CHAPTER IV

DATA ANALYSIS AND INTERPRETATION

4 1 Introduction

This chapter presents the findings of the study entitled

«the use of accounting ratios in decision making» in AMAZI YA HUYE.

It also presents a brief description of AMAZI YA HUYE as the case study. It

also based on the analysis of both primary and secondary data collected to

achieve the stated objectives. The analysis of the data collected was done in

accordance with the study objectives and hypothesis. The results were reported

in tables and summarizing answers to major questions asked. The researcher used

focus group interview to obtain first hand information, whereby all six staff

of the company who deal with accounting and finance were involved in the

discussion. In short, this chapter examines the empirical evidence and

establishes grounds upon which the researcher hypothesis can be proved before

concluding the results of this research.

4 2 The Profile of AMAZI YA HUYE

AMAZI YA HUYE is a private company that was formed in 1998, with

the key aim of mineral water production and its base is in Huye District former

Butare town in the Southern Province.

Their first mineral water product appeared at the market

beginning with the year 2000, after the scientific laboratory experiment by the

University of Shanghai in china. Experts from this University confirmed the

purity of the mineral water manufactured by AMAZI YA HUYE enterprise

AMAZI YA HUYE Company do not only produce mineral water but also

produces the plastic bottles into which their mineral water products are

packed.

4 1 2 AMAZI YA HUYE location

Its head office is in Kigali city at Muhima near Kabuga's

building because of availability of large market. This company still sells its

products locally but it imports its raw materials abroad specifically from

China.

4 3 AMAZI YA HUYE's mission

It seeks to increase the productive capacity of the mineral

water and play a key role in transforming the economy and enhancing the well

being of people. Through their dynamic and responsive teams, it aims at

providing the products and maintains the highest levels of customer service and

professional integrity.

4 4 AMAZI YA HUYE's objectives

> To support the development of the industrial sector

generally through innovative and the transfer international best practice.

> To support the drive of the private sector investment for

the development of the economy working with locals as well as international

investment and development focused agencies.

> To meet needs and expectations of its customers by providing

the products at the right quality and at the right time.

4 5 The environment of AMAZI YA HUYE

The AMAZI YA HUYE Company is not a monopoly one but operates with

a perfect competition market structure.

In order to adapt itself to the business investment, this

enterprise makes sure that it has a good relationship with the commercial banks

and even other industries operating in Rwandan territory and other

countries.

4 6 Juridical statute of AMAZI YA HUYE

AMAZI YA HUYE enterprise is an individual Industrial company

of Mr. GAKWAYA Etienne whose capital was 83,404,822 RWF at the beginning in

1998 but currently the capital is 149,000,000 RWF

Figure 4 1 Organization structure of AMAZI YA

HUYE

Executive Director

Director of commerce

|

IT Manager

|

|

|

|

Chief Accountant

|

|

Importation Officer

|

|

Engineer

|

|

Human

Resou rce

manager

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accountant A

|

|

Acco unta nt

|

|

|

|

Secretary

|

|

Cashier

|

|

|

Acco unta nt

|

|

|

|

|

|

|

|

|

|

|

|

Manpower

|

|

Drivers

|

|

Officer messengers

|

|

|

|

|

Source: Marketing Department of AMAZI YA HUYE.

4 7 Tasks description

By making description of the above organization structure,

different tasks attributed to general management and different departmental

services are precised in accordance to the organizational arrangement of the

chart.

A. Executive Director

The executive director of AMAZI YA HUYE is responsible for

taking all the dec isions relating to effective management and policy

formulation of the enterprise. He is also in charge of the following

activities:

- To insure the coordination and management of different

department like commercial service, production service and financial

service.

B. Director of commerce

This one is responsible for the evolution of commercial and

marketing services and making survey on the areas of competition. He takes

measures on the quality and quantity of mineral water to be taken to the

market, he makes follow-up on the buying and the selling conditions, for the

interest of the clients.

Sometimes he proceeds to the ground to investigate the consumers

perception upon certain decisions under took and these assist him to underlay

appropriate strategies.

