DEDICATION

To the Almighty God

To my late parents

To my late

brother KALISA P.

To my brother KWIZERA J D

To the family HABIRYAYO

Cyprien

To my friends and relatives

I dedicate this dissertation

«God bless you»

II

DECLARATION

I, KABERA Lambert, hereby declare that this dissertation

entitled «The use of accounting ratios in decision making» is my own

work and it has not been submitted anywhere for the award of any degree

Student's Names

Student's signature

III

ACKNOWLDGEMENT

I am thankful to many individuals who have contributed to the

accomplishment of this dissertation. Special appreciation goes to my director

Prof RAMA B. RAO for his pieces of advice and corrections throughout the course

of the course of this research.

Further thanks go to the Faculty of Economics and Management

especially to the Head of the Management Department and all lecturers for their

tireless efforts towards the accomplishment of this dissertation in particular

and the completion of my course in general.

I further convey my gratitude to the family Habiryayo Cyprien,

the family Munyengabe Joseph, the family Munyanziza Andre, my cousins, brother

and sisters for their financial and moral support rendered to me over since I

lost my both parents.

My thanks go especially to Mrs Kabarere Venantie for her role

played in the darkness event that I passed through, also for both my

grandmothers, uncles and aunts I do recognize their effort to help me to

recover when I lost my parents.

Further appreciation goes to my friends Ndati, Kibonge Sam,

Hilde, Tiro, Makombe, Muhire and I would like to extent my heart-felt

appreciation to all BAS Year IV 2005-2009 friends for their co-operation during

my stay at NUR.

Last but not least, my best regards go to the Government of

Rwanda that granted me a Scholar ship at the National University of Rwanda as

well as for AMAZI YA HUYE management staff for being cooperative with me to

conduct my research on their company.

iv

TABLE OF CONTENTS

DEDICATION I

DECLARATION II

ACKNOWLDGEMENT III

TABLE OF CONTENTS IV

LIST OF ACCRONYMES AND ABBREVIATIONS VII

LIST OF TABLES VIII

LIST OF FIGURES IX

ABSTRACT XI

CHAPTER 1 1

INTRODUCTION 1

1 1 BACKGROUND OF THE STUDY 1

1 2 STATEMENT OF THE PROBLEM 2

1 3 RESEARCH QUESTIONS 3

1 4 OBJECTIVES OF THE STUDY 3

1 5 HYPOTHESES 3

1 6 SIGNIFICANCE OF THE STUDY 4

1 7 SCOPE OF THE STUDY 4

1 8 ORGANIZATION OF THE STUDY 4

CHAPTER II 6

LITERATURE REVIEW 6

2.0 INTRODUCTION 6

2 1 DEFINITION OF KEY TERMS 6

2 1 1 Accounting 6

2 1 2 Ratios 6

2.1.3 Accounting ratios 6

2 1 4 Financial ratios 7

2 1 5 Decision making 7

2 2 ESSENCE OF RATIOS ANALYSIS 7

2 3 STANDARDS OF COMPARISON 7

2 3 1 Time series analysis 8

2 3 2 Pro forma analysis 8

2 3 3 Industry analysis 8

2 3 4 Cross-sectional analysis 9

2 4 TYPES OF ANALYSIS USING ACCOUNTING RATIOS IN DECISIONS MAKING

9

2 4 1 Analyzing Liquidity 9

V

2.4.2 Analyzing Debt 9

2 4 3 Analyzing Sales and Profita bility 10

2 4 4 Analyzing Efficiency 12

2.4.5 Multiple Discriminant Analysis 12

2.4.6 Trend Analysis 13

2.5 THE COMPONENTS OF DECISION MAKING 13

2.5.1 Decision environment 13

2.5.2 Decision Model 14

2.6 USES AND LIMITATIONS OF RATIO ANALYSIS 15

2.6.1 Uses 15

2.6.2 Limitations 15

CHAPITER III 16

METHODOLOGY 16

3 0 INTRODUCTION 16

3 1 RESEARCH DESIGN 16

3 1 1 The analyti cal research 16

3 2 POPULATION OF THE STUDY 17

3 3 SOURCES OF DATA 17

3 3 1 Primary Data 17

3 3 2 Secondary Data 18

3 4 DATA COLLECTION TECHNIQUES 18

3 4 1 Documentary Review 18

3 4 2 Document Analysis 18

3 4 3 Interview Guide 19

3 4 4 Sample size and selection 19

3 5 SAMPLING TECHNIQUE 19

3 6 DATA PROCESSING AND ANALYSIS 19

3 7 STUDY LIMITATIONS 20

CHAPTER IV 21

DATA ANALYSIS AND INTERPRETATION 21

4 1 INTRODUCTION 21

4 2 THE PROFILE OF AMAZI YA HUYE 21

4 1 2 AMAZI YA HUYE location 21

4 3 AMAZI YA HUYE'S MISSION 22

4 4 AMAZI YA HUYE'S OBJECTIVES 22

4 5 THE ENVIRONMENT OF AMAZI YA HUYE 22

4 6 JURIDICAL STATUTE OF AMAZI YA HUYE 23

4 7 TASKS DESCRIPTION 23

4 8 DATA ANALYSIS 25

4 8 1 In depth Interview 26

4 8 3 Preferred ratios in decision making 27

4 10 ACCOUNTING RATIOS AND DECISION MAKING 29

vi

4 11 ANALYSIS OF ACCOUNTING RATIO AS A DECISION MODEL 30

4 11 1 Liquidity analysis 30

4 11 2 Debt analysis 33

4 11 3 Sales and profitability analysis 34

4 11 4 Efficiency analysis 38

4 11 5 Multiple discriminant analysis 40

4 12 HYPOTHESIS TESTING 41

CHAPTER V 43

SUMMARY, CONLUSION AND RECOMMENDATIONS 43

5 1 SUMMARY 43

5 2 CONCLUSION 44

5 3 RECOMMENDATIONS 46

5 6 AREA FOR FURTHER RESEARCH 47

BIBLIOGRAPHY 48

APPENDICES 50

VII

LIST OF ACCRONYMES AND ABBREVIATIONS

A P: Accounts payable

BAS: Bachelor of Accounting Sciences

EAT: Earnings after taxes

EBIT: Earnings before interest and taxes

ICPAR: Institute of Certified Public Accountants

of Rwanda

MDA: Multiple Discriminant Analysis

NUR: National University of Rwanda

ROA: Return on assets ROE:

Return on equity ROI: Return on investment

ROS: Return on sales

SGR: Sustainable growth rate

VIII

LIST OF TABLES

TABLE 3 1 TOTAL POPULATION OF MANAGEMENT AND ACCOUNTING

DEPARTMENTS OF AMAZI YA HUYE 17

TABLE 4 1 RESPONDENTS' VIEW ON THE LINKAGE BETWEEN

ACCOUNTING RATIOS AND DECISION MAKING 29

TABLE 4 2 TREND OF LIQUIDITY RATIOS 31

TABLE 4 3 TREND OF DEBT RATIOS 33

TABLE 4 4 TREND OF SALES AND PROFITABILITY RATIOS

35

TABLE 4 5 TREND OF EFFICIENCY RATIOS 38

TABLE 4 6 TREND OF MULTIPLE DISCRIMINANT ANALYSIS

40

ix

LIST OF FIGURES

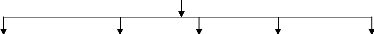

FIGURE 4 1 ORGANIZATION STRUCTURE OF AMAZI YA HUYE 23

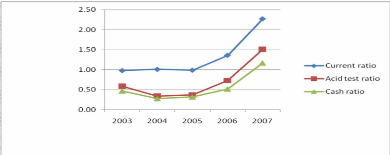

FIGURE 4 2 AMAZI YA HUYE LIQUIDITY RATIOS 2003 - 2007 32

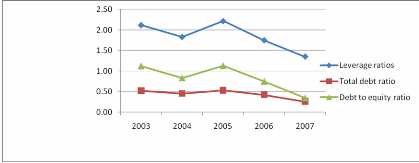

FIGURE 4 3 AMAZI YA HUYE DEBT RATIOS 2003 - 2007 34

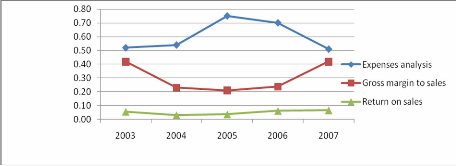

FIGURE 4 4 AMAZI YA HUYE EXPENSES ANALYSIS, GROSS MARGIN TO

SALES, RETURN ON SALES RATIOS 2003-2007

37

FIGURE 4 5 AMAZI YA HUYE RECEIVABLES AND PAYABLES TURNOVER RATIOS

2003-2007 39

FIGURE 4 6 AMAZI YA HUYE MULTIPLE DISCRIMINANT ANALYSIS 2

003-2007 41

x

LIST OF APPENDICES

1. A qui de droit

2. The letter of request for collaboration in the research

3. Interview guide

4. Financial statements of AMAZI YA HUYE

xi

ABSTRACT

This research entitled» The use of accounting ratios in

decision making» tried to find out the degree to which accounting ratios

can be used to draw conclusion upon which decision are made. This has been done

considering AMAZI YA HUYE as a case study. The research specifically had to

identify different ratios used in financial statement analysis in decision

making, also the role of financial ratios analysis in decision making had to be

indicated and lastly the use and limitation of accounting ratios .

Both secondary and primary data were consulted during this

research. Primary data was collected with the help of interview given to the

members of the management staff. Respondents were selected based on their role

in financial activities in AMAZI YA HUYE. Under secondary data financial

statements of AMAZI YA HUYE, textbooks, and internet resources were

consulted.

This study revealed that the accounting ratios are

indispensable in reasonable decision making. Generally, some of business entity

uses accounting ratios in a proper way. The use of accounting ratios in

financial statements analysis varies according to the decision to be made by

those who use them. Different managers use different analytical tools and

techniques depending on the objectives of the analyst and nature of the

business, it was further found out that the accounting ratios reduce the long

array of financial statement in decision making.

On the basis of the study's major findings, there was no

sufficient evaluation to reject the alternative, namely,» The use of

accounting ratios guides management as an effective tool in decision-making.

CHAPTER 1

INTRODUCTION

1 1 Background of the study

This research is about the impact of using accounting ratios

in decision making. Decision making is the most important element in management

activities of all kinds of enterprises; profit oriented, nonprofit oriented and

public institutions. This research is carried out in profit oriented enterprise

where decisions are made based on different aspects among which the use of

accounting ratios should have a great impact.

The use of financial reporting is the main aspect in decision

making. According to (Charles H. GIBSON, 1989: 10), financial reporting is not

the end in its self but it is intended to provide information that is useful in

making business and economic decisions. It is in this regard the researcher was

motivated in finding the extent to which management dealers may depend on

accounting ratios in decision making.

The main objective of this chapter is to introduce the

researcher' s topic and its content include : background of the study,

statement of the problem, objectives of the study, hypothesis, research

questions, significance of the study, scope of the study and organisation of

the study.

As an art, management has been practised since the early

beginning of twentieth century. It had got a great evolution at the time of

industrial revolution which started in England around mideighteenth century.

Prior to this, most of business enterprises were characterised by craftsmanship

rather than mechanisation or technology and faced the problem much simpler than

those faced today's firms in our complex industrial and technological

society.

With reference to this industrial revolution till nowadays;

legal, social and technological environment tend to generate industrial growth

and economical environment development that prompt entrepreneurs to react. At

the same time when these changes taking place, there were basic changes in the

form of management especially in managerial strategies for decision making;

this generates separation of ownership of the business from its management.

In consequences, managers had to look for the means of

discharging their stewardship responsibility; this can be obtained through the

use of accounting ratios.

The use of accounting ratios is a time-tested method of

analyzing a business. Wall Street investment firms, bank loan officers and

knowledgeable business owners all use accounting ratio analysis to learn more

about a company's current financial health as well as its potential (P.

Vernmmen, 2006).

Ratios analysis simplified, summarises, and systematises a

long array of accounting figures. Its main contribution lies in bringing out

the inter-relationship which exists between various segments of business.

Ratios are more of a diagnostic tool that helps to identify problem areas and

opportunities within a company.

1 2 Statement of the problem

The management of enterprise is depending on accounting

information for taking various strategic decisions. Financial statements

provide such information. This information is made useful by analyzing and

interpretation of financial statements with help of financial analysis

techniques among which the common and easy technique to use is financial ratios

also known as accounting ratios. (Prof. Harvey B. Lermack, 2003).

(James C. Van Horne and John M. Wachowicz, 2005: 132) say

«to evaluate the firm's financial condition and performance, the financial

analysis needs to perform checkups on various aspects of a firm's financial

health. A tool frequently used during these checkups is financial

ratios».

Accounting ratios are important tools in the management for

decision making. (R.K. Sharma, Shashi K. Gupta, 2001: 4.4), financial

statements are prepared primarily for decision making, but the information

provided in financial statements is not an end in itself and no meaningful

conclusion can be drawn from these statements alone. Ratio analysis helps in

making decisions from the information provided in these financial statements.

Thus, the proper use of accounting ratios assists management in communicating

information which is pertinent and purposeful for decision makers to ensure the

effectiveness of management in the enterprise.

In modern business environment, which is becoming more

competitive, the survival of firms, be it small or large; depend upon the

strategic decisions made by management. This is however done with the help of

accounting ratios, which is a big challenge to most countries having shortage

of professional accountants as it is the case to our country.

As such, this study is aimed at finding out the impact of

using accounting ratios in assisting rational decision making by Rwandan

business community with more emphasis on the management of AMAZI YA HUYE.

1 3 Research questions

The researcher has been guided by the following research

questions while carrying out his study.

1. Why should managers rely on accounting ratios in decision

making?

2. Of what significance are different types of accounting ratios

to management in decision making?

3. What is the requirement needed to use accounting ratios?

1 4 Objectives of the study

The general objective of this study is to exanimate the impact of

using accounting ratios for decision making. The specific objectives are as

follows:

1. To understand the importance of using accounting ratios as a

pillar to draw conclusions upon which decisions are made;

2. To identify hindrances of using accounting ratios in AMAZI YA

HUYE;

3. To provide suggestion for further improvement.

1 5 Hypotheses

1. The use of accounting ratios guides management as an

effective tool in decision making;

2. The result of using accounting ratios relies on the

effectiveness of accounting and how accountants are skilled in financial

analysis techniques.

1 6 Significance of the study

This study is of importance to the researcher as it equips him

the knowledge of financial analysis techniques and interpretation of the

available data for managerial purpose using accounting ratios. I t further

helps in designating proper solution for identified problems.

The research enable managers to understand better the role

that plays accounting ratios in decision making and it will attempt to make a

causative analysis and designed the possible alternative for improvement of

managerial decisions for growth of AMAZI YA HUYE, these would thus become a

basis for further research and provide the necessary information for action by

the concerned parties. Finally, this study will enable the researcher to obtain

a Bachelor' degree in Accounting Sciences.

1 7 Scope of the study

The study will make a great emphasis on analysis of financial

reports of AMAZI YA HUYE using accounting ratios. This report is made of all

balance sheets, income statements over the last 5 years period, that from 2003

to 2007.

1 8 Organization of the study

The study is divided into five chapters. The first chap

ter will be made up of introduction, background of the study, statement of

the problem, research questions, and objectives of the study, hypothesis,

methodology, and significance of the study, scope of the study and organization

of the study.

with the research topic will be defined ,the accent will be put

on the impact of using accounting ratios for decision making.

The third chapter will identify methodology to follow

while conducting this research.

Chapter four will focus on the research findings

analysis and interpenetration of data collected. Findings will be linked with

objectives set.

Chapter five will present summary of research findings,

conclusion and recommendations.

