ANNEXES

BASE DES DONNEES

|

Année

|

DPT

|

INST

|

PFN

|

PIBHB

|

TXINFL

|

CDRT

|

|

1980

|

0,672

|

1

|

7,901

|

613,644

|

36,8

|

0,0041

|

|

1981

|

0,583

|

1

|

8,807

|

612,006

|

40,9

|

0,0044

|

|

1982

|

0,700

|

1

|

10,783

|

594,009

|

35,3

|

0,0045

|

|

1983

|

0,482

|

0

|

72,372

|

587,424

|

100,8

|

0,0062

|

|

1984

|

1,012

|

0

|

6,618

|

604,202

|

33,4

|

0,0130

|

|

1985

|

0,771

|

0

|

6,897

|

590,935

|

26,5

|

0,0160

|

|

1986

|

0,928

|

0

|

8,066

|

601,881

|

32,8

|

0,0153

|

|

1987

|

1,535

|

0

|

8,784

|

600,599

|

99,5

|

0,0189

|

|

1988

|

3,142

|

0

|

10,565

|

585,571

|

121,5

|

0,0155

|

|

1989

|

1,417

|

1

|

8,519

|

559,760

|

95,8

|

0,0385

|

|

1990

|

0,788

|

1

|

12,890

|

505,049

|

233,2

|

0,1175

|

|

1991

|

0,396

|

1

|

15,214

|

445,366

|

3644,9

|

0,0197

|

|

1992

|

0,301

|

1

|

15,843

|

383,046

|

2989,6

|

0,0031

|

|

1993

|

0,770

|

1

|

30,679

|

318,545

|

4651,7

|

0,0048

|

|

1994

|

0,000

|

1

|

8,401

|

294,950

|

9796,9

|

0,0031

|

|

1995

|

0,166

|

0

|

6,741

|

287,301

|

370,3

|

3,1386

|

|

1996

|

0,236

|

1

|

7,450

|

276,232

|

693

|

1,4515

|

|

1997

|

0,093

|

0

|

4,200

|

254,085

|

13,7

|

0,6058

|

|

1998

|

1,009

|

1

|

8,460

|

243,992

|

134,8

|

9,8398

|

|

1999

|

0,000

|

0

|

7,550

|

227,881

|

483,7

|

0,0000

|

|

2000

|

0,105

|

1

|

15,177

|

206,567

|

511,2

|

0,8800

|

|

2001

|

0,166

|

0

|

4,844

|

196,502

|

135,1

|

0,7392

|

|

2002

|

0,115

|

0

|

4,857

|

196,252

|

15,8

|

0,0311

|

|

2003

|

0,109

|

0

|

5,416

|

200,775

|

4,4

|

0,0142

|

|

2004

|

0,634

|

1

|

8,095

|

207,547

|

9

|

0,0978

|

|

2005

|

0,261

|

1

|

7,780

|

213,310

|

21,5

|

0,2893

|

|

2006

|

0,524

|

0

|

9,981

|

217,535

|

18,2

|

4,5116

|

|

2007

|

0,885

|

0

|

12,280

|

223,780

|

9,9

|

5,4085

|

|

2008

|

1,509

|

0

|

15,076

|

230,119

|

27,6

|

9,1708

|

|

2009

|

1,084

|

1

|

16,366

|

229,142

|

53,4

|

6,0565

|

|

2010

|

0,809

|

0

|

16,364

|

237,572

|

9,8

|

6,8236

|

|

2011

|

1,135

|

1

|

16,029

|

245,869

|

15,4

|

8,4213

|

|

2012

|

0,622

|

1

|

16,935

|

255,208

|

2,7

|

6,2969

|

|

2013

|

0,744

|

0

|

15,630

|

268,277

|

1,03

|

7,1271

|

ANNEXES

A. STATIONNARITE

A.1. Pibhb

|

Null Hypothesis: PIBHB has a unit root

|

|

|

Exogenous: Constant, Linear Trend

|

|

|

Lag Length: 0 (Automatic - based on SIC, maxlag=0)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

0.656093

|

0.9993

|

|

Test critical values:

|

1% level

|

|

-4.262735

|

|

|

5% level

|

|

-3.552973

|

|

|

10% level

|

|

-3.209642

|

|

|

|

|

|

|

|

|

|

|

|

|

*MacKinnon (1996) one-sided p-values.

