUTO, 2008; p.13). Instead of

solidarity the system, however, this would only serve to weaken it, pushing

people into highly risky investments that could only guarantee one thing: that

hundreds of billions of retirement dollars are pumped into Wall Street and

corporate coffers. Under current rules, people may claim social security

retirement or dependents benefits as early as age set by the country and

survivors (Holzmann R. and Stiglitz J.E, 2000, p.23)

In the purpose of making activities that assigned and

contribute to the well being of the contributors, SSFR provided benefits to the

pensioners and compensations of the occupational Hazard as shown in the table

below:

2.12. Social security in

other countries

Chile

Chile has one of the most interesting cases to study in the

area of social security. This was a result of a weakened economy where

mismanagement by the military had created a diversity of problems ranging from

unemployment, high inflation, rampant strikes and corruption. In order to

address these evils, the military government in 1980 took a drastic decision of

rewriting the labor laws which included reforms of the pension and social

security sector.

Under the new law the function of pension and social security

management was divested from government and was instead transferred was to

private pension companies known as pension fund administrative companies.

USA Vs Japan

Worthy mentioned here is what is called the tantalization

agreement with Japan. Under this agreement, workers can transfer from USA to

Japan and vice versa without losing their pension contributions. They can work

part of their time in USA and the other part in Japan. Pensions can then be

saved in one country and be transferred to another country. Any savings that

were made in one country before the worker transferred can then be shifted to a

new account in the new country. All interest earned is not affected. The worker

can also work in one country and retire in another one with his pension being

transferee accordingly. This also shows a major shift from the traditional

system where pensions had to be paid in the country where the worker was

engaged.

Mauritius

In a bid to strengthen the role of Government in the provision

of welfare to her people, the government in 2000/2001 decided that 5% of the

budget should be spent on the provision of welfare to the citizens. The country

has a full Ministry of social security, national solidarity senior citizens

welfare and reform institutions which administers and oversees social security

and pensions. The country three levels of protection arrangements which one

level is the basic non-contributory pension and social aid, the second is

contributory pension scheme and savings and the third is Voluntary Private

schemes.

Social Security in

Uganda

Article 22 of the universal declaration of human rights,

December 12, 1948 states, that every member if society, every human being has a

right to social security. In line with this declaration, the colonial

government in Uganda formed a social security department in the ministry of

labour which was the precursor of present day NSSF. NSSF was formed by Art

No.8, 1985 which made NSSF a corporate body.

The mission statement of NSSF states as to provide social

security benefits as prescribed by law through the efficient and roleive

management of the fund (NSSF, Annual report 2003).

The major activity of the NSSF are collecting members

contributions, keeping members accounts, enforcing compliance, investment of

funds, payment of interest to members accounts and payment of benefits.

Social security in

Rwanda

The Social Security Fund of Rwanda is a public institution

created in 1962 to manage the Social Security regime put in place by the Law of

15/11/1962. It is under the state guarantee and the tutelage is ensured by the

Ministry of Finance and Economic Planning.

The vision of social security fund of Rwanda is to «To be

the best Social Security service provider in the region»

The Mission of social security fund of Rwanda is to be

«Efficiently manage members' funds and provide high quality service to

beneficiaries and other stakeholders»

The main activities of SSFR are To evaluate and collect social

security contributions of employers and employees; To pay benefits to

Pensioners, to the invalids and/or to their legitimate benefactors; To invest

excess funds in the most rational ways in order to be assured of their

profitability and contribution to the economic growth of the country; To

mobilize long term saving; To collect the appropriate statistics necessary to

facilitate planning and implementation of the above mentioned missions.

The management of SSFR is headed by the Board of Director and

structured with the following department: Resources&Administration

Department, Finance Department, Pension&Benefits Department, Contributor's

Education & Customer Relations, Legal&Corporate Services Department,

Planning ,Research & StatisticsDepartment, Investments Department, Quality

Assurance &Audit Department, Real Estate Department and Information

Technology Department

Investment

Dictionary definition gives investment as buying shares or

property with a hope of getting profit. Investment theory depends on two

factors namely return and risk.

Return on investment

The term return refers to income generated by the investment

plus any change in market price of the asset being invested, expressed as a

percentage of the beginning market price of the investment.

Portfolio investment

A portfolio is a combination of two or more assets or

securities.

