|

Microfinance and street children: is microfinance an appropriate tool to address the street children issue ?( Télécharger le fichier original )par Badreddine Serrokh Solvay Business School - Free University of Brussels - Management engineer degree 2006 |

Moreover, we added 2 PRA sessions, with a total number of 38 participants, in order to assess their perception of money, credit and savings. 4. DATA ANALYSISPreliminary note: the data below will be expressed in local currency: Exchange rate: 1 US $ = 68 US$ Purchase Power Parity Rate: 1 US $ = 13 TK 4.1. Entering their financial world: the first steps...40(*)4.1.1. Street Children's perception of Money: what does money mean to them? Our participatory sessions identified that the street children's perception of money was articulated around five aspects: 1. Problem 2. Future 3. Survival and a mean to meet emergencies 4. Purchase Power 5. The reward of our work What is money? A poem written by Mohidul Kooser Samim JibonMoney is the dust of hand (meaning: it's nothing) Money is problem Money is something which enables to have large things Money is a mean to fill wishes Money is future Money means good food Money means expensive dress Money means what mind wants Money means to live on earth Money is the root of business Money means the light of life PRA Session (translated by Nahar) - 27/12/2005 Dhaka § Money is problem «When we sleep at night, then the thief steals our money» A child during the PRA Session First, children usually depicted money as a problem, linking money with the sinister side of their street life experience. Indeed, many of them already experienced some troubles because of money. As they did not have a safe place where to deposit their earnings, many were keeping their money in their pockets, trying to hide it as best as they could, being therefore a source of problems as other children and adults knew this. Children mentioned the plethora of pickpockets that are there, especially in highly frequented places (as the vegetable market of Karawan Bazar in which children work during the night). § Money is future «Money means something which helps us to make sound live» A child during the PRA Session The children participating in our sessions made a strong link between money and future. Even if money was expressed as a «problem», it was perceived as being useful and having a lot of advantages, one being that it enabled them to build their future. Money was associated with «good job», i.e. the element which would enable them to have a pretty life. A good future was also linked with «education», as the «school» is still for some of them a mean to have a better future. As some girls summarized: «With money, we can start life in a good environment» § Money is survival and a mean to meet emergencies There was a particular emphasise on the link between money, emergencies and more generally survival. Many pointed out how money was needed for eating, treatment, shelter and for daily survival. A particular interesting point is the altruistic view of «survival» and «emergencies». Indeed, the majority of children was specifying how money was necessary for the survival of their families, and therefore was informing us on the significant role they are playing to contribute to the well-being of their families. Moreover, it gives an introduction to the difficult living environment surrounding them and their responsibility in meeting their families' basic needs. § Money is «purchase power» «Money is something which enables us to have many things, to buy nice food and expensive dress» A child during the PRA Session Children highlighted how money was necessary to buy assets: dress, tea, machinery tools, etc. The assets were not only for consumption, but also inputs for their businesses. Indeed, many mentioned how money helps them to buy tea, vegetables, «chutneys» (i.e. indian sauce), in other words products that were necessary to run their businesses. Here too, we can see how their world is structured around the work. § Money is the reward of our work As highlighted in our first chapter, the majority of street children are working. It is therefore logical to find expressed the link between money and work. Money is not something they received from their parents, but the result of their work. It may seem very anodyne to raise this point, but it is extremely important to consider it, as this is impacting our view on the street children, which need to be seen as «economic agents». 4.1.2. Street Children's perception of money management strategies This section aspires to draw the perceptions of street children on the conventional money management strategies, in other words to analyse what does savings and credit mean to them. § What is Savings? Many different definitions of savings arose. It was very interesting to see how street children, often very young, were able to define precisely this notion41(*). The following box gives a sample of some definitions: § Savings is daily income from which we take a part and we put in a safe place § Savings is income less expenditure. § Savings means to put money in a safe place § Savings means to keep money in a bank or cooperative Many street children perceived savings as a mean «to save their life» and to enable them a better future. Some did point out the relationship between savings and business, as saving money was a mean to start their own businesses...»we sell chips with our savings»

Street children made a strong relationship between credit and investment. It was perceived as a mean to start or reinforce their business. Moreover, children perceived credit as an opportunity to get education and to meet emergencies. Here is a sample of the definitions that arose during the PRA sessions and FGD:

4.2. Street children economic activitiesIn order to assess correctly the demand for financial services, we need to understand the economic activities in which the street children, who took part in our research, are involved. During our research, the majority of street children were found to have a job and quite innovative ways to earn money. Our previous chapter underlined that street children are particularly present in the informal labour market, and our findings in Dhaka do confirm it. Padakhep identified more than 30 economic activities in which street children are involved: carpenter, mason, small trade, shopkeeper, welding, van puller, rickshaw puller, driver, scavenger, day labour, trainees, sales boy, iron man, garments, domestic helper, garage work, boutique work, hotel boy, Tokai, bakery, water seller, tea stall worker, helper, sewing, service, factory, vender, beggar, Minti, electrical work, beautician, packet making, etc. As we see, the range of economic activities is long and shows how street children have a broad imagination in finding income generating activities. We can segregate those occupations into two broad categories: trade related activities and wage related activities. Regarding their trade related activities, the majority of children were found to work as «Tokai», a Bangali term who defines a child who moves around the town to pick up various used items like papers, bottles, shoes, clothes, etc in order to sell them. Many were reselling those items around different markets (especially Kawran Bazaar) and were earning 30 TK to 50 TK daily. Some other sell flowers, snacks (chips, chocolates, etc) or cigarettes in the streets. Some, like Swapon, are also selling vegetables: Swapon is a young boy of 16 years old. He used to be ill-treated by his parents and thus decided, one day, to leave home and look for happiness in the streets. He was then 12 years old. However, he quickly understood that the street life was far to be easy and that he needed to work in order to survive. He therefore decided to use his negotiating skills and found a way to buy vegetables at 8Tk per kg and to resell it 9 TK. Others are involved in seasonal businesses, and reported to earn quite high during those occasional periods. For example, many children buy food during Ramadan and sell it for «iftar»42(*). Children highly valued those seasonal businesses and pointed out how they were earning significantly during those periods (i.e. a daily profit up to 200 TK). Some were involved in wage related activities. The most recurrent job among them was the «Minti» i.e. persons who carry luggage - fish or vegetables and other goods for shop owners and customers- in markets, railway stations, bus stations and shops. It is the informal equivalent of the «Cooli», who does the same job but is registered with the government and earn higher wage rates (ILO, 2003). Having visited this vegetable market at night, we found that street children were working there under difficult conditions. They were generally working all the day. In the evening, they rest a bit, before starting again to work by midnight (when the first trucks come). Then, they work all the night until early morning. Other wage related activities include jobs such as van pullers, where children unload and push trucks and rickshaws. As for the wages, they vary on the job involved and the age of the worker. For example, young «Minti» (from 8 to 12 years old) earn between 30 to 50Tk daily. Older children, working as Minti, earn between 50 and 70 Tk daily. Many children had seasonal businesses and were reported to earn consequently during those periods. For example, many children sell «iftar» during Ramadan and earn up to 200 Tk daily. Other children, such as hotel boys, get a salary partly in cash and partly in nature, receive a package: a small salary in cash, plus a place for sleeping and food from the hotel. Street children involved in embroidery earn between 100 to 250 TK, depending on the quantity, intensity and quality of work (Iglebaeck and Hassan, 2005). Some are lucky to find a job at Padakhep (in the drop-in-center), as peer educators, and earn 1000 Tk/ month. Others are working as employees in Padakhep Bipanon, a retail shop created by Padakhep. Whenever talking about their preferences, children reported how wage related activities (such as Minti and van pullers) were not appreciated, because people often were blaming and insulting them. Iglebaeck and Hassan (2005) confirm this finding and indicate that those jobs are in general hazardous and not valued by children themselves. Their dream was to leave their current jobs and to start their own businesses. So, the desire for self-employment was highly visible, as those children perceived it as a way to earn higher income and to avoid hazardous working conditions When discussing the reasons underpinning their working activities, street children pointed out, logically, that they were working in order to meet their financial needs, which can be grouped in two categories: · Present financial needs: it does include day-to-day basic expenditures, such as food, transportation and clothes; these scored particularly high in the street children spending portfolio. · Future financial needs: it does include expenditures such as supporting family, buying medicines, paying for education or investing in an income generating activity. 4.3. Why do street children need savings?Our data tend to show that street children, as any other people in the world, need savings in order to meet their future financial needs, which are of 3 kinds (following Rutherford's typology): · Life-cycle, such as supporting their family or getting education · Emergencies, in order to be able to meet their own as well as their families' emergency costs · Opportunities, in order to invest it (either directly, or either through the loan they can get thanks to their savings) Those are the three pillars of their savings needs. However, what makes particular a street child from another person is its street life insecurity, which is the root of their needs for savings. Let us therefore discuss quickly this argument, before moving on to the three pillars. 4.3.1. The street life insecurityStreet Children of all ages and categories have reported how the street is an unsafe environment. Passing most of their time there, their money was often stolen, especially when sleeping on the streets. They reported that, usually, other street children were stealing money from them. Moreover, another source of fear and theft was the «Mastaans» (see Box) who threat them in order to get money. Box 2.1. : The world of Mastaans - Dhaka Underworld «A number of the mastaans have good relationships with the political parties (both ruling and opposition parties). In some areas mastaans collaborate with each other, whereas in other areas they fight over territory. Mastaans use children for a number of illegal activities, such as carrying drugs, small arms or throwing bombs. Mastaans target and identify street children from street to work for them. For targeted children escaping from the claws of the mastaan is by nature almost impossible and children who try to escape are usually killed. People are aware of the activities of mastaans. At the same time people are scared to talk about mastaans. Children are paid according to activities performed, and payment is related to trust between the mastaan and the child, scale of illegality, skills and experience». ( from Iglebaeck and Hassan, 2005) Consequently, they look for ways to keep their money safe and were doing so by using three strategies (before joining Padakhep and benefiting from access to savings services): short-term devices, informal intermediaries and «the quick spending'. A. Short-term devices: Street children find innovative ways to store their money, such as trousers, shoes, etc. They indicated the usefulness of such strategies for very short-term period, as money is quickly accessible. However, it is inappropriate because it can get wet when it rains, or can be lost if they change clothes; and it is unsafe, as other children know that they keep money with them and may attack them. Mohamed Kawsar explains us this danger. Mohammed Kawsar is a 10 years old boy. He is living alone in Dhaka city and left his village in order to help financially his family. He is working in a vegetable market and gets 20 to 30 Tk daily. In order to protect his money, he used to hide it in his pocket. However, one time, as he was sleeping on the street, somebody came, cut his pocket and stole all his earnings. Since then, Mohammed Kawssar deposits his money in Padakhep. Fig. 2.1: a picture taken during one of our FGD showing a «category 1» street child who stores money in his shirt

