|

![]()

![]()

![]()

BAYESIAN PORTFOLIO SELECTION: An empirical Analysis of

the JSE-ALSI 2003-2010

M. Frankie MBUYAMBA

MCom Financial Economics (2010), University of Johannesburg,

(frankiem@uj.ac.za)

1. Abstract

Finance theory can be used to form informative prior beliefs

in financial decision making. This paper approaches portfolio selection in a

Mean-Variance, Mean-Conditional Variance and Black Litterman covariance and

Bayesian framework that incorporates a prior degree of belief in an asset

pricing model. Sample evidence on a period of 8 years and value and size

effects is evaluated from an asset-allocation perspective. Investor's belief in

the domestic CAPM must be very strong to justify the home bias observed in

their equity holdings. The same strong prior belief results in large and stable

optimal positions in this selection.

Keywords: Bayesian CAPM, Bayesian

portfolio selection, Black-Litterman(BL)

2. INTRODUCTION

Modem portfolio theory has providing a really framework for

portfolio optimization when investors who are risk-averse prefer investment

portfolios that are mean-variance efficient. Optimal portfolio selection

requires knowledge of each asset's expected return, variance, and covariance

with other asset returns. In practice, each asset's expected return, variance,

and covariance with other asset returns are unknown and must be estimated from

available historical or subjective information. We assume that the portfolio

manager has a goal of maximizing the expected return for a given level of risk.

We use monthly data comprise the performance of the benchmark; JSE-ALSI, to

capture the behaviour of weekly data in 400 observations of prices. We

construct our analysis by applying the mean conditional Value at Risk in order

to determine the weights of the portfolio and after that the paper is

implementing the work of Black and Litterman by using the variance-covariance

matrix so that we can provide an analysis of asset allocation and the weights

of choice of the optimal portfolio. Finally we look at the theory related to

the Black Litterman Bayesian CAPM where we use the benchmark, the risk free

rate and each of every stock so that we can have the weight value of the

portfolio to be mean-variance efficient to the market stock.

In our analysis we are looking to the Bayesian portfolio

selection because it's encountered the uncertainties problems of investors

while the Mean-Variance model ignores them. The fundamental of Bayesian

approach in portfolio selection is based on the notion of probability which is

defined by a degree of belief and makes possible to incorporate a belief about

the hypothesis which is valid to the probability that its alternative is valid.

One of the major matters with mean-variance models is the function between

variance-covariance/expected return inputs and the optimal portfolio weights is

highly nonlinear and can be very sensitive to the small changes in the views of

the manager1(*). The above

reasoning tells us that errors in covariance estimation are less damaging than

errors in covariance estimation which have less damage compare to the

estimation error in the expected return.

The paper is based in the first section on presenting the

paradigm of the portfolio optimization under uncertainty. The second section

will describe the models and methods of capturing the distributions of the

returns in three stages. The third section will be the presentation of the

empirical results on the ALSI and the height stocks since 1995 till now. The

last section is showing the implications of our results by stating the

relevance, implications and significance of the findings.

3. METHODOLOGY AND MODELLING

a) Mean-VaR Portfolio Selection

The expected return on the portfolio by minimizing the variance

of return will be like this:

Min 12XT?Xsubject to { XTi = 1 and XTu = up

(1)

We assume in the model that the market has n assets, the rate

of return of a single asset i is a random variable and the expected rate of

return for the asset is estimated through the observed return of the asset at

time t. Then ri =1Tt=1TRit (2)

The mean conditional VaR; Max {E (rp) - CVaRá

(rp); this is the alternative (or supplement) to VaR and it capture

the risk metric for continuous distributions.

For continuous distributions, CVaR, also known as the Mean

Excess Loss, Mean Shortfall, and Tail VaR, is the conditional expected loss

given that the loss exceeds VaR. That is, CVaR is given by

öá(x)= ?(1- á)?^2 ?_(f

(x,y)>æ(x,á)) f (x, y)p(y)dy,

(3)

The method to be used in this framework first is the

Mean-Variance that determines the weight of the portfolio and the mean VaR

weight in order to have the mean of return and the portfolio risk. The

following step is looking to the budget risk where we have the mean of the

portfolio return and the portfolio risk according to the Mean Conditional Value

at Risk (MCVaR).

b) Bayesian portfolio selection

The Bayesian portfolio selection is coming from conditional

probability distribution and it provides inferences about the distribution of

returns which is unknown by applying available signal or information.