CHAPTER THREE RESEARCH METHODOLOGY

3.1. Overview

The purpose of this chapter is identifying the appropriate

methodology that was undertaken for this study. This methodology demonstrates

the entire process of this study, as well as an analysis of the various

research methods employed during the conduct of the research. This chapter

highlights the study design, the sources of data, the research design, the

sample selection and size, data collection procedures. This, in different ways

enabled the study to achieve the research objectives and questions that were a

guide to the researcher in the study.

Additionally, the chapter examines the research methodology

suitable for analyzing the SSFR and the socio-economic development under the

dissertation. The methodology demonstrates the entire research process as well

as an analysis of the various research techniques that have been administered.

Besides, the chapter considers the research design and methodology on which the

dissertation is based. The chapter highlights the salient features of the

research methodology, while developing the underlying thesis of the

dissertation.

This section describes the practical procedures for carrying

out the study. It gives the details of the research design that were adopted,

population study, sampling procedures, data collection procedures, and the

final data analysis techniques that were applied. It gives the framework within

which data was collected and analyzed.

3.2

Sources and data collection

Primary and secondary data collection sources are popularly

applied in research, there are two main sources of data, that being; primary

and secondary data. Therefore, the sources of data for this study were of two

kinds; primary and secondary sources.

3.3.1.

Primary sources of data

Primary data is data collected from the

source and is often referred to as original data (Korthari, C.R 2004; p.31).

Therefore in order for the researcher to fulfill the objectives, which involve

analysis, the SSFR toward the socio-economic development of RWANDA and it was

important to undertake interviews. Conversely, Primary sources include

obtaining data at the primary level such as reports. The researcher collected

information afresh from the different stakeholders in SSFR such as experts, the

providers and the clients. In collecting those primary data, the methods of

questioning, observation and interviews were applied.

3.3.2.

Secondary sources of data

The only secondary sources relating to analysis of the SSFR

toward the socio-economic development of RWANDA, official reports from SSFR,

reviewing related literature on the SSFR performance and from libraries,

internet, other institutional annual reports, journals and any other form of

literature on the above study, and news paper articles. However, they gave

quantitative data and explained the crises that had occurred and what might

have gone wrong, but did not provide sufficient information on the causes of

SSFR toward the socio-economic of RWANDA. For this study a qualitative data

approach was thought likely to reveal a greater understanding of the casual

factors and therefore the research concentrated on the collection of primary

data.

Additionally, a literature search was conducted to investigate

the SSFR and the socio-economic development of RWANDA. Remarkably, in this

research, the application of secondary data enables the researcher to mitigate

the costs of time of gathering data; it is also an imperative need to relate

secondary data to what is obtaining in the field. Therefore this was achieved

though the administration of questionnaires and semi-structured interviews.

Other data had been collected from a wide range of written

documents, reports and research papers as shown in the bibliography. This

information helped the researcher to get, on one hand, a sound and wide

understanding about the different principles underlying the social security and

social economic development. They helped, on the other hand, to reach a real

analysis of the different trends that foster the present social security fund

of RWANDA movement to efficiency and sustainability toward the social economic

development of RWANDA.

3.4.

Research design

This study employed the descriptive survey design to determine

the socio-economic development of RWANDA with particular attention on SSFR the

focus of the research. It also involved both quantitative and qualitative data

collection.

In this chapter, the researcher had a background against which

findings of the study were assessed regarding its validity and reliability.

Therefore this section highlighted the research design, area and population of

study, sample selection and size, the data collection methods, data analysis

and the limitations to the study anticipated. Furtherance to that, the study

mainly focused on two (2) type of respondent, (those who received benefits

directly (retired or invalid) and those who received benefits indirectly

(survivors) in order to collect opinions on the social contribution of the SSF

to RWANDA, and contribute to the achievement of the objectives of the study.

3.5.

Study population

The study population is 264 composed of 72 pensioners, 64

deceased beneficiaries, 8 Directors at SSFR and 10 staff from the SSFR

3.6. Sampling technique

The sample size is 35 respondents under

pension 17 beneficiaries and 8 persons made of SSFR staff. The sampling

technique used in this research is purposive sampling to those whose knowledge

will provide the required information. In this sampling the researcher took the

payment made from the system and sorted by bank; 7 beneficiaries from the local

banks of Kacyiru, 7 beneficiaries from the Popular Bank of Kimironko, 3

Beneficiaries from the Popular Bank of Remera, whose benefits are above

500.000frw per quarter to analyze the social contribution of SSF to RWANDA. To

analyze the economic development of SSF to RWANDA; questionnaire has been

prepared and administrated to 8 Directors and 10 staff from the Department of

Real Estate and the Department of Investment.