|

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller Test Equation

|

|

|

Dependent Variable: D(PIBHB)

|

|

|

|

Method: Least Squares

|

|

|

|

Date: 06/15/16 Time: 20:58

|

|

|

|

Sample (adjusted): 2 34

|

|

|

|

Included observations: 33 after adjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

PIBHB(-1)

|

0.032181

|

0.049050

|

0.656093

|

0.5168

|

|

C

|

-45.92640

|

31.73640

|

-1.447121

|

0.1582

|

|

@TREND(1)

|

1.394878

|

0.851608

|

1.637935

|

0.1119

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.165915

|

Mean dependent var

|

-10.46566

|

|

Adjusted R-squared

|

0.110309

|

S.D. dependent var

|

22.05590

|

|

S.E. of regression

|

20.80388

|

Akaike info criterion

|

8.994665

|

|

Sum squared resid

|

12984.05

|

Schwarz criterion

|

9.130711

|

|

Log likelihood

|

-145.4120

|

Hannan-Quinn criter.

|

9.040440

|

|

F-statistic

|

2.983771

|

Durbin-Watson stat

|

0.512607

|

|

Prob(F-statistic)

|

0.065790

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Null Hypothesis: D(PIBHB) has a unit root

|

|

|

Exogenous: Constant, Linear Trend

|

|

|

Lag Length: 0 (Automatic - based on SIC, maxlag=0)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

-2.185354

|

0.4812

|

|

Test critical values:

|

1% level

|

|

-4.273277

|

|

|

5% level

|

|

-3.557759

|

|

|

10% level

|

|

-3.212361

|

|

|

|

|

|

|

|

|

|

|

|

|

*MacKinnon (1996) one-sided p-values.

|

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller Test Equation

|

|

|

Dependent Variable: D(PIBHB,2)

|

|

|

Method: Least Squares

|

|

|

|

Date: 06/15/16 Time: 20:58

|

|

|

|

Sample (adjusted): 3 34

|

|

|

|

Included observations: 32 after adjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

D(PIBHB(-1))

|

-0.261721

|

0.119761

|

-2.185354

|

0.0371

|

|

C

|

-9.741193

|

6.043473

|

-1.611854

|

0.1178

|

|

@TREND(1)

|

0.415384

|

0.280787

|

1.479360

|

0.1498

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.155336

|

Mean dependent var

|

0.459607

|

|

Adjusted R-squared

|

0.097083

|

S.D. dependent var

|

14.41126

|

|

S.E. of regression

|

13.69386

|

Akaike info criterion

|

8.160832

|

|

Sum squared resid

|

5438.130

|

Schwarz criterion

|

8.298244

|

|

Log likelihood

|

-127.5733

|

Hannan-Quinn criter.

|

8.206380

|

|

F-statistic

|

2.666584

|

Durbin-Watson stat

|

1.898732

|

|

Prob(F-statistic)

|

0.086481

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Null Hypothesis: D(PIBHB,2) has a unit root

|

|

|

Exogenous: Constant, Linear Trend

|

|

|

Lag Length: 0 (Automatic - based on SIC, maxlag=0)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

-5.834472

|

0.0002

|

|

Test critical values:

|

1% level

|

|

-4.284580

|

|

|

5% level

|

|

-3.562882

|

|

|

10% level

|

|

-3.215267

|

|

|

|

|

|

|

|

|

|

|

|

|

*MacKinnon (1996) one-sided p-values.

|

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller Test Equation

|

|

|

Dependent Variable: D(PIBHB,3)

|

|

|

Method: Least Squares

|

|

|

|

Date: 06/15/16 Time: 20:58

|

|

|

|

Sample (adjusted): 4 34

|

|

|

|

Included observations: 31 after adjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

D(PIBHB(-1),2)

|

-1.080072

|

0.185119

|

-5.834472

|

0.0000

|

|

C

|

-1.172044

|

5.974613

|

-0.196171

|

0.8459

|

|

@TREND(1)

|

0.122363

|

0.298013

|

0.410595

|

0.6845

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.549320

|

Mean dependent var

|

0.648049

|

|

Adjusted R-squared

|

0.517129

|

S.D. dependent var

|

21.20126

|

|

S.E. of regression

|

14.73253

|

Akaike info criterion

|

8.309759

|

|

Sum squared resid

|

6077.332

|

Schwarz criterion

|

8.448532

|

|

Log likelihood

|

-125.8013

|

Hannan-Quinn criter.

