1.

TEST DE STATIONNARITE SUR LES VARIABLES

Tableau n° 15 : Stationarisation en

différence première du LCR

|

Null Hypothesis: D(LCRE) has a unit root

|

|

|

Exogenous: None

|

|

|

|

LagLength: 0 (Fixed)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

-4.137609

|

0.0001

|

|

Test critical values:

|

1% level

|

|

-2.621185

|

|

|

5% level

|

|

-1.948886

|

|

|

10% level

|

|

-1.611932

|

|

|

|

|

|

|

|

|

|

|

|

|

*MacKinnon (1996) one-sided p-values.

|

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller Test Equation

|

|

|

Dependent Variable: D(LCRE,2)

|

|

|

|

Method: Least Squares

|

|

|

|

Date: 07/10/15 Time: 19:02

|

|

|

|

Sample (adjusted): 2002Q3 2012Q4

|

|

|

Included observations: 42 afteradjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

D(LCRE(-1))

|

-0.570057

|

0.137775

|

-4.137609

|

0.0002

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Null Hypothesis: D(LIPC) has a unit root

|

|

|

Exogenous: None

|

|

|

|

LagLength: 0 (Fixed)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

-1.987775

|

0.0459

|

|

Test critical values:

|

1% level

|

|

-2.621185

|

|

|

5% level

|

|

-1.948886

|

|

|

10% level

|

|

-1.611932

|

|

|

|

|

|

|

|

|

|

|

|

|

*MacKinnon (1996) one-sided p-values.

|

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller Test Equation

|

|

|

Dependent Variable: D(LIPC,2)

|

|

|

|

Method: Least Squares

|

|

|

|

Date: 07/10/15 Time: 19:07

|

|

|

|

Sample (adjusted): 2002Q3 2012Q4

|

|

|

Included observations: 42 afteradjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

D(LIPC(-1))

|

-0.174420

|

0.087746

|

-1.987775

|

0.0535

|

|

|

|

|

|

|

|

|

|

|

Tableau n° 16 :

Stationnarisation en différence première du LIPC

Source : Calculs de l'auteur

à l'aide du logiciel E-views 7

Tableau n° 17 :

Stationnarisation en différence première du LPIB

|

Null Hypothesis: D(LPIB) has a unit root

|

|

|

Exogenous: Constant

|

|

|

|

LagLength: 0 (Fixed)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

-3.365975

|

0.0180

|

|

Test critical values:

|

1% level

|

|

-3.596616

|

|

|

5% level

|

|

-2.933158

|

|

|

10% level

|

|

-2.604867

|

|

|

|

|

|

|

|

|

|

|

|

|

*MacKinnon (1996) one-sided p-values.

|

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller Test Equation

|

|

|

Dependent Variable: D(LPIB,2)

|

|

|

|

Method: Least Squares

|

|

|

|

Date: 07/10/15 Time: 19:18

|

|

|

|

Sample (adjusted): 2002Q3 2012Q4

|

|

|

Included observations: 42 afteradjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

D(LPIB(-1))

|

-0.440737

|

0.130939

|

-3.365975

|

0.0017

|

|

C

|

0.006754

|

0.002173

|

3.107908

|

0.0035

|

|

|

|

|

|

|

|

|

|

|

Source : Calculs de l'auteur

à l'aide du logiciel E-views 7

Source : Calculs de l'auteur

à l'aide du logiciel E-views 7

Source : Calculs de l'auteur

à l'aide du logiciel E-views 7

Tableau n° 18 :

Stationnarisation en différence première du LTC

|

Null Hypothesis: D(LTC) has a unit root

|

|

|

Exogenous: None

|

|

|

|

Lag Length: 0 (Automatic - based on SIC, maxlag=9)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