The inference makes the probability statements about the generating process of

return.

Bayesian theorem is used to determine what one's probability

for the hypothesis should be, once the outcome D from the experiment is known.

The probability of the hypothesis once the outcome from the experiment is known

is called the posterior probability2(*).

p(èA) = P(A,?)p(A)=pA?p(?)p(A)

p(èA)?P(Aè)P(è) Posterior?Likelihood

x Prior (4) The prior is normally distributed and the

posterior probability is proportional to the likelihood of the observed data,

multiplied by the prior probability, and is given by Bayes' theorem. As the

investor with rational behavior will provide a predictive mean-variance

p(Rt+1At) (5) The equation (4) is called the posterior

distribution of future returns Let t denote the time, R the expected return and

A the historical return data observed.

To predict we observe A, and compute p(A) the predictive

distribution

P(A) = ?p(è)p(èA)dè

(6). The regression model will be Yi=Xiß+?i where

?i~Normal(0,ói) (7).

Bayesian regression model of joint distribution of Y and X

P(X,Y)= P(XØ)P(YX,â,s2) (8) Where Ø is

a priori or a set of information independent of (â,ó).

At this stage we will compare two methods of Black Litterman

where the first one will consist on the covariance through the BLCOP in order

to get the weight and the risk of the portfolio by using the historical returns

and the other stage will be based on the Bayesian CAPM which generates the

alpha and beta coefficient of each stock by using the Markov Chain Monte Carlo

package in R software (MCMC pack), we applying the excess return observed and

the alpha in addition with the beta which forms the product with the excess

market estimate in order to obtain the excess return of each stock estimate and

after that we use the covariance of this dataset according to BLCOP where we

have the weight and risk of the portfolio.

4. EMPIRICAL RESULTS

Fig.1

![]()

Fig.1

|

Portf Mean

|

Portf Risk

|

VaR

|

CVaR

|

|

M-V

|

0.0024

|

0.0171

|

0.0242

|

0.0372

|

|

MCVaR

|

0.00208

|

0.02274

|

0.0285

|

0.043

|

|

BL Cov

|

0.0032

|

0.0214

|

0.0000

|

0.0000

|

|

BL CAPM

|

0.0034

|

0.0221

|

|

|

In this empirical section we consider the weekly return data

on the JSE-ALSI from early February 2003 till late September 2010. The market

capitalization weights on the efficient portfolio are dominant of 24.9% on the

USD/ZAR exchange rate following by Chemical Index and there is no weight

allocated to Life insurance Index. The mean conditional variance is giving the

following figures through the risk budgets; the highest shares are in chemical,

technology and beverage by respectively 22.7%, 22.6% and 20.1%. The life

insurance stills the only stock which doesn't have any allocation.

The fig.1 tells us that at a lowest risk with almost all the

weight will be allocated to USDZAR and some negative return on the USDZAR and

Technology Index. It's telling us also that at optimal point we have to

combine an important weight of the USDZAR with a target return of 0.000662 and

risk profile of 0.0111, following by Technology Index and almost a close weight

between the Bank Index and the Chemical. The highest level of risk will be

achieved with a target return of 0.0049 and Telecom will have the entire

maximum weight allocated.

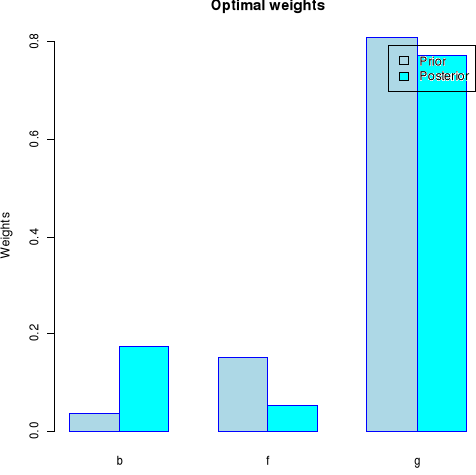

The prior of the beverage index is very low to his posterior

while telecom has a high prior than the posterior. The highest weight is found

on the technology index where the prior and the posterior are almost closer to

0.8.

