|

Financial Development and Economic Growth:

Evidence

from Niger

Abstract

The relationship between financial development and economic

growth is a controversial issue. For developing countries, empirical studies

have provided mixed results. This study seeks to explore the relationship

between financial development and economic growth in Niger from 1970 to 2010.

We used two variables to proxy financial development namely; credit to the

private sector to GDP denoted by CP and financial deepening denoted by FD. The

economic growth is proxied by real GDP. In order to check this relationship a

Vector Error Correction Model was carried out. Unit root test was conducted for

stationarity, and all the series were found to be nonstationary at level.

However their first differences were stationary at the same order.

Additionally, Cointegration test was carried out, revealing that there was long

run equilibrium relationship among the variables and economic growth. In case

of the long run, financial deepening (FD) had positive impact on GDP however,

credit to the private sector to GDP was found to hinder economic growth.

Consequently, the authority in Niger should enact laws and policies to

establish a central credit bureau linking all banks to limit defaults on loan

payments. They should also build stronger and more diversified financial and

banking sector by continuing with the liberalization policy so as to create

competition among the banks. Finally, the populace should be sensitized and

educated on the security of the banks against collapse in order to create

confidence in citizens about the sustainability of the banking sector.

Keys Words: Financial Development; Economic

Growth; Niger, Credit to private sector, Africa.

Table of Contents

Chapter 1 Introduction 1

1.1. Motivation 3

1.2. Scope of the Study 3

1.3 Brief overview of economic growth and financial

sector Development in

Niger 3

1.3.1 Economic Growth 3

1.3.2 Financial Sector Development 4

1.4 Disposition 5

Chapter 2 Literature Review 6

2.1 Financial development: a factor for economic growth

6

2.2 Financial development: a less factor for economic

growth 8

2.3 Financial liberalization and economic growth in the

WAEMU countries 8

Chapter 3 Empirical Analysis 10

3.1 Data and Description of Variables 10

3.1.1 Data 10

3.1.2 Economic Growth Indicator 10

3.1.2 Financial Development Indicators 10

3.2 Unit root Test 14

3.2.1 ADF test 15

3.2.2 Test Results 16

3.3 Empirical results 16

3.3.1. Vector Autoregression (VAR) Lag Length

17

3.3.2. Cointegration Test 17

3.3.3. Cointegration results 18

3.3.4. Vector Error Correction Model (VECM)

19

Chapter 4 Conclusion and Policy Implications

23

4.1. Conclusion 23

4.2. Policy Implications 23

References 25

Appendix 28

Acknowledgment 33

Table of Figures

Figure 3.1: Trend of individual variables GDP, FD, and CP in log

level 12

Figure 3.2: Log first differences of individual variables 13

List of Tables

Table 3.1 Descriptive statistic of the variables 14

Table 3.2 Descriptive statistic of the first difference of the

Variables 14

Table 3.3 Unit root test of level 16

Table 3.4 Unit root test of first difference 16

Table 3.5 VAR lag order selection criteria 17

Table 3.7 Vector error correction estimates 20

Chapter 1 Introduction

Niger's economic growth in the past decades has been

relatively modest and was below the population growth rate, in the early 1960s

through to the late 1970s economic growth was weakened by series of droughts

that adversely affected the agricultural sector (accounting 40 percent of Niger

GDP). From 1979 to 1982, economic growth was strengthened due to the world

demand for uranium (Niger's main export product). This improved the terms of

trade and raised export revenues base of the country. However, this strong

growth was short lived due to the collapse of the global uranium price in the

early 1980s, causing and accelerating prolonged recession. Although the 1994

devaluation of the CFA1 franc improved the country's external

competitiveness, real GDP growth was too low to boost per capita income; IMF

(2007); Ministry of Finance and economy of Niger (2006).

Over the years, the study of economic growth has become one of

the hottest research areas due to the strategic implications of economic growth

to national development. Modern theories on economic growth offer several

explanations to this; Katheline (2000). According to the classic definition of

François Perroux (1981), economic growth is «an increase in the

capacity of an economy to produce goods and services, compared from one period

of time to another''. In practice, gross domestic product (GDP) is used to

measure economic growth and the rate of economic growth is evaluated by the

rate of change of GDP. The financial sector is an important contributor to GDP

in every economy. Therefore, the level of growth and development of an economy

is tied partly to profound reforms made in the financial and monetary

structures as well as policy interventions. Changes in the financial sector are

fundamental and vital for these reforms due to its role in spreading risk and

mobilizing savings. It is therefore imperative to highlight the contributions

of this sector to economic growth. Nonetheless, economic theories are divided

on the importance of this sector in economic growth; Bagehot (1873); Hicks

(1969); Goldsmith (1969); Schumpeter (1912); Robinson (1952); Lucas (1988).

1 Local currency share by an eight former French

colonies in West Africa

Consequently, two main hypotheses are advanced whose central

issue is whether or not the financial sector supports economic development. The

first is led by Bagehot and others; Bagehot (1873); Mackinnon (1973); Shaw

(1973); and Schumpeter (1912). They highlight the active role of the financial

sector in promoting economic growth; Robinson (1952) and Lucas (1988) on the

other hand believe there is no relationship between the financial sector and

economic growth.

Crises in the banking sector in 1980s resulted in collapse of

banks in developing countries especially in Africa; particularly, south of the

Sahara. It forced the West African and Monetary Union (WAEMU) countries (among

which Niger is a member) to engage in financial liberalization advocated by

researchers as an intervention measure; McKinnon and Shaw (1973). This

intervention, as envisaged at the time, would allow the recovery of the banking

and the financial sectors and in fact, propel the growth of the economy.

Unfortunately, the intervention has not been successful due to the fact that

the financial sector is highly concentrated with higher intermediation margins;

resulting in excess liquidity which has adverse effects on banking efficiency;

Igué (2006).

A developed financial sector enhances economic growth, by

promoting and mobilizing savings and providing information on investments

opportunities so that resources can be channeled to productive ventures. It

monitors the disbursement of funds, promotes trading, diversification and

management of risk as well as facilitating the exchange of goods and services

leading to economic growth; Levine (1997, 2004).

The objective of this study is to investigate whether the

development of financial sector in Niger in the past 40 years has contributed

to economic growth or not. Empirically, real GDP was used to indicate economic

growth; two variables were used to indicate financial development. Financial

deepening M2/GDP denoted by FD, and credit to the private sector to GDP by CP.

Based on these, investigation to determine whether or not there was any

relationship between financial development and economic growth in Niger was

done.

1.1. Motivation

There have been some studies on the financial development and

economic growth in some WAEMU countries, however to the best of my knowledge

there has not been any report in the case of Niger. Its financial sector has

not been given the necessary attention in research studies as an important

indicator of economic growth. Hence, the need to fill this research and

academic gap is of paramount importance. This study therefore, aims at

analyzing the relationship between the financial development and economic

growth of Niger and providing implicit and explicit policy suggestions that may

be adopted by policy makers to promote financial development and economic

growth.