C. Human resource manager

The human resource manager is in charge of recruitment of the

employees and makes sure that the recruited employees are ones with competent

skills which can lead to the general improvement of the company' s

performances.

He assigns duties and responsibilities to the employees and

makes supervisions to different department to approve if the delegation of

power is respected by departments.

He posses power to appoint and dismiss misbehaved workers after

his consent with the executive director.

D. Accounting department

The responsibilities of this department are as follows:

- Keeping records of the day to day business transactions

- Preparation of the financial statements of the company

- Keeping the books of accounts like the journals, ledgers and

trial balance.

- Recording the daily operations of expenses and revenues of the

company of AMAZI YA HUYE

- Analyzing financial transactions and gives information to the

management and the third parties.

- Advising the top management on the financial position and

decision making.

E. Importation officer The importation officer

has the following key duties:

- He makes sure that all the logistical and procurement services

are done smoothly with in the enterprise.

- Importation of required technical instruments to run

enterprise's daily production affairs. - Monitoring on the quality of

production basing on capacity of machines.

F. Engineer The responsibilities of an engineer

include:

- Rendering mechanical services at any time when technical

errors happen. - Repairing of machines that have experienced technical

problems.

- Control and measures the electricity used by the company.

G. IT Manager: This one has got the following

tasks

- System soft ware in the company

- Distribution of information system in all the departments -

Repair of computers that are experiencing errors.

4 8 Data analysis

has been a result of a number of factors, but the main factor

is a lack of rational decision making. As finalist student in Accounting

Sciences in this research, we picked interest in one of techniques that is

commonly used in decision making since it naturally provides much information

in almost every aspect of the business. The researcher was motivated to find

out the effectiveness of using accounting ratios in decision making of the

enterprise. The student was also interested in knowing whether this techniques

is used or not, and what could be the requirement to use them effectively.

4 8 1 In depth Interview

To the opinion of the accountant and management department

executives on important issues related to accounting ratios group interview (in

depth interview) was conducted. All six staff of management department in AMAZI

YA HUYE was interviewed including the accountants of this enterprise

The discussion took place at AMAZI YA HUYE headquarter as well

as at the factory residence whereby all the participants were requested to

think on all matters concerning accounting ratios in AMAZI YA HUYE. After each

interview, notes are taken to unable analysis to be made. For some question

clarifications are given to the interviewee so that they can give their views

and opinions.

The discussion was designated to accomplish the following

objectives:

1. To identify the importance of using accounting ratios in

decision making

2. To know whether accounting ratios are used in AMAZI YA

HUYE

3. To determine the linkage between accounting ratios and

decision made in AMAZI YA HUYE

4. To determine other factors used in decision making

5. To identify the constraints that hinder the proper use of

accounting ratios

4 8 2 Type of ratios used

For this purpose 32 ratios were selected based upon a review

of text books. These ratios were divided into 5 categories of analysis, such as

ratios to use in analyzing liquidity, efficiency, sales profitability, debt,

and in multiple dicsriminant analysis. The management staff of AMAZI YA HUYE

disclosed that ratios are frequently used by the company in analyzing

profitability and liquidity. They said that ratios used in this manner are more

significant to take any decision.

After knowing that accounting ratios are used in AMAZI YA HUYE

as a tool of analysis in decision making and after knowing that the staff

management of AMAZI YA HUYE are interested in their use in decision making the

researcher wanted to investigate how this technique is used.

4 8 3 Preferred ratios in decision making

To determine the preferred ratios the researcher asked the

following question» What among the following kind of accounting ratios do

you take into account while making decisions and for which purpose?»

· Liquidity ratios

· Debt ratios

· Efficiency ratios

· Sales and profitability ratios

One of the respondent said that while analyzing liquidity

position liquidity ratios are used, in analyzing efficiency of the company

inven tory turnover ratio is used and some ratios are used especially in

analyzing sales and profitability.

4 8 3 1 Preferred ratios in analyzing liquidity

Basing on the review of text books, the researcher chose the

following ratios in analyzing liquidity:

· Current ratio

· Quick ratio (acid test ratio)

· Cash ratio

As said in the above response these ratio are used in analyzing

liquidity position of the company. One of the managing explained that the use

of this kind of ratios presents an importance to the company because it helps

to know the level at which the company can pay its short term debts.