Money stored in a short-term device B. Informal financial intermediaries: such as mud banks, money guards or bamboos43(*), etc. Children expressed two critics regarding those intermediaries. First is the relative low access they have, due to their status of «destitute» among the Bangladeshi society. Street children have highlighted that many do not want to accept their money, because they are considered as theft and criminals and want to avoid problems. Iglebaeck and Hassan (2005) explain that one reason might be the low access to «private spheres» that urban poor children in Bangladesh have, in comparison to their rural counterparts. Second is the lack of safety of those intermediaries; indeed, many children pointed out their fears regarding those providers who were usually disappearing with the money of their «customers» after some time. «One time, one man left with 500,000 Taka and all people in the slum were very sad» (Rafik) Moreover, even if those providers do not disappear, they may not want to give them back their money because they know that nobody will pursue them if they do so. The police is, indeed, far to protect street children and even if they tell the police that they have stored their money with a particular person, the police would not believe them. C. Quick spending The last available strategy that street children have is to spend their earnings quickly, before loosing it. Al Amin quotation summarizes their strategy: «If we don't have a place where to deposit our money, we know other street children will steal it from us. So, it's better to spend it quickly, before loosing it! «(Al Amin - 13 years old) Another child pointed out the same behaviour: «When we have a lot of money on us, we spend it quickly, buying lot of Pulao Byriani (i.e. bangali food made of rice), ice cream, video games and going to the cinema.» Consequently, street children may be trapped into a vicious cycle. Indeed, because of their vulnerability, they will be pushed to misuse their money; because of this, they will not be able to meet their expenditures, enhancing therefore their vulnerability. In such a circle, the children, from being the victim of robbery, can become the author of it, as they will not have enough money to meet their expenditures. Stealing becomes therefore an habit, and sooner or later, negatively impacts the child. 4.3.2. Life-cycle needs:Street children, although their street life hardship, pointed out how they need savings in order to meet their life-cycle needs. Those needs refer to the predictable events that hit the children (adapted from Rutherford, 1999), and can be classified in three categories: 1. Support family, 2. Get education and 3. Other 1. Support family Providing financial support to the family came as one of the most important expenditure in the street children's budget and was significant in terms of financial pressure and frequency. Although expressed by children of all categories and ages, their financial behaviours in terms of family support were different. In order to capture this diversity, we can categorize the children into 2 different sets, based on their physical proximity with their families: #177; Set 1: category 1 & 3 This first set contains children who live far from their families (i.e. parents). Both categories have, in most cases, their families staying in villages, the main difference being that Category 1 street children have no relatives (uncle, aunt, etc) to live with in Dhaka city. Category 1: who work and live on the street day and night without their family They appeared to support (or not) their family in a different way, depending on the reason(s) that made them leave their villages. Here, we can underscore 3 profiles of children: § Children who left their families for economic reasons: They left (or had to leave) in order to help financially their families staying at the home village. Their support was very high and children were finding very innovative ways to send money to their families. The money transfer was done through different strategies. The first consisted of a direct transfer where the child went to the village, directly, and gave the money to his/her parents. It was usually done 2 or 3 times a year (for special occasions). The second strategy was to use an intermediary and to transfer the money through a trustworthy person. § Children who left their families for non-economic reasons and did not face any abuse They left generally in order to seek autonomy and `independence', as the urban life fascinates them. However, many acknowledged the role they need to play in the family's life and tried to help it financially whenever they can. This support was either in cash or in kind, sending therefore money or some gifts to their brothers/sisters/cousins staying in the villages. § Children who left their families for non-economic reasons and did face abuse/harassment They completely cut contact with their families, and no support of any kind is given to them. All those children, except the last category, highlighted how access to savings was needed in order to cope with these expenditures, and that having no access to savings would mean that no support to family would be possible. Category 3: who work on the street during the day and return to their relatives by night Although not living with their own families, those children bear a double «burden»: first, many tell they support their families generally living in their villages; second, they were expressing how they were contributing (or had to contribute44(*)) to their relatives in Dhaka city (i.e. aunt, uncle, grandmother-father, etc). This is the case of Munna, a young boy living in Dhaka: Munna is 16 years old. Living with his grand mother, he is working in a «Shai Doccan» (i.e. tea stall) every day. This job gives him at the end of the day 40 to 50 TK). Munna left his parents in the village some years ago because of poverty. So, as he feels responsible towards them, he sends every month some amount of money. But it is not the only expenditure he has to afford. Living with his uncle, he needs to give him 100 TK every month (1, 50 Euros), and to bear daily family costs. To do so, Munna spends a big part of his daily income, but saves some money in Padakhep in order to be able to give the monthly «rent» and to meet any emergency which may occur to his uncle's family, or to his close family in the village. This hardship of life does not prevent Munna from dreaming to become a big business man in the future... In order to afford these expenditures, they need to manage their money. From their earnings, children were giving a part to their relatives in Dhaka. Another small part was used for their own tiny spendings The third part which remains was put in a savings account in order to send to their parents in the village. So, here, street children expressed the need to have access to savings in order to be able to send some money to their families, otherwise «our relatives will take all our money». #177; Set 2: category 2 and 4 This second set of children lives far from their parents, who are generally settled in their villages. Category 2 - Who work and live on the street day and night with their family (pavements) They appeared to support their parents on a permanent basis, a large part of their income being given to them in order to support their basic needs, and the needs of their siblings. They are using their income to cope with their family needs. For this category, therefore, the interest of financial services was not directly expressed as a mean to meet this financial need, as they are mainly using their income to do so. However, as pointed by so many children, savings facilities were a mean for them to meet this expenditure without neglecting themselves. Indeed, as the major part of their income was going to their family, they were keeping one part of it which they were depositing on their savings account. The purpose expressed is to build a better future. In fact, if no savings facilities were made available to them, they would have hardly been able to think about themselves, as the family pressure and the misuse propensity would have been too big to keep some money in their pockets. Category 4: Who work on the street during the day and return to their family at night Those children were generally working with their parents. They were therefore also supporting their families on a permanent basis, but more with their «working force» (as usually do rural children). Therefore, they were not giving cash to their parents, but the opposite was sometimes happening: parents were giving some «pocket money» to the children, but rarely a regular salary, and used to urging them to save money. Finally, we must note that this reflects the general trend and that some children from category 4 highlighted that they give money to their parents on a permanent basis, as they are not working (disabilities, etc) However, apart from this support, a significant part of their savings amount is said to be used in order to help their families in case of an emergency (when a brother/sister/mother/father is sick). Surprisingly, many of the children interviewed expressed that their parents were urging them to save (especially the younger ones, from 8 to 12 years old). Usually, the money deposited in their savings account was the one received from their parents, as a «reward» for the help they have furnished to the family's business. So, we can draw from this behaviour a vicious circle, where children are paid for their job, but urged to put all the money in their savings account, money which will be returned after to the family. Therefore, the child appears here as a mean for adult members to access savings facilities. However, many SC expressed how they were using the money they were saving for themselves and how the «pressure» practiced by the parents was a lot of time beneficial. (as the girl who is saving because her mother urged her to do so for her marriage, etc). 2. Get education Street children did not consider work and education as mutually exclusive. Indeed, many children pointed out how savings was needed in order to pay for their school fees or the school fees of their siblings. Even if children were getting non formal education at the drop-in-centre, some of them re-entered the formal education system. However, it was mainly the case better off street children (i.e. category 4), but some other children did also express the same concern. This was the case of AL AMIN, a child of 13 years old who is struggling to become a doctor. Alone in the streets of Dhaka, his father being dead and his mother living in the home village, he is allocating a large part of his income in buying school furniture and in paying his school fees. To do so, he works as a Minti and, when he finishes his work, goes to the school.