3.7. Data collection

instruments

The study used three instruments of data collection namely;

questionnaires, in-depth interviews and documentation.

3.8.

Data collection procedures

The researcher presented a letter to the CEO of SSFR seeking

permission to conduct the study in the respective area and the formulated

questionnaire was pre-tested for validity. Thereafter, administration of the

questionnaire and collection of the questionnaire was done. Prior to the data

collection exercise, a reconnaissance was made to establish contact with the

beneficiaries. During the reconnaissance, the study purpose was explained to

the respondents. The types of information and feasibility to carry out the

study were determined. All the interview questions were written and

administered in Kinyarwanda language. The researcher translated the

questionnaire into English and recorded down the responses by filling the

questionnaires and by using the tape recorder to capture some verbal

responses.

3.9

Data analysis

Primary data was processed and analyzed both during and after

collection. During collection, the researcher studied the notes and responses

taken on daily basis and organized them into complete sets of data basing on

themes and content in line with the study objectives. This helped to avoid the

loss of information, checked for incompleteness, accuracy, uniformity,

consistence of the responses, and identified areas which needed more probing in

the subsequent interviews. Statistical tables were also drawn by adding and

counting the coded responses to determine the percentages and frequencies for

clear interpretation and presentation of the findings.

Data categories was identified and edited with a view of

checking for completeness and accuracy. Moreover, the data from questionnaires

was entered and coded. Thereafter, the data was analyzed using a computer-aided

tool Excel as charts and tabulations were derived using the same program.

3.10

Quantitative data analysis

Since data was edited before leaving the respondents, the

analysis of data aimed at showing respondents the importance of identifying the

contribution of SSF to the socio-economic development of RWANDA. In addition,

data collected was coded, tabulated and the coded data was broken down into

appropriate summary statistics and involved statistical presentation. In other

words, during data analysis, primary data gathered from the survey was reduced

into frequency distributions and tabulations.

3.11

Qualitative data analysis

An important characteristic of the qualitative approach is

that it seeks to provide a holistic view of the situation within an

organization. Individual or organizational behavior is perceived not as the

outcome of a finite set of discrete variables but rather as a lived experience

of a social setting. By using an individual centered research methodology, it

was hoped that the research would be able to examine the process that had been

at work in the lived experience, and to pin point causes of the change that

occurred. The idiographic approach provides a better understanding of

organizational behavior particularly where the research is made by intensive

study of a few beneficiaries interacting in real organization. The qualitative

approach is based on the view that one can only understand the social world by

first obtaining first-hand knowledge of the subject under investigation. It

emphasized the analysis of the subjective accounts which one generates by

getting inside situations.

Therefore in order to get inside and gain first-hand knowledge

of the perceptions of the respondents to gather their views though a well

structured interview and codify their responses in order to come up with a

thorough interpretation.

3.12

Ethical considerations

Extreme confidentiality had to be promised and it was only

promising secrecy that the respondents agreed to answer the questionnaires and

be interviewed. This imposition of confidentiality, albeit necessary, affects

the results of the interviews in findings of the study. In this research the

respondents were assured that their opinions and outcomes of the interviews are

for academic purposes.

3.13

limitation of the study

The study was conducted at the Headquarter of SSFR to analyze

the contribution of the SSFR to the economic development of RWANDA because of

the SSFR's headquarter is the responsible of investment and portfolio

management and decision maker. The period of study is from 2003-2008.

CHAPTER FOUR PRESENTATION AND ANALYSIS

OF RESEARCH FINDINGS

4.1.

Overview

The researcher after gathering opinions from different

informants who are beneficiaries of benefits in SSFR; they were visited for a

thorough analysis. Information collected from different pensioners in the

social security fund of RWANDA was tabulated in their raw form. These data are

presented under various headings which constitute the different areas of the

researcher. An appropriate interpretation had been then carried out coupled

with supporting arguments; other views from other researchers were used to

support or discuss the findings. It was done in accordance with the three

objectives and research questions that guided the study which was to analyze

benefits paid to old age and survivors eligible in the period of retirement,

towards their well being, to analyse the contributions of the SSFR towards the

socio-economic development of RWANDA, and suggest some modifications on the law

regarding the pension in RWANDA in order to contribute to the well being of the

beneficiaries in particular and the socio-economic of RWANDA in general. An

investigation was done and findings are shown below with their respective

questions.