4 8 3 2 Preferred ratios in analyzing efficiency

Concerning efficiency ratios, the researcher chose some of them

basing on the review of text books. Following are some of these ratios:

· Inventory Turnover

· Days in Inventory

· Assets turnover

· Receivables Turnover

· Average Collection period

· Accounts Payable turnover

· Days AP outstanding

The management staff showed much interest in efficiency

ratios, one of them said,» efficiency measuring is very important for

any business», He went on commenting that, the efficiency ratios can

help to adjust the inventory to sales collection using inventory turnover, days

in inventory. Most of them had the same views but the put emphasize on

profitability ratios by saying, «When a company is profitable it means

that it is efficiently performing its operations».

4.9.3.3 Preferred ratios in analyzing debt

Basing on the review of text books, the researcher chose the

following set of ratios to analyse debts of our case study.

· Total Debt ratio

· Debt-Equity Ratio

· Long-term Debt to capital

· Asset-Equity Ratio or Leverage Ratio

One of the management staff said that debt ratio help to measure

the extent to which a company rely on outsiders funds.

4 10 Accounting ratios and decision making

To determine whether there exists a linkage between accounting

ratios and organization sustainable growth, the researcher asked the following

question to the respondents «Do you agree that, the use of accounting

ratios can lead to the decision making?» The following table shows

categories of their responses:

Table 4 1 Respondents' view on the linkage

between accounting ratios and decision making

Personnel

Responses

Agree 3

Disagree 1

Neutral 2

Source: Primary data

There seems to be a majority who agree that there is a linkage

between accounting ratios and decision making. The chef accountant commented

that decision model like financial ratios plays a great role in assessing the

financial performance of the company but he presented the problem of a lack of

capacity to use them. One of the accounting department said, though

financial ratio analysis is not the only measure of performance, still it is

the best to measure the financial health of the company to take any

decision.

added that this tool is as important as accounting

ratio. The researcher asked which purpose the have while using this

method; he replied that the use a flexible budget since it gives room for any

change in the future.

Another participant added that in AMAZI YA HUYE they put more

emphasize on the importance of preparing budget for each cots center. The

researcher wanted to know different kinds of budget prepared there, one of the

respondent said, here we prepare various budget like purchase budget, sales

budget, production budget, selling and distribution budget.The remaining

participant didn't to have any comment because she said that her task have no

linkage with decisions taken in the company because she is a book keeper.

The researcher if there are any techniques used to make

decisions that avoid bankruptcy as it had occurred to SORWAL SARL, among this

type of analysis the researcher presented them a set of significant ratios used

in the multiple discriminant analysis. The manager officer said, this could

be the effective tool to take decision for avoiding bankruptcy but he added

that is not yet used in their company. He concluded by saying that,

what is important is to use the accounting ratios as a decision model

effectively, but he insisted saying that the problem related with such

use is a lack of skilled people in this area.

4 11 Analysis of accounting ratio as a decision

model

The secondary data also are used as source of information of a

part of the analytical research, for this reason, financial statements of five

consecutive years of AMAZI YA HUYE are used, that is from 2003 to 2007. The

following analysis was done basing on the secondary data

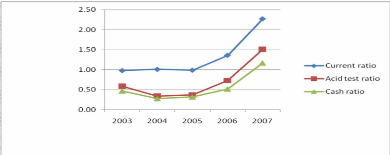

4 11 1 Liquidity analysis

The table below presents the trend of liquidity position of the

company as far as current, quick and cash ratios are concerned, from

2003-2007.