|

8.354996

|

|

F-statistic

|

17.06417

|

Durbin-Watson stat

|

1.927870

|

|

Prob(F-statistic)

|

0.000014

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Null Hypothesis: DPT has a unit root

|

|

|

Exogenous: Constant

|

|

|

|

Lag Length: 0 (Automatic - based on SIC, maxlag=0)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

-3.056490

|

0.0400

|

|

Test critical values:

|

1% level

|

|

-3.646342

|

|

|

5% level

|

|

-2.954021

|

|

|

10% level

|

|

-2.615817

|

|

|

|

|

|

|

|

|

|

|

|

|

*MacKinnon (1996) one-sided p-values.

|

|

A.2. Depot

|

Null Hypothesis: DPT has a unit root

|

|

|

Exogenous: Constant

|

|

|

|

Lag Length: 0 (Automatic - based on SIC, maxlag=0)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

-3.056490

|

0.0400

|

|

Test critical values:

|

1% level

|

|

-3.646342

|

|

|

5% level

|

|

-2.954021

|

|

|

10% level

|

|

-2.615817

|

|

|

|

|

|

|

|

|

|

|

|

|

*MacKinnon (1996) one-sided p-values.

|

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller Test Equation

|

|

|

Dependent Variable: D(DPT)

|

|

|

|

Method: Least Squares

|

|

|

|

Date: 06/15/16 Time: 21:00

|

|

|

|

Sample (adjusted): 2 34

|

|

|

|

Included observations: 33 after adjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

DPT(-1)

|

-0.463212

|

0.151550

|

-3.056490

|

0.0046

|

|

C

|

0.324465

|

0.140031

|

2.317090

|

0.0273

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.231573

|

Mean dependent var

|

0.002206

|

|

Adjusted R-squared

|

0.206785

|

S.D. dependent var

|

0.594396

|

|

S.E. of regression

|

0.529385

|

Akaike info criterion

|

1.624490

|

|

Sum squared resid

|

8.687702

|

Schwarz criterion

|

1.715188

|

|

Log likelihood

|

-24.80409

|

Hannan-Quinn criter.

|

1.655007

|

|

F-statistic

|

9.342131

|

Durbin-Watson stat

|

2.019304

|

|

Prob(F-statistic)

|

0.004581

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A.3. Profondeur financière

|

Null Hypothesis: PFN has a unit root

|

|

|

Exogenous: Constant, Linear Trend

|

|

|

Lag Length: 0 (Automatic - based on SIC, maxlag=0)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

-5.565672

|

0.0004

|

|

Test critical values:

|

1% level

|

|

-4.262735

|

|

|

5% level

|

|

-3.552973

|

|

|

10% level

|

|

-3.209642

|

|

|

|

|

|

|

|

|

|

|

|

|

*MacKinnon (1996) one-sided p-values.

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller Test Equation

|

|

|

Dependent Variable: D(PFN)

|

|

|

|

Method: Least Squares

|

|

|

|

Date: 06/15/16 Time: 21:01

|

|

|

|

Sample (adjusted): 2 34

|

|

|

|

Included observations: 33 after adjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

PFN(-1)

|

-1.013296

|

0.182062

|

-5.565672

|

0.0000

|

|

C

|

15.73148

|

5.148519

|

3.055535

|

0.0047

|

|

@TREND(1)

|

-0.160320

|

0.224923

|

-0.712780

|

0.4815

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.508027

|

Mean dependent var

|

0.234211

|

|

Adjusted R-squared

|

0.475229

|

S.D. dependent var

|

16.86156

|

|

S.E. of regression

|

12.21470

|

Akaike info criterion

|

7.929665

|

|

Sum squared resid

|

4475.967

|

Schwarz criterion

|

8.065711

|

|

Log likelihood

|

-127.8395

|

Hannan-Quinn criter.

|

7.975441

|

|

F-statistic

|

15.48947

|

Durbin-Watson stat

|

2.008222

|

|

Prob(F-statistic)

|

0.000024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A.4. Taux d'inflation

|

Null Hypothesis: TXINFL has a unit root

|

|

|

Exogenous: None

|

|

|

|

Lag Length: 0 (Automatic - based on SIC, maxlag=0)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