4.2. Analysis of

Characteristic of respondents

To start the analysis of the role of the SSFR on

socio-economic development of Rwanda, the researcher would first analyze the

Social characteristics of the respondents. The characteristics from the

respondents on age are shown is the Table No.1.

Table No. 4.1: Age characteristic of

respondents

|

Age

|

Number

|

%

|

|

18-27

|

6

|

17

|

|

28-37

|

3

|

9

|

|

38-47

|

0

|

0

|

|

48-57

|

12

|

34

|

|

58+

|

14

|

40

|

|

Total

|

35

|

100%

|

Source: Primary Data

It is seen that the most of the respondent of the

questionnaire are aged of 58+ years because they are the ones who are

benefiting the benefits from the social security fund of Rwanda. They were the

targeted people in the sampling techniques. This age interval ensured the

research to find the reliable information and contribute to the achievement of

the objectives.

It is seen also from the above table that respondent on this

questionnaire is aged of 38-47, this interval age are not even eligible to the

direct pension, or to the deceased benefits. Another big percentage on this

characteristic analysis is the interval 48-57 which represent 34% of the

respondents, they are also benefiting from the social security fund through

their savings.

The interval age of 18-27 is corresponding to the survivors

who are getting benefits of the deceased. These beneficiaries must be children

who did not attained the age of 25 above while studying and less 18 age. The

table shows that they represent 17% of the respondents.

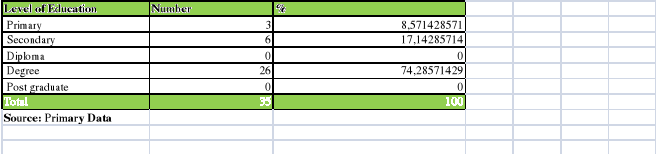

Table No. 4.2: Level of Education for respondents'

analysis

From the illustrated table above, the researcher realized that the

status level of education of the respondents is that, the degree holders are

represented by 74% of the respondents. This means that most of pensioners in

SSFR have a high level of education. In this table any level postgraduate is

represented. This is a high level where by pensioners cannot get in the period

of retirement. It is seen also in this representation that 17% of respondents

are the survivors who are still at school and benefiting the pension of their

deceased. And 8% are have the background of primary school and still benefiting

social security benefits. From the illustrated table above, the researcher realized that the

status level of education of the respondents is that, the degree holders are

represented by 74% of the respondents. This means that most of pensioners in

SSFR have a high level of education. In this table any level postgraduate is

represented. This is a high level where by pensioners cannot get in the period

of retirement. It is seen also in this representation that 17% of respondents

are the survivors who are still at school and benefiting the pension of their

deceased. And 8% are have the background of primary school and still benefiting

social security benefits.

Table No.4. 3. Occupational characteristics of the

respondents analysis

Information provided through these occupational characteristics

revealed that 51% are still working and represent the Staff workers of Social

security fund of Rwanda interviewed. 17 among 35 interviewed are unemployed

because they got the retirement period. 14% of the respondents are business

person. These business people, after getting benefits from social security

fund, they make business for small activities so that at a certain time they

may generate return. Information provided through these occupational characteristics

revealed that 51% are still working and represent the Staff workers of Social

security fund of Rwanda interviewed. 17 among 35 interviewed are unemployed

because they got the retirement period. 14% of the respondents are business

person. These business people, after getting benefits from social security

fund, they make business for small activities so that at a certain time they

may generate return.

4.3

Analysis of beneficiaries affiliated in SSFR

The analysis of the beneficiaries of the SSFR was guided by a

question, which is stated «Are you a member of SSFR?

«The elicited responses from the 35 respondents interviewed are

as follows: 6 direct beneficiaries interviewed said that they are registered as

SSFR contributors but up to now they are receiving benefits and they could not

contribute because they are in the retirement period. 3 respondents were the

indirect beneficiaries, they responded that they are still in school, and they

are not affiliated in the SSFR because they don't earn any income. Whereas, 18

staff of SSFR responded that they are affiliated in SSFR and some of them are

waiting for retirement to be provided for pension.