CHAPTER II

LITERATURE REVIEW

2.0 Introduction

This chapter presents the related literature and concepts

about accounting ratios and decision making. Accounting ratios as an integral

part in decision making, the researcher wanted to investigate whether the use

of accounting ratios can intervene in decision making in AMAZI YA HUYE. Using

accounting ratios and decision making concepts, the researcher will attempt to

relate their theories and what could be their applicability in AMAZI YA

HUYE.

2 1 Definition of key terms

2 1 1 Accounting

Accountancy or accounting is the art of communicating

financial information about a business entity to users such as shareholders and

managers. The communication is generally in the form of financial statements

that show in money terms the economic resources under the control of

management.

2 1 2 Ratios

According to the Webster's New Collegiate Dictionary, Mass:

G&C (1975: 958), a ratio is defined as «the indicated quotient of two

mathematical expressions» and as «the relation between two or more

things»

(Rustagi R.P., 2000: 53) notes that; a ratio is a relationship

expressed in mathematical terms between two individual and groups of figures

connected with each other in some logical manner.

2.1.3 Accounting ratios

2 1 4 Financial ratios

These are tools for interpreting financial statements to provide

a basis for valuing securities and appraising financial and management

performance.

2 1 5 Decision making

It is the study of identifying and choosing alternatives based

on the values and preferences of the decision maker. Decision making is also

the process of sufficiently reducing uncertainty and doubt about alternatives

to allow a reasonable choice to be made from among them. (Robert Version,

1998).

2 2 Essence of Ratios Analysis

The essence of the financial soundness of a company lies in

balancing its goals, commercial strategy, product-market choices and resultant

financial needs. The company should have financial capability and flexibility

to pursue its commercial strategy.

According to (Butters, K.J., 1981: 3-7), ratio analysis is a

very useful analytical technique to raise pertinent questions on a number of

managerial issues. While assessing the financial health of a company with the

help of ratio analysis answers to questions relating to the company's

profitability, as sets utilization, liquidity, financing and strategies

capabilities may be sought.

2 3 Standards of Comparison

The ratio analysis involves comparison for useful

interpretation of financial statements. A single ratio in itself does not

indicate favorable or unfavorable condition. It should be compared with some

standard.

According to (Anthony, R. N. and Reece, J. S, 1975:

260-263), standards of comparison may consist of:

· Past ratios: ratios

calculated from the past financial statements of the same firm;

· proj ected ratios: ratios developed using the

projected or pro forma financial statements of the same firm;

· competitors `ratios: ratios of some selected

firms, especially the most progressive and successful competitor, at the same

point in time and

· Industry ratios: ratios of the industry to which

the firm belongs. 2 3 1 Time series analysis

This is the way used to evaluate the performance of a firm by

comparing its current ratios with the past ratios. It gives an indication of

the direction of change and reflects whether the firm's financial performance

has improved, deteriorated or remained constant over time. (I. M Pandey, 1995:

105)

2 3 2 Pro forma analysis

Sometimes future ratios are used as a standard of comparison.

Future ratios can be developed from the pro forma financial statements. The

comparison of current ratios and the future ratios shows the firm's relative

strengths and weaknesses in the past ant the future ratios indicate weak

financial position, corrective actions should be initiated. (I. M Pandey, 1995:

105)

2 3 3 Industry analysis

To determine the financial condition and performance of a

firm, its ratios may be compared with average ratios of industry of which a

firm is a member. This sort of analysis helps to ascertain financial standing

and capability of the firm vis-à-vis other firms in the industry.

Industry ratios are important standards in view of the fact each industry has

its characteristics which influence the financial and operating relationship.

(I. M Pandey, 1995: 105)

2 3 4 Cross-sectional analysis

It consists at comparing ratios of one firm with some selected

firms in the same industry at the same point of time. This kind of a comparison

indicates the relative financial position and performance of the firm. A firm

can hardly resort to such a comparison, as it is difficult to get the published

financial statements of the similar firm. (I. M Pandey, 1995: 105)

2 4 Types of analysis using accounting ratios in decisions

making

2 4 1 Analyzing Liquidity

Liquid assets are those assets that can be converted into cash

quickly. The short-term liquidity ratios show the firm's ability to meet

short-term obligations. Thus a higher ratio (#1 and #2) would indicate a

greater liquidity and lower risk for short-term lenders. The Rule of Thumb (for

acceptable values): Current Ratio (2:1), Quick Ratio (1:1) While high liquidity

means that the company will not default on its short-term obligations, note

that by retaining assets as cash, valuable investment opportunities might be

lost. Obviously, Cash by itself does not generate any return only if it is

invested will we get future return. In quick ratio, we subtract the inventories

from total current assets since they are the least liquid (among the current

assets. (Prof. Phill Russeil, 2003)

Since the cash is the most liquid asset, a financial analyst

may examine the ratio of cash and its equivalent to current liabilities. Trade

investment and marketable securities are equivalent of cash therefore they may

be included in the computation of current ratio. (I.M Pandey, 1995: 112).

1. Current Ratio = Total Current Assets/Total Current

Liabilities

2. Quick or Acid-test Ratio = Total Current Assets - Inventories

/Total Current Liabilities

3. Cash ratio = Cash + Marketable securities/Current

liabilities.

These ratios show the extent to which a firm is relying on

debt to finance its investments/operations and how well it can manage the debt

obligation. Obviously, if the company is unable to repay its debt or make

timely payments of interest, it will be forced into bankruptcy. On the positive

side, use of debt is beneficial as it provides valuable tax benefits to the

firm. Note total debt should include both short-term debt (bank advances +

current portion of long-term debt) and long-term debt (such as bonds, leases,

and notes payable). (Prof. Phill Russeil, 2003).

Asset-Equity Ratio or Leverage Ratio= Assets/Shareholder's

Equity

This shows firm's reliance on external debt for financing (or

the degree of leverage). Any number above 100% shows that the company relies on

external debt for financing some of its assets. If the number equals 100%, it

implies that the assets are fully financed by the shareholders.

Some analysts tend to use the Debt ratio (given by total

Debt/total assets) or Debt/Equity ratio given by total long-term debt/equity).

These ratios also show company's reliance on external sources for financing its

assets. (Prof. Phill Russeil, 2003)

1. Total Debt ratio = Total Debt/Total assets

2. Debt-Equity Ratio = Total Debt/Equity

3. Long-term Debt to capital = Debt/Debt + Equity

For a lender, more important than the degree of leverage is the

firm's ability to service the debt and this is captured in the following

ratio.

2 4 3 Analyzing Sales and Profitability

Profitability is a relative term. It is hard to say «what

percentage of profits» represents a profitable firm as the profits will

depend on the product life cycle, competitive conditions in the market,

borrowing costs, expense management. Analysts will be interested in the

(historical and forecasted), the set of ratios here include some of the

traditional earnings based performance

measures such as ROS, ROA, ROI, and ROE. For a better

understanding of growth rates, it will be useful to know the «real growth

rate» as opposed to «nominal growth rate». For example, it is

quite possible that the sales growth rate figures are impressive due to

inflation (rather than an increase in the number of items sold). (Prof. Phill

Russeil, 2003).

The following are ratios selected to analyse profitability and

sales ;

1. Sales Growth Rate = {(Current year sales - last year

sales)/last year sales} * 100

2. Expense analysis = various expenses /Sales

3. Gross Margin/Sales = Gross Profit/Total Sales

4. Operating Profit/Sales = Operating Profit/Net Sales

5. EBIT to Sales = EBIT/Net Sales

6. Return on Sales (ROS) or net profit ratio = Net Income/Net

Sales

7. Return on Investment (ROI) = Net Income/Total Assets

8. Return on Assets (ROA) = Net Income/Total Assets

9. Return on Equity (ROE) = EAT/Shareholders' Equity

10. Payout ratio = Cash Dividends/ Net Income

11. Retention ratio = Retained Earnings/Net Income

12. Sustainable growth rate (SGR)= ROE * Retention Ratio

It is useful to disaggregate the ROE figure into three

elements as follows to get a better insight 13 ROE = {Net Income/Sales} *

{Sales/Assets} * (Assets/Equity)

The above formulation clearly shows that if management wishes

to improve their ROE, they need to improve profitability, efficiently use the

assets, and optimize the use of debt in their capital structure.

