ANNEXE

ANNEXE 1

|

ANNEES

|

TCE

|

PTN

|

PIB/hab.

en %

|

TX INF

|

MM

|

|

1992

|

265

|

-10.4

|

217.49

|

2730

|

448874919

|

|

1993

|

283

|

-13.5

|

272.76

|

4583

|

20817217315

|

|

1994

|

555

|

-3.9

|

142.97

|

9796.9

|

531907

|

|

1995

|

499

|

0.7

|

134.33

|

370

|

2464978

|

|

1996

|

512

|

1.1

|

133.84

|

1705

|

13698948

|

|

1997

|

2.45

|

-5.4

|

138.18

|

14

|

21323175

|

|

1998

|

2.4

|

-1.7

|

138.24

|

135

|

665298765

|

|

1999

|

4.5

|

-4.3

|

102.67

|

484

|

3915273633

|

|

2000

|

50.0

|

-6.9

|

406.57

|

511.2

|

23558063993

|

|

2001

|

311.6

|

-2.1

|

154.42

|

135.09

|

77143732

|

|

2002

|

382.1

|

3.5

|

176.26

|

15.8

|

98832881

|

|

2003

|

405.0

|

5.8

|

175.34

|

4.44

|

130119

|

|

2004

|

398.3

|

6.6

|

196.19

|

9.22

|

222227

|

|

2005

|

473.8

|

7.8

|

221.45

|

21.27

|

277111

|

|

2006

|

468.0

|

5.3

|

257.17

|

18.2

|

436922

|

|

2007

|

516.7

|

6.3

|

286.14

|

9.96

|

658834

|

|

2008

|

561.1

|

6.2

|

326.14

|

28

|

382543

|

|

2009

|

806.5

|

2.9

|

301.93

|

53.44

|

502160

|

|

2010

|

905.9

|

7.1

|

346.70

|

9.84

|

466073

|

|

2011

|

919.4

|

6.9

|

404.11

|

15.43

|

434006

|

|

2012

|

919.4

|

7.1

|

446.03

|

2.7

|

509285

|

|

2013

|

919.7

|

8.5

|

484.21

|

1.07

|

540316

|

|

2014

|

925.2

|

9.5

|

462.6

|

1.03

|

472432

|

|

2015

|

926.0

|

6.9

|

442

|

0.82

|

390177

|

|

2016

|

1010.3

|

2.4

|

513.2

|

23.6

|

281939

|

82

ANNEXE 2

Method: Least Squares

Date: 01/04/20 Time: 07:06 Sample: 1992 2016

|

Included observations: 25

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error t-Statistic

|

Prob.

|

|

C

|

-10.95760

|

71.50739 -0.153237

|

0.8797

|

|

LPPTN

|

17.21741

|

7.706508 2.234139

|

0.0371

|

|

LPIBH

|

1.800403

|

0.272798 6.599771

|

0.0000

|

|

LTXINF

|

0.048575

|

0.015217 3.192126

|

0.0046

|

|

LMM

|

-1.80E-08

|

6.60E-09 -2.734512

|

0.0128

|

|

R-squared

|

0.854728

|

Mean dependent var

|

520.8940

|

|

Adjusted R-squared

|

0.825673

|

S.D. dependent var

|

324.1368

|

|

S.E. of regression

|

135.3350

|

Akaike info criterion

|

12.83024

|

|

Sum squared resid

|

366311.3

|

Schwarz criterion

|

13.07402

|

|

Log likelihood

|

-155.3780

|

Hannan-Quinn criter.

|

12.89785

|

|

F-statistic

|

29.41817

|

Durbin-Watson stat

|

1.687390

|

|

Prob(F-statistic)

|

0.000000

|

|

|

|

LTCH

|

LPPTN

|

LPIBH

|

LTXINF

|

LMM

|

|

LTCH

|

1

|

0.67838193

|

0.73870718

|

-

|

-

|

|

|

26287626

|

22105079

|

0.12197802

|

0.38849554

|

|

|

|

|

76351747

|

81806467

|

|

LPPTN

|

0.67838193

|

1

|

0.42388928

|

-

|

-

|

|

26287626

|

|

16356769

|

0.52240721

|

0.60079413

|

|

|

|

|

62729525

|

66820976

|

|

LPIBH

|

0.73870718

|

0.42388928

|

1

|

-

|

0.11597393

|

|

22105079

|

16356769

|

|

0.26849017

|

5091608

|

|

|

|

|

83017969

|

|

|

LTXINF

|

-

|

-

|

-

|

1

|

0.21974828

|

|

0.12197802

|

0.52240721

|

0.26849017

|

|

6937497

|

|

76351747

|

62729525

|

83017969

|

|

|

|

LMM

|

-

|

-

|

0.11597393

|

0.21974828

|

1

|

|

0.38849554

|

0.60079413

|

5091608

|

6937497

|

|

|

81806467

|

66820976

|

|

|

|

83

ANNEXE 3

Breusch-Godfrey Serial Correlation LM Test:

F-statistic 0.338495 Prob. F(2,18) 0.7173

Obs*R-squared 0.906183 Prob. Chi-Square(2) 0.6357

Test Equation:

Dependent Variable: RESID

Method: Least Squares

Date: 01/04/20 Time: 07:25

Sample: 1992 2016

Included observations: 25

Presample missing value lagged residuals set to zero.