The table No.4.4. Below shows the

opinions from the informants

|

Response

|

Number

|

%

|

|

Yes

|

32

|

91.4

|

|

No

|

3

|

8.6

|

|

Total

|

35

|

100%

|

Source: Primary data

The above table indicates that 91.4% of respondents who are

working and aware of SSFR at the same time affiliated, whereby 6.4% of

respondent representing 3 are not affiliated to the SSFR because they are not

working , but they are benefiting from their deceased who saved for their

future.

4.4

Analyzing the importance of being insured in SSFR

The objective of this question was to analyze if the

respondents know the importance of being contributors of SSFR. Opinions from

respondents were that they are aware of importance of SSFR through the benefits

they received in the retirement period without working and professional hazard

is compensated. SSFR help old age to retire with dignity. The question has

been responded and the information is tabulated in the table below:

Table No.4.5. Awareness of

Importance of SSFR

|

Responses

|

Number

|

%

|

|

Yes

|

35

|

100%

|

|

No

|

0

|

0%

|

|

Total

|

35

|

100%

|

Source: Primary Data

The above table 8 shows the research that they are aware of

importance of being insured by SSFR, which represent 100% of the responded.

4.5.

Analysis if benefits are paid on time

The question viewed to get information from the informant if

they receive their benefits on time. The findings from the study show the

different responses from the 35 respondents interviewed by the researcher, they

said that they receive it on quarterly basis. They said that the trimester is

not a best time to pay the benefits and suggested that a payment should be on

monthly basis. For further understanding the table 9 below shows the

statistics.

Table NO.4.6. Analysis on benefits

to be paid on time

|

Responses

|

Number

|

%

|

|

Yes

|

0

|

0%

|

|

No

|

35

|

100%

|

|

Total

|

35

|

100%

|

Source: Primary Data

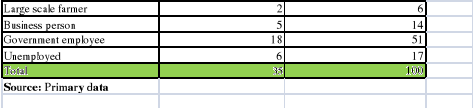

4.5 Analysis of allocation of benefits received from

SSFR

The objective of the question was to get

enlighten about the beneficiaries' view about the use of the allocated money

from SSFR . Opinions varied according every one's needs. Indeed, with the total

of 17 respondents, 14 said that they allocate usually the benefits received in

Children Education, Food and Shelter, agriculture, health care and

rehabilitation of their houses and this represent 82.4% of the respondents.

Whereby 3 representing 17.6% of the respondents said that benefits that SSFR

provides is not enough to be allocated in any business or other social

responsibilities. Hence, they are allocated to food and shelter. The views of

respondents are presented in the table below:

Table No.4.7. Analysis of SSFR

benefits allocation

|

Responses

|

Number

|

%

|

|

Education and Employment

|

14

|

82.4%

|

|

Healthcare and Disease

|

15

|

88.2%

|

|

Food and Shelter

|

17

|

100%

|

|

Water and Sanitation

|

17

|

100%

|

|

Savings

|

0

|

0%

|

|

Infrastructure

|

3

|

17.6%

|

Source: Primary Data

The above table illustrated shows that the majority of

beneficiaries allocate the Fund in Food and shelter, water and sanitation

covered 100%. Whereas, Education and employment come after satisfying their

basic needs and represent 82.4%. 17.6% of the respondent rehabilitates their

houses because they are gaining more money from benefits. It is apparently seen

that psychological needs are the ones satisfied as demonstrated by Keynes

theory of income illustrated « (Y= C+I+S-T). Since, the revenue from SSFR

only satisfies consumption; thus, these allocations do not align with the

economic trends. It is worth to note that standards of living are difficult to

measure, but indicators of social and economic development do exist. One of the

crudest measures is Gross Domestic Product (GDP) per capital, determined by the

value of all goods and services produced within a region over a given time of

period, averaged per person. Respondent answers are presented below in the

graph:

Graph 4.1. Trends on how benefits

are allocated

Source: Primary Data

The above analysis aimed to find an answer to the first

research question as stated «Are the Benefits paid to old age and

survivors in the period of retirement contributed to the well being of the

ensured» Therefore, after, a thorough analysis as presented in the tables

above, it was found out that, those affiliated do get their benefits at a

stated date of retirement. However, these benefits are very little and can only

sustain psychological needs such as food, shelter etc. Apart from being little;

they are also given at a later date on a quarterly basis. Thus, the SSFR policy

does not comply with their client's whims and today's economic trends.

4.6

Investigation of the benefits paid to the retirees at the time of

retirement

Due to the information provided by the respondent, it is seen

that the benefits received by the pensioners and survivors, has the role on

their well being and to their welfare in particular and therefore, role on the

social Development of RWANDA.