SGR shows how much the company will grow in the future if some

of the key ratios remain the same as in previous years. It is useful to

disaggregate the sustainable growth rate (SGR) as follows.

? SGR = f (Profitability, Asset Efficiency, Leverage, Dividend

policy)

· SGR = Return on Sales * Asset turnover ratio * Leverage *

Retention ratio

· SGR= (Net income/sales) * (sales/assets) *

(assets/equity) * (RE/net income)

2 4 4 Analyzing Efficiency

These ratios reflect how well the firm's assets are being

managed. The inventory ratios show how fast the inventory is being produced and

sold. Ratio #1 shows how quickly the inventory is being turned over (or sold)

to generate sales higher ratio implies the firm is more efficient in managing

inventories by minimizing the investment in inventories. Thus a ratio of 12

would mean that the inventory turns over 12 times or the average inventory is

sold in a month. Some High ratio by itself does not mean high level of

efficiency as high ratio could also mean shortage. Ratio #2 is referred to as

the «shelf-life» i.e. how many days the inventory was held in the

shelf. Ratio #3 shows how much sales the firm is generating for every currency

unit of investment in assets, naturally, higher the better. However, note that

this ratio is biased (as assets are listed at historical costs while sales are

based on current prices). Ratios #4 and #5 show the firm's efficiency in

collecting from credit sales. While a low ratio is good it could also mean that

the firm is being very strict in its credit policy, which may drive away some

customers. Ratios #6 and 7 focus on efficiency in making payments. (Prof. Phill

Russeil, 2003)

1. Inventory Turnover = Cost of Goods Sold/Average Inventory

2. Days in Inventory = (Average Inventory/Cost of Sales)*365

3. As sets turnover = Net Sales/Total As sets

4. Receivables Turnover = Credit Sales/Accounts Receivables

5. Average Collection period = (Accounts Receivable/Net Sales)*3

65

6. Accounts Payable turnover = Purchases/Accounts Payable

7. Days AP outstanding = (Accounts Payable/Cost of Sales)*3

65

2.4.5 Multiple Discriminant Analysis

The use of MDA helps to consolidate the effect of a set of

ratios by looking at a number of separate clues (ratios to sickness or

failure).It would be more useful to combine the difference ratios into a single

measure of the probability of sickness or failure (bankruptcy).

According to (Altman E., 1968: 589-609), as the first man to

apply discriminant analysis in finance for studying bankruptcy, his study

helped in identifying five ratios that were efficient in predicting

bankruptcy.

The model was developed from a sample of 66 firms half of which

went bankrupt. He derived the following discriminant function:

Z = 0.01 2X1+0.0 1 4X2+0.03 3X3+0,006X4+0.999X5 Z= discriminant

function score of a firm;

1. X1= net working capital/total assets (%);

2. X2= retained earning/total assets (%);

3. X3= EBIT/total assets (%);

4. X4=market value of total equity/book value of debt (%);

5. X5= sales/total assets (times)

Alman, established a guideline Z score which can be used to

classify firms as either financially sound a score above 2.675 or a headed

towards bankruptcy a score below 2.675. The lower the score, the greater the

like hood of bankruptcy and vice versa.

2.4.6 Trend Analysis

Using the past history of a firm for comparison is called

trend analysis. By looking at the trend in a particular ratio, one sees whether

that ratio is failing, rising, or remaining relatively constant. From this, a

problem is detected or good management is observed. (Charles H.GIB SON, 1989:

123).

2.5 The Components of Decision Making 2.5.1

Decision environment

decision environment would include all possible information, all

of it accurate, and every possible alternative.

However, both information and alternatives are constrained

because the time and effort to gain information or identify alternatives are

limited (Robert Version, 1998).

2.5.2 Decision Model

Decision model can be used to represent a productive system in

mathematical terms. A decision model is expressed in terms of performance

measures, constraints, and decision variables. The purpose of such a model is

to find optimal or satisfactory values of decision variables which improve

systems performance within the applicable constraints. These models can then

help guide management decision making. (ROGER G. SCHROEDER, 1985: 7).

2.5.2.1. The effects of using a decision model

A decision model has great impact on the profits of the

company. It forces the management to rationalize the depreciation, inventory

and inflation policies. It warns the management against impending crises and

problems in the company. It specially helps in following areas:

- The management knows exactly how much credit it could take,

for how long (for which maturities) and in which interest rate. It has been

proved that without proper feedback, managers tend to take too much credit and

burden the cash flow of their companies.

- A decision model allows for careful financial planning and

tax planning. Profits go up, non cash outlays are controlled, tax liabilities

are minimized and cash flows are maintained positive throughout.

- As a result of all the above effects the value of the company

grows and its shares appreciate.

The decision model is an integral part of financial

management. It is completely compatible with financial ratios analysis and

derives all the data that it needs from information extant in the financial

statements of the company.

2.6 Uses and limitations of Ratio Analysis 2.6.1 Uses

· To evaluate performance (compared to previous years);

· To set benchmarks or standards for performance;

· To highlight areas those need to be improved or highlight

areas that offer the most promising future potential;

· To enable external parties (such as investors/lenders) in

assessing the creditworthiness/profitability of the firm.

2.6.2 Limitations

· There is considerable subjectivity involved as there

is no theory as to what should be the «right» number for the various

ratios. Further, it is hard to reach a definite conclusion when some of the

ratios are favourable and some are unfavourable.

· Ratios may not be strictly comparable for different firms

due to a variety of factors such as different accounting practices, different

fiscal year.

· Ratios are based on financial statements that reflect the

past and not the future. Unless the ratios are stable, one cannot make

reasonable projections about the future trend.

· Financial statements provide an assessment of the

costs and not value. For example, the market value of items may be very

different from the cost figure given in the balance sheet.

· Financial statements do not include all items. For

example, it is hard to put a value on human capital (such as management

expertise).

· Accounting standards and practices vary across countries

and thus hamper meaningful global comparisons.

CHAPITER III

METHODOLOGY

3 0 Introduction

This chapter explains methods and instruments used to

collect, analyze and to test the hypothesis the use of accounting ratios guides

management as an effective tool in decision making.(Kenneth R. HOOVER, 1988:

33) says «the scientific method is the method that seeks to test thoughts

against reality in a disciplined manner with each step in the process made

explicit». This section covers the methods that the researcher is going to

use to obtain the necessary data to achieve the objective and to come up with a

suitable conclusion.

3 1 Research Design

Research design refers to outline, plan or strategy

specifying the procedure to be used in investigating the research problem.

(Christensen, 1991: 269). In the due course the researcher collects relevant

data needed to test the researcher hypothesis. The design of the study is

analytical in nature.

3 1 1 The analytical research

According to (Jill and Roger Hussey, 1997: 11) the analytical

research design is continuation of the descriptive research. The researcher

goes beyond merely describing the characteristics to analyzing and explaining

why and how it is happening. Thus, this research aims to understand the use of

accounting ratios by measuring causal relation among them in decision

making.

In this study the researcher adopted a case study approach,

where by AMAZI YA HUYE was particularly chosen. According to (CHRISTENSEN,

1991: 92), a case study is an intensive description and analysis of single

individual, organization or event, based on information obtained from a variety

of sources. It is in this regard AMAZI YA HUYE was chosen because the

researcher was interested in manufacturing enterprises.

3 2 Population of the Study

As (Grinnell and Williams, 1990: 118), put it that, «a

population can be defined as the totality of persons or objects with which a

study is concerned». The population was comprised sorely the staff

managers and accountant of AMAZI YA HUYE, financial statements and other

records available of the 5 year period, which are from 2003-2007.