-5.521838

|

0.0000

|

|

Test critical values:

|

1% level

|

|

-2.621185

|

|

|

5% level

|

|

-1.948886

|

|

|

10% level

|

|

-1.611932

|

|

|

|

|

|

|

|

|

|

|

|

|

*MacKinnon (1996) one-sided p-values.

|

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller Test Equation

|

|

|

Dependent Variable: D(LTC,2)

|

|

|

|

Method: Least Squares

|

|

|

|

Date: 07/10/15 Time: 19:21

|

|

|

|

Sample (adjusted): 2002Q3 2012Q4

|

|

|

Included observations: 42 afteradjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

D(LTC(-1))

|

-0.853002

|

0.154478

|

-5.521838

|

0.0000

|

|

|

|

|

|

|

|

|

|

|

Sourc

e : Calculs de l'auteur à

l'aide du logiciel E-views 7

Tableau n°19 : Test

de causalité de granger

|

Pairwise Granger Causality Tests

|

|

Date: 07/10/15 Time: 20:10

|

|

Sample: 2002Q1 2012Q4

|

|

|

Lags: 1

|

|

|

|

|

|

|

|

|

|

|

|

NullHypothesis:

|

Obs

|

F-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

DLCRE does not Granger Cause DLPIB

|

42

|

0.07872

|

0.7805

|

|

DLPIB does not Granger Cause DLCRE

|

4.37488

|

0.0430

|

|

|

|

|

|

|

|

|

|

DLTC does not Granger Cause DLPIB

|

42

|

0.49641

|

0.4853

|

|

DLPIB does not Granger Cause DLTC

|

0.06966

|

0.7932

|

|

|

|

|

|

|

|

|

|

DLIPC does not Granger Cause DLPIB

|

42

|

3.42962

|

0.0716

|

|

DLPIB does not Granger Cause DLIPC

|

0.31323

|

0.5789

|

|

|

|

|

|

|

|

|

|

DLTC does not Granger Cause DLCRE

|

42

|

3.32393

|

0.0760

|

|

DLCRE does not Granger Cause DLTC

|

0.13255

|

0.7178

|

|

|

|

|

|

|

|

|

|

DLIPC does not Granger Cause DLCRE

|

42

|

3.40013

|

0.0728

|

|

DLCRE does not Granger Cause DLIPC

|

0.35800

|

0.5531

|

|

|

|

|

|

|

|

|

|

DLIPC does not Granger Cause DLTC

|

42

|

0.32426

|

0.5723

|

|

DLTC does not Granger Cause DLIPC

|

4.72940

|

0.0358

|

|

|

|

|

|

|

|

|

Tableau 2O : ESTIMATION

DU VAR

1.ESTIMATION DU

VAR(1)

|

VectorAutoregressionEstimates

|

|

|

|

Date: 07/10/15 Time: 20:34

|

|

|

|

Sample (adjusted): 2002Q3 2012Q4

|

|

|

|

Included observations: 42 afteradjustments

|

|

|

Standard errors in ( ) & t-statistics in [ ]

|

|

|

|

|

|

|

|

|

|

|

|

|

DLTC

|

DLIPC

|

DLPIB

|

DLCRE

|

|

|

|

|

|

|

|

|

|

|

|

DLTC(-1)

|

0.107896

|

0.207482

|

0.002420

|

-0.292308

|

|

(0.20434)

|

(0.09819)

|

(0.01816)

|

(0.30418)

|

|

[ 0.52803]

|

[ 2.11313]

|

[ 0.13322]

|

[-0.96096]

|

|

|

|

|

|

|

DLIPC(-1)

|

-0.219457

|

0.512560

|

-0.045276

|

-0.279235

|

|

(0.30599)

|

(0.14703)

|

(0.02720)

|

(0.45550)

|

|

[-0.71721]

|

[ 3.48607]

|

[-1.66461]

|

[-0.61302]

|

|

|

|

|

|

|

DLPIB(-1)

|

-0.641748

|

0.503108

|

0.466517

|

3.373542

|

|

(1.61599)