Variable Coefficient Std. Error t-Statistic Prob.

C 11.24339 75.29343 0.149328 0.8830

LPPTN -1.195170 8.172084 -0.146250 0.8853

LPIBH -0.013440 0.284212 -0.047290 0.9628

LTXINF -0.005967 0.017340 -0.344140 0.7347

LMM -1.44E-10 7.20E-09 -0.019982 0.9843

RESID(-1) 0.198094 0.259463 0.763478 0.4551

RESID(-2) -0.106927 0.250501 -0.426854 0.6745

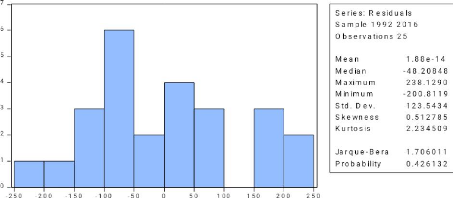

R-squared 0.036247 Mean dependent var 1.88E-14

Adjusted R-squared -0.285004 S.D. dependent var 123.5434

S.E. of regression 140.0463 Akaike info criterion 12.95332

Sum squared resid 353033.5 Schwarz criterion 13.29460

Log likelihood -154.9165 Hannan-Quinn criter. 13.04798

Heteroskedasticity Test: White

F-statistic 1.191830 Prob. F(4,20) 0.3448

Obs*R-squared 4.812108 Prob. Chi-Square(4) 0.3071

Scaled explained SS 1.900990 Prob. Chi-Square(4) 0.7540

Test Equation:

Dependent Variable: RESID^2 Method: Least Squares

84

Date: 01/04/20 Time: 07:28 Sample: 1992 2016

|

Included observations: 25

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error t-Statistic

|

Prob.

|

|

C

|

22153.42

|

5924.288 3.739423

|

0.0013

|

|

LPPTN^2

|

-91.40968

|

96.53994 -0.946859

|

0.3550

|

|

LPIBH^2

|

-0.057120

|

0.044585 -1.281145

|

0.2148

|

|

LTXINF^2

|

-6.58E-05

|

0.000177 -0.371908

|

0.7139

|

|

LMM^2

|

4.71E-17

|

2.76E-17 1.704239

|

0.1038

|

|

R-squared

|

0.192484

|

Mean dependent var

|

14652.45

|

|

Adjusted R-squared

|

0.030981

|

S.D. dependent var

|

16615.82

|

|

S.E. of regression

|

16356.41

|

Akaike info criterion

|

22.41948

|

|

Sum squared resid

|

5.35E+09

|

Schwarz criterion

|

22.66326

|

|

Log likelihood

|

-275.2435

|

Hannan-Quinn criter.

|

22.48710

|

|

F-statistic

|

1.191830

|

Durbin-Watson stat

|

1.236968

|

|

Prob(F-statistic)

|

0.344836

|

|

|

|

ANNEXE 3

|

|

|

|

|

Estimation Command:

|

|

|

|

=========================

LS LTCH C LPPTN LPIBH LTXINF LMM

Estimation Equation:

=========================

LTCH = C(1) + C(2)*LPPTN + C(3)*LPIBH + C(4)*LTXINF + C(5)*LMM

Substituted Coefficients:

=========================

LTCH = -10.957596851 + 17.2174083778*LPPTN + 1.80040292806*LPIBH

+ 0.0485749181651*LTXINF - 1.80464258989e-08*LMM

Null Hypothesis: D(LTCH) has a unit root

Exogenous: Constant, Linear Trend

Lag Length: 0 (Automatic - based on SIC, maxlag=5)

t-Statistic

Elliott-Rothenberg-Stock DF-GLS test statistic

-4.447647

Test critical values: 1% level -3.770000

5% level -3.190000

10% level -2.890000

*Elliott-Rothenberg-Stock (1996, Table 1)

Warning: Test critical values calculated for 50 observations and

may not be accurate for a sample size of 23

DF-GLS Test Equation on GLS Detrended Residuals

Dependent Variable: D(GLSRESID)

Method: Least Squares

Date: 10/05/18 Time: 14:05

Sample (adjusted): 1994 2016

Included observations: 23 after adjustments

Variable Coefficient Std. Error t-Statistic Prob.

GLSRESID(-1) -0.947297 0.212988 -4.447647 0.0002

85

|

R-squared

|

0.473450

|

Mean dependent var

|

0.415909

|

|

Adjusted R-squared

|

0.473450

|

S.D. dependent var

|

201.2123

|

|

S.E. of regression

|

146.0073

|

Akaike info criterion

|

12.84769

|

|

Sum squared resid

|

468998.7

|

Schwarz criterion

|

12.89706

|

|

Log likelihood

|

-146.7485

|

Hannan-Quinn criter.

|

12.86011

|

|

Durbin-Watson stat

|

1.872651

|

|

|

|

Heteroskedasticity Test: White

|

|

|

|

F-statistic

|

1.189716

|

Prob. F(4,20)

|

0.3457

|

|

Obs*R-squared

|

4.805211

|

Prob. Chi-Square(4)

|

0.3079

|

|

Scaled explained SS

|

1.896229

|

Prob. Chi-Square(4)

|

0.7548

|

Test Equation:

Dependent Variable: RESID^2 Method: Least Squares Date: 10/05/18

Time: 13:56 Sample: 1992 2016

|