1.2. Scope of the Study

Financial development is a broad term; it is a combination of

the developments of financial institutions financial markets and financial

assets []. The focus of this study is mainly on the development of financial

institutions. Other aspects such as stock market will not be considered as the

country has no effective and operational stock market. In fact, the whole of

the West African Economic and Monetary Union (WAEMU)2, has only one

stock market located in Abidjan, Ivory Coast. Be it as it may, this regional

stock exchange3 is not well developed to compete with and to break

the monopoly of the banks.

1.3 Brief overview of economic growth and financial

sector Development in Niger

1.3.1 Economic Growth

Since independence (in 1960), Niger has experienced several

profound economic growth. This span of economic developments may be divided

into five (5) different periods.

1963-78 The rural sector contribute more than

half of total value added to GDP, with mining accounting for about 7 percent.

Within this period, there were series of

2 an eight member organization comprising of former French

colonies, Niger, Mali, Benin, Burkina Faso, Cote D'Ivoire, Togo, Senegal and

Guinea Bissau.

3 Common Stock market shared by the former French

Colonies

droughts that weakened the agricultural sector which account

for about 40 percent of the GDP, negatively impacting on growth. Per capita

real GDP growth averaged about 0.8 percent per year; Ministry of Finance of

Niger (2006).

1979#177;82: Higher uranium prices pushed per

capita real GDP growth to an average of about 2.5 percent per year, in this

period. The mining sector contributed an overall GDP of about 13 percent. This

increased government revenue and facilitated greater public investment in

infrastructure; Ministry of Finance of Niger (2006).

1983#177;93: International uranium prices and

Niger's terms of trade declined sharply, significantly reducing export

earnings, slowing investment, and weakening the financial sector. Limited

policy adjustments to the terms of trade and political instability worsened the

situation. Per capita real GDP declined, by an average of 3.4 percent a year;

Ministry of Finance of Niger (2006).

1994#177;98: Along with devaluation of the

CFA franc (in 1994), the Nigerien authorities initiated reforms that worked

towards liberalizing the economy. These measures improved external

competitiveness and strengthened the economy's overall supply response. Good

weather conditions boosted the performance of the agricultural sector, although

per capita real GDP growth still averaged just about 0.5 percent a year; IMF

(2007).

1999-2010: The 1999 elections ushered in a

democratic government and brought consensus on the need for prudent policies

and reforms to strengthen growth and reduce poverty. Consequently state-owned

companies were privatized and domestic and external trade liberalized. While

these reforms strengthened the economy's supply response, droughts continued

to hit the economy leading to limited progress in agricultural productivity

resulting in modest per capita real GDP growth; IMF (2007).

1.3.2 Financial Sector Development

Niger is a member of the Economic and Monetary Union of the

West Africa (WAEMU) which comprise of 8 former French colonies in West Africa.

The Central Bank of the States of West Africa, known as Banque Centrale des

Etats de l'Afrique de l'Ouest (BCEAO) in French which was established in 1962

is responsible for both the

management of the monetary policies, regulating and

supervising the banking services of the member countries. The financial sector

of Niger is relatively underdeveloped. The sector includes the central bank,

ten commercial banks; the national fund of social security system; five

insurance companies; three brokerage firms and about 270 microfinance

institutions MFIs; Monograph of BCEAO (2004). Among the WAEMU member countries,

Niger's ratio of broad money to GDP and deposit to GDP is the lowest. Based on

this, it is safe to conclude that the financial intermediation in Niger is

still very low. Total assets of the financial system at the end of 2005 stood

at about 373 billion CFA francs, representing 21% of the GDP. The banking

sector dominates the financial system with total assets accounting for about

63% where as the non financial sector accounted for about 29% with the

insurance sector accounting for about 5.3% and the microfinance institutions

accounting for about 2.7%; WAEMU (2005). The financial sector suffered serious

difficulties in the late 80s and 90s. Banks, security funds and microfinance

institutions went through severe financial crisis. Additionally, long period of

political and economic instability and sluggish economic growth are factors

that contributed to this financial crisis. Other factors that affected the

sector include the inefficiency of the judiciary, poor financial sector

policies, including supervision, lax banking, the rigidity of the structure of

interest rates and sectoral allocation of credit; WAEMU (2003). Mismanagement,

subsidized loans (especially in the late 70s and the 80s) and budget deficits

also contributed to the failure of the financial institutions.

1.4 Disposition

The study is structured in four parts; the first chapter is an

introduction focusing on the motivation, the scope and a brief history of

Niger's economic growth and financial sectors. The second chapter is an

overview of theories concerning financial development and economic growth. The

third chapter is the description of data, variables, and results of empirical

validation. The final chapter is the conclusion and policy implication of

findings of the study.

Chapter 2 Literature Review

Economic growth is a goal and national development policy of

every nation. Developed economies provide living evidence of the importance of

the financial sector in economic growth. Financial development stimulates

economic growth through investment which invariably contributes to increasing

national productivity.

2.1 Financial development: a factor for economic

growth

The positive correlation between financial development and

economic growth has been recognized in the literature for over decades Bagehot

and others Bagehot (1873), Schumpeter (1912), Goldsmith (1969) are among the

pioneers of this topic. Financial structure quickly became one of the

fundamental economic developments spurred by authors Gurley and Shaw (1967);

McKinnon (1973), King and Levine (1993). In almost all studies, findings

confirm that an efficient financial system contributes strongly to economic

growth. The correlation between the two variables is widely accepted however

the direction of causality is yet debatable. The concept of financial system

generally includes banks and financial markets. Levine (2004) advanced five

arguments that theoretically support the existence of strong and positive link

between financial development and economic growth. He stated that financial

system would:

· Cushion against the risk;

· Allow optimal allocation of resources;

· Allow better control of the company management

· Facilitate the mobilization of domestic savings;

· Facilitate the exchange of goods and services.

Schumpeter (1911) argued that an efficient financial system

greatly helps the growth of a nation's economy. For him well-functioning banks

encouraged technological innovation by offering funding to entrepreneurs that

have the best chances of successfully implementing production processes for

innovative products. Goldsmith (1969) is another pioneer in studying the links

between growth and financial development. His study focused on a sample of 35

countries over the period 1860 to

1963. He concluded that there is a positive link between the

financial sector and economic growth. In an attempt to address the weakness in

the work of Goldsmith, King and Levine (1993), focused their analysis on a

sample of 80 developed countries over a period 1960 to 1989 by reviewing all

financial factors likely to influence long-term economic growth and concluded

that there was statistically significant and positive contribution of financial

variables on economic growth.