3. Others Some children expressed the need to get access to savings in order to pay their loans instalments or to payback the loan instalments of their parents. «I took a credit of 500Tk from Padakhep in order to buy chocolate and to sell it. I had a daily profit of 50-60Tk and saved all my profits at Padakhep. Thanks to these savings, I was able to repay my loan» Other children were saving in order to meet their own future occasional expenditures, as buying a new dress for girls in special occasions (e.g. Eid festival), or to go to the cinema. Other expenditures were expressed, some of them being a bit «dark». 4.3.3. Emergencies«Today we have a job, tomorrow we don't have it» - A child during PRA session. «Meeting emergencies» was another important reason underscored by children of all ages and categories whenever referring to savings demand. Indeed, crisis situations (such as income shocks due to the loss of their job) are very usual in their lives, and an access to savings facilities was expressed as a mean to secure their livelihoods in dangerous periods and to enable them to answer adequately to all crises that may appear in their lives. However, «emergencies» had different meanings depending on the child's age and category. Children who had no contact with their families (i.e. mostly category 1) were mainly facing personal emergency costs and were defining «emergency» as an urgent need that hit them personally. «I was working in a vegetable market and I lost my job. Now, I do not get any income and use the money I saved to survive» ( Kanchan -15 years old ) Category 1 Other children, whose family's links were sharper, defined it as a sudden event that hit them OR/AND their family. Moreover, young street children (aged 8 to 12 years old) generally referred to an emergency as an event hitting exclusively their families, as they are more dependent to the family nexus. «When any member of my family is sick, I can buy medicine with the money I have saved». (Aktar) «One time, my mother was sick. I therefore withdrew some money from my savings account to treat her». (Shugon) «When my parents face some problems with their business, I use my savings to help them. (Chahida) «Category 4» Street children Regarding the intensity of this need, it appeared that it was positively correlated to the child's vulnerability. Indeed, the more the child was vulnerable to a crisis situation, the more he squeezed out the need to save money. For example, «category 1» street children, generally engaged on high (informal) competitive market were exposed to some job uncertainty. They expressed intensively how savings facilities were needed and useful in case they loose their job. This was a way to afford their basic needs and to avoid begging in order to survive. Many street children also expressed the need to save money in order to buy some medicines in case of illness. Others (especially category 4) were saving in order to bear the emergency costs of their families. Regarding the latter, two types of emergency costs appeared: the ones that are directly attached to the family members (i.e. sickness, etc) and the ones that are linked to the family's business. Therefore, those children were usually saving to help their family when they felt sick, and to help them when their business was facing a problem 4.3.4. OpportunitiesMany children pointed out how saving money is needed in order to create their businesses or to help their families to do so, in order to improve their income. Here, two profiles can be drawn. First are the children who plan to take a credit in the future, and who know that they need to save money in order to access credit. The second profile is children who save money with the hope to start an income generating activity in the future. Consolidated analysisThis section has demonstrated that street children of Dhaka city have a range of future financial needs that need to be met, which is of three kinds: life-cycle, emergencies and opportunities. However, as pointed by Conticini (2004), «street children (of Dhaka city) do not save very regularly and tend to spend all their income quickly, living on a day-by-day basis». Our findings agree with this statement, but do transfer the responsibility of such «day-by-day» behaviour from the child to the street life hardship. Indeed, we have demonstrated that it was the insecurity in the street and the lack of proper ways to save money in the informal financial market that lead street children to enter into a vicious circle and to misuse their money quickly. This behaviour does not allow them to meet their future expenditures and hence increases their vulnerability. Consequently, street children do need savings to protect their money and to break the vicious circle in which they have entered. These findings are coherent with Judith Ennew observations (having a long lifetime working experience with street children all around the world), who states that street children have two ways to keep their money safe. The first is to look for some places in which to store it: «In Colombo, children sleep on the street with their money in their mouths». She adds that the second option is to spend all the money fast, often sharing with friends who will reciprocate when they in turn are in funds (...). This rapid spending of money gives the appearance of not wishing for anything other than short-term pleasure, but it really illustrates that there are practical obstacles to saving or making long-term plans» (Ennew, 2000 : 137-138). 4.4. Why do street children need credit?4.4.1. For their income generating activities45(*)Two profiles of demand emerged among the street children interviewed The most vulnerable street children (i.e. category 1) who did not finish their vocational training46(*) and were involved in wage related activities pointed out their desire to get occasionally access to credit in order to start some seasonal businesses, which was perceived as an opportunity to increase their income, or some temporary businesses whenever they loose their jobs. Most of them were buying mineral water, food and chocolate in order to sell them and to earn a profit on that. Usually, this happened during special periods (i.e. New Year, Ramadan, etc). For example, during Ramadan, some street children were buying food and preparing a meal, selling it to the people on the street for «iftar» (i.e. sunset meal). These seasonal businesses were generally combined with their actual work, and provided additional sources of income. For others, it was a mean to get some money whenever they loose their jobs. Indeed, the probability to loose their jobs is very high, and relying on savings whenever this happened was effective for short-term period. So, in case street children stay without a job for a quite long period, a credit enabled them to get some sources of income for their survival. However, whenever talking about their future, many wanted to leave their actual jobs and to start their own income generating activity, after their vocational training being finished. The second profile of street children needed credit in order to start their desired businesses, as their preference for self-employment was also very high. The business investments were generally related to the vocational training that was provided to them (e.g.: if the child received some training in tailoring, he desired to invest in a tailoring machine) and were usually expressed as their main point of interest: purchase a tailoring machine, create a tea stall, expanding or creating a grocery shop, buy electrical goods or cycle rickshaw47(*) servicing materials, etc. When asking the children whether they got some access to credit before joining Padakhep, all pointed out that «nobody wants to give us a credit because they think we will fly with the money; but we are not like that; we are responsible!». Moreover, some children highlighted that some people sometimes give them credit, but they charge very high interest rates - about 10% a month. «Before Padakhep, I was working as a Ferry Wallah, carrying and selling some goods from one shop to another. To do so, I was buying some goods in credits. After selling it, I was returning the money with a high interest rate to the MOHAJAN (i.e. the money lender) A study of the ILO (2003) underscored that the main source of credit for street children in Bangladesh are their friends, who lend them some money, mainly for consumption purposes. Iglebaeck and Hassan (2005) findings indicate that, as it was the case for savings, urban poor children have less access to credit facilities than their rural counterparts, but the few access they get is from people whom they had working relationships with.48(*) We must note that the root cause of doing such a business is closely related to the reasons mentioned below when discussing their spending needs: the objective is to guarantee a source of income to the children, in order to afford their present and future expenditures. 4.4.2. For their families' income generating activitiesWithout any surprise, children who were said to have very close relations with their families (category 2 and 4), and were supporting them on a permanent basis, did generally express the importance of having access to a credit in order to allocate the money to their parents for creating a business or to help (sustain - expand) their families' businesses. This was also perceived as a logical way to support their family and children were generally employed in their families' businesses. The children living with their relatives in Dhaka city expressed also this need, and many were found to need credit in order to give it to their relatives in order to start an income generating activity. However, no children expressed the need to access credit in order to send it to their parents in their villages. Regarding younger street children (from 8 to 12 years old), they have expressed the interest of such loan for their guardians, as Padakhep was normally not giving those young children a direct access to credit but giving it through their parents. 4.4.3. For their futureMany children were expressing how access to credit was a way forward for them, as it gives them hope and the capacity to build a better future. In order to assess exactly these statements, we have asked to all the children interviewed what they wanted to do in the future. Two types of answers came out: some children wanted to become engineers, or doctors, or social workers. The others wanted to be business men and to become «professionals» in their actual business activities or in another type of business activity. However, when going a bit deeply in our discussions, we discovered that the high majority of children who highlighted the first type of answers made a difference between «what they wanted to be» and «what they had to be». Because of their economical and social condition, those children underscored that they wanted to start a business as they had to do so in order to live in dignity. Many girls interviewed wanted to become dancers or musicians, but the life's reality pushed them to start a business. An interesting point is that very few children wanted to become employee. Most preferred to start their own activities, as this was a way of liberation from the pressure of their employers. Indeed, «our salary depends of the mood of our employer»49(*) Finally, we must mention how credit is perceived as a mean for autonomy. Having credit, street children were able to start a business and to be self-dependent. This was of particular importance for children having no close ties with their families. 4.4.4. «We do not need credit»Some children claimed that they do not need credit at that time, but may be interesting in the future. The main reason expressed was the fact that they did not desire to start a business activity at that time and that they preferred to work, day by day, as an «employee». This appeared to be more the case for girls than for boys. This is also an indication that children do not take a credit and think afterwards of what they will do with that money, but have generally a precise idea before taking it. Finally, we must note that children did not express the need for credit to meet basic consumption needs (buy food, to pay for transportation, etc.). This was generally done through their income or, whenever impossible, through their savings. Consolidated analysisOur exploration in Dhaka city made us discover how street children needed credit in order to start or to sustain their own or their families' income generating activities. Regarding their own income generating activities, these were of two types:

Regarding their families' businesses, children who had their families in Dhaka city did support them by giving them a credit in order to start an income generating activity, and were generally working with them after. These findings are consistent with some observations worldwide regarding street working children, who point out at how those children have entrepreneurial skills but dot get access to credit. However, they use some credit services, provided by employers (advances, with no interest), or buying goods on credit (with interest) and neighbours/known people. Therefore, urban children do use mainly credit from informal market. These credits are generally claimed to be needed for both consumption and for business (Wilson and Hall, 2006), but resort to it when income flows and savings were inadequate to meet their financial needs (Iglebaeck and al, 2005). Our findings from Padakhep did not confirm the fact that children needed credit for consumption, as those children knew that, to get a loan, one condition was to invest it in an income generating activity and were generally meeting their expenditures needs through a management of their income and their savings. However, other experiences worldwide show that street children may need credit for consumption purposes. CHAPTER 3: DEMAND VS. SUPPLY