Table 3 1 Total population of Management and

Accounting departments of AMAZI YA HUYE Description Population Sample

selected Technique used Basic for

selection

Managers 2 1

Accountants 4 3

Cashier 3 2

|

Universal

|

The selection of the population was based on the role of each

personnel plays in decision

making

|

Total 9 6

|

|

|

Source: Primary data 3 3 Sources of

Data

Data source refers to any material consulted or used in the due

course of the study. Both the primary and secondary data were used in the

study.

3 3 1 Primary Data

As put forward by (HAGOOD and PRICE, 1952: 20) «if a

person or agency that has published data has earlier been collected or

supervised the collection of data, the publication is called a primary

source.» (Audrey et al, 1989: 57) adds that «primary sources come

straight from people or workers you are researching and therefore the most

direct kind of information you can

collect». That is the reason why primary data were first

hand gathered by the researcher himself as a result of the researcher's

investigation.

3 3 2 Secondary Data

Roth further states that these are one step removed from the

original and are often an examination of a study someone else has made on a

subject or an evaluation of commentary, or summary of primary materials,

journal articles, critical reviews are the most common secondary sources.

The secondary sources of data for this study included financial

statements, company records, internet publications, library books and

memoires.

3 4 Data Collection Techniques

Documentary review (library, internet search and financial

statement) was used to collect secondary data while primary data was obtained

through interview guide

3 4 1 Documentary Review

A number of documents available in the library, on the

internet, memoires and financial statements of the company chosen as a case

study, were consulted for the purpose of obtaining secondary information

relevant to the subject matter.

3 4 2 Document Analysis

(Paige Wilson, 1989:3) stated that a document analysis

«is a system which formally acknowledges the sources consulted for

researcher». The document review was based on the consultation of the

company's annual reports, journal and other documents. The researcher used the

balance sheets and income statements of the five year period to analyze,

interpret and comment on different types of accounting ratios. The advantage of

this method is that the researcher got useful information about the company's

financial health which would be difficult to acquire using other instruments

3 4 3 Interview Guide

This technique involves exchange of ideas between the

interviewer (researcher) and the interviewee (managers) to get the opinion of

the interviewee on the use of accounting ratios in decision making. During the

course of interview, notes were taken after asking questions on any information

relevant to the study by the interviewer.

3 4 4 Sample size and selection

According to (William G. Cochran, 1997: 126) a sample is a

part of population which is deliberately selected for the purpose of

investigation. For our case study, the sample size is 6 people. The researcher

selected two respondents from the top management and four from financial

executives. The researcher chooses them because they are only respondents who

can provide relevant information concerning the use of accounting ratios n

decision making (AMAZI YA HUYE as the case of the study).

3 5 Sampling technique

The sampling technique that the researcher will use in this

study is universal sampling. According to (Richard & Margaret, 1990: 125)

«Universal sampling refers to the selection of sample where not all the

people in the population have the same profitability of being included in the

sample and each one of them, the probability of being selected is unknown.

The researcher preferred to use universal sampling technique

to select respondents from the top management and finance department because

they are the ones who may provide the useful information to test the hypothesis

of this research.

3 6 Data processing and analysis

(Nachimias D. and Nichimias C., 1976: 143) argue that

«data processing and analysis involves the transformation of data gathered

from the field into a systematic categories and the transformation of these

categories into codes to enable quantitative analysis and tabulation; the data

collected was classified into a meaningful manner for easy interpretation and

understanding.

This involves preparing data collected into some useful,

clear and understandable data. The whole exercise involved calculations of

different types of ratios to analyze, liquidity, debt, efficiency, sales and

profitability, compute the trend analysis and the multiple discriminant

analysis for the secondary sources.

While for the first hand information the researcher has

summarized the recorded interview (discussion).

3 7 Study limitations

Some limitations were encountered during the process of data

collection; however salutation were sought in order to make the findings of the

study available as planned. The following are the limitations that were

encountered:

· Financial constraints as funds provided by the National

University for the research were delayed.

· Access to the financial statements of companies in Rwanda

is not easy Solutions to the above limitations:

· The researcher has to borrow funds from friends and ask

support to his family members in order to accomplish the research in time

· A letter of authorization from the university was used

by the researcher as evidence to the management staff of AMAZI YA HUYE to prove

that the research is conducted for the academic purpose

CHAPTER IV

DATA ANALYSIS AND INTERPRETATION

4 1 Introduction

This chapter presents the findings of the study entitled

«the use of accounting ratios in decision making» in AMAZI YA HUYE.

It also presents a brief description of AMAZI YA HUYE as the case study. It

also based on the analysis of both primary and secondary data collected to

achieve the stated objectives. The analysis of the data collected was done in

accordance with the study objectives and hypothesis. The results were reported

in tables and summarizing answers to major questions asked. The researcher used

focus group interview to obtain first hand information, whereby all six staff

of the company who deal with accounting and finance were involved in the

discussion. In short, this chapter examines the empirical evidence and

establishes grounds upon which the researcher hypothesis can be proved before

concluding the results of this research.

4 2 The Profile of AMAZI YA HUYE

AMAZI YA HUYE is a private company that was formed in 1998, with

the key aim of mineral water production and its base is in Huye District former

Butare town in the Southern Province.

Their first mineral water product appeared at the market

beginning with the year 2000, after the scientific laboratory experiment by the

University of Shanghai in china. Experts from this University confirmed the

purity of the mineral water manufactured by AMAZI YA HUYE enterprise

AMAZI YA HUYE Company do not only produce mineral water but also

produces the plastic bottles into which their mineral water products are

packed.

4 1 2 AMAZI YA HUYE location

Its head office is in Kigali city at Muhima near Kabuga's

building because of availability of large market. This company still sells its

products locally but it imports its raw materials abroad specifically from

China.

4 3 AMAZI YA HUYE's mission

It seeks to increase the productive capacity of the mineral

water and play a key role in transforming the economy and enhancing the well

being of people. Through their dynamic and responsive teams, it aims at

providing the products and maintains the highest levels of customer service and

professional integrity.

4 4 AMAZI YA HUYE's objectives

> To support the development of the industrial sector

generally through innovative and the transfer international best practice.

> To support the drive of the private sector investment for

the development of the economy working with locals as well as international

investment and development focused agencies.

> To meet needs and expectations of its customers by providing

the products at the right quality and at the right time.

4 5 The environment of AMAZI YA HUYE

The AMAZI YA HUYE Company is not a monopoly one but operates with

a perfect competition market structure.

In order to adapt itself to the business investment, this

enterprise makes sure that it has a good relationship with the commercial banks

and even other industries operating in Rwandan territory and other

countries.

4 6 Juridical statute of AMAZI YA HUYE

AMAZI YA HUYE enterprise is an individual Industrial company

of Mr. GAKWAYA Etienne whose capital was 83,404,822 RWF at the beginning in

1998 but currently the capital is 149,000,000 RWF

Figure 4 1 Organization structure of AMAZI YA

HUYE

Executive Director

Director of commerce

|

IT Manager

|

|

|

|

Chief Accountant

|

|

Importation Officer

|

|

Engineer

|

|

Human

Resou rce

manager

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accountant A

|

|

Acco unta nt

|

|

|

|

Secretary

|

|

Cashier

|

|

|

Acco unta nt

|

|

|

|

|

|

|

|

|

|

|

|

Manpower

|

|

Drivers

|

|

Officer messengers

|

|

|

|

|

Source: Marketing Department of AMAZI YA HUYE.

4 7 Tasks description

By making description of the above organization structure,

different tasks attributed to general management and different departmental

services are precised in accordance to the organizational arrangement of the

chart.

A. Executive Director

The executive director of AMAZI YA HUYE is responsible for

taking all the dec isions relating to effective management and policy

formulation of the enterprise. He is also in charge of the following

activities:

- To insure the coordination and management of different

department like commercial service, production service and financial

service.