Levine and Zervos (1998) assessed the impact of exchange stock

market and development of the banking sector on economic growth with a sample

of 49 countries over the period of 1976-1993 and using asset turnover, and

market capitalization ratios, market volatility and bank development indicators

as financial variables. They also considered as growth rate of real GDP,

capital, productivity and savings as endogenous variables in line with earlier

studies; King and Levine (1993). Their result highlighted the positive impact

of financial variables on economic growth and penciled two mechanisms through

which financial development is affected economic growth. The first is the

increased efficiency of capital, through better resource allocation, and the

second is the mobilization of savings which increases the volume of investment.

They concluded that economies with high levels of financial development

exhibited higher growth rates. Venet et al. (1998) in a study on the economies

of sub-Saharan countries from 1970-1995 found out that financial deepening

played a major role in the real growth of majority of countries within WAEMU,

including Cameroon. They used economic growth measured by real GDP per capita

as regressor and ratios of M2 to GDP, the nominal credit to the private sector

and stock of real credit per capita as financial variables and concluded that

there was a causal link between financial deepening and real economic growth of

the countries except Niger. In its case, there was no causal significance; yet,

according to them, the result does not necessarily imply the absence of

economic ties between the two sectors of Niger.

2.2 Financial development: a less factor for economic

growth

In fact, the issue of the relationship between financial

development and economic growth is still debated. Some economists believe there

is no significant relationship between financial system and economic growth.

For instance, Lucas (1988) dismissed the finance-economic growth relationship

by stating that economists «badly over-stress» the role financial

factors play in economic growth. Mayer (1988) argues that a developed stock

market is not important for financing of companies. Nonetheless, some authors

such as Robinson (1952) assert that economic growth creates demand for

financial instruments and that where enterprise leads, finance follows. Nguema

(2000) studied financial intermediation and growth on Gabon, and concluded that

despite the regular periods of excess liquidity in the banking system, banks

did not finance growth. In other words, the development of the financial sector

did not influence the economic growth of the country.

2.3 Financial liberalization and economic growth in the

WAEMU countries

Generally, the term "financial repression" refers to the

effects of strict regulation of financial systems and the arrays of

restrictions imposed by States on the activity of financial institutions.

Adopting financial liberalization policies was often considered a prerequisite

for healthy and efficient financial sector; McKinnon and Shaw (1973).

Theoretical and empirical studies conclude that financial development plays

important role in economic growth, and that less developed financial systems

may hinder economic growth, and that reforms involving the deployment of market

mechanisms must be pursued. Evidence from these studies has been the foundation

for the wave of financial liberalization of many developed and developing

economies. For the WAEMU countries, the liberalization of financial systems to

stop the collapse of the banks and propel investment began in the late 1980s;

WAEMU annual report (2003). The reforms were primarily liberalization of

interest rates, elimination of credit, operationalization of the minimum

reserve system, renovation of the money market, creation of the Regional Stock

Exchange known as Bourse Regionale de Valeures Mobilieres (BRVM) in French, and

promotion of the microfinance sector. These

measures were implemented (as part of the liberalization

policy in the monetary area) to improve the efficiency of banks for economic

growth. However, some argue that financial repression has a reducing effect on

growth.

McKinnon and Shaw (1973), King and Levine (1993) are the main

advocates for financial liberalization. For them, a repressed financial system

where the state controls the banking sectors is ineffective because government

plays important role in credit allocation, through the maintenance of very low

interest rates, subsidized interest rates for priority sectors (especially

SOEs) and very high reserve requirements. This development is believed to

disturb relative prices and resource allocation. Financial liberalization

therefore, must first promote greater collection of savings, by increasing the

supply of savings instruments and raising real interest rates. There is also

the tendency to finance less productive investments in a financially repressed

economy; McKinnon (1973). Furthermore, Shaw (1973) showed that the rate limits

aggravate risk aversion and liquidity preference of financial intermediaries.

According to Fry (1997), credit allocation is usually based on political

affiliations rather than on the basis of efficiency in a repressed financial

system. King and Levine (1993) also stated that financial repression reduces

the services offered by the financial system for clients. It hinders innovation

and weakens the growth rate of the economy. Therefore, theoretically, there is

ample evidence that shows that financial repression adversely affects both the

financial sphere and the real economy. Hence, the liberalization of financial

systems advocated by economists as a measure to induce economic growth seems to

be in the right direction. In contrast, a second approach argues that financial

liberalization is harmful to financial development innovation and economic

growth. Stiglitz (1981) opined that the function of capital markets, driven

mainly by financial liberalization is affected by asymmetric information flow

which undermines its effectiveness. For example, the head of a credit bank has

more information on the terms and conditions on loans than the client who is

taking risks to borrow. This results in adverse selection, and moral hazard.

Chapter 3 Empirical Analysis

Macroeconomic performance in Niger has been quite poor over

the years and real GDP varied between 1970 and 2010. In this chapter variables

of the study are described, data are analyzed and results validated

empirically. Initially, the presence of unit root is enquired before

determination of Cointegration. After Cointegration between the variables was

established the existence of long run equilibrium relationship was confirmed.

Finally, a Vector Error Correction technique was employed to examine the short

and long run dynamics with the help of Eviews 7.1 Software.

3.1 Data and Description of Variables

3.1.1 Data

Annual time series data were used from 1970 - 2010. The data

was collected from the International Financial Statistics (IFS) and World Bank

Development Indicators (WDI) databases (

http://www.imf.org/external/data.htm;

http://data.worldbank.org ).

3.1.2 Economic Growth Indicator

Unlike Levine (2000) who used real GDP per capita in measuring

economic growth, herein, real GDP was used as a proxy for economic growth

because the population growth rate of Niger is higher than the GDP growth; such

that dividing the real GDP by the population does not reflect the growth of the

country. This variable would reflect the evolution of the economic development.

Note that this indicator reflects the economic health of a country and its

ability to finance domestic investment. Therefore the natural logarithm of real

GDP is used as indicator of economic growth denoted by (GDP).

3.1.2 Financial Development Indicators

Based on Niger's situation and availability of data, two

variables were successively selected to measure financial development, which

are the ratio M2 divided by GDP denoted FD and credit to the private sector

also divided by GDP denoted by CP. The ratio of credit to the private sector to

GDP has been designed as

an indicator of financial intermediation. The higher this

ratio is, the larger the volume of credit lending to the private sector.

Additionally, credit to private sector to GDP as a proxy of financial

development indicates not only a high level of domestic investments, but also a

high development of the financial system. Furthermore, Financial deepening (FD)

is designed as an indicator to capture the evolution of the liquidity of the

economy. Moreover, Demetriades and Hussein (1996), King and Levine (1993) used

this variable to measure the development of the financial sector. Increase in

FD corresponds to increase in liquidity of the economy. The sign of FD was

expected to be positive because the more liquid an economy is, the more

opportunities exists for continued and sustainable growth. However, the sign

for credit to the private sector to GDP (CP) may be ambiguous; allocation of

non-performing credits may be a source of crises for banks as well as the

economy and thus relate negatively to growth. On the other hand, it may be

positively correlated with GDP if credits are deployed efficiently; [].