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Savings as on August 2004 |

Savings indicated by CDB's (as on March 1st 2005) |

|

|

Chennai |

0 |

1180 |

|

Delhi |

510 |

50170 |

|

Kolkata |

547 |

38215 |

|

Muzaffarpur |

116 |

14320 |

|

Total India (In US$) |

1,217 |

103,885 |

|

Afghanistan |

322 |

23984 |

|

Bangladesh |

1052 |

417101 |

|

Nepal |

467 |

353243 |

|

Total Afgh, Nepal, Bangladesh |

1,841 |

794,328 |

|

GRAND TOTAL (in US$) |

6,072 |

898,213 |

1 US$ = 45 Indian Rs

At the age of 15 years, the members are eligible to apply for loans and to set up a business of their choice. To benefit from the loan (called « advances » in the CDB lexicon), children must have been members of the bank for at least 3 months and need to have 20% of the loan amount in their account. Both individual and group loans are available. In order to secure the loan (which is provided after the loan committee, composed of the children themselves, has examined the application), two guarantors are required (e.g. a shopkeeper or another street child).

Two types of advances are being provided

1. Welfare advance : an interest free amount aimed at helping street children in their emergency expenditures

2. Development advance: to initiate economic enterprise, provided only to adolescents (interest rate: 5%)

Loan repayments are made daily, weekly or monthly, at the discretion of the loan committee.

Only in Delhi, advances were given to several children for various businesses. From June 2004 to March 1st 2005 about RS 18,000 (i.e. 400 US$) was given to children to start economic enterprise and about 15% was considered bad debt, «as children either could not continue with their business or had to leave the place and go somewhere else and some went back to their families»..

The Bal Vikas Bank is now spreading to some other neighbourhood countries (Nepal, Afghanistan, Bangladesh, etc), and the number of members increases day after day.

800 1638 2881 3405

Girls 494-30% 724-25% 892-26%

Boys 1144 2157 2513

(Source: CDB Annual Report (2005))

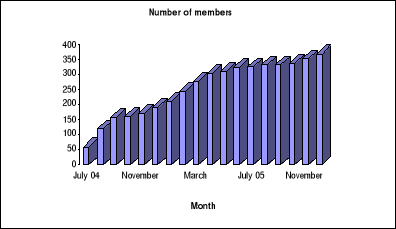

The total membership status is illustrated in the following figure:

Source: CDB annual report (2005)

Finally, we must note that the «children's development bank» is a project initiated by Butterflies but which relies on local youth organisations in order to implement it. As pointed in their international training report (2004),

«Butterflies» identifies NGOs working with street and working children who should necessarily have participation and involvement of children as a core value.

Regarding the effectiveness of their programs, no comprehensive impact assessment has yet been undertaken. However, through the collection of some case studies, the organisation is pointing out that children value a lot those services. Indeed, the increase of the members is one of the core indicators. Moreover, some individual case studies indicate that many children have been empowered thanks to their new business activities started thanks to their credit. Finally, the children's development bank core emphasize is on participation; and it says to bring considerable added value to the children as it enables them to learn the principles of democracy and solidarity.

b. AFRICA - Street Kids International (SKI)73(*)

SKI initiated, in 1996, a joint program with the Zambia Red Cross Society and the YWCA Council of Zambia called the Youth Skills Enterprise Initiative (YSEI). By targeting street youth in Zambia aged between 14 and 22, this program had two core objectives: to earn increased daily income and to learn useful business and life skills. The goal was therefore to encourage economic empowerment of the youth, by listening to what street children have to say and do express as their needs, considering their actual capabilities. Indeed, as pointed by SKI, this is a particularly new approach in working with street children, which is mainly built on a new paradigm: rather than using the paradigm of absence - in which children and youth are «absent» without a voice and without recognition of their experience - SKI uses the (new) paradigm of the child as a person» (Sauvé, 2003). This leads therefore to see street youth as capable human beings, who have something to offer rather than «empty vessels needed to be filled and helped» (ibid). They can therefore not benefit from financial services.

SKI has therefore developed a Street Business Toolkit, aimed at helping street based working children to develop a viable business plan for a street-enterprise initiative, prior to loan distribution.

Four program elements are part of the foundation of this program.

These are:

§ Accompaniment : Youth workers support participants while they establish their business within the larger context of their life

§ Skills training: access to business planning and management.

§ Credit and Savings : each participant is encouraged to save and can access a total of three loans (the 2nd and 3rd are larger)

§ Peer Support Networking : as participants' share skills and opinions, they mutually reinforce each other's efforts towards positive change in their lives

The SKI approach is more based on a general intervention aimed at stimulating enterprise creation among street based working children and «credit and savings» is one of the components of this program.

Concerning the effectiveness of such intervention, SKI is pointing out several positive impacts:

Box. 3.4.: Impacts of SKI microfinance program

Impact on Street Children

· Greater financial resources to buy food, clothes and

household essentials.

· The ability to identify goals for themselves and for

their business.

· Reduced involvement in high-risk behaviour.

· Greater understanding of how HIV/AIDS is transmitted

and prevented.

· Friendship and support from other participants.

· Improved relationship with their family.

· Sense of pride, self-identity, and purpose.

Impact on Families

· Meals and household supplies supplemented through the

participants' contributions.

· In several cases, the participants subsidized

siblings' school fees.

· Parents/guardians feel proud of their child's

productive use of time.

· The participant is much less dependent on family

resources and financial support.

Impact on Communities

· Participants are staying in the community and off of

the streets.

· Participants are becoming positive role models for

their peers.

· More products are accessible in the communities, and

are often available on credit.

From Street Kids International (2002 : 37)

c. LATIN AMERICA: Pronats74(*)

Pronats is based in Peru and has been implemented in 1994 by Manthoc, a famous working children's organisation, and by various other partner organisations. Their approach is based on the paradigm of children «as subject» with its own desires and needs. The organisation is particularly renown for its successful struggle to

Pronats microfinance program is mainly based on an integration of the informal microfinance practices. Indeed, street working children of Lima and Cajamarca are provided loans (up to a maximum of US $188) on a system of rotating funds and invest it in different activities. «Children use these loans to initiate their business or supplement their savings to start up businesses (...) and has registered a return rate of 50 to 70 %» (SKI, 2002). In order to get this loan, the child put forward a proposal and is then interviewed to discuss it. The repayment schedule is quite flexible and Pronats has penalties in case of arrears.

«It helps us to develop a business. When a person wants to get funding, they have to talk to the coordinator who talks to the fund and they give you an interview...you say how much you need and how much you will earn. The fund aks you what you will do with that money,...if you can pay the loan. The rotating fund lends you up to 500 soles (about US $188) and asks you how much you can pay...I used to pay every 15 days.»

A girl from Pronats - Tolfree (1998)

include the recognition of children's right to work in Peru's national children's code, and working children covered under the same medical plan as adult workers (Moore, 1999)75(*).

One particularly important aspect is that street children are involved in different workshops for discussing themes such as «how to use loans», business administration, the principles of selling, working conditions, managing money, etc.