-3.159252

|

0.0025

|

|

Test critical values:

|

1% level

|

|

-2.634731

|

|

|

5% level

|

|

-1.951000

|

|

|

10% level

|

|

-1.610907

|

|

|

|

|

|

|

|

|

|

|

|

|

*MacKinnon (1996) one-sided p-values.

|

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller Test Equation

|

|

|

Dependent Variable: D(TXINFL)

|

|

|

|

Method: Least Squares

|

|

|

|

Date: 06/15/16 Time: 21:51

|

|

|

|

Sample (adjusted): 2 35

|

|

|

|

Included observations: 34 after adjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

TXINFL(-1)

|

-0.464428

|

0.147006

|

-3.159252

|

0.0034

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.232216

|

Mean dependent var

|

-1.045294

|

|

Adjusted R-squared

|

0.232216

|

S.D. dependent var

|

1992.873

|

|

S.E. of regression

|

1746.220

|

Akaike info criterion

|

17.79727

|

|

Sum squared resid

|

1.01E+08

|

Schwarz criterion

|

17.84216

|

|

Log likelihood

|

-301.5535

|

Hannan-Quinn criter.

|

17.81257

|

|

Durbin-Watson stat

|

2.166439

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A.5. Investissement (INV)

|

Null Hypothesis: D(INV) has a unit root

|

|

|

Exogenous: Constant, Linear Trend

|

|

|

Lag Length: 0 (Automatic - based on SIC, maxlag=0)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

-4.643400

|

0.0041

|

|

Test critical values:

|

1% level

|

|

-4.273277

|

|

|

5% level

|

|

-3.557759

|

|

|

10% level

|

|

-3.212361

|

|

|

|

|

|

|

|

|

|

|

|

B. COINTEGRATION

B.1. Détermination du lag optimal

|

VAR Lag Order Selection Criteria

|

|

|

|

|

Endogenous variables: DDPIBHB DINV DPT CDRT TXINFL PFN

|

|

|

Exogenous variables: C

|

|

|

|

|

Date: 06/17/16 Time: 19:42

|

|

|

|

|

Sample: 1 35

|

|

|

|

|

|

Included observations: 29

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lag

|

LogL

|

LR

|

FPE

|

AIC

|

SC

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0

|

-650.9959

|

NA

|

1.92e+12

|

45.31006

|

45.59295*

|

|

1

|

-604.6929

|

70.25289

|

1.00e+12

|

44.59951

|

46.57973

|

|

2

|

-574.6654

|

33.13379

|

2.15e+12

|

45.01141

|

48.68896

|

|

3

|

-500.6830

|

51.02237*

|

4.88e+11*

|

42.39193*

|

47.76682

|

|

|

|

|

|

|

B.2. Analyse de la causalité par le test de

granger

|

Pairwise Granger Causality Tests

|

|

Date: 06/15/16 Time: 21:05

|

|

Sample: 1 35

|

|

|

|

|

|

|

|

|

|

|

Null Hypothesis:

|

Obs

|

F-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

DPT does not Granger Cause DDPIBHB

|

31

|

5.08979

|

0.0321

|

|

DDPIBHB does not Granger Cause DPT

|

0.02370

|

0.8788

|

|

|

|

|

|

|

|

|

|

PFN does not Granger Cause DDPIBHB

|

31

|

6.67955

|

0.0153

|

|

DDPIBHB does not Granger Cause PFN

|

2.89365

|

0.1000

|

|

|

|

|

|

|

|

|

|

TXINFL does not Granger Cause DDPIBHB

|

31

|

5.48367

|

0.0265

|

|

DDPIBHB does not Granger Cause TXINFL

|

5.87536

|

0.0221

|

|

|

|

|

|

|

|

|

|

INST does not Granger Cause DDPIBHB

|

31

|

0.19834

|

0.6595

|

|

DDPIBHB does not Granger Cause INST

|

1.66137

|

0.2080

|

|

|

|

|

|

|

|

|

|

PFN does not Granger Cause DPT

|

33

|

0.07622

|

0.7844

|

|

DPT does not Granger Cause PFN

|

0.09131

|

0.7646

|

|

|

|

|

|

|

|

|

|

TXINFL does not Granger Cause DPT

|

33

|

0.96629

|

0.3335

|

|

DPT does not Granger Cause TXINFL

|

0.14443

|

0.7066

|

|

|

|

|

|

|

|

|

|

INST does not Granger Cause DPT

|

33

|

8.02142

|

0.0082

|

|

DPT does not Granger Cause INST

|

0.69650

|

0.4106

|

|

|

|

|

|

|

|

|

|

TXINFL does not Granger Cause PFN

|

33

|

0.04314

|

0.8369

|

|

PFN does not Granger Cause TXINFL

|

1.91483

|

0.1766

|

|

|

|

|

|

|

|

|

|

INST does not Granger Cause PFN

|

33

|

1.85640

|

0.1832

|

|

PFN does not Granger Cause INST

|

0.11382

|

0.7382

|

|

|

|

|

|

|

|

|

|

INST does not Granger Cause TXINFL

|

33

|

1.15297

|

0.2915

|

|

TXINFL does not Granger Cause INST

|

0.00015

|

0.9902

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B.3. Estimation par le MCO

|

Dependent Variable: DDPIBHB

|

|

|

|

Method: Least Squares

|

|

|

|

Date: 06/17/16 Time: 15:50

|

|

|

|

Sample (adjusted): 3 34

|

|

|

|

Included observations: 32 after adjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

C

|

4.977284

|

4.928219

|

1.009956

|

0.3215

|

|

DPT

|

-4.527171

|

3.863368

|

-1.171820

|

0.2515

|

|

PFN

|

0.048687

|

0.194444

|

0.250389

|

0.8042

|

|

TXINFL

|

0.003344

|

0.001304

|

2.564396

|

0.0162

|

|

INST

|

-9.647416

|

4.970172

|

-1.941063

|

0.0628

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.285685

|

Mean dependent var

|

0.459607

|

|

Adjusted R-squared

|

0.179861

|

S.D. dependent var

|

14.41126

|

|

S.E. of regression

|

13.05106

|

Akaike info criterion

|

8.118216

|

|

Sum squared resid

|

4598.913

|

Schwarz criterion

|

8.347238

|

|

Log likelihood

|

-124.8915

|

Hannan-Quinn criter.

|

8.194131

|

|

F-statistic

|

2.699613

|

Durbin-Watson stat

|

2.646561

|

|

Prob(F-statistic)

|

0.051744

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C. DIAGNOSTIC DU MODEL

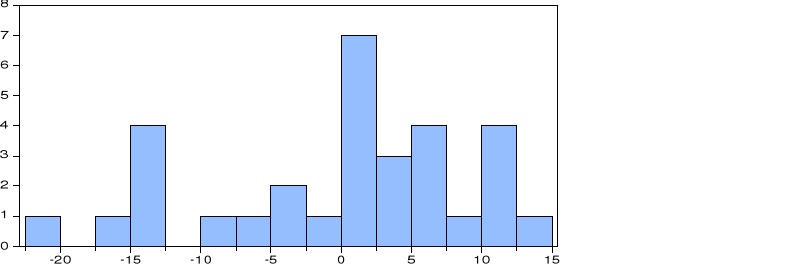

C.1. test de normalité des erreurs

C.2. Test d'autocorrelation des erreurs

|

Breusch-Godfrey Serial Correlation LM Test:

|

|

|

F-statistic

|

0.698757

|

Prob. F(2,19)

|

0.5095

|

|

Obs*R-squared

|

2.123933

|

Prob. Chi-Square(2)

|

0.3458

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

C

|

2.441063

|

6.297803

|

0.387605

|

0.7026

|

|

DDPIBHB(-1)

|

-0.246184

|

0.283023

|

-0.869837

|

0.3952

|

|

DPT

|

-0.248253

|

4.662547

|

-0.053244

|

0.9581

|

|

DPT(-1)

|

-1.332227

|

4.314676

|

-0.308766

|

0.7609

|

|

PFN

|

-0.033383

|

0.184562

|

-0.180877

|

0.8584

|

|

PFN(-1)

|

-0.003731

|

0.178686

|

-0.020879

|

0.9836

|

|

TXINFL

|

0.000372

|

0.001587

|

0.234248

|

0.8173

|

|

TXINFL(-1)