Therefore, the logarithm of CP and FD were used as financial development

indicators.

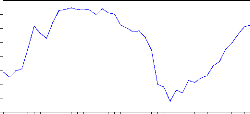

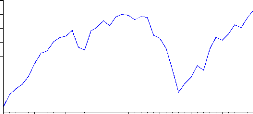

The Figures below illustrate each series in log levels of the

variables as well as the first differences of the logs. As indicated in Figure

3.1, each series appears to be nonstationary. Whereas the first differences of

the logs of the series in Figure 3.2 have stationary appearance.

Figure 3.1: Trend of individual variables GDP, FD, and CP

in log level

The variables fluctuate over the years. The CP appears to

decrease from 1970 up 1972, then increase abruptly in

CP

1975. It then fell in 1978 and picked to a maximum in 1979.

Thereafter, it decrease steadily in 1997 and finally

increase from 1997 to

2010. The FD increased from 1970 to 1980, then dropped to 1983 and increased

steadily to

FD

1994, then decreased to 1997 and finally increased in 2010. The

GDP increased from 1970 to 1971, decreased in 1973, then increased steadily to

1979 and then dropped in 1984.Thereafter,it increased till 2010.

GDP

Figure 3.2: Log first differences of individual

variables

From Figure DCP increased from 1970 to 1972, and then

decreased sharply in 1976. It stabilizes a little in 1992,

1980 1985 1990 1995 2000 2005 200

and dropped 1995.Thereafter it fluctuates steadily till 2010.

The trend of DGDP decreased from 1970 to 1972, and

then increased from 1972

to 1975. It then fell from 1978 to 1983. It increased so sharply from 1983 to

1985.

DGDP

Finally, it fluctuates steadily from 1985 to 2010 even though

it decreased in some years. The DFD decreased from year 1970 to 1972, and then

increased litter in 1975.Thereafter decreased from 1980 to 1983 and picked up

from 1983 to 1985. It then decreased slightly up 1999. From 1999 it increased

sharply to 2004 then dropped till 2010.

Below are descriptive statistics at the level and the first

difference of the variables.

Table 3.1 Descriptive statistic of the

variables

|

GDP

|

FD

|

CP

|

|

Mean

|

27.36909

|

2.544895

|

2.203026

|

|

Median

|

27.30820

|

2.657242

|

2.334714

|

|

Maximum

|

27.90803

|

3.065516

|

2.871635

|

|

Minimum

|

26.99595

|

1.675567

|

1.194554

|

|

Std. Dev.

|

0.230233

|

0.374789

|

0.523250

|

|

Skewness

|

0.688648

|

-0.623488

|

-0.312218

|

|

Kurtosis

|

2.706422

|

2.307543

|

1.709129

|

|

Jarque-Bera

|

3.387850

|

3.475511

|

3.512791

|

|

Probability

|

0.183797

|

0.175915

|

0.172666

|

N.B: There were 41 observations from 1970-2010.

Table 3.2 Descriptive statistic of the first difference

of the Variables

|

DGDP

|

DFD

|

DCP

|

|

Mean

|

0.018184

|

0.034749

|

0.020999

|

|

Median

|

0.026446

|

0.062450

|

0.017334

|

|

Maximum

|

0.126391

|

0.305851

|

0.402673

|

|

Minimum

|

-0.186903

|

-0.332989

|

-0.609583

|

|

Std. Dev.

|

0.064037

|

0.143077

|

0.180374

|

|

Skewness

|

-1.475985

|

-0.811726

|

-0.702480

|

|

Kurtosis

|

5.997952

|

3.522487

|

5.410074

|

|

Jarque-Bera

|

29.50307

|

4.847649

|

12.97062

|

|

Probability

|

0.000000

|

0.088582

|

0.001526

|

N.B: There were 40 observations.

3.2 Unit root Test

Most macroeconomics data are nonstationary; hence it was

primordial to test for stationarity before the regression in order to avoid

misleading results. Therefore, a formal test is applied in order to check the

stationarity of the series. Series which are stationary at level is said to be

integrated of order zero, I (0). The ones which attained

stationarity after differencing is said to be integrated of order

one, I (1).

3.2.1 ADF test

Augmented Ducky Fuller (ADF) test was used to test for the

stationarity. It consists of running a regression of the first differences of

the series against the series lagged once, lagged difference terms and

optionally, a constant and time trend. This can be expressed as follows:

(1)

Where is the dependent variable, is constant term, trend

variable, is

stochastic disturbance term.

The test for unit root was carried out on the coefficient of ().

If the coefficient

is significant from zero, then the hypothesis that has a unit

root is rejected. The

fact that the null hypothesis is rejected indicates stationarity.

The null hypothesis is

that the variable is a non-stationary series (H0: )

and it is rejected when

is significantly negative ( ).

If the computed value of the ADF statistic is more negative

than the critical values, then the null hypothesis (H0) is rejected and the

series considered to be stationary or integrated of order zero, I(0). Contrary,

failure to reject the null hypothesis implied that the series is non-stationary

leading to another test on the first difference of the series. If the series

attained stationarity after the first difference, they are considered

integrated of the order one, I (1). If not, further difference was conducted

until stationarity was reached.

Table 3.3 Unit root test of level

|

variable

|

Constant

|

Trend

|

|

ADF

statistic

|

1%

|

5%

|

10%

|

ADF

statistic

|

1%

|

5%

|

10%

|

|

GDP

|

0.581

|

-3.605

|

-2.937

|

-2.607

|

-1.766

|

-4.205

|

-3.526

|

-3.195

|

|

FD

|

-2.035

|

-3.605

|

-2.936

|

-2.606

|

-1.883

|

-4.205

|

-3.526

|

-3.194

|

|

CP

|

-1.948

|

-3.615

|

-2.941

|

-2.609

|

-2.207

|

-4.219

|

-3.533

|

-3.198

|

Table 3.4 Unit root test of first difference

|

variable

|

Constant

|

Trend

|

|

ADF

statistic

|

1%

|

5%

|

10%

|

ADF

statistic

|

1%

|

5%

|

10%

|

|

D(GDP)

|

-6.250

|

-4.211

|

-3.529

|

-3.196

|

-6.250

|

-4.212

|

-3.529

|

-3.197

|

|

D(FD)

|

-4.663

|

-3.610

|

-2.938

|

-2.607

|

-4.585

|

-4.211

|

-3.529

|

-3.196

|

|

D(CP)

|

-2.818

|

-3.621

|

-2.943

|

-2.610

|

-3.769

|

-4.226

|

-3.536

|

-3.200

|

3.2.2 Test Results

Results of the unit root test showed that all the series were

nonstationary. The ADF test statistics were lesser than the critical values

indicating that the series were nonstationary at level (Table 3.3).