Another interesting point is that the organisation is pushing street children to change activity regularly in order to find what suits them the best and the work which would offer better financial rewards.

I was selling sweets in the middle of the streets and was always facing the dangers of being hit by cars. Now, thanks to a credit received from Pronats, I was able to change activity and to sell cassettes in front of a school, a safer place!

A girl from Pronats

Adapted from Tolfree (1998)

d. Learning points : Demand and supply

Those three case studies highlight three important elements:

· Subject oriented approach: the three projects are built on the new approach which has been highlighted in our chapter 1, which perceives non hazardous work as an essential vehicle of juvenile socialization, training and self-esteem and which highlights the necessity to listen to the street children, and to consider them as capable human beings which know about their affaires and are supported in this.

· Demand for financial services: Our chapter 2 highlighted how the street children who took part in our research do need financial services for various reasons. The three programs outlined before extend our findings and tend to show that street children in other Asian countries, as well as in Africa and Latin America do need financial services and this demand can not be argued to be «supply-driven» (in other words that the organisations did create the demand by supplying their services) as those organisations are built on a subject-oriented approach.

· Holistic approach: All those programs do offer more than traditional savings and credit products. They do argue that street children do need additional services, such as training and life skills, and that microfinance intervention should be sequenced with those services in order to have a positive impact on street children.

Our previous section outlined that microfinance is a new way of intervening in the lives of street children and sketched some programs worldwide. This section is aimed at discussing the two important concepts which will follow us in the next pages of our paper, and which must be kept in mind whenever discussing microfinance for street children.

Any intervention addressing street children need to be effective, i.e. it needs to create a positive impact on them. The three programs highlighted above, although no formal impact assessment has been carried out, underline that such interventions do have positive impacts on street children, as street children are asking for it and such access does enhance the street children self-esteem and helps them to have a better future.

However, two objections may be put forward by MFIs and YSOs who are still reluctant to serve street children.

· Supply-driven demand: Providing financial services to street children may be a pushing factor to the street, because of the supply-driven demand it may generate: the greater is the supply and the greater may be the demand, and the worst may be the street children issue. For example, Lewis (1998)76(*) does argue that programs for street children often make life on the street more bearable, thereby contributing to an increase rather than a decrease in the number of street children.

· Mitigation of positive impacts: even if some positive impacts may exist for some street children, they can be mitigated by negative ones. For example, street children may use the money provided to them in buying things that increase their vulnerability, such as drugs and alcohol; they may also want to leave completely school, and to start working because of their new profitable working activity.

What could those organisations argue against those objections? Mainly two things:

· Targeting strategy: Kobayashi (2004) points out that some solutions exist in order to mitigate those incentive effects and propose two solutions:

a. Good targeting mechanism, by setting clear criteria in order to have a barrier to entry in the programs;

b. Prevention, by initiating some activities in the local places of children in order to avoid migration.

· Holistic approach: In order to mitigate the negative impacts, the programs outlined before point out the necessity to have a well-designed intervention which adopts a holistic approach, and therefore tackles all the vulnerability parameters of street children.

Assuming that such intervention may be effective by following a holistic approach (this assumption will be discussed in the following section), this second argument leads us to analyse the second important concept, namely the sustainability.

Assuming that microfinance for street children may need a holistic approach leads us to discuss our second core concept: the sustainability.

Indeed, providing additional services such as training and education means designing a «microfinance plus program» 77(*) and avoiding a minimalist approach centred only on the provision of financial services.

However, as pointed by Nagarajan (2004), a microfinance plus program is generally costly to administer, and may face difficulty in achieving viability without continued subsidies. In other words, this approach can jeopardize the sustainability.

Indeed, financial sustainability requires the organisation to cover all its costs (cost of capital, administrative costs and provisions for loan losses) thanks to the revenues generated by the intervention in order to reach the maximum of poor people thanks to a minimum of resources78(*).

This means essentially doing two things:

§ Keep operating costs to a minimum

§ Set interest rates on loans in such a way that it covers all these costs

But those two criteria may be hardly reached in case of street children taking into account the necessity to provide a holistic approach. Indeed, keeping operating costs to a minimum would mean providing no additional services that street children may need. Moreover, setting high interest rates would mean targeting the better off street children as well as reducing the total profits of the child.

So here appears a trade-off between effectiveness and sustainability, where on one side we may have an effective but a financially unsustainable project; and on the other side a financially sustainable project, but which is less or not effective.

Taking into account our objective, i.e. to maximise the street children well-being, we would argue that even if the microfinance program for street children is financially unsustainable, it could have sense to launch it if the project is effective. This leads therefore to assume that, most probably, a microfinance intervention for street children will not be financially sustainable and therefore will need to depend on subsidies.

But assuming this should not stop us from thinking about our research topic. Indeed, if the provision of financial services to street children is an effective system of delivering those subsidies, a microfinance program for street children could have all its sense. Moreover, the impossibility (or difficulty) to have a financial sustainable program must not avoid us from thinking about program sustainability, which means finding a way to guarantee a long-term viability of the program, keeping in mind the limited amount of subsidies available. We will therefore view in this paper «program sustainability» in terms of two parameters:

1. Minimization of the intervention costs

2. Ability and commitment of the organisation to keep delivering the adequate services in the

long-term

This section is aimed at discussing the core elements that need to be part of a microfinance intervention targeting street children. Our challenge in the next pages is to propose a well-designed microfinance framework for street children, taking into account the need to reach a good balance between effectiveness and sustainability.

This will be done through a progressive approach, by building up three microfinance frameworks: a minimalist (section 2.3.1), a microfinance plus (section 2.3.2.), and finally a comprehensive microfinance plus framework (section 2.3.2.)

A. Microsavings for street children

Thirty years ago, whenever talking of poor adults financial needs, we were pointing out that those people did not need savings services for two reasons (Aghion and al., 2005: 160):

· They are too impoverished and too undisciplined to be forward looking (Bhaduri 1973)79(*)

· Even if they are forward looking, there are many informal ways to do so, and there is therefore no sense in providing this through a semi-formal way.

These two hypotheses have now been rejected for adult people, and considerable evidence tends to show that even poor households are eager to save, if given appealing interest rates, a conveniently located facility and flexible accounts (Morduch, 1999:1606).

Concerning street children, our second chapter, having reviewed the demand of street children for financial services, pointed out how those two arguments were false:

· Street children are forward looking, but are quickly trapped into a vicious cycle due to the street insecurity.

· Because of their perceived statute of `destitute' and `criminal', very few safe informal ways of saving money do exist for them.

Therefore, at this stage, we know that street children need savings deposits. Then, one question remains: what sort of savings services do street children need? Rutherford (2002) teaches us that a saving scheme must have three main characteristics: reliability, convenience and flexibility. Let us review it in application with street children.

1. Reliability

Reliability is the «quality that, above all others, is conspicuously missing in the world of money management of the poor» (Rutherford, 2002). The need of security is therefore important for each poor, and it may even be more important for street children. Indeed, our demand analysis has demonstrated how street is an unsafe environment for them and how the informal devices were as much risky. Street children need therefore a place where their money will be in high security. It is therefore essential for such saving scheme to be very secure.