|

(0.77650)

|

(0.14364)

|

(2.40563)

|

|

[-0.39712]

|

[ 0.64791]

|

[ 3.24772]

|

[ 1.40235]

|

|

|

|

|

|

|

DLCRE(-1)

|

-0.038597

|

-0.022361

|

-0.001112

|

-0.043746

|

|

(0.10475)

|

(0.05033)

|

(0.00931)

|

(0.15593)

|

|

[-0.36847]

|

[-0.44426]

|

[-0.11947]

|

[-0.28054]

|

|

|

|

|

|

|

C

|

0.044943

|

0.011375

|

0.010250

|

0.081534

|

|

(0.03286)

|

(0.01579)

|

(0.00292)

|

(0.04891)

|

|

[ 1.36786]

|

[ 0.72046]

|

[ 3.50944]

|

[ 1.66699]

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.018626

|

0.460327

|

0.369117

|

0.159525

|

|

Adj. R-squared

|

-0.087469

|

0.401984

|

0.300914

|

0.068663

|

|

Sum sq. resids

|

0.169449

|

0.039125

|

0.001339

|

0.375508

|

|

S.E. equation

|

0.067674

|

0.032518

|

0.006015

|

0.100742

|

|

F-statistic

|

0.175557

|

7.890023

|

5.411997

|

1.755684

|

|

Log likelihood

|

56.17491

|

86.95670

|

157.8301

|

39.46463

|

|

Akaike AIC

|

-2.436900

|

-3.902700

|

-7.277622

|

-1.641173

|

|

Schwarz SC

|

-2.230035

|

-3.695834

|

-7.070756

|

-1.434307

|

|

Meandependent

|

0.024032

|

0.044809

|

0.015141

|

0.107987

|

|

S.D. dependent

|

0.064895

|

0.042050

|

0.007195

|

0.104389

|

|

|

|

|

|

|

|

|

|

|

|

Determinant resid covariance (dof adj.)

|

6.89E-13

|

|

|

|

Determinantresid covariance

|

4.15E-13

|

|

|

|

Log likelihood

|

360.3405

|

|

|

|

Akaike information criterion

|

-16.20669

|

|

|

|

Schwarz criterion

|

-15.37923

|

|

|

|

|

|

|

|

|

|

|

|

|

Source : Calculs de l'auteur

à l'aide du logiciel E-views 7

1. ANALYSE

DYNAMIQUE

Graphique 2 : Réponses

impulsionnelles

Source : Calculs de l'auteur

à l'aide du logiciel E-views 7

Tableau 21 :

Décomposition de la variance

|

|

|

|

|

|

|

|

|

|

|

|

|

Variance Decomposition of DLTC:

|

|

|

|

|

|

|

Period

|

S.E.

|

DLTC

|

DLIPC

|

DLPIB

|

DLCRE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1

|

0.067674

|

100.0000

|

0.000000

|

0.000000

|

0.000000

|

|

2

|

0.068052

|

98.94231

|

0.514105

|

0.289580

|

0.254000

|

|

3

|

0.068221

|

98.61624

|

0.574189

|

0.555151

|

0.254417

|

|

4

|

0.068261

|

98.54769

|

0.573745

|

0.622220

|

0.256347

|

|

5

|

0.068266

|

98.53385

|

0.576315

|

0.633120

|

0.256710

|

|

6

|

0.068268

|

98.53041

|

0.578511

|

0.634376

|

0.256699

|

|

7

|

0.068269

|

98.52948

|

0.579337

|

0.634485

|

0.256700

|

|

8

|

0.068270

|

98.52925

|

0.579556

|

0.634492

|

0.256706

|

|

9

|

0.068270

|

98.52919

|

0.579606

|

0.634493

|

0.256709

|

|

10

|

0.068270

|

98.52918

|

0.579616

|

0.634493

|

0.256710

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Variance Decomposition of DLIPC:

|

|

|

|

|

|

|

Period

|

S.E.