On fig.2 we have a highest portfolio mean on a Bayesian CAPM

which is the higher expected return and the lowest risk of the portfolio is

assigned to the Mean-Variance method. The highest expected value which can be

loosed and the highest expected value plus all negative losses is given by the

mean conditional value at risk method.

5. CONCLUSION

Traditional mean-variance portfolio optimization assumes that

it is extremely difficult to estimate expected returns precisely. In practice,

portfolios that ignore estimation error have very poor properties: the

portfolio weights have extreme values that fluctuate dramatically over time and

deliver very low Sharpe ratios over time. The Bayesian approach allows a

Bayesian investor to include a certain degree of belief in a portfolio

selection model. In this paper, we have shown how to allow

for the possibility of multiple priors about the estimated expected returns and

the underlying market return model. And, in addition to the standard

optimization of the mean-variance objective function over the choice of

weights, one also will provide the lowest value at risk and the conditional

value at risk. This study uses theoretically motivated prior and posterior

information about expected returns in portfolio selection. From an estimation

perspective, the focus on expected returns could be helpful since it is well

known that means are in general estimated with much less precision than

covariance. Nevertheless, using prior information to impose some structure on

the Black Litterman covariance matrix could potentially also be beneficial,

especially for a large number of stocks.

Reference

1. Polson, N. G., and Tew, B. V., 2000. Bayesian

portfolio selection: An empirical analysis of the S&P 500 index

1970-1996. Journal of Business & Economic Statistics,

18(2)

2. J.M MWAMBA, Slides of Bayesian asset pricing,

MCom Financial Economics, 2010

6. Appendix

VaR.5% : -0.02851397 CVaR.5% : -0.04303770

Title:

MV Efficient Portfolio

Portfolio Weights:

Alsi Bank Beverage Chemical Equity.Inv Life.Insur

Telecom

0.0000 0.0854 0.1421 0.2242 0.0747 0.0000

0.0958

Technol USDZAR Risk.free

0.1244 0.2489 0.0044

Covariance Risk Budgets:

Alsi Bank Beverage Chemical Equity.Inv Life.Insur

Telecom

0.0000 0.1034 0.2012 0.2256 0.0814 0.0000

0.1432

Technol USDZAR Risk.free

0.2270 0.0185 -0.0003

Target Return and Risks:

mean mu Cov Sigma CVaR VaR

0.0024 0.0024 0.0171 0.0171 0.0372 0.0242

![]()

Iterations = 1001:11000

Thinning interval = 1

Number of chains = 1

Sample size per chain = 10000

1. Empirical mean and standard deviation for each variable,

plus standard error of the mean:

Mean SD Naive SE Time-series

SE

(Intercept) -0.0001138 8.713e-04 8.713e-06

1.073e-05

Dataset$Bank 0.1434273 3.481e-02 3.481e-04

2.628e-04

Dataset$Beverage 0.2692399 3.065e-02 3.065e-04

2.718e-04

Dataset$Chemical 0.1113228 3.898e-02 3.898e-04

3.467e-04

Dataset$Equity.Inv 0.0349513 3.327e-02 3.327e-04

3.460e-04

Dataset$Life.Insur 0.1670380 3.429e-02 3.429e-04

3.237e-04

Dataset$Telecom 0.1217420 2.772e-02 2.772e-04

2.699e-04

Dataset$Technol 0.1121895 2.673e-02 2.673e-04

2.366e-04

Dataset$USDZAR -0.0245311 3.799e-02 3.799e-04

3.799e-04

sigma2 0.0003003 2.175e-05 2.175e-07

2.134e-07

2. Quantiles for each variable:

2.5% 25% 50% 75%

97.5%

(Intercept) -0.0018314 -0.0007030 -0.0001028 0.0004741

0.0015800

Dataset$Bank 0.0758993 0.1192552 0.1433875 0.1667630

0.2121726

Dataset$Beverage 0.2088588 0.2486275 0.2690060 0.2898102

0.3288659

Dataset$Chemical 0.0353141 0.0851677 0.1112476 0.1371965

0.1893481

Dataset$Equity.Inv -0.0310190 0.0126328 0.0350995 0.0573648

0.1001137

Dataset$Life.Insur 0.0991277 0.1438379 0.1670621 0.1899787

0.2345747

Dataset$Telecom 0.0672014 0.1030527 0.1216117 0.1406669

0.1759571

Dataset$Technol 0.0593993 0.0945787 0.1124306 0.1299468

0.1643140

Dataset$USDZAR -0.0993244 -0.0497875 -0.0244516 0.0011008

0.0491126

sigma2 0.0002603 0.0002851 0.0002993 0.0003141

0.0003461

$priorPfolioWeights

a b c d e f

g

0.00000000 0.03770282 0.00000000 0.00000000 0.00000000 0.15294225

0.80935492

h

0.00000000

$postPfolioWeights

a b c d e f

g h

0.00000000 0.17475666 0.00000000 0.00000000 0.00000000 0.05346057

0.77178277

0.00000000

![]()

Title:

MV Tangency Portfolio

Estimator: .priorEstim

Solver: solveRquadprog

Optimize: minRisk

Constraints: LongOnly

Portfolio Weights:

a b c d e f g h

0.0417 0.2299 0.2235 0.0374 0.0000 0.1561 0.1818 0.1297

Covariance Risk Budgets:

a b c d e f g h

Target Return and Risks:

mean mu Cov Sigma CVaR VaR

0.0000 0.0030 0.0213 0.0000 0.0000

Description:

Tue Sep 28 15:35:54 2010 by user: General

$posteriorOptimPortfolio

Title:

MV Tangency Portfolio

Estimator: .posteriorEstim

Solver: solveRquadprog

Optimize: minRisk

Constraints: LongOnly

Portfolio Weights:

a b c d e f g h

0.0064 0.2508 0.2846 0.0000 0.0000 0.1357 0.1875 0.1350

Covariance Risk Budgets:

a b c d e f g h

Target Return and Risks:

mean mu Cov Sigma CVaR VaR

0.0000 0.0032 0.0214 0.0000 0.0000

Description:

Tue Sep 28 15:35:54 2010 by user: General

attr(,"class")

[1] "BLOptimPortfolios"

Iterations = 1001:11000

Thinning interval = 1

Number of chains = 1

Sample size per chain = 10000

1. Empirical mean and standard deviation for each variable,

plus standard error of the mean:

Mean SD Naive SE Time-series SE

(Intercept) 0.0009522 9.041e-04 9.041e-06 1.113e-05

Dataset$ebank 0.1398387 3.472e-02 3.472e-04 2.861e-04

Dataset$ebev 0.2688045 3.071e-02 3.071e-04 2.712e-04

Dataset$echem 0.1319496 3.712e-02 3.712e-04 3.282e-04

Dataset$eequit 0.0540071 3.231e-02 3.231e-04 3.318e-04

Dataset$elife 0.1775072 3.386e-02 3.386e-04 3.226e-04

Dataset$etelec 0.1266767 2.786e-02 2.786e-04 2.673e-04

Dataset$etech 0.1179304 2.654e-02 2.654e-04 2.457e-04

Dataset$eusazar -0.0094296 3.607e-02 3.607e-04 3.740e-04

sigma2 0.0003012 2.182e-05 2.182e-07 2.140e-07

2. Quantiles for each variable:

2.5% 25% 50% 75%

97.5%

(Intercept) -0.0008301 0.0003408 0.0009637 0.0015623

0.0027097

Dataset$ebank 0.0720157 0.1161651 0.1402517 0.1631226

0.2073024

Dataset$ebev 0.2085894 0.2482177 0.2686163 0.2893781

0.3291133

Dataset$echem 0.0599178 0.1070750 0.1317707 0.1565901

0.2057048

Dataset$eequit -0.0100727 0.0322763 0.0539325 0.0757838

0.1172233

Dataset$elife 0.1106212 0.1548548 0.1774808 0.2002120

0.2440648

Dataset$etelec 0.0719587 0.1081133 0.1265930 0.1455601

0.1808797

Dataset$etech 0.0657202 0.1002334 0.1182699 0.1358541

0.1696935

Dataset$eusazar -0.0808365 -0.0333380 -0.0095017 0.0147699

0.0617244

sigma2 0.0002611 0.0002860 0.0003002 0.0003151

0.0003471

* 1 Further reading of Polson

and Tew

* 2 Slides of Bayesian asset

pricing

|