B. Director of commerce

This one is responsible for the evolution of commercial and

marketing services and making survey on the areas of competition. He takes

measures on the quality and quantity of mineral water to be taken to the

market, he makes follow-up on the buying and the selling conditions, for the

interest of the clients.

Sometimes he proceeds to the ground to investigate the consumers

perception upon certain decisions under took and these assist him to underlay

appropriate strategies.

C. Human resource manager

The human resource manager is in charge of recruitment of the

employees and makes sure that the recruited employees are ones with competent

skills which can lead to the general improvement of the company' s

performances.

He assigns duties and responsibilities to the employees and

makes supervisions to different department to approve if the delegation of

power is respected by departments.

He posses power to appoint and dismiss misbehaved workers after

his consent with the executive director.

D. Accounting department

The responsibilities of this department are as follows:

- Keeping records of the day to day business transactions

- Preparation of the financial statements of the company

- Keeping the books of accounts like the journals, ledgers and

trial balance.

- Recording the daily operations of expenses and revenues of the

company of AMAZI YA HUYE

- Analyzing financial transactions and gives information to the

management and the third parties.

- Advising the top management on the financial position and

decision making.

E. Importation officer The importation officer

has the following key duties:

- He makes sure that all the logistical and procurement services

are done smoothly with in the enterprise.

- Importation of required technical instruments to run

enterprise's daily production affairs. - Monitoring on the quality of

production basing on capacity of machines.

F. Engineer The responsibilities of an engineer

include:

- Rendering mechanical services at any time when technical

errors happen. - Repairing of machines that have experienced technical

problems.

- Control and measures the electricity used by the company.

G. IT Manager: This one has got the following

tasks

- System soft ware in the company

- Distribution of information system in all the departments -

Repair of computers that are experiencing errors.

4 8 Data analysis

has been a result of a number of factors, but the main factor

is a lack of rational decision making. As finalist student in Accounting

Sciences in this research, we picked interest in one of techniques that is

commonly used in decision making since it naturally provides much information

in almost every aspect of the business. The researcher was motivated to find

out the effectiveness of using accounting ratios in decision making of the

enterprise. The student was also interested in knowing whether this techniques

is used or not, and what could be the requirement to use them effectively.

4 8 1 In depth Interview

To the opinion of the accountant and management department

executives on important issues related to accounting ratios group interview (in

depth interview) was conducted. All six staff of management department in AMAZI

YA HUYE was interviewed including the accountants of this enterprise

The discussion took place at AMAZI YA HUYE headquarter as well

as at the factory residence whereby all the participants were requested to

think on all matters concerning accounting ratios in AMAZI YA HUYE. After each

interview, notes are taken to unable analysis to be made. For some question

clarifications are given to the interviewee so that they can give their views

and opinions.

The discussion was designated to accomplish the following

objectives:

1. To identify the importance of using accounting ratios in

decision making

2. To know whether accounting ratios are used in AMAZI YA

HUYE

3. To determine the linkage between accounting ratios and

decision made in AMAZI YA HUYE

4. To determine other factors used in decision making

5. To identify the constraints that hinder the proper use of

accounting ratios

4 8 2 Type of ratios used

For this purpose 32 ratios were selected based upon a review

of text books. These ratios were divided into 5 categories of analysis, such as

ratios to use in analyzing liquidity, efficiency, sales profitability, debt,

and in multiple dicsriminant analysis. The management staff of AMAZI YA HUYE

disclosed that ratios are frequently used by the company in analyzing

profitability and liquidity. They said that ratios used in this manner are more

significant to take any decision.

After knowing that accounting ratios are used in AMAZI YA HUYE

as a tool of analysis in decision making and after knowing that the staff

management of AMAZI YA HUYE are interested in their use in decision making the

researcher wanted to investigate how this technique is used.

4 8 3 Preferred ratios in decision making

To determine the preferred ratios the researcher asked the

following question» What among the following kind of accounting ratios do

you take into account while making decisions and for which purpose?»

· Liquidity ratios

· Debt ratios

· Efficiency ratios

· Sales and profitability ratios

One of the respondent said that while analyzing liquidity

position liquidity ratios are used, in analyzing efficiency of the company

inven tory turnover ratio is used and some ratios are used especially in

analyzing sales and profitability.

4 8 3 1 Preferred ratios in analyzing liquidity

Basing on the review of text books, the researcher chose the

following ratios in analyzing liquidity:

· Current ratio

· Quick ratio (acid test ratio)

· Cash ratio

As said in the above response these ratio are used in analyzing

liquidity position of the company. One of the managing explained that the use

of this kind of ratios presents an importance to the company because it helps

to know the level at which the company can pay its short term debts.

4 8 3 2 Preferred ratios in analyzing efficiency

Concerning efficiency ratios, the researcher chose some of them

basing on the review of text books. Following are some of these ratios:

· Inventory Turnover

· Days in Inventory

· Assets turnover

· Receivables Turnover

· Average Collection period

· Accounts Payable turnover

· Days AP outstanding

The management staff showed much interest in efficiency

ratios, one of them said,» efficiency measuring is very important for

any business», He went on commenting that, the efficiency ratios can

help to adjust the inventory to sales collection using inventory turnover, days

in inventory. Most of them had the same views but the put emphasize on

profitability ratios by saying, «When a company is profitable it means

that it is efficiently performing its operations».

4.9.3.3 Preferred ratios in analyzing debt

Basing on the review of text books, the researcher chose the

following set of ratios to analyse debts of our case study.

· Total Debt ratio

· Debt-Equity Ratio

· Long-term Debt to capital

· Asset-Equity Ratio or Leverage Ratio

One of the management staff said that debt ratio help to measure

the extent to which a company rely on outsiders funds.

4 10 Accounting ratios and decision making

To determine whether there exists a linkage between accounting

ratios and organization sustainable growth, the researcher asked the following

question to the respondents «Do you agree that, the use of accounting

ratios can lead to the decision making?» The following table shows

categories of their responses:

Table 4 1 Respondents' view on the linkage

between accounting ratios and decision making

Personnel

Responses

Agree 3

Disagree 1

Neutral 2

Source: Primary data

There seems to be a majority who agree that there is a linkage

between accounting ratios and decision making. The chef accountant commented

that decision model like financial ratios plays a great role in assessing the

financial performance of the company but he presented the problem of a lack of

capacity to use them. One of the accounting department said, though

financial ratio analysis is not the only measure of performance, still it is

the best to measure the financial health of the company to take any

decision.

added that this tool is as important as accounting

ratio. The researcher asked which purpose the have while using this

method; he replied that the use a flexible budget since it gives room for any

change in the future.

Another participant added that in AMAZI YA HUYE they put more

emphasize on the importance of preparing budget for each cots center. The

researcher wanted to know different kinds of budget prepared there, one of the

respondent said, here we prepare various budget like purchase budget, sales

budget, production budget, selling and distribution budget.The remaining

participant didn't to have any comment because she said that her task have no

linkage with decisions taken in the company because she is a book keeper.

The researcher if there are any techniques used to make

decisions that avoid bankruptcy as it had occurred to SORWAL SARL, among this

type of analysis the researcher presented them a set of significant ratios used

in the multiple discriminant analysis. The manager officer said, this could

be the effective tool to take decision for avoiding bankruptcy but he added

that is not yet used in their company. He concluded by saying that,

what is important is to use the accounting ratios as a decision model

effectively, but he insisted saying that the problem related with such

use is a lack of skilled people in this area.

4 11 Analysis of accounting ratio as a decision

model

The secondary data also are used as source of information of a

part of the analytical research, for this reason, financial statements of five

consecutive years of AMAZI YA HUYE are used, that is from 2003 to 2007. The

following analysis was done basing on the secondary data

4 11 1 Liquidity analysis

The table below presents the trend of liquidity position of the

company as far as current, quick and cash ratios are concerned, from

2003-2007.