|

DLTC

|

DLIPC

|

DLPIB

|

DLCRE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1

|

0.032518

|

46.06213

|

53.93787

|

0.000000

|

0.000000

|

|

2

|

0.041983

|

59.25786

|

40.02934

|

0.488799

|

0.224002

|

|

3

|

0.044055

|

61.70960

|

37.35262

|

0.586692

|

0.351087

|

|

4

|

0.044386

|

62.12957

|

36.90057

|

0.589801

|

0.380066

|

|

5

|

0.044426

|

62.18400

|

36.84281

|

0.588733

|

0.384461

|

|

6

|

0.044430

|

62.18945

|

36.83650

|

0.589134

|

0.384920

|

|

7

|

0.044431

|

62.18988

|

36.83571

|

0.589455

|

0.384955

|

|

8

|

0.044431

|

62.18992

|

36.83557

|

0.589560

|

0.384957

|

|

9

|

0.044431

|

62.18993

|

36.83553

|

0.589584

|

0.384958

|

|

10

|

0.044431

|

62.18993

|

36.83552

|

0.589589

|

0.384958

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Variance Decomposition of DLPIB:

|

|

|

|

|

|

|

Period

|

S.E.

|

DLTC

|

DLIPC

|

DLPIB

|

DLCRE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1

|

0.006015

|

5.233447

|

2.447857

|

92.31870

|

0.000000

|

|

2

|

0.006939

|

8.794009

|

6.684828

|

84.50087

|

0.020293

|

|

3

|

0.007343

|

13.48400

|

8.818370

|

77.67656

|

0.021069

|

|

4

|

0.007522

|

16.15959

|

9.464995

|

74.33959

|

0.035823

|

|

5

|

0.007585

|

17.19136

|

9.615218

|

73.14666

|

0.046757

|

|

6

|

0.007604

|

17.50595

|

9.645541

|

72.79727

|

0.051238

|

|

7

|

0.007609

|

17.58868

|

9.651480

|

72.70724

|

0.052596

|

|

8

|

0.007610

|

17.60876

|

9.652739

|

72.68556

|

0.052942

|

|

9

|

0.007610

|

17.61353

|

9.653043

|

72.68041

|

0.053024

|

|

10

|

0.007610

|

17.61467

|

9.653124

|

72.67916

|

0.053042

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Variance Decompositionof DLCRE:

|

|

|

|

|

|

|

Period

|

S.E.

|

DLTC

|

DLIPC

|

DLPIB

|

DLCRE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1

|

0.100742

|

21.79763

|

0.388271

|

0.014707

|

77.79939

|

|

2

|

0.108233

|

27.98171

|

1.210369

|

3.276086

|

67.53183

|

|

3

|

0.109303

|

28.40759

|

1.543730

|

3.816499

|

66.23218

|

|

4

|

0.109766

|

28.70628

|

1.708388

|

3.909788

|

65.67555

|

|

5

|

0.109940

|

28.84464

|

1.766857

|

3.919206

|

65.46930

|

|

6

|

0.109999

|

28.89676

|

1.784058

|

3.918980

|

65.40020

|

|

7

|

0.110016

|

28.91295

|

1.788535

|

3.918574

|

65.37994

|

|

8

|

0.110021

|

28.91738

|

1.789632

|

3.918450

|

65.37453

|

|

9

|

0.110022

|

28.91851

|

1.789897

|

3.918424

|

65.37317

|

|

10

|

0.110023

|

28.91879

|

1.789963

|

3.918419

|

65.37283

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cholesky Ordering: DLTC DLIPC DLPIB DLCRE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

