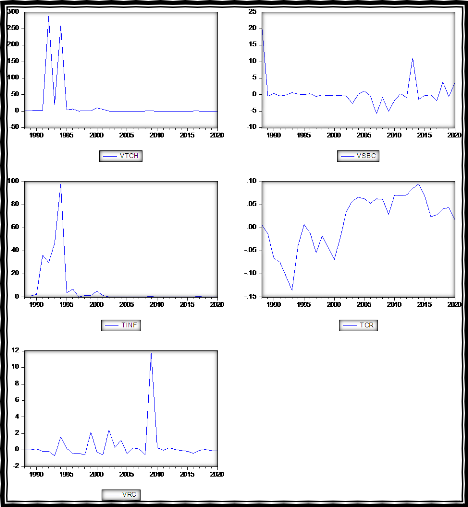

ANNEXE 2 : GRAPHIQUES

ANNEXE 3 : TESTS DE STATIONNARITE

3.1. Test de stationnarité de la variation du taux de

change

|

Null Hypothesis: VTCH has a unit root

|

|

|

Exogenous: Constant

|

|

|

|

Lag Length: 8 (Automatic - based on SIC, maxlag=8)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

-9.755488

|

0.0000

|

|

Test critical values:

|

1% level

|

|

-3.737853

|

|

|

5% level

|

|

-2.991878

|

|

|

10% level

|

|

-2.635542

|

|

|

|

|

|

|

|

|

|

|

|

|

*MacKinnon (1996) one-sided p-values.

|

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller Test Equation

|

|

|

Dependent Variable: D(VTCH)

|

|

|

|

Method: Least Squares

|

|

|

|

Date: 08/02/21 Time: 14:54

|

|

|

|

Sample (adjusted): 1997 2020

|

|

|

|

Included observations: 24 after adjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

VTCH(-1)

|

-1.377532

|

0.141206

|

-9.755488

|

0.0000

|

|

D(VTCH(-1))

|

0.488990

|

0.110383

|

4.429924

|

0.0006

|

|

D(VTCH(-2))

|

-0.053407

|

0.012406

|

-4.305024

|

0.0007

|

|

D(VTCH(-3))

|

-0.042704

|

0.010110

|

-4.223821

|

0.0009

|

|

D(VTCH(-4))

|

-0.048336

|

0.003400

|

-14.21582

|

0.0000

|

|

D(VTCH(-5))

|

-0.053824

|

0.004756

|

-11.31598

|

0.0000

|

|

D(VTCH(-6))

|

-0.033008

|

0.007826

|

-4.217604

|

0.0009

|

|

D(VTCH(-7))

|

-0.027853

|

0.006754

|

-4.123965

|

0.0010

|

|

D(VTCH(-8))

|

-0.010032

|

0.002615

|

-3.836079

|

0.0018

|

|

C

|

0.097494

|

0.038479

|

2.533666

|

0.0239

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.998107

|

Mean dependent var

|

-0.251782

|

|

Adjusted R-squared

|

0.996891

|

S.D. dependent var

|

2.760936

|

|

S.E. of regression

|

0.153955

|

Akaike info criterion

|

-0.609977

|

|

Sum squared resid

|

0.331830

|

Schwarz criterion

|

-0.119121

|

|

Log likelihood

|

17.31972

|

Hannan-Quinn criter.

|

-0.479753

|

|

F-statistic

|

820.3289

|

Durbin-Watson stat

|

1.819583

|

|

Prob(F-statistic)

|

0.000000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.2. Test de stationnarité de la variation du solde de la

balance commerciale

|

Null Hypothesis: VSBC has a unit root

|

|

|

Exogenous: None

|

|

|

|

Lag Length: 0 (Automatic - based on SIC, maxlag=8)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

-9.665946

|

0.0000

|

|

Test critical values:

|

1% level

|

|

-2.639210

|

|

|

5% level

|

|

-1.951687

|

|

|

10% level

|

|

-1.610579

|

|

|

|

|

|

|

|

|

|

|

|

|

*MacKinnon (1996) one-sided p-values.

|

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller Test Equation

|

|

|

Dependent Variable: D(VSBC)

|

|

|

|

Method: Least Squares

|

|

|

|

Date: 08/02/21 Time: 14:55

|

|

|

|

Sample (adjusted): 1989 2020

|

|

|

|

Included observations: 32 after adjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

VSBC(-1)

|

-1.042406

|

0.107843

|

-9.665946

|

0.0000

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.748459

|

Mean dependent var

|

-0.526477

|

|

Adjusted R-squared

|

0.748459

|

S.D. dependent var

|

5.442570

|

|

S.E. of regression

|

2.729662

|

Akaike info criterion

|

4.876984

|

|

Sum squared resid

|

230.9826

|

Schwarz criterion

|

4.922788

|

|

Log likelihood

|

-77.03174

|

Hannan-Quinn criter.

|

4.892167

|

|

Durbin-Watson stat

|

1.995314

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.3. Test de stationnarité du taux d'inflation

|

Null Hypothesis: TINF has a unit root

|

|

|

Exogenous: None

|

|

|

|

Lag Length: 5 (Automatic - based on SIC, maxlag=8)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

-2.134307

|

0.0338

|

|

Test critical values:

|

1% level

|

|

-2.653401

|

|

|

5% level

|

|

-1.953858

|

|

|

10% level

|

|

-1.609571

|

|

|

|

|

|

|

|

|

|

|

|

|

*MacKinnon (1996) one-sided p-values.