Furthermore, all the variables attained stationarity at first difference at 10%

significance level. The calculated values of the ADF statistics were more

negative than the critical values implying that the series were integrated of

order one I (1) (Table 3.4).

3.3 Empirical results

In this section, an optimal lag length is chosen and results of

the Cointegration test as well as the Vector error correction model (VECM)

estimates are presented.

3.3.1. Vector Autoregression (VAR) Lag Length

Since all the variables are integrated of order one, application

of Johansen Cointegration test is more appropriate; Johansen (1991, 1995). Yet,

Johansen Cointegration test is sensitive to the lag length. Therefore an

optimal lag length (p) must be chosen. Also, before estimation of the VECM

model with associated cointegrating vector, it is necessary to select optimal

lag length of initial VAR. Different information criteria were computed for

different time lags; each at 5% level of Likelihood Ratio (LR), Final Predict

Error (FPE), Akaike Information Criteria (AIC), Schwarz Information Criteria

(SC), and Hannan-Quinn information criteria (HQ). Result showed that the

appropriate lag for all the criteria was one. Hence, the number of lags

required in the Cointegration test was set to one (p=1).

Table 3.5 VAR lag order selection criteria

|

Lag

|

LogL

|

LR

|

FPE

|

AIC

|

SC

|

HQ

|

|

0

|

-16.792

|

NA

|

0.006

|

1.099

|

1.231

|

1.145

|

|

1

|

99.058

|

205.957*

|

1.60e-06*

|

-4.836*

|

-4.308*

|

-4.652*

|

|

2

|

105.206

|

9.905

|

1.89e-06

|

-4.678

|

-3.754

|

-4.356

|

|

3

|

110.411

|

7.517

|

2.41e-06

|

-4.467

|

-3.147

|

-4.007

|

|

4

|

119.311

|

11.373

|

2.57e-06

|

-4.462

|

-2.746

|

-3.863

|

|

5

|

128.401

|

10.099

|

2.82e-06

|

-4.467

|

-2.355

|

-3.729

|

* indicates lag order selected by the criterion , LR:

sequential modified LR test statistic (each test at 5% level)

FPE: Final prediction error, AIC: Akaike information criterion,

SC: Schwarz information criterion, HQ: Hannan-Quinn information criterion

3.3.2. Cointegration Test

As Engle and Granger (1987) pointed out, it is possible that a

linear combination of nonstationary series may be stationary. If such

stationary combination exists, the non-stationary time series are said to be

co-integrated and it is then possible to interpret it as a long-run equilibrium

relationship among the variables. Johansen (1995) suggested two test statistics

based on Likelihood ratio (LR); the trace statistics and the Maximum Eigenvalue

statistic. The first statistic tests the null hypothesis that the number of

Cointegration vector is less than or equal to r against the

alternative that

the number of Cointegration vector is equal to r. The

second statistic tests the null hypotheses that the number of Cointegration

vector is equal to r against the alternative that it is equal to

r+1.

Table 3.6 Johansen Cointegration test

|

Unrestricted Cointegration Rank Test (Trace)

|

|

|

Hypothesized

No. of CE(s)

|

Eigenvalue

|

Trace

Statistic

|

0.05

Critical Value

|

Prob.**

|

|

None

|

0.441

|

26.032

|

29.797

|

0.127

|

|

At most 1

|

0.061

|

2.763

|

15.494

|

0.976

|

|

At most 2

|

0.006

|

0.227

|

3.841

|

0.633

|

|

Trace test indicates no cointegration at the 0.05 level *

denotes rejection of the hypothesis at the 0.05

level **MacKinnon-Haug-Michelis (1999) p-values

|

|

Unrestricted Cointegration Rank Test (Maximum Eigenvalue)

|

|

Hypothesized

No. of CE(s)

|

Eigenvalue

|

Max-Eigen

Statistic

|

0.05

Critical Value

|

Prob.**

|

|

None *

|

0.441

|

23.268

|

21.131

|

0.024

|

|

At most 1

|

0.061

|

2.535

|

14.264

|

0.972

|

|

At most 2

|

0.005

|

0.227

|

3.841

|

0.633

|

|

Max-eigenvalue test indicates 1 cointegrating eqn(s) at the 0.05

level * denotes rejection of the

hypothesis at the 0.05 level **MacKinnon-Haug-Michelis (1999)

p-values

|

3.3.3. Cointegration results

The number of cointegrating vectors was tested based on the

assumption that the series have linear deterministic trend and that there is an

intercept. The null hypothesis that there is no cointegrating vector concerning

the trace statistics could not be rejected since its value was greater than the

5% critical value. Since we failed to reject the null hypothesis with no

Cointegrating equation this indicates that any cointegrating equation has not

been found concerning the trace statistic. However, the maximum eigenvalue

statistics test indicates one (1) cointegrating equation among the variables.

Thus, there was one Cointegrating equation indicating long-run equilibrium

relationship among the variables (Table 3.6).

3.3.4. Vector Error Correction Model (VECM)

The use of the vector error correction model was necessitated

by the fact that the time series were nonstationary in their levels except in

their differences, coupled with the fact that the variables were cointegrated.

In case there was no Cointegration, VECM was not required. The VECM was applied

in order to evaluate the short run properties of the cointegrated series and to

find the real link between the variables. It enables the integration of the

short-run fluctuations. The coefficient of the error correction term must be

negative to report a force towards the long-run equilibrium. The regression

equation of the VECM is express as:

(2)

(3)

(4)

Where Ä is the first difference operator, is the error

correction term lagged one

period, are the short-run coefficients are constant terms,

are coefficient of the vectors and are

the white noise terms.