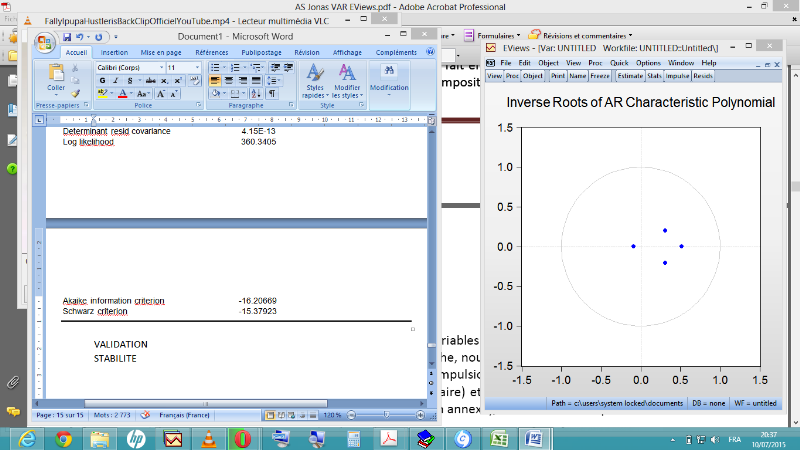

1. TEST

D'HYPOTHESE

a.

Test de stabilité du var

Graphique 3 :Test de

stabilité du var

Source : Calculs de l'auteur

à l'aide du logiciel E-views 7

b. Test d'auto corrélation

d'erreurs

Tableau 22 : Test d'auto corrélation

d'erreurs

|

VAR Residual Serial Correlation LM Tests

|

|

Null Hypothesis: no serial correlation at lag order h

|

|

Date: 07/10/15 Time: 20:39

|

|

Sample: 2002Q1 2012Q4

|

|

Included observations: 42

|

|

|

|

|

|

|

|

Lags

|

LM-Stat

|

Prob

|

|

|

|

|

|

|

|

1

|

14.97460

|

0.5265

|

|

2

|

16.57455

|

0.4136

|

|

3

|

15.73225

|

0.4718

|

|

4

|

45.14240

|

0.5341

|

|

5

|

6.628386

|

0.9798

|

|

|

|

|

|

|

|

|

|

|

Probs from chi-square with 16 df.

|

c. Test

d'hétéroscedasticité

Tableau 23 :Test

d'hétéroscedasticité

|

VAR Residual Heteroskedasticity Tests: Includes Cross Terms

|

|

|

Date: 07/10/15 Time: 20:41

|

|

|

|

|

Sample: 2002Q1 2012Q4

|

|

|

|

|

Included observations: 42

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Joint test:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chi-sq

|

Df

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

125.5734

|

140

|

0.8033

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Individual components:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dependent

|

R-squared

|

F(14,27)

|

Prob.

|

Chi-sq(14)

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

res1*res1

|

0.393438

|

1.250942

|

0.2983

|

16.52440

|

0.2824

|

|

res2*res2

|

0.319592

|

0.905862

|

0.5631

|

13.42286

|

0.4935

|

|

res3*res3

|

0.181868

|

0.428715

|

0.9505

|

7.638452

|

0.9073

|

|

res4*res4

|

0.262779

|

0.687431

|

0.7666

|

11.03672

|

0.6831

|

|

res2*res1

|

0.318392

|

0.900874

|

0.5677

|

13.37248

|

0.4974

|

|

res3*res1

|

0.476979

|

1.758800

|

0.1011

|

20.03313

|

0.1291

|

|

res3*res2

|

0.319516

|

0.905546

|

0.5634

|

13.41967

|

0.4938

|

|

res4*res1

|

0.252668

|

0.652036

|

0.7979

|

10.61204

|

0.7162

|

|

res4*res2

|

0.263308

|

0.689309

|

0.7649

|

11.05893

|

0.6814

|

|

res4*res3

|

0.358971

|

1.079986

|

0.4155

|

15.07680

|

0.3729

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Source : Calculs de l'auteur

à l'aide du logiciel E-views 7

|