|

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller Test Equation

|

|

|

Dependent Variable: D(TINF)

|

|

|

|

Method: Least Squares

|

|

|

|

Date: 08/02/21 Time: 15:30

|

|

|

|

Sample (adjusted): 1994 2020

|

|

|

|

Included observations: 27 after adjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

TINF(-1)

|

-0.514348

|

0.240991

|

-2.134307

|

0.0448

|

|

D(TINF(-1))

|

-0.141192

|

0.246527

|

-0.572723

|

0.5729

|

|

D(TINF(-2))

|

-0.037143

|

0.230075

|

-0.161437

|

0.8733

|

|

D(TINF(-3))

|

0.158849

|

0.222168

|

0.714993

|

0.4825

|

|

D(TINF(-4))

|

-0.057315

|

0.214260

|

-0.267501

|

0.7917

|

|

D(TINF(-5))

|

-0.061202

|

0.188836

|

-0.324100

|

0.7491

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.400974

|

Mean dependent var

|

-1.717126

|

|

Adjusted R-squared

|

0.258349

|

S.D. dependent var

|

21.07055

|

|

S.E. of regression

|

18.14577

|

Akaike info criterion

|

8.827882

|

|

Sum squared resid

|

6914.651

|

Schwarz criterion

|

9.115846

|

|

Log likelihood

|

-113.1764

|

Hannan-Quinn criter.

|

8.913509

|

|

Durbin-Watson stat

|

1.927106

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.4. Test de stationnarité de la variation des

réserves de change

|

Null Hypothesis: VRC has a unit root

|

|

|

Exogenous: None

|

|

|

|

Lag Length: 0 (Automatic - based on SIC, maxlag=8)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

-5.793023

|

0.0000

|

|

Test critical values:

|

1% level

|

|

-2.639210

|

|

|

5% level

|

|

-1.951687

|

|

|

10% level

|

|

-1.610579

|

|

|

|

|

|

|

|

|

|

|

|

|

*MacKinnon (1996) one-sided p-values.

|

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller Test Equation

|

|

|

Dependent Variable: D(VRC)

|

|

|

|

Method: Least Squares

|

|

|

|

Date: 08/02/21 Time: 15:45

|

|

|

|

Sample (adjusted): 1989 2020

|

|

|

|

Included observations: 32 after adjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

VRC(-1)

|

-1.039694

|

0.179473

|

-5.793023

|

0.0000

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.519819

|

Mean dependent var

|

-0.005277

|

|

Adjusted R-squared

|

0.519819

|

S.D. dependent var

|

3.233151

|

|

S.E. of regression

|

2.240416

|

Akaike info criterion

|

4.481951

|

|

Sum squared resid

|

155.6033

|

Schwarz criterion

|

4.527755

|

|

Log likelihood

|

-70.71122

|

Hannan-Quinn criter.

|

4.497134

|

|

Durbin-Watson stat

|

1.999649

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.5. Test de stationnarité du taux de croissance

économique

|

Null Hypothesis: TCR has a unit root

|

|

|

Exogenous: None

|

|

|

|

Lag Length: 12 (Fixed)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

-2.294622

|

0.0244

|

|

Test critical values:

|

1% level

|

|

-2.685718

|

|

|

5% level

|

|

-1.959071

|

|

|

10% level

|

|

-1.607456

|

|

|

|

|

|

|

|

|

|

|

|

|

*MacKinnon (1996) one-sided p-values.

|

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller Test Equation

|

|

|

Dependent Variable: D(TCR)

|

|

|

|

Method: Least Squares

|

|

|

|

Date: 08/02/21 Time: 15:48

|

|

|

|

Sample (adjusted): 2001 2020

|

|

|

|

Included observations: 20 after adjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

TCR(-1)

|

-0.442256

|

0.192736

|

-2.294622

|

0.0554

|

|

D(TCR(-1))

|

0.325871

|

0.308628

|

1.055868

|

0.3261

|

|

D(TCR(-2))

|

-0.058433

|

0.298844

|

-0.195529

|

0.8505

|

|

D(TCR(-3))

|

0.075294

|

0.281501

|

0.267474

|

0.7968

|

|

D(TCR(-4))

|

0.248649

|

0.259891

|

0.956742

|

0.3706

|

|

D(TCR(-5))

|

0.091493

|

0.287894

|

0.317803

|

0.7599

|

|

D(TCR(-6))

|

0.322713

|

0.303441

|

1.063511

|

0.3229

|

|

D(TCR(-7))

|

0.577637

|

0.237818

|

2.428904

|

0.0455

|

|

D(TCR(-8))

|

0.347975

|

0.223838

|

1.554582

|

0.1640

|

|

D(TCR(-9))

|

0.524154

|

0.235559

|

2.225151

|

0.0614

|

|

D(TCR(-10))

|

0.329311

|

0.285130

|

1.154950

|

0.2860

|

|

D(TCR(-11))

|

0.173806

|

0.244397

|

0.711165

|

0.5000

|

|

D(TCR(-12))

|

0.430464

|

0.253938

|

1.695151

|

0.1339

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.667941

|

Mean dependent var

|

0.004295

|

|

Adjusted R-squared

|

0.098696

|

S.D. dependent var

|

0.025782

|

|

S.E. of regression

|

0.024476

|

Akaike info criterion

|

-4.332053

|

|

Sum squared resid

|

0.004194

|

Schwarz criterion

|

-3.684827

|

|

Log likelihood

|

56.32053

|

Hannan-Quinn criter.

|

-4.205707

|

|

Durbin-Watson stat

|

1.835663

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|