Table 3.7 Vector error correction estimates

|

Cointegrating Eq:

|

CointEq1

|

|

|

GDP(-1)

|

1.000000

|

|

|

CP(-1)

|

0.765

(0.144)

[ 5.279]

|

|

|

FD(-1)

|

-1.311

(0.206)

[-6.355]

|

|

|

C

|

-25.714

|

|

|

Error Correction:

|

D(GDP)

|

D(CP)

|

D(FD)

|

|

CointEq1

|

-0.061

(0.031)

[-1.935]

|

0.183

(0.089)

[ 2.059]

|

0.283

(0.058)

[ 4.805]

|

|

C

|

0.018

(0.009)

[ 1.858]

|

0.021

(0.027)

[ 0.766]

|

0.035

(0.018)

[ 1.922]

|

|

R-squared

|

0.089

|

0.100

|

0.377

|

|

Adj. R-squared

|

0.065

|

0.076

|

0.361

|

|

Sum sq. resids

|

0.145

|

1.141

|

0.496

|

|

S.E. equation

|

0.062

|

0.173

|

0.114

|

|

F-statistic

|

3.744

|

4.243

|

23.090

|

|

Log likelihood

|

55.560

|

14.374

|

31.019

|

|

Akaike AIC

|

-2.678

|

-0.619

|

-1.451

|

|

Schwarz SC

|

-2.593

|

-0.534

|

-1.366

|

|

Mean dependent

|

0.018

|

0.021

|

0.035

|

|

S.D. dependent

|

0.064

|

0.180

|

0.143

|

|

Determinant resid covariance (dof adj.) Determinant resid

covariance

Log likelihood

Akaike information criterion

Schwarz criterion

|

1.40E-06

|

|

|

1.20E-06

|

|

|

102.433

|

|

|

-4.671

|

|

|

-4.291

|

|

NB: Standard errors in ( ) & t-statistics in [ ]

Short run dynamic

variable coefficient Standard error t-statistic

D(GDP) -0.061* 0.032 -1.935

(*), indicates significant at 10% level

The coefficient should be negative and significant to show

that the long run relationship exists among the variables and that deviation

from equilibrium in the previous year is adjusted back to equilibrium in the

current year. In other words, this indicates a long-run error correction among

the variables. In particular, given that the

coefficient of is -0.061, this means that 6.1% of the

disequilibrium in the previous

year were adjusted back to equilibrium in the current year.

|

Long run dynamic

|

|

|

|

|

Variables

|

Coefficient

|

Standard error

|

t-statistics

|

|

GDP(-1)

CP(-1)

FD(-1)

C

|

1.000000 0.765*** -1.311*** -25.714

|

0.145

0.206

|

5.279

-6.355

|

(*), (**) (***) indicates 10% 5% and 1% significance level,

respectively.

Based on the long run dynamic analysis the relationship between

GDP, CP and FD can be expressed in terms of the coefficients as

(5)

We interpreted the coefficients in terms of elasticity. The

GDP increased by 1.311 percent with an increase of one percent of FD. It had

significant influence on the economic growth of Niger. However, an increase of

one percentage of CP led to a decrease in GDP by 0.765 percent, which confirms

the ambiguity of the sign of CP. With effective allocation of resources, it

will be correlated positively with economic growth; otherwise not, especially

in countries where the financial systems are not well developed. Generally, CP

is expected to have positive effect on investment leading to economic growth;

Demetriades and Hussein, (1996). Contrary, we found negative and significant

impact of CP on economic growth in Niger. This result could be explained by the

huge non performing loans on the private sector between 1970 and 1980. Higher

CP means wider financial sector and higher

financial intermediation. Yet for Niger's case, the CP was

lower; indicating restraint of the financial sector and lower financial

intermediation. Additionally, the attitude of bankers to finance less risky

projects lead to low capital intensity. This does little to improve investment

and may create distortions in the economy. Furthermore, investment in Niger is

weak and unstable leading to unexpected negative returns from projects with

attendant negative impact on economic growth; De Gregorio and Guidotti

(1995).

Chapter 4 Conclusions and Policy Implications

Chapter 4 Conclusion and Policy Implications

4.1. Conclusion

We investigated the existence of relationship between

financial developments and economic growth in Niger with annual time series

data from 1970 to 2010 using Vector Error Correction techniques. Results of ADF

unit root test demonstrated that the series were non stationary at their levels

but stationary at first difference. Additionally, Johansen Cointegration test

was applied to study the long run equilibrium relationship among the variables

and results indicate the existence of Cointegration among the variables. The

VECM was estimated to improve the dynamism of the short and long run

relationships. The error correction term is negative and statistically

significant indicating that after a shock in a previous year, the long run

disequilibrium will converge towards equilibrium at about 6.1% percent in a

current year. In the long run, we found that an increase in financial deepening

(FD) leads to an increase in GDP however; there was a negative and significant

effect between credit to the private sector to GDP and economic growth.

4.2. Policy Implications

Based on the findings of the empirical analysis, suggestions

are advanced for policy interventions. The negative relationship between credit

to private sector and economic growth may be due to inefficient allocation of

funds to productive sectors. This is mainly due to the fact that most borrowers

default on loan payments. As a result, banks are reluctant to give out credit

to many customers; they pursue selective lending to few sectors, especially the

mining and telecommunication industries. This creates a situation where there

is no readily available credit to legitimate entrepreneurs, leading to less

economic growth. Hence, to boost economic growth and development, the authority

in Niger should enact laws and policies to establish a central credit bureau

linking all banks. This will collate the names and history of all borrowers

such that previous loan defaulters as well as the ability of borrowers to honor

loan payments can easily be determined by credit officers. On the other

hand,

Financial Development and Economic Growth Evidence from

Niger

the positive correlation of financial deepening to economic

growth indicated that financial deepening had much influence on the economic

growth and developments of Niger. Therefore, to induce economic growth and

developments, the government has to work towards building a stronger and more

diversified financial and banking sector by continuing to liberalize the

financial sector so as to create competition among the banks. Competition will

drive banks to institute innovative policies and programs that are customer

friendly. For instance banks may be forced to embark on vigorous advertisement

to educate customers on the advantages of banking with them or allow creation

of zero-balanced deposit accounts. This will encourage more clients to save

resulting in more liquidity to promote economic growth. Another intervention is

to formulate directives for banks to conduct periodic and scheduled

sensitization and education programs for the populace about the security of the

banks against collapse. There is the general belief that the banks in Niger may

collapse at any time, resulting in many people not wanting to save. This

perception is borne out of the collapse of the banking sector in the 1980s.

Therefore, creating confidence among the citizens is vital for the

sustainability of the banks and the economic growth of Niger.

References

Arestis, P. Demetriades, P.(1997), «Financial development

and economic growth: Assessing the Evidence» Economic Journal,

107:783-799.

Bagehot, W. (1873), Lombard Street: «A Description of the

Money Market», EP Dutton and Company Reprint 1920 New York.

Baptiste.V Anne J., Marc R. (1998), «Financial Deepening and

Growth: an empirical analysis of Sub-Saharan».CREFED-CERPEM, pp.11.

BCEAO (2004), Monographie des institutions financiqre de

l'UEMOA.

De Gregorio, J. and Guidotti,P.(1995), «Financial

Development and Economic Growth.»World Development 23 (3):433-448.

Demetriades, P.O and Hussein, K.A.(1996) ,«Does financial

development cause Economic Growth?» Times series evidence from 16

countries, Journal of development economics ,51(2):387-411.

Engle, Robert F. and W.J.Granger (1987), «Co-integration and

Error Correction: Representation, Estimation and Testing». Econometrica,

55:251-276.

Fritz, Richard G.(1994), «Time Series Evidence on the Causal

Relationship between «Financial Deepening and Economic Development».