The response on this question was Yes and represent 100% of

the respondents as indicated in the table below:

Table No.4.8. Analysis of the role

of SSF toward the social development of RWANDA

|

Responses

|

Number

|

%

|

|

Yes

|

35

|

100%

|

|

No

|

0

|

0%

|

|

Total

|

35

|

100%

|

Source: Primary Data

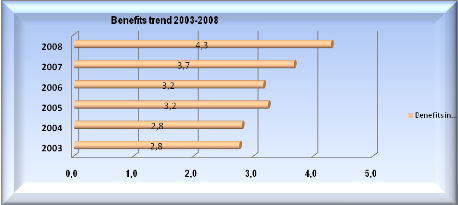

Table No.4.9: Benefits payment trend

|

Year

|

Pension

|

Occupational risks

|

Total

|

Growth rate

|

|

2003

|

2, 595, 107,863

|

170, 574,443

|

2, 765, 682,306

|

-

|

|

2004

|

2, 786, 263,481

|

179, 958,252

|

2, 966, 221,733

|

7.3%

|

|

2005

|

3, 199, 802,990

|

194, 075,862

|

3, 393, 878,852

|

14.4%

|

|

2006

|

3, 068, 606,003

|

190, 728,520

|

3, 259, 334,523

|

-4.0%

|

|

2007

|

3, 525, 524,113

|

215, 999,138

|

3, 741, 523,251

|

14.8%

|

|

2008

|

4, 078, 071,636

|

232, 863,081

|

4, 310, 934,717

|

15.2%

|

Source: SSFR, Annual report, 2003-2008

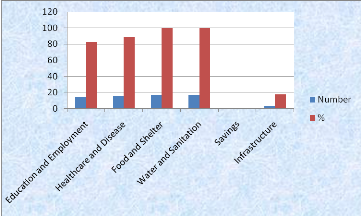

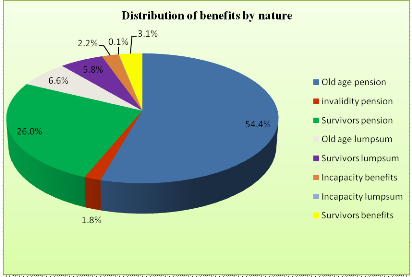

According to the existing social security law, the Fund offers

two types of benefits, pension and occupational risks. These benefits can be

further sub-grouped into old age, invalidity, survivorship, work injury and

occupational diseases as shown in the tables and graphs below.

In 2008, the Fund spent Rwf 4.3 billion as

benefits received by 23,725 and 1,624

beneficiaries for pension and occupational risks respectively. Since the year

2003, benefits have been increasing at an average growth rate of 9.5%. As

highlighted in previous annual reports, the processing of benefits has always

been constrained by huge declaration records that have not been computerized.

One of the major initiatives made during the year, is the computerization of

all declarations missing in the database. Over 6.7 million

declarations were entered into the system. The different types of benefits

and amounts paid are shown in tables and graphs that follow.

Graph

4.2: Benefits trend 2003-2008

Source: SSFR, Annual report, 2003-2008

Graph 4.3: Trends of

benefits

Source: SSFR, Annual report, 2003-2008

4.7.

To find out how the contributions funds are invested towards the Socio-Economic

Development of Rwanda

The Board and Management have a legal and fiduciary obligation

to act in the best financial interest of the Fund's beneficiaries and to

exercise the highest standard of care. This must override all other

considerations. Members' contributions and Investment earnings are the most

important funding source for the Fund. Therefore, investment policies and

strategies are vital to all of the Fund's stakeholders. Investment policy

establishes eligible investments, asset class weights and the amount of

discretion given to management. These factors are the principal determinants of

risk and return. As such, investment policy plays a crucial role in determining

the extent to which benefit obligations can be offset by the Fund's investment

earnings. On a long-term basis, a low risk investment policy for the Fund will

earn low rates of return. On the other hand, a high-risk policy would be

expected to provide a higher rate of return but may lead to unacceptable levels

of return volatility. It is therefore critical that the investment policy

establishes a balance between the Fund's risk tolerance and return objectives.

The goal of this investment policy statement is to establish guidelines, which

ensure that the Fund is managed within a return on investment at a high

level.

4.7.1 Investment vehicles

at SSFR

NSSF Management is to manage the Fund using a multi-product