|

0.000350

|

0.001538

|

0.227377

|

0.8226

|

|

INST

|

0.108599

|

4.860582

|

0.022343

|

0.9824

|

|

INST(-1)

|

-2.869127

|

6.031770

|

-0.475669

|

0.6397

|

|

RESID(-1)

|

0.441810

|

0.382360

|

1.155481

|

0.2622

|

|

RESID(-2)

|

-0.154120

|

0.287278

|

-0.536484

|

0.5979

|

|

|

|

|

|

|

|

|

|

|

C.3. Test

d'hétéroscedasticité

|

Heteroskedasticity Test: Breusch-Pagan-Godfrey

|

|

|

|

|

|

|

|

|

|

|

|

F-statistic

|

0.483965

|

Prob. F(9,21)

|

0.8691

|

|

Obs*R-squared

|

5.325288

|

Prob. Chi-Square(9)

|

0.8051

|

|

Scaled explained SS

|

1.742016

|

Prob. Chi-Square(9)

|

0.9949

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Test Equation:

|

|

|

|

|

Dependent Variable: RESID^2

|

|

|

|

Method: Least Squares

|

|

|

|

Date: 06/15/16 Time: 21:16

|

|

|

|

Sample: 4 34

|

|

|

|

|

Included observations: 31

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

C

|

81.54419

|

58.15245

|

1.402249

|

0.1755

|

|

DDPIBHB(-1)

|

-0.018286

|

1.871881

|

-0.009769

|

0.9923

|

|

DPT

|

-17.00285

|

45.37412

|

-0.374726

|

0.7116

|

|

DPT(-1)

|

7.173907

|

40.18486

|

0.178523

|

0.8600

|

|

PFN

|

-1.262712

|

1.782448

|

-0.708414

|

0.4865

|

|

PFN(-1)

|

-0.717613

|

1.742322

|

-0.411872

|

0.6846

|

|

TXINFL

|

0.010921

|

0.014077

|

0.775828

|

0.4465

|

|

TXINFL(-1)

|

-0.007789

|

0.014433

|

-0.539678

|

0.5951

|

|

INST

|

34.82321

|

46.42291

|

0.750130

|

0.4615

|

|

INST(-1)

|

33.47325

|

53.77542

|

0.622464

|

0.5403

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.171783

|

Mean dependent var

|

83.30678

|

|

Adjusted R-squared

|

-0.183166

|

S.D. dependent var

|

101.1143

|

|

S.E. of regression

|

109.9855

|

Akaike info criterion

|

12.49427

|

|

Sum squared resid

|

254033.0

|

Schwarz criterion

|

12.95685

|

|

Log likelihood

|

-183.6612

|

Hannan-Quinn criter.

|

12.64506

|

|

F-statistic

|

0.483965

|

Durbin-Watson stat

|

2.038192

|

|

Prob(F-statistic)

|

0.869074

|

|

|

|

|

|

|

|

|

|

|

|

|

|

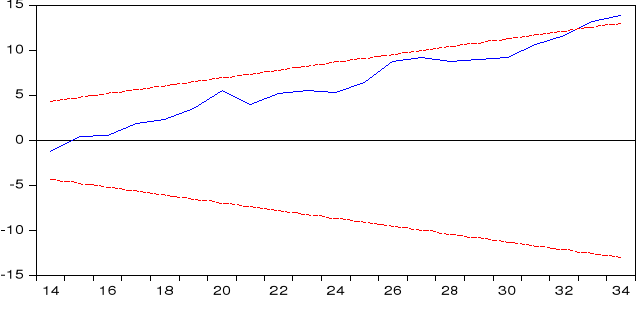

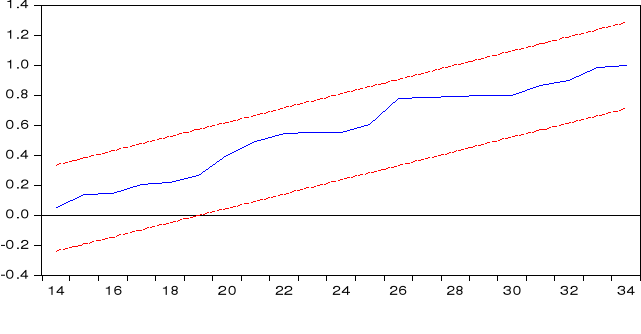

C.4. Test de stabilité du

modèle

92

|

|