Journal of Economic Development, 91-112.

Fonds Monétaire International (2007), Niger Questions

Générale et Appendice Statistique Rapport du FMI No 07/14 Janvier

2007.

Fry.M (1988), «Money, interest and banking in economic

development», the Johns Hopkins press.

Fry,M. (1997),«Money, interest and banking in economic

development», Second Edition the Johns Hopkins University Press, Baltimore

& London.

Granger, C. W. J. (1969), «Investigating Causal Relations by

Econometric Models and Cross- Spectral Methods», Econometrica,

37: 424-438.

Goldsmith, R. W. (1969), «Financial structure and

development».Yale Univ Press New Haven CT.

Gurley, J. and E, Shaw. (1967) «Financial Structure and

Economic Development'' Economic Development and Cultural Change.

Hicks, J. (1969), «A Theory of Economic History,

Oxford»: Claredon Press.

Igué, C .(2006), ``Reformes du syst me financier

:efficacité bancaire et croissance économique :

Une référence a la zone UEMOA'' thèse de

Doctorat, Université de Ouagadougou, Burkina-Faso.

Johansen, S.(1991) ), «Estimation and Hypothesis Testing of

Cointegration Vectors in Gaussian Vector Autoregressive Models»

Econometrica, 59: 1551-1580.

Johansen,S.(1995),«Likelihood-base Inference in Cointegrated

Vector Autoregressive, Models», Oxford University Press.

Katheline, S. (2000), «Analyse macroéconomique : la

croissance», Editions la découverte & Syros Paris

collections Repères.

King R. G. R. Levine, (1993), «Finance and growth:

Schumpeter might be right» Quarterly Journal of Economics, 108(3):

717-738.

Levine, R. (1997),«Stock Markets, Growth, and Tax

Policy» E The journal of Finance V.XLVI (4): 1445-1465.

Levine, R. (1997). «Financial Development and Economic

Growth: Views and Agenda», Journal of Economic Literature 35: 688-726.

Levine R.,( 2004), «Finance and Growth:

Theory and Evidence», Working Paper,10766, National Bureau of Economic

Research (NBER), Cambridge MA.

Levine R et Zervos, (1998) «Stock market

banks and growth», The American Economic Review Vol 88 No3.

Levine, R. (2000),«Bank Concentration: Chile and

international comparisons» Working paper No 62.

Lucas, R. E. (1988), «On the Mechanics of

Economic Development», Journal of Monetary Economics 33(1).

Mckinnon, I. (1973), «Money and Capital in Economic

Development.» Washington, DC: Brookings Institution.

Mba Nguema, B.(2000), «Intermédiation

Financière et croissance Economique dans les pays de la CEMAC : cas du

Gabon'', mémoire de DEA-PTCI, Université de Libreville Gabon.

Perroux, F. (1981), ``Pour une philosophie du nouveau

développement''. Paris, Aubier.

Robinson, J. (1952), "The Generalization of the General Theory,

In: the rate of interest and others

essays» London: MacMillan.

Schumpeter, Joseph A. (1911),«The Theory of Economic

Development.»Cambridge, MA: Harvard University Press.

Schumpeter, Joseph A. (1939), «Business Cycles: A

Theoretical, Historical and Statistical Analysis of the Capitalist

processes».ENew York: McGraw-Hill.

Shaw, E. S. (1973), «Financial Deepening in Economic

Development». New York: Oxford Univ Press.

Stiglitz J. E. et A. Weiss, (1981),«Credit rationing in

markets with imperfect information» American Economic Review, vol 71,

No.3.

Rapport du Ministtre de l'économie et des finances du

Niger (2006). WAEMU Banking Commission, (2004) and (2005) Annual Report.

Appendix

A1 VAR lag length

|

VAR Lag Order Selection Criteria Endogenous variables: CP GDP M2

Exogenous variables: C

Date: 07/26/12 Time: 03:52

Sample: 1970 2010

Included observations: 36

|

|

Lag

|

LogL

|

LR

|

FPE

|

AIC

|

SC

|

HQ

|

|

0

|

-16.79238

|

NA

|

0.000603

|

1.099577

|

1.231537

|

1.145634

|

|

1

|

99.05879

|

205.9576*

|

1.60e-06*

|

-4.836600*

|

-4.308760*

|

-4.652370*

|

|

2

|

105.2066

|

9.904788

|

1.89e-06

|

-4.678144

|

-3.754425

|

-4.355741

|

|

3

|

110.4105

|

7.516778

|

2.41e-06

|

-4.467251

|

-3.147652

|

-4.006676

|

|

4

|

119.3113

|

11.37318

|

2.57e-06

|

-4.461737

|

-2.746258

|

-3.862989

|

|

5

|

128.4008

|

10.09944

|

2.82e-06

|

-4.466709

|

-2.355351

|

-3.729789

|

|

* indicates lag order selected by the criterion

|

|

LR: sequential modified LR test statistic (each test at 5%

level)

|

|

FPE: Final prediction error

|

|

AIC: Akaike information criterion

|

|

SC: Schwarz information criterion

|

|

HQ: Hannan-Quinn information criterion

|

A2 Cointegration test

Date: 08/16/12 Time: 13:14

|

|

Sample (adjusted): 1971 2010

|

|

Included observations: 40 after adjustments

|

|

Trend assumption: Linear deterministic trend

|

|

Series: CP GDP FD

|

|

Lags interval (in first differences): No lags

|

|

Unrestricted Cointegration Rank Test (Trace)

|

|

Hypothesized

|

|

Trace

|

0.05

|

|

|

No. of CE(s)

|

Eigenvalue

|

Statistic

|

Critical Value

|

Prob.**

|

|

None

|

0.441065

|

26.03211

|

29.79707

|

0.1277

|

|

At most 1

|

0.061416

|

2.763230

|

15.49471

|

0.9766

|

|

At most 2

|

0.005682

|

0.227925

|

3.841466

|

0.6331

|

|

Trace test indicates no cointegration at the 0.05 level * denotes

rejection of the

hypothesis at the 0.05 level **MacKinnon-Haug-Michelis (1999)

p-values

Unrestricted Cointegration Rank Test (Maximum

Eigenvalue)

|

|

Hypothesized

|

|

Max-Eigen

|

0.05

|

|

|

No. of CE(s)

|

Eigenvalue

|

Statistic

|

Critical Value

|

Prob.**

|

|

None *

|

0.441065

|

23.26888

|

21.13162

|

0.0246

|

|

At most 1

|

0.061416

|

2.535305

|

14.26460

|

0.9728

|

|

At most 2

|

0.005682

|

0.227925

|

3.841466

|

0.6331

|

|

Max-eigenvalue test indicates 1 cointegrating eqn(s) at the 0.05

level * denotes

rejection of the hypothesis at the 0.05 level

**MacKinnon-Haug-Michelis (1999)

p-values

Unrestricted Cointegrating Coefficients (normalized by

b'*S11*b=I):