Table 4 2 Trend of liquidity ratios

|

Formula

|

2003

|

2004

|

2005

|

2006

|

2007

|

|

RATIOS

|

|

|

|

|

|

|

|

Current ratio

|

Current asset/current liabilities

|

0.98

|

1.01

|

0.99

|

1.36

|

2.27

|

|

Current asset-Inventory/current

|

|

|

|

|

|

|

Acid test ratio

|

liabilities

|

0.59

|

0.34

|

0.37

|

0.73

|

1.51

|

|

Cash+ Marketable

|

|

|

|

|

|

|

Cash ratio

|

securities/Current liabilities

|

0.47

|

0.28

|

0.32

|

0.52

|

1.17

|

Source: Computed from secondary data Ratio

interpretations

We compare the results of the current ratio basing on the

standard ratio 2: 1. As far as the current ratio is concerned, it was 0.98:1 in

2003 that is not satisfactory even for three successive years of 2004, 2005 and

2006 the ratio computation is 1.01, 0.99.1.36 respectively, for this case the

liquidity position went down below the standard but in 2007, the ratio was

satisfactory as it was above the standard 2:1, as it was 2.27:1.

Compared to the standard of 1:1 the quick ratio of the company

shows unsatisfactory situation from 2003 till 2006, as in 2003 it was 0.59:1,

in 2004 it was 0.34, in 2005 it was 0.37:1 and in 2006 it was 0.73 :1. Since

2007 the ratio became satisfactory as its result was 1.51:1.

As far as the cash ratio is concerned, it is 0.47:1 in 2003,

0.28: 1 in 2004, 0.37:1 in 2005, 0.52:1 in 2006 and 1.17:1 in 2007. Basing on

the standard of 0.5: 1, the result of this ratio shows unsatisfactory case in

2003, 2004 and 2005. But in 2006 and 2007 there is a satisfactory situation of

liquidity as the ratio computation is 0.52:1 in 2006, 1.17:1 in 2007, what we

can also include to the result of 2007 is that there is a portion of idle

resources of 0.17.

Figure 4 2 AMAZI YA HUYE Liquidity ratios 2003 -

2007

RATIOS

Time years

Comments

As the table 4 3 and fig 4 1 show, the company' liquidity

ratios exbhit a diclining pattern from 2003 to 2005 basing on the rule of

thumb.As shown by the above figure, the cuurent ratio, quick ratio, and the

cash ratio dropped from the recommendable ratio in 2003,2004 and 2005 as per

the role of thumb, 2:1 to current ratio, 1:1 to quick ratio, 0.5:1 to cash

ratio, that prove the less liquidity to meet the short term obligations, basing

on the above analysis, in 2003, and 2005 the company has no working capital

even in 2004 it was not interesting. The situation got change in 2006 and get

improvement in 2007 when the results shows the figures above the recommendable

ratio.

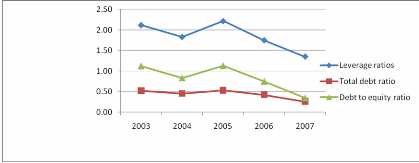

4 11 2 Debt analysis

The following table indicates the trend of Debt ratios in AMAZI

YA HUYE for the period of our research that is 2003 - 2007.

Table 4 3 Trend of debt ratios

|

Formula

|

2003

|

2004

|

2005

|

2006

|

2007

|

|

RATIOS

|

|

|

|

|

|

|

|

Leverage ratios

|

Assets/Shareholder's equity

|

2.12

|

1.83

|

2.22

|

1.75

|

1.35

|

|

Total debt ratio

|

Total debt/total asset

|

0.52

|

0.45

|

0.53

|

0.42

|

0.26

|

|

Debt to equity ratio

|

Total debt/equity

|

1.12

|

0.84

|

1.13

|

0.75

|

0.35

|

|

Long term debt to capital

|

Debt/Debt Equity

|

0.52

|

0.45

|

0.53

|

0.42

|

0.26

|

|

Interest coverage ratio

|

EBIT/Annual interest expenses

|

0.53

|

0.46

|

0.53

|

0.43

|

0.26

|

Source: Computed from secondary data Ratio

interpretation

The total debt ratio indicates the extent to which the firm is

using debt to finance its assets. The better when the ratio is 0.5:1 or less.

In 2003 the ratio was 0.53:1, in 2004 it declined to 0.45:1, in 2005 it got

increase to 0.53:1, in 2006 it deceased when it was 0.42 and in 2007 it was

0.26:1.