Table 4 2 Trend of liquidity ratios

|

Formula

|

2003

|

2004

|

2005

|

2006

|

2007

|

|

RATIOS

|

|

|

|

|

|

|

|

Current ratio

|

Current asset/current liabilities

|

0.98

|

1.01

|

0.99

|

1.36

|

2.27

|

|

Current asset-Inventory/current

|

|

|

|

|

|

|

Acid test ratio

|

liabilities

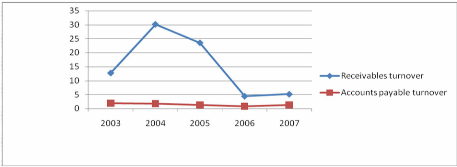

|

0.59

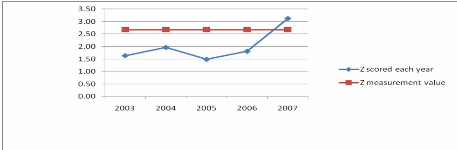

|

0.34

|

0.37

|

0.73

|

1.51

|

|

Cash+ Marketable

|

|

|

|

|

|

|

Cash ratio

|

securities/Current liabilities

|

0.47

|

0.28

|

0.32

|

0.52

|

1.17

|

Source: Computed from secondary data Ratio

interpretations

We compare the results of the current ratio basing on the

standard ratio 2: 1. As far as the current ratio is concerned, it was 0.98:1 in

2003 that is not satisfactory even for three successive years of 2004, 2005 and

2006 the ratio computation is 1.01, 0.99.1.36 respectively, for this case the

liquidity position went down below the standard but in 2007, the ratio was

satisfactory as it was above the standard 2:1, as it was 2.27:1.

Compared to the standard of 1:1 the quick ratio of the company

shows unsatisfactory situation from 2003 till 2006, as in 2003 it was 0.59:1,

in 2004 it was 0.34, in 2005 it was 0.37:1 and in 2006 it was 0.73 :1. Since

2007 the ratio became satisfactory as its result was 1.51:1.

As far as the cash ratio is concerned, it is 0.47:1 in 2003,

0.28: 1 in 2004, 0.37:1 in 2005, 0.52:1 in 2006 and 1.17:1 in 2007. Basing on

the standard of 0.5: 1, the result of this ratio shows unsatisfactory case in

2003, 2004 and 2005. But in 2006 and 2007 there is a satisfactory situation of

liquidity as the ratio computation is 0.52:1 in 2006, 1.17:1 in 2007, what we

can also include to the result of 2007 is that there is a portion of idle

resources of 0.17.

Figure 4 2 AMAZI YA HUYE Liquidity ratios 2003 -

2007

RATIOS

Time years

Comments

As the table 4 3 and fig 4 1 show, the company' liquidity

ratios exbhit a diclining pattern from 2003 to 2005 basing on the rule of

thumb.As shown by the above figure, the cuurent ratio, quick ratio, and the

cash ratio dropped from the recommendable ratio in 2003,2004 and 2005 as per

the role of thumb, 2:1 to current ratio, 1:1 to quick ratio, 0.5:1 to cash

ratio, that prove the less liquidity to meet the short term obligations, basing

on the above analysis, in 2003, and 2005 the company has no working capital

even in 2004 it was not interesting. The situation got change in 2006 and get

improvement in 2007 when the results shows the figures above the recommendable

ratio.

4 11 2 Debt analysis

The following table indicates the trend of Debt ratios in AMAZI

YA HUYE for the period of our research that is 2003 - 2007.

Table 4 3 Trend of debt ratios

|

Formula

|

2003

|

2004

|

2005

|

2006

|

2007

|

|

RATIOS

|

|

|

|

|

|

|

|

Leverage ratios

|

Assets/Shareholder's equity

|

2.12

|

1.83

|

2.22

|

1.75

|

1.35

|

|

Total debt ratio

|

Total debt/total asset

|

0.52

|

0.45

|

0.53

|

0.42

|

0.26

|

|

Debt to equity ratio

|

Total debt/equity

|

1.12

|

0.84

|

1.13

|

0.75

|

0.35

|

|

Long term debt to capital

|

Debt/Debt Equity

|

0.52

|

0.45

|

0.53

|

0.42

|

0.26

|

|

Interest coverage ratio

|

EBIT/Annual interest expenses

|

0.53

|

0.46

|

0.53

|

0.43

|

0.26

|

Source: Computed from secondary data Ratio

interpretation

The total debt ratio indicates the extent to which the firm is

using debt to finance its assets. The better when the ratio is 0.5:1 or less.

In 2003 the ratio was 0.53:1, in 2004 it declined to 0.45:1, in 2005 it got

increase to 0.53:1, in 2006 it deceased when it was 0.42 and in 2007 it was

0.26:1.

The result of debt to equity ratio indicates the relationship

between lenders' contribution for each franc of the owners' contribution. It in

this case, the lenders have contributed more in 2006 for 1 franc given by the

owners the lenders give 1.12, and in 2005 for 1 franc from owners the lenders

provide 1.13. For the other periods the situation was good as in 2004 for one

franc from the owners, lenders provide 0.84, in 2006 for 1 franc from the

owner, lenders provide 0.75, and in 2007 for 1 franc from the owners, lenders

provide 0.35.

The total leverage ratio relates total as sets to shareholders

`equity. This ratio is a degree to which

management has financed the

company's asset investment with no ownership capital. The result

of the

leverage ratio computation for AMAZI YA HUYE reveals the following situation:

in 2003

the ratio was 2.21 which means, to 1 franc from owners 1.12

has been used to find the company's assets from outsiders, in 2004 the ratio

was 1.83, to 1 franc from owners, outsiders provide 0.83 to fund the company's

assets, in 2005 the ratio was 2.22, to 1 franc from owners, outsiders provide

1.22 to fund the company's assets, in 2006 the ratio was 0.75, to 1 franc from

owners the outsiders provide 0.75, in 2007 the ratio was 0.32, to 1 franc from

owners the outsiders provide 0.32.

Figure 4 3 AMAZI YA HUYE debt ratios 2003 -

2007

RATIOS

Time in years

Comments

The debt ratios generate the company's ability to meet its

obligations, otherwise it measures the dependability of the company to the

outsiders. Basing on the ratio computation in table 4 3 and its representation

in figure 4.3, in 2003 there was an increase in dependability of the company to

the outsiders funds, it declined in 2004, but in 2005 it increased which means

that in this period the claims of creditors were greater than those of owners.

Starting to 2006 till 2007 these ratios were trending downward, for this

reason, the dependability to the outsiders declined which shows a good sign of

solvency of the company.

4 11 3 Sales and profitability analysis

The table below shows the sales and profitability of AMAZI YA

HUYE for the period covering five successive years, that is to say 2003 -

2007.

Table 4 4 Trend of sales and profitability

ratios

|

RATIOS

|

Formula

|

2003

|

2004

|

2005

|

2006

|

2007

|

|

Sales growth

|

(current year sales-last year

|

|

|

|

|

|

|

rate

|

sales)/last year sales)*100

|

0.00%

|

15.00%

|

-7.2%

|

-32.04%

|

-1.21%

|

|

Expenses analysis

|

Various expenses/Sales

|

0.52

|

0.74

|

0.75

|

0.70

|

0.51

|

|

Gross margin to sales

|

Gross profit/ Total sales

|

0.42

|

0.23

|

0.21

|

0.24

|

0.42

|

|

Operating profit to sales

|

Operating profit / Sales

|

0.08

|

0.04

|

0.05

|

0.09

|

0.10

|

|

EBIT to Sales

|

EBIT/ Net sales

|

0.08

|

0.04

|

0.05

|

0.09

|

0.10

|

|

Return on sales

|

Net income / Net sales

|

0.06

|

0.03

|

0.04

|

0.06

|

0.07

|

|

Return on investment

|

Net income / Fixed assets

|

1.75

|

1.94

|

1.67

|

1.47

|

1.84

|

|

Return on assets

|

Net income / Total assets

|

0.83

|

1.05

|

0.79

|

0.60

|

0.77

|

|

Return on equity

|

EAT /Shareholder's equity

|

0.09

|

0.58

|

0.06

|

0.07

|

0.07

|

|

Payout ratio

|

Cash dividend /Net income

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

|

Retention ratio

|

Retained earring/ Net income

|

0.01

|

0.01

|

0.01

|

0.01

|

0.01

|

|

Sustainable

growth rate

|

REO*Retention ratio

|

0.0500

|

0.0175

|

0.0021

|

0.0040

|

0.0045

|

Source: Computed from secondary data

Ratio interpretation

The sales growth rate was 0.0 in 2003 as there is no data

given for the previous. Basing on 2003 in 2004 there was growth of 15%, in 2005

comparing to 2004 there was growth of 7.20%, in 2006 basing on 2005 sales there

was growth of -32.04%, and in 2007 there is growth of -1.12% of sales. The

results obtained shows that in 2006 the sales declined with a great percentage

which

follows buy a bit decline in 2007 all of these situations involve

the reinforcements of the marketing activities of the company to ensure a

sustainable growth.

