IV.5. ArcelorMittal Case Study

Nowadays, ArcelorMittal is cross-listed on 5 European stock

exchanges, but also in the United States through ADR:

4 Euronext Amsterdam

4 Euronext Brussels

4 Euronext Paris

4 Bourse de Luxembour

4 BME Madrid

4 Nyse

According to ArcelorMittal, the multiple foreign cross-listings

allow the company

4 To have an access to the capital markets

4 To benefit from an more attractive financial profile towards

investors

4 To benefit from better liquidity for its shares

ArcelorMittal's five foreign cross-listings are the result of

successive merger and acquisition operations:

Initially, Mittal Steel was a Dutch company listed on

Euronext Amsterdam and on the Nyse, whereas Arcelor was an European company

with headquarters in Luxembourg. Arcelor's multi cross-listings were the result

of a previous merger (2002) between Usinor (listed on Euronext Paris), Arbed

(listed on Bourse de Luxembourg and on Euronext Brussels) and Aceralia (listed

on BME Madrid).

Following the Mittal's successful takeover bid on Arcelor in

2006, the newly formed group ArcelorMittal had required the admission of its

ordinary shares on Mittal's former listing places: Euronext Amsterdam and

Nyse.

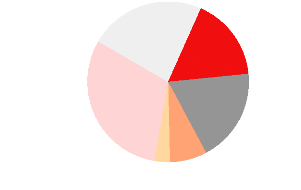

Nowadays, in terms of traded volumes for the ArcelorMittal's

shares, Paris, Amsterdam and New York are the most important places,

respectively representing during the last 6-months 40.29%, 30.08% and

29.22%54 of the total volumes.

Volumes traded on Brussels, Luxembourg and Madrid are very

limited; each one gathering below 0.5% of the total volumes.

54

Sources: ThomsonReuters Datastream

#40: Distribution of the 6-Months Average Daily Volumes

Nyse

29.22%

Amsterdam

30.08%

Paris

40.29%

Madrid,

Brussels,

Luxembourg

below 0.5%

Source: ThomsonReuters Datastream, as of 28/10/2008

#41: Evolutions of the 6-months Average Volume

Distribution

between each Listing Places

23.48%

|

|

22.15%

|

36.58%

|

|

39.92%

|

38.88%

|

|

36.98%

|

April 2007 Oct. 2007

|

|

0.48%

|

|

0.28%

|

24.63%

|

|

33.48%

|

|

41.36%

|

|

|

April 2008 Oct. 2008

Jan. 2007

80%

60%

40%

20%

0%

35.27%

40.31%

21.45%

100%

2.87%

1.02%

0.92%

Paris Amsterdam Nyse Brussels Madrid Luxembourg

Source: ThomsonReuters Datastream as of 28/10/2008

Note: Brussels and Luxembourg accounts respectively for

0.12% and 0.0023% of the total volumes in October 2008.

#42: Free Float-Rotation and Variations of Share in the total

Volumes

between each Listing Places (Period 01/2007-10/2008)

|

Free-Float Rotation Variation of Volumes

Share

|

Amsterdam

|

0.47% -25.4%

|

|

Paris

|

0.63% +87.8%

|

|

Brussels

|

0.00%

|

+250.3%

|

|

Madrid

|

0.01%

|

-90.3%

|

|

Luxembourg

|

0.00%

|

-96.6%

|

|

New York

|

0.42%

|

-17.1%

|

|

|

Source: ThomsonReuters Datastream as of 28/10/2008

Since the merger of 2006, it is worth to notice the growing

weight hold by Paris in the total volumes at the expense of the other places,

more especially Euronext Amsterdam, the Nyse and BME Madrid (N.B: regarding its

negligible weight of 0.12% in the total volumes, we do not consider Euronext

Brussels and its +250.3%). This example illustrates the tendency enounced in

part IV.3.b. Current Tendency: the "Fading Listing", i.e. over the years more

and more investors tend to buy and to sell their shares on the most liquid

place.

#43: Breakdown of Institutional Investors in ArcelorMittal

U.K

23%

France

17%

North America

31%

Rest of Europe

19%

Belgium : 0.4% Spain : 0.2% Luxembourg : 0.1%

Rest of the World

3%

Netherlands

7%

Source: Thomson Financial

The liquidity attracting the liquidity, that is why the great

majority of investors prefer to trade the shares of a company on the main

trading market, which are, in the case of ArcelorMittal Paris and Amsterdam.

Since the merger between Nyse Group and Euronext (Paris, Amsterdam, Brussels

and Luxembourg) has probably facilitated the investments of American investors

directly on Euronext Paris.

According to the definition of an efficient foreign

cross-listing given in part IV.1. Empirical Determination of the Efficiency,

only three listing places present volumes above 5%: Paris, Amsterdam and New

York. Hence, there are no financial rationales of keeping the cross-listings in

Madrid, Brussels and Luxembourg, but the relevance concerning a complete

cross-delisting from these three last places is apparently not a topical

subject. Indeed as we stated in part I.3.b. Corporate Governance Motivations,

we have to take into consideration factors of "national sensibility" since the

company is the result of mergers of several national entities from Netherlands,

France, Spain, Luxembourg and Belgium. Hence, such delisting operations would

not be unfeasible in the future, but would be complicated by the fact of taking

into consideration the realpolitik, i.e. the governments' requirements.

Finally, even if the volumes in Amsterdam and in New York

continue to decrease, their figures are quite significant to remain above 5% in

a mid-term perspective. The question of delisting from these places is not

topical, but could become in the future if the tendency is confirmed.

#44: 25-Days Volatility of ArcelorMittal on its Different

Listing Places

2.0 1.8 1.6 1.4 1.2 1.0 0.8 0.6

|

|

|

|

0.4

0.2

|

|

|

|

Jan-07 Mar-07 May-07 Jul-07 Sep-07 Nov-07 Jan-08 Mar-08 May-08

Jul-08 Sep-08 Nov-08 Brussels Madrid Luxembourg New York Amsterdam Paris

Source: ThomsonReuters Datastream as of 28/10/2008

|