I-2\ A persistent anomaly in time:

In the United States, at the end of

the first day of trading, the shares traded on average at 18.9% above the offer

price at which the company sold them (1990-2007). Underpricing has averaged

21.2% in the 1960s, 9% in the 1970s, and increasing from 7.8% in the 1980s to

14.4% in the 1990s and to a surprisingly and severe underpricing of 63.5% that

exceeded any level previously seen in 1999 and 2000 (reflecting the internet

boom years) before falling to 14% in 2001, averaged 11.8% from 2002 to 2006

before rising to 14% in 2007. These are the average levels of underpricing

observed in the United States IPO market. When we observe these different

levels and percentages of underpricing, we can say that underpricing fluctuates

so much and its level changes over time, but it is persistent over time. This

anomaly is always observed in the IPO market, whatever the industry to which

the offering belongs and whatever the period of going public. The level changes

but this anomaly is persistent.

In dollar terms, IPO firms appear to leave many billions

«on the table» every year in the U.S. IPO market alone. But the

highest amount is in 1999 and 2000, period of internet bubble, this amount of

money left on the table at IPO market has reached 66.63 billion dollars, an

amount that exceeded any level previously seen. It is the period of internet

bubble that attracted the attention of much research effort. Ritter documents

that in 1999 and 2000 only, 803 companies went public in the United States,

raising about $123 billion, and leaving about $65 billion on the table in the

form of initial returns. Loughran and Ritter (2004)1 explain

low-frequency movements in underpricing (or first-day returns) that occur less

often than hot and cold issue markets. On a data for IPOs over 1980-2003, they

find that IPO underpricing doubled from 7% during 1980-1989 to almost 15%

during 1990-1998 before reverting to 12% during the post-bubble period of 2001-

2003, there are some level differences over time but underpricing is

persistent.

1 Loughran and Ritter (2004): «Why Has IPO

Underpricing Changed Over Time?».

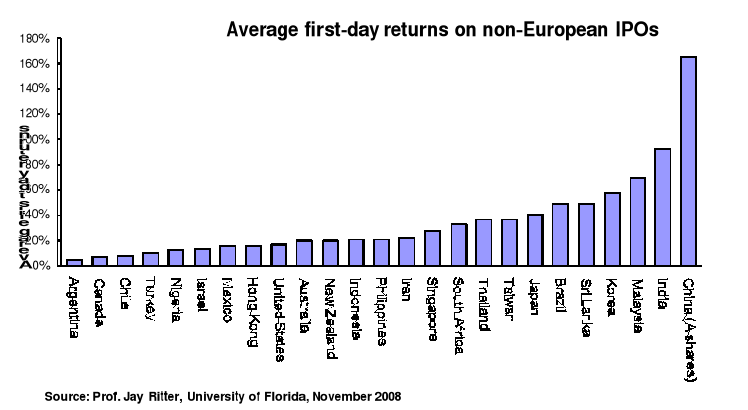

I-3\ A persistent anomaly in all countries:

Many researchers have been concentrated in

studying the persistence of underpricing anomaly internationally. The

underpricing phenomenon of Initial Public Offerings (IPOs) has been widely

studied across different stock markets around the world and it is a persistent

phenomenon all over the world.

Loughran, Ritter and Rydqvist (1994)2 documented

that the underpricing anomaly exists in all IPO markets. They collected data

for 45 countries for different periods and found that underpricing is

persistent for all the IPO markets with no exceptions but surely with different

levels.

A comparative study by Jenkinson (1990) examines the

performance of IPOs in Japan as well as IPOs in the U.S. and the U.K., and

concludes that IPOs in these countries are systematically priced at a discount

relative to their subsequent trading price. In the U.S. the discount is around

10% while in the U.K., it is around 7%. But when we see the next figures

presented by Jay Ritter and that represent the underpricing average in 2008 for

many countries, we can see that the level of underpricing has been increased in

comparison to the earlier results that were presented by many researchers.

Figure 1- Underpricing on non-European IPOs (2008)

2 Loughran, Ritter and Rydqvist (1994):

«Initial Public Offerings: international insights».

Figure 2- Underpricing on European IPOs (2008)

Loughran et al. (1994) provide also a comprehensive survey of

companies going public in 25 countries and find that underpricing is a

persistent phenomenon. Ritter (2003) reports the extent of underpricing in 38

countries and finds the same results.

Table 1. Average first day returns of some studies

3

|

Country

|

Sample size

|

Time period

|

Avg first-day return %

|

|

Australia

|

381

|

1976-1995

|

12.1

|

|

Brazil

|

62

|

1979-1990

|

78.5

|

|

Canada

|

500

|

1971-1999

|

6.3

|

|

Indonesia

|

106

|

1989-1994

|

15.1

|

|

Mexico

|

37

|

1987-1990

|

33.0

|

|

Norway

|

68

|

1984-1996

|

12.5

|

|

Taiwan

|

293

|

1986-1998

|

31.1

|

|

UK

|

3.042

|

1959-2000

|

17.5

|

|

US

|

14.76

|

1960-2000

|

18.4

|

3 This table presents the results of some different

studies that were advanced. It is a demonstration of the persistence of IPO

underpricing for different countries regardless the period of the study, to

insist on the fact that this persistence is not only due to the period of IPOs.

Regardless the period, underpricing phenomenon exists for all countries.

|