The gross margin to sales ratio is an indication of the

management's ability to mark up its products over their cost. In 2003 the ratio

was 0.42 that means to 1 unit sold the cost of product sold was 0.58, 2004 it

was 0.23 that means to 1 unit sold 0.77 was the cost of product sold, in 2005

it was 0.21 that means to 1 unit sold 0.79 was cost of goods sold, in 2006 the

ratio was 0.24 that means to 1 unit sold 0.76 was the cost of product sold, in

2007 the ratio was 0.42 that means to 1 unit sold the cost of product was

0.58.

The expense analysis ratio shows the rate of expenses incurred

after each sale. It helps to control the expenses comparing to the rate of

margin to sales. The result of this ratio was 0.52 in 2003, in 2004 it was

0.74, in 2005 it was 0.75, in 2006 it was 0.70 and in 2007 it was 0.51.

The return on sales indicates the relationship between sales

and the earning of the period. It helps in controlling expenses with the rate

of margin. In 2003 the ratio was 0.06, in 2004 it was 0.03, in 2004 the ratio

was 0.04, in 2005 it was 0.06, and in 2007 it indicates 0.07.

The return on assets ratio shows the relationship between

total assets and sales realized. The trend of this ratio in AMAZI YAHUYE

indicates that in 2003 for 1 franc invested in fixed and current assets the

return is 0.83 on sales, in 2004 for 1 franc invested in fixed and current

assets the return is 1.05 on sales, in 2005 for 1 franc invested in fixed and

current assets the return is 0.79on sales, in 2006 for 1 franc invested in

fixed and current assets the return is 0.60 on sales, in 2007 for 1 franc

invested in fixed and current assets the return is 0.77 on sales.

The trend of return on investment helps to analyze the income

earned and capital employed. In 2003 to generate 1 franc in sales the company

invested 1.75 in fixed assets , in 2004 to earn 1 franc in sales the company

invested 1.94 in fixed assets, in 2005 to generate 1 franc in sales the company

invested 1.67 , in 2006 to earn 1 franc in sales the company 1.47 , in 2007 to

generate 1 franc in sales the company invested 1.84.

The return on equity indicates how well the company has used

the owners's resources. In our

case study, the result of this ratio was 0.09

in 2003, 0.058 in 2004, 0.06 in 2005, and 0.07 in

2006 and in 2007. The

percentage of this ratio reveals the relative performance and strength of

the company in attracting future investments; it means that in

2003 the capacity of AMAZI YA HUYE was too high comparing to the following

years when it declined slightly till the level of 7% in 2007.

Figure 4 4 AMAZI YA HUYE expenses analysis, gross

margin to sales, return on sales ratios

2003-200 7

RATIOS

Time in years

Comments

Basing on the results from the table 4 4, from 2003 to 2006,

there was a decrease of gross margin ratio, but on the other side there was an

increase in expenses as shown in expenses analysis ratio. This situation leads

to the reduction of net profit regarding these periods that means there is no

expenses management basing on sales and cost of goods sold. This set of ratio

can help to take measures for the future sales and their expenses. In 2007, we

consider a slight decrease of gross profit margin, as well as a slight increase

in expenses analysis ratio which provide a bit higher return on sales ratios

comparing to the previous periods.

The above comments are depicted in the figure 4 4 that

represents together gross profit margin ratio, expenses analysis ratio, and

return on sales ratio of AMAZI YA HUYE from 2003 to 2007. In 2003-2005 the

expenses curve was upward sloping comparing to the gross profit curve that was

down ward sloping in 2006-2007 the expense curve changed, it was down ward

sloping, comparing to the gross profit curve that was up ward sloping. These

situations make an impact on the net profit of the company that could be

greater in 2003-2005, but the expenses became uncontrollable comparing to the

margin of cost of raw material to sales realized in that time, in the following

two years, the expenses management was controlled basing on cost of raw

material

to sales, the reason the sales turnover was lower than the

previous years but the net profit was somehow closer to those of these periods

even the sales turnover of these periods was higher (2003, 2004 and 2005).

4 11 4 Efficiency analysis

The table below shows the trend of the efficiency ratios of AMAZI

YA HUYE from 2003 - 2004.

Table 4 5 Trend of efficiency ratios

|

RATIOS

|

Formula

|

2003

|

2004

|

2005

|

2006

|

2007

|

|

Inventory

|

Cost of Goods Sold/Average

|

|

|

|

|

|

|

turnover

|

Inventory

|

8.9

|

8.93

|

8

|

7.8

|

8.73

|

|

Days in

|

(Average Inventory/Cost of

|

|

|

|

|

|

|

inventory

|

Sales)*365

|

41 days

|

41 days

|

46 days

|

46 days

|

42days

|

|

Asset turnover

|

Net Sales/Total Assets

|

0.83

|

1.5

|

0.85

|

0.6

|

0.72

|

|

Receivables turnover

|

Credit Sales/Accounts Receivables

|

12.7

|

30.1

|

23.5

|

4.4

|

5.13

|

|

Average collection

|

(Accounts Receivable/Net

|

|

|

|

|

|

|

period

|

Sales)*365

|

28 days

|

12 days

|

16days

|

83 days

|

71days

|

|

Accounts ayable turnover

|

Purchases/Accounts Payable

|

1.98

|

1.8

|

1.32

|

0.83

|

1 29

|

|

Days AP

|

(Accounts Payable/Cost of

|

325

|

183

|

274

|

435

|

282

|

|

outstanding

|

Sales) *365

|

days

|

days

|

days

|

days

|

days

|

Source: Computed from secondary data Ratio

interpretation

The trend of inventory turnover shows how rapidly the

inventory into receivable through sales. In 2003 the ratio was 8.9 that is to

say 41 days the raw material remain outstanding, in 2004 the ratio was 8.93 so

the stock of raw material remain outstanding for 41 days, in 2006 the ratio was

8 it means that the stock of raw material remain outstanding for 42 days, in

2007 7.8 that is to say 42 days that the stock of raw material remain

outstanding.

RATIOS

Time in years

The trend of receivables (debtors) turnover measures the

quality of debtors since it indicates the speed of their collection. Its

interpenetration is combined together with the result of average collection

period. In AMAZI YA HUYE in 2003 this ratio was 12.3 that means 20 days that

the book debts remains outstanding, in 2004 the ratio was 30.1 which means 10

days that book debts remains outstanding, in 2005 the ratio was 23.5 which

means 13 days that the book debts remains outstanding, in 2006 the ratio was

4.4 that means 55 days that the book debts remains outstanding, in 2007 the

ratio was 5.13 that means 42 days that the book debts remains outstanding.

Looking on the trend of accounts receivable turnover ratios in

days from 2003 to 2004, we can see that accounts receivable are well managed at

AMAZI YA HUYE as there is an downward trend from 325 days in 2004 to 183 days

in 2005 the rend became upward a bit till 274 days but the situation changed in

2006 when the trend reached 435 days, this is so because the late payment on