Morduch (1999) points out that only tightly regulated institutions should be entrusted to hold savings, but this would exclude most microfinance programs worldwide. Moreover, as pointed by Rutherford (1999), many state-owned banks in developing countries are unreliable. So, security conditions must be a priority of all saving scheme. In case of street children, any place which serves as deposit (centre-based or not) must carefully check its security conditions.

2. Convenience to pay-in and take-out

We have underlined how street children need savings in order to cope with emergencies. Saving deposits need therefore to be convenient, i.e. to be both accessible and quick, so that children will find it easy to withdraw money when a sudden emergency hits them.

In order to be accessible, the deposit service has to be local, i.e. to be based in the location of the child. Placing a deposit service far away from the children living and working place would be inappropriate, as the child will have no incentive to deposit his/her money. A particular place can meet this first criterion: the drop-in-centres. Indeed, street children, after integrating some programs launched by diverse NGOs, are provided with various services in some centres. Those centres are places where children can feel relaxed and comfortable, safe and looked after (Ennew, 2000: 111). It can also provide night shelters, but it is not always the case. In those protected places, street children usually gather and spend a large part of their time. It seems therefore that the best accessible solution would be to settle the saving scheme in or near drop-in-centres80(*).

In order to be quick, minimum delay must follow the child's request to access his account. In order to guarantee such mechanism, transaction costs have to be restricted (i.e. no heavy paperwork, etc.). Two options do exist in terms of registering:

1. Personal passbook: even if this has the big advantage to create a positive effect on the child's willingness to save, as the child may feel more committed to the project, this has two disadvantages:

1. Costly to administer: the passbooks, even if done in the most basic material, have a cost; moreover, given the high probability for the child of loosing it in the street, it does need a specific place in or near the drop-in-centre in order to store it.

2. Not quick: the registering officer must record the amount on the saving book of the child and on a register in order to keep general records in the organisation in case children loose their passbooks or for reporting data.

2. Register book based in or near the drop-in-centre seems to the best solution. Two options do exist: a manual book and a computerized system, the latter being the best one (a simple Excel file may be appropriate, or better a specialized microfinance software if available)

3. Flexibility

Flexibility is a key element of deposit services quality. Indeed, our demand analysis pointed out that street children do generally handle very small amounts of money, which they may need to deposit though. Consequently, the system in place needs to guarantee flexibility by allowing the children to save and to withdraw any amount of money, as small as this could be. Therefore, the core of the process must be based on voluntary savings, and the organisation should not avoid children withdrawing their money for any kind of imaginable reason: it is the children's money, and the only person that must have control on it is the child, nobody else.

However, the children's development bank and SKI do point out the question of compulsory savings, which may be important for two reasons: as a learning opportunity for the child; and as financial collateral for loan disbursements. This point will be discussed in our next section, dedicated to credit.

Now that those three fundamental criteria have been underlined as being the foundations of a microsaving scheme for street children, we need to highlight two other important elements, namely the need to find innovative ways to attract saving deposits, and the need to provide more than money deposits:

#177; Stimulate saving deposits: the importance of returns

It is generally said that returns are important in order to stimulate savings. The Children's development Bank, for example, is giving 10% a year, and 50% for those who do not withdraw savings for six months. Although interesting, this solution can cost a lot to the organisation and may impact the program sustainability. How can we therefore find another way of stimulating saving?

As pointed in our chapter 1, street children are vulnerable and this vulnerability may impact their self-esteem. Providing them with what we can call «non monetary returns» may therefore be useful. Those returns can consist of giving some rewards in public to the street children who saved regularly. Apart from enhancing the self-esteem of the child, it could be a high incentive for other children to save more and more and to feel more concerned by the program.

Finally, we must point out that our aim is not to avoid giving «monetary returns» to children, which can enhance their income and be profitable to them and their family, but we try in this paper to find some ways to maximize the effectiveness of the intervention, given the sustainability criteria, which one requirement is a cost minimization. Indeed, without the last aspect, we could argue that providing both monetary and non monetary returns are needed. However, we think that «non monetary returns» may be sufficient in stimulating saving deposits and that given the high need of street children to save money, interest rates may be of little importance to them.

#177; Assets deposits

As pointed by Ennew (2000: 112) street children may not only need to save money, but also to store some valuable things, such as working materials, or personal belongings. Therefore, offering the possibility to the children to deposit their assets is crucial, particularly after a child may start his/her business.

B. Microcredit for street children

Our chapter 1 (section 2.3) highlighted how street children accumulate skills and are plenty of capacities due their street life experience. Moreover, our demand analysis (chapter 2) pointed out how some street children need credit in order to start their own income generating activities whose returns are used for meeting their diverse expenditures and their families' expenditures, but do have a very low access to credit and hence can not initiate their own enterprises.

This finding is coherent with our three programs outlined below and it tends to show that this need is not only confined to Bangladesh. For example, SKI (2002) points out interestingly that:

Poverty combined with the lack of access to credit are some of the biggest obstacles that face street youth wanting to engage in healthy and safe income generation. Without money, street youth are unable to make the investment necessary to buy the initial assets their business needs. Most lending organizations do not trust the credibility and reliability of street youth seeking loans. Hence, street youth are left feeling discouraged». (SKI, 2002: 15)

Access to credit is therefore perceived as way to secure the future of the children, as it encourages economic empowerment and supports their socialization process. Moreover, it is a way to enhance their self-esteem by the success of their business activity, enhancing therefore their personal agency.81(*)

This section is therefore aimed at throwing light on the appropriate product design and delivery needed in order to address street children effectively and in a sustainable way.

1. Product design

As pointed in our first section, a microcredit is characterized by three elements: a size, a term and an interest rate. Let us review those three components in application with street children

1.1. Loan size: small but tailored

Our previous case studies tend to demonstrate that loan sizes provided to street children must be smaller than conventional microcredit scheme and that the credit amounts tend to be comprised between US $ 20 and US $100, depending on the program. Indeed, small loan sizes have advantages both in terms of effectiveness and sustainability:

ü Effectiveness: it limits the risk faced by the child to fall into high indebtedness in case his/her investment fails, compromising his/her ability to repay, and creating instability in the future as the child must look for other ways of repaying back the money during a considerable long period.

ü Sustainability: it limits the risk of default facing the provider and it increases the provider's outreach.

However, the loan amount should be sufficient to meet the child's investment costs, and needs absolutely to be tailored to the child individual needs and his/her ability to repay (depending on his/her ability to make good investments, to manage correctly his/her business, as well as the child's repayment discipline). So, different categories of credit amounts must be proposed, from the smallest one, to the «largest» one.

1.2. Loan term: flexible but delimited

Flexibility is a key issue, in both savings and credit. Regarding credit, flexibility means that the term of the loan could be changed if the child is not able to meet the first deadline. This has been pointed by SKI as an essential factor of success, for both the lender and the borrower.

ü Effectiveness: it avoids the child to fall into indebtedness (borrowing money from other people, and creating tensions if the child is not able to repay to the informal lender) in order to meet the deadline.

ü Sustainability: it guarantees a higher final repayment rate, as non flexible loan terms might push the child, who is witnessing that he might hardly be able to repay the loan before the deadline, to run away.