The result of debt to equity ratio indicates the relationship

between lenders' contribution for each franc of the owners' contribution. It in

this case, the lenders have contributed more in 2006 for 1 franc given by the

owners the lenders give 1.12, and in 2005 for 1 franc from owners the lenders

provide 1.13. For the other periods the situation was good as in 2004 for one

franc from the owners, lenders provide 0.84, in 2006 for 1 franc from the

owner, lenders provide 0.75, and in 2007 for 1 franc from the owners, lenders

provide 0.35.

The total leverage ratio relates total as sets to shareholders

`equity. This ratio is a degree to which

management has financed the

company's asset investment with no ownership capital. The result

of the

leverage ratio computation for AMAZI YA HUYE reveals the following situation:

in 2003

the ratio was 2.21 which means, to 1 franc from owners 1.12

has been used to find the company's assets from outsiders, in 2004 the ratio

was 1.83, to 1 franc from owners, outsiders provide 0.83 to fund the company's

assets, in 2005 the ratio was 2.22, to 1 franc from owners, outsiders provide

1.22 to fund the company's assets, in 2006 the ratio was 0.75, to 1 franc from

owners the outsiders provide 0.75, in 2007 the ratio was 0.32, to 1 franc from

owners the outsiders provide 0.32.

Figure 4 3 AMAZI YA HUYE debt ratios 2003 -

2007

RATIOS

Time in years

Comments

The debt ratios generate the company's ability to meet its

obligations, otherwise it measures the dependability of the company to the

outsiders. Basing on the ratio computation in table 4 3 and its representation

in figure 4.3, in 2003 there was an increase in dependability of the company to

the outsiders funds, it declined in 2004, but in 2005 it increased which means

that in this period the claims of creditors were greater than those of owners.

Starting to 2006 till 2007 these ratios were trending downward, for this

reason, the dependability to the outsiders declined which shows a good sign of

solvency of the company.

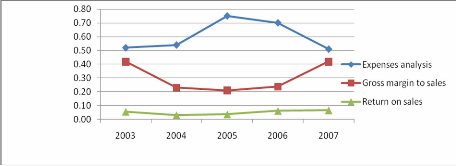

4 11 3 Sales and profitability analysis

The table below shows the sales and profitability of AMAZI YA

HUYE for the period covering five successive years, that is to say 2003 -

2007.

Table 4 4 Trend of sales and profitability

ratios

|

RATIOS

|

Formula

|

2003

|

2004

|

2005

|

2006

|

2007

|

|

Sales growth

|

(current year sales-last year

|

|

|

|

|

|

|

rate

|

sales)/last year sales)*100

|

0.00%

|

15.00%

|

-7.2%

|

-32.04%

|

-1.21%

|

|

Expenses analysis

|

Various expenses/Sales

|

0.52

|

0.74

|

0.75

|

0.70

|

0.51

|

|

Gross margin to sales

|

Gross profit/ Total sales

|

0.42

|

0.23

|

0.21

|

0.24

|

0.42

|

|

Operating profit to sales

|

Operating profit / Sales

|

0.08

|

0.04

|

0.05

|

0.09

|

0.10

|

|

EBIT to Sales

|

EBIT/ Net sales

|

0.08

|

0.04

|

0.05

|

0.09

|

0.10

|

|

Return on sales

|

Net income / Net sales

|

0.06

|

0.03

|

0.04

|

0.06

|

0.07

|

|

Return on investment

|

Net income / Fixed assets

|

1.75

|

1.94

|

1.67

|

1.47

|

1.84

|

|

Return on assets

|

Net income / Total assets

|

0.83

|

1.05

|

0.79

|

0.60

|

0.77

|

|

Return on equity

|

EAT /Shareholder's equity

|

0.09

|

0.58

|

0.06

|

0.07

|

0.07

|

|

Payout ratio

|

Cash dividend /Net income

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

|

Retention ratio

|

Retained earring/ Net income

|

0.01

|

0.01

|

0.01

|

0.01

|

0.01

|

|

Sustainable

growth rate

|

REO*Retention ratio

|

0.0500

|

0.0175

|

0.0021

|

0.0040

|

0.0045

|

Source: Computed from secondary data

Ratio interpretation

The sales growth rate was 0.0 in 2003 as there is no data

given for the previous. Basing on 2003 in 2004 there was growth of 15%, in 2005

comparing to 2004 there was growth of 7.20%, in 2006 basing on 2005 sales there

was growth of -32.04%, and in 2007 there is growth of -1.12% of sales. The

results obtained shows that in 2006 the sales declined with a great percentage

which

follows buy a bit decline in 2007 all of these situations involve

the reinforcements of the marketing activities of the company to ensure a

sustainable growth.