|

|

CP

|

GDP

|

FD

|

|

|

|

-2.494180

|

-3.258155

|

4.272959

|

|

|

|

-1.553644

|

1.676929

|

-0.177757

|

|

|

|

|

|

|

|

|

0.893488

|

4.323155

|

0.391353

|

|

|

|

Unrestricted Adjustment Coefficients (alpha):

|

|

|

D(CP)

|

-0.056446

|

0.038557

|

-0.001286

|

|

|

D(GDP)

|

0.018937

|

0.006920

|

0.003697

|

|

|

D(FD)

|

-0.086857

|

-0.003577

|

0.003878

|

|

|

1 Cointegrating Equation(s): Log likelihood 102.4326

|

|

Normalized cointegrating coefficients (standard error in

parentheses)

|

|

CP

|

GDP

|

M2

|

|

|

|

1.000000

|

1.306303

|

-1.713172

|

|

|

|

(0.34947)

|

(0.20415)

|

|

|

|

Adjustment coefficients (standard error in parentheses)

|

|

|

D(CP)

|

0.140787

|

|

|

|

|

(0.06835)

|

|

|

|

|

D(GDP)

|

-0.047233

|

|

|

|

|

(0.02441)

|

|

|

|

|

D(FD)

|

0.216637

|

|

|

|

|

(0.04508)

|

|

|

|

|

2 Cointegrating Equation(s): Log likelihood 103.7002

|

|

Normalized cointegrating coefficients (standard error in

parentheses)

|

|

CP

|

GDP

|

FD

|

|

|

|

1.000000

|

0.000000

|

-0.712449

|

|

|

|

|

(0.61835)

|

|

|

|

0.000000

|

1.000000

|

-0.766072

|

|

|

|

|

(0.47572)

|

|

|

|

Adjustment coefficients (standard error in parentheses)

|

|

|

D(CP)

|

0.080882

|

0.248568

|

|

|

|

(0.07840)

|

(0.09776)

|

|

|

|

D(GDP)

|

-0.057983

|

-0.050097

|

|

|

|

(0.02857)

|

(0.03563)

|

|

|

|

D(FD)

|

0.222195

|

0.276995

|

|

|

|

(0.05309)

|

(0.06620)

|

|

|

A3 vector Autoregression Estimates

|

Vector Autoregression Estimates

|

|

|

Date: 09/06/12 Time: 11:16

|

|

|

Sample (adjusted): 1971 2010

|

|

|

Included observations: 40 after adjustments

|

|

Standard errors in ( ) & t-statistics in [ ]

|

|

GDP

|

CP

|

FD

|

|

GDP(-1)

|

0.965886

(0.05650)

[ 17.0957]

|

0.243011

(0.15534)

[ 1.56440]

|

0.293759

(0.10513)

[ 2.79437]

|

|

CP(-1)

|

-0.054680

(0.03062)

[-1.78580]

|

1.079734

(0.08418)

[ 12.8258]

|

0.225660

(0.05697)

[ 3.96086]

|

|

FD(-1)

|

0.081135

(0.04281)

[ 1.89506]

|

-0.248549

(0.11771)

[-2.11150]

|

0.631017

(0.07966)

[ 7.92114]

|

|

C

|

0.865941

(1.52758)

[ 0.56687]

|

-6.172351 (4.19993) [-1.46963]

|

-7.562115

(2.84233)

[-2.66054]

|

|

R-squared

|

0.931321

|

0.899022

|

0.897710

|

|

Adj. R-squared

|

0.925598

|

0.890607

|

0.889186

|

|

Sum sq. resids

|

0.143120

|

1.081871

|

0.495495

|

|

S.E. equation

|

0.063052

|

0.173355

|

0.117319

|

|

F-statistic

|

162.7258

|

106.8380

|

105.3140

|

|

Log likelihood

|

55.90150

|

15.44621

|

31.06402

|

|

Akaike AIC

|

-2.595075

|

-0.572311

|

-1.353201

|

|

Schwarz SC

|

-2.426187

|

-0.403423

|

-1.184313

|

|

Mean dependent

|

27.37380

|

2.215064

|

2.566628

|

|

S.D. dependent

|

0.231156

|

0.524134

|

0.352429

|

|

Determinant resid covariance (dof adj.)

|

1.53E-06

|

|

|

Determinant resid covariance

|

1.12E-06

|

|

|

Log likelihood

|

103.8142

|

|

|

Akaike information criterion

|

-4.590710

|

|

|

Schwarz criterion

|

-4.084046

|

|

A4 Vector error Correction Estimates

|

Vector Error Correction Estimates

Date: 08/16/12 Time: 22:31

Sample (adjusted): 1971 2010

Included observations: 40 after adjustments Standard errors in (

) & t-statistics in [ ]

|

|

Cointegrating Eq:

|

CointEq1

|

|

|

GDP(-1)

|

1.000000

|

|

|

CP(-1)

|

0.765519

(0.14499)

[ 5.27997]

|

|

|

FD(-1)

|

-1.311466

(0.20636)

[-6.35514]

|

|

|

C

|

-25.71474

|

|

|

Error Correction:

|

D(GDP)

|

D(CP)

|

D(FD)

|

|

CointEq1

|

-0.061700

(0.03189)

[-1.93501]

|

0.183910

(0.08928)

[ 2.05985]

|

0.282994

(0.05889)

[ 4.80530]

|

|

C

|

0.018184

(0.00979)

[ 1.85806]

|

0.020999

(0.02740)

[ 0.76631]

|

0.034749

(0.01808)

[ 1.92244]

|

|

R-squared

|

0.089695

|

0.100443

|

0.377976

|

|

Adj. R-squared

|

0.065740

|

0.076770

|

0.361607

|

|

Sum sq. resids

|

0.145582

|

1.141404

|

0.496608

|

|

S.E. equation

|

0.061896

|

0.173312

|

0.114318

|

|

F-statistic

|

3.744264

|

4.242996

|

23.09087

|

|

Log likelihood

|

55.56039

|

14.37487

|

31.01913

|

|

Akaike AIC

|

-2.678019

|

-0.618744

|

-1.450957

|

|

Schwarz SC

|

-2.593575

|

-0.534300

|

-1.366513

|

|

Mean dependent

|

0.018184

|

0.020999

|

0.034749

|

|

S.D. dependent

|

0.064037

|

0.180374

|

0.143077

|

|

Determinant resid covariance (dof adj.)

|

1.40E-06

|

|

|

Determinant resid covariance

|

1.20E-06

|

|

|

Log likelihood

|

102.4326

|

|

|

Akaike information criterion

|

-4.671629

|

|

|

Schwarz criterion

|

-4.291632

|

|

Acknowledgment

Acknowledgment

|