However, the child must be aware that flexibility is not unlimited, but is settled between correct boundaries (e.g. between 6 months and 1 year)

1.3. Interest rate: low but adequate 82(*)

The three programs outlined below show a mixture of practice in terms of interest rates. For example, SKI is charging 15% and the children's development bank stands relatively low with either an interest of 5% (development advance), either no interest (welfare advance). Foy (2000) indicates that some other programs worldwide are charging no interest at all.

Charging interest rate can have two impacts on effectiveness and sustainability

ü Effectiveness: an interest rate reduces the total available income of the children

ü Sustainability: more than the question of bringing additional revenue which may cover a part of the administrative costs, it can also be a barrier to entry to those who do not have a business project, limiting therefore the amount of loss (given a successful investment)

But in order to avoid depleting too much of the effectiveness, such interest rate must remain small. The range of 5-15% seems to be the most commonly used among practitioners.

So, we should suggest designing two different products, as does the Children's Development Bank: one with interest (for business starting activity) and one without interest (for emergencies, etc.)

2. Criteria for accessing credit

One of the core elements that could guarantee the effectiveness and the sustainability of microfinance for street children programs is the setting up of conditions to be met before any loan is disbursed. Those are essentially based on two pillars:

2.1. Good targeting:

Targeting the appropriate children is essential. Indeed, our chapter 1 illustrates the diversity existing among street children, across and inside countries. Therefore, it is important to keep in mind that not all street children are potential entrepreneurs and need to start a business. Our chapter 2 has highlighted this point, some children stating that «they do not need credit» at all. This implies the necessity to have a well-designed targeting strategy in order to target the children that will be the most committed, able and motivated of doing so. This targeting could be built on four elements:

ü Age: all programs do highlight the necessity to provide loans for older street children, as the younger ones have lower capacity to start businesses. For example, the children's development bank gives business loans to children of minimum 15 years and SKI to children of minimum 14 years.

ü Membership: one of the key considerations in such a program is the necessity to know the child before disbursing the credit; this means that a loan must only be disbursed to the child who has been «member» for some months. This allows avoiding disbursing a credit to a child who may be too much vulnerable (e.g. drug addicted); but this implies also disbursing credit to the ones who showed good performances in the past.

ü Willing, motivated and able: a microcredit program needs to address the street children who are willing, motivated and capable to start a business activity in order to analyse if such activity may be the most suitable for the child.

ü Feasible business plan: Pronats and SKI highlight the necessity for the child to think deeply of his business and to propose a small business plan before disbursing the credit. This business plan must be feasible and take into account the local informal market structure and competition.

2.2. Collateral substitutes

The collateral can take two forms

a. Compulsory savings: loans are given to children who had previously saved and the loan amount provided will be equal to «x» times the last saving balance

b. Guarantors: the children's development bank is giving loans to children who can provide two guarantors (e.g. a shopkeeper and another street working child)

3. Product delivery

Now that we have an idea on the product that may suit the best street children and the criteria for accessing such product, we need to discuss the way of delivering such product, in order to ensure both effectiveness and sustainability.

3.1. Group-lending

Our chapter 1 (section 2.3.) underlined that one of the main characteristic of street children is their altruistic behaviour and the supportive networks they do create among themselves. Kobayashi (2004) indicates interestingly that, because solidarity among street-involved children and youth is very strong in general, and they tend to enjoy interacting among themselves, many programs have incorporated group activities and promoted interaction to maximize the positive effect of peer groups»

Moreover, microfinance best practices demonstrate how the providers need to integrate the strength of their beneficiaries into their programs to transform it into an advantage. In that regard, the prevalence of solidarity among a particular group is a precious strength, which can both benefit the children and the provider.

In terms of effectiveness, a group lending system can be doubly beneficial:

1. The peer support gives the children the opportunity to share skills, opinions and ideas. This is a good learning opportunity - they support themselves and collaborate for the success of their respective businesses and therefore reinforce each other's efforts towards positive change.

2. This enhances their self-esteem and self-confidence, as they feel that they have a place and a role in the society, and that their voice does account for something.

In terms of sustainability, it can:

1. Increase repayment rates, thanks to the peer monitoring and peer support.

2. Enhance the sustainability of the project, from a double perspective: a good repayment rate, and a higher feeling of belonging to the organisation, guaranteeing therefore their long term commitment.

Concerning the size of the group, SKI advises to limit it at about 5-7 members per group, as a bigger may lead to less flexibility for children in choosing their partners.

Moreover, concerning street children, we can broaden the traditional concept of group-lending (i.e. disbursing credit to individuals who are part of a group) to include the notion of group-enterprise, where the loan might be disbursed to a group of street children in order to create together their enterprise. For example, the children's development bank, after having witnessed the limitations of individual lending, is orientating its future activities towards group-enterprise:«...in a group enterprise there is peer pressure and the children are motivated to move along with the group and continue to put in their efforts to make the enterprise successful. Thus, now the focus is on providing skills to a group of children and initiating a solid group enterprise» (CDB, 2005).

The idea proposed is therefore to try to launch, in parallel to or in place of individual business, a group business where the children will initiate and manage together their own business.

3.2. Progressive lending

All organisations point out the importance of starting small, and of expanding the loan size with the performance of the child. SKI does adhere to such philosophy, by offering a first loan up to US $ 40 and a second loan up to US $ 80 and a third loan up to US $ 85. As a consequence, the child's reliability will be tested and this will increase his/her opportunity cost of non repayment.

3.3. Frequent repayment schemes

Padakhep's repayment period is weekly based. This has been emphasized as a necessary condition for street children, as it would enable them to avoid falling into debt if trying to repay a high amount at the end of a longer period. Moreover, it is a way for the institution to screen the child's ability and willingness to repay the loan amount. Starting very early after the loan disbursement seems to be also of high importance, but it has to consider the child's ability to repay in order to avoid indebtedness of the child.

3.4. Linking the guardians

Our chapter 1 pointed out how the majority of street children around the world are closely connected to their families, passing most of their time on the streets in order to support their family and returning back home at night. Linking the guardians (i.e. parents or relatives) is therefore important and, as pointed by SKI, the importance is to guarantee that they approve the child's participation in the program, without interfering with his/her business, but supporting the child whenever he faces any problem. The youth workers may do this, as proposed by SKI, through the signature of a contract by the guardians.

C. microcredit and microsaving: a bridge

Providing credit in order to allow the child to start an economic activity will not be effective if the child is not pushed to save his/her money in order to reinvest it into his/her business.

D. A minimalist microfinance framework: visual summary

FIG. 3.1.

EFFECTIVE AND SUSTAINABLE FINANCIAL SERVICES FOR STREET CHILDREN

CREDIT

SAVINGS

· SIZE: SMALL BUT TAILORED

TERM: FLEXIBLE BUT DELIMITED

INTEREST RATE: LOW

RELIABLE

CONVENIENT

FLEXIBLE

NON MONETARY RETURNS

ASSETS DEPOSITS

DESIGN

CRITERIA BEFORE EDELIVERY

DELIVERY

GROUP-LENDING

PROGRESSIVE LENDING

FREQUENT REPAYMENT SCHEME

LINKING THE GUARDIANS