The gross margin to sales ratio is an indication of the

management's ability to mark up its products over their cost. In 2003 the ratio

was 0.42 that means to 1 unit sold the cost of product sold was 0.58, 2004 it

was 0.23 that means to 1 unit sold 0.77 was the cost of product sold, in 2005

it was 0.21 that means to 1 unit sold 0.79 was cost of goods sold, in 2006 the

ratio was 0.24 that means to 1 unit sold 0.76 was the cost of product sold, in

2007 the ratio was 0.42 that means to 1 unit sold the cost of product was

0.58.

The expense analysis ratio shows the rate of expenses incurred

after each sale. It helps to control the expenses comparing to the rate of

margin to sales. The result of this ratio was 0.52 in 2003, in 2004 it was

0.74, in 2005 it was 0.75, in 2006 it was 0.70 and in 2007 it was 0.51.

The return on sales indicates the relationship between sales

and the earning of the period. It helps in controlling expenses with the rate

of margin. In 2003 the ratio was 0.06, in 2004 it was 0.03, in 2004 the ratio

was 0.04, in 2005 it was 0.06, and in 2007 it indicates 0.07.

The return on assets ratio shows the relationship between

total assets and sales realized. The trend of this ratio in AMAZI YAHUYE

indicates that in 2003 for 1 franc invested in fixed and current assets the

return is 0.83 on sales, in 2004 for 1 franc invested in fixed and current

assets the return is 1.05 on sales, in 2005 for 1 franc invested in fixed and

current assets the return is 0.79on sales, in 2006 for 1 franc invested in

fixed and current assets the return is 0.60 on sales, in 2007 for 1 franc

invested in fixed and current assets the return is 0.77 on sales.

The trend of return on investment helps to analyze the income

earned and capital employed. In 2003 to generate 1 franc in sales the company

invested 1.75 in fixed assets , in 2004 to earn 1 franc in sales the company

invested 1.94 in fixed assets, in 2005 to generate 1 franc in sales the company

invested 1.67 , in 2006 to earn 1 franc in sales the company 1.47 , in 2007 to

generate 1 franc in sales the company invested 1.84.

The return on equity indicates how well the company has used

the owners's resources. In our

case study, the result of this ratio was 0.09

in 2003, 0.058 in 2004, 0.06 in 2005, and 0.07 in

2006 and in 2007. The

percentage of this ratio reveals the relative performance and strength of

the company in attracting future investments; it means that in

2003 the capacity of AMAZI YA HUYE was too high comparing to the following

years when it declined slightly till the level of 7% in 2007.

Figure 4 4 AMAZI YA HUYE expenses analysis, gross

margin to sales, return on sales ratios

2003-200 7

RATIOS

Time in years

Comments

Basing on the results from the table 4 4, from 2003 to 2006,

there was a decrease of gross margin ratio, but on the other side there was an

increase in expenses as shown in expenses analysis ratio. This situation leads

to the reduction of net profit regarding these periods that means there is no

expenses management basing on sales and cost of goods sold. This set of ratio

can help to take measures for the future sales and their expenses. In 2007, we

consider a slight decrease of gross profit margin, as well as a slight increase

in expenses analysis ratio which provide a bit higher return on sales ratios

comparing to the previous periods.

The above comments are depicted in the figure 4 4 that

represents together gross profit margin ratio, expenses analysis ratio, and

return on sales ratio of AMAZI YA HUYE from 2003 to 2007. In 2003-2005 the

expenses curve was upward sloping comparing to the gross profit curve that was

down ward sloping in 2006-2007 the expense curve changed, it was down ward

sloping, comparing to the gross profit curve that was up ward sloping. These

situations make an impact on the net profit of the company that could be

greater in 2003-2005, but the expenses became uncontrollable comparing to the

margin of cost of raw material to sales realized in that time, in the following

two years, the expenses management was controlled basing on cost of raw

material

to sales, the reason the sales turnover was lower than the

previous years but the net profit was somehow closer to those of these periods

even the sales turnover of these periods was higher (2003, 2004 and 2005).

4 11 4 Efficiency analysis

The table below shows the trend of the efficiency ratios of AMAZI

YA HUYE from 2003 - 2004.

Table 4 5 Trend of efficiency ratios

|

RATIOS

|

Formula

|

2003

|

2004

|

2005

|

2006

|

2007

|

|

Inventory

|

Cost of Goods Sold/Average

|

|

|

|

|

|

|

turnover

|

Inventory

|

8.9

|

8.93

|

8

|

7.8

|

8.73

|

|

Days in

|

(Average Inventory/Cost of

|

|

|

|

|

|

|

inventory

|

Sales)*365

|

41 days

|

41 days

|

46 days

|

46 days

|

42days

|

|

Asset turnover

|

Net Sales/Total Assets

|

0.83

|

1.5

|

0.85

|

0.6

|

0.72

|

|

Receivables turnover

|

Credit Sales/Accounts Receivables

|

12.7

|

30.1

|

23.5

|

4.4

|

5.13

|

|

Average collection

|

(Accounts Receivable/Net

|

|

|

|

|

|

|

period

|

Sales)*365

|

28 days

|

12 days

|

16days

|

83 days

|

71days

|

|

Accounts ayable turnover

|

Purchases/Accounts Payable

|

1.98

|

1.8

|

1.32

|

0.83

|

1 29

|

|

Days AP

|

(Accounts Payable/Cost of

|

325

|

183

|

274

|

435

|

282

|

|

outstanding

|

Sales) *365

|

days

|

days

|

days

|

days

|

days

|

Source: Computed from secondary data Ratio

interpretation

The trend of inventory turnover shows how rapidly the

inventory into receivable through sales. In 2003 the ratio was 8.9 that is to

say 41 days the raw material remain outstanding, in 2004 the ratio was 8.93 so

the stock of raw material remain outstanding for 41 days, in 2006 the ratio was

8 it means that the stock of raw material remain outstanding for 42 days, in

2007 7.8 that is to say 42 days that the stock of raw material remain

outstanding.

RATIOS

Time in years

The trend of receivables (debtors) turnover measures the

quality of debtors since it indicates the speed of their collection. Its

interpenetration is combined together with the result of average collection

period. In AMAZI YA HUYE in 2003 this ratio was 12.3 that means 20 days that

the book debts remains outstanding, in 2004 the ratio was 30.1 which means 10

days that book debts remains outstanding, in 2005 the ratio was 23.5 which

means 13 days that the book debts remains outstanding, in 2006 the ratio was

4.4 that means 55 days that the book debts remains outstanding, in 2007 the

ratio was 5.13 that means 42 days that the book debts remains outstanding.

Looking on the trend of accounts receivable turnover ratios in

days from 2003 to 2004, we can see that accounts receivable are well managed at

AMAZI YA HUYE as there is an downward trend from 325 days in 2004 to 183 days

in 2005 the rend became upward a bit till 274 days but the situation changed in

2006 when the trend reached 435 days, this is so because the late payment on

behalf of debtors leads the firm to the lack of liquidity to pay its

liabilities on due time, in 2007 the trend indicated an downward trend from 435

days to 282 this situation became so as the company' s liquidity ratio reached

an interesting level

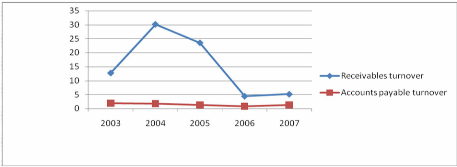

Figure 4 5 AMAZI YA HUYE receivables and payables

turnover ratios 2003-200 7

From the above table 4 5 and fig 4 4, keeping in mind that

creditors are source of funds and debtors (receivables) are use of funds,

although AMAZI YA HUYE's receivables for the period of the study have generally

been higher in figures than its creditors, the company benefited by collecting

receivables before paying its creditors since 2003 till 2007. It should be

noted that creditors are an interest -free form of financing called, this is a

spontaneous sources of financing.

The collection period in 2003-2005 was not so long and in

2006-2007 it become long a bit, comparing to the days that payables remain

outstanding, the company should take advantage of the extended credit period to

lengthen a bit the credit sales periods for undoubtiful customers to attract

for instance the potential consumers for their products

4 11 5 Multiple discriminant analysis

Table 4 6 Trend of multiple discriminant

analysis

|

RATIO

|

Formula

|

2003

|

2004

|

2005

|

2006

|

2007

|

|

Z

|

discriminant function score of a firm

|

|

|

|

|

|

|

X1

|

Net working capital/total assets (%)

|

-0.72%

|

-0.48%

|

-0.17%

|

15.50%

|

32.40%

|

|

X2

|

Retained earnings/total assets (%)

|

4.60%

|

3.20%

|

2.80%

|

3.70%

|

5.03%

|

|

X3

|

EBIT/total assets (%)

|

6.60%

|

4.45%

|

4.03%

|

5.34%

|

7.18%

|

|

Market value of total equity/book value

|

|

|

|

|

|

|

X4

|

of debt (%)

|

88.80%

|

119.70%

|

88.63%

|

132.80%

|

282.90%

|

|

X5

|

Sales/total assets (times)

|

0.83

|

1.05

|

0.79

|

0.60

|

0.73

|

|

0.01 2X1+0.0 14X2+0.033X3+0,006X4+

|

|

|

|

|

|

|

Z

|

0.999X5

|

1.64

|

1.96

|

1.49

|

1.81

|

3.12

|

Source: Computed from secondary data The MDA

interpretation

The MDA as an academic study on the use of accounting ratios

to forecast the financial failure, the management of each company can use it to

take preventive measures to the bankruptcy. Firms also can use this model in

making credit decisions and in monitoring receivables.

Basing on the standard, the higher of the Z score the better,

and this score below 2.675 the risk to the company to go bankrupt. In our case

study, in 2003, 2004, 2005, 2006 the company shows the sing of going bankrupt

as the Z score as computed in the above table 4 6 was respectively, 1.64, 1.96,

1.49, 1.81 but in 2007 this situation change toward a level to which the

financial sound of the company can't lead to the bankruptcy, as the Z score was

above the standard, it was 3.12.

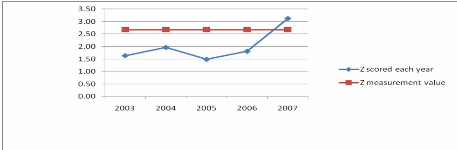

Figure 4 6 AMAZI YA HUYE Multiple Discriminant

Analysis 2003-2007

Z score

Time in years

Comments

Looking at the Z measurement curve, the situation of AMAZI YA

HUYE to go bankruptcy was too high in 2005, even in 2003, 2004 and 2006 also

the level of AMAZI YA HUYE towards bankruptcy was remarkable. But in 2007, the

situation changed as seen on the Z scored curve in 2007, so the management of

AMAZI YA HUYE should take measures to maintain such situation by computing the

MDA for each year the predict the financial failure.

4 12 Hypothesis testing

The study hypothesis stated that: The use of accounting ratios

guides management as an effective tool in decision making. From the findings

derived in this study, the researcher has enough evidence to confirm the

hypothesis. Based on the responses of the personnel of the company in table 4 1

of this chapter, about respondent's view on the linkage between accounting

ratios and decision making, it is clear that, there is majority who agree that,

ratio analysis is a

vital tool in decision making. Also the analysis made from

different kind of ratios computed using financial statements of AMAZI YA HUYE

proved that the management stands the better to take decision by using

accounting ratios rather than not.

Another hypothesis stated that: The result of using accounting

ratios relies on the effectiveness of accounting and how accountants are

skilled in financial analysis techniques. From the findings derived in this

study, the researcher has obtained the testimony from the accountant that the

use of accounting ratios can guide management, but there was hindrance

presented of using this technique which is a lack of capacity to use them. Also

this hypothesis is tested.

|